Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 2)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

o ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 000-54457

GENERAL CANNABIS CORP

(Exact name of registrant as specified in its charter)

|

COLORADO

|

|

90-1072649

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

6565 E. Evans Avenue

Denver, Colorado 80224

(Address of principal executive offices)

Registrant’s telephone number, including area code: (303) 759-1300

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulations S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

Non-accelerated filer

|

x

|

|

Smaller reporting company

|

x

|

Emerging growth company

|

o

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes o No x

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the closing sale price of the registrant’s common stock on June 30, 2019, was $31,638,715.

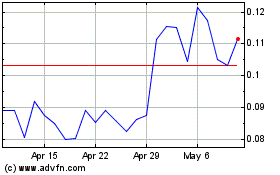

As of May 5, 2020, the Registrant had 40,281,881 issued and outstanding shares of common stock.

Table of Contents

EXPLANATORY NOTE

This Amendment No. 2 on Form 10-K/A (this “Amendment”) to the Annual Report on Form 10-K of General Cannabis Corp (the “Company”) for the fiscal year ended December 31, 2019 (the “Original Form 10-K”), as filed with the Securities and Exchange Commission (the “SEC”) on May 14, 2020 and amended by Amendment No.1 thereto filed with the SEC on June 22, 2020, is being filed to amend and restate our audited consolidated financial statements and related disclosures as of and for the year ended December 31, 2019.

Background of the Restatement

On July 1, 2020, the audit committee of the board of directors and management of the Company concluded that the Company’s previously issued audited consolidated financial statements for the year ended December 31, 2019, should no longer be relied upon because of an error in the Company’s accounting for certain outstanding common stock warrants, which we refer to as the 2019 Warrants in this Amendment.

The error relates to the determination of the number of shares of common stock subject to the 2019 Warrants that were issued by the Company in May 2019, which contain certain anti-dilution adjustment provisions with respect to subsequent issuances of securities by the Company at a price below the exercise price of such warrants. At the time of issuance, the 2019 Warrants represented the right to purchase 3,000,000 shares of common stock at a per share exercise price of $1.30. In the Company’s Form 10-K for the year ended December 31, 2019, the Company accounted for certain dilutive issuances of securities by the Company during 2019 by reflecting that the exercise price of such warrants had decreased to $0.45 per share as a result of the anti-dilution adjustment provisions contained in the warrants, but the Company did not correctly account for the increase in shares subject to such warrants resulting from the anti-dilution adjustment provisions contained in the warrants. Such adjustment provisions increased the number of shares subject to the 2019 Warrants to 8,666,666 shares as of December 31, 2019.

The cumulative effect of the restatement on the Company’s financial statements is an increase in the derivative liability balance and a corresponding increase in loss on derivative instruments of $3.2 million at December 31, 2019. Refer to Item 8, Note 2 for further details regarding the amounts of the adjustments. These adjustments are non-cash and do not impact the Company’s revenue, operating expenses, operating income, cash flows or cash and cash equivalents as previously reported.

This Amendment amends the Original Filing only to the extent necessary to reflect the restatement. The following items in the Orignial Filing have been amended by the Amendment to reflect the restatement.:

· Part I - Item 1A. Risk Factors

· Part II - Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations;

· Part II - Item 8. Financial Statements and Supplementary Data; and;

· Part II - Item 9A. Controls and Procedures;

This Amendment also includes as exhibits, the required officer certifications from our Chief Executive Officer and Principal Accounting and Financial Officer dated as of the date of the Amendment.

Items in the Original Filing that have not been amended have been omitted from this Amendment. This Amendment is as of the date of the Original Filing on the Form 10-K and has not been updated to reflect events occurring subsequent to the date of the Original Filing other than those associated with the restatement of the Company’s audited consolidated financial statements.

ITEM 1A. RISK FACTORS.

There are no changes to Item 1A as disclosed in our originally filed Annual Report on Form 10-K for the year ended December 31, 2019 except for the addition of the following risk factor.

Risks Related to Our Common Stock

We have identified a material weakness in our internal control over financial reporting that resulted in the restatement of our consolidated financial statements included in this Annual Report on Form 10-K/A. This material weakness, uncorrected, could continue to affect adversely our ability to report our results of operations and financial condition accurately and in a timely manner.

3

Table of Contents

Our management is responsible for maintaining internal control over financial reporting designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements for external purposes in accordance with GAAP. Our management assessed the effectiveness of our internal control over financial reporting as of December 31, 2019, and identified a material weakness related to the failure to ensure timely application of the anti-dilution adjustment provisions contained in certain outstanding warrants. As a result of this material weakness, our management concluded that our internal control over financial reporting and our disclosure controls and procedures were not effective as of December 31, 2019. See Part II - Item 9A, “Controls and Procedures.”

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis. The effectiveness of any controls or procedures is subject to certain limitations, and as a result, there can be no assurance that our controls and procedures will detect all errors or fraud. A control can provide only reasonable, not absolute, assurance that the objectives of the control system will be attained. We also cannot assure you that other material weaknesses will not arise as a result of our past failure to maintain adequate internal controls and procedures or that circumvention of those controls and procedures will not occur. Additionally, even improved controls and procedures may not be adequate to prevent or identify errors or irregularities or ensure that our financial statements are prepared in accordance with generally accepted accounting principles. If we cannot maintain and execute adequate internal control over financial reporting or implement required new or improved controls that provide reasonable assurance of the reliability of the financial reporting and preparation of our financial statements for external use, we could suffer harm to our reputation, fail to meet our public reporting requirements on a timely basis, or be unable to report properly on our business and the results of our operations, and the market price of our securities could be materially adversely affected.

PART II

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Management’s Discussion and Analysis (“MD&A”) is intended to provide an understanding of our financial condition, results of operations and cash flows by focusing on changes in certain key measures from year to year. This discussion should be read in conjunction with the consolidated financial statements and related notes in Item 8 of this Report.

Restatement

As discussed in the Explanatory Note to this Amended Filing, the Company is amending and restating its audited consolidated financial statements and related disclosures as of and for the years ended December 31, 2019, as included in Item 8, Note 2. The Original Filing was filed with the Securities and Exchange Commission (“SEC”) on May 14, 2020, as amended by Amendment No. 1 thereto filed on June 22, 2020.

