As filed with the Securities and

Exchange Commission on September 15, 2020

Registration No. 333-248528

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENZON PHARMACEUTICALS, INC.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

2836

|

|

22-2372868

|

|

(State or other jurisdiction

of incorporation)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(IRS Employer

Identification No.)

|

20 Commerce Drive (Suite 135)

Cranford, New Jersey 07016

(732) 980-4500

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Andrew Rackear

Chief Executive Officer and Secretary

20 Commerce Drive (Suite 135)

Cranford, New Jersey 07016

(732) 980-4500

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Todd E. Mason, Esq.

Thompson Hine LLP

335 Madison Avenue, 12th Floor

New York, New York 10017

(212) 908-3946

Approximate date of commencement of

proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

check the following box. x

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

|

Accelerated filer

|

¨

|

|

|

|

|

|

|

Non-accelerated filer

|

x

|

|

Smaller reporting company

|

x

|

|

Emerging Growth Company

|

¨

|

|

|

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

Title

of Each Class of

Securities to be Registered

|

|

Proposed Maximum

Aggregate Offering

Price(1)

|

|

Amount

of

Registration Fee(4)

|

|

Units,

each consisting of (a) one share of Preferred Stock; and (b) 750 shares of Common Stock (“Units”)

|

|

$43,600,000(2)

|

|

$5,659.28

|

|

Transferable

Rights to purchase Units(2)

|

|

—

|

|

—

|

|

Common

Stock included as part of the Units(3)

|

|

Included with Units above

|

|

—

|

|

Preferred

Stock included as part of the Units

|

|

Included

with Units above

|

|

—

|

|

Total

|

|

$43,600,000

|

|

$5,659.28

|

|

(1)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) of

the Securities Act of 1933, as amended (the “Act”).

|

|

(2)

|

Transferable Rights to purchase Units are being issued without consideration. Pursuant to Rule 457(g) under

the Act, no separate registration fee is required for the Rights because the Rights are being registered in the same registration

statement as the Common Stock of the registrant underlying the Rights.

|

|

(3)

|

In addition to the shares of Common Stock set forth in this table, pursuant to Rule 416 under

the Act, this registration statement also registers such indeterminate number of shares of Common Stock as may become issuable

from time to time by reason of share dividends, recapitalizations or other similar transactions.

|

|

|

|

|

(4)

|

A registration fee of $5,659.28 was previously paid in connection with the initial filing of

this Registration Statement on September 1, 2020.

|

The registrant hereby amends this registration statement

on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities

and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not

complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange

Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED SEPTEMBER 15, 2020

PRELIMINARY PROSPECTUS

Subscription Rights to Purchase Up to

40,000 Units

Consisting of an Aggregate of Up to

30,000,000 Shares of Common Stock

and Up to 40,000 Shares of Series C

Preferred Stock

at a Subscription Price of $1,090 Per

Unit

We are distributing to holders of our

common stock, par value $0.01 per share, at no charge, transferable subscription rights (“Subscription Rights”)

to purchase units (“Units”). We refer to the offering that is the subject of this prospectus as the “Rights

Offering.” In the Rights Offering, you will receive one Subscription Right for every share of common stock owned at

5:00 p.m., New York City Time, on September 23, 2020, the record date of the Rights Offering (the “Record Date”).

The Subscription Rights will be transferable and will be a new issue of securities with no prior trading market. Although the

Subscription Rights are transferable, we do not intend to list the Subscription Rights for trading on any securities exchange

or recognized trading system and your ability to transfer the Subscription Rights will be limited and difficult.

For every 1,105 Subscription Rights

held, you will be entitled to purchase one Unit at a subscription price per Unit of $1,090 (the “Subscription Price”).

Each Unit consists of one share of newly designated Series C Preferred Stock, par value $0.01 per share (the “Preferred

Stock”), and 750 shares of common stock.

The Preferred Stock will rank senior

to our common stock. The liquidation preference of the Preferred Stock will initially be $1,000 per share. On an annual basis,

our Board of Directors may, at its sole discretion, cause a dividend with respect to the Preferred Stock to be paid in cash to

the holders in an amount equal to 3% of the liquidation preference then in effect. If the dividend is not so paid in cash, the

liquidation preference will be adjusted and increased annually by an amount equal to 5% of the liquidation preference per share

as in effect at such time. The Preferred Stock will be non-convertible and, except as required by law, holders of Preferred Stock

will have no voting rights. On and after November 1, 2022, we will have the option to redeem

the shares of Preferred Stock, in whole or in part, at any time for an amount up to or equal to the liquidation preference per

share as in effect at such time. Shares of Preferred Stock will also be redeemable, at the option of the holder, in the event

of a change of control, as defined herein, of our company. The Preferred Stock will not be listed for trading or quoted on any

securities exchange or recognized trading system.

The maximum aggregate number of Units,

and the corresponding aggregate number of shares of common stock and Preferred Stock listed on this cover page and elsewhere

in this prospectus, are based on 44,214,603 shares of common stock outstanding as of the Record Date.

The Subscription Rights are transferable

until the Expiration Date as hereinafter defined and, therefore, you may sell, transfer or assign your Subscription Rights to

anyone during the offering period. There is no public market for the Subscription Rights and we do not intend to list the Subscription

Rights on any securities exchange or recognized trading system. If you desire to transfer your Subscription Rights, you will need

to locate a buyer or transferee of your Subscription Rights. We do not intend to facilitate transfers among stockholders or otherwise

create a market for transfers and sales. Accordingly, we cannot provide you any assurances as to the liquidity of a market for

the Subscription Rights and your ability to transfer the Subscription Rights will be limited and difficult.

The Subscription Rights will expire

if they are not exercised by 5:00 p.m., New York City Time, on October 9, 2020, unless the Rights Offering is extended or earlier

terminated by us in our sole discretion (as it may be so extended, or earlier terminated, the “Expiration Date”); provided,

however, that we may not extend the Expiration Date by more than 30 calendar days past the original Expiration Date.

If you exercise your Subscription Rights, you may revoke such exercise before the Expiration Date by following the instructions

herein. If the Expiration Date is extended, you may revoke your exercise of Subscription Rights at any time until the final Expiration

Date as so extended. If we terminate the Rights Offering, all subscription payments received will be returned as soon as practicable

thereafter without interest or deduction.

We have entered into

an investment agreement (the “Investment Agreement”) with Icahn Capital LP, which, together with its affiliates,

beneficially owns approximately 15% of our common stock before giving effect to the Rights Offering, pursuant to which, and subject

to the terms and conditions thereof, Icahn Capital LP has agreed to subscribe for its pro-rata share of the Rights Offering.

Icahn Capital LP has also agreed to purchase all Units that remain unsubscribed for at the expiration of the Rights Offering to

the extent that other holders elect not to exercise all of their respective Subscription Rights. No fees will be paid by us to

Icahn Capital LP in consideration of such investment commitment. In light of the investment commitment, we anticipate that we

will receive gross proceeds of at least $43.6 million if the Rights Offering is completed, whether or not any of the Subscription

Rights are exercised by the holders thereof.

