UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The

Securities Exchange Act of 1934

(Amendment No. 2)

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

x

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Under Rule 14a-12

|

CytoDyn Inc.

(Name of Registrant as Specified in Its Charter)

PAUL A. ROSENBAUM

JEFFREY PAUL BEATY

ARTHUR L. WILMES

THOMAS J. ERRICO, M.D.

BRUCE PATTERSON, M.D.

PETER STAATS, M.D., MBA

MELISSA YEAGER

CCTV PROXY GROUP, LLC

(Name of Persons(s) Filing Proxy Statement, if

Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

¨ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee

was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

DATED OCTOBER 5, 2021

CYTODYN INC.

SUPPLEMENT NO. 2 TO

PROXY STATEMENT

OF

PAUL A. ROSENBAUM

JEFFREY P. BEATY

ARTHUR L. WILMES

The following supplements

and amends the definitive proxy statement (the “Definitive Proxy Statement”) filed with the Securities and

Exchange Commission (the “SEC”) on August 18, 2021 and first supplemented on September 17, 2021 (the Definitive Proxy Statement, as may be amended and supplemented,

the “Proxy Statement”) by Paul A. Rosenbaum, Jeffrey P. Beaty, Arthur Wilmes, Thomas J. Errico, M.D., Bruce

Patterson, M.D., Peter Staats, M.D., MBA, Melissa Yeager and CCTV Proxy Group, LLC (together, the “Participants”)

in connection with their solicitation of proxies (the “Proxy Solicitation”) from the stockholders of CytoDyn

Inc., a Delaware corporation (“CYDY” or the “Company”), for the election of five

highly qualified director candidates to the board of directors (the “Board”) of the Company at the Company’s

annual meeting of stockholders scheduled to be held online via a live webcast at 8:00 a.m., Pacific Time, on Thursday, October 28, 2021

(including any adjournments or postponements thereof, the “Annual Meeting”).

Except as described in this

supplement, the information provided in the Proxy Statement continues to apply and this supplement should be read in conjunction with

the Definitive Proxy Statement and the First Supplemental Proxy Statement, as defined below. To the extent the following information differs from, updates or conflicts with information contained in the Definitive Proxy Statement or the First Proxy Statement Supplement, the supplemental information below is more current. Capitalized terms used herein, but not otherwise defined, shall have the

meanings set forth in the Proxy Statement.

PLEASE SIGN, DATE AND MAIL

THE ENCLOSED WHITE PROXY CARD TODAY

We, the Participants,

are the beneficial owners of an aggregate of 6,087,946 shares, or approximately 1% of the outstanding common stock, par value $0.001 per

share (the “Common Stock”), of CytoDyn Inc., a Delaware corporation. We are sending this proxy statement supplement

(the “Proxy Supplement”) and accompanying WHITE proxy card in connection with the solicitation of proxies in

connection with the Company’s 2021 Annual Meeting of Stockholders scheduled to be held online via a live webcast at 8:00 a.m., Pacific

Time, on Thursday, October 28, 2021.

The Participants

filed their Definitive Proxy Statement on August 18, 2021. The Participants filed a supplement to the Definitive Proxy Statement with

the SEC on September 17, 2021 (the “First Proxy Statement Supplement”). The Company filed its preliminary

proxy statement for the Annual Meeting with the SEC on September 24, 2021 (the “Company Proxy Statement”).

This Proxy Supplement discloses certain information about the Annual Meeting included in the Company Proxy Statement that had not been

publicly available at the time we filed our Definitive Proxy Statement. Notwithstanding the foregoing, the Company has not yet disclosed

certain information concerning the Annual Meeting, including the instructions for pre-registering for the meeting. Once the Company publicly

discloses this information, we intend to further supplement our Definitive Proxy Statement to disclose such information and file revised

definitive materials with the SEC.

