Offering Circular, Dated February 28, 2020

Filed

pursuant to Rule 253(g)(1)

File No. 024-11090

Greene Concepts,

Inc.

13195 U.S. Highway

221 N

Marion, North

Carolina, 28752

(844) 889-2837;

www.greeneconcepts.com

Best

Efforts Offering of up to 2,000,000,000 Shares of Common Stock

Greene

Concepts, Inc. (which we refer to as “our company,” “we,” “our” and “us”) is offering

up to two billion (2,000,000,000) shares of its Common Stock at a fixed offering price of $0.0015 per share. The aggregate amount

of gross proceeds we are seeking to raise is three million dollars ($3,000,000). There is no minimum number of shares that must

be sold in order to close this offering and thus no escrow account is being utilized. See “Plan of Distribution” beginning

on page 19 and “Securities Being Offered” beginning on page 39.

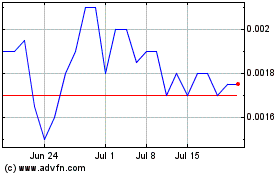

Our Common

Stock is quoted on the OTC Pink Market maintained by OTC Markets Group Inc., under the trading symbol “INKW” and the

closing bid price of our Common Stock on February 6, 2020 was $0.0022. Our Common Stock currently trades on a sporadic and limited

basis. Our board of directors used its business judgment in setting a value of $0.0015 per share of common stock of our company

as the offering price for this offering. The purchase price per share bears no relationship to our book value or any other measure

of our current value or worth.

The proposed

sale of our common stock in this offering will begin as soon as practicable after this offering statement has been qualified by

the Securities and Exchange Commission, or the SEC, and the relevant state regulators, as necessary. This offering will terminate

at the earlier of: (1) the date on which the maximum offering amount has been sold, (2) the date which is one year after this

offering has been qualified by the SEC or (3) the date on which this offering is earlier terminated by us in our sole discretion.

This offering

is being conducted on a “best efforts” basis pursuant to Regulation A of Section 3(b) of the Securities Act of 1933,

as amended, or the Securities Act, for Tier 1 offerings and there is no minimum offering amount. We plan to hold a series of closings

at which we and investors will execute subscription documents, we will receive the funds from investors and issue the shares to

investors. See “Plan of Distribution” and “Securities Being Offered” for a description of our capital

stock.

|

|

|

Price

to Public

|

|

Underwriting

Discount and Commissions(1)

|

|

Proceeds

to Issuer(2)

|

|

Proceeds

to Other Persons

|

|

Per share

|

|

$

|

0.0015

|

|

|

$

|

0

|

|

|

$

|

0.0015

|

|

|

$

|

0

|

|

|

Total Maximum

|

|

$

|

3,000,000

|

|

|

$

|

0

|

|

|

$

|

3,000,000

|

|

|

$

|

0

|

|

|

|

(1)

|

We

do not intend to use commissioned sales agents or underwriters.

|

|

|

(2)

|

The

amounts shown are before deducting offering costs to us, which include legal, accounting,

printing, due diligence, marketing, consulting, selling and other costs incurred in this

offering.

|

We are

an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, and, as such,

may elect to comply with certain reduced reporting requirements for this offering circular and future filings after this offering.

Investing

in this offering involves a high degree of risk, and you should not invest unless you can afford to lose your entire investment.

See “Risk Factors” beginning on page 10 for a discussion of certain risks that you should consider in connection with

an investment in our securities.

Generally,

no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual

income or your net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation

that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For

general information on investing, we encourage you to refer to www.investor.gov.

THE

U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE

TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS.

THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE

AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

This offering circular is following

the offering circular format described in Part II (a)(1)(i) of Form 1-A.

The approximate date of commencement of proposed

sale to the public is February 28, 2020.

|

Summary

|

4

|

|

Risk Factors

|

10

|

|

Dilution

|

17

|

|

Plan of Distribution

|

19

|

|

Use of Proceeds

|

22

|

|

Description of Business

|

23

|

|

Description of Property

|

28

|

|

Management’s Discussion

and Analysis of Financial Condition and Results of Operations

|

29

|

|

Directors, Executive Officers and

Significant Employees

|

34

|

|

Compensation of Directors and Executive

Officers

|

35

|

|

Security Ownership of Management

and Certain Securityholders

|

37

|

|

Interest of Management and Others

in Certain Transactions

|

38

|

|

Securities Being Offered

|

39

|

|

Legal

Matters

|

44

|

|

Interests

of Named Experts and Counsel

|

44

|

|

Where

You Can Find More Information

|

44

|

|

Financial Statements

|

F-1

|

THIS OFFERING

CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN

AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION

CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,”

“PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT” AND SIMILAR

EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH

RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER

MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE

FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE.

We are

offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You

should rely only on the information contained in this offering circular. We have not authorized anyone to provide you with any

information other than the information contained in this offering circular. The information contained in this offering circular

is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither

the delivery of this offering circular nor any sale or delivery of our securities shall, under any circumstances, imply that there

has been no change in our affairs since the date of this offering circular. This offering circular will be updated and made available

for delivery to the extent required by the federal securities laws.

SUMMARY

This summary

highlights information contained elsewhere in this offering circular. This summary does not contain all of the information that

you should consider before deciding to invest in our securities. You should read this entire offering circular carefully, including

the “Risk Factors” section, our historical financial statements and the notes thereto, each included elsewhere in

this offering circular.

Our

Company

Overview

Our company

name is Greene Concepts, Inc. We are headquartered in Marion, North Carolina. We are a New York corporation that was incorporated

on August 18, 1952 and previously operated as Tech-OHM Resistor Corporation, Tech-OHM Electronics, Inc., International Citrus

Corporation, Princeton Commercial Holdings, Inc., Eurowind Energy, Inc., First Petroleum and Pipeline Inc., and Luke Entertainment,

Inc. Since our inception, we have operated different businesses under these different names before changing our name to Greene

Concepts, Inc. and engaging in our current business line. Through our wholly-owned subsidiary, Mammoth Ventures Inc., or Mammoth,

we are now a bottling and beverage company committed to providing the world with high quality, healthy, and enhanced beverage

choices. Our beverage and bottling facility is located in Marion, North Carolina. The facility is a 55,000 square foot bottling

and beverage plant that is located within the boundaries of the Pisgah National Forest. The bottling facility has as its water

sources a combination of seven (7) spring and artesian wells that are fed from a natural aquifer that is located deep below the

Pisgah National Forest. We are focused on producing a variety of beverage product lines including, but not limited to, spring

and artesian water, cannabinoid, or CBD, infused beverages, pH balanced water and beverage offerings, as well as enhanced athletic

drinks in addition to other product offerings. Additionally, we expect that Mammoth will act as a third-party producer and bottler

of "white label" beverage and water products. White label bottling services are provided for clients that desire to

market their own product formulations, brand name and labeling while outsourcing the production and bottling of their products

to Mammoth.