Continental Stock Transfer & Trust

Company, our transfer agent, will serve as the Subscription Agent for the Rights Offering, and Georgeson LLC will serve as the

Information Agent for the Rights Offering. The Subscription Agent will hold the funds we receive from subscribers until we complete,

abandon or terminate the Rights Offering. If you want to participate in this Rights Offering and you are the record holder of

your shares, we recommend that you submit your subscription documents to the Subscription Agent well before the deadline. If you

want to participate in this Rights Offering and you hold shares through a broker, dealer, bank or other nominee, you should promptly

contact your broker, dealer, bank or other nominee and submit your subscription documents in accordance with the instructions

and within the time period provided by your broker, dealer, bank or other nominee. For a detailed discussion, see “Description

of the Rights Offering.”

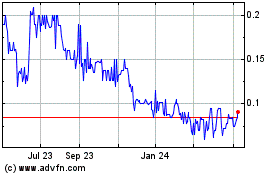

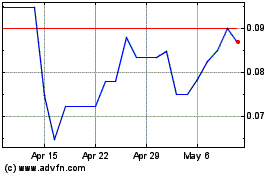

Our common stock is currently

quoted on the OTCQX market of the OTC Markets Group, Inc. (“OTC”) under the symbol “ENZN.” On

September [ ], 2020, the last reported sale price of our common stock was

$[ ] per share. There is no established public trading market for the Subscription Rights, the

Units or the Preferred Stock, and we do not intend to list or quote the Subscription Rights, the Units or the Preferred Stock

on any securities exchange or recognized trading system. Although the Subscription Rights are transferable, we cannot

give you any assurance that a market for the Subscription Rights will develop or, if a market does develop, how long it will

continue or at what prices the Subscription Rights will trade. You are urged to obtain a current price quote for our

common stock before exercising your Subscription Rights.

The exercise of your Subscription Rights

and investment in our securities involves a high degree of risk. You should carefully read the Risk Factors beginning on page 16,

as well as the risk factors in any document we incorporate by reference into this prospectus before you make a decision as to the

exercise of your Subscription Rights.

|

|

|

Per Unit

|

|

|

Total

|

|

|

Subscription Price

|

|

$

|

1,090

|

|

|

$

|

43,600,000

|

(1)

|

(1) Before deducting estimated expenses of approximately $200,000.

Our Board of Directors

is not making any recommendation regarding whether you should exercise your Subscription Rights.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the

accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

It is anticipated

that delivery of the common stock and Preferred Stock comprising the Units will be made by book-entry credit on or about October [ ],

2020.

The date of this prospectus is

, 2020.

TABLE OF CONTENTS

ABOUT THIS

PROSPECTUS

This prospectus

is part of a registration statement that we have filed with the Securities and Exchange Commission (the “Commission”).

The exhibits to the registration statement contain the full text of certain contracts and other important documents we have summarized

in this prospectus. Since these summaries may not contain all the information that you may find important in deciding whether to

purchase our securities, you should review the full text of these documents. The registration statement and the exhibits can be

obtained from the Commission as indicated under the sections of this prospectus entitled “Where You Can Find More Information”

and “Incorporation of Certain Documents by Reference.”

You should

rely only on the information contained in this prospectus or in any prospectus supplement or free-writing prospectus or any amendment

thereto. We have not authorized anyone to provide you with additional or different information from that contained in this prospectus.

The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus regardless

of the time of delivery of this prospectus or any exercise of the Subscription Rights. Our business, financial condition, results

of operations and prospects may have changed since those dates. You should read carefully the entirety of this prospectus and

any applicable prospectus supplement, as well as the documents incorporated by reference in this prospectus and any applicable

prospectus supplement, before making an investment decision.

The distribution

of this prospectus and the Rights Offering and the sale of our securities in certain jurisdictions may be restricted by law. This

prospectus does not constitute an offer of, or a solicitation of an offer to buy, any of our securities in any jurisdiction in

which such offer or solicitation is not permitted. No action is being taken in any jurisdiction outside the United States to permit

an offering of our securities or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession

of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions

as to this offering and the distribution of this prospectus applicable to those jurisdictions.

References

in this prospectus to “Enzon,” the “Company,” “we,” “us,”

“our,” or “its,” unless the context otherwise requires, refer to Enzon Pharmaceuticals, Inc.,

a Delaware corporation, together with its consolidated subsidiaries, and references in this prospectus to the “Board

of Directors” or “Board,” unless the context otherwise requires, refer to the Board of Directors

of Enzon Pharmaceuticals, Inc.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus

includes “forward-looking statements,” as such term is used within the meaning of the Private Securities Litigation

Reform Act of 1995. These “forward-looking statements” are not based on historical fact and involve assessments of

certain risks, developments, and uncertainties in our business looking to the future. Such forward-looking statements can be identified

by the use of terminology such as “may,” “will,” “should,” “expect,” “anticipate,”

“estimate,” “intend,” “continue,” or “believe,” or the negatives or other variations

of these terms or comparable terminology. Forward-looking statements may include projections, forecasts, or estimates of future

performance and developments. Forward-looking statements contained in this prospectus are based upon assumptions and assessments

that we believe to be reasonable as of the date of this prospectus. Whether those assumptions and assessments will be realized

will be determined by future factors, developments, and events, which are difficult to predict and may be beyond our control.

Actual results, factors, developments, and events may differ materially from those we assumed and assessed. Risks, uncertainties,

contingencies, and developments, including those identified in the “Risk Factors” section of this prospectus and in

our most recent annual report on Form 10-K, subsequent quarterly reports on Form 10-Q and other filings we

make with the Commission pursuant to Section 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), incorporated by reference herein, could cause our future operating results to differ

materially from those set forth in any forward-looking statement. We cannot assure you that any such forward-looking statement,

projection, forecast or estimate contained can be realized or that actual returns, results, or business prospects will not differ

materially from those set forth in any forward-looking statement. Given these uncertainties, readers are cautioned not to place

undue reliance on such forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce

the results of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments.

QUESTIONS

AND ANSWERS RELATING TO THE RIGHTS OFFERING

The following are examples of what we

anticipate will be common questions about the Rights Offering. The answers are based on selected information from this prospectus.

The following questions and answers do not contain all of the information that may be important to you and may not address all

of the questions that you may have about the Rights Offering. This prospectus contains more detailed descriptions of the terms

and conditions of the Rights Offering and provides additional information about us and our business, including potential risks

related to the Rights Offering, our common stock and Preferred Stock and our business.

Why are we conducting the Rights Offering?

The purpose of the offering is to position

us as a public company acquisition vehicle, where we can become an acquisition platform and more fully utilize our net operating

loss carryforwards and enhance stockholder value. However, we do not have any current plans, arrangements or understandings with

respect to any acquisitions or investments, and we are not currently involved in any negotiations with respect to any such transactions.

See “Use of Proceeds.”

What is the Rights Offering?

We are distributing, at no charge, to all

holders of our common stock on the Record Date, transferable Subscription Rights to purchase Units. For every 1,105 Subscription

Rights held, you will be entitled to purchase one Unit at the Subscription Price of $1,090 per Unit. In the Rights Offering, you

will receive one Subscription Right for every share of common stock owned at 5:00 p.m., New York City Time, on the Record Date.

Each Unit consists of one share of newly designated Preferred Stock and 750 shares of our common stock.

