SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED): May 13, 2014

LIVEWIRE ERGOGENICS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-54588 |

26-1212244 |

| (State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

| of incorporation) |

|

Identification No.) |

24845 Corbit Place, Yorba Linda, CA 92887

(Address of principal executive offices and Zip Code)

Registrant's telephone number, including area code (714) 940-0155

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|_| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|_| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|_| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|_| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On May 13, 2014 the Company completed the acquisition of a majority stake of Apple Rush Company, Inc., pursuant to a Memorandum of Understanding which the Company had disclosed on Form 8K filed on March 10, 2014.

Under the final terms of the transaction, the Company acquired from Robert Corr, the former CEO of APRU, and members of Mr. Corr’s family, 10,000,000 shares of super-majority convertible preferred stock (the “Preferred Stock”) and the “CANNA Bliss” and “CANNA Rush” trademarks for a purchase price of $50,000 and 4 million restricted shares of the Company’s common stock (a copy of the Stock and Trademark Purchase and Assignment Agreement is attached hereto as Exhibit 10.1). Each share of Preferred Stock has a face value of $1.00 and is convertible into APRU common stock at a conversion price equal to the average closing price of APRU for the ten (10) trading days immediately prior to a notice of conversion, less a discount of twenty percent (20%). As of May 13, 2014, the Preferred Stock was convertible into 18,115,942,028 shares of APRU and as of that date the Company provided to APRU a notice of conversion for 5,000,000 shares of the Preferred Stock convertible into 9,057,971,014 restricted shares of APRU. The Company also reached an agreement with APRU on May 13, 2014, to acquire from APRU 7,252,034,443 newly issued restricted shares of APRU common stock (the “Common Stock”) in exchange for 1,000,000 restricted shares of the Company’s common stock (a copy of the Stock Purchase Agreement is attached hereto as Exhibit 10.2). As a result of the conversion of the Preferred Stock and the acquisition of the Common Stock the Company owns 16,310,005,457 shares of APRU common stock representing approximately 77% of the outstanding common stock of APRU. Concurrent with the transaction APRU and Corr Brands, Inc. entered into a long-term license agreement whereby APRU shall be the exclusive worldwide licensee of the Apple Rush and Ginseng Rush branded products (a copy of the License Agreement is attached hereto as Exhibit 10.3).

The Company intends to treat the acquisition of the Preferred Stock and the Common Stock as an acquisition of property and APRU will continue to operate and trade as a separate public company.

Item 9.01 Financial Statements and Exhibits.

The following Exhibits are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LIVEWIRE ERGOGENICS, INC |

|

| |

|

|

|

|

Date: May 20, 2014

|

By:

|

/s/ Bill Hodson |

|

| |

|

Bill Hodson |

|

| |

|

Chief Executive Officer |

|

| |

|

|

|

3

EXHIBIT 10.1

STOCK AND TRADEMARK PURCHASE AND ASSIGNMENT AGREEMENT

This Stock and Trademark Purchase and Assignment Agreement (the “Agreement”) is entered into as of May 13, 2014 (the “Effective Date”) by and between Livewire Ergogenics, Inc., a Nevada corporation (“Livewire”), Apple Rush Company, Inc., a Texas corporation (“APRU”), and Robert J. Corr, an individual, Brandon B. Corr, an individual, Sharon S. Corr, an individual (Robert, Brandon and Sharon are sometimes referred to herein as the “Sellers” or the “Corrs”), Rush Beverage Company, an Illinois corporation (“RBC”) and Corr Brands, Inc., an Illinois corporation (“CBI”) with reference to the following facts:

RECITALS

A. The Sellers collectively own 10,000,000 shares of Series A Preferred Stock issued to them by APRU (the “Preferred Stock”), with ownership of the Preferred Stock divided among the Corrs as follows; Robert J. Corr owns 1,500,000 shares of the Preferred Stock, Brandon B. Corr owns 4,000,000 shares of the Preferred Stock and Sharon S. Corr owns 4,500,000 shares of the Preferred Stock: and

B. Brandon B. Corr owns the pending trademark applications for “Canna Rush” (USPTO serial # 86191009) and “Canna Bliss” (USPTO serial # 86209566) (the “Pending Trademarks”) and CBI owns the Apple Rush and Ginseng Rush trademarks (the “CBI Trademarks”); and

C. Sellers desire to sell and assign the Preferred Stock to Livewire, Brandon B. Corr desires to assign the Pending Trademarks to APRU and CBI desires to enter into an agreement to license the CBI Trademarks to APRU. Livewire desires to purchase the Preferred Stock, have the Pending Trademarks assigned to APRU and have APRU enter into an agreement to license the CBI Trademarks..