Before

acquiring Mammoth on February 6, 2019, we operated our legacy business, which was the manufacture and distribution of a line of

25 high quality consumer focused inkjet kits. On April 30, 2019, our board of directors made a determination to wind down our

legacy business and to transition into the beverage and bottling business.

On February

6, 2019, we entered into a Stock Purchase Acquisition Agreement and Merger Agreement and Promissory Note Agreement with BNL Capital

LLC, or BNL Capital. Pursuant to the terms of the agreement, BNL Capital agreed to sell 100% of the outstanding shares of Mammoth

to us for a purchase price of $1,350,000. Mammoth acquired certain assets of the defunct business formerly referred to as “North

Cove Springs Bottling and Beverage,” which includes the Marion, North Carolina bottling facility and related assets. We

financed the acquisition through a secured promissory note in the amount of $1,350,000 in favor of BNL Capital. The promissory

note was secured by 100% of the outstanding shares of Mammoth that are owned by our company. See “Description of Business

– Terms of Acquisition of Mammoth Ventures, Inc.” for a description of the terms of our acquisition of Mammoth.

Upon

acquiring Mammoth, we began the process of performing required maintenance to revitalize all the equipment and facility infrastructure

in order to relaunch production at the plant. At the time of the acquisition all of the plant equipment was in good condition

although the equipment had not operated for several years and it did require a thorough inspection and light maintenance to assure

proper operation when the bottling lines are relaunched. At the time of the acquisition, we hired, Kenneth Porter, a 30+ year

veteran of the beverage and bottling industry, as plant manager to oversee operations as well as the revitalization and expected

relaunch of the facility.

The Food

and Drug Administration, or FDA, requires adherence to current good manufacturing practice, or CGMP, regulations for the processing

and bottling of bottled drinking water, which includes facility inspection and documentation of corrective measures and reporting

requirements, as well as new requirements for hazard assessments and food safety, or HACCP, plans mandated by the Food Safety

and Modernization Act, or FSMA. Final preparations for inspection are underway, including building and facility maintenance such

as pressure washing, painting, general cleaning, and minor building repairs.

In addition

to complete cleaning and maintenance of the 55,000 square foot facility, standard operating policies and procedures must be documented

in accordance with federal legislation. This documentation includes conducting and reporting of microbial testing of source water

and any finished product, which must be completed prior to initiating filling and packaging of bottles for shipment from our production

lines.

In concert

with the coordination of the final preparations for inspection and the launching of production, we are presently working with

a number of distributors and retailers to presale orders for production once the plant is fully operational. We expect to relaunch

the plant during the first quarter of 2020.

Our

Industry

Consumers

are consistently switching from carbonated drinks to water and healthy energy drinks. As a result, the beverage market has seen

increased demand for enhanced water and other functional drinks. Overall, rapid urbanization, along with widening base of the

middle-class population, has increased the demand for a variety of healthy beverages.

This

higher demand for water and functional beverages has benefited the packaging industry. Moreover, increasing consumer demand for

quality products, made from organic and naturally sourced ingredients, requires science-based formulations of effective products

in the beverage industry. These factors have created growth potential for beverage packaging service providers who have the expertise

and knowledge required to create successful products in an increasingly discerning market.

Modor

Intelligence predicts the global beverage packaging market to grow at a compounded annual growth rate, or CAGR, of 4.17% and reach

a value of $142.28 billion by 2023. Currently, North America accounts for the largest market share, poised to reach $28.84 billion

by 2023. According to Statistica, revenue in the US bottled water segment alone amounts to US$67.5 billion in 2019 and is expected

to grow annually by 5.5% (CAGR 2019-2023).

The International

Bottled Water Association (IBWA), and the Beverage Marketing Corporation (BMC), reports bottled water volume grew to 13.2 billion

gallons in 2017 to 13.8 gallons in 2018, an almost five percent increase over the previous year (as compared to more than 6% growth

in 2017). This growth is fueled in large part by increased numbers of consumers choosing bottled water instead of soda. Carbonated

soft drink sales decreased for the thirteenth consecutive year, according to the most recent numbers from BMC. BMC statistics

show per capita consumption exceeded 42 gallons of bottled water, a 6.2 percent increase and the average annual intake of carbonated

soft drinks has declined to 37.5 gallons. BMC foresees bottled water consumption will climb higher than 50 gallons per capita

within just a few years. According to BMC, nearly all Americans (94 percent) believe that bottled water is a healthier choice

than soft drinks, and 93 percent say bottled water should be available wherever drinks are sold.

The shift

away from sugary drinks is having a dramatic impact on sales of functional beverages. The global functional drinks market size

is expected to reach USD 93.68 billion by 2019, according to a new study by Grand View Research, Inc., progressing at a CAGR of

6.1% during the forecast period. Per Grand View Research, the global functional drink market is anticipated to reach $93.68 billion

in 2019, at a CAGR of 6.1%. According to the Grand View Report, four players hold 55.2% of this market. Functional beverages include

energy drinks and sports drinks, and nutritional drinks. In 2014, energy drinks represented almost 56% of all functional beverage

sales. Ibis World reports, over the past five years, the US energy drink production industry has grown by 5.2% to reach revenue

of $9 billion in 2018. The energy drinks market is forecast to register a CAGR of 3.6% till 2023, whereas, the sports drinks market

will grow at a CAGR of 4.3% during the same period.

In contrast

to the energy and sports drink categories, functional drinks with nutraceutical formulations are designed to support consumer

desire for establishing healthy lifestyle routines. Often formulated using herbs, botanicals, vitamins and minerals, these beverages

are designed to support digestive wellness, reduce stress and improve sleep, as examples. They are often sold as dietary supplements,

and subject to additional regulation by the FDA. As a result, they are sold at a higher price point. Netherlands-based Innova

Market Insights, in its 2017 “Functional Drinks” reports 30.5 percent of all functional drink launches were vitamin/mineral

fortified, while 22.8 percent contained high amounts of protein. Rounding out the Top 5 were energy/alertness (20 percent), digestive/gut

health (19 percent), and antioxidants (12.7 percent).

