As filed with the Securities and Exchange Commission on September 20, 2019

Registration Statement No. 333-220419

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO FORM S-3 ON

FORM S-1REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

|

INNOVATION PHARMACEUTICALS INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

2834

|

|

30-0565645

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

100 Cummings Center, Suite 151-B

Beverly, MA 01915

(978) 921-4125

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Leo Ehrlich, Chief Executive Officer and Chief Financial Officer

100 Cummings Center, Suite 151-B

Beverly, MA 01915

(978) 633-3623

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

David R. Crandall, Esq.

Hogan Lovells US LLP

1601 Wewatta Street, Suite 900

Denver, Colorado 80202

Telephone: (303) 899-7300

Facsimile: (303) 899-7333

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

Accelerated filer

|

¨

|

|

Non‑accelerated filer

|

x

|

Smaller reporting company

|

x

|

|

|

|

Emerging growth company

|

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On September 11, 2017, the registrant filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-3 (No. 333-220419), which was declared effective by the SEC on September 21, 2017 (the “Original Registration Statement”). The Original Registration Statement was filed to register shares of the registrant’s Class A common stock, preferred stock, debt securities, warrants and units, including shares of Class A common stock or preferred stock upon conversion of debt securities, Class A common stock upon the conversion of preferred stock, or Class A common stock, preferred stock or debt securities upon the exercise of warrants. In connection with the Original Registration Statement, the registrant offered and sold shares of Series B preferred stock, which shares are convertible into shares of Class A common stock, and warrants to purchase shares of Series B preferred stock or Class A common stock pursuant to prospectus supplements filed with the U.S. Securities and Exchange Commission on October 9, 2018 and May 10, 2019.

This Post-Effective Amendment No. 1 to Form S-3 on Form S-1 is being filed to convert the Original Registration Statement into a Registration Statement on Form S-1, and contains an updated prospectus relating to the offering and sale of the shares of Series B preferred stock and Class A common stock that were registered on the Original Registration Statement.

All applicable registration and filing fees were paid by the registrant in connection with filing the Original Registration Statement.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated September 20, 2019

PROSPECTUS

INNOVATION PHARMACEUTICALS INC.

7,320 Shares of Series B 5% Convertible Preferred Stock issuable upon the exercise of outstanding warrants

64,000,000 Shares of Class A Common Stock issuable upon the conversion of Series B Preferred Stock

This prospectus relates to (i) 6,920 shares of our Series B 5% convertible preferred stock, which we refer to as our Series B preferred stock, which are issuable upon the exercise of warrants described below, (ii) 400 shares of our Series B preferred stock issuable pursuant to the terms of a warrant restructuring and additional issuance agreement dated May 9, 2019, which shares are issuable in connection with the exercise of warrants as provided in the agreement, and (iii) 64,000,000 shares of Class A common stock, par value $0.0001 per share, which we refer to as our common stock, issuable from time to time upon conversion of Series B preferred stock.

Each share of Series B preferred stock has an initial stated value of $1,080 and may be converted at any time at the holder’s option into shares of our common stock at a conversion price equal of the lower of (i) $0.31625 per share and (ii) 85% of the lowest volume weighted average price of our common stock as reported on Bloomberg L.P. on a trading day during the ten trading days prior to and ending on, and including, the conversion date. The conversion price may be adjusted following certain triggering events and is subject to appropriate adjustment in the event of stock splits, stock dividends, recapitalization or similar events affecting our common stock.

The warrants are composed of four series and were originally issued as follows: (i) on October 9, 2018, series 1 warrants to purchase 1,563 shares of Series B preferred stock, series 2 warrants to purchase 1,563 shares of Series B preferred stock, and series 3 warrants to purchase 1,875 shares of Series B preferred stock, (ii) on October 12, 2018, series 1 warrants to purchase 937 shares of Series B preferred stock, series 2 warrants to purchase 937 shares of Series B preferred stock, and series 3 warrants to purchase 1,125 shares of Series B preferred stock, and (iii) on May 9, 2019, series 4 warrants to purchase 2,500 shares of Series B preferred stock. The holders of the warrants exercised 3,580 series 1 and series 2 warrants to purchase 3,580 shares of our Class B preferred stock prior to the date hereof, leaving 6,920 warrants outstanding as of the date of this prospectus. Each warrant entitles the holder thereof to purchase shares of Series B preferred stock at $982.50 per share. The series 1 and series 2 warrants each have an initial term of 15 months following issuance, the series 3 warrants have an initial term of 24 months following issuance, and the series 4 warrants have a term of 9 months following issuance.

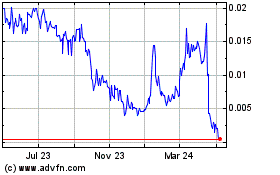

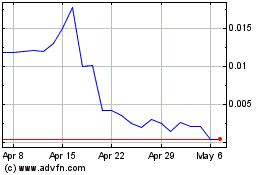

Our common stock is currently quoted on the OTCQB under the symbol “IPIX.” On September 19, 2019, the last reported sales price of our common stock on the OTCQB was $0.1389 per share. There is no established public trading market for our Series B preferred stock and we do not expect a market to develop. In addition, we do not intend to apply for listing our Series B preferred stock on any national securities exchange or any other nationally recognized trading system.

Investing in our securities involves a high degree of risk. You should read “Risk Factors” beginning on page 4 of this prospectus and the reports we file with the Securities and Exchange Commission (the “SEC”) pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), incorporated by reference in this prospectus, to read about factors to consider before purchasing our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2019.

TABLE OF CONTENTS

We have not authorized anyone to provide you with information different from that contained or incorporated by reference in this prospectus, any applicable prospectus supplement or any free writing prospectus we prepare or authorize, and we do not take any responsibility for any other information that others may give you. This prospectus is not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus, any applicable prospectus supplement or any free writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS

This document is called a prospectus and is part of a registration statement on Form S-1 that we have filed with the SEC. From time to time, we may file one or more prospectus supplements to add, update or change information included in this prospectus. This prospectus covers offers and sales of our securities only in jurisdictions in which such offers and sales are permitted.

We urge you to carefully read this prospectus, any applicable prospectus supplement and any related free writing prospectus, together with the information incorporated herein by reference as described under the heading “Information Incorporated by Reference,” before buying any of the securities being offered.

The registration statement containing this prospectus, including exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus and any applicable prospectus supplement. We have filed, and plan to continue to file, other documents with the SEC that contain information about us and our business. Also, we will file legal documents that control the terms of the securities offered by this prospectus as exhibits to the reports that we file with the SEC. The registration statement and other reports can be read at the SEC Internet site mentioned under the heading “Where You Can Find More Information.”