This

Proxy Supplement is dated October 5, 2021, and is first being furnished to stockholders on or about October 7, 2021. This Proxy

Supplement should be read in conjunction with the Definitive Proxy Statement and the First Proxy Statement Supplement. Defined terms

used but not defined below have the meanings ascribed to them in the Definitive Proxy Statement or the First Proxy Statement Supplement. Except as updated or supplemented

by this Proxy Supplement, all information set forth in the Definitive Proxy Statement remains unchanged and should be considered in

casting your vote at the Annual Meeting.

According to the

Company Proxy Statement, the Annual Meeting is scheduled to be held online via a live webcast at 8:00 a.m., Pacific Time, on Thursday,

October 28, 2021. The Annual Meeting will be held in a virtual meeting format only via live webcast at www.cesonlineservices.com/cydy_vm.

Attendance at the Annual Meeting or any adjournment or postponement thereof will be limited to stockholders of the Company as of the close

of business on the record date and guests of the Company. You will not be able to attend the Annual Meeting in person at a physical location.

In order to attend the virtual meeting, you will need to pre-register at www.cesonlineservices.com/cydy_vm by 8:00 a.m. Pacific Time on

Wednesday, October 27, 2021.

The Company has set the

record date for determining shareholders entitled to notice of and to vote at the Annual Meeting (the “Record

Date”) as September 1, 2021. Shareholders of record at the close of business on the Record Date will be entitled to

vote at the Annual Meeting. According to the Company Proxy Statement, as of the record date, the Company had 651,746,095 shares of

Common Stock outstanding.

As disclosed in

the accompanying WHITE proxy card, we are soliciting proxies to vote on the following proposals at the Annual Meeting:

|

Proposal

|

|

Our Recommendation

|

|

1.

|

Election of the Investor Group’s five

director nominees, Thomas Errico, M.D., Bruce Patterson, M.D., Paul A. Rosenbaum, Peter Staats, M.D. and Melissa Yeager (each a “Nominee”

and, collectively, the “Nominees”) to hold office until the 2022 Annual Meeting of Stockholders (the “2022

Annual Meeting”) and until their respective successors have been duly elected and qualified.

|

|

FOR ALL

|

|

2.

|

The Company’s proposal to ratify, on an advisory

(non-binding) basis, the selection of Warren Averett, LLC as the Company’s independent registered public accounting firm for

the fiscal year ending May 31, 2022.

|

|

NO RECOMMENDATION

|

|

3.

|

The Company’s proposal to approve, on an advisory (non-binding) basis, the compensation of the Company’s named executive officers.

|

|

AGAINST

|

|

4.

|

The Company’s proposal to amend the Company’s Certificate

of Incorporation to increase the total number of authorized shares of common stock from 800,000,000 to 1,000,000,000.

|

|

AGAINST

|

|

5.

|

The transaction of any other business as may properly

come before the Annual Meeting or any postponements or adjustments thereof.

|

|

|

As disclosed in

our Definitive Proxy Statement, we anticipated that the Company Proxy Statement would include Proposals 1, 2 and 3 on the agenda for the

Annual Meeting and that the Company Proxy Statement would disclose certain details and additional information regarding such proposals.

Additionally, the Company has added a new Proposal 4, seeking stockholder approval to amend the Company’s Certificate of Incorporation

to increase the total number of authorized shares of Common Stock from 800,000,000 to 1,000,000,000. Stockholders should refer to the

Company Proxy Statement for additional details regarding Proposals 1, 2, 3 and 4 and with respect to the Company’s six director

nominees.