NOW THEREFORE, in consideration of the mutual promises and agreements set forth herein, and other good valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the parties, the parties hereby agree as follows:

1. Representations and Warranties. (i) Each of the Sellers represent and warrant that they own their respective shares of Preferred Stock free and clear of all liens and encumbrances and each of them are fully authorized to enter into this Agreement to sell and assign to Livewire all right, title and interest in and to their respective shares of Preferred Stock, (ii) each of the Sellers, on behalf of themselves and any of their affiliates, represent and warrant that after the sale of the Preferred Stock to Livewire they do not have any rights of any kind, contingent or otherwise, to acquire preferred or common shares from APRU, (iii) each of the Sellers, on behalf of themselves and any of their affiliates, represent and warrant that they do not own any shares of preferred stock issued by Rushnet, Inc. (a Nevada corporation), and do not have any rights of any kind, contingent or otherwise, to acquire preferred or common shares from Rushnet, Inc., (iv) Brandon B. Corr represents and warrants that he owns the Pending Trademark applications and that he may assign such applications to APRU free and clear of all liens and encumbrances and that he is fully authorized to enter into this Agreement to assign all right, title and interest in and to the Pending Trademark applications to APRU, and (v) CBI represents that concurrent with the execution of this Agreement it shall enter into an agreement with APRU to license the CBI Trademarks to APRU.

2. Purchase Price. As payment in full for the Preferred Stock and the Pending Trademarks, Livewire shall pay $50,000 in cash to Brandon B. Corr, who shall receive such payment on behalf of all the Sellers (including Brandon B. Corr as owner of the Pending Trademarks) and shall issue, or cause to be transferred, to Brandon B. Corr (acting on behalf of all the Sellers) 4,000,000 shares of Livewire’s common stock, with restrictive legend (the $50,000 and the 4,000,000 shares are referred to as the “Consideration”). The Consideration, which each of the Corrs (including Brandon B. Corr individually as owner of the Pending Trademarks), do hereby represent and agree shall be payable to Brandon B. Corr on behalf of all the Corrs, shall be deemed payment in full for all of the shares of Preferred Stock owned by each of the Sellers and the assignment of the Pending Trademarks from Brandon B. Corr to APRU.

3. Effect of Execution of this Agreement by the Parties. (i) Each of the Sellers agrees and understands that upon execution of this Agreement by the Parties, all right, title and interest in and to their respective shares of the Preferred Stock shall be transferred and assigned to Livewire as of the Effective Date and such transfer shall be irrevocable except in the case of Livewire failing to pay the consideration as set forth in section 4(c), and (ii) Brandon B. Corr understands and agrees that upon execution of this Agreement by the Parties, all right, title and interest he has in the Pending Trademark applications shall be transferred and assigned to APRU as of the Effective Date and such transfers shall be irrevocable except in the case of Livewire failing to pay the Consideration as set forth in section 4(c).

4. Covenants.

(a) Each of the Sellers covenant that in conjunction with the execution of this Agreement they shall provide to Tony Torgerud (President of APRU) the original certificates representing their respective shares of the Preferred Stock (if any certificate has been lost, then the parties shall execute and deliver whatever documentation that the transfer agent requires to cancel the lost certificate and re-issue a new one to Livewire). In addition, the Corrs shall execute and provide to Livewire whatever documentation required by APRU’s transfer agent which may be necessary for the Transfer Agent to effectuate the transfer of the Preferred Shares to Livewire, provided however, the Parties agree and understand that this Agreement itself serves to transfer and assign all right, title and interest in and to the Preferred Shares which transfer is irrevocable except in the case of Livewire failing to pay the Consideration as set forth in section 4(c). Notwithstanding the fact that this Agreement serves to assign all right, title and interest in and to the Preferred Stock to Livewire, each of the Sellers covenant that they shall execute such further documentation necessary in order to effectuate the transfer of the Preferred Stock on the records of APRU’s Transfer Agent.

(b) Brandon B. Corr covenants that he shall execute any document, perform any act or take any action necessary to effect the assignment of the Pending Trademark applications to APRU, provided however, Mr. Corr agrees and understands that this Agreement itself serves to transfer and assign all right, title and interest in and to the Pending Trademark applications, which transfer is irrevocable except in the case of Livewire failing to pay the Consideration as set forth under section 4(c). Notwithstanding the fact that this Agreement serves to assign all right, title and interest in and to the Pending Trademarks to APRU, Mr. Corr covenants that he shall execute such further documentation necessary in order to effectuate the transfer on the records of the USPTO and hereby explicitly disclaims any interest of any kind in the Pending Trademark applications, other than as assignor to APRU, which disclaimer shall become effective as of the Effective Date. Further, such disclaimer shall be irrevocable under any circumstances other than in the case of Livewire failing to pay the Consideration as set forth under section 4(c). In addition, Robert J. Corr and Sharon S. Corr each covenant that they have no interest of any kind in the Pending Trademark applications and hereby explicitly disclaim any interest of any kind in the Pending Trademark applications..

