Additional Proxy Soliciting Materials (definitive) (defa14a)

August 13 2018 - 2:42PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

|

[ ]

|

Preliminary Proxy Statement

|

|

[ ]

|

Definitive Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

[X]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to Sec. 240.14a-11(c) or sec. 240.14a-12

|

|

GIGA-TRONICS INCORPORATED

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

N/A

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

[X]

|

Fee not required.

|

|

[ ]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary materials.

|

|

[ ]

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

Giga-tronics Incorporated

CEO Letter

Fiscal 2018

August 13, 2018

To Our Shareholders,

Our fiscal year ended March 31, 2018 (“fiscal 2018”) was, in many ways, both a challenging and pivotal year for Giga-tronics. It also marked our first year focused solely on opportunities within the EW market with our RADAR filters and our recently completed Advanced Signal Generation and Analysis (ASG/ASA) test platform (formerly referred to as “Hydra”). The company has long recognized the need to move away from our prior “commodity” general-purpose test and measurement products lines (which we divested over the past few years) and transition to a market with significantly greater chances for improved future revenue growth and higher gross margins. Although our Microsource subsidiary’s microwave RADAR filter business once again provided us with a steady, predictable revenue stream in fiscal 2018, orders and sales of our ASG/ASA EW test platform fell far short of our expectations. We booked $7.1 million in new orders for RADAR filters in fiscal 2018, which will support higher scheduled shipments of filters in fiscal 2019 versus fiscal 2018. However, the Giga-tronics division booked only three new ASG/ASA platform orders throughout fiscal 2018 totaling $2.05 million, which greatly impacted our operating performance during fiscal 2018.

As a result, our fiscal 2018 sales were $9.8 million, which was $6.5 million or 40% lower than fiscal 2017. This was primarily due to having fully divested the Company’s legacy products, lower than anticipated ASG/ASA orders and lower scheduled shipments of our Microsource RADAR filters in fiscal 2018. Our resulting net loss for fiscal 2018 was $3.1 million, which was $1.6 million or 101% greater compared to fiscal 2017.

Our cash resources were also significantly impacted by our lower than expected sales and poor operating results in fiscal 2018. Although we took significant steps to reduce our cost structure in fiscal 2018 which included reducing our year over year headcount and operating expenses by 26% and 15%, respectively, along with relocating to a smaller, more efficient facility in April 2018, we were unable to maintain our financial covenants related to our $1.5 million loan from Partners For Growth, IV LTD (PFG) made during April 2017. Additionally, during the fourth quarter of fiscal 2018, we needed to raise additional capital to fund operations and to restructure our PFG debt agreement. As a result, during March 2018, we raised $1.12 million through the issuance of our new 6% Series E Senior Convertible Voting Perpetual Preferred Stock (“Series E”) using Emerging Growth Equities, Ltd. (“EGE”) as our placement agent, together with modifying our loan agreement with PFG. EGE previously acted as our placement agent for our $3.5 million common stock financing in January 2016. I’m pleased to report that for the four month period following our fiscal year-end we have received an additional $275,000 in gross proceeds from sales of Series E shares which nearly completes the $1.5 million Series E financing previously authorized by our Board in March 2018.

Also during fiscal 2018, we were unable to maintain our NASDAQ market listing and, as a result, our stock began trading on the OTCQB under the symbol GIGA on October 30, 2017.

The experience we gained selling ASG/ASA products during the past two fiscal years and the opportunity to better grow our market position within the EW segment led us to change our sales approach during the fourth quarter of fiscal 2018 from selling individual ASG/ASA components to offering more complete EW test solutions. We also took steps to improve our competency in selling, integrating and supporting full solutions by revamping our business development staff, pursuing and vetting technology partners and investing in demonstration equipment to show prospective customers our capability in streaming playback and recording systems, as examples. The Company is currently pursuing two new Threat Emulation systems for the U.S. Navy, as well as an associated support contract in recognition that the required maintenance of complex systems is also a source of revenue. We are also pursuing several new opportunities for wideband recording systems that include the Company’s Advanced Signal Analyzer (ASA) and third party data capture and storage solutions.

The Company also made several key management changes during fiscal 2018 including adding Dr. Lutz Henckels (a member of our Board of Directors since 2012) to our senior management team as Executive Vice President and Interim Chief Financial Officer and promoting Jeff Towne to operations manager. Mr. Towne came to Giga-tronics after 22 years serving as an officer in the US Air force, including as an Electronic Warfare officer. He is a SIX SIGMA Green Belt, LEAN certified and holds a PMP certification. We also made improvements reorganizing our engineering team by promoting Armand Pantalone, an expert in Electronic Warfare test applications, to the position of Chief Technology Officer in recognition that much of our future success lies in focusing on offering full EW test solutions. We further strengthened our executive leadership team during July 2019 by hiring Tim Ursprung as Vice President, Sales & Marketing. Mr. Ursprung is an experienced executive with more than 35 years selling into the EW marketplace.

We believe the combination of our past expense reductions, higher scheduled shipments of RADAR filters in fiscal 2019 and the new focus on delivering full EW test solutions will allow the company to achieve profitability during fiscal 2019. We will continue to monitor closely the various opportunities and interest in our ASG/ASA EW test platform and are committed to remaining focused on return on investment, cash flow and profitability and will take the steps necessary to further restructure the company if it appears significant additional investment will be required to make the ASGA business profitable and self-sustaining.

Finally, I wish to acknowledge and thank our employees, customers and vendors for their continued support and loyalty.

Sincerely,

John Regazzi

CEO

Giga-tronics Incorporated

This letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in that are not statements of historical facts, such as those concerning future orders and future operating results, are forward-looking statements. Forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include whether we will receive expected customer orders and whether orders or shipments may be delayed, our ability to successfully implement our business plan and manage our liquidity and expenses, and other risks described in our Form 10-K for the fiscal year ended March 31, 2018. We undertake no obligation to update publicly any of these forward-looking statements.

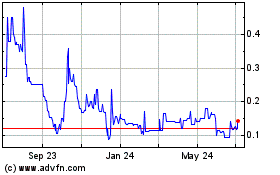

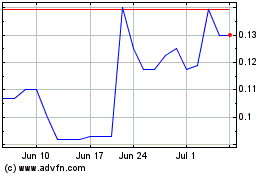

Giga Tronics (QB) (USOTC:GIGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Giga Tronics (QB) (USOTC:GIGA)

Historical Stock Chart

From Apr 2023 to Apr 2024