We believe

that the growth in bottled water and other healthy beverages and away from carbonated or sugary beverages will create opportunities

for our company. We also believe that recent market trends will continue to grow as federal and state regulation is for hemp derived

CBD products is codified. The CBD market now stands at $1.01 trillion with forecasts calling for it to grow to $22 billion by

2022. Many analysts are calling for 20% or more of that growth to occur in the CBD infused beverage space. This trend, plus the

opportunity presented by the US private label beverage market, which, according to Technavio, will have revenue of almost USD

140 billion by 2021, are expected by management to fuel growth of our bottling and distribution business for years to come.

Our

Products

Our bottling

facility is not yet operational, and we have not begun selling any products yet.

We expect

that our future products will include:

|

|

·

|

Enhanced

spring and artesian water;

|

|

|

·

|

Functional

beverages and liquid dietary supplements for a variety of market needs, including, but

not limited to, pH balanced water, enhanced athletic drinks;

|

|

|

·

|

CBD

infused beverages; and

|

|

|

·

|

Beverages

that meet the nutritional needs for unique defined populations and health conditions.

|

We also

plan to operate as a third-party producer and bottler of "white label" beverage and water products once our facility

is fully licensed and becomes operational.

Our

Production

We plan

to produce our future products at our 55,000 square foot bottling and beverage plant that is located within the boundaries of

the Pisgah National Forest in Marion, North Carolina. The bottling facility has as its water sources a combination of seven (7)

spring and artesian wells that are fed from a natural aquifer that is located deep below the Pisgah National Forest. We are focused

on producing a variety of beverage product lines including, but not limited to spring and artesian water, cannabinoid, or CBD,

infused beverages, pH balanced water and beverage offerings, as well as enhanced athletic drinks in addition to other product

offerings.

Since

we will not rely on independent third-party bottlers to manufacture and market our products, we believe we can more effectively

manage quality control and consumer appeal while responding quickly to changing market conditions. We expect that we will produce

substantially all of the concentrates and essences used in our future branded products. We believe that our ability to control

our own formulas in the future will allow us to craft products in a uniform manner with high quality standards while innovating

flavors to meet changing consumer preferences.

Our

Distribution

Given

our particular interest in the natural health, organic and dietary supplement arenas, our primary distribution systems will utilize

the fresh, natural and organic wholesale food distributors and representatives. Distribution will be targeted to independent natural

food retailers and large box stores through both independent warehouse distribution system and direct-store delivery system. ‘White

label’ products will utilize customer shipping and qualified independent shipping companies for direct delivery to the convenience

channels. At this time, we do not have plans to distribute through food service industry.

Sales

and Marketing

We plan

to sell and market our products through an internal sales force as well as networks of brokers.

We will

seek to reach consumers directly through digital marketing, digital social marketing, social media engagement and creative content.

Our marketing efforts will be focused on increasing our digital presence and capabilities to further enhance the consumer experience

across our future brands. We may retain agencies to assist with social media content creative and platform selection for our brands.

Additionally,

we expect that we will create brand recognition and loyalty through a combination of regional event participation, special event

marketing, endorsements, consumer coupon distribution and product sampling.

More

specifically, we expect to use the following techniques to market our product offerings and attract customers:

|

|

·

|

Attending

Trade and Other Events: We will attend these events in order to create awareness of our

brand/ products and develop relationships with potential commercial customers. The potential

customers will then be followed up in order to convert them into regular customers for

whom we can provide white label services.

|

|

|

·

|

Signboards

and Billboards Marketing

|

|

|

·

|

Printing

and Distributing Brochures and Flyers

|

|

|

·

|

Search

Engine Optimization (SEO) of our Website: SEO will be employed as it will bring our website

at the top positions in natural search queries on widely used search engines like Google

and Bing.

|

|

|

·

|

CRM

Software: We plan to utilize client relationship management, or CRM, software to offer

materials, such as free guides or informative materials, ready to be downloaded in exchange

of contact details. The software will then automatically send marketing materials to

available contacts in order to convert them into customers.

|

|

|

·

|

Google

AdWords: We will start different campaigns including text-based search ads, graphic display

ads, and YouTube video ads in order to reach our targeted audience(s) with AdWords.

|

|

|

·

|

Word

of Mouth/ Recommendations

|

|

|

·

|

Referral

Marketing: Referrals are one of the most valuable assets for our company. We will add

our customers to a special, dedicated group and give them benefits on referring us to

others.

|

Raw

Materials

The products

that we expect to produce and sell will be packaged in various materials suitable for cold pack beverages, including aluminum,

glass, paper and plastic bottles, including recyclable and reusable containers. Ingredients for our functional beverage lines

will include minerals, vitamins, herbs and botanicals, as well as flavors and naturally derived sweeteners. Ingredients will be

sourced from cGMP compliant companies who are committed to transparency and traceability relating to origin, identify, testing

and quality. Certifications for gluten-free, Kosher, Organic and other relevant ingredient criteria will be required on an as-needed

basis. The majority of materials and ingredients we will purchase will be presently available from several suppliers. However,

our specialized approach to formulation and quality standards may result in reduced availability of some ingredients due to weather,

governmental controls or price/supply fluctuations, which would lead to price fluctuations. Therefore, we expect to clearly delineate

our supply program qualifications and enroll suppliers in our own supplier program to ensure continued access to the ingredients

we seek for production.

Seasonality

We expect

that our operating results will not be materially affected by seasonal factors, including fluctuations in costs of raw materials,

holiday and seasonal programming and weather conditions. Our products are “functional” beverages chosen by consumers

who ascribe to a certain lifestyle, and as such we do not expect our products to be impacted by seasonal factors.

Our

Competition and Competitive Strengths

Our products

will compete with many varieties of liquid refreshment, including water products, soft drinks, juices, fruit drinks, energy drinks

and sports drinks, as well as powdered drinks, coffees, teas, dairy-based drinks, functional beverages and various other nonalcoholic

beverages. We will also compete with bottlers and distributors of national, regional and private label products. Several competitors,

including those that dominate the beverage industry, such as Nestlé S.A., PepsiCo and The Coca-Cola Company, have greater

financial resources than we have and aggressive promotion of their products may adversely affect sales of our brands.

The principal

methods of competition in the beverage industry are price and promotional activity, advertising and marketing programs, point-of-sale

merchandising, retail space management, customer service, product differentiation, packaging innovations and distribution methods.

