Filed

Pursuant to Rule 424(b)(3)

Registration

No. 333-225049

Prospectus Supplement

(to Prospectus dated

July 23, 2018)

Jones

Soda Co.

Up

to 11,315,000 Shares of Common Stock

This

prospectus supplement supplements the prospectus, dated July 23, 2018 (the “Prospectus”), which forms a part of our

Amendment No. 1 to our Registration Statement on Form S-3 on Form S-1 (Registration No. 333-225049). This prospectus supplement

is being filed to update, amend and supplement the information included or incorporated by reference in the Prospectus with the

information contained in our current report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”)

on August 8, 2019 (the “Current Report”). Accordingly, we have attached the Current Report (including exhibits) to

this prospectus supplement.

The

Prospectus and this prospectus supplement relates to the sale of up to 11,315,000 shares of our common stock which may be resold

from time to time by the selling shareholders identified in the Prospectus. The shares of common stock covered by the Prospectus

and this prospectus supplement

are issuable upon the conversion of a portion or all

of the convertible subordinated promissory notes (the “Convertible Notes”) issued pursuant to that certain Note Purchase

Agreement dated as of March 23, 2018 among the Company and the purchasers of the Convertible Notes

.

We are not selling any common stock under the Prospectus and this prospectus supplement and will not receive any of the proceeds

from the sale or other disposition of shares by the selling shareholders.

This

prospectus supplement should be read in conjunction with the Prospectus. This prospectus supplement updates, amends and supplements

the information included or incorporated by reference in the Prospectus. If there is any inconsistency between the information

in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our

common stock is listed for quotation on the OTCQB quotation system under the symbol “JSDA.” The last bid price of our

common stock on August 7, 2019 was $0.655 per share.

Investing

in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading

“

Risk Factors

” of the Prospectus, and under similar headings in any amendment or

supplements to the Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of the Prospectus or this prospectus supplement. Any representation to the contrary is a criminal

offense.

The

date of this prospectus supplement is August 8, 2019.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported):

August 5, 2019

Jones Soda Co.

(Exact Name of Registrant as Specified in Charter)

|

Washington

|

0-28820

|

52-2336602

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

66 South Hanford Street, Suite 150, Seattle, Washington 98134

|

|

(Address of Principal Executive Offices) (Zip Code)

|

(206) 624-3357

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2019, Jones Soda Co. (the “

Company

”) issued a press release announcing its financial results for the quarter ended June 30, 2019. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The Company will discuss its results for the quarter ended June 30, 2019 on its scheduled conference call today, August 8, 2019, at 4:30 p.m. Eastern time (1:30 p.m. Pacific time). This call will be webcast and can be accessed by visiting http://public.viavid.com/player/index.php?id=135692 or our website at

www.jonessoda.com

. Investors may also listen to the call via telephone by dialing (800) 479-1004 (confirmation code: 8209705

).

In addition, a telephone replay will be available by dialing (844) 512-2921 (confirmation code: 8209705) through August 15, 2019, at 7:30 p.m. Eastern Time.

The information in this Current Report in Item 2.02 and Exhibit 99.1 is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”) or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Director Resignations

On August 5, 2019, Vanessa Walker informed the Company that she would resign from the Board of Directors (the “

Board

”) of the Company effective immediately due to personal reasons and time considerations. Ms. Walker’s resignation was not the result of any disagreement between Ms. Walker and the Company, its management, Board of Directors or any committee of the Board of Directors, or with respect to any matter relating to the Company’s operations, policies or practices. As there are no disagreements as contemplated by Item 5.02(a) of Form 8-K, and the Company is disclosing this information pursuant to Item 5.02(b) of Form 8-K.

On August 6, 2019, Ray Silcock informed the Company that he would resign from the Board effective immediately due to personal reasons and time considerations. Mr. Silcock’s resignation was not the result of any disagreement between Mr. Silcock and the Company, its management, Board of Directors or any committee of the Board of Directors, or with respect to any matter relating to the Company’s operations, policies or practices. As there are no disagreements as contemplated by Item 5.02(a) of Form 8-K, and the Company is disclosing this information pursuant to Item 5.02(b) of Form 8-K.