The common stock to be issued in the

Rights Offering, like our existing shares of common stock, will be quoted on the OTCQX market of the OTC under the symbol “ENZN”

and will not be listed for trading on a national securities exchange. The Subscription Rights, Units and Preferred Stock to be

issued in the Rights Offering will not be listed for trading or quoted on any securities exchange or recognized trading system.

The Subscription Rights granted to you

are transferable until the Expiration Date and, therefore, you may sell, transfer or assign your Subscription Rights to anyone

during the offering period. The Subscription Rights will be a new issue of securities with

no prior trading market. Although the Subscription Rights are transferable, we do not intend to apply to list the Subscription

Rights for trading on any securities exchange or any other market and your ability to transfer the Subscription Rights will be

limited and difficult. If you desire to transfer your Subscription Rights, you will need to locate a buyer or transferee of your

Subscription Rights. We do not intend to facilitate transfers among stockholders or otherwise create a market for transfers and

sales. Accordingly, we cannot provide you any assurances as to the liquidity of a market for the Subscription Rights. Furthermore,

because there is likely to be an illiquid market for the Subscription Rights, if any, the value that you receive, if any, upon

transfer of a Subscription Right will likely be reduced, and may vary significantly from other transferors. We are not responsible

if you elect to sell your Subscription Rights and no public or private market exists to facilitate the purchase of Subscription

Rights.

The maximum aggregate number of Units,

and the corresponding aggregate number of shares of common stock and Preferred Stock listed on this cover page and elsewhere

in this prospectus, are based on 44,214,603 shares of common stock outstanding as of the Record Date.

The Subscription Rights will expire if they

are not exercised by 5:00 p.m., New York City Time, on the Expiration Date, unless the Rights Offering is extended or earlier

terminated by us in our sole discretion; provided, however, that we may not extend the Expiration Date by more

than 30 calendar days past the original Expiration Date. We will not be required to issue Units to you if the Subscription Agent

receives your Subscription Rights Certificate or your subscription payment after that time.

How do I exercise my Subscription Rights?

If you are a record holder of our common

stock and wish to participate in the Rights Offering, you must deliver to the Subscription Agent, prior to the Expiration Date,

all of the following, which the Subscription Agent must receive (and funds must clear) prior to 5:00 p.m., New York City Time,

on October 9, 2020, which is [ ] [

] calendar days after the date of this prospectus:

|

|

·

|

Your payment

for exercise of the Subscription Rights. See the section in this prospectus under the

caption “Description of the Rights Offering—Payment Method”; and

|

|

|

·

|

Your completed and

fully executed Subscription Rights Certificate.

|

If you cannot deliver your Subscription

Rights Certificate to the Subscription Agent before the Expiration Date, you may use the procedures for guaranteed delivery as

described in “Description of the Rights Offering—Guaranteed Delivery Procedures.”

If you are a beneficial owner of shares

of our common stock that are registered in the name of a broker, dealer, bank, or other nominee, you will not receive a Subscription

Rights Certificate. Instead, we will issue one Subscription Right to such nominee record holder for every share of our common

stock held by such nominee at the Record Date. If you are not contacted by your nominee, you should promptly contact your nominee

in order to subscribe for Units in the Rights Offering and follow the instructions provided by your nominee.

If you are a record holder of our common

stock, the number of Units you may purchase pursuant to your Subscription Rights is indicated on the enclosed Subscription Rights

Certificate. If you hold your shares in the name of a broker, dealer, bank, or other nominee who uses the services of the Depository

Trust Company (“DTC”), you will not receive a Subscription Rights Certificate. Instead, DTC will issue one

Subscription Right to your nominee record holder for every share of our common stock that you beneficially own as of the Record

Date. See “Description of the Rights Offering—Exercise of Rights.”

If you exercise your Subscription Rights,

you may revoke such exercise before the Expiration Date by following the instructions herein. If the Expiration Date is extended,

you may revoke your exercise of Subscription Rights at any time until the final Expiration Date as so extended. If we terminate

the Rights Offering, all subscription payments received will be returned as soon as practicable thereafter without interest or

deduction.

Will the Subscription Rights be listed or quoted?

No. We do not intend to list or quote

the Subscription Rights on any securities exchange or recognized trading system. Although the Subscription Rights granted to you

are transferable and, therefore, you may sell, transfer or assign your Subscription Rights to anyone during the offering period,

your ability to transfer the Subscription Rights will be limited and difficult. If you desire to transfer your Subscription Rights,

you will need to locate a buyer or transferee of your Subscription Rights. We do not intend to facilitate transfers among stockholders

or otherwise create a market for transfers and sales. We cannot

give you any assurance that a market for the Subscription Rights will develop or, if a market does develop, how long it will continue

or at what prices the Subscription Rights will trade. Furthermore, because there is likely to be an illiquid market for the Subscription

Rights, if any, the value that you receive, if any, upon transfer of a Subscription Right will likely be reduced, and may vary

significantly from other transferors. We are not responsible if you elect to sell your Subscription Rights and no public or private

market exists to facilitate the purchase of Subscription Rights.

Please

see “Risk Factors—Although the Subscription Rights are transferable, there may not be a trading market for the Subscription

Rights, and the transfer of Subscription Rights may be limited and difficult,” and “Risk Factors—If you purchase

Subscription Rights from a transferor, we cannot assure you that you will be able to exercise the Subscription Rights prior to

the expiration of the Rights Offering.”

What if I own shares in an amount that is not a whole multiple

of 1,105 as of the Record Date?

In the Rights Offering, you will receive

one Subscription Right for every share of common stock owned at 5:00 p.m., New York City Time, on the Record Date. For every 1,105

Subscription Rights held, you will be entitled to purchase one Unit at the Subscription Price. We will not issue fractional Subscription

Rights or fractional Units in the Rights Offering. Accordingly, if you hold shares of common stock in an amount other than a whole

multiple of 1,105 shares and wish to acquire a certain number of Units in the Rights Offering, you will need to either acquire

(i) additional shares of common stock in the open market prior to the Record Date or (ii) additional Subscription Rights

during the offering period of the Rights Offering, in each case in an amount sufficient to increase your ownership of Subscription

Rights to allow you to participate at a level you desire to participate.

For example, if you hold 10,000 shares

of common stock as of the Record Date, you will receive 10,000 Subscription Rights but will only be entitled to exercise 9,945

Subscription Rights for 9 Units (consisting of an aggregate of 9 shares of Preferred Stock and 6,750 shares of common stock) for

a Subscription Price of $9,810. You will not be able to exercise any of the remaining 55 Subscription Rights you hold (10,000

Subscription Rights minus the 9,945 Subscription Rights exercised) unless you acquire an additional number of Subscription Rights

to hold at least 1,105 Subscription Rights during the offering period. Similarly, you could increase the number of Subscription

Rights you receive as of the Record Date by acquiring 1,050 additional shares of common stock prior to the Record Date.

What are the material terms of the Preferred Stock?

