Filed pursuant to Rule 253(g)(2)

File No. 024-11086

GREEN STREAM HOLDINGS INC.

16,666,666 SHARES OF COMMON STOCK

Green Stream Holdings Inc. (“we”

or the “Company”) is offering up to 16,666,666 shares of our common stock, $.001 par value, for $0.60 per share on

a “best efforts” basis, for gross proceeds of up to $10,000,000.00, before deduction of offering expenses, assuming

all shares are sold. Selling Securityholders are offering up to 266,665 shares of our common stock, $.001 par value, for $0.60

per share, for gross proceeds of up to $159,999.00 on a “best efforts” basis. The Company originally priced this offering

at $.75 per share and it was qualified by the Securities and Exchange Commission on March 10, 2020. Due to current market conditions

we have repriced the offering. No shares were sold at the original offering price. No shares shall be sold by the selling securityholders

until an aggregate of 888,883 shares offered by the Company has been purchased from the Company in this Offering, and the

transfer agent of the Company will be instructed as such. Funds tendered by investors in connection with the sale of the shares

by the Selling Securityholders will not be made available to the Company.

The minimum investment established for

each investor is $10,000.00, unless such minimum is waived by the Company in its sole discretion, which may be done on a case-by-case

basis. There is no such restriction for offering by Selling Securityholders. For more information regarding the securities being

offered, see the section entitled “Securities Being Offered” on page 36. There is no minimum aggregate offering amount

and no provision to escrow or return investor funds if any minimum amount of shares is not sold.

Shares offered by the Company will be sold

by our directors and executive officers on a “best efforts” basis. Sellers offered by Selling Securityholders may be

sold by our officers and directors on a “best effort” basis, or may be sold by Selling Securityholders on a “best

effort” basis, provided full compliance of Selling Securityholders with applicable securities laws. We or Selling SecurityHolders

may also elect to engage licensed broker-dealers. No sales agents have yet been engaged to sell shares. All shares (whether offered

by the Company or by Selling Securityholders) will be offered on a “best-efforts” basis.

The sale of shares will begin once the

offering statement to which this circular relates is qualified by the Securities and Exchange Commission (“SEC”) and

will terminate one year thereafter or once all 16,666,666 shares are sold, whichever occurs first. We expect the offering to commence

on the date on which the offering statement of which this offering circular is a part is qualified by the SEC. Notwithstanding,

the Company may extend the offering by an additional 90 days or terminate the offering at any time.

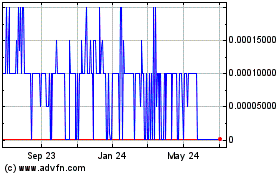

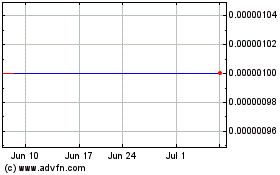

Our common stock is not now listed on any

national securities exchange or the NASDAQ stock market; however, our stock is quoted on OTC Markets Group, Inc.’s Pink marketplace

under the trading symbol “GSFI.” There is currently only a limited market for our securities. There is no guarantee

that our securities will ever trade on any listed exchange or be quoted on the OTCQB or OTQX marketplaces.

Investing in our securities involves

a high degree of risk. See “Risk Factors” beginning on page 4 of this offering circular for a discussion of information

that should be considered in connection with an investment in our securities.

This offering is being made pursuant to

Tier 1 of Regulation A following the Offering Circular Form 1-A disclosure format.

|

Shares Offered by the Company

|

|

Price Per

Share to Public

|

|

|

Proceeds to

Company(1)(2)

|

|

|

Per Offered Share

|

|

$

|

0.60

|

|

|

$

|

10,000,000.00

|

|

|

Maximum Offering Amount(1)

|

|

$

|

0.60

|

|

|

$

|

10,000,000.00

|

|

[1] Pursuant to Rule 416 under the Securities

Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be

issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

[2] There are no underwriting fees or commissions

currently associated with this offering; however, the Company may engage sales associates after this offering commences. Does not

include expenses of the offering including legal and accounting expenses and costs of blue sky compliance and the transaction fees,

in any. Aggregate offering expenses payable by us are estimated to be approximately 150,000,000.

|

Shares Offered by the Selling Securityholders

|

|

Price Per

Share to Public

|

|

|

Proceeds to Selling

Securityholders

|

|

|

Per Offered Share

|

|

$

|

0.60

|

|

|

$

|

159,999.00

|

|

|

Maximum Offering Amount

|

|

$

|

0.60

|

|

|

$

|

159,999.00

|

|

This offering is highly speculative

and these securities involve a high degree of risk and should be considered only by persons who can afford the loss of their entire

investment. SEE “RISK FACTORS” ON PAGE 4.

THE UNITED STATES SECURITIES AND EXCHANGE

COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES

IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED

PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION

THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

Green Stream Holdings

Inc.

16620 Marquez Ave

Pacific Palisades,

CA 90272

(310) 230-0240

E-mail: info@greenstreamholdingsinc.com

www.greenstreamholdingsinc.com

The date of this Offering Circular is March

12, 2020.

TABLE OF CONTENTS

Please read this offering circular

carefully. It describes our business, our financial condition, and results of operations. We have prepared this offering circular

so that you will have the information necessary to make an informed investment decision.

You should rely only on the information

contained in this offering circular. We have not authorized any other person to provide you with different information. This offering

circular is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is

not permitted. The information in this offering circular is complete and accurate as of the date on the front cover, but the information

may have changed since that date.

SUMMARY INFORMATION

This summary provides an overview of selected

information contained elsewhere in this offering circular. It does not contain all the information you should consider before

making a decision to purchase the shares we are offering. You should very carefully and thoroughly read the more detailed information

in this offering circular and review our financial statements contained herein.

The Company

We are a provider of next-generation solar

energy solutions to underrepresented and/or growing market segments. To date, we announced the first-ever construction of a solar

greenhouse incorporating proprietary greenhouse technology which uses customized red greenhouse glass and seamless solar panels.

The Company is concurrently operating in multiple markets and is prepared for conducting business in several industry-friendly

countries, states, and regions including California, Nevada, Arizona, Washington, New York, New Jersey, Massachusetts, New Mexico,

Colorado, Hawaii, and Canada. Our business office is located at 16620 Marquez Ave Pacific Palisades, CA 90272.

Green Stream Holdings Inc. (the “Company”)

was originally incorporated on April 12, 2004, in the State of Nevada under the name of Ford-Spoleti Holdings, Inc. On June 4,

2009, the Company merged with Eagle Oil Holding Company, a Nevada corporation, and the surviving entity, the Company, changed

its name to “Eagle Oil Holding Company, Inc.” On April 25, 2019, the Company changed its name to “Green Stream

Holdings Inc.” On May 15, 2019, the Company elected to convert the Company from Nevada corporation to Wyoming corporation.

