As

filed with the Securities and Exchange Commission on July 15, 2020

Registration

Statement No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Elite

Pharmaceuticals, Inc.

(Exact

name of Registrant as specified in its charter)

|

Nevada

|

|

22-3542636

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification No.)

|

165

Ludlow Avenue

Northvale,

NJ 07647

(201)

750-2646

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Nasrat

Hakim

President &

Chief Executive Officer

Elite

Pharmaceuticals, Inc.

165

Ludlow Avenue

Northvale,

NJ 07647

(201)

750-2646

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Richard

Feiner, Esq.

Wall

Street Plaza

88

Pine Street, 22nd Floor

New

York, NY 10005

Telephone:

(646) 822-1170

Facsimile:

(917) 720-0863

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans,

please check the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans,

check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities

Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall

become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the

following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

Smaller reporting company

|

☒

|

|

|

|

Emerging growth company

|

☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered (1)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price Per

Share (2)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee

|

|

|

Common stock

|

|

|

262,500,000

|

|

|

$

|

0.08

|

|

|

$

|

21,000,000

|

|

|

$

|

2,725.80

|

(3)

|

|

|

(1)

|

Pursuant

to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall

be deemed to cover the additional securities of the same class as the securities covered by this registration statement issued

or issuable prior to completion of the distribution of the securities covered by this registration statement as a result of a

split of, or a stock dividend on, the registered securities.

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act.

|

|

|

(3)

|

In

accordance with Rule 457(p) under the Securities Act, $1,453 of the $2,725.80 filing fee due for this registration statement has

been offset by the filing fees associated with all of the unsold securities under the Registration Statement on Form S-3 (Registration

No. 333-217866), filed by the registrant with the Securities and Exchange Commission on May 10, 2017.

|

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JULY 15, 2020

PROSPECTUS

ELITE

PHARMACEUTICALS, INC.

262,500,000

Shares of Common Stock

This

prospectus relates to the sale of up to 262,500,000 shares of our common stock by Lincoln Park Capital Fund, LLC, or Lincoln Park

or the selling stockholder.

The

shares of common stock being offered by the selling stockholder have been or may be issued to Lincoln Park pursuant to the purchase

agreement, dated July 8, 2020, that we entered into with Lincoln Park (the “Purchase Agreement”). See “The

Lincoln Park Transaction” for a description of the purchase agreement and “Selling Stockholder” for additional

information regarding Lincoln Park. We are not selling any securities under this prospectus and will not receive any of the proceeds

from the sale of shares of common stock by the selling stockholder. As consideration for Lincoln Park’s irrevocable commitment

to purchase common stock upon the terms of and subject to satisfaction of the conditions set forth in the Purchase Agreement,

upon execution of the Purchase Agreement, we issued to Lincoln Park 5,975,857 shares of common stock as commitment shares. We

have agreed to issue up to 5,975,857 additional shares of common stock as additional commitment shares, on a pro rata basis at

such times during the term of the Purchase Agreement as we may direct Lincoln Park to purchase shares of common stock under the

Purchase Agreement.

The

selling stockholder may sell or otherwise dispose of the shares of common stock described in this prospectus in a number of different

ways and at varying prices. See “Plan of Distribution” for more information about how the selling stockholder may

sell or otherwise dispose of the shares of common stock being registered pursuant to this prospectus. The selling stockholder

is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities

Act”).

The

selling stockholder will pay all brokerage fees and commissions and similar expenses. We will pay the expenses (except brokerage

fees and commissions and similar expenses) incurred in registering the shares, including legal and accounting fees. See “Plan

of Distribution”.

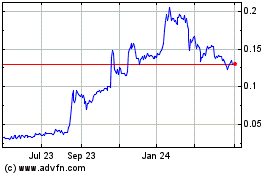

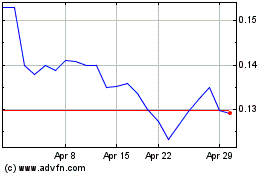

Our

common stock is dually quoted on the OTCBB and the OTCQB. On July 13, 2020, the last reported sale price of our common stock on

the OTCQB was $0.078 per share.

You

should read this prospectus, together with additional information described under the headings “Incorporation of Certain

Information by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our

securities.

Investing

in our securities involves a high degree of risk. These risks are described in the “Risk Factors” section on page

4 of this prospectus. You should also consider the risk factors described or referred to in any documents incorporated by reference

in this prospectus, before investing in these securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This

prospectus is dated , 2020

ELITE

PHARMACEUTICALS, INC.

TABLE

OF CONTENTS

We

have not, and the selling stockholder has not, authorized anyone to provide you with information different from that contained

or incorporated by reference in this prospectus or in any supplement to this prospectus or free writing prospectus, and neither

we nor the selling stockholder takes any responsibility for any other information that others may give you. This prospectus is

not an offer to sell, nor is it a solicitation of an offer to buy, the securities in any jurisdiction where the offer or sale

is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free

writing prospectus is accurate as of any date other than the date on the front cover of those documents, or that the information

contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated

by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition,

results of operations and prospects may have changed since those dates.

This

prospectus relates to the offering of our common stock. Before buying any of our common stock, you should carefully read this

prospectus, any supplement to this prospectus, the information and documents incorporated herein by reference and the additional

information under the heading “Where You Can Find More Information” and “Information Incorporated by Reference.”

These documents contain important information that you should consider when making your investment decision.

References

to the “Company,” “Elite,” “we,” “our” and “us” in this prospectus

are to Elite Pharmaceuticals, Inc. and its consolidated subsidiaries, unless the context otherwise requires. This document includes

trade names and trademarks of other companies. All such trade names and trademarks appearing in this document are the property

of their respective holders.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents we have incorporated by reference contain “forward-looking statements” within the meaning

of Section 27A of the Securities and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results,

performance or achievements, or industry results, to be materially different from any future results, performance or achievements

expressed or implied by such forward-looking statements. When used in this report, statements that are not statements of current

or historical fact are forward-looking statements, and include, without limitation, estimated future results of operations, estimates

of future revenues, future expenses, future net income and future net income per share, as well as statements regarding future

financing activities, the impact of the novel strain of coronavirus referred to as COVID-19 on the health and welfare of our employees

and on our business, including any response to COVID-19 such as anticipated return to historical purchasing decisions by customers,

the economic impact of COVID-19, changes in consumer spending, decisions to engage in certain medical procedures, future governmental

orders that could impact our operations and the ability of our manufacturing facilities and suppliers to fulfill their obligations

to us, and any other statements that refer to our expected, estimated or anticipated future results. Without limiting the foregoing,

the words “plan,” “intend,” “may,” “will,” “expect,” “believe,”