The Preferred Stock will rank senior to

our common stock. The liquidation preference of the Preferred Stock will be initially $1,000 per share. On an annual basis, our

Board of Directors may, at its sole discretion, cause a dividend with respect to the Preferred Stock to be paid in cash to the

holders in an amount equal to 3% of the liquidation preference as in effect at such time. If the dividend is not so paid in cash,

the liquidation preference will be adjusted and increased annually by an amount equal to 5% of the liquidation preference per

share as in effect at such time, that is not paid in cash to the holders on such date. The accretion will continue until the shares

of Preferred Stock are redeemed, or until we liquidate, dissolve, or wind-up our affairs at which time the Preferred Stock will

have a preference in respect of assets available for distribution to our stockholders. Due to our ability to pay dividends on

our Series C Preferred Stock in kind by increasing the liquidation preference of the shares of our Series C Preferred

Stock, the payment of accrued dividends in cash may be deferred until the redemption by us or the holders, as applicable, of the

Preferred Stock, or until our dissolution, liquidation or winding up. No plan, arrangement or agreement is currently in place

that would prevent us from paying dividends with respect to the Preferred Stock in cash.

On and after November 1, 2022, we will

have the option to redeem the shares of Preferred Stock, in whole or in part, at any time for an amount up to or equal to the

liquidation preference per share as in effect at such time. The Preferred Stock is also redeemable at the option of the holders

if we undergo a change in control, which is defined as the earliest to occur of (a) the date on which a majority of the members

of our Board of Directors are not Continuing Directors (as defined in the Certificate of Designation) and (b) the date on

which a “person” or “group” (within the meaning of Section 13(d)(3) of the Exchange Act) beneficially

owns in excess of 50% of our common stock. The Preferred Stock is not convertible into shares of our common stock or any other

series or class of our capital stock. Except as required by law, holders of shares of Preferred Stock will have no voting rights.

For additional information about the terms

of the Preferred Stock, see “Description of Securities—Preferred Stock—Series C Preferred Stock.”

Will the Units or Preferred Stock be listed or quoted?

The Units and Preferred Stock will not

be listed for trading or quoted on any securities exchange or recognized trading system.

Will fractional Subscription Rights or fractional Units

be issued?

No. We will not issue fractional Subscription

Rights or fractional Units or cash in lieu of such fractions in this Rights Offering. As a result, if you hold shares of common

stock in an amount other than a whole multiple of 1,105 shares and wish to acquire a certain number of Units in the Rights Offering,

you will need to either acquire (i) additional shares of common stock in the open market prior to the Record Date or (ii) additional

Subscription Rights during the offering period of the Rights Offering, in each case in an amount sufficient to increase your ownership

of Subscription Rights to allow you to participate at a level you desire to participate. See “What if I own shares in an

amount that is not a whole multiple of 1,105 as of the Record Date?” above.

What effect will the Rights Offering have on our outstanding

common stock?

Based on 44,214,603 shares of common

stock outstanding as of the Record Date, assuming no other transactions by us involving our common stock prior to the expiration

of the Rights Offering, we expect to have 74,214,603 shares of our common stock issued and outstanding and 40,000 shares

of Preferred Stock issued and outstanding following the completion of the Rights Offering (including the investment commitment).

The number of shares of common stock and Preferred Stock that we will issue in this Rights Offering is based on 40,000 Units to

be subscribed for in the Rights Offering and reflects the completion of the investment commitment.

How was the Subscription Price determined?

The Subscription Price of $1,090 per share

was determined by the Board of Directors based on many factors, including, among other things: (i) the price at which our

stockholders might be willing to participate in the Rights Offering, (ii) the amount of proceeds desired to achieve our financing

goals, (iii) potential market conditions, (iv) historical and current trading prices for our common stock, and (v) the

terms of the Preferred Stock.

The Subscription Price was not determined

on the basis of any investment bank or third-party valuation that was commissioned by us. The Subscription Price does not bear

any particular relationship to the book value of our assets, past operations, cash flows, losses, financial condition or other

criteria for ascertaining value. You should not consider the Subscription Price as an indication of the value of our company or

any inherent value of shares of our common stock or Preferred Stock. The Board of Directors reserves the right, exercisable in

its sole discretion, to change the Subscription Price or determine to cancel or otherwise alter the terms of the Rights Offering.

After the date of this prospectus, our common stock may trade at prices below the Subscription Price. You should obtain a current

price quote for our common stock before exercising your Subscription Rights and make your own assessment of our business and financial

condition, our prospects for the future, and the terms of this Rights Offering. In addition, there is no established trading market

for the Preferred Stock to be issued pursuant to this Rights Offering, and the Preferred Stock may not be widely distributed.

Am I required to exercise all of the Subscription Rights

I receive in the Rights Offering?

No. For every 1,105 Subscription Rights

held, you will be entitled to purchase one Unit at the Subscription Price. We will not issue fractional Subscription Rights or

fractional Units in the Rights Offering. As a result, assuming you own Subscription Rights in an amount that equals a whole multiple

of 1,105, you may exercise any number of your Subscription Rights in multiples of 1,105, or you may choose not to exercise any

Subscription Rights. If you do not exercise any Subscription Rights, the number of shares of our common stock you own will not

change and you will not receive any shares of Preferred Stock. However, if you choose not to exercise your Subscription Rights

in full (or you cannot exercise any Subscription Rights because you do not hold Subscription Rights in an amount that equals a

whole multiple of 1,105) and other holders of Subscription Rights do exercise their Subscription Rights, your proportionate ownership

interest in our company will decrease. See “What if I own shares in an amount that is not a whole multiple of 1,105 as of

the Record Date?” above.

How soon must I act to exercise my Subscription Rights?

If you received a Subscription Rights

Certificate and elect to exercise any or all of your Subscription Rights, the Subscription Agent must receive your completed and

signed Subscription Rights Certificate and payment for your Subscription Rights you elect to exercise before the Rights Offering

expires on October 9, 2020, at 5:00 p.m., New York City Time. If you hold your shares of common stock in the name of a broker,

dealer, bank, or other nominee, your nominee may establish a deadline before the expiration of the Rights Offering by which you

must provide it with your instructions to exercise your Subscription Rights, along with the required subscription payment.

May I transfer my Subscription Rights?

The Subscription Rights are transferable

until the Expiration Date and, therefore, you may sell, transfer or assign your Subscription Rights to anyone during the offering

period. The value of the Subscription Rights, if any, will be reflected by the market price. Subscription Rights will be sold

by individual holders. See “Will the Subscription Rights be listed or quoted?” above.

Record Holders.

If you are a holder of record of our common stock, you may transfer the Subscription Rights evidenced by a single Subscription

Rights Certificate by completing the transfer instructions in accordance with the instructions on your Subscription Rights Certificate.

A portion of the Subscription Rights evidenced by a single Subscription Rights Certificate may be transferred by delivering to

the Subscription Agent a Subscription Rights Certificate properly endorsed for transfer, with instructions to register that portion

of the Subscription Rights indicated in the name of the transferee and to issue a new Subscription Rights Certificate to the transferee

evidencing the transferred Subscription Rights.

Other Holders. If you are a beneficial

owner of common stock that is registered in the name of a broker, dealer, bank or other nominee, you will need to coordinate a

transfer through your broker, dealer, bank or other nominee

All Holders. If

you wish to transfer all or a portion of your Subscription Rights, you should allow a sufficient amount of time prior to the Expiration

Date for: (i) the transfer instructions to be received and processed by the Subscription Agent or applicable broker, dealer, bank

or other nominee; (ii) if required, a new Subscription Rights Certificate to be issued and transmitted to the transferee or transferees

with respect to transferred Subscription Rights and to the transferor with respect to retained Subscription Rights, if any; and

(iii) the Subscription Rights evidenced by such new Subscription Rights Certificates to be exercised by the recipients thereof.

