Integrated Ventures Reports Q2/2020 Featuring 54% Revenue Growth And A Significant Reduction Of Operational Expenses

February 11 2020 - 9:45AM

InvestorsHub NewsWire

Integrated Ventures Reports Q2/2020

Featuring 54% Revenue Growth And A Significant Reduction Of

Operational Expenses

PHILADELPHIA, PA -- February 11, 2020 --

InvestorsHub NewsWire

-- Integrated Ventures Inc. (OTCQB: INTV)

(“Company”) is pleased to confirm the filing with SEC

of its

Q2 (“Form 10Q”), for financial period, ending December 31,

2019.

Financial analysis and key highlights are listed

below:

-

For the 3 months, ended December 31,

2019, the Company had generated total revenues of $134,301 vs

$87,470, for period ended December 31, 2018, which equates to 54%

growth rate. Company reported a

significant reduction in total general and administrative expenses

from $173,512, for the 3 months, as of December 31, 2018, to

$87,140, as of December 31, 2019.

-

For the 6 months, ended December 31,

2019, the Company had generated total revenues of $243,142 vs

$202,715, for period ended December 31, 2018, which equates to 20%

growth rate. Company reported a

significant reduction in total general and administrative expenses

from $730,434 (excluding one time impairment of assets charge), for

the 6 months, as of December 31, 2018, to $194,525, as of December

31, 2019.

-

As of December 31, 2019, the Company's

total assets were valued at $978,911.

-

For the same financial period, the

Company had reported a positive total stockholders’ equity of

$987,911.

-

The Company had invested $117,954 into

purchases of Antminer T17 and Antminer S17, during last 3

months.

-

Company's reported total liabilities of

$944,459 (non-cash) or the 6 months, ended December 31, 2019, vs

total liabilities of $2,208,259, as of December 31, 2018 and only

$34,722 (accounts payable) will require a cash

payment.

-

The Company's net income loss from

operations for the 6 months, ended December 31, 2019, has been

reduced to $128,909, from $1,171,446, as of December 31,

2018.

Steve Rubakh, CEO, adds the following commentary:

“For the 3 months, ended December 31, 2019 vs December 2018, the

Company's total revenues grew at 54%. Total outstanding amount owed

to StGeorge Investments has been reduced from $500,000 to $161,044.

The Company safely navigated the crypto market downturn and is

confident in its ability to maintain its revenue growth by

deploying profitable mining equipment and aggressively pursuing

strategic M&A transactions with goal of rapidly increasing

shareholder's value. In next few weeks, the Company plans to update

shareholders and investors with detailed updates and relevant

disclosures.”

Integrated Ventures Inc is Technology

Portfolio Holdings Company with main focus onBlockchain Technology

and Cryptocurrency Mining. For more details, please visit company's

web: www.integratedventuresinc.com.

Safe Harbor

Statement:

The

information posted in this release may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. You can identify these statements by use of the

words "may," "will," "should," "plans," "explores," "expects,"

"anticipates," "continue," "estimate," "project," "intend," and

similar expressions. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those projected or anticipated. These risks and uncertainties

include, but are not limited to, general economic and business

conditions, effects of continued geopolitical unrest and regional

conflicts, competition, changes in technology and methods of

marketing, and various other factors beyond the company's

control.

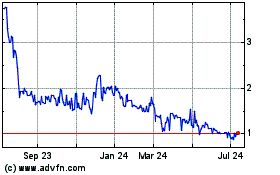

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

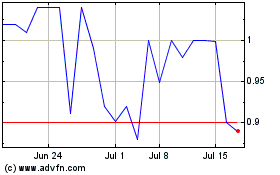

Integrated Ventures (QB) (USOTC:INTV)

Historical Stock Chart

From Apr 2023 to Apr 2024