THE PREMIUM SERVICE FOR SUBSCRIBERS OF

VALUE-DEPESCHE - August 23rd 2021

Defence

Therapeutics

The vaccination specialist is about to become

popular

The

biotech company is developing vaccines against cancer and Corona. A

vaccine against cancer is expected to be launched in late 2022, and

one against Corona in early 2023. The share is about to become

popular.

Since Biontech and Moderna with

their novel vaccines against viruses, cancer has also come back

into focus. The two companies now also want to develop a vaccine

against cancer and this is boosting their share price. What about

Covid-19 18 months ago? At that time, the two biotech companies

were on the hook to develop a vaccine against the virus and after

announcing these activities, their shares went through the roof

within a few weeks or within two or three months. The mere fact of

"developing a vaccine against Covid" brought the two stocks an

increase in price of + 100 % and more in a short time.

Even before the price surge, Biontech and Moderna were companies

with market values of EUR 5.0 and 10.0 billion

respectively.

As announced a week ago, I have now

unearthed another promising player from that sector for you. Unlike

Biontech and Moderna, however, with valuations in the billions even

before the market launch of a Covid vaccine and the announcement of

its development, this company is only worth EUR 165 million on

the stock market.

"For the time being" is all I can

say. Because my review of Defence Therapeutics has tremendous

prospects! I expect the share price to multiply within the next two

years!

I expect the share price to exceed

10 euros by 2022 at the latest!

The Vancouver biotech company is

working not only on vaccines against infectious diseases and

viruses, but also on a vaccine against cancer and against

Covid-19.

Defence Therapeutics works with a

specially developed platform to potentiate treatment options, for

example against cancer, using ADC antibody-drug conjugates.

Compared to conventional cancer treatments using chemotherapy and

radiation these ADCs have low side effects and act very

specifically against a tumor. ADCs consist of a highly potent toxin

that is coupled with an antibody and, when administered, is

absorbed by a tumor cell which is then killed by the toxin in the

ADC.

The technology developed by Defence

increases the active ingredient of the ADC by a factor of ten in

some cases. The technology has already been successfully tested on

mice and various studies in the approval process with the US Food

and Drug Administration (FDA) are scheduled for the coming months

and quarters.

Well-informed quarters assume that

Defence will launch its first vaccine against cancer by the end of

2022. Defence's platform, together with the corresponding ADC-based

drugs, can be used to develop new active substances relatively

easily and quickly, but also compounds against a wide range of

other diseases.

Industry experts believe that

Defence will have a total of five compounds, for various types of

cancer and infectious diseases, on the market by 2025, i.e. in four

years' time.

That's not all. I have heard from

well-informed sources that the Canadians are working at high speed

to develop a vaccine against Corona. Well-informed sources are 100%

sure that Defence will successfully launch a vaccine on the market.

This should be as early as the first half of 2023, possibly as

early as the beginning of the year.

Conclusion: I see a similar development

coming for Defence as for Biontec and Moderna. In just a few years,

the company could become a billion-dollar corporation. If further

development successes are achieved with the first cancer drug or

the vaccination against Corona, a licensing partnership with a

large pharmaceutical company or even a takeover could be possible.

In the case of a licensing partnership, I believe upfront payments

for Defence of several hundred million dollars are possible as

early as next year. In the event of a takeover, far more could be

paid. In the next two to three years, I expect Defence to have a

market capitalization of more than EUR 1.0 billion euros.

Today it is EUR 165 million. A clear buy for all

risk-loving investors

Risk notice/disclaimer/transparency

notice/other:

All information provided in this newsletter has

been carefully researched and comes from sources we believe to be

reliable. Nevertheless, even the editors may be subject to

misinformation or incorrect information may arise from other

circumstances. All information is therefore provided without

warranty. Liability for lost profits or other financial losses is

therefore excluded. Good results in the past do not guarantee

positive results in the future. This also explicitly applies to any

form of share transactions, in particular option and warrant

transactions: Shares, options and certificates are subject to

various influencing factors. Therefore, it is pointed out that the

investment in shares, options, etc. involves speculative risks

which, depending on the development of the influencing factors, may

lead to losses, in the worst case even to a total

loss.

It is expressly advised against spreading

investment funds over only a few investments or taking out loans

for this purpose. As a precaution, we draw your attention to the

fact that the editorial reviews in VALUE-DEPESCHE cannot replace

individual investment advice from your investment advisor or

investment consultant. The reviews are addressed to all

subscribers/subscribers and readers of our stock letter, who are

very different in their investment behavior and investment

objectives. Therefore, the reviews of this stock letter do not take

into account your personal investment situation in any way. The

investments discussed in VALUE- DEPESCHE are for information purposes

only and do not constitute an invitation to buy or sell

securities.

Members of the editorial team advise investment

products. The securities discussed in VALUE-DEPESCHE or Hot Stock

are part of the investment universe of the product. Members of the

editorial staff, their affiliates or related parties may hold a

long or short position of securities described in VALUE-DEPESCHE

publications and/or options, futures and other derivatives based on

those securities, or other investments related to information

published in the articles. Members of the editorial staff may

advise or have advised the companies mentioned in the articles or

may have a business relationship of some other

kind.

Despite careful control of the content, we assume

no liability for the content of external links. The operators of

the linked pages are solely responsible for their

content.

Subscription

and cancellation

Subscription to Value-Depesche costs EUR 420 (CHF

450) for an annual subscription and EUR 280 (CHF 300) for a

semi-annual subscription. Hot Stock, exclusively for VALUE-DEPESCHE

subscribers, costs EUR 325 (CHF 340). If the service is not

cancelled in writing up to three months before the end of the

subscription period (the easiest way is to send an e-mail to:

leserbrief@value- depesche.ch), the subscription is extended by the last

agreed subscription period of one year or six months at the then

current regular subscription price.

Copyright as well as all publishing rights and

copyrights to "Value-Depesche" and Hot Stock are held by Georg

Pröbstl. Reprints and copies, including excerpts, only with the

written consent of the editors.

Charts courtesy of vwd-group (www.vwd.com)

Data protection: Information on data protection can be

found at http://value-

depesche.ch/content/impress

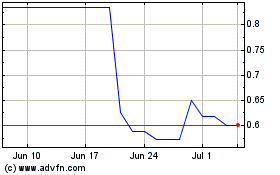

Defence Therapeutics (QB) (USOTC:DTCFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Defence Therapeutics (QB) (USOTC:DTCFF)

Historical Stock Chart

From Apr 2023 to Apr 2024