“could,” “would,” “continue,” “pursue,” “anticipate,” “estimate,”

“forecast,” “contemplate,” “envisage,” “project” or “continue” or

the negative other variations thereof, or similar expressions or other variations or comparable terminology are intended to identify

such forward-looking statements. All statements other than statements of historical fact included and incorporated by reference

in this prospectus regarding our financial position, business strategy and plans or objectives for future operations are forward-looking

statements. Without limiting the broader description of forward-looking statements above, we specifically note, without limitation,

that statements regarding the preliminary nature of the clinical program results and the potential for further product development,

that involve known and unknown risks, delays, uncertainties and other factors not under our control, the requirement of substantial

future testing, clinical trials, regulatory reviews and approvals by the Food and Drug Administration and other regulatory authorities

prior and subsequent to the commercialization of products under development and those currently related to commercial operations,

our ability to fund all of our activities and our ability to manufacture and sell any products, gain market acceptance earn a

profit from sales or licenses of any drugs or our ability to discover new drugs in the future are all forward-looking in nature.

In

addition, because these statements reflect our current views concerning future events, these forward-looking statements involve

risks and uncertainties including, without limitation, the risks related to the impact of COVID-19 (such as, without limitation,

the scope and duration of the pandemic and the resulting economic crisis and levels of unemployment, governmental actions and

restrictive measures implemented in response, material delays and cancellations of certain medical procedures, potential manufacturing

and supply chain disruptions and other potential impacts to the business as a result of COVID-19) and the other risks and uncertainties

more fully described under the caption “Risk Factors”, including disclosures incorporated therein by reference. These

risks and uncertainties, many of which are outside of our control, and any other risks and uncertainties that we are not currently

able to predict or identify, individually or in the aggregate, could have a material adverse effect on our business, financial

condition, results of operations and cash flows and could cause our actual results to differ materially and adversely from those

expressed in forward-looking statements contained or incorporated by reference in this document.

We

do not undertake any obligation to update our forward-looking statements after the date of this prospectus for any reason, even

if new information becomes available or other events occur in the future, except as may be required under applicable securities

law. You are advised to consult any further disclosures we make on related subjects in our reports filed with the Securities and

Exchange Commission. You are notified and should understand that it is not possible to predict or identify all such factors and

consequently should not consider this to be a complete, all-inclusive discussion of all potential risks or uncertainties.

In

light of these risks, uncertainties and assumptions, you are cautioned not to place undue reliance on forward-looking statements,

which are inherently unreliable and speak only as of the date of this prospectus, any free writing prospectus, or any document

incorporated by reference in this prospectus. When considering forward-looking statements, you should keep in mind the cautionary

statements in this prospectus or any free writing prospectus, and the documents incorporated by reference in this prospectus.

We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements,

whether as a result of new information, future events or otherwise, except as required by law. In light of these risks, uncertainties

and assumptions, the forward-looking events discussed in or incorporated by reference in this prospectus or any accompanying prospectus

supplement or free writing prospectus might not occur.

PROSPECTUS

SUMMARY

This

summary highlights selected information about Elite Pharmaceuticals, Inc. and this offering of common stock. This summary does

not contain all of the information that may be important to you in making an investment decision. For a more complete understanding

of Elite Pharmaceuticals, Inc. you should read carefully this entire prospectus, including the “Risk Factors” section

and the other documents we refer to and incorporate by reference. Unless otherwise indicated, “common stock” means

our common stock, par value $0.001 per share.

About

Us

We

are a specialty pharmaceutical company principally engaged in the development and manufacture of oral, controlled-release products,

using proprietary know-how and technology, particularly as it relates to abuse resistant products and the manufacture of generic

pharmaceuticals. Our strategy includes improving off-patent drug products for life cycle management, developing generic versions

of controlled-release drug products with high barriers to entry and the development of branded and generic products that utilize

our proprietary and patented abuse resistance technologies.

We

occupy manufacturing, warehouse, laboratory and office space at 165 Ludlow Avenue and 135 Ludlow Avenue in Northvale, NJ (the

“Northvale Facility”). The Northvale Facility operates under Current Good Manufacturing Practice (“cGMP”)

and is a United States Drug Enforcement Agency (“DEA”) registered facility for research, development and manufacturing.

We

focus our efforts on the following areas: (i) manufacturing of a line of generic pharmaceutical products with approved Abbreviated

New Drug Applications (“ANDAs”); (ii) development of additional generic pharmaceutical products; (iii) development

of the other products in our pipeline including the products with our partners; (iv) commercial exploitation of our products either

by license and the collection of royalties, or through the manufacture of our formulations; and (v) development of new products

and the expansion of our licensing agreements with other pharmaceutical companies, including co-development projects, joint ventures

and other collaborations.

We

believe that our business strategy enables us to reduce its risk by having a diverse product portfolio that includes both branded

and generic products in various therapeutic categories and to build collaborations and establish licensing agreements with companies

with greater resources thereby allowing us to share costs of development and improve cash-flow.

For

additional information as to our business, properties and financial condition, please refer to the documents cited in “Where

You Can Find More Information.”

The

Purchase Agreement with Lincoln Park

On

July 8, 2020, we entered into a purchase agreement with Lincoln Park, which we refer to in this prospectus as the Purchase Agreement,

pursuant to which Lincoln Park has agreed to purchase from us up to an aggregate of $25,000,000 of our common stock (subject to

certain limitations) from time to time over the term of the Purchase Agreement. Also on July 8, 2020, we entered into a registration

rights agreement with Lincoln Park, which we refer to in this prospectus as the Registration Rights Agreement, pursuant to which

we filed with the Securities and Exchange Commission (the “SEC”) the registration statement that includes this prospectus

to register for resale under the Securities Act of 1933, as amended, or the Securities Act, the shares of common stock that have

been or may be issued to Lincoln Park under the Purchase Agreement.

This

prospectus covers the resale by the selling stockholder of 262,500,000 shares of our common stock, comprised of: (i) 5,975,857

shares that we already issued to Lincoln Park as a commitment fee for making the commitment under the Purchase Agreement, which

we refer to as the “initial commitment shares,” (ii) an additional 250,548,286 shares we have reserved for issuance

to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement;

and (iii) up to an additional 5,975,857 shares as “additional commitment shares,” on a pro rata basis at such times

during the term of the Purchase Agreement as we may direct Lincoln Park to purchase shares under the Purchase Agreement.

Other

than the 5,975,857 initial commitment shares that we have already issued to Lincoln Park pursuant to the terms of the Purchase

Agreement, we have not issued any other shares of common stock to Lincoln Park under the Purchase Agreement. We do not have the

right to commence any sales of our common stock to Lincoln Park under the Purchase Agreement until all of the conditions set forth

in the Purchase Agreement have been satisfied, including that the SEC has declared effective the registration statement that includes

this prospectus registering the shares being issued and sold to Lincoln Park, which we refer to in this prospectus as the Commencement.