(c) Livewire covenants that upon receipt by Mr. Torgerud of the Preferred Stock it shall pay the Consideration by promptly wire transfering $50,000 to Brandon B. Corr (as instructed by Mr. Corr) and promptly causing the issuance or transfer of 4,000,000 shares of Livewire common stock to Brandon B. Corr within 10-business days of the Effective Date.

(d) Concurrent with this Agreement, APRU shall enter into a consulting agreement with CBI.

(e) The Parties agree that neither this Agreement nor any of the terms or covenants contained herein may be cancelled, terminated, rescinded or revoked once this Agreement has been executed for any reason other than (i) the failure of Livewire to pay the Consideration as required under section 4(c) within 10-business days of the Effective Date, (ii) the failure of the Corrs to perform as required under section 4(a) within 10-business days of the Effective Date, or (iii) the failure of Brandon B. Corr to perform as required under section 4(b) within 10-business days of the Effective Date. If any Party desires to invoke this provision for the purpose of canceling, terminating, rescinding or revoking this Agreement it must do so by giving notice to the other party of such intent and such notice must give the other Party at least 5-business days to cure their default (the time to cure begins one day after the notice has been sent to the defaulting Party). Any notice provided for under this provision may only be sent by either fax, email or overnight mail. This provision shall not be construed to automatically cancel, terminate, rescind or revoke this Agreement without notice pursuant to the procedures set forth in this provision. Nothing contained in this provision or this Agreement shall prevent a Party from waiving, or extending the time, for a defaulting Party to comply with its obligations set forth in this provision and nothing contained in this provision or this Agreement shall prevent a party, or serve to replace a party’s right, to seek (as an alternative to cancellation, termination, rescission or revocation) injunctive relief or specific performance in order to have a Court require that a defaulting party perform as required under this Agreement or to comply with its terms.

(f) The Parties shall take all necessary steps and undertake to do all such acts and take all such actions necessary to insure their compliance with their obligations set forth in this Agreement.

5. Definitions. In addition to the definition of the term “affiliate” as set forth under Rule 144(a)(1) and (2), for purposes of this Agreement, RBC and CBI shall be deemed as “affiliates” of each of the Corrs and each of the Corrs are deemed as affiliates of one another .

6. Attorneys’ Fees. In the event any dispute arises under this Agreement and the parties hereto resort to litigation to resolve such dispute, the prevailing party in any such litigation, in addition to all other remedies at law or in equity, shall be entitled to an award of costs and fees from the other party, which costs and fees shall include, without limitation, reasonable attorneys’ fees and legal costs.

7. Choice of Law; Venue. This Agreement will be construed and enforced in accordance with and governed by the laws of the State of California and the federal law of the United States without reference to principles of conflicts of law. The parties agree that, in the event of any dispute arising out of this Agreement or the transactions contemplated thereby, venue for such dispute shall be in the state or federal courts located in San Diego, California, and that each party hereto waives any objection to such venue based on forum non conveniens.

8. Modification of Statute of Limitations. Notwithstanding any state, federal or other statute of limitations of longer duration to the contrary, the parties agree that any action to resolve a breach of this Agreement shall be commenced no later than six (6) months from the date of such breach.

9. Severability. Should any one or more of the provisions of this Agreement be determined to be illegal or unenforceable, such provision(s) shall (i) be modified to the minimum extent necessary to render it valid and enforceable, or (ii) if it cannot be so modified, be deemed not to be a part of this Agreement and shall not affect the validity or enforceability of the remaining provisions.

10. Neutral Interpretation. The Parties shall be deemed to have cooperated in the drafting and preparation of this Agreement. Hence, any construction to be made of this Agreement shall not be construed against any Party.

11. Advice of Counsel. Each Party to this Agreement acknowledges that it has had the benefit of advice of competent legal counsel or the opportunity to retain such counsel with respect to its decision to enter into this Agreement. The individuals whose signatures are affixed to this Agreement in a personal or representative capacity represent that they are competent to enter into this Agreement and are doing so freely and without coercion by any other Party or non-party hereto.

12. Further Assurances. Each party shall perform or cause to be performed any further acts and execute and deliver any documents that may be reasonably necessary or advisable to carry out the provisions of this Agreement.

