Current Report Filing (8-k)

July 10 2019 - 5:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 3, 2019

LIQUIDMETAL TECHNOLOGIES, INC.

(

Exact name of Registrant as Specified in its Charter

)

|

Delaware

|

001-31332

|

33-0264467

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

20321 Valencia Circle

Lake Forest, CA 92630

(Address of Principal Executive Offices; Zip Code)

Registrant’s telephone number, including area code:

(949) 635-2100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.001 par value per share

|

LQMT

|

OTCQB

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item

2.05

|

Costs Associated with Exit or Disposal Activities

|

As part of the previously announced comprehensive review of Liquidmetal Technologies, Inc.’s (the “Company”) operating strategy, the Company’s board of directors has approved a corporate restructuring plan proposed by management (“the Restructuring Plan”) pursuant to which the Company intends to wind down its manufacturing operations at the Company’s Lake Forest, CA facility and seek to outsource the manufacture of parts utilizing the Company’s technology through its domestic and international manufacturing partners. The Company will seek to identify and develop additional strategic partners to engage in domestic manufacturing efforts. In addition, the Restructuring Plan includes reductions in operational costs and employee headcount, with the goal of preserving and maximizing the value of the Company’s assets. Pursuant to the Restructuring Plan, the Company intends to dispose of equipment that is not expected to be utilized prospectively, lease the Company’s operating facility to a commercial tenant, and identify additional opportunities in order to realize the full value of the Company’s intellectual property.

Total pre-tax charges associated with the Restructuring Plan are expected to be approximately $250,000. Most charges are expected to be incurred during the third quarter of 2019. The charges are expected to be related to employee severance, retention, early contract termination and other restructuring related costs. The Company expects to reduce headcount by approximately 15 employees as a result of these actions. As the Company completes these actions over the coming months, additional charges and headcount reductions could occur.

|

Item 2.06

|

Material Impairments

|

The Company has concluded that non-cash impairment charges to the Company’s long-lived assets are required under generally accepted accounting principles of the United States as a result of the above-described Restructuring Plan. In connection with the Restructuring Plan, discussed in Item 2.05 above, the Company has reevaluated the asset grouping and future use of its manufacturing assets.

The Company considers the approval of the Restructuring Plan be a triggering event that will require the Company to perform an impairment analysis of its manufacturing assets, utilizing different asset group assumptions than those previously considered. This analysis will be performed as of June 30, 2019. While quantitative amounts are not yet estimable, the Company expects to record a material non-cash impairment charge as part of its June 30, 2019 consolidated financial statements. Final amounts will be included in the Company’s next Quarterly Report on Form 10-Q or in an amendment to this Form 8-K.

Item 7.01. Regulation FD Disclosure.

The Company has issued a press release, dated July 10, 2019, relating to the Restructuring Plan. The press release is attached to this Form 8-K as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

.

Exhibit Number

Description

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunder duly authorized.

|

|

LIQUIDMETAL TECHNOLOGIES, INC.

|

|

|

|

|

|

By: /s/ Bryce Van

|

|

|

Bryce Van,

|

|

|

Vice President- Finance

|

|

|

|

|

Date: July 10, 2019

|

|

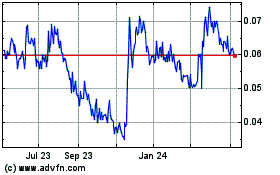

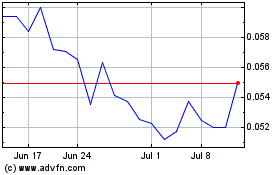

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Apr 2023 to Apr 2024