Current Report Filing (8-k)

December 15 2020 - 5:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 9, 2020

MITESCO, INC.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

000-53601

|

|

87-0496850

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

7535 East Hampden Avenue, Ste. 400

Denver, Colorado 80231

|

|

(Address of principal executive offices) (Zip Code)

|

(844) 383-8689

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

N/A

|

N/A

|

N/A

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into Material Definitive Agreement

|

Sale and Issuance of Eagle Equities, LLC Term Note

Mitesco, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “SPA”) and 12% Convertible Redeemable Note due December 9, 2021 (the “Note”), each dated December 8, 2020, and funded on December 9 2020, with Eagle Equities, LLC. The aggregate principal amount of the new note is $220,000, it carries a 12% interest rate and has a maturity date of twelve (12) months from the date of execution. The Company may prepay the note, and management intends to fulfill this option, at a premium of 110% to 140% of principal and interest between the date of issuance and 180 days thereafter. Should the note not be paid in full, any remaining balance, at any time after 180 days after issuance may be convertible into the Company’s common stock at a conversion price for each share of common stock equal to 70% of the lowest traded price of the Company's common stock for the 20 prior trading days including the day upon which a notice of conversion is received by the Company.

Item 1.01 of this Current Report on Form 8-K contains only a brief description of the material terms of the Note and SPA, and does not purport to be a complete description of the rights and obligations of the parties thereunder, and such descriptions are qualified in their entirety by reference to the full text of the Note and SPA, filed as Exhibits 4.01 and 10.01, respectively, to this Current Report on Form 8-K, and are incorporated herein by reference.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 above with respect to the Company entering into the Note with Eagle Equities, LLC is hereby incorporated by reference into this Item 2.03, insofar as it relates to the creation of a direct financial obligation of the Company.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The applicable information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02. The issuance of the securities set forth herein was made in reliance on the exemption provided by Section 4(a)(2) of the Securities Act for the offer and sale of securities not involving a public offering. The recipient of the Note is an accredited investor.

|

Item 7.01

|

Regulation FD Disclosure.

|

On October 15, 2020, the Company issued a press announcing that it has entered into two (2) letters of intent with Lennar Corporation which call for the expansion of its “The Good Clinic” business operation into the Denver, Colorado marketplace.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information presented in Item 7.01 of this Current Report on Form 8-K and Exhibit 99.1 is being furnished and shall not be deemed filed for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise be subject to the liabilities of that section, nor is it incorporated by reference into any filing of the Company, under the Securities Act of 1933, or the Securities Exchange Act of 1934, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Plans to expand “The Good Clinic” into the Denver, Colorado marketplace

The Company has executed two (2) Letter of Intent agreements with a division of Lennar Corporation calling for the expansion of its “The Good Clinic” operations into two (2) sites being developed by Lennar in the Denver, Colorado marketplace. The Company has previously announced its nationwide expansion plans to include up to fifty (50) clinic sites over the next three (3) years, contingent on the availability of suitable financing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MITESCO, INC.

|

|

|

|

|

|

Date: December 15, 2020

|

By:

|

/s/ Lawrence Diamond

|

|

|

|

|

Lawrence Diamond

|

|

|

|

Chief Executive Officer and Interim Chief Financial Officer

|

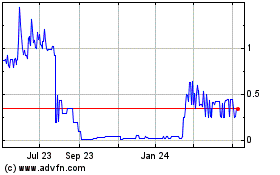

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Mar 2024 to Apr 2024

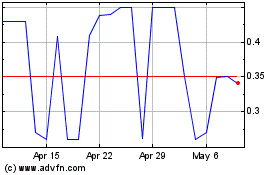

Mitesco (PK) (USOTC:MITI)

Historical Stock Chart

From Apr 2023 to Apr 2024