13. Counterparts/Facsimile Signatures. This Agreement may be executed in one or more counterparts, each of which when so signed shall be deemed to be an original, and such counterparts together shall constitute one and the same instrument. In lieu of the original, a facsimile transmission or copy of the original shall be as effective and enforceable as the original.

IN WITNESS WHEREOF, the parties hereto have executed this Stock and Trademark Purchase and Assignment Agreement as of the day and year first written above.

Livewire Ergogenics,Inc.

a Nevada corporation

By: ________________________________

Bill Hodson, CEO

[Signatures Continued on Next Page]

Apple Rush Company.

a Texas corporation

By: ________________________________

David E. Torgerud, President

Robert J. Corr,

an individual

By: ________________________________

Robert J. Corr

Brandon B. Corr,

an individual

By: ________________________________

Brandon Corr

Sharon S. Corr,

an individual

By: ________________________________

Sharon S. Corr

Rush Beverage Company,

an Illinois corporation

By: ________________________________

Robert J. Corr, President

Corr Brands, Inc.,

an Illinois corporation

By: ________________________________

Brandon B. Corr, President

Page 5 of 5

EXHIBIT 10.2

STOCK PURCHASE AGREEMENT

This Stock Purchase Agreement (the “Agreement”) is entered into as of May 13, 2014 (the “Effective Date”) by and between Livewire Ergogenics, Inc., a Nevada corporation (“Livewire”) and Apple Rush Company, a Texas corporation (“APRU”), with reference to the following facts:

RECITALS

A. Livewire desires to acquire 7,252,034,443 restricted shares of APRU’s common stock. (the “Common Stock”): and

B. APRU desires to sell the Common Stock to Livewire.

NOW THEREFORE, in consideration of the mutual promises and agreements set forth herein, and other good valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the parties, the parties hereby agree as follows:

1. Representations and Warranties. (i) APRU represents and warrants that it is fully authorized to issue and sell the Common Stock to Livewire and that upon issuance of the Common Stock and receipt of the Consideration (as defined in Section 2) the shares shall be fully paid, non assessable and free and clear of any and all liens and encumbrances as of the Effective Date, (ii) Livewire represents and warrants that (a) it is an "accredited investor" (or a corporation or entity not formed for the purpose of investing in APRU) as such term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended, and they confirm that APRU has made available to Livewire the opportunity to (A) ask questions of and receive answers from APRU concerning APRU and the activities of APRU, and (B) otherwise obtain any additional information, to the extent that APRU possesses such information and can lawfully provide such to Livewire or could acquire it without unreasonable effort or expense, and (b) that it is fully authorized to enter into the transactions contemplated by this Agreement and has received all necessary approvals, including but not limited to, Board approval, to do so.

2. Purchase Price. As payment in full for the Common Stock, Livewire shall issue to APRU 1,000,000 restricted shares of it common stock, which shares, upon issuance and receipt of the Common Stock, shall be fully paid, non assessable and free and clear of any and all liens and encumbrances as of the Effective Date (the “Consideration”).

3. Attorneys’ Fees. In the event any dispute arises under this Agreement and the parties hereto resort to litigation to resolve such dispute, the prevailing party in any such litigation, in addition to all other remedies at law or in equity, shall be entitled to an award of costs and fees from the other party, which costs and fees shall include, without limitation, reasonable attorneys’ fees and legal costs.

4. Choice of Law; Venue. This Agreement will be construed and enforced in accordance with and governed by the laws of the State of California and the federal law of the United States without reference to principles of conflicts of law. The parties agree that, in the event of any dispute arising out of this Agreement or the transactions contemplated thereby, venue for such dispute shall be in the state or federal courts located in San Diego, California, and that each party hereto waives any objection to such venue based on forum non conveniens.

5. Severability. Should any one or more of the provisions of this Agreement be determined to be illegal or unenforceable, such provision(s) shall (i) be modified to the minimum extent necessary to render it valid and enforceable, or (ii) if it cannot be so modified, be deemed not to be a part of this Agreement and shall not affect the validity or enforceability of the remaining provisions.

6. Neutral Interpretation. The Parties shall be deemed to have cooperated in the drafting and preparation of this Agreement. Hence, any construction to be made of this Agreement shall not be construed against any Party.

7. Advice of Counsel. Each Party to this Agreement acknowledges that it has had the benefit of advice of competent legal counsel or the opportunity to retain such counsel with respect to its decision to enter into this Agreement. The individuals whose signatures are affixed to this Agreement in a personal or representative capacity represent that they are competent to enter into this Agreement and are doing so freely and without coercion by any other Party or non-party hereto.

8. Further Assurances. Each party shall perform or cause to be performed any further acts and execute and deliver any documents that may be reasonably necessary or advisable to carry out the provisions of this Agreement.

