UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported)

November 5, 2015

Dewmar International BMC, Inc.

(Exact Name of Registrant as Specified in Its Charter)

NEVADA

(State or Other Jurisdiction of Incorporation)

| | |

| 001-32032 | 26-4465583 |

| (Commission File Number) | (IRS Employer Identification No.) |

132 E. Northside Dr., Suite C

Clinton, Mississippi 39065

(Address of Principal Executive Offices) (Zip Code)

(877) 747-5326

(Registrant's Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 8.01 - OTHER EVENTS

Classification or SIC Code

On December 10, 2014 Dewmar International BMC, Inc. (“the Company’) changed its primary Industry Classification or SIC code from 2080 Beverages to 8741 Management Services to more accurately reflect the Company’s broad portfolio of products and services it manages across various vertical markets.

Dewmar International Brand Management Company, Inc. is a U.S. based brand management services company that specializes in developing or acquiring new products, brands or companies for successful launch or distribution in both national and international markets. Dewmar International's primary business strategy has been in transforming high profit-margin brands traditionally set for niche consumer markets and making them available to general consumer markets by building a sustainable business growth model. The Company currently manages multiple brands and services across a complimentary set of consumer good categories and Health & Wellness industry verticals.

Additionally, the Company now recognizes it’s secondary SIC code as 7389 Business Services, Not Elsewhere Classified. This new SIC Code designation is the result of a significant portion of the company’s revenues being generated through Fee-For-Service (FFS) agreements entered into with companies in the health care and pharmaceutical industry to provide them with outsourced sales and marketing functions. Fulfillment of these service agreements has been provided by Dewmar International’s subsidiary, Health & Wellness Research Consortium, LLC (HWRC). Upon consolidation of financials with its subsidiary company, HWRC; the majority of Dewmar International’s revenue is now generated from business activity beyond beverage sales.

For history on our SIC Code status, reference the company’s 8K filing on June 25, 2013 which announced the company’s pursuit to update its SIC Code in an effort to better categorize the business with its strategic outlook and business functions. At the time, the company was not allowed to update its SIC Code because its primary source of revenue was from the sales of products and brands classified within the beverage category. As stated above, the more current sources of revenue for the company has broadened beyond beverages and in Management’s opinion, the updated SIC Codes more accurately reflect the company’s current business activity.

Authorized Shares

As of November 5, 2015, the total number of Authorized Shares are 4,500,000,000 with the number of Issued and Outstanding shares currently at 2,426,163,513. The current float remains at 2,225,613,590 shares with no change reported since March 30, 2014.

Financial Statements And Exhibits

Information presented herein in based on UNAUDITED consolidated financial statements of Dewmar International BMC, Inc. and its subsidiaries for the full year 2014. The financials were compiled by a third party accounting firm and HAVE NOT been reviewed by our auditor of record, Malone Bailey.

These unaudited financial statements do not substitute the Company’s plan to provide the audited 2014 financial results which are scheduled for release in the first quarter of 2016.

2

The unaudited financial information set forth herein is preliminary and subject to adjustments and modifications. Adjustments and modifications to the financial statements may be identified during the course of the audit work, which could result in significant differences from this preliminary unaudited financial information.

After review of the financial presentation, in management’s opinion, the financial statements present fairly, in all material respects, the financial position of the company in light of the facts known up to the date of disclosure.

Dewmar International BMC, Inc. does not assume responsibility for, or makes any representation or warranty, express or implied, with respect to, the accuracy, adequacy or completeness of the information contained in this presentation and expressly disclaims any liability based on such information, errors therein or omissions therefrom. This presentation includes elements of subjective judgment and information that may or may not prove to be accurate or correct.

This document has been prepared solely for informational purposes in connection with a sizable proposed, material event to assist interested parties in receiving information on Dewmar International BMC, Inc. Recipients are responsible for making their own evaluation of Dewmar International BMC, Inc. and its financial standing. Information and figures herein do not purport to be all-inclusive or to contain all the information that recipients may desire. In all cases, interested parties should conduct their own independent investigation and analysis and are reminded of the pending audited financials for the full fiscal year 2014 which are scheduled for release in the first quarter of 2016.

ITEM 9.01 FINANCIAL STATEMENTS, PRO FORMA FINANCIAL INFORMATION AND EXHIBITS.

a) Not Applicable.

b) Not Applicable.

c) Not Applicable.

d) Exhibits

| | |

| No. | Exhibits |

| | |

| 99.1 | Consolidated Balance Sheet 12-31-14 |

| 99.2 | Consolidated Cash Flow Statement 12-31-14 |

| 99.3 | Consolidated Profit & Loss Statement 12-31-14 |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 5, 2015

By: /s/ Marco Moran

Name: Marco Moran

Title: Chief Executive Officer

4

EXHIBIT INDEX

| | |

| Exhibit No. | Description of Exhibit |

| | |

| 99.1 | Consolidated Balance Sheet 12-31-14 |

| 99.2 | Consolidated Cash Flow Statement 12-31-14 |

| 99.3 | Consolidated Profit & Loss Statement 12-31-14 |

5

Dewmar International BMC, Inc.