Cautionary Statement Regarding Forward-looking Statements

Our MD&A contains forward-looking statements that discuss, among other things, future expectations and projections regarding future developments, operations and financial condition. All forward-looking statements are based on management’s existing beliefs about present and future events outside of management’s control and on assumptions that may prove to be incorrect. If any underlying assumptions prove incorrect, our actual results may vary materially from those anticipated, estimated, projected or intended. We undertake no obligation to publicly update or revise any forward-looking statements to reflect actual results, changes in expectations or events or circumstances after the date of this Report is filed.

Going Concern

The consolidated financial statements included elsewhere in this Form 10-K, have been prepared on a going concern basis, which assumes we will be able to realize our assets and discharge our liabilities in the normal course of business for the foreseeable future. Our cash of approximately $224,994 as of December 31, 2019 is not sufficient to absorb our operating losses

and retire our debt of $2,330,351 and other obligations as they come due. The warrants associated with this debt, if exercised, would provide sufficient funds to retire the debt; however, there is no guarantee that these warrants will be exercised. Our ability to continue as a going concern is dependent upon our generating profitable operations in the future and / or obtaining the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come

4

Table of Contents

due. Management believes that (a) we will be successful obtaining additional capital and (b) actions presently being taken to further implement our business plan and generate additional revenues provide opportunity for the Company to continue as a going concern. While we believe in the viability of our strategy to generate additional revenues and our ability to raise additional funds, there can be no assurances to that effect. Accordingly, there is substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Results of Operations

As of December 31, 2019, we made the strategic decision to cease operations of Chiefton and STOA Wellness. All operations were abandoned in January 2020. Separately, we classified Iron Protection Group as held for sale as of December 31, 2019, in which the contracts of the Colorado division were sold in January 2020 and the remaining contracts in California have been abandoned. The completed and planned divestiture of these non-core businesses has changed the way in which we evaluate performance and allocate resources. As a result, during the year ended December 31, 2019, we revised our business segments, consistent with our management of the business and internal financial reporting structure.

The following tables set forth, for the periods indicated, statements of operations data. The tables and the discussion below should be read in conjunction with the accompanying consolidated financial statements and the notes thereto appearing in Item 8 in this Report.

Consolidated Results

|

|

|

Year ended December 31,

|

|

|

|

Percent

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

Change

|

|

|

Revenues

|

|

$

|

3,666,346

|

|

$

|

1,737,256

|

|

$

|

1,929,090

|

|

111

|

%

|

|

Costs and expenses

|

|

(12,528,035

|

)

|

(12,308,231

|

)

|

(219,804

|

)

|

2

|

%

|

|

Other expense

|

|

(4,946,569

|

)

|

(5,564,335

|

)

|

617,766

|

|

(11

|

)%

|

|

Net loss from continuing operations

|

|

(13,808,258

|

)

|

(16,135,310

|

)

|

2,327,052

|

|

(14

|

)%

|

|

Loss from discontinued operations

|

|

(1,675,539

|

)

|

(838,448

|

)

|

(837,091

|

)

|

100

|

%

|

|

Net loss

|

|

$

|

(15,483,797

|

)

|

$

|

(16,973,758

|

)

|

$

|

1,489,961

|

|

(9

|

)%

|

The following discussion of our results of operations relates to our continuing operations. See Note 4 to the consolidated financial statements for information concerning discontinued operations.

Revenues

Revenue increased for our Operations and Investments Segments, offset by a loss from discontinued operations. See Segment discussions below for further details.

Costs and expenses

|

|

|

Year ended December 31,

|

|

|

|

Percent

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

Change

|

|

|

Cost of service revenues

|

|

$

|

858,714

|

|

$

|

1,055,593

|

|

$

|

(196,879

|

)

|

(19

|

)%

|

|

Cost of goods sold

|

|

1,608,386

|

|

400,097

|

|

1,208,289

|

|

302

|

%

|

|

Selling, general and administrative

|

|

4,379,800

|

|

3,411,724

|

|

968,076

|

|

28

|

%

|

|

Share-based compensation

|

|

3,966,621

|

|

5,995,007

|

|

(2,028,386

|

)

|

(34

|

)%

|

|

Professional fees

|

|

1,598,818

|

|

1,383,367

|

|

215,451

|

|

16

|

%

|

|

Depreciation and amortization

|

|

115,696

|

|

62,443

|

|

53,253

|

|

85

|

%

|

|

|

|

$

|

12,528,035

|

|

$

|

12,308,231

|

|

$

|

219,804

|

|

2

|

%

|

Cost of service revenues typically fluctuates with the changes in revenue for our Operations Segments. Cost of goods sold varies with changes in product sales, including an increase in products sold by our Operations Segment, which have smaller margins. See Segment discussions below for further details.

Selling, general and administrative expense increased in 2019 primarily due to increases for (a) salaries; (b) premiums for liability, and directors and officer’s insurance; (c) computer and internet costs; and (d) marketing costs.

5

Table of Contents

Share-based compensation included the following:

|

|

|

Year ended December 31,

|

|

|

|

Percent

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

Change

|

|

|

Employee awards

|

|

$

|

3,040,497

|

|

$

|

3,626,271

|

|

$

|

(585,774

|

)

|

(16

|

)%

|

|

Consulting awards

|

|

85,683

|

|

306,466

|

|

(220,783

|

)

|

(72

|

)%

|

|

Feinsod Agreement

|

|

840,441

|

|

2,062,270

|

|

(1,221,829

|

)

|

(59

|

)%

|

|

|

|

$

|

3,966,621

|

|

$

|

5,995,007

|

|

$

|

(2,028,386

|

)

|

(34

|

)%

|

Employee awards are issued under our 2014 Equity Incentive Plan, which was approved by shareholders on June 26, 2015, and expense varies primarily due to the number of stock options granted and the share price on the date of grant. Consulting awards are granted to third parties in lieu of cash for services provided. The Feinsod Agreement expense represents equity-based compensation pursuant to agreements with Michael Feinsod for serving as the Executive Chairman of our Board.

Professional fees consist primarily of accounting and legal expenses and have increased slightly from 2018 due primarily to the cost of raising debt.