We believe we will be able to differentiate ourselves in the following ways:

|

|

·

|

Formulations

of products for specific, targeted audiences who have unique health and exercise requirements

|

|

|

·

|

Infusion

of ingredients with scientific research regarding the effectiveness of the products to

address specific health and wellness needs.

|

|

|

·

|

Utilization

of ingredients sourced from quality companies committed to our quality standards

|

|

|

·

|

Access

to research opportunities and outcomes to support our future family of functions beverages

|

|

|

·

|

Regulatory

capacity that ensures brands and stores are selling product that meets the standards

of states and governments

|

|

|

·

|

Access

to industry stakeholders, influencers and high-profile consumers who can provide third-party

endorsement of our products.

|

Our

Growth Strategies

We expect

that our first product will be spring water and that we will white label our spring water for third parties. Although we

are in negotiations with third parties for the white label of our expected first product (spring water) we have not yet received

any purchase orders or entered into any contracts for the sale of this product because our facility is not yet fully licensed.

We have completed licensing of our facility and expect to launch our white label spring water sometime during the first

quarter of 2020. Following the launch of our first product, we will be working on the development of other products and expect

to launch other products in the second half of 2020.

Recent

Developments

On January

11, 2020, we cancelled 225,000,000 shares of our common stock that were registered in the name of Andy Greider. The shares were

cancelled pursuant an understanding between us and Mr. Greider that dated back to October 2018 and is evidenced by a written letter

from Mr. Greider to our transfer agent. Mr. Greider previously provided consulting services to our company and agreed to forfeit

these shares when he ceased providing such services.

Corporate

Information

Our principal

executive offices are located at 13195 U.S. Highway 221 N, Marion, North Carolina, 28752 and our telephone number is (844) 889-2837.

We maintain a website at www.greeneconcepts.com. Information available on our website is not incorporated by reference in and

is not deemed a part of this offering circular.

The

offering

|

Securities being offered:

|

|

Up to 2,000,000,000 shares

of Common Stock, par value $0.0001, for a maximum offering amount of $3,000,000.

|

|

|

|

|

|

Offering price per share:

|

|

$0.0015 per share.

|

|

|

|

|

|

Minimum subscription:

|

|

The minimum subscription amount is $100,

but we may waive such minimum amount in our sole discretion.

|

|

|

|

|

|

Shares outstanding before the offering:

|

|

637,861,741 shares of Common Stock and

13,119,500 shares of Preferred Class A Stock as of February 6, 2020.

|

|

|

|

|

Shares outstanding after the offering:(1)

|

|

Assuming this offering is fully funded,

there will be 2,637,861,741 shares of Common Stock issued and outstanding and 13,119,500 shares of Preferred Class A Stock

issued and outstanding.

|

|

|

|

|

Best efforts offering:

|

|

We are offering shares on a “best

efforts” basis through our Chief Executive Officer, Mr. Greene, who will not receive any discounts or commissions for

selling the shares. There is no minimum number of shares that must be sold in order to close this offering.

|

|

|

|

|

|

Restrictions on investment amount:

|

|

Generally, no sale may be made to you in

this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth.

Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment

does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(c) of Regulation A. For general information

on investing, we encourage you to refer to www.investor.gov.

|

|

|

|

|

|

No Escrow account:

|

|

We have not engaged an escrow agent for

this offering. Funds invested will be deposited directly into our company’s operating account and immediately

available for our use.

|

|

|

|

|

|

Termination of the offering:

|

|

This offering will commence as soon as

practicable after this offering statement has been qualified by the SEC and will terminate at the earlier of: (1) the date

on which the maximum offering amount has been sold, (2) the date which is one year after this offering has been qualified

by the SEC or (3) the date on which this offering is earlier terminated by us in our sole discretion.

|

|

|

|

|

|

Use of proceeds:

|

|

We estimate

that, at a per share price of $0.0015, the net proceeds from the sale of the 2,000,000,000 shares in this offering will

be approximately $2,947,000, after deducting the estimated offering expenses of approximately $53,000.

We

intend to use the net proceeds of this offering for working capital expenses. See

“Use of Proceeds” for details.

|

|

|

|

|

Market for our Common Stock:

|

|

Our Common Stock is currently quoted on

the OTC Pink Market under the trading symbol “INKW”.

|

|

|

|

|

|

Risk factors:

|

|

Investing in our securities involves risks.

See the section entitled “Risk Factors” in this offering circular and other information included in this offering

circular for a discussion of factors you should carefully consider before deciding to invest in our securities.

|

RISK

FACTORS

Investing

in our shares involves a significant degree of risk. In evaluating our company and an investment in the shares, careful consideration

should be given to the following risk factors, in addition to the other information included in this offering circular. Each of

these risk factors could materially adversely affect our business, operating results or financial condition, as well as adversely

affect the value of an investment in our shares. The following is a summary of the most significant factors that make this offering

speculative or substantially risky. We are still subject to all the same risks that all companies in our industry, and all companies

in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological

developments (such as cyber-security). Additionally, early-stage companies are inherently riskier than more developed companies.

You should consider general risks as well as specific risks when deciding whether to invest.

Risks

Related to our Business, Operating Results and Industry

Our

bottling facility is not yet operational, and we do not yet have all of the licenses we will require to operate our facility.

A failure to obtain such licenses or any significant delays in our budgeted time for the commencement of operations will have

a material adverse effect on our financial condition and prospects.

Upon

acquiring the Marion, North Carolina bottling facility, Mammoth began the process of performing required maintenance to revitalize

all the equipment and facility infrastructure in order to relaunch production at the plant. At the time of the acquisition the

plant equipment had laid dormant for several years and all of the equipment required a thorough inspection and light maintenance

to assure proper operation when the bottling lines are relaunched. We continue the process of maintaining our equipment and getting

our facility ready for operation. The Food and Drug Administration, or FDA, requires adherence to current good manufacturing practice,

or CGMP, regulations for the processing and bottling of bottled drinking water, which includes facility inspection and documentation

of corrective measures and reporting requirements, as well as new requirements for hazard assessments and food safety, or HACCP,

plans mandated by the Food Safety and Modernization Act, or FSMA. Final preparations for inspection are underway, including building

and facility maintenance such as pressure washing, painting, general cleaning, and minor building repairs. No assurance can be

given that we will be able to pass such governmental inspections within our expected timeframe. Any delays in completing required

inspections could delay the commencement of our operations, which would have a material adverse effect on our financial conditions

and prospects.

In addition

to complete cleaning and maintenance of the 55,000 square foot facility, standard operating policies and procedures must be documented

in accordance with federal legislation. This documentation includes conducting and reporting of microbial testing of source water

and any finished product, which must be completed prior to initiating filling and packaging of bottles for shipment from our production

lines. Delays in documenting our standard operating policies and procedures in accordance with federal legislation could similarly

delay the commencement of our operations and have a material adverse effect on our financial condition and prospects.