Thereafter, we may, from time to time and at our sole discretion for a period of 36-months, on any business day that we select,

direct Lincoln Park to purchase up to 500,000 shares, which amounts may be increased depending on the market price of our common

stock at the time of sale, which we refer to in this prospectus as “regular purchases.” In addition, at our discretion,

Lincoln Park has committed to purchase other “accelerated amounts” and/or “additional accelerated amounts”

under certain circumstances. We will control the timing and amount of any sales of our common stock to Lincoln Park. The purchase

price of the shares that may be sold to Lincoln Park in regular purchases under the Purchase Agreement will be based on an agreed

upon fixed discount to the market price of our common stock immediately preceding the time of sale as computed under the Purchase

Agreement. The purchase price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend,

stock split, or other similar transaction occurring during the business days used to compute such price. We may at any time in

our sole discretion terminate the Purchase Agreement without fee, penalty or cost upon one business day notice. There are no restrictions

on future financings, rights of first refusal, participation rights, penalties or liquidated damages in the Purchase Agreement

or Registration Rights Agreement, other than a prohibition on our entering into certain types of transactions that are defined

in the Purchase Agreement as “Variable Rate Transactions.” Lincoln Park may not assign or transfer its rights and

obligations under the Purchase Agreement.

As

of July 13, 2020, there were 846,954,821 shares of our common stock outstanding, of which 827,309,769 shares were held by non-affiliates,

including the 5,975,857 initial commitment shares that we have already issued to Lincoln Park under the Purchase Agreement. Although

the Purchase Agreement provides that we may sell up to an aggregate of $25,000,000 of our common stock to Lincoln Park, only 262,500,000

shares of our common stock are being offered under this prospectus, which represents the 5,975,857 initial commitment shares that

we have already issued to Lincoln Park under the Purchase Agreement, the 5,975,857 additional commitment shares which we may issue

to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement,

and 250,548,286 additional shares of common stock that we may issue and sell to Lincoln Park as “purchase shares”

in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement. Depending

on the market prices of our common stock at the time we elect to issue and sell shares to Lincoln Park under the Purchase Agreement,

we may need to register for resale under the Securities Act additional shares of our common stock in order to receive aggregate

gross proceeds equal to the $25,000,000 total commitment available to us under the Purchase Agreement. If all of the 262,500,000

shares offered by Lincoln Park under this prospectus were issued and outstanding as of the date hereof, such shares would represent

approximately 24% of the total number of shares of our common stock outstanding and approximately 24% of the total number of outstanding

shares held by non-affiliates, in each case as of the date hereof. If we elect to issue and sell more than the 262,500,000 shares

offered under this prospectus to Lincoln Park, which we have the right, but not the obligation, to do, we must first register

for resale under the Securities Act any such additional shares, which could cause additional substantial dilution to our stockholders.

The number of shares ultimately offered for resale by Lincoln Park is dependent upon the number of shares we sell to Lincoln Park

under the Purchase Agreement.

The

Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of common stock if those shares, when

aggregated with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would result

in Lincoln Park and its affiliates having beneficial ownership, at any single point in time, of more than 4.99% of the then total

outstanding shares of our common stock, as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 thereunder,

which limitation we refer to as the “beneficial ownership cap.”

Issuances

of our common stock in this offering will not affect the rights or privileges of our existing stockholders, except that the economic

and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number

of shares of common stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders

will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

Summary

of the Offering

|

Common

stock offered by the selling stockholder

|

262,500,000

shares consisting of:

●

5,975,857 commitment shares issued to Lincoln Park upon the execution of the Purchase Agreement;

●

up to 5,975,857 additional commitment shares, on a pro rata basis at such times during the term of the Purchase Agreement

as we may direct Lincoln Park to purchase shares under the Purchase Agreement; and

●

up to 250,548,286 purchase shares that we may sell to Lincoln Park under the Purchase Agreement.

|

|

|

|

|

Common

stock outstanding

|

846,954,821

shares of common stock.

|

|

Use

of proceeds

|

We

will receive no proceeds from the sale of shares of common stock by Lincoln Park in this offering. We may receive up

to $25,000,000 aggregate gross proceeds under the Purchase Agreement from any sales we make to Lincoln Park pursuant to the

Purchase Agreement. Any proceeds that we receive from such sales are anticipated to be used for research and product development,

general corporate purposes and working capital requirements. See “Use of Proceeds.”

|

|

|

|

|

OTCQB

symbol

|

“ELTP”

|

|

|

|

|

Risk

Factors

|

See

“Risk Factors” beginning on page 4 of this prospectus and the other information included in, or incorporated by

reference into, this prospectus for a discussion of certain factors you should carefully consider before deciding to invest

in our securities.

|

The

number of shares of common stock is based on 846,954,821 shares outstanding as of July 13, 2020, and excludes:

|

|

●

|

5,375,000

shares of common stock issuable upon the exercise of options outstanding as of July 13,

2020;

|

|

|

●

|

79,008,661

shares of common stock issuable upon exercise of warrants held by Nasrat Hakim and outstanding

as of July 13, 2020;

|

|

|

●

|

158,017,321

shares of common stock issuable upon conversion of Series J Convertible Preferred Stock

owned by Nasrat Hakim as of July 13, 2020;

|

|

|

●

|

2,750,000

additional shares of common stock reserved for future issuance under our 2014 Equity

Incentive Plan; and

|

|

|

●

|

31,074,817

shares of common stock due and owing Directors, employees and consultants as of July

13, 2020.

|

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. Before making an investment decision, you should carefully

consider the risks described below, as well as the risks described under the caption “Risk Factors” in our Annual

Report on Form 10-K

for the year ended March 31, 2020 and in the other filings we make with the SEC pursuant to Sections 13(a), 13(c), 14 or

15(d) of the Exchange Act, which we have incorporated herein by reference. Our business, financial condition, results of

operations and cash flows could be materially adversely affected by any of these risks, and the market or trading price of

our common stock could decline due to any of these risks. In addition, please read “Cautionary Note Regarding

Forward-Looking Statements” in this prospectus, where we describe additional uncertainties associated with our business

and the forward-looking statements included or incorporated by reference in this prospectus. Please note that additional

risks not presently known to us or that we currently deem immaterial may also impair our business and

operations.

Risks

Related to this Offering and Ownership of Our Common Stock

The

sale or issuance of our common stock to Lincoln Park may cause dilution and the sale of the shares of common stock acquired by

Lincoln Park, or the perception that such sales may occur, could cause the price of our common stock to fall.