Depreciation and amortization expense increased due to normal depreciation expense for our ERP system.

Other Expense

|

|

|

Year ended December 31,

|

|

|

|

Percent

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

Change

|

|

|

Amortization of debt discount

|

|

$

|

2,019,726

|

|

$

|

4,234,823

|

|

$

|

(2,215,097

|

)

|

(52

|

)%

|

|

Interest expense

|

|

345,371

|

|

323,557

|

|

21,814

|

|

7

|

%

|

|

Loss on derivative liability

|

|

2,204,172

|

|

—

|

|

2,204,172

|

|

100

|

%

|

|

Loss from Desert Created Investment

|

|

—

|

|

182,136

|

|

(182,136

|

)

|

(100

|

)%

|

|

Impairment of Desert Created Investment

|

|

—

|

|

823,819

|

|

(823,819

|

)

|

(100

|

)%

|

|

Gain/loss on extinguishment of debt

|

|

377,300

|

|

—

|

|

377,300

|

|

100

|

%

|

|

|

|

$

|

4,946,569

|

|

$

|

5,564,335

|

|

$

|

(617,766

|

)

|

(11

|

)%

|

Amortization of debt discount costs generally varies with our debt balance and, in 2019, includes $318,681 of costs associated with the 2019 Warrants (as defined below). Interest expense varied between 2019 and 2018 due to the payoff of the 12% Notes in January 2018, the payoff of the Infinity Note in February 2018, and the issuance of the 8.5% Notes in April 2018. We recognized issuance costs in relation to the 2019 Warrants included in our registered direct offering in May 2019. The loss on investment in Desert Created is our 50% share of the net loss of Desert Created during the three quarters September 30, 2018. The impairment of Desert Created occurred primarily because the agreement was priced in November 2017, however, the transaction did not close until January 2018. In the interim, our stock price increased substantially, thus the consideration we paid, in equity instruments, was higher than the fair value of the investment received. In October 2018, we sold our 50% interest to DNFC for cash consideration of $23,045 and, accordingly, impaired the remaining balance. The loss on warrant derivative liability reflects the change in fair value of the 2019 Warrants.

Operations Consulting and Products

|

|

|

Year ended December 31,

|

|

|

|

Percent

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

Change

|

|

|

Revenues

|

|

$

|

3,570,909

|

|

$

|

1,718,507

|

|

$

|

1,852,402

|

|

108

|

%

|

|

Costs and expenses

|

|

(3,372,174

|

)

|

(1,932,598

|

)

|

(1,439,576

|

)

|

74

|

%

|

|

|

|

$

|

198,735

|

|

$

|

(214,091

|

)

|

$

|

412,826

|

|

193

|

%

|

Increased revenues in 2019 primarily related to revenue from license application consulting; and an increase in product sales throughout 2019. The higher margin is due to completed applications in the third and fourth quarters of 2019. Costs and expenses increased in 2019 primarily due to increased product sales.

6

Table of Contents

Investments

|

|

|

Year ended December 31,

|

|

|

|

Percent

|

|

|

|

|

2019

|

|

2018

|

|

Change

|

|

Change

|

|

|

Revenues

|

|

$

|

95,437

|

|

$

|

18,749

|

|

$

|

76,688

|

|

409

|

%

|

|

Costs and expenses

|

|

(71,723

|

)

|

—

|

|

(71,723

|

)

|

100

|

%

|

|

Investment in Desert Created

|

|

—

|

|

(1,005,955

|

)

|

1,005,955

|

|

(100

|

)%

|

|

|

|

$

|

23,714

|

|

$

|

(987,206

|

)

|

$

|

1,010,920

|

|

(102

|

)%

|

The increase in revenues in 2019 is related to three new notes receivables that were executed during 2019. All revenue is from interest and loan origination fees related to these new notes. The investment in Desert Created includes an $823,819 impairment charge and our share of their net loss of $182,136.

Non-GAAP Financial Measures

For the non-GAAP Adjusted EBITDA (Earnings (loss) Before Interest, Taxes, Depreciation and Amortization) per share-basic and diluted measures presented above, we have provided (1) the most directly comparable GAAP measure; (2) a reconciliation of the differences between the non-GAAP measure and the most directly comparable GAAP measure; (3) an explanation of why our management believes this non-GAAP measure provides useful information to investors; and (4) additional purposes for which we use this non-GAAP measure.

We believe that the disclosure of Adjusted EBITDA per share-basic and diluted provides investors with a better comparison of our period-to-period operating results. We exclude the effects of certain items from net loss per share-basic and diluted when we evaluate key measures of our performance internally, and in assessing the impact of known trends and uncertainties on our business. We also believe that excluding the effects of these items provides a more balanced view of the underlying dynamics of our business. Adjusted EBITDA per share-basic and diluted excludes the impacts of interest expense, tax expense, depreciation and amortization, gain (loss) on its derivative liability, amortization of debt discount and share-based compensation. Weighted average number of common shares outstanding - basic and diluted (adjusted) excludes the impact of shares issued in connection with share-based compensation.

Tabular reconciliations of this supplemental non-GAAP financial information to our most comparable GAAP information are contained in this Report. We present such non-GAAP supplemental financial information, as we believe such information provides additional meaningful methods of evaluating certain aspects of our operating performance from period-to-period on a basis that may not be otherwise apparent on a non-GAAP basis. This supplemental financial information should be considered in addition to, not in lieu of, our Consolidated Financial Statements.