As of September 25, 2019, the Company is in good standing with the state of Wyoming and is deemed to have been domesticated as

of that date. On December 03, 2019, the Company filed its amended and restated articles of incorporation.

The Company is currently authorized to

issue a total of 10,000,000,000 shares of Common Stock with a par value of $0.001 and 12,000,000 shares of Preferred Stock with

a par value of $0.001. Out of the 12,000,000 shares of Preferred Stock, the following series of Preferred Stock are designated

as of the date of this offering:

|

|

●

|

1,000,000

shares of Convertible Series A Preferred Shares. Convertible Series A Preferred Shares

are convertible into the shares of Common Stock at a ratio of 1,000 shares of Convertible

Series A Preferred Shares to 1 share of Common Stock.

|

|

|

●

|

1,000,000

shares of Convertible Series B Preferred Shares. Convertible Series B Preferred Shares

are convertible into the shares of Common Stock at a ratio of 1,000,000 shares of Common

Stock for each single Convertible Series B Preferred Share.

|

|

|

●

|

10,000,000

shares of Convertible Series C Preferred Shares. Convertible Series C Preferred Shares

are convertible into Common Stock at a ratio of 1,000 shares of Convertible Series C

Preferred Share for one share of Common Stock.

|

The Company’s securities are currently

quoted on the OTC Markets Group Inc.’s Pink marketplace under the symbol “GSFI.” There is a limited market for

the shares included in this offering.

Business Overview

The Company operates as a holding company

of its wholly-owned subsidiary, Green Stream Finance, Inc., a Wyoming corporation founded in the year 2016. Green Stream Finance,

Inc. has its offices in Malibu, California, and New York. The Company is focused on exploiting currently unmet markets in the

solar energy space. The Company is concurrently operating in multiple markets and is prepared for conducting business in several

industry-friendly countries, states, and regions including California, Nevada, Arizona, Washington, New York, New Jersey, Massachusetts,

New Mexico, Colorado, Hawaii, and Canada. Our business office is located at 16620 Marquez Ave Pacific Palisades, CA 90272. The

Company plans is to expand to more locations in North America in the next year as funding becomes available.

The Company was founded in the year 2004

under the name “Ford-Spoleti Holdings, Inc.” in the State of Nevada. The Company subsequently changed its name to

Eagle Oil Holding Company Inc. in accordance with Articles of Merger filed with the Secretary of State of Nevada on June 4, 2009,

and was trading on OTC Markets Group, Inc.’s Pink marketplace under the trading symbol “EGOH.” Afterward, on

February 14, 2019, the Company entered a certain acquisition and merger agreement, under which the Company acquired 96% shares

of common stock of Green Stream Finance Inc., changed its name to Green Stream Holdings, Inc.

The Company is a Wyoming corporation as

of September 25, 2019.

Going Concern

As of September 30, 2019, the Company

had an accumulated loss of $173,926. Management has taken a certain action and continues to implement changes designed to improve

the Company’s financial results and operating cash flows. The actions involve certain – growing strategies, including

– expansion of the business model into new markets. Management believes that these actions will enable the Company to improve

future profitability and cash flow in its continuing operations. As a result, the financial statements do not include any adjustments

to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of

liabilities that may result from the outcome of the Company’s ability to continue as a going concern.

Summary of the Offering

|

Securities

Offered

|

|

16,666,666 shares of common stock, par value $0.001 (the “Common

Stock”)

|

|

|

|

|

|

Securities Offered

by the Company

|

|

16,666,666 shares

of Common Stock on a best-efforts basis.

|

|

|

|

|

|

Securities Offered

by Selling Securityholders

|

|

266,665 shares of

Common Stock on a best-efforts basis.

|

|

|

|

|

|

Additional information

about the Offering

|

|

Shares offered by the Company will be sold by our directors and executive

officers. We may also elect to engage licensed broker-dealers. No sales agents have yet been

engaged to sell shares. The Company will not pay for any selling expenses of the selling Security

Holders. All shares will be offered on a “best-efforts” basis. Investors may be

publicly solicited provided the “blue sky” regulations in the states in which

the Company solicits investors allow such solicitation.

|

|

|

|

|

|

Settlement

Agreement

|

|

Please note that this

sale shall be subject to certain mutual release and settlement agreement (hereinafter referred

to as the “Settlement”) dated May 29, 2019, as amended. The Settlement is attached

to this Offering as an exhibit to this Offering. Eagle Oil Parties, as defined in the Settlement,

are Selling Securityholders, as defined hereto. Please see the relevant risk factors with

regard to the Settlement Agreement in the “Risk Factors” section at page 4. Please

also review section “Legal Proceedings” carefully at page 26.

|

|

|

|

|

|

Offering price per

Share

|

|

$0.60 per share

|

|

|

|

|

|

Number of shares

outstanding before the offering of common shares

|

|

26,100,665 shares

of Common Stock as of the date hereof, and 1,000,000,002,000 shares potentially issuable upon exercise or conversion

of outstanding options, warrants, and preferred stock.

|

|

|

|

|

|

Number of shares

outstanding after the offering of common shares if all the shares being offered are sold

|

|

42,767,331 shares

of Common Stock will be issued and outstanding after this offering is completed if all the shares being offered are sold.

|

|

|

|

|

|

Minimum number of

shares to be sold in this offering

|

|

None.

|

|

Minimum

investment

|

|

The

minimum investment established for each investor is $10,000.00, unless such minimum is waived by the Company in its sole discretion,

which may be done on a case-by-case basis.

|

|

|

|

|

|

Market for the common

shares

|

|

There is only a

limited public market for the common shares and a broad public market may never develop. The common stock is quoted on OTC

Pink, informally known as the “Pink Sheets,” under the symbol “GSFI.”

|

|

|

|

|

|

Use of proceeds

|

|

The Company intends to use the

proceeds of this offering for marketing, inventory, acquisition and for general and administrative purposes. See “Use

of Proceeds” section for details.

There is no minimum offering amount

and no provision to escrow or return investor funds if any minimum number of shares is not sold. All funds raised by the

Company from this offering will be immediately available for the Company’s use.

|

|

|

|

|

|

Termination of the

offering

|

|

The offering will conclude upon the earlier of the sale of all the shares or one year after

the date of this offering circular.

|

You should rely only upon the information

contained in this offering circular. The Company has not authorized anyone to provide you with information, including projections

of performance, different from that which is contained in this offering circular. The Company is offering to sell shares of common

stock and seeking offers only in jurisdictions where offers and sales are permitted. The information contained herein is accurate

only as of the date of this offering circular, regardless of the time of delivery of this offering circular or of any sale of

the common stock.