On July 8, 2020, we entered into the Purchase

Agreement with Lincoln Park, pursuant to which (i) we issued 5,975,857 initial commitment shares to Lincoln Park as a partial

commitment fee payment for making its irrevocable commitment under the Purchase Agreement, (ii) Lincoln Park has committed to

purchase up to an additional $25,000,000 of our common stock; and (iii) we may issue to Lincoln Park up to an additional 5,975,857

shares as additional commitment shares, on a pro rata basis at such times during the term of the Purchase Agreement as we may

direct Lincoln Park to purchase shares under the Purchase Agreement.

The

shares of our common stock that may be issued under the Purchase Agreement may be sold by us to Lincoln Park at our discretion

from time to time over a 36-month period commencing after the satisfaction of certain conditions set forth in the Purchase Agreement,

including that the SEC has declared effective the registration statement on Form S-3 that includes this prospectus. The purchase

price for the shares that we may sell to Lincoln Park under the Purchase Agreement will fluctuate based on the price of our common

stock. Depending on market liquidity at the time, sales of such shares may cause the trading price of our common stock to fall.

We

generally have the right to control the timing and amount of any future sales of our shares to Lincoln Park. Additional sales

of our common stock, if any, to Lincoln Park will depend upon market conditions and other factors to be determined by us. We may

ultimately decide to sell to Lincoln Park all, some or none of the additional shares of our common stock that may be available

for us to sell pursuant to the Purchase Agreement. If and when we do sell additional shares to Lincoln Park, after Lincoln Park

has acquired the shares, Lincoln Park may resell all, some or none of those shares at any time or from time to time in its discretion.

Therefore, sales to Lincoln Park by us could result in substantial dilution to the interests of other holders of our common stock.

Additionally, the sale of a substantial number of shares of our common stock to Lincoln Park, or the anticipation of such sales,

could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we

might otherwise wish to effect sales.

We

may require additional financing to sustain our operations, without which we may not be able to continue operations, and the terms

of subsequent financings may adversely impact our stockholders.

We

may direct Lincoln Park to purchase up to $25,000,000 worth of shares of our common stock under our agreement over a 36-month

period generally in amounts up to 500,000 shares of our common stock, which may be increased to up to 900,000 shares of our common

stock depending on the market price of our common stock at the time of sale, and, in each case, subject to a maximum limit of

$1,000,000 per purchase, on any single business day (such share amounts being subject to adjustment for any reorganization, recapitalization,

non-cash dividend, stock split, reverse stock split or other similar transaction as provided in the Purchase Agreement). We also

may direct Lincoln Park to purchase additional shares pursuant to Accelerated Purchases (see “The Lincoln Park Transaction”).

Assuming a purchase price of $0.078 per share (the closing sale price of the common stock on July 13, 2020) and the purchase by

Lincoln Park of 500,000 purchase shares, proceeds to us would only be $39,000.

The

extent we rely on Lincoln Park as a source of funding will depend on a number of factors including the prevailing market price

of our common stock and the extent to which we are able to secure working capital from other sources. If obtaining sufficient

funding from Lincoln Park were to prove unavailable or prohibitively dilutive, we will need to secure another source of funding

in order to satisfy our working capital needs. Even if we sell all $25,000,000 under the Purchase Agreement to Lincoln Park, we

may still need additional capital to finance our future business plans and working capital needs, and we may have to raise funds

through the issuance of equity or debt securities. Depending on the type and the terms of any financing we pursue, stockholders’

rights and the value of their investment in our common stock could be reduced. A financing could involve one or more types of

securities including common stock, preferred stock, convertible debt or warrants to acquire common stock. These securities could

be issued at or below the then prevailing market price for our common stock. In addition, if we issue secured debt securities,

the holders of the debt would have a claim to our assets that would be prior to the rights of stockholders until the debt is paid.

Interest on these debt securities would increase costs and negatively impact operating results. If the issuance of new securities

results in diminished rights to holders of our common stock, the market price of our common stock could be negatively impacted.

Should

the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the

consequences could be a material adverse effect on our business, operating results, financial condition and prospects.

Our

management will have broad discretion over the use of the net proceeds from our sale of shares of common stock to Lincoln Park,

you may not agree with how we use the proceeds and the proceeds may not be invested successfully.

Our

management will have broad discretion as to the use of the net proceeds from our sale of shares of common stock to Lincoln Park,

and we could use them for purposes other than those contemplated at the time of commencement of this offering. Accordingly, you

will be relying on the judgment of our management with regard to the use of those net proceeds, and you will not have the opportunity,

as part of your investment decision, to assess whether the proceeds are being used appropriately. It is possible that, pending

their use, we may invest those net proceeds in a way that does not yield a favorable, or any, return for us. The failure of our

management to use such funds effectively could have a material adverse effect on our business, financial condition, operating

results and cash flows.

The

Company has no history of paying dividends on its common stock, and we do not anticipate paying dividends in the foreseeable

future.

The

Company has not previously paid dividends on its common stock. We currently anticipate that we will retain all of our available

cash, if any, for use as working capital and for other general corporate purposes. Any payment of future dividends will be at

the discretion of our Board of Directors and will depend upon, among other things, our earnings, financial condition, capital

requirements, level of indebtedness, statutory and contractual restrictions applicable to the payment of dividends and other considerations

that our Board of Directors deems relevant. Investors must rely on sales of their common stock after price appreciation, which

may never occur, as the only way to realize a return on their investment.

THE

LINCOLN PARK TRANSACTION

General

On

July 8, 2020, we entered into a purchase agreement with Lincoln Park, which we refer to in this prospectus as the Purchase Agreement,

pursuant to which Lincoln Park has agreed to purchase from us up to an aggregate of $25,000,000 of our common stock (subject to

certain limitations) from time to time over the term of the Purchase Agreement. Also on July 8, 2020, we entered into a registration

rights agreement with Lincoln Park, which we refer to in this prospectus as the Registration Rights Agreement, pursuant to which

we have filed with the SEC the registration statement that includes this prospectus to register for resale under the Securities

Act the shares of common stock that have been or may be issued to Lincoln Park under the Purchase Agreement.

This prospectus covers the resale by the

selling stockholder of 262,500,000 shares of our common stock, comprised of: (i) 5,975,857 initial commitment shares that we

already issued to Lincoln Park as partial payment of a commitment fee for making its irrevocable commitment under the

Purchase Agreement, (ii) an additional 250,548,286 purchase shares we have reserved for issuance and sale to Lincoln Park in

the future under the Purchase Agreement, if and when we decide to sell shares to Lincoln Park under the Purchase Agreement;

and (iii) up to an additional 5,975,857 shares as additional commitment shares, on a pro rata basis at such times during the

term of the Purchase Agreement as we may direct Lincoln Park to purchase shares under the Purchase Agreement.