|

|

|

Year ended December 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

Net loss attributable to common stockholders

|

|

$

|

(17,824,797

|

)

|

$

|

(16,973,758

|

)

|

|

Adjustment for loss from discontinued operations

|

|

1,675,539

|

|

838,448

|

|

|

Loss from continuing operations attributable to common stockholders

|

|

(16,149,258

|

)

|

(16,135,310

|

)

|

|

Adjustments:

|

|

|

|

|

|

|

Share-based expense

|

|

3,966,621

|

|

5,995,007

|

|

|

Depreciation and amortization

|

|

115,696

|

|

62,443

|

|

|

Impairment of Desert Created investment

|

|

—

|

|

823,819

|

|

|

Amortization of debt discount and equity issuance costs

|

|

2,019,726

|

|

4,234,823

|

|

|

Loss on extinguishment of debt

|

|

377,300

|

|

—

|

|

|

Interest expense

|

|

345,371

|

|

323,557

|

|

|

Loss on warrant derivative liability

|

|

2,204,172

|

|

—

|

|

|

Loss on investment of Desert Created

|

|

—

|

|

182,136

|

|

|

Total adjustments

|

|

9,028,886

|

|

11,621,785

|

|

|

Adjusted EBITDA

|

|

$

|

(7,120,372

|

)

|

$

|

(4,513,525

|

)

|

|

|

|

|

|

|

|

|

Per share – basic and diluted:

|

|

|

|

|

|

|

Net loss

|

|

$

|

(0.47

|

)

|

$

|

(0.49

|

)

|

|

Adjusted EBITDA

|

|

(0.20

|

)

|

(0.13

|

)

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding:

|

|

|

|

|

|

|

Net loss

|

|

38,106,781

|

|

34,938,978

|

|

|

Adjusted EBITDA

|

|

36,222,752

|

|

34,297,078

|

|

7

Table of Contents

Liquidity

Sources of liquidity

Our sources of liquidity include cash generated from operations, the cash exercise of common stock options and warrants, debt, and the issuance of common stock or other equity-based instruments. We anticipate our more significant uses of resources will include funding operations, developing infrastructure, as well as potential loans, investments, and business acquisitions.

In September 2019, we completed a $1,506,000 private placement with certain accredited investors pursuant to the 2019 12% Notes and the 2019 12% Warrants”). In July 2019, we completed a $855,000 private placement pursuant to the SBI Note.

In May 2019, we raised approximately $3 million by issuing three million shares of our common stock and the 2019 Warrants to purchase three million shares of our common stock (together “2019 Units”) in a registered direct offering for $1.00 per 2019 Unit. The 2019 Warrants had an initial exercise price of $1.30 per share and are exercisable for five years from the date of issuance. We received cash of $2,604,355, which is net of $395,645 of issuance costs. The 2019 Warrants contain certain anti-dilution adjustment provisions with respect to subsequent issuances of securities by the Company at a price below the exercise price of such warrants. As a result of certain dilutive issuances of securities by the Company during the fourth quarter of 2019, the exercise price of the 2019 Warrants decreased to $0.45 per share and the number of shares subject to the 2019 Warrants increased to 8,666,666 shares as of December 31, 2019.

In April 2018, we completed a $7,500,000 private placement pursuant to a promissory note (“8.5% Notes”) and warrant purchase agreement (the “8.5% Agreement”) with certain accredited investors, bearing interest at 8.5%, with principal due May 1, 2019, and interest payable quarterly. The proceeds were made available for general working capital purposes and acquisitions.

Sources and uses of cash

We had cash of approximately $224,994 and $8.0 million, respectively, as of and December 31, 2019 and 2018. Our cash flows from operating, investing and financing activities were as follows:

|

|

|

Year ended December 31,

|

|

|

|

|

2019

|

|

2018

|

|

|

Net cash used in operating activities

|

|

$

|

(5,328,661

|

)

|

$

|

(5,726,207

|

)

|

|

Net cash used in investing activities

|

|

(753,639

|

)

|

(568,266

|

)

|

|

Net cash provided by (used in) financing activities

|

|

(1,649,875

|

)

|

9,214,855

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities decreased in 2019 by $397,546 compared to 2018, primarily due to reduction of expenses and personnel. Where possible, we continue to use non-cash equity-based instruments to obtain consulting services and compensate employees.

Net cash used in investing activities in 2019 relates primarily to purchasing fixed assets, including the opening of STOA Wellness retail location. In the 2018, we purchased fixed assets and invested in the Flowhub SAFE.

Net cash used in financing activities related to the payoff of the notes payable, offset by a capital raise in May 2019. Net cash provided by financing activities in 2018 related to the exercise of warrants and options offset by paying off debt.

Capital Resources

We have no material commitments for capital expenditures as of December 31, 2019. Part of our growth strategy, however, is to acquire businesses. We would fund such activity through cash on hand, the issuance of debt, common stock, warrants for our common stock or a combination thereof.

8

Table of Contents

Off-balance Sheet Arrangements

We currently have no off-balance sheet arrangements.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the amounts of revenues and expenses. Critical accounting policies are those that require the application of management’s most difficult, subjective or complex judgments, often because of the need to make estimates about the effect of matters that are inherently uncertain and that may change in subsequent periods. In applying these critical accounting policies, our management uses its judgment to determine the appropriate assumptions to be used in making certain estimates. Actual results may differ from these estimates.

We define critical accounting policies as those that are reflective of significant judgments and uncertainties and which may potentially result in materially different results under different assumptions and conditions. In applying these critical accounting policies, our management uses its judgment to determine the appropriate assumptions to be used in making certain estimates. These estimates are subject to an inherent degree of uncertainty.

Purchase Accounting for Acquisitions

Acquisition of a business requires companies to record assets acquired and liabilities assumed at their respective fair market values at the date of acquisition. Any amount of the purchase price paid that is in excess of the estimated fair value of the net assets acquired is recorded as goodwill. We determine fair value using widely accepted valuation techniques, primarily discounted cash flows and market multiple analyses. These types of analyses require us to make assumptions and estimates regarding industry and economic factors, the profitability of future business strategies, discount rates and cash flow. If actual results are not consistent with our assumptions and estimates, or our assumptions and estimates change due to new information, we may be exposed to an impairment charge in the future.

Accounting for Discontinued Operations

We regularly review underperforming assets to determine if a sale or disposal might be a better way to monetize the assets. When an asset group is considered for sale or disposal, we review the transaction to determine if or when the entity qualifies as a discontinued operation in accordance with the criteria of FASB ASC Topic 205-20 “Discontinued Operations.” The FASB has issued authoritative guidance that raises the threshold for disposals to qualify as discontinued operations. Under this guidance, a discontinued operation is (1) a component of an entity or group of components that have been disposed of or are classified as held for sale and represent a strategic shift that has or will have a major effect on an entity’s operations and financial results, or (2) an acquired business that is classified as held for sale on the acquisition date.