We are seeking to

change a majority of the Board because we believe that the Board must be significantly reconstituted to ensure that the Company capitalizes

on the tremendous potential of Leronlimab. Through the Definitive Proxy Statement, as supplemented, and the enclosed WHITE proxy

card, we are soliciting proxies to elect our five Nominees. The Board is currently comprised of six directors. At the time of our stockholder

nominations, which were submitted timely prior to the deadline set forth in the Company’s Bylaws, the size of the Board was five

directors, and we nominated five nominees—constituting a full slate. Subsequent to the stockholder nomination submission deadline,

the Company announced that the Board had expanded its size to six directors. While we had expected the Company to nominate five directors

for election to the Board, the Company disclosed in the Company Proxy Statement, that it is nominating six directors. Because we are nominating

a majority of the present size of the Board, we cannot permit stockholders to vote for any of the Company’s nominees on our WHITE

proxy card. If the Board size remains at six directors, at a minimum, the one Company nominee receiving the highest vote, will be elected.

We reserve the right to make an additional nomination to complete the slate. The names, backgrounds and qualifications and other information

for the Company’s nominees can be found in the Company Proxy Statement. There is no assurance that any of the Company’s

nominees will serve as directors if any or all of our Nominees are elected.

Even

if you previously submitted a proxy card, we urge you to fill out and submit the enclosed WHITE proxy card today. The WHITE

proxy card enclosed with this Proxy Supplement differs from the proxy cards previously furnished to you in that the enclosed WHITE

proxy card reflects the Company’s new Proposal 4 to amend the Company’s Certificate of Incorporation to increase the number of

authorized shares of Common Stock by 25%. Any proxy card or voting instruction form may be revoked at any time prior to its exercise

at the Annual Meeting as described in the Definitive Proxy Statement. Only your latest dated and signed proxy card or voting form

will be counted. If you would like to oppose the possible dilution of your shares and vote for our Nominees, you must fill out

and submit the enclosed WHITE proxy card. WE URGE YOU TO DISREGARD AND DISCARD, AND NOT TO VOTE, ANY PROXY CARD THAT YOU RECEIVE

FROM THE COMPANY.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently comprised of six directors.

At the time of our stockholder nominations, which were submitted timely prior to the deadline set forth in the Company’s Bylaws,

the size of the Board was five directors, and we nominated five nominees, constituting a full slate. Subsequent to the stockholder nomination

submission deadline, the Company announced that the Board had expanded its size to six directors. While we had expected the Company to

nominate five directors for election to the Board, the Company has disclosed in the Company Proxy Statement, that it has nominated six

directors. Because we are nominating a majority of the present size of the Board, we cannot permit stockholders to vote for any of the

Company’s nominees on our WHITE proxy card.

The six nominees for election as directors at the Annual Meeting who receive the highest number of affirmative votes properly cast will

be elected, provided that a quorum is present at the Annual Meeting. Stockholders are not permitted to cumulate their votes for the election

of directors. Votes may be cast for or withheld from the nominees for election as directors listed below as a group, or for or withheld

from each individual nominee. Shares that are not represented at the Annual Meeting, shares that are withheld, and broker non-votes will

have no effect on the outcome of the election.

We are seeking your support at the Annual Meeting to elect our five Nominees. If the Board

size remains at six directors, at a minimum, the one Company nominee receiving the highest vote, will be elected.

The following sets forth certain biographical information about our Nominees. Please see the Definitive Proxy

Statement for more information about our Nominees, and please see the Company Proxy Statement for information about the Company’s

nominees.

Thomas Errico, M.D.,

age 69, is a world-class surgeon, entrepreneur, and FDA consultant, and has served as Associate Director of Pediatric Orthopedic and

Neurosurgical Spine at Nicklaus Children’s Hospital Center for Spinal Disorders in Miami, Florida since January 2019, where

he specializes in pediatric spinal deformities. Prior to joining Nicklaus Children’s Hospital, Dr. Errico served for over

two decades as Chief of the Division of Spine at NYU Langone Medical Center. While working at NYU Langone, Dr. Errico co-founded

SpineCore, Inc. (“SpineCore”), a spine technology company focused on alleviating spinal pain without immobilizing

spinal segments. In 2004 SpineCore was sold to Stryker Corporation (“Stryker”). Dr. Errico also co-founded

electroCore, Inc. (“electroCore”), which specializes in neuromodulation. He led the company through venture

funding before and it’s 2018 IPO. He currently serves on the company’s board of directors and is its principal investor.