9. Counterparts/Facsimile Signatures. This Agreement may be executed in one or more counterparts, each of which when so signed shall be deemed to be an original, and such counterparts together shall constitute one and the same instrument. In lieu of the original, a facsimile transmission or copy of the original shall be as effective and enforceable as the original.

IN WITNESS WHEREOF, the parties hereto have executed this Stock Purchase and Assignment Agreement as of the day and year first written above.

Livewire Ergogenics,Inc.

A Nevada corporation

By: _____________________________

Bill Hodson, CEO

Apple Rush Company, Inc.,

a Texas corporation

By: _______________________________

David A. Torgerud, President

Page 2 of 2

EXHIBIT 10.3

LICENSE AGREEMENT

This License Agreement ("Agreement") is made as of the 13th day of May, 2014 (the "Effective Date") between Corr Brands, Inc. an ILLINOIS corporation ("Principal"), and APPLE RUSH COMPANY INC. a Texas Corporation (the “Company”).

BACKGROUND.

Principal and its predecessors have been in the business of selling and distributing foodstuffs and beverages under the trademark RUSH and variations thereof including APPLE RUSH since 1978, including the Products (GINSENG RUSH). Apple Rush Company, Inc. will market, brand manage and coordinate distribution of the Products (as defined herein) throughout the Territory. Principal is desirous of appointing Apple Rush Co. Inc. as its exclusive licensee within the Territory with respect to the Products.

AGREEMENT

1.0 Defined Terms. The following terms, each bearing initial capital letters, shall have the meanings set forth below:

1.1 "Products" shall mean only those products known as “Apple Rush” and “Ginseng Rush” for which Principal possesses a proprietary formulation and future products bearing the brand Apple Rush and Ginseng Rush. Products shall not include any other beverage products that the Company may manufacture, market, brand, distribute and/or sell that do not bear the Apple Rush or Ginseng Rush trademarks. Nothing in this Agreement shall convey, or be construed to convey, to Principal the right to any licensing fee, royalty, or any other right of any kind, in beverage products that the Company may itself develop, brand and/or market.

1.2 "Trademarks" shall mean specifically the Apple Rush (USPTO serial # 3786261) and Ginseng Rush (USPTO serial # 78973828) trademarks as registered with the United States Patent and Trademark Office as when and if used by the Company in connection with the marketing, distribution and sale of the Products pursuant to this Agreement.

1.3 "Territory" shall mean the worldwide market,

2.1 Appointment.

2.2 Appointment. Principal hereby appoints APPLE RUSH COMPANY INC. as the exclusiveLicensee of the Products within the Territory, This includes but is not limited to:

• National, regional or independent chains;

• Natural food stores;

• Club stores;

• Mass merchandising or drug store chains;

• Gourmet or specialty outlets;

• Department stores;

• Food service industry and other institutional sales; and

• Armed forces sales and outlets.

During the Term, Principal agrees: (i) not to distribute or sell, directly or indirectly, the Products in the Territory, (ii) not to license ( see above ) or otherwise authorize any third party to distribute or sell, directly or indirectly, the Products in the Territory, (iii) not to license or otherwise authorize any third party to use the Trademarks in any fashion or for any reason within the Territory, and (iv) to refer all inquiries with respect to the Products received from prospective customers within the Territory to APPLE RUSH COMPANY, INC.

2.3 Acceptance. Apple Rush Company, Inc. hereby accepts the appointment and agrees to exercise commercially reasonable efforts to produce, market, manage and distribute the Products and to maximize the sale of the Products within the Territories as provided herein.

3.1 Fees, Payment and Production.

3.2 Prices. Principal's licensing fees for the Products are set forth on Exhibit "B”, hereto. All fees shall be in U.S. Dollars, and paid as a cost of goods prior to production of each run. Principal will be notified of all production runs 15 days in advance.

3.3 APPLE RUSH COMPANY INC, within one hundred and twenty (120) days of the Effective Date, shall schedule a production run for a minimum of 2000 cases of the Products. If the Company does not schedule the production run within the time set forth herein, it may pay to Principal the licensing fee for the minimum amount of cases (2000cs. per month at $1.75 = $3,500 Per month), which payment will serve to keep the Company in compliance with the terms of this Agreement.

3.5 Resale Prices. APPLE RUSH COMPANY INC. will be solely responsible for establishing its prices to its customers.

4.1 Duties of APPLE RUSH COMPANY INC. and Principal.

4.2 APPLE RUSH COMPANY INC’s Duties. During the Term, APPLE RUSH COMPANY INC. shall have the following duties and obligations:

4.2.1 To exercise its commercially reasonable efforts to maximize the sale and distribution of the Products within the Territory.