Impairment of Long-lived Assets

We periodically evaluate whether the carrying value of long-lived assets has been impaired when circumstances indicate the carrying value of those assets may not be recoverable. The carrying amount is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. If the carrying value is not recoverable, the impairment loss is measured as the excess of the asset’s carrying value over its fair value.

Our impairment analyses require management to apply judgment in estimating future cash flows as well as asset fair values, including forecasting useful lives of the assets, assessing the probability of different outcomes, and selecting the discount rate that reflects the risk inherent in future cash flows. If the carrying value is not recoverable, we assess the fair value of long-lived assets using commonly accepted techniques, and may use more than one method, including, but not limited to, recent third party comparable sales and discounted cash flow models. If actual results are not consistent with our assumptions and estimates, or our assumptions and estimates change due to new information, we may be exposed to an impairment charge in the future.

9

Table of Contents

Debt with Equity-linked Features

We may issue debt that has separate warrants, conversion features, or no equity-linked attributes.

When we issue debt with warrants, we determine the value of the warrants using the Black-Scholes Option Pricing Model (“Black-Scholes”) or the Binomial Model, using the stock price on the date of issuance, the risk-free interest rate associated with the life of the debt, and the estimated volatility of our stock.

When we issue debt with a conversion feature, we must first assess whether the conversion feature meets the requirements to be treated as a derivative. If the conversion feature within convertible debt meets the requirements to be treated as a derivative, we estimate the fair value of the convertible debt derivative using Black-Scholes upon the date of issuance, using the stock price on the date of issuance, the risk free interest rate associated with the life of the debt, and the estimated volatility of our stock. If the conversion feature is not treated as a derivative, we assess whether it is a beneficial conversion feature (“BCF”). A BCF exists if the conversion price of the convertible debt instrument is less than the stock price on the commitment date. This typically occurs when the conversion price is less than the fair value of the stock on the date the instrument was issued. The value of a BCF is equal to the intrinsic value of the feature, the difference between the conversion price and the common stock into which it is convertible.

Equity-based Payments

We estimate the fair value of equity-based instruments issued to employees or to third parties for services or goods using Black-Scholes or the Binomial Model, which requires us to estimate the volatility of our stock and forfeiture rate.

Revenue Recognition

On January 1, 2018, we adopted ASC Topic 606, “Revenue from Contracts with Customers” (“ASC 606”). The core principle of ASC 606 requires that an entity recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. ASC 606 defines a five-step process to achieve this core principle and, in doing so, it is possible more judgment and estimates may be required within the revenue recognition process than required under existing U.S. GAAP including identifying performance obligations in the contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation.

The following five steps are applied to achieve that core principle:

· Step 1: Identify the contract with the customer;

· Step 2: Identify the performance obligations in the contract;

· Step 3: Determine the transaction price;

· Step 4: Allocate the transaction price to the performance obligations in the contract; and

· Step 5: Recognize revenue when the company satisfies a performance obligation.

10

Table of Contents

ITEM 8. REVISED AND RESTATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors of

General Cannabis Corp.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheet of General Cannabis Corp. (the “Company”) as of December 31, 2019, the related consolidated statements of operations, changes in stockholders’ equity (deficit) and cash flows for the year then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2019, and the results of its operations and its cash flows for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

Explanatory Paragraph — Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As more fully described in Note 1 the Company has a significant working capital deficiency, has incurred significant losses and needs to raise additional funds to meet its obligations and sustain its operations. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Restatement of Previously Issued Financial Statements

As disclosed in Note 2 to the accompanying consolidated financial statements, the Company has restated its financial statements for the year ended December 31, 2019 to correct an error.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

/s/ Marcum LLP

Marcum LLP

We have served as the Company’s auditor since 2019.

Melville, NY

May 14, 2020, except for the effects of the restatement disclosed in Note 2 to the consolidated financial statements as to which the date is July 6, 2020.

11

Table of Contents

GENERAL CANNABIS CORP

CONSOLIDATED BALANCE SHEETS

|

|

|

December 31,

|

|

|

|

|

2019

(Restated)

|

|

2018

|

|

|

ASSETS

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

122,390

|

|

$

|

7,604,562

|

|

|

Accounts receivable, net

|

|

85,204

|

|

116,622

|

|

|

Note receivable, net — current portion

|

|

375,000

|

|

50,000

|

|

|

Prepaid expenses and other current assets

|

|

546,970

|

|

421,579

|

|

|

Assets held for sale

|

|

375,218

|

|

649,775

|

|

|

Assets of discontinued operations

|

|

47,453

|

|

144,365

|

|

|

Total current assets

|

|

1,552,235

|

|

8,986,903

|

|

|

|

|

|

|

|

|

|

Note receivable, net

|

|

93,333

|

|

—

|

|

|

Property and equipment, net

|

|

1,507,327

|

|

1,439,067

|

|

|

Investment

|

|

250,000

|

|

250,000

|

|

|

Assets held for sale

|

|

15,584

|

|

66,255

|

|

|

Assets of discontinued operations

|

|

83,525

|

|

—

|

|

|

Total Assets

|

|

$

|

3,502,004

|

|

$

|

10,742,225

|

|

|

|

|

|

|

|

|

|

LIABILITIES & STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

1,221,194

|

|

$

|

442,707

|

|

|

Interest payable

|

|

93,375

|

|

—

|

|

|

Customer deposits

|

|

562,803

|

|

308,111

|

|

|

Accrued stock payable

|

|

80,657

|

|

—

|

|

|

Notes payable (net of discount)

|

|

2,230,684

|

|

5,273,906

|

|

|

Related party note payable (net of discount)

|

|

99,667

|

|

—

|

|

|

Warrant derivative liability

|

|

4,620,593

|

|

—

|

|

|

Liabilities held for sale

|

|

149,249

|

|

159,944

|

|

|

Liabilities of discontinued operations

|

|

207,993

|

|

6,220

|

|

|

Total current liabilities

|

|

9,266,216

|

|

6,190,888

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies (Note 13)

|

|

—

|

|

—

|

|

|

|

|

|

|

|

|

|

Stockholders’ Equity (Deficit)

|

|

|

|

|

|

|

Preferred stock, no par value; 5,000,000 shares authorized; no shares issued and outstanding at December 31, 2019 and 2018

|

|

—

|

|

—

|

|

|

Common Stock, $0.001 par value; 100,000,000 shares authorized; 39,497,480 shares and 36,222,752 shares issued and outstanding on December 31, 2019 and 2018, respectively

|

|

39,498

|

|

36,223

|

|

|

Additional paid-in capital

|

|

61,468,034

|

|

56,303,061

|

|

|

Accumulated deficit

|

|

(67,271,744

|

)

|

(51,787,947

|

)

|

|

Total Stockholders’ Equity (Deficit)

|

|

(5,764,212

|

)

|

4,551,337

|

|

|

|

|

|

|

|

|

|

Total Liabilities & Stockholders’ Equity (Deficit)

|

|

$

|

3,502,004

|

|

$

|

10,742,225

|

|

See Notes to consolidated financial statements.