Appointment of New Directors

On August 6, 2019, upon the recommendation of the Nominating Committee of the Board and in accordance with the Company’s Amended and Restated Bylaws (the “

Bylaws

”), appointed Paul Norman and Clive Sirkin to fill two existing vacancies on the Board. This appointment was made in accordance with Section 2 of that certain Investor Rights Agreement dated July 11, 2019 (the “

IRA

”) entered into by the Company, Heavenly Rx Ltd. (“

HeavenlyRx

”) and certain of the Company’s shareholders (filed as Exhibit 10.3 to the Company’s current report on Form 8-K filed on July 12, 2019 and incorporated herein by reference). Each of Messrs. Norman and Sirkin are “Investor Designees” of HeavenlyRx, as defined in the IRA. Each of Messrs. Norman and Sirkin’s term of office will expire at the Company’s 2020 annual meeting of shareholders, or his earlier resignation, death or removal.

Since June 2019, Paul Norman has been chairman and CEO of HeavenlyRx, where he is focused on developing a long-term strategic direction and growing the company’s brand portfolio. Previously, Norman spent over 30 years at the Kellogg Company, a multinational food manufacturing company, and most recently served as president of the company’s North American operations from April 2015 to April 2018. During his multi-decade career at Kellogg, Norman led various transformation efforts through strategic portfolio innovation and management that resulted in long-term, profitable growth. Norman holds a bachelor’s degree in French studies from the University of Portsmouth, and previously was a board member for the Grocery Manufacturers Association, where he served on the executive committee.

Clive Sirkin is a seasoned marketing executive who has held various executive roles in large, multinational CPG companies. Most recently, from December 2015 to February 2019, he served as chief growth officer at the Kellogg Company, where he was responsible for overseeing sales and marketing strategies, along with leading product innovation and R&D efforts. Prior to Kellogg, from February 2012 to November 2015 , Sirkin held the role of chief marketing officer at Kimberly-Clark, a multinational personal care company, in which he oversaw all marketing operations across the business-to-business and business-to-consumer divisions. Sirkin holds a bachelor’s degree in marketing and economics from the University of Witwatersrand in South Africa. He currently serves on the board of directors for Screendragon, Generation UCAN and 70 Faces Media.

Each of Messrs. Norman and Sirkin will be eligible to participate in the Company’s amended compensation plan for non-employee directors in effect and as amended from time to time, as described in the Company’s proxy statement on Schedule 14A for its 2019 Annual Meeting of Shareholders filed with the Securities and Exchange Commission on March 26, 2019.

A copy of the Company’s press release announcing the resignations of Ms. Walker and Mr. Silcock and the appointment of Messrs. Norman and Sirkin is filed with this report as Exhibit 99.2, and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press Release dated August 8, 2019.

|

|

|

|

99.2

|

|

Press Release dated August 8, 2019.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Jones Soda Co.

|

|

|

|

|

|

|

|

|

|

Date: August 8, 2019

|

By:

|

/s/ Jennifer L. Cue

|

|

|

|

Jennifer L. Cue

|

|

|

|

President, Chief Executive Officer and Acting Principal Financial Officer

|

|

|

|

|

EXHIBIT 99.1

Jones Soda Reports Second Quarter 2019 Results

SEATTLE, Aug. 08, 2019 (GLOBE NEWSWIRE) -- Jones Soda Co. (the “Company”) (OTCQB: JSDA), a leader in the craft soda category and known for its unique branding and authentic connection to its consumers, today announced results for the second quarter ended June 30, 2019.

Second Quarter 2019 Financial Summary vs. Year-Ago Quarter

-

Revenue was $3.5 million compared to $3.9 million.

-

Gross profit as a percentage of sales was 22.6% compared to 23.2%.

-

Net loss was $576,000, or $(0.01) per share, compared to a net loss of $363,000, or $(0.01) per share.

-

Adjusted EBITDA

1

was $(357,000) compared to $(235,000).