We

have almost $2 million in convertible debt outstanding and some of such debt is already in default or about to go into default.

If the holders of such debt bring a legal action against us either in bankruptcy or otherwise, our financial condition and future

prospects would be materially adversely affected.

We provide

a detailed table of our outstanding convertible notes in this offering circular under “Securities Being Offered –

Convertible Notes.” Such table provides the maturity date of each of our outstanding convertible notes among other information.

Of the outstanding convertible notes, over $100,000 in obligations is already past due and we are, therefore, in default under

such notes. Several other notes will mature over the next few months. Accordingly, we are in default under the matured notes and

the holders of those notes could bring an action against our company for its failure to pay the note when due. We have obtained

the non-binding verbal agreement of the noteholders who hold past due notes to forbear against bringing any such action against

us for a period expiring at the earliest on April 30, 2020. However, no assurance can be given that such noteholders will abide

by his nonbinding verbal agreement. Each such holder has the right to bring an action against us immediately and may be able to

bring an action in bankruptcy court against us. Any such legal action would have a material adverse effect on our financial condition,

operations, and future prospects.

We

will need additional financing to execute our business plan which we may not be able to secure on acceptable terms, or at all.

We will

require additional financing in the near and long term to fully execute our business plan. Our success depends on our ability

to raise such additional financing on reasonable terms and on a timely basis. Conditions in the economy and the financial markets

may make it more difficult for us to obtain necessary additional capital or financing on acceptable terms, or at all. If we cannot

secure sufficient additional financing, we may be forced to forego strategic opportunities or delay, scale back or eliminate further

development of our goals and objectives, operations and investments or employ internal cost savings measures.

In

order for us to compete and grow, we must attract, recruit, retain and develop the necessary personnel who have the needed experience.

Recruiting

and retaining highly qualified personnel is critical to our success. These demands may require us to hire additional personnel

and will require our existing management personnel to develop additional expertise. We face intense competition for personnel.

The failure to attract and retain personnel or to develop such expertise could delay or halt the sales and licensing of our product.

If we experience difficulties in hiring

and retaining

personnel in key positions, we could suffer from delays in our development, loss of customers and sales and diversion of management

resources, which could adversely affect operating results. Our future consultants and advisors may be employed by third parties

and may have commitments under consulting or advisory contracts with third parties that may limit their availability to us.

Quality

management plays an essential role in determining and meeting customer requirements, preventing defects, improving our products

and services and maintaining the integrity of the data that supports the safety and efficacy of our products.

Our future success

depends on our ability to maintain and continuously improve our quality management program. An inability to address a quality

or safety issue in an effective and timely manner may also cause negative publicity, a loss of customer confidence in us or our

current or future products, which may result in the loss of sales and difficulty in successfully launching new products. In addition,

a successful claim brought against us in excess of available insurance or not covered by indemnification agreements, or any claim

that results in significant adverse publicity against us, could have an adverse effect on our business and our reputation.

Our success depends

on the services of our Chief Executive Officer, the loss of whom could disrupt our business.

We

depend to a large extent on the services of our CEO, Mr. Leonard Greene. Given his knowledge and experience, he is important to

our future prospects and development as we rely on his expertise in developing our business strategies and maintaining our operations.

The loss of the service of Mr. Greene and the failure to find timely replacements with comparable experience and expertise could

disrupt and adversely affect our business.

Although

dependent on certain key personnel, we do not have any key person life insurance policies on any such people.

We are

dependent on Leonard Greene in order to conduct our operations and execute our business plan, however, we have not purchased any

insurance policies with respect to him in the event of his death or disability. Therefore, if Leonard Greene dies or becomes disabled,

we will not receive any compensation to assist with his absence. The loss of Leonard Greene could negatively affect us and our

operations.

We

face significant competition for our beverage and bottling business.

The commercial

beverage and bottling industry is highly competitive and we compete with a number of other companies that provide similar products.

Our ability to compete successfully in the commercial beverage industry and to manage our planned growth will depend primarily

upon the following factors:

|

|

·

|

maintaining

continuity in our management and key personnel;

|

|

|

·

|

ability

to react to competitive product and pricing pressures;

|

|

|

·

|

the

strength of our brand;

|

|

|

·

|

the

ability to expand into specialized bottling, including carbonated beverages, unique sizes

and shapes;

|

|

|

·

|

increasing

the productivity of our future sales employees;

|

|

|

·

|

effectively

marketing and selling our products;

|

|

|

·

|

acquiring

new customers for our products;

|

|

|

·

|

ability

to respond to complaints if necessary;

|

|

|

·

|

developing

and improving our operational, financial and management controls;

|

|

|

·

|

developing

and improving our information reporting systems and procedures; and

|

|

|

·

|

the

design and functionality of our products.

|

Many

of our competitors have greater financial, technical, product development, marketing and other resources than we do. These organizations

may be better known than we are and may have more customers or users than we do. We cannot provide assurance that we will be able

to compete successfully against these organizations, which may lead to lower customer satisfaction, decreased demand for our solutions,

loss of market share or reduction of operating profits.

The

forecasts of market growth included in this offering circular may prove to be inaccurate, and even if the markets in which we

compete achieve the forecasted growth, we cannot assure you our business will grow at similar rates, if at all.

Growth

forecasts are subject to significant uncertainty and are based on assumptions and estimates that may not prove to be accurate.

The forecasts contained in this offering circular may prove to be inaccurate. Even if these markets experience the forecasted

growth described in this offering circular, we may not grow our business at similar rates, or at all. Our growth is subject to

many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties. Accordingly,

the forecasts of market growth included in this offering circular should not be taken as indicative of our future growth.

Reductions

in future sales of our products will have an adverse effect on our profitability and ability to generate cash to fund our business

plan.

The following

factors, among others, could affect future market acceptance and profitability of our products:

|

|

·

|

the

introduction of additional competitive or alternative beverage products or white label

bottlers;

|

|

|

·

|

changes

in consumer preferences among commercial beverages products;

|

|

|

·

|

changes

in awareness of the environmental impact of commercial beverages products;

|

|

|

·

|

the

level and effectiveness of our sales and marketing efforts;

|

|

|

·

|

any

unfavorable publicity regarding our products or services;

|

|

|

·

|

any

unfavorable publicity regarding our future brands;

|

|

|

·

|

litigation

or threats of litigation with respect to our future products or services;

|

|

|

·

|

the

price of our products or services compared to those of our competitors;

|

|

|

·

|

price

increases resulting from rising commodity costs;

|

|

|

·

|

regulatory

developments affecting the manufacturing or marketing of our products;

|

|

|

·

|

any

changes in government policies and practices related to our products; and

|

|

|

·

|

new

science or research or regulatory barriers that impede the development of our future

CBD products.

|

Adverse

developments with respect to the manufacturing or sale of our products would significantly reduce our net sales and profitability

and have a material adverse effect on our ability to maintain profitability and achieve our business plan.