12

Table of Contents

GENERAL CANNABIS CORP

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

Year ended December 31,

|

|

|

|

|

2019

(Restated)

|

|

2018

|

|

|

REVENUES

|

|

|

|

|

|

|

Service

|

|

$

|

1,787,863

|

|

$

|

1,186,624

|

|

|

Rent and interest

|

|

95,437

|

|

18,749

|

|

|

Product sales

|

|

1,783,046

|

|

531,883

|

|

|

Total revenues

|

|

3,666,346

|

|

1,737,256

|

|

|

|

|

|

|

|

|

|

COSTS AND EXPENSES

|

|

|

|

|

|

|

Cost of service revenues

|

|

858,714

|

|

1,055,593

|

|

|

Cost of goods sold

|

|

1,608,386

|

|

400,097

|

|

|

Selling, general and administrative

|

|

4,379,800

|

|

3,411,724

|

|

|

Share-based expense

|

|

3,966,621

|

|

5,995,007

|

|

|

Professional fees

|

|

1,598,818

|

|

1,383,367

|

|

|

Depreciation and amortization

|

|

115,696

|

|

62,443

|

|

|

Total costs and expenses

|

|

12,528,035

|

|

12,308,231

|

|

|

|

|

|

|

|

|

|

OPERATING LOSS

|

|

(8,861,689

|

)

|

(10,570,975

|

)

|

|

|

|

|

|

|

|

|

OTHER (INCOME) EXPENSE

|

|

|

|

|

|

|

Amortization of debt discount and equity issuance costs

|

|

2,019,726

|

|

4,234,823

|

|

|

Loss on extinguishment of debt

|

|

377,300

|

|

—

|

|

|

Interest expense, net

|

|

345,371

|

|

323,557

|

|

|

Loss on warrant derivative liability

|

|

2,204,172

|

|

—

|

|

|

Loss from Desert Created investment

|

|

—

|

|

182,136

|

|

|

Impairment of Desert Created investment

|

|

—

|

|

823,819

|

|

|

Total other expense, net

|

|

4,946,569

|

|

5,564,335

|

|

|

|

|

|

|

|

|

|

NET LOSS FROM CONTINUING OPERATIONS

|

|

$

|

(13,808,258

|

)

|

$

|

(16,135,310

|

)

|

|

|

|

|

|

|

|

|

Loss from discontinued operations

|

|

(1,675,539

|

)

|

(838,448

|

)

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

$

|

(15,483,797

|

)

|

$

|

(16,973,758

|

)

|

|

Deemed dividend

|

|

(2,341,000

|

)

|

—

|

|

|

|

|

|

|

|

|

|

NET LOSS ATTRIBUTABLE TO COMMON STOCKHOLDERS

|

|

$

|

(17,824,797

|

)

|

$

|

(16,973,758

|

)

|

|

|

|

|

|

|

|

|

PER SHARE DATA — Basic and diluted

|

|

|

|

|

|

|

Net loss from continuing operations per share

|

|

$

|

(0.36

|

)

|

$

|

(0.46

|

)

|

|

|

|

|

|

|

|

|

Net loss from discontinued operations per share

|

|

$

|

(0.04

|

)

|

$

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders per share

|

|

$

|

(0.47

|

)

|

$

|

(0.49

|

)

|

|

Weighted average number of common shares outstanding

|

|

38,106,781

|

|

34,938,978

|

|

See Notes to consolidated financial statements.

13

Table of Contents

GENERAL CANNABIS CORP

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

Year ended December 31,

|

|

|

|

|

2019

(Restated)

|

|

2018

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

Net loss

|

|

$

|

(15,483,797

|

)

|

$

|

(16,973,758

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

Amortization of debt discount and equity issuance costs

|

|

2,019,726

|

|

4,234,823

|

|

|

Loss on extinguishment of debt

|

|

377,300

|

|

—

|

|

|

Depreciation and amortization expense

|

|

196,247

|

|

149,504

|

|

|

Amortization of loan origination fees

|

|

(13,333

|

)

|

—

|

|

|

Bad debt expense

|

|

174,249

|

|

87,592

|

|

|

Impairment of assets

|

|

147,035

|

|

|

|

|

Loss on disposal of property and equipment

|

|

104,803

|

|

|

|

|

Impairment of Desert Created investment

|

|

—

|

|

823,819

|

|

|

Loss from Desert Created investment

|

|

—

|

|

182,136

|

|

|

Loss on warrant derivative liability

|

|

2,204,172

|

|

—

|

|

|

Share-based payments

|

|

3,966,621

|

|

5,995,007

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

Accounts receivable

|

|

(101,766

|

)

|

(56,954

|

)

|

|

Prepaid expenses and other assets

|

|

(138,254

|

)

|

231,746

|

|

|

Inventory

|

|

(23,772

|

)

|

(88,494

|

)

|

|

Accounts payable and accrued liabilities

|

|

1,242,108

|

|

(311,628

|

)

|

|

Net cash used in operating activities:

|

|

(5,328,661

|

)

|

(5,726,207

|

)

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

(318,639

|

)

|

(241,311

|

)

|

|

Lending on notes receivable

|

|

(705,000

|

)

|

(650,000

|

)

|

|

Proceeds on notes receivable

|

|

270,000

|

|

600,000

|

|

|

Investment in Flowhub SAFE

|

|

—

|

|

(250,000

|

)

|

|

Investment in Desert Created

|

|

—

|

|

(50,000

|

)

|

|

Proceeds on investment in Desert Created

|

|

—

|

|

23,045

|

|

|

Net cash used in investing activities

|

|

(753,639

|

)

|

(568,266

|

)