Management Commentary

“In the second quarter, we experienced a difficult revenue comparison to the prior year period as we did not repeat several limited time offerings in our fountain business,” said Jennifer Cue, CEO of Jones Soda. “Despite this headwind, we still remain very confident in this business as we have a strong pipeline of new opportunities with demand for craft soda continuing to grow. During the quarter, we also made good progress in Canada as we returned to growth primarily driven by robust demand across a number of retailers.

“Our partnership with 7-Eleven USA remains strong with our private label 7-Select segment experiencing a 44% year-over-year increase in revenue. Towards the end of the quarter, we also launched into an additional 1,000 locations and introduced several new programs, which began in June. The initial feedback on these new products has been great, particularly with the Airheads Cherry Pineapple Blast soda, and we expect to continue expanding our relationship with 7-Eleven.

“Subsequent to the quarter’s end, we announced a transformational financing agreement with Heavenly Rx, a SOL Global portfolio company, that provided a significant cash infusion, along with multiple strategic benefits. Through this partnership, we have begun working closely with their team on new product innovations, particularly focusing on the development of a CBD-infused beverage line utilizing Jones’ unique brand image. We have also entered into discussions to further bolster our sales and marketing efforts, enhance our existing product portfolio, and significantly expand our presence through HeavenlyRx’s deep relationships with retail chains and QSRs across the country.

“Looking forward, we are very confident in the direction of our business and believe the HeavenlyRx partnership best positions us to significantly grow our brand. As we begin expanding into new product lines and geographies, along with enhancing our current portfolio, we will remain committed to maintaining Jones’ independent, rebellious and fun brand image that customers have come to love.”

Second Quarter 2019 Financial Results

Revenue in the second quarter of 2019 was $3.5 million compared to $3.9 million for the same quarter a year ago. This was primarily a result of a 54% decrease in fountain revenue, which is attributed to several limited time offerings for a customer chain in 2018 that were not repeated in 2019, offset by a 44% increase in 7-Select revenue.

Gross profit as a percentage of sales was 22.6% for the second quarter of 2019 compared to 23.2% in the same quarter a year ago. The decrease was primarily driven by logistical issues associated with the rollout to Walmart locations in the US.

Net loss for the second quarter of 2019 was $576,000, or $(0.01) per share, compared to a net loss of $363,000, or $(0.01) per share, in the same quarter a year ago.

Adjusted EBITDA

1

in the second quarter of 2019 was $(357,000) compared to $(235,000) in the same quarter a year ago.

At June 30, 2019, cash and cash equivalents totaled $138,000 compared to $1.0 million at December 31, 2018. The Company’s line of credit balance at the end of the second quarter totaled $1.2 million compared to $428,000 at December 31, 2018. Subsequent to the quarter end, on July 11, 2019, the company completed a strategic financing through a stock purchase agreement with HeavenlyRx in which 15.0 million shares were purchased at a price of $0.60 per share for a total of $9.0 million.

_____________________

1

Adjusted EBITDA is defined as net loss from operations before interest, taxes, depreciation, amortization and stock-based compensation and is a non-GAAP measure (reconciliation provided below).

Conference Call

Jones Soda will hold a conference call today at 4:30 p.m. Eastern time to discuss its results for the second quarter ended June 30, 2019.

Date: Thursday, August 8, 2019

Time: 4:30 p.m. Eastern time (1:30 p.m. Pacific time)

Toll-free dial-in number: 1-800-479-1004

International dial-in number: 1-323-794-2598

Conference ID: 8209705

Please call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 1-949-574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website at www.jonessoda.com.

A replay of the conference call will be available after 7:30 p.m. Eastern time on the same day through August 15, 2019.