We

will rely on other companies to provide materials for our products.

We will

depend on suppliers and subcontractors to meet our contractual obligations to our future customers and conduct our operations.

Our ability to meet our obligations to our customers may be adversely affected if suppliers or subcontractors do not provide the

agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective

manner. Likewise, the quality of our future products may be adversely impacted if companies from whom we acquire such items do

not provide materials which meet required specifications and perform to our and our customers’ expectations. Our distributors

and suppliers may be less likely than us to be able to quickly recover from natural disasters and other events beyond their control

and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk

of these adverse effects may be greater in circumstances where we may rely on only one or two distributors or suppliers for a

particular material.

We plan to source certain

materials from a number of third-party suppliers and, in some cases, single-source suppliers.

Although

we believe that alternative suppliers will be available, the loss of any of our future material suppliers could adversely affect

our results of operations and financial condition. Our inability to preserve the expected economics of these agreements could

expose us to significant cost increases in future years.

Substantial

disruption to a future distributors’ or suppliers’ manufacturing facilities could occur.

A disruption

in production at a future distributors’ or suppliers’ manufacturing facilities could have an adverse effect on our

business. The disruption could occur for many reasons, including fire, natural disasters, weather, water scarcity, manufacturing

problems, disease, strikes, transportation or supply interruption, government regulation, cybersecurity attacks or terrorism.

Alternative facilities with sufficient capacity or capabilities may not be available, may cost substantially more or may take

a significant amount of time to start production, each of which could negatively affect our business and results of operations.

Increased

costs could affect our company.

An increase

in the cost of raw materials could affect our profitability. Commodity and other price changes may result in unexpected increases

in the cost of raw materials and other materials used by us. We may also be adversely affected by shortages of raw materials.

In addition, energy cost increases could result in higher transportation, freight and other operating costs. We may not be able

to increase our prices to offset these increased costs without suffering reduced volume, sales and operating profit, and this

could have an adverse effect on your investment.

Any

disruption in our information systems could disrupt our future operations and could adversely impact our business and results

of operations.

We plan

to depend on various information systems to support our customers’ requirements and to successfully manage our business,

including managing orders, supplies, accounting controls and payroll. Any inability to successfully manage the procurement, development,

implementation or execution of our information systems and back-up systems, including matters related to system security, reliability,

performance and access, as well as any inability of these systems to fulfill their intended purpose within our business, could

have an adverse effect on our business and results of operations. Such disruptions may not be covered by our future business interruption

insurance, which is insurance that we plan to, but have not yet, obtained.

Manufacturing

or design defects, unanticipated use of our products, or inadequate disclosure of risks relating to the use of the products can

lead to injury or other adverse events.

These

events could lead to recalls or safety alerts relating to our products (either voluntary or required by governmental authorities)

and could result, in certain cases, in the removal of a product from the market. Any recall could result in significant costs

as well as negative publicity that could

reduce demand for our products. Personal injuries relating to the use of our products can also result in product liability claims

being brought against us. In some circumstances, such adverse events could also cause delays in new product approvals. Similarly,

negligence in performing our services can lead to injury or other adverse events.

We

will need to increase brand awareness.

Due to

a variety of factors, our opportunity to achieve and maintain a significant market share may be limited. Developing and maintaining

awareness of our brand name, among other factors, is critical. Further, the importance of brand recognition will increase as competition

in our market increases. Successfully promoting and positioning our brand, products and services will depend largely on the effectiveness

of our marketing efforts. Therefore, we may need to increase our financial commitment to creating and maintaining brand awareness.

If we fail to successfully promote our brand name or if we incur significant expenses promoting and maintaining our brand name,

it would have a material adverse effect on our results of operations.

Our

future advertising and marketing efforts may be costly and may not achieve desired results.

We plan

to incur substantial expense in connection with our advertising and marketing efforts. Although we plan to target our advertising

and marketing efforts on current and potential customers who we believe are likely to be in the market for the products we plan

to sell, we cannot assure you that our advertising and marketing efforts will achieve our desired results. In addition, we will

periodically adjust our advertising expenditures in an effort to optimize the return on such expenditures. Any decrease in the

level of our advertising expenditures, which may be made to optimize such return could adversely affect our sales.

We

expect our future intellectual property rights will be critical to our success, and the loss of such rights may materially adversely

affect our business.

We expect

to own trademarks as we launch new products in the future. We expect that these trademarks will be very important to our business.

We may also own copyright in, and to, the content on the packaging of our products. We view these future intellectual property

rights as very important to our potential success and plan to protect such intellectual property through registration and enforcement

actions. However, there can be no assurance that other parties will not infringe or misappropriate our future trademarks, copyrights

and similar proprietary rights. If we lose some or all of our future intellectual property rights, our business may be materially

adversely affected.

We

plan to obtain insurance that may not provide adequate levels of coverage against claims.

We have

obtained commercial product liability insurance that covers us for up to $1,400,000 in overall damages and $1,000,000 per occurrence.

This policy also covers us for general liability for up to $500,000 for damages to equipment and property. However, there are

types of losses we may incur that cannot be insured against or that we believe are not economically reasonable to insure. Such

losses could have a material adverse effect on our business and results of operations.

Changes

in laws and regulations relating to beverage containers and packaging could increase our costs and reduce demand for our products.

We expect

that our initial products will involve nonrefillable recyclable containers in the United States. Legal requirements have been

enacted in various jurisdictions in the United States and overseas requiring that deposits or certain ecotaxes or fees be charged

in connection with the sale, marketing and use of certain beverage containers. Other proposals relating to beverage container

deposits, recycling, tethered bottle caps, ecotax and/or product stewardship have been introduced in various jurisdictions in

the United States and overseas, and we anticipate that similar legislation or regulations may be proposed in the future at local,

state and federal levels, both in the United States and elsewhere. Consumers' increased concerns and changing attitudes about

solid waste streams and environmental responsibility and the related publicity could result in the adoption of such legislation

or regulations. If these types of requirements are adopted and implemented on a large scale in any of the major markets in which

we operate, they could affect our costs or require changes in our distribution model, which could reduce our net operating revenues

and profitability.