ABOUT THIS CIRCULAR

We have prepared this offering circular

to be filed with the SEC for our offering of securities. The offering circular includes exhibits that provide more detailed descriptions

of the matters discussed in this circular. You should rely only on the information contained in this circular and its exhibits.

We have not authorized any person to provide you with any information different from that contained in this circular. The information

contained in this circular is complete and accurate only as of the date of this circular, regardless of the time of delivery of

this circular or sale of our shares. This circular contains summaries of certain other documents, but the reference is hereby

made to the full text of the actual documents for complete information concerning the rights and obligations of the parties thereto.

All documents relating to this offering and related documents and agreements, if readily available to us, will be made available

to a prospective investor or its representatives upon request.

INDUSTRY AND MARKET DATA

The industry and market data used throughout

this circular have been obtained from our own research, surveys or studies conducted by third parties and industry or general

publications. Industry publications and surveys generally state that they have obtained information from sources believed to be

reliable, but do not guarantee the accuracy and completeness of such information. We believe that each of these studies and publications

is reliable. We have not engaged any person or entity to provide us with industry or market data.

TAX CONSIDERATIONS

No information contained herein, nor in

any prior, contemporaneous or subsequent communication should be construed by a prospective investor as legal or tax advice. We

are not providing any tax advice as to the acquisition, holding or disposition of the securities offered herein. In making an

investment decision, investors are strongly encouraged to consult their own tax advisor to determine the U.S. Federal, state and

any applicable foreign tax consequences relating to their investment in our securities. This written communication is not intended

to be “written advice,” as defined in Circular 230 published by the U.S. Treasury Department.

RISK

FACTORS

Please consider the following risk factors

and other information in this offering circular relating to our business and prospects before deciding to invest in our common

stock.

This offering and any investment in our

common stock involve a high degree of risk. You should carefully consider the risks described below and all of the information

contained in this offering circular before deciding whether to purchase our common stock. If any of the following risks actually

occur, our business, financial condition and results of operations could be harmed and you may lose all or part of your investment.

The Company considers the following to

be all known material risks to an investor regarding this offering. The Company should be viewed as a high-risk investment and

speculative in nature. An investment in our common stock may result in a complete loss of the invested amount. Please consider

the following risk factors before deciding to invest in our common stock.

RISKS RELATED TO THE INDUSTRY

The demand for products requiring

significant initial capital expenditures such as solar power products and related services are affected by general economic conditions.

The United States and countries worldwide

have recently experienced a period of declining economies and turmoil in financial markets. A sustained economic recovery is uncertain.

In particular, terrorist acts and similar events, continued unrest in the Middle East or war, in general, could contribute to

a slowdown of the market demand for products that require significant initial capital expenditures, including demand for solar

power systems and solar greenhouses. In addition, increases in interest rates may increase financing costs to customers, which

in turn may decrease demand for our solar power products. If economic recovery is slowed as a result of the recent economic, political

and social events, or if there are further terrorist attacks in the United States or elsewhere, we may experience decreases in

the demand for our solar power products, which may harm our operating results.

If there is a shortage of components

and/or key components rise significantly in price that may constrain our revenue growth.

The market for photovoltaic installations

has continued to grow despite worldwide financial and economic issues. The introduction of significant production capacity has

continued and has increased supply and reduced the cost of solar panels. If demand increases and supply contracts, the resulting

likely price increase could adversely affect sales and profitability. From 2009 through 2014, there was a tremendous increase

in the capacity to produce solar modules, primarily from China, which coupled with the worst economic downturn in nearly a century,

significantly reduced the price of solar panels. As demand for solar panels will likely increase with an economic recovery, demand

and pricing for solar modules could increase, potentially limiting access to solar modules and reducing our selling margins for

panels.

Shortages of silicon and inverters or

supply chain issues could adversely affect the availability and cost of our solar energy systems. Manufacturers of photovoltaic

modules depend upon the availability and pricing of silicon, one of the primary materials used in photovoltaic modules. The worldwide

market for silicon from time to time experiences a shortage of supply, which can cause the prices for photovoltaic modules to

increase and supplies to become difficult to obtain. While we have been able to obtain sufficient supplies of solar photovoltaic

modules to satisfy our needs to date, this may not be the case in the future. Future increases in the price of silicon or other

materials and components could result in an increase in costs to us, price increases to our customers or reduced margins.

Other international trade conditions such

as work slowdowns and labor strikes at port facilities or major weather events can also adversely impact the availability and

price of solar photovoltaic modules.

Existing regulations and policies

and changes to these regulations and policies may present technical, regulatory and economic barriers to the purchase and use

of solar power products, which may significantly reduce demand for our products.

The market for electricity generation

is heavily influenced by foreign, U.S. federal, state and local government regulations and policies concerning the electric utility

industry, as well as policies promulgated by electric utilities. These regulations and policies often relate to electricity pricing

and technical interconnection of customer-owned electricity generation. In the U.S. these regulations and policies are being modified

and may continue to be modified. Customer purchases of or further investment in the research and development of alternative energy

sources, including solar power technology, could be deterred by these regulations and policies, which could result in a significant

reduction in the potential demand for our solar power products, for example, without certain major incentive programs and or the

regulatory mandated exception for solar power systems, utility customers are often charged interconnection or standby fees for

putting distributed power generation on the electric utility network. These fees could increase the cost to our customers of using

our solar power products and make them less desirable, thereby harming our business, prospects, results of operations and financial

condition.

We anticipate that our solar power products

and their installation will be subject to oversight and regulation in accordance with national and local ordinances relating to

building codes, safety, and environmental protection, utility interconnection and metering and related matters. It is difficult

to track the requirements of individual states and design equipment to comply with the varying standards. Any new government regulations

or utility policies pertaining to our solar power products may result in significant additional expenses to us and our resellers

and their customers and, as a result, could cause a significant reduction in demand for our solar power products.

The reduction, elimination or expiration

of government subsidies and economic incentives for on-grid solar electricity applications could reduce demand for solar power

systems and harm our business.

The market for solar energy applications

depends in large part on the availability and size of local, state, and federal government and economic incentives that vary by

geographic market. The reduction, elimination or expiration of government subsidies and economic incentives for solar electricity

may negatively affect the competitiveness of solar electricity relative to conventional and non-solar renewable sources of electricity

and could harm or halt the growth of the solar electricity industry and our business.

The cost of solar power currently is less

than retail electricity rates in most markets, and we believe solar will continue to do so for the foreseeable future. As a result,

federal, state and local government bodies, the United States has provided incentives in the form of feed-in tariffs, or FITs,

rebates, tax credits and other incentives to system owners, distributors, system integrators and manufacturers of solar power

systems to promote the use of solar electricity in on-grid applications and to reduce dependency on other forms of energy. Many

of these government incentives expire, phase out over time, terminate upon the exhaustion of the allocated funding or require

renewal by the applicable authority. In addition, electric utility companies or generators of electricity from other non-solar

renewable sources of electricity may successfully lobby for changes in the relevant legislation in their markets that are harmful

to the solar industry. Reductions in, or eliminations or expirations of, governmental incentives could result in decreased demand

for and lower revenue from solar PV systems, which would adversely affect sales of our products.