In 2004, Dr. Errico also co-founded K2M, a developer of innovative complex spine and minimally invasive spine technologies and techniques

used by spine surgeons to treat complicated spinal pathologies. K2M was acquired by Stryker in 2018. Formerly, Dr. Errico was the

Chief of the Division of Spine Surgery in the Department of Orthopedics at NYU Langone Medical Center and NYU Langone Orthopedic Hospital

from 1997 to 2018. Throughout his career, Dr. Errico has built a strong relationship with the FDA, developing over 150 patents and

serving as a consultant to companies including Pfizer and Howmedica. Additionally, he has served as president of the North American Spine

Society and the International Society for the Advancement of Spine Surgery and was instrumental in founding the International Association

of Spine Patients. Dr. Errico received his undergraduate degree from Rutgers University before completing a residency in orthopedics

at NYU Langone Medical Center and a fellowship in spine surgery at Toronto General Hospital in Canada. The Investor Group believes Dr. Errico’s

medical and FDA expertise, as well as his industry knowledge, will make him a valuable addition to the Board.

Bruce Patterson, M.D., age 63, is a leading

authority on the effects of viral pathogens on the human immune system. He is currently serving as Founder and, since October 2009,

Chief Executive Officer of IncellDx, a leading biotechnology molecular diagnostics company. In this role, Dr. Patterson has pioneered

technologies that have led to advances in detection, prognosis, and treatment of patients infected with HIV, HPV, cervical cancer, COVID-19,

and other diseases. Dr. Patterson has also created companion diagnostics for FDA clinical trials run by Merck, Pfizer, and others,

and has 91 issued and pending patents worldwide. Dr. Patterson previously served as an Associate Professor and Medical Director of

Diagnostic Virology at Stanford University Hospitals and Clinics, where he was also Director of Clinical Virology, and Co-Director of

the AIDS Research Center. While at Stanford, Dr. Patterson was selected by his peers to enroll in the esteemed Physician Leadership

Program taught by Stanford’s Graduate School of Business faculty. Dr. Patterson graduated from the University of Michigan with

a Bachelor of Science in microbiology and received his M.D. from The Feinberg School of Medicine at Northwestern University. The Investor

Group believes that Dr. Patterson’s medical and industry expertise will make him a valuable addition to the Board.

Paul A. Rosenbaum, age 78, is the Founder

and Chief Executive Officer of SWR, which designs, sells, and markets specialty industrial chemicals. Prior to SWR, Mr. Rosenbaum

was Chief Executive Officer and Chairman of the Board of Directors of global media measurement and research company Rentrak Corporation

from September 2000 until June 2009, a NASDAQ-company, before being sold to comScore. Mr. Rosenbaum was previously Chief

Partner at Rosenbaum Law Center, a private law firm specializing in corporate and administrative law. He also served in the Michigan Legislature

from 1972 to 1978, chairing the House Judiciary Committee, and served as legal counsel to Michigan’s Speaker of the House. Mr. Rosenbaum

currently sits on The Providence St. Vincent Medical Foundation Council of Trustees and The Providence Heart & Vascular Institute

Foundation Advisory Council. He was President of the Providence St. Vincent Medical Foundation Counsel of Trustees from 2015 to 2017.

He was also appointed by former Oregon governor Ted Kulongoski to serve on the nine-member Board of Commissioners for The Port of Portland,

and by current Oregon governor Kate Brown to serve as Chairperson of the Oregon Liquor Control Commission in March 2017 and continues

to serve in that position. Mr. Rosenbaum received his undergraduate degree from Springfield College and his graduate degree from

George Washington University. The Investor Group believes Mr. Rosenbaum’s legal expertise, as well as his industry knowledge,

will make him a valuable addition to the Board.