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

The representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus or any applicable prospectus supplement were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties and covenants were accurate only as of the date when made; therefore, such representations, warranties and covenants should not be relied on as accurate representations of the current state of our affairs.

References to “Innovation Pharmaceuticals,” the “Company”, “we,” “our” and “us” in this prospectus and any applicable prospectus supplement are to Innovation Pharmaceuticals Inc., unless the context otherwise requires. This document includes trade names and trademarks of other companies. All such trade names and trademarks appearing in this document are the property of their respective holders.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any applicable prospectus supplement and the documents we have incorporated by reference contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements convey our current expectations or forecasts of future events. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are generally identifiable by use of the words “estimate,” “project,” “believe,” “intend,” “plan,” “anticipate,” “expect” and similar expressions. These forward-looking statements include, but are not limited to, statements concerning our future drug development plans and projected timelines for the initiation and completion of preclinical and clinical trials; the potential for the results of ongoing preclinical or clinical trials; other statements regarding our future product development and regulatory strategies, including with respect to specific indications; any statements regarding our future financial performance, results of operations or sufficiency of capital resources to fund our operating requirements; and any other statements which are other than statements of historical fact. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Actual results could differ materially from those in forward-looking statements because of, among other reasons, the factors described below and in the periodic reports that we file with the SEC from time to time, including Forms 10-K, 10-Q and 8-K and any amendments thereto. The forward-looking statements are not guarantees of future performance. They are based on numerous assumptions that we believe are reasonable, but they are open to a wide range of uncertainties and business risks.

Key factors that could cause actual results to be different than expected or anticipated include, but are not limited to:

|

|

·

|

our capital needs and ability to continue as a going concern;

|

|

|

|

|

|

|

·

|

our ability to continue to fund and successfully progress internal research and development efforts;

|

|

|

|

|

|

|

·

|

our ability to create effective, commercially-viable drugs;

|

|

|

|

|

|

|

·

|

our ability to effectively and timely conduct clinical trials;

|

|

|

|

|

|

|

·

|

our ability to ultimately distribute our drug candidates;

|

|

|

|

|

|

|

·

|

compliance with regulatory requirements; and

|

|

|

|

|

|

|

·

|

other risks referred to in the section of this prospectus entitled “Risk Factors” and in the SEC filings incorporated by reference in this prospectus.

|

In light of these risks, uncertainties and assumptions, you are cautioned not to place undue reliance on forward-looking statements, which are inherently unreliable and speak only as of the date of this prospectus, any applicable prospectus supplement or as of the date of any document incorporated by reference in this prospectus or any applicable prospectus supplement, as applicable. When considering forward-looking statements, you should keep in mind the cautionary statements in this prospectus, any applicable prospectus supplement and the documents incorporated by reference. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in or incorporated by reference in this prospectus and any applicable prospectus supplement might not occur.

|

PROSPECTUS SUMMARY

This summary highlights selected information about Innovation Pharmaceuticals Inc. This summary does not contain all of the information that may be important to you in making an investment decision. For a more complete understanding of Innovation Pharmaceuticals Inc., you should read carefully this entire prospectus and any applicable prospectus supplement, including the “Risk Factors” section, and the other documents we refer to and incorporate by reference. Unless otherwise indicated, “common stock” means our Class A common stock, par value $0.0001 per share.

Innovation Pharmaceuticals Inc. Overview

We are a clinical stage biopharmaceutical company developing innovative therapies with dermatology, oncology, anti-inflammatory and antibiotic applications. We own the rights to numerous drug compounds, and we devote most of our efforts and resources on our compounds in clinical trials: Brilacidin for treatments of skin infections, ulcerative proctitis (inflammatory bowel disease) and prevention of oral mucositis complicating chemoradiation treatment for cancer, and Kevetrin for the treatment of ovarian cancer.

The Company was incorporated as Econoshare, Inc. on August 1, 2005 in the State of Nevada. On December 6, 2007, the Company acquired Cellceutix Pharma, Inc., a privately owned corporation formed under the laws of the State of Delaware on June 20, 2007. Following the acquisition, the Company changed its name to Cellceutix Corporation. Effective June 5, 2017, the Company amended its Articles of Incorporation and changed its name from Cellceutix Corporation to Innovation Pharmaceuticals Inc.

Our principal executive offices are located at 100 Cummings Center, Suite 151-B, Beverly, Massachusetts 01915, and our telephone number is (978) 921-4125. Our website is www.ipharminc.com. The information contained on or that can be accessed through or website (other than the specified SEC filings incorporated by reference in this prospectus) is not incorporated in, and is not a part of, this prospectus, and you should not rely on any such information in connection with your investment decision to purchase our securities.

|

The Offering

The following summary is provided solely for your convenience and is not intended to be complete. You should read the full text and more specific details contained elsewhere in this prospectus and any applicable prospectus supplement.

|

|

Issuer

|

|

Innovation Pharmaceuticals Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities offered by us

|

|

·

|

6,920 shares of our Series B 5% convertible preferred stock, which we refer to as our Series B preferred stock, which are issuable upon the exercise of outstanding warrants;

|

|

|

|

|

|

|

|

|

|

|

|

|

·

|

400 shares of our Series B preferred stock issuable pursuant to the terms of a warrant restructuring and additional issuance agreement dated May 9, 2019; and

|

|

|

|

|

|

|

|

|

|

|

|

|

·

|

64,000,000 shares of Class A common stock, par value $0.0001 per share, which we refer to as our common stock, issuable from time to time upon conversion of Series B preferred stock.

|

|

|

|

|

|

|

|

|

|

|

Shares of Class A common stock to be outstanding after this offering

|

|

Up to 262,535,967 shares assuming sale of 7,320 shares of Series B preferred stock and conversion of such shares of Series B preferred stock into 56.9 million shares of our Class A common stock. Actual shares issued will vary, among other things, depending on the conversion price of our Series B preferred stock.(1)

|

|

|

|

|

|

|

|

|

|

|

Shares of Series B preferred stock to be outstanding after this offering

|

|

8,416 shares, assuming the exercise of all of the warrants.(1)

|

|

|

|

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering primarily for general working capital purposes. Accordingly, we will retain broad discretion over how these offering proceeds are used. See “Use of Proceeds” on page 5.