Other

than the 5,975,857 initial commitment shares, we have not issued any common stock to Lincoln Park under the Purchase Agreement.

We do not have the right to commence any sales of our common stock to Lincoln Park under the Purchase Agreement until all of the

conditions set forth in the Purchase Agreement have been satisfied, including that the SEC has declared effective the registration

statement that includes this prospectus registering the shares that will be issued and sold to Lincoln Park, which we refer to

in this prospectus as the Commencement. Thereafter, we may, from time to time and at our sole discretion for a period of 36-months,

on any business day that we select, direct Lincoln Park to purchase up to 500,000 shares of common stock, which amounts may be

increased depending on the market price of our common stock at the time of sale, which we refer to in this prospectus as “regular

purchases.” In addition, at our discretion, Lincoln Park has committed to purchase other “accelerated amounts”

and/or “additional accelerated amounts” under certain circumstances. We will control the timing and amount of any

sales of our common stock to Lincoln Park. The purchase price of the shares that may be sold to Lincoln Park in regular purchases

under the Purchase Agreement will be based on an agreed upon fixed discount to the market price of our common stock immediately

preceding the time of sale as computed under the Purchase Agreement. The purchase price per share will be equitably adjusted for

any reorganization, recapitalization, non-cash dividend, stock split, or other similar transaction occurring during the business

days used to compute such price. We may at any time in our sole discretion terminate the Purchase Agreement without fee, penalty

or cost upon one business day notice. There are no restrictions on future financings, rights of first refusal, participation

rights, penalties or liquidated damages in the Purchase Agreement or Registration Rights Agreement, other than a prohibition on

our entering into certain types of transactions that are defined in the Purchase Agreement as “Variable Rate Transactions.”

Lincoln Park may not assign or transfer its rights and obligations under the Purchase Agreement.

As

of July 13, 2020, there were 846,954,821 shares of our common stock outstanding, of which 827,309,769 shares were held by non-affiliates,

including the 5,975,857 shares that we have already issued to Lincoln Park under the Purchase Agreement and additional shares

owned by Lincoln Park. Although the Purchase Agreement provides that we may sell up to an aggregate of $25,000,000 of our common

stock to Lincoln Park, only 262,500,000 shares of our common stock are being offered under this prospectus, which represents the

5,975,857 shares that we have already issued to Lincoln Park under the Purchase Agreement and additional shares which may be issued

to Lincoln Park in the future under the Purchase Agreement, if and when we sell shares to Lincoln Park under the Purchase Agreement,

including additional commitment shares. Depending on the market prices of our common stock at the time we elect to issue and sell

shares to Lincoln Park under the Purchase Agreement, we may need to register for resale under the Securities Act additional shares

of our common stock in order to receive aggregate gross proceeds equal to the $25,000,000 total commitment available to us under

the Purchase Agreement. If all of the 262,500,000 shares offered by Lincoln Park under this prospectus were issued and outstanding

as of the date hereof, such shares would represent approximately 24% of the total number of shares of our common stock outstanding

and approximately 24% of the total number of outstanding shares held by non-affiliates, in each case as of the date hereof. If

we elect to issue and sell more than the 262,500,000 shares offered under this prospectus to Lincoln Park, which we have the right,

but not the obligation, to do, we must first register for resale under the Securities Act any such additional shares, which could

cause additional substantial dilution to our stockholders. The number of shares ultimately offered for resale by Lincoln Park

is dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement.

The

Purchase Agreement also prohibits us from directing Lincoln Park to purchase any shares of common stock if those shares, when

aggregated with all other shares of our common stock then beneficially owned by Lincoln Park and its affiliates, would result

in Lincoln Park and its affiliates having beneficial ownership, at any single point in time, of more than 4.99% of the then total

outstanding shares of our common stock, as calculated pursuant to Section 13(d) of the Exchange Act and Rule 13d-3 thereunder,

which limitation we refer to as the beneficial ownership cap.

Issuances

of our common stock in this offering will not affect the rights or privileges of our existing stockholders, except that the economic

and voting interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number

of shares of common stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders

will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

We

previously sold shares to Lincoln Park pursuant to a prior purchase agreement that expired on July 1, 2020.

Purchase

of Shares Under the Purchase Agreement

Under

the Purchase Agreement, upon Commencement, on any business day that we select, we may direct Lincoln Park to purchase up to 500,000

shares of our common stock in a regular purchase on such business day, which is referred to as a Regular Purchase in this prospectus,

provided, however, that (i) the Regular Purchase may be increased to up to 600,000 shares, provided that the closing sale price

of the common stock is not below $0.15 on the purchase date; (ii) the Regular Purchase may be increased to up to 700,000 shares,

provided that the closing sale price of the common stock is not below $0.20 on the purchase date; (iii) the Regular Purchase may

be increased to up to 800,000 shares, provided that the closing sale price of the common stock is not below $0.25 on the purchase

date; and (iv) the Regular Purchase may be increased to up to 900,000 shares, provided that the closing sale price of the common

stock is not below $0.30 on the purchase date. In each case, Lincoln Park’s maximum dollar commitment in any single Regular

Purchase may not exceed $1,000,000. The Regular Purchase Share Limit is subject to proportionate adjustment in the event of a

reorganization, recapitalization, non-cash dividend, stock split or other similar transaction; provided, that if after giving

effect to such full proportionate adjustment, the adjusted Regular Purchase Share Limit would preclude us from requiring Lincoln

Park to purchase common stock at an aggregate purchase price equal to or greater than $100,000 in any single Regular Purchase,

then the Regular Purchase Share Limit will not be fully adjusted, but rather the Regular Purchase Share Limit for such Regular

Purchase shall be adjusted as specified in the Purchase Agreement, such that, after giving effect to such adjustment, the Regular

Purchase Share Limit will be equal to (or as close as can be derived from such adjustment without exceeding) $100,000.