4.2.2 To comply with all governmental laws and regulations applicable to the storage, transportation, marketing, advertising and sale of the Products in the Territory hereunder and to its performance of its obligations hereunder.

4.2.3 To maintain products liability and general liability insurance on an occurrence basis in the amount of $5,000,000 to provide Principal with customary certificates of insurance evidencing such coverage within 30 days of its first production run and upon any renewal of such policies, and to promptly notify Principal of any cancellation, non-renewal or material modification of such policies.

4.2.4 To inform Principal of any bona fide threats of litigation due to claimed adulteration of the Products, and to cooperate with Principal, as the Company deems necessary and advisable, to respond to customer complaints and suggestions related to the Products.

4.2.5 To perform activities set forth on Exhibit "C"

4.2.6 To perform any other promise to Principal set forth elsewhere in this agreement.

4.2.7 Principal's Duties. During the Term, Principal shall be to protect Trademarks and Logos, and create Brand Awareness.

5.0 Warranties and Representations.

5.1 Principal warrants and represents that each of the warranties and representations in this Section 5.1 are true at the time of the execution of this Agreement and warrants that the same shall remain true in all material respects during the Term. The warranties and representations are as follows:

5.1.1 That it has the right to use and has the Trademarks, free and clear of all liens, encumbrances, security interests or rights of any party whatsoever, and that it has the full and complete right to license the Trademarks to APPLE RUSH COMPANY INC. as set forth in this Agreement.

5.1.2 That it has not licensed or otherwise authorized any third party to utilize the Trademarks in connection with the sale or distribution of the Products to the Retail Channels within the Territory.

5.1.3 That the Trademarks have been duly registered.

5.1.4 That the Trademarks do not infringe any trademark, trade name, copyright or other intellectual property rights of third parties.

5.1.5 That it is the sole owner of the recipes and formulas for the Products free and clear of all liens, encumbrances, security interests or rights of any party whatsoever.

5.1.6 That the recipes and formulas for the Products do not infringe on any other parties ownership, patent or other proprietary rights.

5.1.7 That there is no pending or threatened claim or litigation related in any way to its ownership or use of the Trademarks or of the recipes and formulas for the Products.

5.1.8 That the execution of this Agreement and the consummation of the transactions contemplated hereby do not conflict with or result in a default or breach under any (a) agreement, indenture, mortgage, contract, bylaws or instrument to which Principal is bound or to which any of its assets is subject, (b) any order, writ, injunction, judgment or decree to which Principal or its assets are bound, or (c) any law or regulation applicable to Principal or by which its assets are bound.

5.1.9 That all of the Products by APPLE RUSH COMPANY INC. during the Term (i) shall be merchantable and of first quality at the time of delivery and shall not be at the time of shipment or delivery, adulterated, misbranded or otherwise prohibited within the meaning of the federal Food and Drug Act, as amended, (the Act) and in effect at the time of such shipment or delivery or within the meaning of any applicable federal, state or municipal law in which restrictions pertaining to adulteration or misbranding are substantially the same as contained in the Act; (ii) shall not, at the time of such shipment or delivery, constitute products which may not be introduced or delivered for introduction into interstate commerce under the provisions of the Act; (iii) shall be products which may be legally transported or sold under the provisions of all other applicable federal, state or municipal laws; and (iv) shall have been manufactured, packaged and labeled in accordance with all applicable governmental requirements in the Territory.

5.1.10 That Principal has been duly incorporated and validly exists as a corporation in good standing under the laws of ILLINOIS with full power and authority to enter into this Agreement and to perform the obligations set forth herein.

5.2 APPLE RUSH COMPANY INC Indemnification Obligation. APPLE RUSH COMPANY INC agrees to indemnify, hold harmless and defend. from any and all costs, claims, damages, losses, liabilities and expenses (including reasonable attorneys' fees through appeal) which PRINCIPAL may incur with respect to tort claims made by a third party pertaining to the failure by Apple Rush Company Inc. to comply with applicable law, claims related to the Products.

6.0 Term of Agreement. This Agreement shall commence as of the Effective Date and shall remain in effect as long as it is renewed by Apple Rush Company Inc. This Agreement shall automatically renew unless Apple Rush Company Inc. does not produce any Products using the Trademarks for any 12 month period.