Melissa Yeager, age 67, is an expert in

pharmaceutical, medical device, and biotechnology regulatory affairs. Since 2020, Ms. Yeager has served as Principal of Regulatory

Consulting Group, a regulatory affairs and compliance consultant for development-stage biopharmaceutical companies and Senior Vice President

of Jaguar Health. In these roles, Ms. Yeager develops and reviews technical, preclinical, and clinical data for regulatory submission

to both U.S. and international agencies, and also serves as a regulatory and compliance liaison to global agencies. Ms. Yeager also

serves as the Operating Partner at Accelerator Life Science Partners, where she helps identify new investment areas and provides regulatory

support. From 2018 to 2019, Ms. Yeager was Senior Vice President of Regulatory Affairs at Alder Biopharmaceutics, Inc., where she

was the lead strategist for comprehensive regulatory approval pathways of biologic and neurologic products. She has also served as Chief

Regulatory Officer of Breath Therapeutics from 2017 to 2018, Chief Operating Officer of Cardeas Pharma Corporation from 2010 to 2016,

and Vice President of Regulatory Affairs at Gilead Sciences from 2003 to 2009. Ms. Yeager graduated from Stanford University with

a B.A. in Human Biology and earned her J.D. from Santa Clara University School of Law. She has served on the boards of the Burke Museum

of Natural History and Culture and the University of Washington Robinson Center Advisory Board. The Investor Group believes that Ms. Yeager’s

regulatory affairs and compliance expertise will make her a valuable addition to the Board.

Peter Staats, M.D., MBA, age 58, is one

of the world’s foremost pain management doctors, currently serving as Chief Medical Officer of electroCore (since 2017); Chief Medical

Officer of the National Spine and Pain Centers, the largest pain practice in the U.S. (since 2017); and President of the World Institute

of Pain (since 2020). In these roles, he helps develop and implement minimally invasive procedures for chronic pain, as well as neuromodulation

strategies. Dr. Staats began his career as a Physician at Johns Hopkins Hospital before founding the hospital’s Division of

Pain Medicine, in which he served as division chief and director for a decade. In this capacity, he was the youngest major division chief

in the history of Johns Hopkins Hospital and was the first anesthesiologist to obtain surgical privileges at any academic university in

the United States. Dr. Staats went on to become a founding partner of Premier Pain Centers, where he served as Co-Managing Partner

until its merger with the National Spine and Pain Centers, and Co-Founder of electroCore, along with Dr. Errico. Dr. Staats

has a long track record of working with the FDA, having served as the co-principal investigator on the largest randomized controlled trial

ever performed on intrathecal pumps, and principal investigator on the first large scale trial on a novel intrathecal agent for pain.

His patents have led to the use of novel pharmacologic agents, including Qutenza, Prialt, and Gammacore. Additionally, he currently serves

as president of the World Institute of Pain (“WIP”) and was previously chairman of the Board of Examination

of the WIP. He has also served as president of the North American Neuromodulation Society, American Society of Interventional Pain Physicians,

New Jersey Society of Interventional Pain Physicians, and the Southern Pain Society, and was selected to serve on the United States Health

and Human Services pain task force subcommittee, where he helped define appropriate treatment societies for pain in America. Dr. Staats

received his undergraduate degree from University of California Santa Barbara before earning his medical degree from the University of

Michigan Medical School. He went on to complete his residency and fellowship training at the Johns Hopkins University School of Medicine.

He also holds an MBA from Johns Hopkins. The Investor Group believes Dr. Staats’ medical expertise, his understanding of the

FDA and regulatory path and his familiarity with corporate governance will make him a valuable addition to the Board.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE

NOMINEES ON THE ENCLOSED WHITE PROXY CARD.