Significant

additional labeling or warning requirements or limitations on the marketing or sale of our products may inhibit sales of affected

products.

Various

jurisdictions may seek to adopt significant additional product labeling or warning requirements or limitations on the marketing

or sale of our products as a result of what they contain or allegations that they cause adverse health effects. If these types

of requirements become applicable to one or more of our major products under current or future environmental or health laws or

regulations, they may inhibit sales of such products.

For example,

under one such law in California, known as Proposition 65, if the state has determined that a substance causes cancer or harms

human reproduction, a warning must be provided for any product sold in the state that exposes consumers to that substance, unless

the exposure falls under an established safe harbor level. If we were required to add Proposition 65 warnings on the labels of

one or more of our beverage products

produced for sale in California, the resulting consumer reaction to the warnings and possible adverse publicity could negatively

affect our sales both in California and in other markets.

Any

potential growth in the cannabis or cannabidiol-related industries continues to be subject to new and changing state and local

laws and regulations.

Our future

CBD products will be made from Hemp Finished Products. Under 21 U.S.C. § 802(16), the seeds (incapable of germination) and

the mature stalks of the Cannabis sativa plant, together with products made from these parts, are known as Hemp Finished Products

and are exempted from the definition of cannabis and are legal. Continued development of the cannabis and cannabidiol related

industries is dependent upon continued legislative legalization of cannabis and cannabidiol related products at the state level,

and a number of factors could slow or halt progress in this area, even where there is public support for legislative action. Any

delay or halt in the passing or implementation of legislation for the re-criminalization or restriction of cannabidiol at the

state level could negatively impact our business because of the perception that it is related to cannabidiol. Additionally, changes

in applicable state and local laws or regulations could restrict the products and services we plan to offer or impose additional

compliance costs on us or our customers. Violations of applicable laws, or allegations of such violations, could disrupt our business

and result in a material adverse effect on our operations. We cannot predict the nature of any future laws, regulations, interpretations

or applications, and it is possible that regulations may be enacted in the future that will have a material adverse effect on

our business.

We

are subject to income taxes as well as non-income-based taxes, such as payroll, sales, use, value-added, net worth, property and

goods and services taxes, in the U.S.

Significant

judgment is required in determining our provision for income taxes and other tax liabilities. In the ordinary course of our business,

there are many transactions and calculations where the ultimate tax determination is uncertain. Although we believe that our tax

estimates are reasonable: (i) there is no assurance that the final determination of tax audits or tax disputes will not be different

from what is reflected in our income tax provisions, expense amounts for non-income-based taxes and accruals and (ii) any material

differences could have an adverse effect on our financial position and results of operations in the period or periods for which

the determination is made.

We

are not subject to Sarbanes-Oxley regulations and lack the financial controls and safeguards required of public companies.

We do

not have the internal infrastructure necessary, and are not required, to complete an attestation about our financial controls

that would be required under Section 404 of the Sarbanes-Oxley Act of 2002. There can be no assurances that there are no significant

deficiencies or material weaknesses in the quality of our financial controls. We expect to incur additional expenses and diversion

of management’s time when it becomes necessary to perform the system and process evaluation, testing and remediation required

to comply with the management certification and auditor attestation requirements.

Risks

Related to this Offering and Ownership of our Securities

We

have not engaged a third-party bank or financial institution to act as escrow agent. Your funds will be deposited directly into

our operating account. Since there is no minimum amount required to be raised by us before we can accept funds, there is no guarantee

that any funds other than your own will be invested in this offering.

We

have not currently engaged a third-party bank or financial institution to act as escrow agent. Your funds will be placed in our

general corporate bank account and immediately available for our use. We are not required to raise any minimum amount in this

offering before we may utilize the funds received in this offering. Potential investors should be aware that there is no assurance

that any monies beside their own will be invested in this offering.

We

will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our Common Stock.

The SEC has

adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price

less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate

that our Common Stock will become a “penny stock”, and we will become subject to Rule 15g-9 under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or the “Penny Stock Rule.” This rule imposes additional

sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions

covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s

written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our

securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction

involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure

schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions

payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly

statements are required to be sent disclosing recent price information for the penny stock held in the account and information

on the limited market in penny stock.

We do not anticipate

that our Common Stock will qualify for exemption from the Penny Stock Rule. In any event, even if our Common Stock were exempt

from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority

to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be

in the public interest.

This offering

is being conducted on a self-underwritten “best efforts” basis without a minimum and we may not be able to execute

our growth strategy if the $5 million maximum is not sold.

If you invest

in the Common Stock and less than all of the offered shares are sold, the risk of losing your entire investment will be increased.

We are offering our Common Stock on a self-underwritten “best efforts” basis without a minimum, and we can give no

assurance that all of the offered Common Stock will be sold. If less than $5 million of Common Stock shares offered are sold,

we may be unable to fund all the intended uses described in this offering circular from the net proceeds anticipated from this

offering without obtaining funds from alternative sources or using working capital that we generate. Alternative sources of funding

may not be available to us at what we consider to be a reasonable cost, and the working capital generated by us may not be sufficient

to fund any uses not financed by offering net proceeds. No assurance can be given to you that any funds will be invested in this

offering other than your own.

This is

a fixed price offering and the fixed offering price may not accurately represent the current value of us or our assets at any

particular time. Therefore, the purchase price you pay for our shares may not be supported by the value of our assets at the time

of your purchase.

This is a fixed

price offering, which means that the offering price for our shares is fixed. Therefore, the fixed offering price established

for our shares may not be supported by the current value of our company or our assets at any particular time.

We

may, in the future, issue additional shares of Common Stock, which would reduce investors’ percent of ownership and may

dilute our share value.

Our certificate

of incorporation authorizes the issuance of 3,000,000,000 shares of Common Stock and 20,000,000 shares of Preferred Stock. As

of February 6, 2020, we had 637,861,741 shares of Common Stock outstanding. Accordingly, we may issue up to an additional

362,138,259 shares of Common Stock after this offering. The future issuance of Common Stock may result in substantial dilution

in the percentage of our Common Stock held by our then existing shareholders. We may value any Common Stock issued in the future

on an arbitrary basis. The issuance of Common Stock for future services or acquisitions or other corporate actions may have the

effect of diluting the value of the shares held by our investors and might have an adverse effect on any trading market for our

Common Stock.

We have

broad discretion in the use of the net proceeds from this offering, and our use of the offering proceeds may not yield a favorable

return on your investment.