|

|

|

|

|

|

|

|

|

|

|

Warrant Restructuring and Additional Issuance Agreement

|

|

On May 9, 2019, we entered into a Warrant Restructuring and Additional Issuance Agreement with the Series B holders, pursuant to which the Series B holders agreed to exercise warrants to purchase up to $2.5 million of Series B preferred stock through November 2019, subject to the conditions described therein. In addition, we issued to the Series B holders 100 shares of Series B preferred stock following the execution of the Issuance Agreement and agreed to issue up to an additional 400 shares of Series B preferred stock upon exercise of the warrants to purchase Series B preferred stock. We also issued warrants to purchase 2,500 shares of Series B preferred stock to the Series B holders following execution of the Issuance Agreement.

|

|

|

|

|

|

|

|

|

|

|

OTCQB symbol

|

|

IPIX

|

|

|

|

|

|

|

|

|

|

No Market for Series B preferred stock or warrants

|

|

There is no established public trading market for our Series B preferred stock, and we do not expect any such market to develop. In addition, we do not intend to apply for listing of the Series B preferred stock on any national securities exchange or other nationally recognized trading system.

|

|

|

|

|

|

|

|

|

|

|

Risk factors

|

|

An investment in our securities involves risks, and prospective investors should carefully consider the matters discussed under “Risk Factors” beginning on page 4 of this prospectus and the reports we file with the SEC pursuant to the Securities Exchange Act of 1934, as amended, incorporated by reference in this prospectus before making an investment in our securities.

|

|

|

___________

|

|

|

(1)

|

The number of shares of common stock to be outstanding after this offering is based on 205,620,200 shares of Class A common stock outstanding as of August 27, 2019 and includes 56.9 million shares of common stock issuable upon the conversion of 7,320 shares of Series B preferred stock offered hereby. The number of shares of common stock excludes shares underlying stock options, warrants and other outstanding convertible securities or debt. The number of shares of Series B preferred stock to be outstanding after this offering is based on 1,096 shares of Series B preferred stock outstanding as of June 30, 2019.

|

|

|

|

|

|

|

RISK FACTORS

An investment in our securities involves a high degree of risk. Before making an investment decision, you should consider carefully the risks discussed under the sections captioned “Risk Factors” set forth in the documents and reports filed by us with the SEC, that are incorporated by reference into this prospectus, including in our most recent Annual Report on Form 10-K, as revised or supplemented by our most recent Quarterly Reports on Form 10-Q, each of which are on file with the SEC and are incorporated herein by reference, as well as any risks described in our other filings with the SEC, before deciding whether to buy our securities. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. In addition, please read “Disclosure Regarding Forward-Looking Statements” in this prospectus, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this prospectus. Please note that additional risks not presently known to us or that we currently deem immaterial may also impair our business and operations.

Our Series B preferred stock converts into shares of common stock at a discount to the market price of our common stock. As a result, our common stockholders will experience substantial additional dilution if shares of our Series B preferred stock are converted into common stock.

Our Series B preferred stock may be converted at any time at the holder’s option into shares of our common stock at a conversion price equal of the lower of (i) $0.31625 per share and (ii) 85% of the lowest volume weighted average sale prices of our Class A common stock as reported on Bloomberg L.P. on a trading day during the ten trading days prior to and ending on, and including, the conversion date. In addition, the conversion price may be decreased following certain triggering events. Our Series B preferred stock, of which 1,096 shares were outstanding as of June 30, 2019 and warrants to purchase an additional 6,725 shares were outstanding as of the date of this prospectus and an additional 400 shares of which may be issuable under an agreement with the warrant holders, has substantially similar provisions. As a result, the number of shares of common stock that the holders of our Series B preferred stock will receive upon conversion will increase as our common stock price decreases, and there is no floor to the conversion price, and our common stockholders will experience substantial dilution as shares of our Series B Preferred Stock offered hereby are converted into our common stock. Any dilution or potential dilution may cause our stockholders to sell their shares, which may contribute to a downward movement in the stock price of our common stock.

Management will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the proceeds from sales of our securities in this offering, and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could have a material adverse effect on our business and cause the price of our common stock to decline.

In addition to potential dilution associated with future fundraising transactions, we currently have significant numbers of securities outstanding that are exercisable for our common stock, which could result in significant additional dilution and downward pressure on our stock price.

As of August 27, 2019, there were 205.6 million shares of our common stock outstanding. In addition, as of March 31, 2019, there were outstanding stock options, warrants and convertible securities or debt representing the potential issuance of an additional 75 million shares of our common stock, in addition to the potential issuance of shares of common stock upon the conversion of Series B preferred stock offered hereby. The issuance of these shares in the future would result in significant dilution to our current stockholders and could adversely affect the price of our common stock and the terms on which we could raise additional capital. In addition, the issuance and subsequent trading of shares could cause the supply of our common stock available for purchase in the market to exceed the purchase demand for our common stock. Such supply in excess of demand could cause the market price of our common stock to decline.

The Company has no history of paying dividends on its common stock, and we do not anticipate paying dividends in the foreseeable future.

The Company has not previously paid dividends on its common stock. We currently anticipate that we will retain all of our available cash, if any, for use as working capital and for other general corporate purposes. Any payment of future dividends on our common stock will be at the discretion of our Board of Directors and will depend upon, among other things, our earnings, financial condition, capital requirements, level of indebtedness, statutory and contractual restrictions applicable to the payment of dividends and other considerations that our Board of Directors deems relevant. Investors must rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize a return on their investment.

There is no public market for the Series B preferred stock being offered in this offering.

There is no established public trading market for our Series B preferred stock being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to apply for listing of our Series B preferred stock on any national securities exchange or other nationally recognized trading system. Without an active market, the liquidity of our Series B preferred stock will be limited.

Holders of our Series B preferred stock will have no rights as a holder of our common stock until such holders convert their Series B preferred stock and acquire our common stock.

Until holders of our Series B preferred stock acquire shares of our common stock upon conversion of the Series B preferred stock, holders of Series B preferred stock will have no rights with respect to the shares of our common stock underlying such shares of Series B preferred stock, except as set forth in the related certificate of designation. Upon conversion of the Series B preferred stock, the holders thereof will be entitled to exercise the rights of a holder of our common stock only as to matters for which the record date occurs after the exercise date.

USE OF PROCEEDS

We will receive up to $6.8 million upon the exercise of the warrants sold by us in this offering, which if fully exercised would result in proceeds to us, after deducting estimated offering expenses payable by us, of approximately $6.7 million. We cannot predict when or if the warrants will be exercised, and it is possible that the warrants may expire and never be exercised. We intend to use the net proceeds, if any, from this offering for general working capital purposes. The amounts and timing of expenditures will depend on a number of factors, such as the timing, scope, progress and results of our research and development efforts, the timing and progress of any partnering efforts, and the competitive environment for our product candidates. As of the date of this prospectus, we cannot specify with certainty the particular uses of the proceeds from this offering. Accordingly, we will retain broad discretion over the use of such proceeds. Until we use the proceeds for any purpose, we expect to invest them in short-term investments.