Our success depends, in part, on

the quality and safety of the services we provide.

We do not design and manufacture our own

products. We can and do use a variety of products and do not have a commitment to any single manufacturer. We do not warranty

our products because this is the responsibility of the manufacturer. However, we do warranty our installation workmanship and

could suffer a loss of customer referrals and reputation degradation if our quality workmanship is not maintained.

We may need additional capital to

develop our business.

The development of our services will require

the commitment of resources to increase the advertising, marketing and future expansion of our business. In addition, expenditures

will be required to enable us in 2019 and 2020 to conduct planned business research, development of new affiliate and associate

offices, and marketing of our existing and future products and services. Currently, we have no established bank-financing arrangements.

Therefore, it is possible that we would need to seek additional financing through a subsequent future private offering of our

equity securities, or through strategic partnerships and other arrangements with corporate partners.

We cannot give any assurance that any

additional financing will be available to us, or if available, will be on terms favorable to us. The sale of additional equity

securities could result in dilution to our stockholders. Sales of existing shareholders of the common stock and preferred stock

in the public market could adversely affect prevailing market prices and could impair the Company’s future ability to raise

capital through the sale of the equity securities. The incurrence of indebtedness would result in increased debt service obligations

and could require us to agree to operating and financing covenants that would restrict our compensation. If adequate, additional

financing is not available on acceptable terms, we may not be able to implement our business development plan or continue our

business operations.

Our liability insurance may not

be adequate in a catastrophic situation.

We do not currently maintain property

damage insurance or product liability insurance. Material damage to, or the loss to our facilities or equipment due

to fire, severe weather, flood or other catastrophe, even if insured against, could result in a significant loss to the Company.

The services we intend to provide

to customers may not gain market acceptance, which would prevent us from achieving sales and market share.

The market for solar power is emerging

and rapidly evolving, and its future success is uncertain, especially when solar power services are combined with other products

such as greenhouses. If solar power technology proves unsuitable for widespread commercial deployment or if demand for solar power

products fails to develop sufficiently, we would be unable to achieve sales and market share. In addition, demand for solar power

in the markets and geographic regions we target may not develop or may develop more slowly than we anticipate. Many factors may

influence the widespread adoption of solar power technology and demand for solar power, including:

|

|

●

|

Performance and reliability

of solar power products as compared with conventional and non-solar alternative energy

products;

|

|

|

|

|

|

|

●

|

Cost-effectiveness

of solar power technologies as compared with conventional and competitive alternative

energy technologies;

|

|

|

|

|

|

|

●

|

Success of alternative

distributed generation technologies such as hydrogen fuel cells, wind turbines, bio-diesel

generators, and large-scale solar thermal technologies;

|

|

|

|

|

|

|

●

|

Fluctuations in economic

and market conditions that impact the viability of conventional and competitive alternative

energy sources;

|

|

|

|

|

|

|

●

|

Increases or decreases

in the prices of oil, coal and natural gas;

|

|

|

|

|

|

|

●

|

Capital expenditures

by customers, who tend to decrease when domestic or foreign economies slow; and

|

|

|

|

|

|

|

●

|

Continued deregulation

of the electric power industry and broader energy industry.

|

We face intense competition from

other system integrators and other energy generation products. If we fail to compete effectively, we may be unable to increase

our market share and sales.

The mainstream power generation market

and related product sectors are well established and we are competing with power generation from more traditional processes that

can generate power at lower costs than most renewable or environmentally driven processes. Further, within the renewable power

generation and technologies markets, we face competition from other methods of producing renewable or environmentally positive

power. Then, the solar power market itself is intensely competitive and rapidly evolving. Our competitors have established market

positions more prominent than ours, and if we fail to attract and retain customers, we may be unable to achieve sales and market

share. There are a number of major multi-national corporations that provide solar installation services such as REC, Solar City,

and Sunpower Corporation. Established integrators are growing and consolidating, including GoSolar, Sunwize, Sunenergy, and Real

Good Solar and we expect that future competition will include new entrants to the solar power market. Further, many of our competitors

may be developing or may be currently providing products based on new solar power technologies that may have costs similar to,

or lower than, our projected costs.

Some of our competitors are substantially

larger than we are, have longer operating histories and have substantially greater financial, technical, manufacturing and other

resources than we do. Our competitors’ greater sizes in some cases provide them with competitive advantages with respect

to manufacturing costs and the ability to allocate costs across a greater volume of production and purchase raw materials at lower

prices. They also have far greater name recognition, an established distribution network and an installed base of customers. In

addition, many of our competitors have well-established relationships with current and potential resellers, which have extensive

knowledge of our target markets. As a result, our competitors will be able to devote greater resources to the research, development,

promotion, and sale of their products and may be able to respond more quickly to evolving industry standards and changing customer

requirements than we can.

Our sales and installations are

subject to seasonality of customer demand and weather conditions which are outside of our control.

Our sales are subject to the seasonality

of when customers buy solar energy systems. Historically, we are expected to experience spikes in orders during the spring and

summer months which, due to lead time, result in installations and revenue increase during the summer and fall. Tax incentives

can generate additional backlog prior to the end of the year, depending upon the incentives available and whether customers are

looking to take advantage of such incentives before the end of the year.

Our ability to construct systems outdoors

may be impacted by inclement weather, which can be most prominent in our geographic installation regions during the first and

fourth quarters of the year. As a result of these factors, our first quarter is generally our slowest quarter of the year. If

unexpected natural events occur and we are unable to manage our cash flow through these seasonal factors, there could be a negative

impact on our financial position, liquidity, results of operations and cash flow.

Our inability to respond to changing

technologies and issues presented by new technologies could harm our business.

The solar energy industry is subject to

technological change. If we rely on products and technologies that cease to be attractive to customers, or if we are unable to

respond appropriately to changing technologies and changes in product function or quality, we may not be successful in capturing

or retaining significant market share. In addition, any new technologies utilized in our solar energy systems may not perform

as expected or as desired, in which event our adoption of such products or technologies may harm our business.

We rely heavily on a limited number

of designers, suppliers, installers and other vendors, and if these companies were unable to deliver critical components and services,

it would adversely affect our ability to operate and our financial results.