PROPOSAL NO. 2

ADVISORY VOTE ON

RATIFICATION OF

INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company Proxy Statement, the Company is conducting a non-binding, advisory vote for stockholders

to ratify the appointment of Warren Averett, LLC as the Company’s independent registered public accounting firm to

examine the Company’s financial statements for the fiscal year ending May 31, 2022. According to the Company Proxy Statement,

if the selection of Warren Averett, LLC is not ratified, the Audit Committee will reconsider its selection of Warren Averett, LLC.

Provided that a quorum

is present, this proposal will be approved by the majority of the votes properly cast on such matter. Shares that are not represented

at the Annual Meeting, abstentions and broker non-votes, if applicable, with respect to this proposal, will have no effect on the outcome

of the voting on this proposal.

WE MAKE NO RECOMMENDATION

WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

PROPOSAL NO. 3

ADVISORY VOTE ON

EXECUTIVE COMPENSATION

As discussed in further

detail in the Company Proxy Statement, the Company is conducting a non-binding, advisory vote to approve the compensation of

its executive officers in the fiscal year ended May 31, 2021. According to the Company Proxy Statement, the Board will take

into account the outcome of the vote when considering future executive compensation.

Provided that a quorum is present, this proposal

will be by the majority of the votes properly cast on such matter. Shares that are not represented at the Annual Meeting, abstentions,

and broker non-votes, if applicable, with respect to this proposal, will have no effect on the outcome of the voting on this proposal.

WE RECOMMEND A VOTE

“AGAINST” THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

PROPOSAL NO. 4

APPROVAL OF AMENDMENT

TO

CERTIFICATE OF INCORPORATION

The Board is submitting

for a vote of stockholders a proposal to amend the Certificate of Incorporation of the Company to increase the number of shares of Common

Stock authorized for issuance by 200,000,000 shares of Common Stock, bringing the total number of shares of common stock authorized from

800,000,000 to 1,000,000,000 shares. Additional information about this proposal and the full text of the proposed certificate of amendment

to the Company’s Certificate of Incorporation are contained in the Company Proxy Statement.

We oppose this

proposal with the current Board in place. If we successfully elect a majority of directors to the Board, we intend to re-evaluate the

need to increase the number of shares of common stock authorized for issuance.

Provided that a

quorum is present, this proposal will be approved by the affirmative vote of holders of a majority of the shares of common stock outstanding

and entitled to vote. Abstentions and broker non-votes, if applicable, will have the same practical effect as a vote against this proposal.

WE RECOMMEND A VOTE

“AGAINST” THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “AGAINST” THIS PROPOSAL.

OTHER SUPPLEMENTAL DISCLOSURES

Expenses of the Solicitation

CCTV estimates that through the date hereof its expenses in furtherance of, or in connection with, the solicitation are approximately

$2.5 million. CCTV may seek reimbursement from the Company of all or a portion of the expenses it incurs in connection with this solicitation

but does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

In addition to the individuals named in the First Proxy Statement Supplement, the following individuals have contributed additional funds

to CCTV: Lance Tullius, Arlyn Bossenbrook and Francesco Tosco and are “Contributing Persons,” as such term is defined in the

First Proxy Statement Supplement.

Other than Paul Rosenbaum, Dr. Errico, Dr. Staats, Mr. Beaty and Mr. Wilmes, the persons who have contributed funds to

CCTV have no involvement, control or ability to influence the solicitation being conducted by the Investor Group. None of the Gifting

Persons or Contributing Persons have any right or expectation of the return or repayment of funds.

Stockholder Proposals

As disclosed in the Company

Proxy Statement, for the 2022 Annual Meeting, pursuant to the Company’s Bylaws, a proposal to take action at the

meeting may be made by any stockholder of record who is entitled to vote at the meeting and who delivers timely written notice. To be

considered timely, the notice must be received between June 30, 2022 and July 30, 2022, inclusive; provided that, if the 2022 Annual Meeting

is not first convened between September 28, 2022 and December 27, 2022, inclusive, then the notice must be delivered prior to the later

of (x) the ninetieth day prior to the meeting date or (y) the tenth day following the first public announcement of the meeting date.