RATIO OF EARNINGS TO FIXED CHARGES

The table below presents the ratio of earnings to fixed charges and the coverage for the last five completed fiscal years and nine months ended March 31, 2019 and 2018.

|

|

|

For the Year Ended June 30,

|

|

|

For the nine months ended March 31,

|

|

|

|

|

2014

|

|

|

2015

|

|

|

2016

|

|

|

2017

|

|

|

2018

|

|

|

2018

|

|

|

2019

|

|

|

Ratio of earnings to combined fixed charges and preferred stock dividends

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

|

N/A

|

|

|

Deficiency (in million)

|

|

$

|

(8.2

|

)

|

|

$

|

(13.1

|

)

|

|

$

|

(12.9

|

)

|

|

$

|

(15.5

|

)

|

|

$

|

(16.4

|

)

|

|

$

|

(11.5

|

)

|

|

$

|

(7.2

|

)

|

Our earnings were inadequate to cover fixed charges for each of the periods indicated above. We did not pay any preferred stock dividends during the periods. The amount of the deficiency by which our earnings did not cover our fixed charges for each such period is disclosed in the second line of the above table.

This information should be read in conjunction with our consolidated financial statements and the accompanying notes incorporated by reference in this prospectus.

DILUTION

Our net tangible book deficit as March 31, 2019 was approximately $(4.3) million, or $(0.02) per share. We calculate net tangible book deficit per share by dividing the net tangible book deficit, which is tangible assets less total liabilities, by the number of outstanding shares of our common stock. Dilution per share of our common stock to investors in this offering represents the difference between the assumed amount paid per share of our common stock underlying the Series B preferred stock (assuming full exercise of the warrants) and the assumed net tangible book deficit per share of our common stock following the completion of this offering.

After giving effect to the issuance of 7,320 shares of our Series B preferred stock for net proceeds of approximately $6.8 million after deducting estimated offering expenses payable by us, and assuming a conversion price of $0.1389 per share, which is closing price of our common stock on September 19, 2019, our as adjusted net tangible book value as of March 31, 2019 would have been approximately $2.5 million, or $0.01 per share of common stock. This represents an immediate increase in net tangible book value of $0.03 per share to existing stockholders and assumed immediate dilution in net tangible book deficit of $0.1289 per share to investors participating in this offering. The following table illustrates this dilution on a per share basis:

|

Assumed average conversion price

|

|

$

|

0.14

|

|

|

Net tangible book deficit per share as of March 31, 2019

|

|

$

|

(0.02

|

)

|

|

Increase per share attributable to the offering

|

|

$

|

0.03

|

|

|

As adjusted net tangible book value per share as of March 31, 2019, after giving effect to this offering

|

|

$

|

0.01

|

|

|

Dilution per share to new investors

|

|

$

|

0.13

|

|

The foregoing dilution information is based on 187,575,318 shares of our common stock outstanding as of March 31, 2019. The actual price at which investors convert their Series B preferred stock may be higher or lower than the assumed price of $0.1389 per share and our total shares may continue to change, and is expected to continue to change. A decrease of $0.05 per share in the conversion price would result in the same adjusted net tangible book value per share after the offering but would decrease the dilution in net tangible book value per share to new investors in this offering to $0.08 per share, after deducting estimated aggregate offering expenses payable by us. An increase of $0.05 per share in the conversion price would result in the same adjusted net tangible book value per share after the offering but would increase the dilution in net tangible book value per share to new investors in this offering to $0.18 per share, after deducting estimated aggregate offering expenses payable by us. This information is supplied for illustrative purposes only.

The number of shares of common stock to be outstanding after this offering is based on 187,575,318 million shares of Class A common stock outstanding as of March 31, 2019 and excludes approximately an additional 75 million shares of our common stock issuable upon the exercise of stock options, exercise of warrants, and conversion of convertible securities, in addition to the potential issuance of shares of common stock upon the conversion of Series B preferred stock offered hereby.

DESCRIPTION OF SECURITIES

In this offering, we are offering 7,320 shares of our Series B preferred stock, and 64,000,000 shares of common stock that are issuable from time to time upon conversion of such Series B preferred stock.

There is no established public trading market for our Series B preferred stock, and we do not expect any such market to develop. In addition, we do not intend to apply for listing of our Series B preferred stock on any national securities exchange or other nationally recognized trading system.

Description of Class A Common Stock

We are authorized to issue 600,000,000 shares of Class A common stock, par value $0.0001 per share, and 100,000,000 Class B common stock, par value $0.0001 per share. As of August 27, 2019, there were 205.6 million shares of our Class A common stock outstanding and 909,090 shares of Class B common stock outstanding.

Each holder of Class A common stock is entitled to one vote for each share on all matters submitted to a vote of the stockholders, including the election of directors, and each holder does not have cumulative voting rights. Accordingly, the holders of a majority of the shares of Class A common stock entitled to vote in any election of directors can elect all of the directors standing for election.

Subject to preferences that may be applicable to any then outstanding preferred stock, holders of Class A common stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by the board of directors out of legally available funds. In the event of our liquidation, dissolution or winding up, holders of Class A common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any outstanding shares of preferred stock.

Holders of Class A common stock do not have preemptive or conversion rights or other subscription rights, and there are no redemption or sinking fund provisions applicable to the Class A common stock. All outstanding shares of Class A common stock are, and the shares of Class A common stock offered by us in any offering utilizing this prospectus, when issued and paid for, will be fully paid and nonassessable. The rights, preferences and privileges of the holders of Class A common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock which we may designate in the future.

Description of Series B Preferred Stock

The following is a summary of certain terms and provisions of the Certificate of Designation of Preferences, Rights and Limitations of Series B 5% Convertible Preferred Stock (as amended, the “Certificate of Designation”) establishing the rights and preferences of the Series B preferred stock offered in this offering. The description of the Series B preferred stock contained herein does not purport to be complete and is qualified in its entirety by reference to the Certificate of Designation, which is an exhibit to the registration statement of which this prospectus forms a part.

General

Our Amended and Restated Articles of Incorporation authorizes our Board of Directors to issue up to 10,000,000 shares of preferred stock, par value $0.001 per share, of which no shares are issued and outstanding.