The required time will depend upon the method by which delivery of the Subscription Rights Certificates and payment is made and

the number of transactions you instruct the Subscription Agent to effect. Please bear in mind that the Rights Offering period

is limited. Neither we nor the Subscription Agent shall have any liability to a transferee or transferor of rights if Subscription

Rights are not received in time for exercise prior to the Expiration Date. Subscription Rights not exercised by the Expiration

Date will expire and have no value. Neither we nor the Subscription Agent shall have any liability with respect to any expired

Subscription Rights.

For more information

on transferring your Subscription Rights, see “Description of the Rights Offering—Transferability of Subscription

Rights.”

Do any directors, officers, or principal stockholders have

an interest in the Rights Offering?

All holders of our common stock as of

the Record Date for the Rights Offering will receive, at no charge, the transferable Subscription Rights to purchase Units as

described in this prospectus. To the extent that our directors and officers hold shares of our common stock as of the Record Date,

they will receive the Subscription Rights and, while they are under no obligation to do so, will be entitled to participate in

the Rights Offering. As of September 14, 2020, none of our directors or officers hold shares of our common stock.

Pursuant to the Investment Agreement, Icahn

Capital LP has agreed to exercise in full the Subscription Rights issued to it and, additionally, upon the expiration of the Rights

Offering, to purchase from us, at a price per Unit equal to the Subscription Price, all Units that remain unsubscribed for at

the expiration of the Rights Offering. Icahn Capital LP, together with its affiliates, is one of our largest stockholders and

beneficially owns approximately 15% of our common stock.

Other than as described, our officers,

directors and principal stockholders have no interests in the Rights Offering, and we have not otherwise received any indication

from any of our directors, officers or other stockholders as to whether they plan to subscribe for Units in the Rights Offering.

Why is Icahn Capital LP acting as backstop for the Rights

Offering?

Our objective is to raise $43.6 million

in gross proceeds from our Rights Offering. In the event that holders do not exercise all of the Subscription Rights, we would

fall short of that objective. We have therefore entered into the Investment Agreement with Icahn Capital LP, which, together with

its affiliates, is one of our largest stockholders, to ensure we will receive $43.6 million in gross proceeds from this Rights

Offering; provided, that the gross proceeds from the Rights Offering and investment commitment will not exceed the amount

of $43.6 million in the aggregate. Additionally, we do not believe that Icahn Capital LP’s increase in our stock ownership

should impair our ability to potentially use our net operating loss carryforwards even if no stockholders other than Icahn Capital

LP participate in the Rights Offering. Accordingly, having Icahn Capital LP provide the investment commitment should not affect

the potential impact of the Rights Offering on our net operating loss carryforwards.

How many shares will Icahn Capital LP own after the Rights

Offering?

Icahn Capital LP, together with its affiliates,

is one of our largest stockholders and beneficially owns approximately 15% of our common stock.

We expect to issue approximately 40,000

Units comprised of 30,000,000 shares of common stock and 40,000 shares of Preferred Stock in the Rights Offering, as a result

of which we will have an aggregate of approximately 74,214,603 shares of common stock issued and outstanding following the Rights

Offering. If each of our stockholders as of the Record Date purchases the full number of Units to which each such holder is entitled, Icahn

Capital LP and its affiliates would beneficially own approximately 15% of our combined issued and outstanding common stock. If

none of our stockholders as of the Record Date purchases Units in the Rights Offering, then Icahn Capital LP will purchase, pursuant

to the Investment Agreement, all Units offered in the Rights Offering and would own approximately 49.3% of our issued and outstanding

common stock.

In view of the large percentage of our

common stock currently owned by Icahn Capital LP, together with additional common stock that may be acquired by Icahn Capital

LP pursuant to the Investment Agreement, we expect that Icahn Capital LP will continue to have the ability to exert significant

influence over our management and policies.

How does the investment commitment by Icahn Capital LP work?

Subject to certain conditions and pursuant

to the Investment Agreement, Icahn Capital LP has agreed to exercise in full the Subscription Rights issued to it and, additionally,

upon expiration of the Rights Offering, to purchase from us, at a price per Unit equal to the Subscription Price, that number

of Units that remain unsubscribed for at the expiration of the Rights Offering. If

all 40,000 Units available in this Rights Offering are sold pursuant to the exercise of Subscription Rights, there will be no

unsubscribed Units, and no excess Units will be sold to Icahn Capital LP pursuant to the Investment Agreement. Please see “The

Investment Agreement” for further conditions to the obligation of Icahn Capital LP to consummate the transactions contemplated

by the Investment Agreement.

Is Icahn Capital LP receiving any fees for its investment

commitment?

No. Icahn Capital LP will not receive

any fees for its investment commitment. However, we have agreed to pay all of our own fees and expenses (including attorneys’

fees) incurred in connection with the Investment Agreement and the transactions contemplated thereby. In addition, as part of

the consideration for entering into the Investment Agreement, we have agreed to terminate the Standstill Agreement, dated December 8,

2016, entered into with Icahn Capital LP and the parties identified therein, as well as waive the applicability of Section 203

of the General Corporation Law of the State of Delaware. Furthermore, we have agreed to use our best efforts to register for resale

all of the shares of common stock then held by Icahn Capital LP and its affiliates following the closing of the Rights Offering.

Has the Board of Directors made a recommendation to stockholders

regarding the Rights Offering?

No. Neither our Board of Directors

nor our management has made any recommendation regarding your exercise of the Subscription Rights. Rights holders who exercise

Subscription Rights and receive Units comprised of shares of our common stock and Preferred Stock will incur investment risk on

new money invested. We cannot predict the price at which our shares of common stock will trade, and, therefore, we cannot assure

you that the market price for our common stock before, during or after this Rights Offering will be above the Subscription Price,

or that anyone purchasing Units at the Subscription Price will be able to sell the shares of common stock or Preferred Stock comprising

the Units in the future at a price equal to or greater than the Subscription Price. You are urged to make your decision to invest

based on your own assessment of our business and financial condition, our prospects for the future, the terms of the Rights Offering,

the information in this prospectus and other information relevant to your circumstances. Please see “Risk Factors”

for a discussion of some of the risks involved in investing in our securities.

How do I exercise my Subscription Rights?

If you are a stockholder of record (meaning

you hold your shares of our common stock in your name and not through a broker, dealer, bank, or other nominee) and you wish to

participate in the Rights Offering, you must deliver a properly completed and signed Subscription Rights Certificate, together

with full payment of the Subscription Price for the Units subscribed for, to the Subscription Agent before 5:00 p.m., New York

City Time, on the Expiration Date. If you are exercising your Subscription Rights through your broker, dealer, bank, or other

nominee, you should promptly contact your broker, dealer, bank, or other nominee and submit your subscription documents and full

payment for the Units subscribed for in accordance with the instructions and within the time period provided by your broker, dealer,

bank or other nominee.

What if my shares are held in “street name”?

If you hold your shares of our common stock

in the name of a broker, dealer, bank, or other nominee, then your broker, dealer, bank, or other nominee is the record holder

of the shares you beneficially own. The record holder must exercise the Subscription Rights on your behalf. Therefore, you will

need to have your record holder act for you.