The

purchase price per share for each such Regular Purchase will be equal to 97% of the lower of:

|

|

●

|

the

lowest sale price for our common stock on the purchase date of such shares; and

|

|

|

●

|

the

arithmetic average of the three lowest closing sale prices for our common stock during

the 10 consecutive business days ending on the business day immediately preceding the

purchase date of such shares.

|

In

addition to Regular Purchases described above, we may also direct Lincoln Park, on any business day on which we have properly

submitted a Regular Purchase notice directing Lincoln Park to purchase the maximum number of shares of our common stock that we

are then permitted to include in a single Regular Purchase notice and the closing price of our common stock on such business day

is not less than $0.03 per share (subject to adjustment for any reorganization, recapitalization, non-cash dividend, stock split,

reverse stock split or other similar transaction as provided in the Purchase Agreement), to purchase an additional amount of our

common stock, which we refer to as an Accelerated Purchase, not to exceed the lesser of:

|

|

●

|

30%

of the aggregate shares of our common stock traded during all or, if certain trading

volume or market price thresholds specified in the Purchase Agreement are crossed on

the applicable Accelerated Purchase date, which is defined as the next business day following

the purchase date for the corresponding Regular Purchase, the portion of the normal trading

hours on the applicable Accelerated Purchase date prior to such time that any one of

such thresholds is crossed, which period of time on the applicable Accelerated Purchase

date we refer to as the Accelerated Purchase Measurement Period; and

|

|

|

●

|

four

times the number of purchase shares purchased pursuant to the corresponding Regular Purchase.

|

The

purchase price per share for each such Accelerated Purchase will be equal to the lower of:

|

|

●

|

97%

of the volume weighted average price of our common stock during the Accelerated Purchase

Measurement Period on the applicable Accelerated Purchase date; and

|

|

|

●

|

the

closing sale price of our common stock on the applicable Accelerated Purchase date; but

in no event would the purchase price for such Accelerated Purchase be less than the applicable

minimum Accelerated Purchase threshold price established in accordance with the Purchase

Agreement.

|

We

may also direct Lincoln Park, not later than 1:00 p.m., Eastern time, on a business day on which an Accelerated Purchase has been

completed and all of the shares to be purchased thereunder (and under the corresponding Regular Purchase) have been properly delivered

to Lincoln Park in accordance with the Purchase Agreement prior to such time on such business day, and provided that the closing

price of our common stock on the business day immediately preceding such business day is not less than $0.03 per share (subject

to adjustment for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock split or other similar transaction

as provided in the Purchase Agreement), to purchase an additional amount of our common stock, which we refer to as an Additional

Accelerated Purchase, of up to the lesser of:

|

|

●

|

30%

of the aggregate shares of our common stock traded during a certain portion of the normal

trading hours on such Accelerated Purchase date as determined in accordance with the

Purchase Agreement, which period of time we refer to as the Additional Accelerated Purchase

Measurement Period; and

|

|

|

●

|

four

times the number of purchase shares purchased pursuant to the Regular Purchase corresponding

to the Accelerated Purchase that was completed on such Accelerated Purchase date on which

an Additional Accelerated Purchase notice was properly received.

|

We

may, in our sole discretion, submit multiple Additional Accelerated Purchase notices to Lincoln Park prior to 1:00 p.m., Eastern

time, on a single Accelerated Purchase date, provided that all prior Accelerated Purchases and Additional Accelerated Purchases

(including those that have occurred earlier on the same day) have been completed and all of the shares to be purchased thereunder

(and under the corresponding Regular Purchase) have been properly delivered to Lincoln Park in accordance with the Purchase Agreement

and the closing sale price of our common stock on the business day immediately preceding the delivery of multiple Additional Accelerated

Purchase notices is greater than $0.03.

The

purchase price per share for each such Additional Accelerated Purchase will be equal to the lower of:

|

|

●

|

97%

of the volume weighted average price of our common stock during the applicable Additional

Accelerated Purchase Measurement Period on the applicable Additional Accelerated Purchase

date; and

|

|

|

●

|

the

closing sale price of our common stock on the applicable Additional Accelerated Purchase

date; but in no event would the purchase price for such Additional Accelerated Purchase

be less than the applicable minimum Additional Accelerated Purchase threshold price established

in accordance with the Purchase Agreement.

|

In

the case of the Initial Purchase, Regular Purchases, Accelerated Purchases and Additional Accelerated Purchases, the purchase

price per share will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split, reverse stock

split or other similar transaction occurring during the business days used to compute the purchase price.

Other

than as described above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will

control the timing and amount of any sales of our common stock to Lincoln Park.

Events

of Default

Events

of default under the Purchase Agreement include the following:

|

|

●

|

the

effectiveness of the registration statement of which this prospectus forms a part lapses

for any reason (including, without limitation, the issuance of a stop order), or any

required prospectus supplement and accompanying prospectus are unavailable for the resale

by Lincoln Park of our common stock offered hereby, and such lapse or unavailability

continues for a period of 10 consecutive business days or for more than an aggregate

of 30 business days in any 365-day period;

|

|

|

●

|

suspension

by our principal market of our common stock from trading for a period of one business

day;

|

|

|

●

|

the

delisting of our common stock from the OTCQB operated by the OTC Markets Group, Inc.

(or nationally recognized successor thereto), provided, however, that our common stock

is not immediately thereafter trading on the New York Stock Exchange, The NASDAQ Capital

Market, The NASDAQ Global Market, The NASDAQ Global Select Market, the NYSE American,

the NYSE Arca, the OTC Bulletin Board or the OTCQX operated by the OTC Markets Group,

Inc. (or nationally recognized successor to any of the foregoing);

|

|

|

●

|

the

failure of our transfer agent to issue to Lincoln Park shares of our common stock within

two business days after the applicable date on which Lincoln Park is entitled to receive

such shares;

|

|

|

●

|

any

breach of the representations or warranties or covenants contained in the Purchase Agreement

or Registration Rights Agreement that has or could have a material adverse effect on

us and, in the case of a breach of a covenant that is reasonably curable, that is not

cured within five business days;

|

|

|

●

|

any

voluntary or involuntary participation or threatened participation in insolvency or bankruptcy

proceedings by or against us; or

|

|

|

●

|

if

at any time we are not eligible to transfer our common stock electronically.

|

Lincoln

Park does not have the right to terminate the Purchase Agreement upon any of the events of default set forth above. During an

event of default, all of which are outside of Lincoln Park’s control, we may not direct Lincoln Park to purchase any shares

of our common stock under the Purchase Agreement.

Our

Termination Rights

We

have the unconditional right, at any time, for any reason and without any payment or liability to us, to give notice to Lincoln

Park to terminate the Purchase Agreement. In the event of bankruptcy proceedings instituted by us, the Purchase Agreement will

automatically terminate. In the event of bankruptcy proceedings instituted against us, the Purchase Agreement will terminate if

the proceedings are not discharged within 90 days.

No Short-Selling

or Hedging by Lincoln Park

Lincoln

Park has agreed that neither it nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our

common stock during any time prior to the termination of the Purchase Agreement.

Prohibitions

on Variable Rate Transactions

There

are no restrictions on future financings, rights of first refusal, participation rights, penalties or liquidated damages

in the Purchase Agreement or Registration Rights Agreement other than a prohibition on entering into a “Variable Rate Transaction,”

as defined in the Purchase Agreement.