Toll-free replay number: 1-844-512-2921

International replay number: 1-412-317-6671

Replay ID: 8209705

Presentation of Non-GAAP Information

This press release contains disclosure of the Company's Adjusted EBITDA, which is a not a United States Generally Accepted Accounting Principle (“GAAP”) financial measure. The difference between Adjusted EBITDA (a non-GAAP measure) and Net Loss (the most comparable GAAP financial measure) is the exclusion of interest expense, income tax expense, depreciation and amortization expense and stock-based compensation. We have included a reconciliation of Adjusted EBITDA to Net Loss in our Non-GAAP Reconciliation in this press release. This non-GAAP measure should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP. Adjusted EBITDA has certain limitations in that it does not take into account the impact of certain expenses to our consolidated statements of operations. In addition, because Adjusted EBITDA may not be calculated identically by all companies, the presentation here may not be comparable to other similarly titled measures of other companies. We believe that Adjusted EBITDA provides useful information to investors about the Company's results attributable to operations, in particular by eliminating the impact of non-cash charges related to stock-based compensation, amortization and depreciation that is consistent with the manner in which we evaluate the Company's performance. These adjustments to the Company's GAAP results are made with the intent of providing a more complete understanding of the Company's underlying operational results and provide supplemental information regarding our current ability to generate cash flow. This non-GAAP financial measure is not intended to be considered in isolation or as a replacement for, or superior to net loss as an indicator of the Company's operating performance, or cash flow, as a measure of its liquidity. Adjusted EBITDA should be reviewed in conjunction with Net Loss as calculated in accordance with GAAP.

About Jones Soda Co.

Headquartered in Seattle, Washington, Jones Soda Co.® (OTCQB: JSDA) markets and distributes premium beverages under the Jones® Soda and Lemoncocco ® brands. A leader in the premium soda category, Jones Soda is known for its variety of flavors, made with cane sugar and other high quality ingredients and incorporating always-changing photos sent in from its consumers. The diverse product line of Jones offers something for everyone – pure cane sugar soda, zero-calorie soda and Lemoncocco ® non-carbonated premium refreshment. Jones Soda is sold across North America in glass bottles, cans and on fountain through traditional beverage outlets, restaurants and alternative accounts. For more information, visit www.jonessoda.com or www.myjones.com or www.drinklemoncocco.com

Forward-Looking Statements Disclosure

Certain statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all passages containing words such as “will,” “aims,” “anticipates,” “becoming,” “believes,” “continue,” “estimates,” “expects,” “future,” “intends,” “plans,” “predicts,” “projects,” “targets,” or “upcoming.” Forward-looking statements also include any other passages that are primarily relevant to expected future events or that can only be evaluated by events that will occur in the future. Forward-looking statements are based on the opinions and estimates of management at the time the statements are made and are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Factors that could affect the Company's actual results include, among others: its ability to successfully execute on its growth strategies and operating plans for the future; the Company’s ability to effectively utilize the proceeds from its recent $9 million strategic financing from HeavenlyRx; the Company’s ability to develop and introduce new products to satisfy customer preferences and respond to changes in consumer demand or market acceptance for its products; the Company’s ability to develop CBD-infused beverages; the Company’s ability to manage operating expenses and generate sufficient cash flow from operations; the Company’s ability to maintain and expand distribution arrangements with distributors, independent accounts, retailers or national retail accounts; consumer response to and market acceptance of the Company’s new products; competition in the Company’s industry, particularly from Coke and Pepsi as well as other producers of craft beverages; imposition of new taxes, including potential taxes on sugar-sweetened beverages; changes in pricing and SKUs of its products; its ability to maintain relationships with manufacturers of its products; its ability to maintain a consistent and cost-effective supply of raw materials and flavors; its ability to maintain brand image and product quality; its ability to attract, retain and motivate key personnel; fluctuations in freight and fuel costs; the impact of currency rate fluctuations; its ability to protect its intellectual property; the impact of future litigation; its ability to access the capital markets for any future equity financing, and any actual or perceived limitations by being traded on the OTCQB Marketplace. More information about factors that potentially could affect the Company’s operations or financial results is included in its most recent annual report on Form 10-K for the year ended December 31, 2018 filed with the Securities and Exchange Commission (“SEC”) on March 22, 2019 and in the other reports filed with the SEC since that that date. Readers are cautioned not to place undue reliance upon these forward-looking statements that speak only as to the date of this release. Except as required by law, the Company undertakes no obligation to update any forward-looking or other statements in this press release, whether as a result of new information, future events or otherwise.