We rely on a limited number of third-party

suppliers to provide the components used in our solar-panel based greenhouses and our solar energy systems. We also rely on key

vendors to provide internal and external services which are critical to our operations, including installation of solar energy

systems, accounting and customer relationship management software, facilities and communications. The failure of our suppliers

and vendors to supply us with products and services in a timely manner or on commercially reasonable terms could result in lost

orders, delay our project schedules, limit our ability to operate and harm our financial results. If any of our suppliers or vendors

were to fail to supply our needs on a timely basis or to cease providing us key components or services we use, we would be required

to secure alternative sources of supply. We may have difficulty securing alternative sources of supply. If this were to occur,

our business would be harmed.

The installation and ongoing operation

of solar energy systems involves significant safety risks.

Solar energy systems generate electricity,

which is inherently dangerous. Installation of these systems also involves the risk of fire, personal injuries occurring at the

job site and other risks typical of construction projects. Although we take many steps to assure the safe installation and operation

of our solar energy systems and greenhouse, and maintain insurance against such liabilities, we may nevertheless be exposed to

significant losses arising from personal injuries or property damage arising from our projects.

United States trade policy affects

our ability to purchase domestic solar panels.

One of the effects of the United States

tariffs on imported solar panels, including solar panels from China, is an increased demand for products manufactured in the United

States which may affect both our ability to purchase solar panels and the price and other terms at which solar panels are available

to us. Because of the increased demand for domestically manufactured solar panels, we cannot assure you that, if we seek to purchase

solar panels from Renewable Energy Development, a New York-based company, it will have the capacity to fill our orders at a commercially

reasonable price or that we will be able to purchase solar panels from other suppliers at a reasonable cost. Our inability to

obtain domestically produced solar panels can impair our ability to generate revenue and maintain reasonable gross margins.

Changes in net metering regulations

could impair the market for solar products.

Net metering is a billing mechanism that

credits solar energy system owners for the electricity that they add to the electricity grid. If the owner of a solar system generates

more electricity than it consumes, the excess electricity is sold back to the grid. California’s first net metering policy

set a “cap” for the three investor-owned utility companies in the state: Pacific Gas & Electric (PG&E), San

Diego Gas & Electric (SDG&E), and Southern California Edison (SCE). All three have reached their cap where total solar

installations in each utility’s territory were capped at five percent of total peak electricity demand. The California Public

Utilities Commission (CPUC) created the known as “Net Metering 2.0” (NEM 2.0) that extends California net metering.

NEM 2.0 is slightly different from the first net metering policy. Under NEM 2.0, customers will still receive the retail credit

for electricity produced but will be required to pay more in Non-Bypassable Charges. NEM 2.0 also requires new solar customers

to pay a one-time Interconnection Application Fee, the amount of which is dependent upon the utility company. For systems under

1MW, this fee is $132 for San Diego Gas & Electric, $145 for Pacific Gas & Electric, and $75 for Southern California Edison.

NEM 2.0 customers are also required to use Time of Use (ToU) rates. These changes alter the return on investment for solar customers,

and our pricing needs to reflect this change in order for the purchase of a solar system to be economically attractive to the

customer, which may be reflected in lower prices and reduced margins.

To the extent that utility companies are

not required to purchase excess electricity from owners of solar systems or are permitted to lower the amounts paid, the market

for solar systems may be impaired. Because net metering can enable the solar system owner to further reduce the cost of electricity

by selling excess electricity to the utility company, any elimination or reduction of this benefit would reduce the cost savings

from solar energy. We cannot assure you that net metering will not be eliminated or the benefits significantly reduced for future

solar systems which may dampen the market for solar energy.

Although we are not regulated as

a utility company, changes in regulations may subject us to regulation as a utility.

We are presently exempt from regulation

as a utility as we have “qualifying facility” status with the Federal Energy Regulatory Commission for all of our

qualifying solar energy projects. Any local, state, federal or foreign regulations which classify us as a utility could place

significant restrictions on our ability to operate our business by prohibiting or otherwise restricting our sale of electricity.

If we were subject to the same state, federal or foreign regulatory authorities as utility companies in the United States or if

new regulatory bodies were established to oversee our business in the United States or in foreign markets such as China, then

our operating costs would materially increase, which would impair our ability to generate a profit from our business.

Our business would be impaired if

we lose our licenses, if more stringent government regulations are enacted or if we fail to comply with the growing number of

regulations pertaining to solar energy and consumer financing industries.

Our business is or may become subject

to numerous federal and state laws and regulations. The installation of solar energy systems performed by us is subject to oversight

and regulation under local ordinances, building, zoning and fire codes, environmental protection regulation, utility interconnection

requirements, and other rules and regulations. The financing transactions the Company are subject to numerous consumer credit

and financing regulations. The consumer protection laws, among other things:

|

|

●

|

require us to obtain

and maintain licenses and qualifications;

|

|

|

|

|

|

|

●

|

limit

certain interest rates, fees and other charges we are allowed to charge;

|

|

|

|

|

|

|

●

|

limit

or prescribe certain terms of the loans to our customers; and

|

|

|

|

|

|

|

●

|

require

specific disclosures and the use of special contract forms.

|

The number of laws affecting both aspects

of our business continues to grow. We can give no assurances that we will properly and timely comply with all laws and regulations

that may affect us. If we fail to comply with these laws and regulations, we may be subject to civil and criminal penalties. In

addition, non-compliance with certain consumer disclosure requirements related to home solicitation sales and home improvement

contract sales affords residential customers with a right to rescind such contracts in some jurisdictions.

Changes in regulations relating

to fossil fuel can impact the market for renewable energy, including solar.

The market for renewable energy in general

and solar energy, in particular, is affected by regulations relating to the use of fossil fuel and the encouragement of renewable

energy. To the extent that changes in regulations have the effect of reducing the cost of gas, oil, and coal or encouraging the

use of such fuels, the market for solar systems may be impaired.

A material decline in the price of

electricity charged by the local utility company to commercial users may impair our ability to attract commercial customers.

Often large commercial customers pay less

for energy from utility companies than residential customers. To the extent that utility companies offer commercial customers

a lower rate for electricity, they may be less willing to switch to solar energy. Under such conditions, we may be unable to offer

solar energy systems in commercial markets that produce electricity at rates that are competitive with the price of retail electricity

they are able to obtain from the local utility company. In such event, we would be at a competitive disadvantage compared to the

local utility company and may be unable to attract new commercial customers, which would impact our revenues.

Solar energy and other forms of renewable

energy compete with other forms of energy and the attractiveness of solar energy reflects the cost of electricity from the local

grid.

Solar energy competes with other all other

forms of energy, including, particularly local utility companies, whose pricing structure effectively determines the market for

solar energy. If consumers, whether residential or commercial, believe that they are paying and will continue to pay too much

for electricity from a local utility company, they may consider other alternatives, including alternative providers of electricity

from local utility companies as well as forms of renewable energy. If they are in a location where, because of the climate and

geography, solar energy is a possibility, they may consider solar energy as an alternative, provided they are satisfied that they

will receive net savings in their cost of electricity and their system will provide them with a constant source of energy. Further,

although some customers may purchase a solar energy system because of environmental considerations, we believe that the cost of

electricity is the crucial factor that influences the decision of a user, particularly a commercial user, to elect to use solar

energy.

