Mortgage Rates Fell This Week, Freddie Mac Says

March 03 2022 - 10:29AM

Dow Jones News

By Matt Grossman

Mortgage rates followed government-bond yields lower in the

latest week, according to housing-finance agency Freddie Mac.

In the week ending Thursday, the average rate on a 30-year

fixed-rate mortgage decreased to 3.76% from 3.89% last week. A year

ago this week, the average rate was 3.02%.

Average 15-year rates were 3.01%, down from 3.14% a week ago,

but up from 2.34% a year ago.

The average rate on a five-year Treasury-indexed hybrid

adjustable-rate mortgage, or ARM, was 2.91%, down from 2.98% last

week. A year ago, the 5-year ARM averaged 2.73%

The Russian invasion of Ukraine has led to geopolitical tensions

and lower yields on U.S. Treasurys, which help set borrowing costs

across the economy.

"While inflationary pressures remain, the cascading impacts of

the war in Ukraine have created market uncertainty," Freddie Mac

Chief Economist Sam Khater said. "Consequently, rates are expected

to stay low in the short term but will likely increase in the

coming months."

Write to Matt Grossman at matt.grossman@wsj.com

(END) Dow Jones Newswires

March 03, 2022 10:14 ET (15:14 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

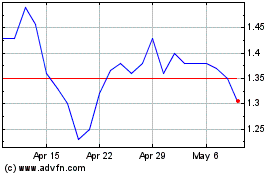

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Federal Home Loan Mortgage (QB) (USOTC:FMCC)

Historical Stock Chart

From Apr 2023 to Apr 2024