In order to be eligible for

inclusion in the Company’s proxy materials for the 2022 Annual Meeting, pursuant to Rule 14a-8 under the Exchange

Act, any stockholder proposal to take action at such meeting must be received by May 13, 2022. Any such proposal should comply with the

SEC’s rules governing stockholder proposals submitted for inclusion in proxy materials. In addition, if the Company receives notice

of a stockholder proposal after May 13, 2022, the persons named as proxies in such proxy statement and form of proxy will have discretionary

authority to vote on such stockholder proposal.

Any proposals to take action

at the 2022 Annual Meeting of stockholders should be addressed to: Corporate Secretary, CytoDyn Inc., 1111 Main Street, Suite 660, Vancouver,

Washington 98660.

Additional Information

WE HAVE OMITTED FROM THIS

PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS INCLUDED IN THE COMPANY PROXY STATEMENT RELATING TO THE

ANNUAL MEETING BASED ON RELIANCE ON RULE 14A-5(C). THIS DISCLOSURE INCLUDES, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION

ON THE COMPANY’S DIRECTORS. WE TAKE NO RESPONSIBILITY FOR THE ACCURACY OR COMPLETENESS OF INFORMATION CONTAINED IN OR EXCERPTED

FROM THE COMPANY PROXY STATEMENT. EXCEPT AS OTHERWISE NOTED HEREIN, THE INFORMATION IN THIS PROXY STATEMENT CONCERNING THE COMPANY

HAS BEEN TAKEN FROM OR IS BASED UPON DOCUMENTS AND RECORDS ON FILE WITH THE SEC AND OTHER PUBLICLY AVAILABLE INFORMATION.

The information concerning

the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available

information. This Proxy Statement and all other solicitation materials in connection with this proxy solicitation will be available on

the internet, free of charge, on the SEC’s website at http://www.sec.gov/.

SCHEDULE I

The following table is reprinted

in its entirety from the Company’s Preliminary Proxy Statement filed with the SEC on September 24, 2021.1

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS,

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the beneficial ownership of Common Stock

as of September 1, 2021, by (i) each person or entity who is known by us to own beneficially more than 5 percent of the outstanding shares

of common stock, (ii) each director and director nominee, (iii) each named executive officer, and (iv) all current directors and executive

officers as a group.

|

Title of class

|

|

Name and Address of Beneficial Owner (1)

|

|

Amount and

Nature of

Beneficial

Ownership (2)

|

|

|

Percent

of Total

(3)

|

|

|

|

|

Directors and Executive Officers

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

Samir Patel, M.D. (4)

|

|

|

9,870,445

|

|

|

|

1.5

|

%

|

|

Common stock

|

|

Jordan G. Naydenov (5)

|

|

|

8,272,720

|

|

|

|

1.3

|

%

|

|

Common stock

|

|

Scott A. Kelly, M.D. (6)

|

|

|

4,049,048

|

|

|

|

*

|

|

|

Common stock

|

|

Nader Z. Pourhassan, Ph.D. (7)

|

|

|

2,649,955

|

|

|

|

*

|

|

|

Common stock

|

|

Nitya G. Ray, Ph.D. (8)

|

|

|

1,374,535

|

|

|

|

*

|

|

|

Common stock

|

|

Christopher P. Recknor, M.D. (9)

|

|

|

802,717

|

|

|

|

*

|

|

|

Common stock

|

|

Alan P. Timmins (10)

|

|

|

261,986

|

|

|

|

*

|

|

|

Common stock

|

|

Antonio Migliarese (11)

|

|

|

69,023

|

|

|

|

*

|

|

|

Common stock

|

|

Gordon A. Gardiner (12)

|

|

|

1,000

|

|

|

|

*

|

|

|

Common stock

|

|

All Current Directors and Executive Officers as a Group

|

|

|

27,351,428

|

|

|

|

4.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Director Nominees

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

Lishomwa C. Ndhlovu, M.D., Ph.D. (13)