If you wish to participate in this Rights

Offering and purchase Units, please promptly contact the record holder of your shares. We will ask the record holder of your shares,

who may be your broker, dealer, bank, or other nominee, to notify you of this Rights Offering.

What form of payment is required?

Payments must be made in full in U.S. currency

by:

|

|

·

|

Personal check drawn on a U.S. bank payable to “Continental

Stock Transfer & Trust Company, as subscription agent for Enzon Pharmaceuticals, Inc.”;

|

|

|

|

|

|

|

·

|

Certified check drawn on a U.S. bank payable

to “Continental Stock Transfer & Trust Company, as subscription agent for Enzon Pharmaceuticals, Inc.”;

|

|

|

·

|

U.S. postal money order payable to “Continental

Stock Transfer & Trust Company, as subscription agent for Enzon Pharmaceuticals, Inc.”; or

|

|

|

|

|

|

|

·

|

Wire transfer of immediately available funds

to the account maintained by the Subscription Agent (see the Subscription Rights Certificate for the wire instructions).

|

Payment received after 5:00 p.m., New

York City Time, on the Expiration Date will not be honored, and, in such event, the Subscription Agent will return your payment

to you, without interest or deduction, as soon as practicable.

If you elect to exercise your Subscription

Rights, you should consider using a wire transfer or certified check drawn on a U.S. bank to ensure that the Subscription Agent

receives your funds before the Rights Offering expires. If you send a personal check, payment will not be deemed to have been

received by the Subscription Agent until the check has cleared. The clearinghouse may require five or more business days to clear

a personal check. Accordingly, holders who wish to pay the Subscription Price by means of a personal check should make payment

sufficiently in advance of the expiration of the Rights Offering to ensure that the payment is received and clears by that date.

If you send a wire directly to the Subscription Agent’s account, payment will be deemed to have been received by the Subscription

Agent immediately upon receipt of such wire transfer. If you send a certified check, payment will be deemed to have been received

by the Subscription Agent immediately upon receipt of such instrument.

The

method of payment of the subscription payment to the Subscription Agent will be at the risk of the holders of Subscription Rights.

If sent by mail, we recommend that you send those certificates and payments by registered mail, properly insured, with return

receipt requested, or by overnight courier, and that you allow a sufficient number of days to ensure delivery to the Subscription

Agent and clearance of payment before the Rights Offering expires.

If you send a payment that is insufficient

to purchase the number of Units you requested, or if the number of Units you requested is not properly specified, then the funds

will be applied to the exercise of Subscription Rights only to the extent of the payment actually received by the Subscription

Agent. If you deliver subscription payments in a manner different than that described in this prospectus, then we may not honor

the exercise of your Subscription Rights.

You should read the instruction letter

accompanying the Subscription Rights Certificate carefully and strictly follow it. DO NOT SEND SUBSCRIPTION RIGHTS CERTIFICATES

OR PAYMENTS DIRECTLY TO US.

When will I receive my new shares of common stock and Preferred

Stock?

We intend to issue the shares of common

stock and Preferred Stock comprising the Units in book-entry, or uncertificated, form to each subscriber as soon as practicable

after completion of the Rights Offering; however, there may be a delay between the Expiration Date and the date and time that

the shares are issued and delivered to you or your nominee, as applicable. We will issue the shares in book-entry, or uncertificated,

form to each subscriber; we will not issue any stock certificates. If you are the holder of record of our common stock, you will

receive a direct registration, or DRS, account statement from our transfer agent, Continental Stock Transfer & Trust

Company, reflecting ownership of the shares of common stock and Preferred Stock comprising the Units that you have purchased in

the Rights Offering. If you hold your shares of common stock in the name of a broker, dealer, bank, or other nominee who uses

the services of the Depository Trust Company (“DTC”), DTC will credit your account with your nominee with the

securities you purchase in the Rights Offering. You may request a statement of ownership from the nominee following the completion

of the Rights Offering.

After I send in my payment and Subscription Rights Certificate

to the Subscription Agent, may I cancel my exercise of Subscription Rights?

Yes. If you exercise your Subscription

Rights, you may revoke such exercise before the Expiration Date by following the instructions herein. If the Expiration Date is

extended, you may revoke your exercise of Subscription Rights at any time until the final Expiration Date as so extended. If we

terminate the Rights Offering, all subscription payments received will be returned as soon as practicable thereafter without interest

or deduction. See the section in this prospectus under the caption “The Rights Offering—Revocation Rights.”

How much will we receive from the Rights Offering?

Assuming that we complete the investment

commitment pursuant to the Investment Agreement and all 40,000 Units are sold in the Rights Offering, we estimate that the net

proceeds from the Rights Offering will be approximately $43.4 million, based on a Subscription Price of $1,090 per Unit and

after deducting other expenses payable by us.

We intend to use the net proceeds from this

offering to position us as a public company acquisition vehicle, where we can become an acquisition platform and more fully utilize

our net operating loss tax carryforwards and enhance stockholder value. However, we do not have any current plans, arrangements

or understandings with respect to any acquisitions or investments, and we are currently not involved in any negotiations with respect

to any such transactions. We cannot specify with certainty the particular uses of the net proceeds stated above, and our allocation

of the proceeds may change depending on the success of our planned initiatives. See “Use of Proceeds” in this prospectus.

Are there risks in exercising my Subscription Rights?

Yes. The exercise of your Subscription

Rights involves risks. Exercising your Subscription Rights involves the purchase of Units comprised of additional shares of our

common stock and Preferred Stock, and you should consider this investment as carefully as you would consider any other investment.

The market price of our common stock may not exceed the Subscription Price, and the market price of our common stock may decline

during or after the Rights Offering. You may not be able to sell shares of our common stock or Preferred Stock acquired in the

Rights Offering at a price equal to or greater than the Subscription Price. In addition, you should carefully consider the risks

described under the heading “Risk Factors” for discussion of some of the risks involved in investing in our securities.

Are there any conditions to the completion of the Rights

Offering?

No. There is no aggregate minimum

subscription we must receive to complete the Rights Offering. However, pursuant to the Investment Agreement, Icahn Capital

LP has agreed to exercise in full the Subscription Rights issued to it and, additionally, upon expiration of the Rights Offering,

to purchase from us, at a price per Unit equal to the Subscription Price, that number of Units that remain unsubscribed for at

the expiration of the Rights Offering.

Can the Board of Directors terminate or extend the Rights

Offering?

Yes. Our Board of Directors may decide

to terminate the Rights Offering at any time and for any reason before the expiration of the Rights Offering. We also have the

right to extend the Rights Offering for additional periods in our sole discretion; provided, however, that we may

not extend the Expiration Date of the Rights Offering by more than 30 days past the original Expiration Date. We do not presently

intend to extend the Rights Offering. We will notify stockholders and the public if the Rights Offering is extended by issuing

a press release announcing the extension no later than 9:00 a.m., New York City Time, on the next business day after the most

recently announced expiration date of the Rights Offering. If we terminate the Rights Offering, we will issue a press release

notifying stockholders and the public of the termination.

If the Rights Offering is not completed or is terminated,

will my subscription payment be refunded to me?

