Current Report Filing (8-k)

March 02 2020 - 5:28PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 26, 2020

HANNOVER

HOUSE, INC.

(Exact

name of registrant as specified in its charter)

|

Wyoming

|

|

000-28723

|

|

91-1906973

|

(State

or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

|

355

N. College Ave

|

|

|

|

Fayetteville,

AR

|

|

72701

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

|

818-481-5277

|

|

(Registrant’s

telephone number, including area code)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

As

of the date of this filing, Issuer Hannover House, Inc. (symbol OTC: HHSE) has not yet registered its securities. The company’s

stock shares are currently being traded on the OTC Markets Pinksheets Exchange. Issuer is in the process of completing the filing

of a Form 10 Registration imminently, after which time, the company’s shares will become registered with the Securities

and Exchange Commission.

Section

1 - Registrant’s Business and Operations

Item

1.01 Entry into a Material Definitive Agreement.

A).

Theatrical Distribution Pact with Snowy Morning, Inc. – On November 15, 2019, Company entered into an agreement with

Snowy Morning, Inc. regarding the licensing of the North American distribution rights to the motion picture “WILDFIRE,”

now in production. Over the course of the next six months, Company shall advance or cause to be paid on behalf of Snowy Morning,

Inc. sums not to exceed one-hundred-fifty-thousand dollars (USD $150,000) as a recoupable advance against theatrical releasing

revenues otherwise due to Snowy Morning, Inc. under the distribution pact with Company. As of the date of this filing, Company

has provided $41,641 to Snowy Morning, Inc. to assist with the ongoing production and post production of the film “WILDFIRE.”

Hannover House, Inc. CEO Eric Parkinson has been providing services on a non-exclusive, work-for-hire basis to Snowy Morning,

Inc. regarding Parkinson’s services in co-writing, co-producing and directing of this feature film. Company shall not be

responsible for any of the other costs or obligations of Snowy Morning, Inc. as a result of Company’s agreement to advance

recoupable sums to Snowy Morning, Inc. for the completion of “WILDFIRE.” Snowy Morning, Inc. shall retain all other

distribution and intellectual property rights (including international, home video, streaming and television), but Hannover

House, Inc. shall retain a lien against any other domestic revenues in the event that net theatrical collections from the release

of the film to theatres in North America are not sufficient to pay to Hannover House it’s applicable fees, plus recoupment

of marketing and releasing costs, plus recoupment of advances paid to Snowy Morning, Inc. by Hannover House, Inc. under this agreement.

B).

Engagement of M2 Compliance for S.E.C. Reporting and Filing – In anticipation of the Company’s filing of the Form

10 Registration Statement (and a separate filing for an additional registration of securities), Company has engaged M2 Compliance

for the formatting, XBRL Conversion work and direct submissions to the S.E.C. Edgar Database. The initial term of the engagement

for M2 Compliance is one (1) year.

C).

Engagement of Interim Chief Financial Officer – Company has entered into an agreement with CPA and financial services

executive Randall Blanton, to perform work for the Company as interim C.F.O., including recent and ongoing assistance with the

preparation and review of Company reports and documents for the Form 10 Registration and the required audits for the Form 10.

After Company’s registration with the S.E.C. is approved, Company intends to purchase “Directors and Officers

Liability Insurance Coverage” for all principal managers and board members. Mr. Blanton’s initial commitment

is for the interim period of ninety (90) days; however, Blanton has expressed his willingness to join Hannover House, Inc. on

a full-time basis at such time that the Directors and Officers Liability Insurance Coverage is in place.

Item

1.02 Termination of a Material Definitive Agreement.

NOT

APPLICABLE

Item

1.03 Bankruptcy or Receivership.

NOT

APPLICABLE

Item

1.04 Mine Safety – Reporting of Shutdowns and Patterns of Violations.

NOT

APPLICABLE

Section

2 - Financial Information

Company’s

balance sheet and notes as of the 12-month period ending Dec. 31, 2019 are included in this information filing under Section 9

below.

Item

2.01 Completion of Acquisition or Disposition of Assets.

SEE

ITEM 1.01-A above.

Item

2.02 Results of Operations and Financial Condition.

SEE

SECTION 9

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

NOT

APPLICABLE

Item

2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

NOT

APPLICABLE

Item

2.05 Costs Associated with Exit or Disposal Activities.

NOT

APPLICABLE

Item

2.06 Material Impairments.

NOT

APPLICABLE

Section

3 - Securities and Trading Markets

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

NOT

APPLICABLE

Item

3.02 Unregistered Sales of Equity Securities.

NOT

APPLICABLE

Item

3.03 Material Modification to Rights of Security Holders.

NOT

APPLICABLE

Section

4 - Matters Related to Accountants and Financial Statements.

NOT

APPLICABLE

Item

4.01 Changes in Registrant’s Certifying Accountant.

NOT

APPLICABLE

Item

4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

NOT

APPLICABLE

Section

5 - Corporate Governance and Management Item 5.01 Changes in Control of Registrant.

NOT

APPLICABLE

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

NOT

APPLICABLE

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The

Company has amended its Bylaws to include a Corporate Code of Ethics, attached hereto as Exhibit “A.”

Item

5.04 Temporary Suspension of Trading Under Registrant’s Employee Benefit Plans.

NOT

APPLICABLE

Section

5.06 -Change in Shell Company Status.

NOT

APPLICABLE

Item

5.07 Submission of Matters to a Vote of Security Holders.

NOT

APPLICABLE

Item

5.08 Shareholder Director Nominations

NOT

APPLICABLE

Section

6 -Asset-Backed Securities.

NOT

APPLICABLE

Item

6.01 ABS Informational and Computational Material.

NOT

APPLICABLE

Item

6.02 Change of Servicer or Trustee.

NOT

APPLICABLE

Item

6.03 Change in Credit Enhancement or Other External Support.

NOT

APPLICABLE

Item

6.04 Failure to Make a Required Distribution.

NOT

APPLICABLE

Item

6.05 Securities Act Updating Disclosure.

NOT

APPLICABLE

Item

6.06 Static Pool.

NOT

APPLICABLE

Section

7 - Regulation FD

NOT

APPLICABLE

Item

7.01 Regulation FD Disclosure.

NOT

APPLICABLE

Section

8 - Other Events

Item

8.01 Other Events.

Section

9 - Financial Statements and Exhibits

A).

Financial Results are listed in item 9.01 below and included in the following pages;

B).

Company Code of Ethics addendum to Corporate Bylaws are attached as Exhibit “A” following officer signature.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

HANNOVER

HOUSE, INC.

|

|

|

(Registrant)

|

|

Date:

March 02, 2020

|

|

|

|

|

/s/

Eric F. Parkinson

|

|

|

By:

|

ERIC

F. PARKINSON

|

|

|

|

Chairman,

C.E.O. & Secretary

|

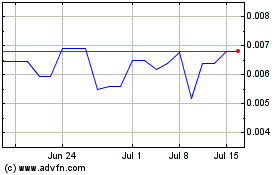

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

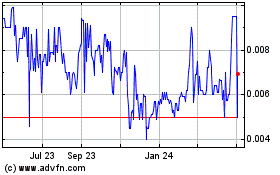

Hannover House (PK) (USOTC:HHSE)

Historical Stock Chart

From Apr 2023 to Apr 2024