Investor Relations Contact

Cody Slach

Gateway Investor Relations

1-949-574-3860

JSDA@gatewayir.com

finance@jonessoda.com

JONES SODA CO.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30,

|

|

Six months ended June 30,

|

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

|

|

Revenue

|

$

|

3,489

|

|

|

$

|

3,927

|

|

|

$

|

6,313

|

|

|

$

|

6,764

|

|

|

Cost of goods sold

|

|

2,702

|

|

|

|

3,014

|

|

|

|

4,959

|

|

|

|

5,235

|

|

|

Gross profit

|

|

787

|

|

|

|

913

|

|

|

|

1,354

|

|

|

|

1,529

|

|

|

Gross profit %

|

|

22.6

|

%

|

|

|

23.2

|

%

|

|

|

21.4

|

%

|

|

|

22.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling and marketing

|

|

638

|

|

|

|

661

|

|

|

|

1,253

|

|

|

|

1,215

|

|

|

General and administrative

|

|

550

|

|

|

|

534

|

|

|

|

1,208

|

|

|

|

1,073

|

|

|

|

|

1,188

|

|

|

|

1,195

|

|

|

|

2,461

|

|

|

|

2,288

|

|

|

Loss from operations

|

|

(401

|

)

|

|

|

(282

|

)

|

|

|

(1,107

|

)

|

|

|

(759

|

)

|

|

Interest expense

|

|

(173

|

)

|

|

|

(77

|

)

|

|

|

(262

|

)

|

|

|

(98

|

)

|

|

Other income (expense), net

|

|

7

|

|

|

|

6

|

|

|

|

9

|

|

|

|

40

|

|

|

Loss before income taxes

|

|

(567

|

)

|

|

|

(353

|

)

|

|

|

(1,360

|

)

|

|

|

(817

|

)

|

|

Income tax expense, net

|

|

(9

|

)

|

|

|

(10

|

)

|

|

|

(12

|

)

|

|

|

(15

|

)

|

|

Net loss

|

$

|

(576

|

)

|

|

$

|

(363

|

)

|

|

$

|

(1,372

|

)

|

|

$

|

(832

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted

|

$

|

(0.01

|

)

|

|

$

|

(0.01

|

)

|

|

$

|

(0.03

|

)

|

|

$

|

(0.02

|

)

|

|

Weighted average basic and diluted common shares outstanding

|

|

42,394,860

|

|

|

|

41,464,373

|

|

|

|

41,996,071

|

|

|

|

41,464,373

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JONES SODA CO.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share data)

|

|

|

|

June 30, 2019

|

|

December 31, 2018

|

|

|

(Unaudited)

|

|

|

|

|

ASSETS

|

|

(In thousands, except share data)

|

|

Current assets:

|

|

|

|

|

|

|

Cash and cash equivalents

|

$

|

138

|

|

|

$

|

991

|

|

|

Accounts receivable, net of allowance of $41 and $40

|

|

2,391

|

|

|

|

1,362

|

|

|

Inventory

|

|

2,102

|

|

|

|

1,349

|

|

|

Prepaid expenses and other current assets

|

|

227

|

|

|

|

245

|

|

|

Total current assets

|

|

4,858

|

|

|

|

3,947

|

|

|

Fixed assets, net of accumulated depreciation of $456 and $489

|

|

175

|

|

|

|

88

|

|

|

Other assets

|

|

33

|

|

|

|

33

|

|

|

Right of use lease asset

|

|

66

|

|

|

|

-

|

|

|

Total assets

|

$

|

5,132

|

|

|

$

|

4,068

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

Accounts payable

|

$

|

2,050

|

|

|

$

|

1,058

|

|

|

Line of credit

|

|

1,166

|

|

|

|

428

|

|

|

Accrued expenses

|

|

873

|

|

|

|

614

|

|

|

Lease liability

|

|

70

|

|

|

|

-

|

|

|

Taxes payable

|

|

3

|

|

|

|

-

|

|

|

Total current liabilities

|

|

4,162

|

|

|

|

2,100

|

|

|

Convertible subordinated notes payable, net

|

|

1,982

|

|

|

|

2,528

|

|

|

Accrued interest expense

|

|

166

|

|

|

|

135

|

|

|

Deferred rent

|

|

-

|

|

|

|

8

|

|

|

Shareholders’ equity (deficit):