Subject to the limitations prescribed by our Articles of Incorporation, our Board is authorized to establish the number of shares constituting each series of preferred stock and to fix the designation, powers, preferences and relative participating, optional and other rights of each of those series and the qualifications, limitations and restrictions of each of those series, all without any further vote or action by our stockholders. Our Board has designated 20,000 of the 10,000,000 authorized shares of preferred stock as Series B 5% Convertible Preferred Stock. When sold, issued and paid for in accordance with the terms of the Issuance Agreement, the shares of Series B preferred stock will be validly issued, fully paid and non-assessable.

Voluntary Conversions by Holders

Each holder of Series B preferred stock may, at any time, elect to convert shares of Series B preferred stock into shares of our common stock at the conversion price, subject to certain beneficial ownership volume limitations described below. The number of shares into which each share of Series B preferred stock is determined by dividing the then stated value of the share of Series B preferred stock by the conversion price. The conversion price is defined as lower of (i) $0.31625 per share and (ii) 85% of the lowest volume weighted average sales price of the Class A Common Stock as reported on Bloomberg L.P. at 4:02 p.m. (New York City time) on a trading day during the ten trading days prior to and ending on, and including, the conversion date. The conversion price is subject to appropriate adjustment in the event of stock splits, stock dividends, recapitalization or similar events affecting our common stock. In addition, upon the occurrence of a triggering event (as defined below), the variable conversion rate will drop to 70% in (ii) above, and the $0.31625 price reflected in (i) could be adjusted downward under certain circumstances. In addition, in the event we issue dilutive securities within five trading days after a holder’s conversion of Series B preferred stock into common stock, we will issue additional shares of common stock to such holder as provided in the Certificate of Designation.

Fundamental Transactions

In the event we effect certain mergers, consolidations, sales of substantially all of our assets, tender or exchange offers, reclassifications or share exchanges in which our common stock is effectively converted into or exchanged for other securities, cash or property, or we consummate a business combination in which another person acquires 50% or more of the outstanding shares of our common stock, then, upon any subsequent conversion of the Series B preferred stock, the holders of such Series B preferred stock will have the right to receive any shares of the successor or acquiring corporation and any additional consideration it would have been entitled to receive if it had been a holder of the number of shares of common stock then issuable upon conversion in full (including accrued but unpaid dividends thereon) of the Series B preferred stock immediately prior to any of the foregoing transactions.

In addition, we have agreed to have any successor entity in any of the foregoing transactions in which we are not the surviving entity to assume in writing all of our obligations under the Certificate of Designation.

Limitations on Conversion and Issuance

The Series B preferred stock may not be converted and shares of our common stock may not be issued under the Certificate of Designation with respect to such Series B preferred stock if, after giving effect to the conversion or issuance, a holder together with its affiliates would beneficially own in excess of 9.99% of the outstanding shares of our common stock.

The holders of the Series B preferred stock are limited in the amount of stated value of the Series B preferred stock they can convert on any trading day. The conversion cap limits conversions by the holders to the greater of $75,000 and an amount equal to 30% of the aggregate dollar trading volume of our common stock on our primary trading market for the five trading days immediately preceding, and including, the conversion date. However, the conversion cap will be increased if the trading volume in the first 30 minutes of any trading session exceeds certain trailing average daily volume amounts.

Dividends

Holders of the Series B preferred stock are entitled to receive, and we shall pay, cumulative dividends at a rate per share of 5% per annum (calculated quarterly as a percentage of the stated value per share for each quarterly period). Unless we elect to pay dividends in cash, dividends on a share of Series B preferred stock will increase such share of Series B preferred stock’s stated value and will be payable on each dividend payment date (plus two trading days or standard settlement period, whichever is shorter).

If at any time while the Series B preferred stock is outstanding, we make distributions of rights, cash or other assets to holders of our common stock, the holders of the Series B preferred stock will be entitled to participate in such distribution, on a per share basis, as if the shares of Series B preferred stock were converted into shares of common stock (without regard to any beneficial ownership limitation) at the time of payment of such distribution.

Liquidation Preference

Upon our liquidation, dissolution or winding up, the holders of the Series B preferred stock shall be entitled to receive out of our assets, whether capital or surplus, an amount equal to such holder’s then stated value for each share of Series B Preferred Stock before any distribution to the holders of our common stock or other junior securities. If there are insufficient assets to pay in full such amounts, then the available assets shall be ratably distributed to the holders of the Series B preferred stock in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full.

Redemption Rights

Shares of Series B preferred stock are not otherwise entitled to any redemption rights, or mandatory sinking fund or analogous fund provisions, other than as set forth under “Triggering Events” below. Following 30 days after the closing, the Company may elect to redeem the Series B preferred stock for 120% of the aggregate stated value then outstanding, plus all accrued but unpaid dividends and all liquidated damages and other amounts due in respect of the Series B preferred stock. The Company’s right to redeem the Series B preferred stock is contingent upon it having complied with a number of conditions, including compliance with its obligations under the Certificate of Designation.

Voting Rights; Negative Covenants

Shares of Series B preferred stock will generally have no voting rights, except as required by law and except that the Company shall not, without the consent of the holders of a majority of the then outstanding shares of the Series B Preferred Stock:

|

|

·

|

alter or change adversely the powers, preferences or rights given to the Series B preferred stock or alter or amend the Certificate of Designation;

|

|

|

|

|

|

|

·

|

authorize or create or issue any class of stock ranking as to dividends, redemption or distribution of assets upon a liquidation senior to, or otherwise pari passu with, the Series B preferred stock;

|

|

|

|

|

|

|

·

|

amend its Articles of Incorporation or other charter documents in any manner that adversely affects any rights of the holders of the Series B preferred stock;

|

|

|

|

|

|

|

·

|

increase the number of authorized shares of Series B preferred stock; or

|

|

|

|

|

|

|

·

|

enter into any agreement with respect to any of the foregoing.

|

In addition, so long as any shares of Series B preferred stock are outstanding, the Company may not, without the consent of at 67% of the stated value of the then outstanding shares of Series B preferred stock:

|

|

·

|

amend the Company’s charter documents, including, without limitation, its articles of incorporation and bylaws, in any manner that materially and adversely affects any rights of the holders of the Series B preferred stock;

|

|

|

|

|

|

|

·

|

repay, repurchase or offer to repay, repurchase or otherwise acquire more than a de minimis number of shares of its common stock or other junior securities, subject to certain exceptions;

|

|

|

|

|

|

|

·

|

pay cash dividends or distributions on its common stock or other junior securities;

|

|

|

|

|

|

|

·

|

enter into any transaction with any affiliate which would be required to be disclosed in any public filing with the SEC, unless such transaction is made on an arm’s-length basis and expressly approved by a majority of the Company’s disinterested directors; or

|

|

|

|

|

|

|

·

|

enter into any agreement with respect to any of the foregoing.