RISKS RELATED TO OUR BUSINESS

Our annual and quarterly financial

results are subject to significant fluctuations depending on various factors, many of which are beyond our control.

Our sales and operating results can vary

significantly from quarter to quarter and year to year depending on various factors, many of which are beyond our control. These

factors include, but are not limited to:

|

|

●

|

seasonal consumer

demand for our products;

|

|

|

|

|

|

|

●

|

discretionary spending

habits;

|

|

|

|

|

|

|

●

|

changes in pricing

in, or the availability of supply in, the used powerboat market;

|

|

|

|

|

|

|

●

|

variations in the

timing and volume of our sales;

|

|

|

|

|

|

|

●

|

the timing of our

expenditures in anticipation of future sales;

|

|

|

●

|

sales promotions

by us and our competitors;

|

|

|

|

|

|

|

●

|

changes in competitive

and economic conditions generally;

|

|

|

|

|

|

|

●

|

consumer preferences

and competition for consumers’ leisure time; and

|

|

|

|

|

|

|

●

|

changes in the cost

or availability of our labor.

|

As a result, our results of operations

may decline quickly and significantly in response to changes in order patterns or rapid decreases in demand for our products.

We anticipate that fluctuations in operating results will continue in the future.

Our limited operating history with

our current business lines makes it difficult to evaluate our current and future prospects and may increase the risk associated

with your investment.

We have a limited operating history with

our current business lines. Consequently, our operations are subject to all the risks inherent in the establishment of new business

lines in industries within which we are not necessarily familiar. We have encountered and will continue to encounter risks and

difficulties frequently experienced by rapidly growing companies in constantly evolving industries, including the risks described

in this prospectus. If we do not address these risks successfully, our business, financial condition, results of operations and

prospects will be adversely affected, and the market price of our common stock could decline. As such, any predictions about our

future revenue and expenses may not be as accurate as they would be if we had a longer operating history in our current business

lines or operated in a more predictable market.

We will need a significant amount

of capital to carry out our proposed business plan and, unless we are able to raise sufficient funds or generate sufficient revenues,

we may be forced to discontinue our operations.

Our ability to obtain the necessary financing

to execute our business plan is subject to a number of factors, including general market conditions and investor acceptance of

our business plan. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable

to us. If we are unable to raise sufficient funds or generate them through revenues, we will have to significantly reduce our

spending, delay or cancel our planned activities or substantially change our current corporate structure. There is no guarantee

that we will be able to obtain any funding or that we will have sufficient resources to continue to conduct our operations as

projected, any of which could mean that we will be forced to discontinue our operations.

A portion of the proceeds raised

from this offering will be distributed to Selling Securityholders.

Certain of our stockholders, will sell

in the aggregate up to approximately 266,665 shares of the Company’s Common Stock in this Offering. As a result, the net

proceeds to the Company from the sale of shares of its Common Stock sold in this offering will be reduced by such amount. Selling

Securityholders may compete with the Company in selling the shares in this Offering, and will not be limited to the minimum investment

amount. As a result, it is possible, that investors will prefer purchasing the shares of the Company’s Common Stock from

Selling Securityholders rather than from the Company. For more information about certain selling Securityholders, please see the

section of this Offering Circular entitled, “Plan of Distribution and Selling Securityholders.”

In the event this Offering Statement is not qualified on

or before March 9, 2020, Selling Shareholders may obtain the majority of the voting power pursuant to the Settlement Agreement

and there may be a change of control.

The Settlement Agreement, as amended, provides

that Selling Securityholders, referred to as Eagle Oil Parties in the Settlement Agreement, are entitled to have shares of the

Company’s common stock underlying their convertible notes qualified under this Offering Statement. In the event this offering

is not qualified by March 9, 2020, “each one of the 5 members of the … [Selling Securityholders] shall receive 30,000

Class B preferred shares, that shall be fully paid and non-assessable, by March 10, 2020,” as per the Settlement Agreement.

As a result, there may be a change of control, the Company’s business plan may change and this Offering may be amended accordingly

or withdrawn. Please additionally review Legal Proceedings on page 26.

There are certain allegations of the

existence of the number of promissory notes of the Company that may result in major litigation against the Company.

Selling Shareholders, their subsidiaries

and affiliates, and a number of third parties purportedly acting together with Selling Shareholder allege the existence of certain

Purported Notes, as defined in Legal Proceedings on page 26. As a result, although the Company believes that the claims regarding

the Purported Notes are invalid and is prepared to vigorously defend itself in court against said claims, in the event the Company’s

judgment of the situation is incorrect, the claims in connection with the Purported Notes may result in major litigation and substantial

losses for the Company. In the event the claimants will prevail with regard to the Purported Notes, the total amount of losses

may be at least $16,427,143, not taking the accrued interest and legal fees into account. Please additionally review Legal Proceedings

on page 26.

We operate in a highly competitive industry and potential

competitors could duplicate our business model.

We are involved in a highly competitive

industry where we compete with numerous other companies who offer products and services similar to those we offer. Although some

aspects of our business may be protected by intellectual property laws (patent protection, trade secret protection, copyrights,

trademarks, etc.), potential competitors will likely attempt to duplicate our business model. Some of our potential competitors

may have significantly greater resources than we have, which may make it difficult for us to compete. There can be no assurance

that we will be able to successfully compete against these other entities. Additionally, our contractors are not subjected to

an exclusive contractual relationship with the Company.

Conflict of Interest

The Company is subject to various potential

and actual conflicts of interest arising out of its relationship with its President and/or affiliates of the Company: transactions

with affiliates of the President of the Company and/or such other persons and entities; the payment of substantial sums from the

proceeds of this offering to such affiliates; and, competition for the time and services of the President, agents, employees,

and affiliates with other projects or businesses that they run.

Limited Full-Time Employees and

Staff

Assuming successful completion of this

Offering, we intend to hire necessary support staff and will hire, as and when needed, such management, support personnel, independent

consultants, as it may deem necessary for the purposes of its business operations and the President. There can be no assurance

that the Company and its President will be able to recruit and hire required support personnel under acceptable terms. The Company’s

business would be adversely affected if it were unable to retain the required personnel.

Dealings with the Company

The President controls the business and

affairs of the Company. Consequently, the President will be able to control the President’s own compensation and to approve

dealings, if any, by the Company with other entities with which the President is also involved. Furthermore, the President controls

the majority of the voting power in the Company. Although the President intends to act fairly and in full compliance with her

fiduciary obligations, there can be no assurance that the Company will not, as a result of the conflict of interest described

above, sometimes enter into arrangements under terms less beneficial to the Company than it could have obtained had it been dealing

with unrelated persons.