7.0 Additional Products.

In the event that Apple Rush Company Inc. shall develop any additional Products that it wishes to sell or distribute on a wholesale or retail basis within the Territory, Principal agrees to extend licensing to APPLE RUSH COMPANY INC. as a Product to be manufactured, marketed and distributed by APPLE RUSH COMPANY INC. pursuant to this Agreement with license fees as per Exhibit “B”

8.0 Notices.

All notices and other communications under this Agreement shall be in writing. Notices shall be sent as follows, or to such addresses as maybe designated by either party from time to time.

| As to PRINCIPAL: |

As to APPLE RUSH COMPANY INC.: |

| CORR BRAND’S INC. |

c/o Livewire Ergogenics, Inc. |

| Brandon B. Corr |

Bill Hodson, CEO |

| PO Box 2517 |

24845 Corbit Place |

| Glenview, IL 60025 |

Yorba Linda, CA92887 |

| (312) 823-9648 |

(714) 940-0155 |

| bbcorr@gmail.com |

bhodson@livewireergogenics.com |

9.0 Rights and Obligations of the Parties on Termination. Except as otherwise provided, upon termination of this Agreement for any reason, APPLE RUSH COMPANY INC. shall cease utilizing the Trademarks.

10.0 Miscellaneous.

10.1 No Partnership, Etc. Nothing contained in this Agreement shall be deemed to give any party the power or right to direct or control the day-to-day activities of the other. APPLE RUSH COMPANY INC in all respects of its relationship to Principal and its performance of its duties hereunder shall be, an independent contractor, and neither this Agreement nor anything contained herein shall be deemed or construed to constitute APPLE RUSH COMPANY INC. and Principal as principal and agent, partners, joint ventures, co-owners or otherwise participants in a joint or common undertaking. Neither APPLE RUSH COMPANY INC. nor Principal shall be or become liable or bound by any agreement, representation, act or omission whatsoever of the other party unless specifically provided for in this Agreement or an addendum hereto.

10.2 Entire Agreement. This Agreement is the sole understanding and agreement between the parties with respect to its subject matter. There are no other terms, covenants, conditions, warranties or representations between the parties, whether written or unwritten, not set forth herein. This Agreement supersedes any other such prior or contemporaneous oral or written discussions, agreements, understandings or correspondence. Any revisions to this Agreement must be reduced to writing and signed by both parties.

10.3 Headings and Recitals. The recitals set forth in the beginning of this Agreement and the headings of the Sections and Subsections of this Agreement are inserted solely for convenience of reference and are not a part of this Agreement and shall not in any way affect, govern, limit or aid in the construction of any of the terms or provisions of this Agreement.

10.4 Exhibits. The exhibits attached hereto are incorporated herein and an integral part

10.5 Damages. In the event of a default under this Agreement, neither party shall have the right to sue the other party for any consequential, incidental or special damages as a result of any breach. Further, Principal’s sole remedy for the Company’s failure, inability or unwillingness, for whatever reason, to sell, market and/or distribute, or to use commercially reasonable efforts to sell, market and/or distribute, the Products within the Territory, is to terminate this Agreement. Notwithstanding the foregoing, in no event shall this limitation apply to indemnification obligations set forth herein or to damages from breach of confidentiality obligations under this Agreement.

10.6 Force Majeure. Neither party shall be liable for any loss, damage or delay resulting from any unavoidable, unforeseeable cause whatsoever beyond its reasonable control, including, without limitation, fire; flood; action or decree of civil or military authority; insurrection; act of war, terrorism or bioterrorism; or embargo. Written notice with full details of any circumstances referenced herein shall be given by the affected party to the other party within ten (10) days after any such occurrence.

10.7 Construction. This Agreement was prepared by both parties with the assistance of counsel; thus any rule of construction against the draftsman shall not be applicable.

10.8 Choice of Law; Venue. This Agreement will be construed and enforced in accordance with and governed by the laws of the State of Illinois and the federal law of the United States without reference to principles of conflicts of law.

10.9 Waiver of Statute of Limitations. Notwithstanding any statute of limitations of longer duration to the contrary, the parties agree that any action to resolve a controversy, claim or breach arising out of or relating to this Agreement shall be commenced within the earlier of six months of the Termination Date or the date that such controversy, claim or breach arose.

10.10 Assignment. Neither party shall assign, pledge or otherwise encumber its rights or obligations under this Agreement without the prior written consent of the other party, which consent shall not be unreasonably withheld. conditioned or delayed. APPLE RUSH COMPANY INC. may assign this Agreement to an affiliate that is wholly owned by APPLE RUSH COMPANY INC In the event of a corporate reorganization, merger, consolidation. sale or transfer, of all or substantially all of its assets or equity, both parties may assign their rights and obligation under this Agreement without the consent of the other party. The parties agree that any assignment or pledge in contravention of this provision shall be deemed null and void.

10.11 No Third Party Beneficiary Intent. Nothing contained herein shall be deemed to create any third party beneficiary rights in any party.