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

Proceeds from sale of common stock and warrants

|

|

2,604,355

|

|

—

|

|

|

Proceeds from the exercise of warrants

|

|

—

|

|

3,985,197

|

|

|

Proceeds from exercise of stock options

|

|

188,770

|

|

721,034

|

|

|

Proceeds from notes payable

|

|

1,455,000

|

|

7,500,000

|

|

|

Payments on notes payable

|

|

(5,898,000

|

)

|

(1,621,250

|

)

|

|

Payments on Infinity Note — related party

|

|

—

|

|

(1,370,126

|

)

|

|

Net cash provided by (used in) financing activities

|

|

(1,649,875

|

)

|

9,214,855

|

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

|

|

(7,732,175

|

)

|

2,920,382

|

|

|

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD

|

|

7,957,169

|

|

5,036,787

|

|

|

CASH AND CASH EQUIVALENTS, END OF PERIOD

|

|

$

|

224,994

|

|

$

|

7,957,169

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL SCHEDULE OF CASH FLOW INFORMATION

|

|

|

|

|

|

|

Cash paid for interest

|

|

$

|

305,195

|

|

$

|

637,586

|

|

|

|

|

|

|

|

|

|

NON-CASH INVESTING & FINANCING ACTIVITIES

|

|

|

|

|

|

|

Deemed dividend from warrant repricing

|

|

$

|

2,603,000

|

|

$

|

—

|

|

|

Operating lease right-of-use asset/Operating lease liability

|

|

154,200

|

|

—

|

|

|

12% Warrants recorded as a debt discount and loss on extinguishment of debt

|

|

392,000

|

|

—

|

|

|

SBI Warrants recorded as a debt discount and loss on extinguishment of debt

|

|

28,800

|

|

—

|

|

|

15% Warrants recorded as a debt discount and additional paid-in capital

|

|

158,100

|

|

—

|

|

|

8.5% Note principal used to exercise 8.5% Warrants

|

|

—

|

|

651,000

|

|

|

8.5% Warrants recorded as debt discount and additional paid-in capital

|

|

—

|

|

5,366,000

|

|

|

Issuance of common stock for accrued stock payable

|

|

—

|

|

321,860

|

|

|

Issuance of common stock and warrants for investment in Desert Created

|

|

—

|

|

979,000

|

|

See Notes to consolidated financial statements.

14

Table of Contents

GENERAL CANNABIS CORP

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

|

Common Stock

|

|

Additional

|

|

Accumulated

|

|

|

|

|

|

|

Shares

|

|

Amount

|

|

Paid-in Capital

|

|

Deficit

|

|

Total

|

|

|

January 1, 2018

|

|

27,692,910

|

|

$

|

27,693

|

|

$

|

38,292,493

|

|

$

|

(34,814,189

|

)

|

$

|

3,505,997

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued upon exercise of warrants for debt

|

|

7,546,286

|

|

7,547

|

|

4,795,510

|

|

—

|

|

4,803,057

|

|

|

Common stock issued upon exercise of stock options

|

|

731,264

|

|

731

|

|

720,303

|

|

—

|

|

721,034

|

|

|

Common stock issued for MHPS acquisition

|

|

104,359

|

|

104

|

|

154,896

|

|

—

|

|

155,000

|

|

|

Common stock and warrants issued for Desert Created acquisition

|

|

75,000

|

|

75

|

|

978,925

|

|

—

|

|

979,000

|

|

|

Common stock issued for services

|

|

72,933

|

|

73

|

|

234,928

|

|

—

|

|

235,001

|

|

|

Stock options granted to employees

|

|

—

|

|

—

|

|

3,626,271

|

|

—

|

|

3,626,271

|

|

|

Stock options under Feinsod Agreement

|

|

—

|

|

—

|

|

2,062,270

|

|

—

|

|

2,062,270

|

|

|

Warrants issued for services

|

|

—

|

|

—

|

|

71,465

|

|

—

|

|

71,465

|

|

|

Warrants issued with the 8.5% notes

|

|

—

|

|

—

|

|

5,366,000

|

|

—

|

|

5,366,000

|

|

|

Net loss

|

|

—

|

|

—

|

|

—

|

|

(16,973,758

|

)

|

(16,973,758

|

)

|

|

December 31, 2018

|

|

36,222,752

|

|

36,223

|

|

56,303,061

|

|

(51,787,947

|

)

|

4,551,337

|

|

|

Sale of common stock, net of issuance costs

|

|

3,000,000

|

|

3,000

|

|

503,614

|

|

—

|

|

506,614

|

|

|

Warrants issued with the 12% Notes

|

|

—

|

|

—

|

|

392,000

|

|

—

|

|

392,000

|

|

|

Warrants issued with the 15% Notes

|

|

—

|

|

—

|

|

158,100

|

|

—

|

|

158,100

|

|

|

Warrants issued with the SBI Note

|

|

—

|

|

—

|

|

28,800

|

|

—

|

|

28,800

|

|

|

Common stock issued for property and equipment

|

|

5,000

|

|

5

|

|

7,995

|

|

—

|

|

8,000

|

|

|

Common stock issued upon exercise of stock options

|

|

269,728

|

|

270

|

|

188,500

|

|

—

|

|

188,770

|

|

|

Stock options granted to employees and consultants

|

|

—

|

|

—

|

|

3,885,964

|

|

—

|

|

3,885,964

|

|

|

Net loss

|

|

|

|

|

|

|

|

(15,483,797

|

)

|

(15,483,797

|

)

|

|

December 31, 2019 (Restated)

|

|

39,497,480

|

|

$

|

39,498

|

|

$

|

61,468,034

|

|

$

|

(67,271,744

|

)

|

$

|

(5,764,212

|

)

|

See Notes to consolidated financial statements.