Limitation of Liability of the President

and Directors

To the maximum extent allowed by law,

the President and Directors will have limited liability for breach of fiduciary duty and for (i) any breach of the duty of loyalty

to the Company or its shareholders; (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing

violation of the law; or (iii) any transactions from which the President and its Affiliates derived an improper personal benefit.

Exclusive Selection of Forum in

the Bylaws

Our corporate bylaws provide that unless

the Corporation consents in writing to the selection of an alternative forum, to the fullest extent permitted by law, all Internal

Corporate Claims, as defined in the Bylaws, may be brought solely and exclusively in the District Court, Sheridan County, Wyoming

(or, if such court does not have jurisdiction, the United States Court for the District of Wyoming). “Internal Corporate

Claims” are defined as claims, including claims in the right of the Corporation, brought by a stockholder (including a beneficial

owner) (i) that are based upon a violation of a duty owed by a current or former Director or officer or stockholder in such capacity

or (ii) as to which the WCC confers jurisdiction upon the District Court. Please read our bylaws carefully in connection with

this risk factor.

Please note that Section 22 of the Securities

Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created

by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provisions apply to claims

arising under the Securities Act and Exchange Act, but there is uncertainty as to whether a court would enforce such provisions

in this context.

You will not be deemed to have waived

the company’s compliance with the federal securities laws and the rules and regulations thereunder. Investors cannot waive

compliance with federal securities laws and the rules and regulations thereunder.

The aforementioned forum selection provisions

may limit your ability to obtain a favorable judicial forum for disputes with us. Alternatively, if a court were to find these

provisions inapplicable to, or unenforceable in an action, we may incur additional costs associated with resolving such matters

in other jurisdictions, which could adversely affect our business, financial condition, or results of operations.

RISKS RELATED TO OUR CORPORATE OPERATIONS

We have a limited operating history

under the current business plan and may never be profitable.

Since we have a limited operating history

following the implementation of the current business plan, it is difficult for potential investors to evaluate our business. We

expect that we will continue to need to raise additional capital in order to fund our operations. There can be no assurance that

such additional capital will be available to us on favorable terms or at all. There can be no assurance that we will be profitable.

Our accountant has indicated doubt

about our ability to continue as a going concern.

Our accountant has expressed doubt about

our ability to continue as a going concern. Our financial statements do not include adjustments that might result from the outcome

of this uncertainty. If we are unable to generate significant revenue or secure financing we may be required to cease or curtail

our operations.

No intention to pay dividends.

A return on investment may be limited

to the value of our common stock. We do not currently anticipate paying cash dividends in the foreseeable future. The payment

of dividends on our common stock will depend on earnings, financial condition, and other business and economic factors affecting

it at such time as the Board may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable

future to increasing our capital base and development and marketing efforts. There can be no assurance that the Company will ever

have sufficient earnings to declare and pay dividends to the holders of our common stock, and in any event, a decision to declare

and pay dividends is at the sole discretion of the Board. If we do not pay dividends, our common stock may be less valuable because

a return on your investment would only occur if the Company’s stock price appreciates.

We depend on key personnel and future

members of management, and the loss of services of one or more members of our senior management team, or our inability to attract

and retain highly qualified personnel, could adversely affect our business, diminish our investment opportunities and weaken our

relationships with lenders, business partners and existing and prospective industry participants, which could negatively affect

our financial condition, results of operations, cash flow and trading price of our common stock.

Our success depends on our ability to

attract and retain the services of executive officers, senior officers, and community managers. There is substantial competition

for qualified personnel in the niche area of solar-panel greenhouse design, manufacturing, and sales industry and the loss of

our key personnel could have an adverse effect on us. Our continued success and our ability to manage anticipated future growth

depend, in large part, upon the efforts of key personnel. The loss of services of senior management and solar-panel design team

which we may hire, or our inability to attract and retain highly qualified personnel, could adversely affect our business, diminish

our investment opportunities and weaken our relationships with lenders, business partners, and industry participants, which could

negatively affect our financial condition, results of operations and cash flow.

The ability of stockholders to control

our policies and effect a change of control of our company is limited by certain provisions of our Articles of Incorporation and

bylaws and by Nevada and Wyoming Law.

There are provisions in our Articles of

Incorporation and bylaws that may discourage a third party from making a proposal to acquire us, even if some of our stockholders

might consider the proposal to be in their best interests. These provisions include the following:

Our Articles of Incorporation authorizes

our board of directors to issue shares of preferred stock with such rights, preferences, and privileges as determined by the board,

and therefore to authorize us to issue such shares of stock. We believe these Articles of Incorporation provisions will provide

us with increased flexibility in structuring possible future financings. The additional classes or series will be available for

issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock

exchange or automated quotation system on which our securities may be listed or traded. Although our board of directors does not

currently intend to do so, it could authorize us to issue a class or series of stock that could, depending upon the terms of the

particular class or series, delay, defer or prevent a transaction or a change of control of our company that might involve a premium

price for holders of our common stock or that our common stockholders otherwise believe to be in their best interests.

Our board of directors may change

our policies without stockholder approval.

Our policies, including any policies with

respect to investments, leverage, financing, growth, debt, and capitalization, will be determined by our board of directors or

those committees or officers to whom our board of directors delegates such authority. Our board of directors will also establish

the amount of any dividends or other distributions that we may pay to our stockholders. Our board of directors or the committees

or officers to which such decisions are delegated will have the ability to amend or revise these and our other policies at any

time without stockholder vote. Accordingly, our stockholders will not be entitled to approve changes in our policies, and, while

not intending to do so, may adopt policies that may have a material adverse effect on our financial condition and results of operations.

Our business could be adversely

impacted if there are deficiencies in our disclosure controls and procedures or internal control over financial reporting.

The design and effectiveness of our disclosure

controls and procedures and internal control over financial reporting may not prevent all errors, misstatements or misrepresentations.

While management will continue to review the effectiveness of our disclosure controls and procedures and internal control over

financial reporting, there can be no guarantee that our internal control over financial reporting will be effective in accomplishing

all control objectives all of the time. Furthermore, our disclosure controls and procedures and internal control over financial

reporting with respect to entities that we do not control or manage may be substantially more limited than those we maintain with

respect to the subsidiaries that we have controlled or managed over the course of time. Deficiencies, including any material weakness,

in our internal control over financial reporting which may occur in the future could result in misstatements of our results of

operations, restatements of our financial statements, a decline in our stock price, or otherwise materially adversely affect our

business, reputation, results of operations, financial condition or liquidity.

