Statement of Changes in Beneficial Ownership (4)

October 14 2020 - 5:01PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

ICAHN CARL C |

2. Issuer Name and Ticker or Trading Symbol

ENZON PHARMACEUTICALS, INC.

[

ENZN

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O ICAHN CAPITAL LP, 16690 COLLINS AVENUE - PH-1 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/9/2020 |

|

(Street)

SUNNY ISLES BEACH, FL 33160

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock (1) | 10/9/2020 | | X(6) | | 29457750 | A | (6) | 36056636 (6) | I | Please see footnotes (1)(2)(3)(4)(5) |

| Preferred Stock (1) | 10/9/2020 | | X(6) | | 39277 | A | (6) | 39277 (6) | I | Please see footnotes (1)(2)(3)(4)(5) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Subscription Rights (right to buy) | $1090 | 10/9/2020 | | X (6) | | | 39277 | 9/23/2020 | 10/9/2020 | Units consisting of Common and Preferred Stock | (6) | $0.00 | 0 | I | Please see footnotes (1)(2)(3)(4)(5) |

| Explanation of Responses: |

| (1) | Icahn Partners LP ("Icahn Partners") directly beneficially owns 21,132,725 shares of Common Stock, $0.01 par value per share ("Common Stock"), and 22,975 shares of Series C?Non-Convertible Redeemable?Preferred Stock, $0.01 par value per share ("Preferred Stock"), and Icahn Partners Master Fund LP ("Icahn Master") directly beneficially owns 14,923,911 shares of Common Stock and 16,302 shares of Preferred Stock. |

| (2) | Beckton Corp. ("Beckton") is the sole stockholder of Icahn Enterprises G.P. Inc. ("Icahn Enterprises GP"), which is the general partner of Icahn Enterprises Holdings L.P. ("Icahn Enterprises Holdings"). Icahn Enterprises Holdings is the sole member of IPH GP LLC ("IPH"), which is the general partner of Icahn Capital LP ("Icahn Capital"). Icahn Capital is the general partner of each of Icahn Onshore LP ("Icahn Onshore") and Icahn Offshore LP ("Icahn Offshore"). Icahn Onshore is the general partner of Icahn Partners. Icahn Offshore is the general partner of Icahn Master. |

| (3) | Beckton is 100 percent owned by Carl C. Icahn. As such, Mr. Icahn is in a position indirectly to determine the investment and voting decisions made by each of Icahn Partners and Icahn Master. |

| (4) | Each of Icahn Onshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn may be deemed to indirectly beneficially own (as that term is defined in Rule 13d-3 under the Act) the shares of Common Stock and Preferred Stock which Icahn Partners owns. Each of Icahn Onshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn disclaims beneficial ownership of such shares except to the extent of their pecuniary interest therein. |

| (5) | Each of Icahn Offshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn may be deemed to indirectly beneficially own (as that term is defined in Rule 13d-3 under the Act) the shares of Common Stock and Preferred Stock which Icahn Master owns. Each of Icahn Offshore, Icahn Capital, IPH, Icahn Enterprises Holdings, Icahn Enterprises GP, Beckton and Mr. Icahn disclaims beneficial ownership of such shares except to the extent of their pecuniary interest therein. |

| (6) | On October 9, 2020, the subscription rights distributed by the Issuer in connection with its rights offering (the "Rights Offering") expired. The Reporting Persons acquired an aggregate of 39,277 units, at a price per unit of $1,090, for an aggregate purchase price of $42,811,930, constituting (x) the Reporting Persons' pro-rata share of the units issued in the Rights Offering (5,971 units) and (y) all units that remained unsubscribed for by other holders at the expiration of the Rights Offering (33,306 units). Each unit acquired by the Reporting Persons consisted of 750 shares of Common Stock and one share of Preferred Stock, resulting in the acquisition by the Reporting Persons of an aggregate of 29,457,750 shares of Common Stock and 39,277 shares of Preferred Stock. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

ICAHN CARL C

C/O ICAHN CAPITAL LP

16690 COLLINS AVENUE - PH-1

SUNNY ISLES BEACH, FL 33160 |

| X |

|

|

Signatures

|

| /S/ Carl C. Icahn | | 10/14/2020 |

| **Signature of Reporting Person | Date |

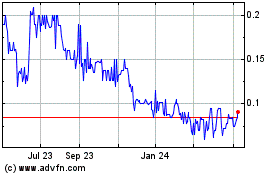

Enzon (QX) (USOTC:ENZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

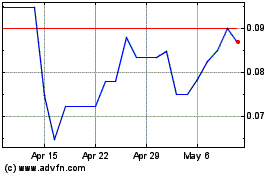

Enzon (QX) (USOTC:ENZN)

Historical Stock Chart

From Apr 2023 to Apr 2024