|

Triggering Events

Upon the occurrence of certain triggering events, the conversion price will decrease as specified under “Voluntary Conversions by Holders” above and the holders of the Series B preferred stock will have the right to require the Company to redeem the preferred stock at a price equal to the greater of (i) 120% of the aggregate stated value then outstanding and (ii) the product of the volume weighted average price on the trading day immediately preceding the date of the triggering event and the stated value divided by the then conversion price, plus in either case all accrued but unpaid dividends thereon and all liquidated damages and other costs, expenses or amounts due in respect of the preferred stock. Each of the following would constitute a triggering event if the holders of a majority of the Series B preferred stock did not otherwise consent:

(i) if the Company fails to provide at all times a registration statement that permits the Company to issue shares of common stock upon conversion of the Series B preferred stock or warrants, subject to a grace period of 20 calendar days in the aggregate in any 365-day period, or if the Company cannot issue shares of common stock under Section 3(a)(9) of the Securities Act of 1933, as amended;

(ii) the Company fails to deliver common stock issuable upon a conversion prior to the seventh trading day after such shares are required to be delivered, or the Company provides written notice that it does not intend to comply with requests for conversion of shares of the Series B preferred stock;

(iii) the Company fails to pay the amount of cash due pursuant to a buy-in (as specified in the Certificate of Designation) within five calendar days after notice;

(iv) the occurrence of an authorized share failure (as defined in the Securities Purchase Agreement);

(v) the Company fails to take certain actions to maintain the effectiveness of a Form S-3 registration statement relating to the securities;

(vi) the Company fails to observe or perform other covenants, agreements or warranties in the Securities Purchase Agreement, Certificate of Designation and other transaction documents and such failure or breach is not cured within 30 calendar days after the date of such failure or breach;

(vii) the Company redeems more a de minimis number of junior securities, subject to certain exceptions;

(viii) the Company is party to a change of control transaction or a fundamental transaction (each as defined in the Certificate of Designation);

(ix) the occurrence of a bankruptcy event involving the Company;

(x) our common stock fails to be listed or quoted for trading on certain specific trading markets for more than five trading days;

(xi) any monetary judgment, writ or similar final process is entered or filed against the Company, any subsidiary or their property or assets for more than $250,000, and such judgment, writ or similar final process remains unvacated, unbonded or unstayed for a period of 60 calendar days;

(xii) the electronic transfer of our common stock through the Depository Trust Company or another established clearing corporation is no longer available or is subject to a “chill”;

(xiii) notice of any litigation or arbitration against the Company or a subsidiary that relates to outstanding accounts payable in an amount that exceeds $500,000 and such litigation or arbitration remains unvacated, unbonded and unstayed for a period of 45 days; or

(xiv) the Company fails to file a Form 8-K disclosing the number of issued and outstanding shares within five trading days of a request.

No Exchange Listing of Preferred Shares

We do not plan on making an application to list the Series B Preferred Stock on any national securities exchange or other nationally recognized trading system. Our common stock issuable upon conversion of shares of Series B preferred stock is quoted on the OTCQB.

PLAN OF DISTRIBUTION

We have entered into a Securities Purchase Agreement, dated October 5, 2018, and a Warrant Restructuring and Additional Issuance Agreement, dated May 9, 2019, pursuant to which we issued warrants to purchase shares of our Series B preferred stock. The warrants are composed of four series and were originally issued as follows: (i) on October 9, 2018, series 1 warrants to purchase 1,563 shares of Series B preferred stock, series 2 warrants to purchase 1,563 shares of Series B preferred stock, and series 3 warrants to purchase 1,875 shares of Series B preferred stock, (ii) on October 12, 2018, series 1 warrants to purchase 937 shares of Series B preferred stock, series 2 warrants to purchase 937 shares of Series B preferred stock, and series 3 warrants to purchase 1,125 shares of Series B preferred stock, and (iii) on May 9, 2019, series 4 warrants to purchase 2,500 shares of Series B preferred stock. The holders of the warrants exercised 3,580 series 1 and series 2 warrants to purchase 3,580 shares of our Class B preferred stock prior to the date hereof, leaving 6,920 warrants outstanding as of the date of this prospectus. Each warrant entitles the holder thereof to purchase shares of Series B preferred stock at $982.50 per share. The series 1 and series 2 warrants each have an initial term of 15 months following issuance, the series 3 warrants have an initial term of 24 months following issuance, and the series 4 warrants have a term of 9 months following issuance. The Securities Purchase Agreement and Warrant Restructuring and Additional Issuance Agreement contain customary representations and warranties by us and the other parties thereto, and provides that the obligations of the other parties thereto to purchase the securities are subject to certain customary conditions precedent. All of the securities sold in this offering will be sold at the same price.

This offering is a best efforts offering being made directly by us, without an underwriter or placement agent. We are not required to sell any specific number or dollar amount of securities in this offering, but will use our best efforts to sell the securities offered. We will receive all of the proceeds from any securities sold in this offering. We currently estimate offering expenses of approximately $50,000, including reimbursement of legal fees and expenses of $10,000 to the lead purchaser.

For the complete terms of the Securities Purchase Agreement and Warrant Restructuring and Additional Issuance Agreement, you should refer to the forms of Securities Purchase Agreement and Warrant Restructuring and Additional Issuance Agreement filed as Exhibit 10.1 to each of our Current Reports on Form 8-K filed on October 9, 2018 and May 10, 2019, respectively, which are incorporated by reference into the registration statement of which this prospectus is part.

LEGAL MATTERS

Gary R. Henrie, Nauvoo, Illinois, has passed upon the validity of the Series B 5% convertible preferred stock and common stock offered hereby.

EXPERTS

The consolidated balance sheets of Innovation Pharmaceuticals Inc. as of June 30, 2018 and 2017, and the related consolidated statements of operations, stockholders’ deficit and cash flows for the years ended June 30, 2018 and 2017 and the effectiveness of internal control over financial reporting as of June 30, 2018 have been audited by Baker Tilly Virchow Krause, LLP, an independent registered public accounting firm, as stated in its report, which is incorporated herein by reference. Such financial statements have been incorporated herein by reference in reliance on the report of such firm given upon their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from commercial retrieval services and at the website maintained by the SEC at www.sec.gov. The reports and other information filed by us with the SEC are also available at our website. The address of our website is www.ipharminc.com. Information contained on our website or that can be accessed through our website is not incorporated by reference into this prospectus or any applicable prospectus supplement.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to incorporate information into this prospectus “by reference,” which means that we can disclose important information to you by referring you to another document that we file separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for any information superseded by information contained directly in this prospectus. These documents contain important information about Innovation Pharmaceuticals and its financial condition, business and results.