Effect

of Performance of the Purchase Agreement on Our Stockholders

All

262,500,000 shares registered in this offering which have been or may be issued or sold by us to Lincoln Park under the Purchase

Agreement are expected to be freely tradable. It is anticipated that shares registered in this offering will be sold over a period

of up to 36-months commencing on the date that the registration statement including this prospectus becomes effective. The sale

by Lincoln Park of a significant amount of shares registered in this offering at any given time could cause the market price of

our common stock to decline and to be highly volatile. Sales of our common stock to Lincoln Park, if any, will depend upon market

conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the

additional shares of our common stock that may be available for us to sell pursuant to the Purchase Agreement. If and when we

do sell shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all, some or none of those

shares at any time or from time to time in its discretion. Therefore, sales to Lincoln Park by us under the Purchase Agreement

may result in substantial dilution to the interests of other holders of our common stock. In addition, if we sell a substantial

number of shares to Lincoln Park under the Purchase Agreement, or if investors expect that we will do so, the actual sales of

shares or the mere existence of our arrangement with Lincoln Park may make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise wish to effect such sales. However, we have the right

to control the timing and amount of any additional sales of our shares to Lincoln Park and the Purchase Agreement may be terminated

by us at any time at our discretion without any cost to us.

Pursuant

to the terms of the Purchase Agreement, we have the right, but not the obligation, to direct Lincoln Park to purchase up to $25,000,000

of our common stock. Depending on the price per share at which we sell our common stock to Lincoln Park pursuant to the Purchase

Agreement, we may need to sell to Lincoln Park under the Purchase Agreement more shares of our common stock than are offered under

this prospectus in order to receive aggregate gross proceeds equal to the $25,000,000 total commitment available to us under the

Purchase Agreement. If we choose to do so, we must first register for resale under the Securities Act such additional shares of

our common stock, which could cause additional substantial dilution to our stockholders. The number of shares ultimately offered

for resale by Lincoln Park under this prospectus is dependent upon the number of shares we direct Lincoln Park to purchase under

the Purchase Agreement.

The

Purchase Agreement prohibits us from issuing or selling to Lincoln Park under the Purchase Agreement any shares of our common

stock if those shares, when aggregated with all other shares of our common stock then beneficially owned by Lincoln Park and its

affiliates, would exceed the beneficial ownership cap.

The

following table sets forth the amount of gross proceeds we would receive from Lincoln Park from our sale of shares to Lincoln

Park under the Purchase Agreement at varying purchase prices:

Assumed

Average

Purchase

Price Per

Share

|

|

|

Number of Registered

Shares to be Issued if

Full Purchase(1)

|

|

|

Percentage of Outstanding

Shares After Giving Effect to

the Issuance to Lincoln

Park(2)

|

|

|

Proceeds from the Sale of Shares

to Lincoln Park Under the

Purchase Agreement(1)

|

|

|

$

|

0.05

|

|

|

|

262,500,000

|

|

|

|

23

|

%

|

|

$

|

12,674,723

|

|

|

$

|

0.078

|

(3)

|

|

|

262,500,000

|

|

|

|

24

|

%

|

|

$

|

19,642,652

|

|

|

$

|

0.10

|

|

|

|

261,951,714

|

|

|

|

24

|

%

|

|

$

|

25,000,000

|

|

|

$

|

0.15

|

|

|

|

178,618,381

|

|

|

|

17

|

%

|

|

$

|

25,000,000

|

|

|

$

|

0.20

|

|

|

|

136,951,714

|

|

|

|

14

|

%

|

|

$

|

25,000,000

|

|

|

1.

|

Although

the Purchase Agreement provides that we may sell up to $25,000,000 of our common stock

to Lincoln Park, we are only registering 262,500,000 shares under this prospectus, including

5,975,857 initial commitment shares that we already issued to Lincoln Park as a partial

commitment fee under the Purchase Agreement and up to an additional 5,975,857 shares

we may issue as additional commitment shares, on a pro rata basis at such times during

the term of the Purchase Agreement as we may direct Lincoln Park to purchase shares under

the Purchase Agreement, which may or may not cover all the shares we ultimately sell

to Lincoln Park under the Purchase Agreement, depending on the purchase price per share.

We have not and will not receive any proceeds from the issuance of the initial commitment

shares or any additional commitment shares to Lincoln Park.

|

|

2.

|

The

denominator is based on 846,954,821 shares outstanding as of July 13, 2020, adjusted

to include the number of shares set forth in the adjacent column which we would have

sold to Lincoln Park, assuming the purchase price in the adjacent column. The numerator

is based on the number of shares issuable under the Purchase Agreement at the corresponding

assumed purchase price set forth in the adjacent column. The table does not give effect

to the prohibition contained in the Purchase Agreement that prevents us from selling

and issuing to Lincoln Park shares such that, after giving effect to such sale and issuance,

Lincoln Park and its affiliates would beneficially own more than 4.99% of the then outstanding

shares of our common stock.

|

|

3.

|

The

closing sale price of our shares on July 13, 2020.

|

USE

OF PROCEEDS

This

prospectus relates to shares of our common stock that may be offered and sold from time to time by Lincoln Park. We will receive

no proceeds from the sale of shares of common stock by Lincoln Park in this offering. We may receive up to $25,000,000 aggregate

gross proceeds under the Purchase Agreement from any sales we make to Lincoln Park pursuant to the Purchase Agreement after the

date of this prospectus. We estimate that the net proceeds to us from the sale of our common stock to Lincoln Park pursuant to

the Purchase Agreement would be up to $24.974 million over an approximately 36-month period, assuming that we sell the full amount

of our common stock that we have the right, but not the obligation, to sell to Lincoln Park under the Purchase Agreement, and

after other estimated fees and expenses. See “Plan of Distribution” elsewhere in this prospectus for more information.

We

intend to use any net proceeds that we receive under the Purchase Agreement for research and product development, general corporate

purposes and working capital requirements. It is possible that no shares will be issued under the Purchase Agreement.

MARKET

FOR COMMON STOCK AND DIVIDEND POLICY

Our

common stock is traded in the over-the-counter market and quoted on the OTCQB and on the OTC Bulletin Board under the symbol “ELTP.”

The last reported sale price of our common stock on July 13, 2020 on the OTCQB was $0.078 per share. As of July 13, 2020, there

were 124 holders of record of our common stock.

We

have never declared or paid any cash dividend on our common stock, nor do we currently intend to pay any cash dividend on our

common stock in the foreseeable future. We expect to retain our earnings, if any, for the growth and development of our business.