15

Table of Contents

GENERAL CANNABIS CORP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. NATURE OF OPERATIONS, HISTORY AND PRESENTATION

Nature of Operations

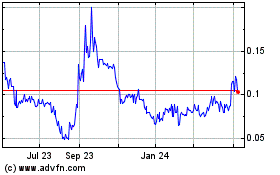

General Cannabis Corp, a Colorado Corporation (the “Company,” “we,” “us,” “our,” or “GCC”) (formerly, Advanced Cannabis Solutions, Inc.), was incorporated on June 3, 2013, and provides services and products to the regulated cannabis industry. On June 6, 2018 we began trading on the OTCQX® Best Market after upgrading from the OTCQB® Venture Market. As of December 31, 2019, our operations are segregated into the following two segments:

Operations Consulting and Products (“Operations Segment”)

Through Next Big Crop (“NBC”), we deliver comprehensive consulting services to the cannabis industry that include obtaining licenses, compliance, cultivation, retail operations, logistical support, facility design and construction, and expansion of existing operations. During 2019 and 2018, 59% and 60% of NBC’s revenue was with three customers and one customer, respectively.

NBC oversees our wholesale equipment and supply business, operated under the name “GC Supply,” which provides turnkey sourcing and stocking services to cultivation, retail and infused products manufacturing facilities. Our products include building materials, equipment, consumables and compliance packaging. There are generally multiple suppliers for the products we sell; however, there are a limited number of manufacturers of certain high-tech cultivation equipment.

Capital Investments and Real Estate (“Investments Segment”)

As a publicly traded company, we have access to capital that may not be available to businesses operating in the cannabis industry. Accordingly, we may provide debt or equity capital through (a) loans or revolving lines of credit, (b) leasing real estate we own, or (c) investing in businesses using cash or shares of our common stock.

Held for Sale - Security and Cash Transportation Services (“Security Segment”)

We provide advanced security, including on-site professionals and cash transport, to licensed cannabis cultivators, cannabis processing facilities and retail shops, under the business name Iron Protection Group (“IPG”) in California and Colorado, and security services to non-cannabis customers in Colorado, such as hotels, apartment buildings and retail. On December 26, 2019, the board of directors and management made the strategic decision to investigate a possible buyer for the security segment and if no buyer could be found, cease operations of the security segment. We transferred all our Colorado security contracts and employees to a company on January 16, 2020. We will receive $1.00 per man hour worked on existing contracts for a period of one year. On February 6, 2020 we cancelled all our security contracts in California.

Discontinued Operations - Consumer Goods and Marketing Consulting (“Consumer Goods Segment”)

Our apparel business, Chiefton, has two primary revenue streams. Chiefton Supply strives to create innovative, unique t-shirts, hats, hoodies and accessories. Our apparel is sold through our on-line shop, cannabis retailers, non-cannabis retailers, and specialty t-shirt and gift shops. Chiefton Design provides design, branding and marketing strategy consulting services to the cannabis industry, which frequently includes sourcing and selling customer-specific apparel and accessories. On December 26, 2019, the board of directors and management made the strategic move to cease operations of Chiefton. All operations of Chiefton were abandoned on December 31, 2019.

Our CBD retail business, STOA Wellness, opened in July of 2019. STOA Wellness offers a curated collection of high quality CBD products for athletes and general wellness. On December 26, 2019, the board of directors committed to a plan to cease operations of STOA Wellness. We transferred all assets of STOA Wellness to an individual on January 10, 2020, in exchange for the release on the outstanding lease.

Basis of Presentation

The accompanying consolidated financial statements include the results of GCC and its ten wholly-owned subsidiary companies: (a) 6565 E. Evans Owner LLC, a Colorado limited liability company formed in 2014; (b) General Cannabis Capital Corporation, a Colorado corporation formed in 2015; (c) GC Security LLC (“GCS”), a

16

Table of Contents

Colorado limited liability company formed in 2015; (d) GC-NY Health, LLC, a New York limited liability company formed in 2019; (e) Standard Cann, Inc., a Colorado corporation formed in 2019; (f) Cannasseur, LLC, a Colorado limited liability company formed in 2019; (g) Cannasseur Dispensary, LLC, a limited liability company formed in 2019; (h) Cannasseur Cultivation, LLC, a limited liability company formed in 2019; (i) Cannasseur Extraction, LLC, a limited liability company formed in 2019 and (j) GC Corp., a Colorado corporation, originally formed in 2013 under the name ACS Corp. In 2015, the name was changed to GC Corp. Intercompany accounts and transactions have been eliminated.

The preparation of our consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses. Although these estimates are based on our knowledge of current events and actions we may undertake in the future, actual results may ultimately differ from these estimates and assumptions. Furthermore, when testing assets for impairment in future periods, if management uses different assumptions or if different conditions occur, impairment charges may result.

Going Concern

The consolidated financial statements have been prepared on a going concern basis, which assumes we will be able to realize our assets and discharge our liabilities in the normal course of business for the foreseeable future. Our cash of approximately $225,000 as of December 31, 2019, is not sufficient to absorb our operating losses and retire our debt of approximately $2,330,000. The warrants associated with this debt, if exercised, would provide sufficient funds to retire the debt; however, there is no guarantee that these warrants will be exercised. Our ability to continue as a going concern is dependent upon our generating profitable operations in the future and / or obtaining the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. Management believes that (a) we will be successful obtaining additional capital and (b) actions presently being taken to further implement our business plan and generate additional revenues provide opportunity for the Company to continue as a going concern. While we believe in the viability of our strategy to generate additional revenues and our ability to raise additional funds, there can be no assurances to that effect. Accordingly, there is substantial doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

Significant Accounting Policies

Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits with banks, and investments that are highly liquid and have maturities of three months or less at the date of purchase. We maintain our cash balances in financial institutions that, from time to time, may exceed amounts insured by the Federal Deposit Insurance Corporation ($250,000 as of December 31, 2019).

Inventory

Our inventory consists of finished goods, including apparel and supplies for the cannabis market. Inventory is stated at the lower of cost (net realizable value), using average cost to determine cost. We monitor inventory cost compared to selling price in order to determine if a write down to net realizable value is necessary. In December 2019, we ceased all operations of Chiefton and determined we would be ceasing operations of STOA in January 2020. As a result, we wrote down all of the remaining inventory to $0 as of December 31, 2019. We recognized $147,035 in expense as a result of this write down of inventory and is included in loss on discontinued operations on the statement of operations.

Accounts Receivable, net