Consolidated Balance Sheet

As of December 31, 2014

UNAUDITED

| | | |

| | Dewmar |

| | International |

| | Consolidated |

| | |

ASSETS | |

| | |

Current Assets | |

| Cash and cash equivalents | $ | 3,603,899 |

Account receivables | | 100,502 |

| Related party receivable | | - |

Advances to related party | | - |

| Inventory | | 128,499 |

Prepaid expenses and other current assets | | - |

| Total Current Assets | $ | 3,832,900 |

| | |

| Investment in Cirrus MD | | 20,000 |

| | |

| Property & equipment, net of accumulated depreciation of $21,760 | | 19,295 |

| | |

| Total assets | $ | 3,872,195 |

| | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | | |

| | |

| Current Liabilities | | |

Accounts payable and accrued liabilities | $ | 762,323 |

| Notes payable and Accrued Interest | | 276,387 |

Convertible Notes payable, net of unamortized | | |

| discount of $34,047 | | 127,911 |

Derivative liability | | 317,665 |

| Total Current Liabilities | $ | 1,484,286 |

| | |

| Total Liabilities | $ | 1,484,286 |

| | |

| Stockholders' Equity | | |

Preferred Stock; $0.001 par value; 50,000,000 shares authorized; 50,000,000 and - issued and outstanding, respectively | $ | 50,000 |

| | | |

Common stock; $0.001 par value; 2,450,000,000 shares authorized, 2,476,163,513 issued and outstanding at December 31, 2014 | | 3,510,513 |

| | | |

Additional paid-in capital | | 3,586,296 |

| Retained Earnings (Accumulated deficit) | | (4,758,900) |

Total Stockholders' Deficit | $ | 2,387,909 |

| | | |

Total Liabilities and Stockholders' Deficit | $ | 3,872,195 |

Dewmar International BMC, Inc.

Consolidated Cash Flow Statement

For the Year Ended December 31, 2014

UNAUDITED

| | | |

| | Dewmar |

| | International |

| | Consolidated |

| | |

Net Income | $ | 2,045,955 |

| Adjustments to reconcile Net Income to Net Cash Provided by Operations | | |

Accounts Receivable | | (77,553) |

| Inventory | | (93,355) |

Prepaid Expenses | | 6,000 |

| Depreciation Expense | | 7,550 |

Accounts Payable and Accrued Liabilities | | 47,453 |

| Notes Payable and Accrued Interest | | 264,496 |

| | |

| Net Cash Provided by Operating Activities | | 2,200,545 |

| | |

| Net Cash Used for Investing Activities | | (20,000) |

| | |

| FINANCING ACTIVITIES | | |

Common Stock | | 442,164 |

| Common Stock Payable | | 599,100 |

Paid-In Capital in Excess of Par | | 374,856 |

| Net cash provided by financing activities | | 1,416,120 |

| | |

| Net cash increase for period | | 3,596,665 |

Cash at beginning of period | | 7,234 |

| Cash at end of period | $ | 3,603,899 |

Dewmar International BMC, Inc.

Profit & Loss Statement

For the Year Ended December 31, 2014

UNAUDITED

| | | |

| | Dewmar |

| | International |

| | Consolidated |

| | |

Revenue, net | $ | 4,130,950 |

| | | |

Cost of goods sold | | 155,989 |

| | | |

Gross profit | $ | 3,974,961 |

| | | |

Operating expenses | | |

| Occupancy and related expenses | $ | 33,144 |

Marketing and advertising | | 36,085 |

| General and administrative expenses | | 1,437,494 |

Contract labor | | 116,647 |

| Total operating expenses | $ | 1,623,370 |

| | |

| Profit (Loss) from operations | $ | 2,351,591 |

| | |

| Other income (expenses) | | |

Interest expense | $ | (49,451) |

| Gain (loss) on derivative liability | | (256,185) |

Loss on settlement of accounts payable | | - |

| Loss on extinguishment of debt | | - |

Total other expenses | $ | (305,636) |

| | | |

Net Income | $ | 2,045,955 |

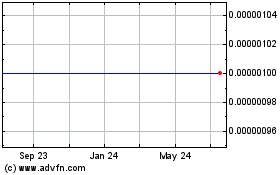

Dewmar International BMC (CE) (USOTC:DEWM)

Historical Stock Chart

From Mar 2024 to Apr 2024

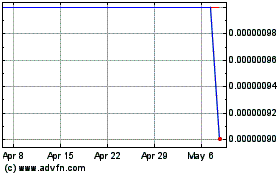

Dewmar International BMC (CE) (USOTC:DEWM)

Historical Stock Chart

From Apr 2023 to Apr 2024