We

intend to use the net proceeds of this offering for working capital. However, our management

has broad discretion over how these proceeds are to be used and based on unforeseen technical, commercial or regulatory issues

could spend the proceeds in ways with which you may not agree. Moreover, the proceeds may not be invested effectively or in a

manner that yields a favorable or any return, and consequently, this could result in financial losses that could have a material

adverse effect on our business, financial condition and results of operations.

We have

never paid cash dividends on our stock and we do not intend to pay dividends for the foreseeable future.

We have paid

no cash dividends on any class of our stock to date and we do not anticipate paying cash dividends in the near term. For the foreseeable

future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying

any cash dividends on our stock. Accordingly, investors must be prepared to rely on sales of their shares after price appreciation

to earn an investment return, which may never occur. Investors seeking cash dividends should not purchase our shares. Any determination

to pay dividends in the future will be made at the discretion of our board of directors and will depend on our results of operations,

financial condition, contractual restrictions, restrictions imposed by applicable law and other factors our Board deems relevant.

Certain

provisions of our certificate of incorporation may make it more difficult for a third party to effect a change-of-control.

Our certificate

of incorporation authorizes our board of directors to issue up to 20,000,000 shares of Preferred Stock. The Preferred Stock may

be issued in one or more series, the terms of which may be determined at the time of issuance by our board of directors without

further action by the stockholders. These terms may include voting rights including the right to vote as a series on particular

matters, preferences as to dividends and liquidation, conversion rights, redemption rights and sinking fund provisions. The issuance

of any Preferred Stock could diminish the rights of holders of existing shares, and therefore could reduce the value of such shares.

In addition,

specific rights granted to future holders of Preferred Stock could be used to restrict our ability to merge with, or sell assets

to, a third party. The ability of our board of directors to issue Preferred Stock could make it more difficult, delay, discourage,

prevent or make it costlier to acquire or effect a change-in control, which in turn could prevent our stockholders from recognizing

a gain in the event that a favorable offer is extended and could materially and negatively affect the market price of our Common

Stock.

DILUTION

Dilution

means a reduction in value, control or earnings of the shares the investor owns.

Immediate

Dilution

An early-stage

company typically sells its shares (or grants options over its shares) to its founders and early employees at a very low cash

cost, because they are, in effect, putting their “sweat equity” into the company. When the company seeks cash investments

from outside investors, like you, the new investors typically pay a much larger sum for their shares than the founders or earlier

investors, which means that the cash value of your stake is diluted because all the shares are worth the same amount, and you

paid more than earlier investors for your shares. Dilution may also be caused by pricing securities at a value higher than book

value or expenses incurred in this offering.

Purchasers

of our shares in this offering will experience an immediate dilution of net tangible book value per share from the public offering

price. Dilution in net tangible book value per share represents the difference between the amount per share paid by

the purchasers of shares and the net tangible book value per share immediately after this offering.

After

giving effect to the sale of all of our shares being offered in this offering at an assumed public offering price of $0.0015

per share and after deducting the estimated offering expenses payable by us, our adjusted

net tangible book value at October 31, 2019 would have been $4,105,401, or $0.00098 per share, assuming the sale of the maximum

number of shares offered for sale in this offering and the conversion of our preferred stock on a one for 100 basis (but not the

conversion of any of our outstanding convertible notes). Assuming the sale of the maximum

number of shares offered for sale in this offering, this represents an immediate increase in net tangible book value per share

of $0.00045 to the existing stockholders and dilution in net tangible book value per share of $0.00052 to new investors who purchase

shares in this offering.

The

following table sets forth the estimated net tangible book value per share after this offering and the dilution to persons purchasing

shares.

|

Offering price per share

|

|

$

|

0.00150

|

|

|

Net tangible book value per share at October 31, 2019

|

|

$

|

0.00053

|

|

|

Adjusted net tangible book value per share after this offering

|

|

$

|

0.00098

|

|

|

Increase in net tangible book value per share to the existing stockholders

|

|

$

|

0.00045

|

|

|

Dilution in net tangible book value per share to new investors

|

|

$

|

0.00052

|

|

The

above dilution calculation gives effect to the conversion of our preferred stock, but not to the conversion of our outstanding

convertible notes. If our outstanding convertible notes are converted into our Common Stock, you will suffer additional dilution

in net tangible book value.

Future

Dilution

Another

important way of looking at dilution is the dilution that happens due to future actions by our company. The investor’s stake

in our company could be diluted due to our issuing additional shares. In other words, when we issue more shares, the percentage

of our company that you own will go down, even though the value of our company may go up. You will own a smaller piece of a larger

company. This increase in number of shares outstanding could result from a stock offering (such as a public offering, an equity

crowdfunding round, a venture capital round or an angel investment), employees exercising stock options, or by conversion of certain

instruments (such as convertible bonds, preferred shares or warrants) into stock.

If we

decide to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control

dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction

in the amount earned per share (though this typically occurs only if we offer dividends, and most early stage companies are unlikely

to offer dividends, preferring to invest any earnings into the company).

The type

of dilution that hurts early-stage investors most occurs when a company sells more shares in a “down round,” meaning

at a lower valuation than in earlier offerings. An example of how this might occur is as follows (numbers are for illustrative

purposes only):

|

|

·

|

In

June 2019, an investor invests $20,000 for shares that represent 2% of a company valued

at $1 million.

|

|

|

·

|

In

December 2019, the company is doing very well and sells $5 million in shares to venture

capitalists on a valuation (before the new investment) of $10 million. The investor now

owns only 1.3% of the company but the investor’s stake is worth $200,000.

|

|

|

·

|

In

June 2020, the company has run into serious problems and in order to stay afloat it raises

$1 million at a valuation of only $2 million (the “down round”). The investor

now owns only 0.89% of the company and the investor’s stake is worth only $26,660.

|

This

type of dilution might also happen upon conversion of convertible notes into shares. Typically, the terms of convertible notes

issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes

get to convert their notes into equity at a “discount” to the price paid by the new investors, i.e., they get more

shares than the new investors would for the same price. Additionally, convertible notes may have a “price cap” on

the conversion price, which effectively acts as a share price ceiling. Either way, the holders of the convertible notes get more

shares for their money than new investors. In the event that the financing is a “down round,” the holders of the convertible

notes will dilute existing equity holders, and even more than the new investors do, because they get more shares for their money.

Investors should pay careful attention to the amount of convertible notes that we may issue in the future and the terms of those

notes.

If you

are making an investment expecting to own a certain percentage of our company or expecting each share to hold a certain amount

of value, it’s important to realize how the value of those shares can decrease by actions taken by us. Dilution can make