11.0 Cancellation.

11.1 Principal and APPLE RUSH COMPANY INC. agree to cooperate in developing a Sales Plan promptly following the execution of this Agreement. It is agreed that APPLE RUSH COMPANY INC does not promise or warrant that it will meet the sales goals set forth in the Sales Plan for any Contract Year, it being understood APPLE RUSH COMPANY INC ability to meet the sales goals depends, in part, on many factors beyond its control. Notwithstanding the foregoing, APPLE RUSH COMPANY INC. agrees to use commercially reasonable efforts to meet the sales goals as set forth in the Sales Plan.

11.2 In the event that either party breaches any of its promises or obligations under this Agreement, such party shall have a period of thirty (30) days from receipt of a written notice of breach from the other party to cure the breach or, in the case of non-monetary breaches which cannot practicably be cured within the aforesaid period, to commence actions to cure the breach and to proceed diligently to do so (the "Cure Period."). In the event such other party fails to cure such breach within the Cure Period, the non-breaching party may terminate this Agreement upon an additional fifteen (15) days' prior written notice to the other party.

11.3 Either Party may terminate this Agreement effective immediately upon the delivery of written notice to the other party in the event that either party commits any act at any time that materially adversely affects or harms the business or reputation of the other party or materially adversely affects or harms the ability of the other party to sell the Products.

11.4 This Agreement may be terminated immediately by either party in the event the other party; (i) files or has filed an involuntarily petition against it (if the involuntary petition is not withdrawn within thirty (30) days of filing) against it under the United States Bankruptcy Code or under or pursuant to any state bankruptcy act or under any similar federal or state law, provided however, this provision does not apply in the case of either party, or any of their affiliates, being a party to the initiation of an involuntary petition against the other party; or (ii) is convicted of, pleads guilty to, or enters a plea of no contest to, the violation of any law or regulation relating to the manufacture, processing, distribution, marketing, or sale of products.

12.0 Confidentiality. From time to time during the Term, both parties may become privy to certain proprietary, confidential or sensitive business information pertaining to the other party, including,... without limitation, business, financial or technical information or data of either party, such as customer lists and key contact information; business and marketing strategies; financial projections; confidential business information; operating margins and pricing policies; formulae; recipes; and other information marked or identified as confidential, provided that such information is confidential in nature according to standard industry practice ("Confidential Information"). The receiving party agrees to hold the Confidential Information in the strictest confidence and to refrain from disclosing such information to third parties (except to its legal, financial and insurance counsel and auditors), directly or indirectly, during the Term or thereafter, except as required by law or regulation or with the prior written consent of the other party or by an order of a court of competent jurisdiction.

13.0 Counterparts/Facsimile Signatures. This Agreement may be executed in one or more counterparts, each of which when so signed shall be deemed to be an original, and such counterparts together shall constitute one and the same instrument. In lieu of the original, a facsimile transmission or copy of the original shall be as effective and enforceable as the original.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by an authorized representative of each party as of the day and year first written above.

PRINCIPAL:

Corr Brands, Inc.,

an Illinois corporation

By: ____________________________________

Brandon B. Corr, President

THE COMPANY:

Apple Rush Company, Inc.,

a Texas corporation

By:_____________________________________

David E. Torgerud, President

EXHIBIT “A" TRADEMARKS

APPLE RUSH

GINSENG RUSH

EXHIBIT "B" LICENSE FEE

APPLE RUSH 24 - 12 ounce bottles (per case) Fee = $ 1.75 per case

The license fee above is for Bottled Beverages.

Other future Products as per the agreement above.

EXHIBIT "C"

APPLE RUSH COMPANY INC. shall perform the following activities:

(i) Provide reasonable amounts of P.O.S. and P.O.P materials to the Retail Channels.

(ii) Advertise and promote the Product through applicable trade publications and through in housesale promotions, sales materials and newsletters.

(iii) Offer the Product for sale through Retail Channels and Distribution

(iv) Provide prompt and efficient deliveries

(v) Provide monthly sales reports.

(vi) Provide samples of advertising and promotional materials used by APPLE RUSH COMPANYINC. to Principal if requested by Principal.

(vii) Respond to all sales inquiries in a timely manner.

Page 8 of 8

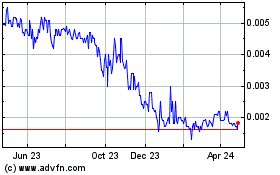

Livewire Ergogenics (PK) (USOTC:LVVV)

Historical Stock Chart

From Mar 2024 to Apr 2024

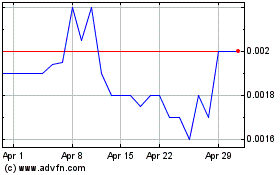

Livewire Ergogenics (PK) (USOTC:LVVV)

Historical Stock Chart

From Apr 2023 to Apr 2024