|

|

|

|

|

|

|

Common stock, no par value:

|

|

|

|

|

|

|

Authorized — 100,000,000; issued and outstanding shares — 43,955,282 shares and 41,464,373 shares, respectively

|

|

54,589

|

|

|

|

53,822

|

|

|

Additional paid-in capital

|

|

9,478

|

|

|

|

9,389

|

|

|

Accumulated other comprehensive income

|

|

337

|

|

|

|

296

|

|

|

Accumulated deficit

|

|

(65,582

|

)

|

|

|

(64,210

|

)

|

|

Total shareholders’ equity (deficit)

|

|

(1,178

|

)

|

|

|

(703

|

)

|

|

Total liabilities and shareholders’ equity (deficit)

|

$

|

5,132

|

|

|

$

|

4,068

|

|

|

|

|

JONES SODA CO.

NON-GAAP RECONCILIATION

(Unaudited, In thousands)

|

|

Three months ended June 30,

|

|

Six months ended June 30,

|

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

GAAP net loss

|

$

|

(576)

|

|

$

|

(363)

|

|

$

|

(1,372)

|

|

$

|

(832)

|

|

Stock based compensation

|

|

26

|

|

|

34

|

|

|

89

|

|

|

83

|

|

Interest expense

|

|

173

|

|

|

77

|

|

|

262

|

|

|

98

|

|

Income tax expense, net

|

|

9

|

|

|

10

|

|

|

12

|

|

|

15

|

|

Depreciation

|

|

11

|

|

|

7

|

|

|

19

|

|

|

11

|

|

Non-GAAP Adjusted EBITDA

|

$

|

(357)

|

|

$

|

(235)

|

|

$

|

(990)

|

|

$

|

(625)

|

EXHIBIT 99.2

Jones Soda Appoints Former Kellogg’s Executives to its Board of Directors

– Paul Norman and Clive Sirkin Join Jones’ Board as Company Introduces New Strategies to the Portfolio and its Upcoming Launch of CBD Beverage Line –

SEATTLE, Aug. 08, 2019 (GLOBE NEWSWIRE) -- Jones Soda Co. (the “Company”) (OTCQB: JSDA), a leader in the craft soda category known for its unique branding and authentic connection to its consumers, has appointed Paul Norman and Clive Sirkin to its board of directors. The two appointments were nominated by Heavenly Rx Ltd. (“HeavenlyRx”) in connection with its strategic financing agreements with the Company and certain other Company shareholders. In addition, both Vanessa Walker and Ray Silcock will be stepping down from the Company’s board of directors, which will now consist of five members and two vacancies, for a total of seven board seats.

Norman is currently chairman and CEO of HeavenlyRx, where he is focused on developing a long-term strategic direction and growing the company’s brand portfolio. Previously, Norman spent over 30 years at the Kellogg Company, a multinational food manufacturing company, and most recently served as president of the company’s North American operations. During his multi-decade career at Kellogg, Norman led various transformation efforts through strategic portfolio innovation and management that resulted in long-term, profitable growth.

Sirkin is a seasoned marketing executive who has held various executive roles in large, multinational CPG companies. Most recently, he served as chief growth officer at the Kellogg Company, where he was responsible for overseeing sales and marketing strategies, along with leading product innovation and R&D efforts. Prior to Kellogg, Sirkin held the role of chief marketing officer at Kimberly-Clark, a multinational personal care company, in which he oversaw all marketing operations across the business-to-business and business-to-consumer divisions. Mr. Sirkin is also an independent contractor to HeavenlyRx.

“Paul and Clive are industry veterans that bring a significant amount of expertise and knowledge in growing CPG brands to our board of directors,” said Jennifer Cue, CEO of Jones Soda. “Both of them have proven backgrounds in implementing and executing various strategies to expand the portfolios and footprints of household brand names. We believe they will be invaluable assets as we look to accelerate growth within our current portfolio and enter into new markets.”

