Current Report Filing (8-k)

September 13 2019 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

September 13, 2019

Date of Report (Date of earliest event reported)

DESTINY MEDIA TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

|

NEVADA

|

000-28259

|

84-1516745

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1110 - 885 West Georgia

Vancouver, British Columbia, Canada

|

V6C 3E8

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(604) 609-7736

Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 3.03 Material Modification to Rights of Security Holders.

As previously announced, the Board of Directors (the "Board") of Destiny Media Technologies Inc. (the "Company") approved a reverse stock split of the Company's common stock, par value $0.001 (the "Common Stock") at a ratio of 1 for 5 (the "Consolidation"). The Consolidation is effective at 12:01 a.m. Pacific Time on September 13, 2019 (the "Effective Date"), and will begin trading on a split-adjusted basis at the open of business on the Effective Date. There will be no change to the Company's stock symbol.

On the Effective Date, every five shares of the Company's pre-consolidation common shares will be automatically converted into one post-consolidation common share. Any fractional shares resulting from the Consolidation will be rounded up to the nearest whole share. There will be no change in the par value per share. The Consolidation will also proportionately reduce the number of authorized shares of common stock from 100,000,000 common shares to 20,000,000 common shares.

Immediately after the Consolidation, each stockholder's percentage ownership interest in the Company and proportional voting power will remain unchanged except for minor adjustments resulting from the rounding up of fractional shares into whole shares. The rights and privileges of the holders of Common Stock will be unaffected by the Consolidation. All options, warrants, or other convertible securities of the Company outstanding immediately prior to the Consolidation will be proportionately adjusted.

On September 12, 2019, the Company filed Articles of Amendment (the "Amendment") with the Secretary of State of the State of Nevada to effect the Consolidation. The Amendment will become effective at the Effective Date as provided in the Amendment. The Consolidation was approved by the Board of Directors of the Company and given effect pursuant to and in accordance with NRS 78.207 and, as such, no stockholder approval of the Consolidation is required. A copy of the Amendment is attached as Exhibit 3.1 and is incorporated herein by reference.

In connection with the Consolidation, the Company's CUSIP number for its Common Stock will also change to 25063G 303.

Stockholders holding their shares in electronic form at a brokerage firm do not need to take any action in connection with the Consolidation. The effect of the Consolidation will automatically be reflected in their brokerage account. Stockholders holding paper certificates may, but are not required, to send the certificates to the Company's transfer agent, Transfer Online, Inc. at 512 SE Salmon St., Portland, OR 97214. The transfer agent will issue a new share certificate reflecting the Consolidation upon such request of the stockholder.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

The information set forth in Item 3.03 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 5.03. A copy of the Certificate is filed as Exhibit 3.1 to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosures.

The Company issued a press release announcing the Consolidation and a Normal Course Issuer Bid on September 12, 2019, a copy of which is furnished herewith as Exhibit 99.1. Exhibit 99.1 is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section.

Item 8.01 Other Events.

2

The Normal Course Issuer Bid will commence effective September 16, 2019 and terminate on or about September 15, 2020. Pursuant to the Normal Course Issuer Bid, the Company may purchase up to a maximum of 550,140 post-Consolidation Shares, representing approximately 5% of the then-outstanding common shares. No more than 2% of the outstanding common shares will be purchased in any 30-day period. Purchases pursuant to the Normal Course Issuer Bid will be made from time to time by RBC Dominion Securities Inc. on behalf of the Company through the facilities of the TSX Venture Exchange at the market price at the time of purchase, subject to daily limits and compliance with the applicable rules of the TSX Venture Exchange and Canadian securities laws. Shares purchased will be paid for with cash available from the Company's working capital. No insiders of the Company intend to participate in the Normal Course Issuer Bid.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

DESTINY MEDIA TECHNOLOGIES INC.

|

|

|

|

|

|

Date: September 13, 2019

|

|

|

|

|

By:

|

/s/ FRED VANDENBERG

|

|

|

|

FRED VANDENBERG

|

|

|

|

Chief Executive Officer, President and Secretary

|

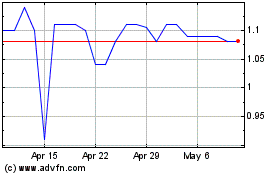

Destiny Media Technologies (QB) (USOTC:DSNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

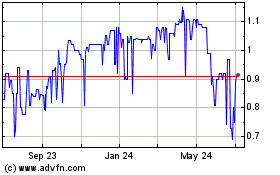

Destiny Media Technologies (QB) (USOTC:DSNY)

Historical Stock Chart

From Apr 2023 to Apr 2024