Solar greenhouses incorporating

proprietary greenhouse technology is a new product that exposes us to many new risks and uncertainties.

Following the merger and acquisition agreement

dated February 14, 2019, we repositioned our business model with an immediate focus on developing solar panel greenhouses products.

Developing a new product under a new brand with solar technology and red glass exposes us to many risks and uncertainties that

are new to our business. We have limited experience in the design, manufacture, marketing, distribution and sale of consumer-oriented

products. Our ability to be successful with our line of consumer-oriented products will depend on a number of factors, including

whether:

|

|

●

|

We can achieve and

maintain customer acceptance of our new products;

|

|

|

|

|

|

|

●

|

We can rapidly develop and successfully introduce large numbers

of new products in response to changing customer preferences;

|

|

|

|

|

|

|

●

|

We can maintain an adequate level of product quality over multiple

consumer lines products which must be designed, manufactured and introduced rapidly to keep pace

with changing consumer preferences and competitive factors;

|

|

|

|

|

|

|

●

|

We can successfully manage our third-party contract designers

and manufacturers located outside and/or inside the U.S. on whom we are heavily dependent for

the production of our consumer-oriented products;

|

|

|

|

|

|

|

●

|

We can successfully distribute our consumer-oriented products

through distributors, wholesalers, internet retailers and traditional retailers (many of whom

distribute products from competing manufacturers) on whom we are heavily dependent; and

|

|

|

|

|

|

|

●

|

We can successfully manage the substantial inventory and other

asset risks associated with the manufacture and sale of our products, given the rapid and unpredictable

pace of product obsolescence in solar panel markets.

|

Our intellectual property rights

or our means of enforcing those rights may be inadequate to protect our business, which may result in the unauthorized use of

our products or reduced sales or otherwise reduce our ability to compete.

Our business and competitive position

depend upon our ability to protect our intellectual property rights and proprietary technology, including any new brands that

we develop. We attempt to protect our intellectual property rights, primarily in the United States, through a combination of patent,

trade secret and other intellectual property laws, as well as licensing agreements and third-party nondisclosure and assignment

agreements. Because of the differences in foreign patent and other laws concerning intellectual property rights, our intellectual

property rights may not receive the same degree of protection in foreign countries as they would in the United States. Our failure

to obtain or maintain adequate protection of our intellectual property rights, for any reason, could have a materially adverse

effect on our business, results of operations and financial condition. Further, any patents issued in connection with our efforts

to develop new technology for solar panel greenhouse modules may not be broad enough to protect all of the potential uses of our

technology.

We also rely on unpatented proprietary

technology. It is possible others will independently develop the same or similar technology or otherwise obtain access to our

unpatented technology. To protect our trade secrets and other proprietary information, we will require our employees, consultants

and advisors to execute proprietary information and invention assignment agreements when they begin working for us. We cannot

assure these agreements will provide meaningful protection of our trade secrets, unauthorized use, misappropriation or disclosure

of trade secrets, know-how or other proprietary information. Despite our efforts to protect this information, unauthorized parties

may attempt to obtain and use information that we regard as proprietary. If we are unable to maintain the proprietary nature of

our technologies, we could be materially adversely affected.

In addition, when others control the prosecution,

maintenance and enforcement of certain important intellectual property, such as technology licensed to us, the protection and

enforcement of the intellectual property rights may be outside of our control. If the entity that controls intellectual property

rights that are licensed to us does not adequately protect those rights, our rights may be impaired, which may impact our ability

to develop, market and commercialize our products. Further, if we breach the terms of any license agreement pursuant to which

a third party licenses us intellectual property rights, our rights under that license may be affected and we may not be able to

continue to use the licensed intellectual property rights, which could adversely affect our ability to develop, market and commercialize

our products.

If third parties claim we are infringing

or misappropriating their intellectual property rights, we could be prohibited from selling our products, be required to obtain

licenses from third parties or be forced to develop non-infringing alternatives, and we could be subject to substantial monetary

damages and injunctive relief.

The solar power industry is characterized

by the existence of a large number of patents and frequent litigation based on allegations of patent infringement. We are aware

of numerous issued patents and pending patent applications owned by third parties that may relate to current and future generations

of solar energy. The owners of these patents may assert the manufacture, use or sale of any of our products infringes one or more

claims of their patents. Moreover, because patent applications can take many years to issue, there may be currently pending applications,

unknown to us, which may later result in issued patents that materially and adversely affect our business. Third parties could

also assert claims against us that we have infringed or misappropriated their intellectual property rights. Whether or not such

claims are valid, we cannot be certain we have not infringed the intellectual property rights of such third parties. Any infringement

or misappropriation claim could result in significant costs or substantial damages to our business or an inability to manufacture,

market or sell any of our PV modules found to infringe or misappropriate. Even if we were to prevail in any such action, the litigation

could result in substantial cost and diversion of resources that could materially and adversely affect our business. A large number

of patents, the rapid rate of new patent issuances, the complexities of the technology involved and uncertainty of litigation

increase the risk of business assets and management’s attention being diverted to patent litigation. Even if obtaining a

license were feasible, it could be costly and time-consuming. We might be forced to obtain additional licenses from our existing

licensors in the event the scope of the intellectual property we have licensed is too narrow to cover our activities, or in the

event, the licensor did not have sufficient rights to grant us the license(s) purportedly granted. Also, some of our licenses

may restrict or limit our ability to grant sub-licenses and/or assign rights under the licenses to third parties, which may limit

our ability to pursue business opportunities.

RISKS RELATED TO THIS OFFERING AND THE

MARKET FOR OUR COMMON STOCK

The offering price of our shares

has been arbitrarily determined.

Our management has determined the number

of shares to be offered by the Company, and the price at which those shares are to be offered. The price of the shares we are

offering was arbitrarily determined based upon the current market value, illiquidity, and volatility of our common stock, our

current financial condition and the prospects for our future cash flows and earnings, and market and economic conditions at the

time of the offering. The offering price for the common stock sold in this offering may be more or less than the fair market value

for our common stock.

We have broad discretion in the

use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion

in the application of the net proceeds and may spend or invest these proceeds in a way with which our stockholders disagree. The

failure by our management to apply these funds effectively could harm our business and financial condition. Pending their use,

we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

There has been only a limited public

market for our common stock and an active trading market for our common stock may not develop following this offering.

There has not been any broad public market

for our common stock, and an active trading market may not develop or be sustained. Shares of our common stock may not be able

to be resold at or above the initial public offering price. The initial public offering price of our common stock has been determined

arbitrarily by management without regard to earnings, book value, or other traditional indication of value. Our common stock may

trade below the initial public offering price following the completion of this offering. The market value of our common stock

could be substantially affected by general market conditions, including the extent to which a secondary market develops for our

common stock following the completion of this offering, the extent of institutional investor interest in us, the general reputation