Norman holds a bachelor’s degree in French studies from the University of Portsmouth, and previously was a board member for the Grocery Manufacturers Association, where he served on the executive committee. Sirkin holds a bachelor’s degree in marketing and economics from the University of Witwatersrand in South Africa. He currently serves on the board of directors for Screendragon, Generation UCAN and 70 Faces Media.

About Jones Soda Co.

Headquartered in Seattle, Washington, Jones Soda Co.® (OTCQB: JSDA) markets and distributes premium beverages under the Jones® Soda and Lemoncocco® brands. A leader in the premium soda category, Jones Soda is made with pure cane sugar and other high-quality ingredients, and is known for packaging that incorporates ever-changing photos sent in from its consumers. Jones’ diverse product line offers something for everyone – pure cane sugar soda, zero-calorie soda and Lemoncocco non-carbonated premium refreshment. Jones is sold across North America in glass bottles, cans and on fountain through traditional beverage outlets, restaurants and alternative accounts. For more information, visit www.jonessoda.com or www.myjones.com or www.drinklemoncocco.com.

Forward-Looking Statements Disclosure

Certain statements in this press release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all passages containing words such as “will,” “aims,” “anticipates,” “becoming,” “believes,” “continue,” “estimates,” “expects,” “future,” “intends,” “plans,” “predicts,” “projects,” “targets,” or “upcoming.” Forward-looking statements also include any other passages that are primarily relevant to expected future events or that can only be evaluated by events that will occur in the future. Forward-looking statements are based on the opinions and estimates of management at the time the statements are made and are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Factors that could affect the Company's actual results include, among others: its ability to successfully execute on its growth strategies and operating plans for the future; the Company’s ability to effectively utilize the proceeds from its recent $9 million strategic financing from HeavenlyRx; the Company’s ability to develop and introduce new products to satisfy customer preferences and respond to changes in consumer demand or market acceptance for its products; the Company’s ability to develop CBD-infused beverages; the Company’s ability to manage operating expenses and generate sufficient cash flow from operations; the Company’s ability to maintain and expand distribution arrangements with distributors, independent accounts, retailers or national retail accounts; consumer response to and market acceptance of the Company’s new products; competition in the Company’s industry, particularly from Coke and Pepsi as well as other producers of craft beverages; imposition of new taxes, including potential taxes on sugar-sweetened beverages; changes in pricing and SKUs of its products; its ability to maintain relationships with manufacturers of its products; its ability to maintain a consistent and cost-effective supply of raw materials and flavors; its ability to maintain brand image and product quality; its ability to attract, retain and motivate key personnel; fluctuations in freight and fuel costs; the impact of currency rate fluctuations; its ability to protect its intellectual property; the impact of future litigation; its ability to access the capital markets for any future equity financing, and any actual or perceived limitations by being traded on the OTCQB Marketplace. More information about factors that potentially could affect the Company’s operations or financial results is included in its most recent annual report on Form 10-K for the year ended December 31, 2018 filed with the Securities and Exchange Commission (“SEC”) on March 22, 2019 and in the other reports filed with the SEC since that that date. Readers are cautioned not to place undue reliance upon these forward-looking statements that speak only as to the date of this release. Except as required by law, the Company undertakes no obligation to update any forward-looking or other statements in this press release, whether as a result of new information, future events or otherwise.

Investor Relations Contact:

Cody Slach

Gateway Investor Relations

1-949-574-3860

JSDA@gatewayir.com

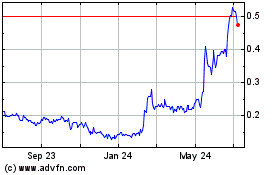

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

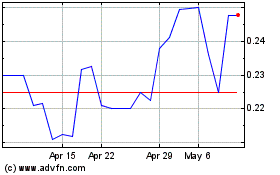

Jones Soda (QB) (USOTC:JSDA)

Historical Stock Chart

From Apr 2023 to Apr 2024