We are incorporating by reference the filings listed below and any additional documents that we may file with the SEC pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act of 1934, as amended, on or after the date we file this prospectus and prior to the termination of the offering, except we are not incorporating by reference any information furnished (but not filed) under Item 2.02 or Item 7.01 of any Current Report on Form 8-K and corresponding information furnished under Item 9.01 as an exhibit thereto:

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended June 30, 2018, filed with the SEC on September 11, 2018;

|

|

|

|

|

|

|

·

|

our Quarterly Reports on Form 10-Q filed with the SEC for the quarters ended September 30, 2018 (filed with the SEC on November 8, 2018), December 31, 2018 (filed with the SEC on February 8, 2019) and March 31, 2019 (filed with the SEC on May 10, 2019);

|

|

|

|

|

|

|

·

|

our Current Reports on Form 8-K filed with the SEC on September 21, 2018, October 9, 2018, November 13, 2018, December 17, 2018, December 18, 2018, January 7, 2019, January 31, 2019, May 10, 2019, July 22, 2019, and September 20, 2019; and

|

|

|

|

|

|

|

·

|

The description of our common stock contained in our Form 8-A filed on April 27, 2015, including any amendments or reports filed for the purpose of updating the description.

|

We will provide, without charge, to each person to whom a copy of this prospectus has been delivered, including any beneficial owner, a copy of any and all of the documents referred to herein that are summarized in this prospectus, if such person makes a written or oral request directed to:

Innovation Pharmaceuticals Inc.

100 Cummings Center, Suite 151-B

Beverly, Massachusetts 01915

Attn: Chief Executive Officer

(978) 633-3623

PART II—INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses of Issuance and Distribution

The following table sets forth the costs and expenses payable by the Company in connection with the registration and sale of the securities being registered. All amounts are estimated except the Securities and Exchange Commission registration fee.

|

SEC registration fee

|

|

$

|

7,209

|

|

|

Printing expense

|

|

$

|

5,000

|

|

|

Accounting fees and expenses

|

|

$

|

10,000

|

|

|

Legal fees and expenses

|

|

$

|

20,000

|

|

|

Miscellaneous fees and expenses

|

|

$

|

5,000

|

|

|

Total

|

|

$

|

47,209

|

|

Item 14. Indemnification of Directors and Officers

Neither our Articles of Incorporation nor bylaws prevent us from indemnifying our officers, directors and agents to the extent permitted under the Nevada Revised Statute (“NRS”). NRS Section 78.7502, provides that a corporation shall indemnify any director, officer, employee or agent of a corporation against expenses, including attorneys’ fees, actually and reasonably incurred by him in connection with any the defense to the extent that a director, officer, employee or agent of a corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding referred to Section 78.7502(1) or 78.7502(2), or in defense of any claim, issue or matter therein. NRS 78.7502(1) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the corporation, by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful.

NRS Section 78.7502(2) provides that a corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense or settlement of the action or suit if he: (a) is not liable pursuant to NRS 78.138; or (b) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the corporation.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim of indemnification against such liabilities (other than the payment by us of expenses incurred or paid by a director, officer or controlling person of ours in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 15. Recent Sales of Unregistered Securities

None.

Item 16. Exhibits and Financial Statement Schedules

|

Exhibit No.

|

|

Title

|

|

Method of Filing

|

|

3.1

|

|

Amended and Restated Articles of Incorporation of Innovation Pharmaceuticals Inc.

|

|

Exhibit 3.1 to the Current Report on Form 8-K of the Company filed on June 7, 2017 (File No. 001-37357)

|

|

3.2

|

|

Amendment to Amended and Restated Articles of Incorporation of Innovation Pharmaceuticals Inc.

|

|

Annex A to Definitive Proxy Statement filed by the Company on August 13, 2019 (File No. 001-37357)

|

|

3.2

|

|

Amended and Restated Bylaws of Innovation Pharmaceuticals Inc.

|

|

Exhibit 3.2 to the Form 10-K for the year ended June 30, 2017 filed on September 11, 2017 (File No. 001-37357)

|

|

3.3

|

|

Amended and Restated Certificate of Designation of Preferences, Rights and Limitations of Series B 5% Convertible Preferred Stock of Innovation Pharmaceuticals Inc.

|

|

Exhibit 3.1 to the Current Report on Form 8-K of the Company filed on May 10, 2019 (File No. 001-37357)

|

|

4.1

|

|

Form of Warrant to Purchase Common Stock

|

|

Exhibit 4.1 to the Current Report on Form 8-K of the Company filed on June 29, 2018 (File No. 001-37357)

|

|

4.2

|

|

Form of Series 1-3 Warrant to Purchase Series B Preferred Stock

|

|

Exhibit 4.1 to the Current Report on Form 8-K of the Company filed on October 9, 2018 (File No. 001-37357)

|

|

4.3

|

|

Form of Series 4 Warrant to Purchase Series B Preferred Stock

|

|

Exhibit 4.1 to the Current Report on Form 8-K of the Company filed on May 10, 2019 (File No. 001-37357)

|

|

5.1

|

|

Opinion of Gary R. Henrie, Esq.

|

|

Exhibit 5.1 to the Registration Statement on Form S-3 filed by the Company on September 11, 2107 (File No. 333-220419 )

|

|

5.2

|

|

Opinion of Gary R. Henrie, Esq.

|

|

Exhibit 5.1 to the Current Report on Form 8-K of the Company filed on October 9, 2018 (File No. 001-37357)

|

|

5.3

|

|

Opinion of Gary R. Henrie, Esq.