SELLING

STOCKHOLDER

This

prospectus relates to the possible resale by the selling stockholder, Lincoln Park, of shares of our common stock that have been

or may be issued to Lincoln Park pursuant to the Purchase Agreement. We are filing the registration statement of which this

prospectus forms a part pursuant to the provisions of the Registration Rights Agreement, which we entered into with Lincoln Park

on July 8, 2020, concurrently with our execution of the Purchase Agreement, in which we agreed to provide certain registration

rights with respect to sales by Lincoln Park of the shares of our common stock that have been or may be issued to Lincoln Park

under the Purchase Agreement.

Lincoln

Park, as the selling stockholder, may, from time to time, offer and sell pursuant to this prospectus any or all of the shares

that we may issue to Lincoln Park from time to time at our discretion under the Purchase Agreement. The “selling stockholder”

may sell some, all or none of its shares. We do not know how long the selling stockholder will hold the shares before selling

them, and we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale

of any of the shares.

The

following table presents information regarding the selling stockholder and the shares that it may offer and sell from time to

time under this prospectus. The table is prepared based on information supplied to us by the selling stockholder, and reflects

its holdings as of July 13, 2020. Neither Lincoln Park nor any of its affiliates has held a position or office, or had any

other material relationship, with us or any of our predecessors or affiliates. Beneficial ownership is determined in accordance

with Section 13(d) of the Exchange Act and Rule 13d-3 thereunder. The percentage of shares beneficially owned prior to the

offering is based on 846,954,821 shares of our common stock actually outstanding as of July 13, 2020.

|

|

|

Shares Beneficially

Owned Prior to Offering

|

|

|

Number of Shares

|

|

|

Shares Beneficially

Owned After Offering(1)

|

|

|

Name

|

|

Number

|

|

|

%

|

|

|

Being Offered

|

|

|

Number

|

|

|

%

|

|

|

Lincoln Park Capital Fund, LLC(2)

|

|

|

5,975,857

|

(3)

|

|

|

*

|

(4)

|

|

|

262,500,000

|

|

|

|

0

|

|

|

|

*

|

(5)

|

|

(1)

|

Assumes

the sale of all shares of common stock registered pursuant to this prospectus, although

the selling stockholder is under no obligation known to us to sell any shares of

common stock at this time.

|

|

(2)

|

Josh

Scheinfeld and Jonathan Cope, the Managing Members of Lincoln Park Capital, LLC, the

manager of Lincoln Park Capital Fund, LLC, are deemed to be beneficial owners of all

of the shares of common stock owned by Lincoln Park Capital Fund, LLC. Messrs. Cope and

Scheinfeld have shared voting and investment power over the shares being offered under

the prospectus filed with the SEC in connection with the transactions contemplated under

the Purchase Agreement. Lincoln Park Capital, LLC is not a licensed broker dealer or

an affiliate of a licensed broker dealer.

|

|

(3)

|

Consists

of 5,975,857 initial commitment shares we issued to Lincoln Park upon the execution of

the Purchase Agreement. Excludes (i) up to 250,548,286 purchase shares being registered

hereunder because the issuance and sale of such shares to Lincoln Park is solely at our

discretion and is subject to certain conditions precedent, the satisfaction of all of

which are outside of Lincoln Park’s control, including the registration statement

on Form S-3 of which this prospectus is a part becoming and remaining effective under

the Securities Act and (ii) up to 5,975,857 additional commitment shares because the

issuance of such shares to Lincoln Park would only occur on a pro rata basis at such

times during the term of the Purchase Agreement as we may direct Lincoln Park to purchase

shares under the Purchase Agreement. Furthermore, under the terms of the Purchase Agreement,

issuances and sales of shares of our common stock to Lincoln Park are subject to certain

limitations on the amounts we may sell to Lincoln Park at any time, including the beneficial

ownership cap. See the description under the heading “Lincoln Park Transaction”

for more information about the Purchase Agreement.

|

|

(4)

|

Calculated

by dividing (1) the total number of shares beneficially owned by the selling stockholder

on July 13, 2020, which pursuant to Rule 13d-3 under the Exchange Act solely consists

of (a) the 5,975,857 shares of common stock held by Lincoln Park and (b) excludes 250,548,286

shares of common stock being registered hereunder because the issuance and sale of such

shares to Lincoln Park is solely at our discretion and is subject to certain conditions

precedent, the satisfaction of all of which are outside of Lincoln Park’s control,

including the registration statement on Form S-3 of which this prospectus is a part becoming

and remaining effective under the Securities Act and (b) up to 5,975,857 additional commitment

shares because the issuance of such shares to Lincoln Park would only occur on a pro

rata basis at such times during the term of the Purchase Agreement as we may direct Lincoln

Park to purchase shares under the Purchase Agreement, by (2) the number of shares of

our common stock outstanding as of July 13, 2020.

|

|

(5)

|

Calculated

by dividing (i) the total number of shares beneficially owned by the selling stockholder

on July 13, 2020 (which pursuant to Rule 13d-3 under the Exchange Act consists of the

5,975,857 initial commitment shares held by Lincoln Park, assuming all shares of common

stock registered hereunder have been resold by (ii) the number of shares of our common

stock outstanding as of July 13, 2020, as adjusted to include the 256,524,143 shares

which may be sold or issued to Lincoln Park as additional commitment shares hereunder

in connection with the Purchase Agreement.

|

PLAN

OF DISTRIBUTION

The

common stock offered by this prospectus is being offered by the selling stockholder, Lincoln Park. The common stock may

be sold or distributed from time to time by the selling stockholder directly to one or more purchasers or through brokers, dealers,

or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing

market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the common stock offered by this prospectus

could be effected in one or more of the following methods:

|

|

●

|

ordinary

brokers’ transactions;

|

|

|

●

|

transactions

involving cross or block trades;

|

|

|

●

|

through

brokers, dealers, or underwriters who may act solely as agents;

|

|

|

●

|

“at

the market” into an existing market for the common stock;

|

|

|

●

|

in

other ways not involving market makers or established business markets, including direct

sales to purchasers or sales effected through agents;

|

|

|

●

|

in

privately negotiated transactions; or

|

|

|

●

|

any

combination of the foregoing.

|

In

order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed

brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for

sale in the state or an exemption from the state’s registration or qualification requirement is available and complied with.

Lincoln

Park is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act.

Lincoln

Park has informed us that it intends to use an unaffiliated broker-dealer to effectuate all sales, if any, of the common stock

that it may purchase from us pursuant to the Purchase Agreement. Such sales will be made at prices and at terms then prevailing

or at prices related to the then current market price. Each such unaffiliated broker-dealer will be an underwriter within

the meaning of Section 2(a)(11) of the Securities Act. Lincoln Park has informed us that each such broker-dealer will receive