Yes. The Subscription Agent will hold funds

received in payment for Units in a segregated account pending completion of the Rights Offering. The Subscription Agent will hold

this money until the Rights Offering is completed or is terminated. To the extent you properly exercise your Subscription Rights

for an amount of Units that exceeds the number of unsubscribed Units available to you, any excess subscription payments will be

returned to you as soon as practicable after the expiration of the Rights Offering, without interest or penalty. If we do not

complete the Rights Offering, all subscription payments received by the Subscription Agent will be returned as soon as practicable

after the termination or expiration of the Rights Offering, without interest or deduction. If you own shares in “street

name,” it may take longer for you to receive your subscription payment because the Subscription Agent will return payments

through the record holder of your shares.

How do I exercise my Subscription Rights if I live outside

the United States?

The Subscription Agent will hold Subscription

Rights Certificates for stockholders having addresses outside the United States. To exercise Subscription Rights, non-U.S. stockholders

must notify the Subscription Agent and timely follow other procedures described in the section entitled “The Rights Offering—Regulatory

Limitations; No Offer Made to California Residents; No Unlawful Subscriptions.”

What fees or charges apply if I exercise my Subscription

Rights?

We are not charging any fee or sales commission

to issue Subscription Rights to you or to issue the Units or shares of common stock or Preferred Stock comprising the Units to

you if you exercise your Subscription Rights. If you exercise your Subscription Rights through a broker, dealer, bank, or other

nominee, you are responsible for paying any fees your broker, dealer, bank, or other nominee may charge you.

What are the U.S. federal income tax consequences of receiving

and/or exercising my Subscription Rights?

For U.S. federal income tax purposes, we

believe you should not recognize income or loss in connection with the receipt or exercise of Subscription Rights in the Rights

Offering. You should consult your tax advisor as to the tax consequences of the Rights Offering in light of your particular circumstances.

For a detailed discussion, see “Material U.S. Federal Income Tax Considerations.”

To whom should I send my forms and payment?

If your shares of common stock are held

in the name of a broker, dealer, bank, or other nominee, then you should send your subscription documents and subscription payment

to that broker, dealer, bank, or other nominee. If you are the record holder, then you should send your subscription documents,

Subscription Rights Certificate, notice of guaranteed delivery (if applicable) and subscription payment to the Subscription Agent

by hand delivery, first class mail or courier service to:

|

By Mail,

Hand or Overnight Courier:

|

Continental Stock Transfer &

Trust Company

Attn: Reorganization Department

1 State Street

30th Floor

New York, NY 10004

(917) 262-2378

|

You or, if applicable, your nominee are

solely responsible for completing delivery to the Subscription Agent of your subscription documents, Subscription Rights Certificate,

notice of guaranteed delivery (if applicable) and subscription payment. You should allow sufficient time for delivery of your

subscription materials to the Subscription Agent and clearance of payment before the expiration of the Rights Offering at 5:00

p.m., New York City Time, on the Expiration Date.

Whom should I contact if I have other questions?

If you have other questions or need assistance,

please contact the Information Agent, Georgeson LLC, at (888) 605-8334 (toll free).

|

PROSPECTUS

SUMMARY

The following summary

provides an overview of us and this offering and may not contain all the information that is important to you. This summary is

qualified in its entirety by, and should be read together with, the information contained in other parts of this prospectus and

the documents we incorporate by reference. You should read this prospectus and any documents that we incorporate by reference

carefully in their entirety before making a decision about whether to invest in our securities.

Enzon Pharmaceuticals, Inc.

We manage our sources of

royalty revenues from existing licensing arrangements with other companies primarily related to sales of certain drug products

that utilize our proprietary technology. We currently have no clinical operations and limited corporate operations. We cannot

assure you that we will earn material future royalties or milestones.

In 2019, we earned limited

revenues primarily from royalties and we do not expect to generate material recurring revenues in future periods. In July 2019,

we received a $7.0 million milestone payment that had been earned and recorded as revenue in December 2018 when the

U.S. Food and Drug Administration (“FDA”) approved the Biologics License Application (“BLA”) filed

by Servier IP UK Limited (“Servier”) for calaspargase

pegol – mknl (brand name ASPARLAS™), also known as SC Oncaspar, as

a component of a multi-agent chemotherapeutic regimen for the treatment of acute lymphoblastic leukemia in pediatric and young

adult patients age 1 month to 21 years.

The primary source of our

royalties and milestone revenues in 2018 was the $7.0 million milestone payment due from Servier. After being notified that the

FDA had approved Servier’s BLA on December 20, 2018, we recorded revenue and a milestone receivable of $7.0 million

at December 31, 2018. Servier, a wholly-owned indirect subsidiary of Les Laboratoires Servier, was the successor in

interest to Sigma-Tau Finanziaria S.p.A. (“Sigma-Tau”) under an asset purchase

agreement (“Asset Purchase Agreement”) entered into in November 2009 by and among Klee

Pharmaceuticals, Inc., Defiante Farmacêutica, S.A. and Sigma-Tau, on the one hand, and us, on the other hand. Under

a letter agreement between us and Servier dated January 30, 2019, Servier

confirmed its obligation under the Asset Purchase Agreement to pay the $7.0 million milestone payment to us, which it agreed to

do following the parties’ completion of procedures for claiming benefits under the double tax treaty between the United

States and the United Kingdom. We received that $7.0 million milestone payment, which had been recorded as a current receivable

on December 31, 2018, in July 2019. Under the letter agreement, we also agreed to waive Servier’s obligations

under the Asset Purchase Agreement to pursue the development of SC Oncaspar in Europe and the approval of SC Oncaspar by the European

Medicines Agency (“EMEA”), provided that we did not waive our right to any applicable milestone payment it

was due, if any, upon EMEA approval of SC Oncaspar. At the present time, we are not aware of any plans that Servier may have to

seek EMEA approval of SC Oncaspar.

In 2017, we and Nektar

Therapeutics, Inc. (“Nektar”) entered into a second amendment (the “Nektar Second

Amendment”) to their Cross-License and Option Agreement (the “Nektar License Agreement”). Pursuant

to the Nektar Second Amendment, Nektar paid us the sum of $7.0 million in full satisfaction of its obligation to make future royalty

payments to us under the Nektar License Agreement. We received the full $7.0 million payment from Nektar in 2017, which was recorded

as non-recurring milestone revenue.

Prior to 2017, our primary

source of royalty revenues was derived from sales of PegIntron, which is marketed by Merck & Co., Inc. (“Merck”).

At December 31, 2018, according to Merck, we had a liability to Merck of approximately $439,000 (net of a 25% royalty interest

that we had previously sold) based, primarily, on Merck’s assertions regarding recoupments related to prior returns and

rebates. In the first quarter of 2019, net royalties from PegIntron were negative $51,000 due to returns and rebates exceeding

the amount of royalties earned. In the second, third and fourth quarters of 2019, net royalty revenues from sales of PegIntron

were $142,000, $2,000 and $22,000, respectively. As such, as asserted by Merck, our net liability to Merck was $324,000 at December 31,

2019. We believe that we will receive minimal additional royalties from Merck and may be charged with additional chargebacks from

returns and rebates in amounts that, based on current estimates, are not expected to be material.

In April 2013, we announced

that we intended to distribute excess cash, expected to arise from royalty revenues, in the form of periodic dividends to stockholders.