|

|

Exhibit 5.1 to the Form 10-Q for the quarterly period ended March 31, 2019 filed on May 10, 2019 (File No. 001-37357)

|

|

10.1

|

|

Patent License Agreement, dated January 3, 2003, between PolyMedix Pharmaceuticals, Inc. (formerly known as PolyMedix, Inc.) and the University of Pennsylvania, Assigned by U.S. Court to Cellceutix

|

|

Exhibit 10.20 to the Form 10-K for the year ended June 30, 2013 filed on September 30, 2013 (File No. 001-37357)

|

|

10.2

|

|

Letter Agreement, dated December 23, 2003, amending the Patent License Agreement, dated January 3, 2003, between PolyMedix Pharmaceuticals, Inc. (formerly known as PolyMedix, Inc.) and the University of Pennsylvania, Assigned by U.S. Court to Cellceutix

|

|

Exhibit 10.21 to the Form 10-K for the year ended June 30, 2013 filed on September 30, 2013 (File No. 001-37357)

|

|

10.3

|

|

Software License Agreement, dated May 30, 2003, between PolyMedix Pharmaceuticals, Inc. (formerly known as PolyMedix, Inc.) and the University of Pennsylvania, Assigned by U.S. Court to Cellceutix

|

|

Exhibit 10.22 to the Form 10-K for the year ended June 30, 2013 filed on September 30, 2013 (File No. 001-37357)

|

|

10.4

|

|

Material Transfer Agreement With Beth Israel Deaconess

|

|

Exhibit 10.38 to the Form 10-Q for the quarterly period ended March 31, 2014 filed on May 12, 2014 (File No. 001-37357)

|

|

10.5

|

|

Agreement dated August 28, 2014 between Cellceutix Corporation and Aruda, Inc.

|

|

Exhibit 10.1 to the Current Report on Form 8-K of the Company filed on September 2, 2014 (File No. 001-37357)

|

|

10.6

|

|

Amendment among Cellceutix Corporation, Wayne Aruda and Aruda Inc.

|

|

Exhibit 10.2 to the Current Report on Form 8-K of the Company filed on September 2, 2014 (File No. 001-37357)

|

|

10.7

|

|

Exclusive License Agreement, dated July 18, 2019, between the Company and Alfasigma S.p.A.

|

|

Exhibit 10.1 to the Current Report on Form 8-K of the Company filed on July 22, 2019

|

|

10.8

|

|

Common Stock Purchase Agreement, dated as of September 6, 2017, between the Company and Aspire Capital Fund, LLC

|

|

Exhibit 10.6 to the Form 10-K for the year ended June 30, 2017 filed on September 11, 2017 (File No. 001-37357)

|

|

10.9

|

|

Registration Rights Agreement, dated as of September 6, 2017, between the Company and Aspire Capital Fund, LLC

|

|

Exhibit 10.7 to the Form 10-K for the year ended June 30, 2017 filed on September 11, 2017 (File No. 001-37357)

|

|

10.10

|

|

Securities Purchase Agreement, dated October 5, 2018, between the Company and the investors party thereto.

|

|

Exhibit 10.1 to the Current Report on Form 8-K of the Company filed on October 9, 2018 (File No. 001-37357)

|

|

10.11

|

|

Form of Warrant Restructuring and Additional Issuance Agreement, dated May 9, 2019, between the Company and the investors party thereto.

|

|

Exhibit 10.1 to the Current Report on Form 8-K of the Company filed on May 10, 2019 (File No. 001-37357)

|

|

10.12

|

|

Demand Unsecured Note between Cellceutix Corporation and Leo Ehrlich dated August 25, 2010

|

|

Exhibit 10.27 to the Form 10-K for the year ended June 30, 2010 filed on March 8, 2011(File No. 001-37357)

|

|

10.13

|

|

Employment Agreement between the Company and Dr. Arthur P. Bertolino.

|

|

Exhibit 10.1 to the Current Report on Form 8-K of the Company filed on July 1, 2016 (File No. 001-37357)

|

|

10.14

|

|

Form of executive employment agreement

|

|

Exhibit 10.1 to the Form 10-Q of the Company for the quarterly period ended September 30, 2016 filed on November 9, 2016 (File No. 001-37357)

|

|

10.15

|

|

Innovation Pharmaceuticals Inc. 2010 Equity Incentive Plan

|

|

Exhibit 99-3 to the Current Report on Form 8-K/A of the Company filed on February 22, 2011 (File No. 001-37357)

|

|

10.16

|

|

Form of Non-qualified Stock Option Agreement for the Innovation Pharmaceuticals Inc. 2010 Equity Incentive Plan

|

|

Exhibit 10.16 to the Form 10-K for the year ended June 30, 2017 filed on September 11, 2017 (File No. 001-37357)

|

|

10.17

|

|

Innovation Pharmaceuticals Inc. 2016 Equity Incentive Plan

|

|

Exhibit 10.2 to the Current Report on Form 8-K of the Company filed on July 1, 2016 (File No. 001-37357)

|

|

10.18

|

|

Form of Incentive Stock Option Agreement for Employees for the Innovation Pharmaceuticals Inc. 2016 Equity Incentive Plan

|

|

Exhibit 10.3 to the Current Report on Form 8-K of the Company filed on July 1, 2016 (File No. 001-37357)

|

|

10.19

|

|

Form of Non-qualified Stock Option Agreement for Employees for the Innovation Pharmaceuticals Inc. 2016 Equity Incentive Plan

|

|

Exhibit 10.4 to the Current Report on Form 8-K of the Company filed on July 1, 2016 (File No. 001-37357)

|

|

10.20

|

|

Form of Non-qualified Stock Option Agreement for Non-Employee Directors for the Innovation Pharmaceuticals Inc. 2016 Equity Incentive Plan

|

|

Exhibit 10.5 to the Current Report on Form 8-K of the Company filed on July 1, 2016 (File No. 001-37357)

|

|

10.21

|

|

Form of Restricted Stock Award Agreement for Employees for the Innovation Pharmaceuticals Inc. 2016 Equity Incentive Plan

|

|

Exhibit 10.6 to the Current Report on Form 8-K of the Company filed on July 1, 2016 (File No. 001-37357)

|

|

10.22

|

|

Form of Restricted Stock Award Agreement for Non-Employee Directors for the Innovation Pharmaceuticals Inc. 2016 Equity Incentive Plan

|

|

Exhibit 10.7 to the Current Report on Form 8-K of the Company filed on July 1, 2016 (File No. 001-37357)

|

|

23.1

|

|

Consent of Independent Registered Public Accounting Firm

|

|

Exhibit 23.1 to the Form 10-K for the year ended June 30, 2018 filed on September 11, 2018 (File No. 001-37357)

|

|

23.2

|

|

Consent of Gary R. Henrie, Esq. (included in Exhibit 5.1)

|

|

|

|

23.3

|

|

Consent of Gary R. Henrie, Esq. (included in Exhibit 5.2)

|

|

|

|

23.4

|

|

Consent of Gary R. Henrie, Esq. (included in Exhibit 5.3)

|

|

|

Item 17. Undertakings

(a) The undersigned registrant hereby undertakes:

1. To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that subparagraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those subparagraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are incorporated by reference in the registration statement.