Current Report Filing (8-k)

August 26 2020 - 5:04PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 22, 2020

GRN

HOLDING CORPORATION

(Exact

Name of Registrant as Specified in its Charter)

|

Nevada

(State

or other jurisdiction of incorporation or organization)

|

Commission

File Number

000-54709

|

27-2616571

(I.R.S.

Employer

Identification

Number)

|

1700

Seventh Avenue, Ste 2300, Seattle, WA 98101

(Address of Principal

Executive Offices and Zip Code)

(425)

830-1192

(Issuer's telephone number)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Section 3 - Securities

and Trading Markets.

Item

3.03 - Material Modification to Rights of Security Holders

(a) On

August 22, 2020, the Board of Directors met and unanimously approved a resolution recommending an amendment to the Registrant’s

articles of incorporation to increase the Company’s authorized shares from a total of 260,000,000 shares, consisting of

250,000,000 common shares and 10,000,000 preferred shares, each with a par value of $0.001 per share, to a total of 760,000,000

shares, consisting of 750,000,000 common shares and 10,000,000 preferred shares, each with a par value of $0.001 per share. The

Board of Directors thereafter called for and convened a special meeting of the stockholders. On August 22, 2020, stockholders

beneficially owning a majority of the shares eligible to vote consented to the amendment of the Registrant’s articles of

incorporation to so increase the number of authorized shares consistent with the recommendation of the Board of Directors.

(b) On

August 22, 2020, the Board of Directors unanimously adopted a resolution amending the Company’s articles of incorporation

to designate a class of preferred stock as: “Series “A” Preferred Stock,” consisting of one hundred (100)

shares. The material preferences qualified by the Series “A” Preferred Stock include: (i) Upon liquidation, the holders

of Shares of Series “A” Preferred Stock then outstanding shall be entitled to be paid out of the assets of the Corporation

available for distribution to its stockholders, before any payment shall be made to the holders of Junior Securities; (ii) Each

holder of outstanding Shares of Series “A” Preferred Stock shall be entitled to a voting preference on any matter

brought before the stockholders under the Company’s articles, by-laws or Nevada law, providing the holders of “Series

“A” Preferred Stock” with not less than the minimum number of votes that would be necessary to authorize or

take such action at a meeting at which all such shares entitled to vote thereon were present and voted. For the avoidance of doubt,

in any matter presented to the stockholders for their consideration and action, in a noticed meeting, special meeting or by written

consent, the holder of the Series “A” Preferred Stock shall be entitled to cast that number of votes equal to the

total number of votes cast, plus one share to equal to a majority of the shares eligible to vote on any matter, consistent with

Section 2.8 of the Corporation’s By Laws. Each holder of outstanding Shares of Series “A” Preferred Stock shall

be entitled to notice of all stockholder meetings (or requests for written consent) in accordance with the Corporation's bylaws.

The Board of Directors issued all one hundred shares to Justin Costello.

By amendment

to this Form 8-K, the Company will file-stamped amendments once received from the State of Nevada.

Section

9 – Financial Statement and Exhibits

Item

9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated August 26, 2020

GRN Holding Corporation

By: /s/ Justin Costello

Justin Costello

Chief Executive Officer

(Principal Executive Officer)

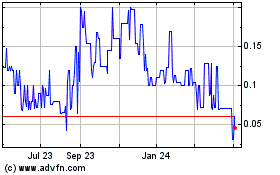

GRN (PK) (USOTC:GRNF)

Historical Stock Chart

From Mar 2024 to Apr 2024

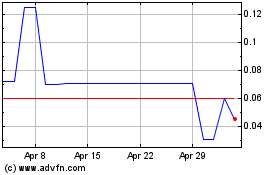

GRN (PK) (USOTC:GRNF)

Historical Stock Chart

From Apr 2023 to Apr 2024