Since that time, we have paid out an aggregate of approximately $149 million in dividends (including approximately $8.0 million

in 2019) to our stockholders.

|

|

On February 4, 2016,

our Board of Directors adopted a Plan of Liquidation and Dissolution (the “Plan of Liquidation and Dissolution”),

the implementation of which was postponed. Following completion of the Rights Offering, we intend to withdraw the Plan of Liquidation

and Dissolution.

We have a marketing agreement

with Micromet AG (“Micromet”), now part of Amgen, Inc. (the “Micromet Agreement”),

that was entered into in 2004, under which Micromet is the exclusive marketer of the parties’ combined intellectual property

portfolio in the field of single-chain antibody technology. Under the Micromet Agreement, the parties agreed to share, on

an equal basis, in any licensing fees, milestone payments and royalty revenue received by Micromet in connection with any licenses

of the patents within the portfolio by Micromet to any third party during the term of the collaboration. To our knowledge, Micromet

has a license agreement with Viventia Biotech (Barbados) Inc. (“Viventia”), now part of Sesen Bio, Inc.

(“Sesen”), that was entered into in 2005, under which Micromet granted Viventia nonexclusive rights, with certain

sublicense rights, for know-how and patents allowing exploitation of certain single chain antibody products, which patents cover

some key aspects of Vicineum, one of Sesen’s drug candidates. To our knowledge, Micromet is entitled to receive (i) certain

milestone payments with respect to the filing of a new drug application (“NDA”) for Vicineum with the FDA or

the filing of a marketing approval application for Vicineum with the EMEA; (ii) certain milestone payments with respect to

the first commercial sale of Vicineum in the U.S. or Europe and (iii) certain royalties on net sales for ten years from the

first commercial sale of Vicineum. Pursuant to the Micromet Agreement, we would be entitled to a 50% share of these milestone

payments and royalties received by Micromet. Due to the challenges associated with developing and obtaining approval for drug

products, there is substantial uncertainty whether any of these milestones will be achieved. We also have no control over the

time, resources and effort that Sesen may devote to its programs and limited access to information regarding or resulting from

such programs. Accordingly, there can be no assurance that we will receive any of the milestone or royalty payments under the

Micromet Agreement. We will not recognize revenue until all revenue recognition requirements are met.

Corporate Information

Our principal address is 20 Commerce Drive,

Suite 135, Cranford, New Jersey, 07016. Our telephone number is (732) 980-4500.

Recent Developments

Appointment of Directors

On August 4, 2020, the Board appointed

Jordan Bleznick and Randolph C. Read as directors to the Board, effective August 4, 2020, to fill the vacancies created by

the resignations of Mr. Jonathan Christodoro and Dr. Odysseas Kostas as of the same date. Messrs. Bleznick and

Read will each serve until the next annual meeting of our stockholders and until such director’s successor is elected and

qualified, subject to such director’s earlier death, resignation, disqualification or removal.

Mr. Bleznick was appointed by the Board

after discussions with Carl C. Icahn, one of our largest stockholders, and after consideration by the Governance and Nominating

Committee. There are no arrangements or understandings between Mr. Bleznick and any other persons pursuant to which Mr. Bleznick

was selected as a director. We are not aware of any relationships or transactions in which Mr. Bleznick has or will have

an interest, or was or is a party, requiring disclosure under Item 404(a) of Regulation S-K. No material plan, contract or

arrangement (written or otherwise) to which Mr. Bleznick is a party or a participant was entered into or materially amended

in connection with him joining the Board, and Mr. Bleznick did not receive any grant or award or any modification thereto,

under any such plan, contract or arrangement in connection with such event, other than the normal cash fees payable to our directors.

Mr. Read was appointed by the Board after

consideration by the Governance and Nominating Committee. There are no arrangements or understandings between Mr. Read and

any other persons pursuant to which Mr. Read was selected as a director. We are not aware of any relationships or transactions

in which Mr. Read has or will have an interest, or was or is a party, requiring disclosure under Item 404(a) of Regulation

S-K. No material plan, contract or arrangement (written or otherwise) to which Mr. Read is a party or a participant was entered

into or materially amended in connection with him joining the Board, and Mr. Read did not receive any grant or award or any

modification thereto, under any such plan, contract or arrangement in connection with such event, other than the normal cash fees

payable to our directors.

Following the new Board appointments, Mr. Read

was elected as Chairman of the Board. The Board also appointed Messrs. Bleznick and Read to its Finance and Audit Committee,

replacing Mr. Christodoro and Dr. Kostas, having determined that each meets the requirements for financial literacy

and independence that the Board has used to select members of that committee. Jennifer McNealey, who also serves as a director

on the Board, is the other member of the Finance and Audit Committee. Messrs. Bleznick and Read were each determined by the

Board to qualify as an “audit committee financial expert,” as defined in Item 407(d)(5) of Regulation S-K. Mr. Read

was elected as the Chairman of the Audit Committee.

|

|

The Board has decided not to continue with

separate compensation and governance and nominating committees, having determined that such committees are not required or necessary

because the functions of such committees can be adequately performed by the full Board, which is comprised entirely of directors

who would be considered independent under Rule 10A-3(b)(1) of the Exchange Act, and Nasdaq Marketplace Rule 5605(a)(2),

and accordingly, has dissolved those committees. While these independence requirements are taken into account when the Board evaluates

candidates for election as directors, we are not currently subject to Rule 10A-3 or Nasdaq listing standards as our common

stock is not listed on Nasdaq or any other national securities exchange and currently trades in the over-the-counter market.

Mr. Bleznick, age 64, has been the Vice

President/Taxes of Starfire Holding Corporation, a privately held holding company of Mr. Icahn, since September 2002.

He has been the Chief Tax Counsel for various affiliates of Mr. Icahn since April 2002. From March 2000 through

March 2002, Mr. Bleznick was a partner in the New York City office of the law firm of DLA Piper, formerly known as Piper

Rudnick, LLP. From March 1984 until February 2000, he was an associate and then a partner at the New York City law firm

of Gordon Altman Weitzen Shalov and Wein. Mr. Bleznick received a B.A. in Economics from the University of Cincinnati in

1976, a J.D. from The Ohio State University College of Law in 1979 and a L.L.M. in Taxation from the New York University School

of Law in 1980.

Mr. Read, age 68, has been President

and Chief Executive Officer of Nevada Strategic Credit Investments, LLC since 2009. Mr. Read has served since November 2018

as an independent manager/director and Chairman of the Board of Managers of New York REIT Liquidating, LLC, a successor to New

York REIT, Inc., a publicly traded (NYSE) real estate investment trust, where Mr. Read served as an independent director

from December 2014 to November 2018, including as Chairman of its Board of Directors from June 2015 to November 2018.

Mr. Read has served as an independent Director of SandRidge Energy, Inc. since June 2018, including as Chairman

of its Audit Committee. Mr. Read has served as an independent director of Luby’s, Inc. since August 2019.

Mr. Read served as an independent director of Business Development Corporation of America from December 2014 to June 2018.

Mr. Read also served as an independent director of Business Development Corporation of America II from December 2014

until its liquidation and dissolution in December 2015. Mr. Read served as the Chairman of the Board of Directors of

Healthcare Trust, Inc., a real estate investment trust, from February 2015 to October 2016. Mr. Read also