|

|

|

50,000

|

|

|

|

*

|

|

|

Common stock

|

|

Harish Seethamraju

|

|

|

—

|

|

|

|

*

|

|

|

Common stock

|

|

Tanya Durkee Urbach

|

|

|

162,113

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beneficial owners of more than 5 percent:

|

|

|

|

|

|

|

|

|

|

Common stock

|

|

Schedule 13D Group led by Paul Rosenbaum (14)

|

|

|

47,066,484

|

|

|

|

7.67

|

%

|

|

*

|

Less than 1% of the outstanding shares of common stock.

|

|

(1)

|

Unless otherwise indicated, the business address of each current director and executive officer for purposes of beneficial ownership is c/o CytoDyn Inc., 1111 Main Street, Suite 660, Vancouver, Washington 98660.

|

1

Once the Company files its definitive proxy statement for the Annual Meeting, the Investor Group intends to supplement this

Proxy Statement to update such information, as necessary, and file revised definitive materials with the SEC.

|

(2)

|

Beneficial ownership includes shares of common stock as to which a person or group has sole or shared voting power or investment power. Shares of common stock subject to stock options and warrants that are exercisable currently or within 60 days of September 1, 2021, are deemed outstanding for purposes of computing the number of shares beneficially owned and percentage ownership of the person or group holding such stock options, warrants or convertible securities, but are not deemed outstanding for computing the percentage of any other person.

|

|

(3)

|

Percentages are based on 651,746,095 shares of common stock outstanding as of September 1, 2021.

|

|

(4)

|

Dr. Patel’s holdings include: (i) 7,333,116 shares of common stock and warrants covering 2,300,000 shares of common stock by a limited liability company for which Dr. Patel is the managing member and has voting and dispositive power; and (ii) 237,329 shares of common stock subject to an option held directly by Dr. Patel.

|

|

(5)

|

Mr. Naydenov’s holdings include: (i) 6,701,323 shares of common stock held directly by Mr. Naydenov; (ii) warrants covering 825,000 shares of common stock held directly by Mr. Naydenov; and (iii) 746,397 shares of common stock subject to options held directly by Mr. Naydenov.

|

|

(6)

|

Dr. Kelly’s holdings include: (i) 1,935,063 shares of common stock held directly by Dr. Kelly; (ii) a warrant covering 500,000 shares of common stock held directly by Dr. Kelly; (iii) 785,417 shares of common stock subject to options held directly by Dr. Kelly; (iv) 782,408 shares of common stock held by Dr. Kelly’s spouse; and (v) 46,160 shares of common stock held by Dr. Kelly, as custodian for his children.

|

|

(7)

|

Dr. Pourhassan’s holdings include: (i) 1,850,688 shares of common

stock held directly by Dr. Pourhassan; (ii) 783,567 shares of common stock subject to options held directly by Dr. Pourhassan; and (iii)

15,700 shares of common stock held by Dr. Pourhassan’s spouse.

|

|

(8)

|

Dr. Ray’s holdings include: (i) 153,968 shares of common stock held directly by Dr. Ray and (ii) 1,220,567 shares of common stock subject to options held directly by Dr. Ray.

|

|

(9)

|

Dr. Recknor’s holdings include: (i) 686,050 shares of common stock held directly by Dr. Recknor and (ii) 116,667 shares of common stock subject to options held directly by Dr. Recknor.

|

|

(10)

|

Mr. Timmins’s holdings include 261,986 shares of common stock subject to options held directly by Mr. Timmins.

|

|

(11)

|

Mr. Migliarese’s holdings include: (i) 3,023 shares of common stock held directly by Mr. Migliarese and (ii) 66,000 shares of common stock subject to options held directly by Mr. Migliarese.

|

|

(12)

|

Mr. Gardiner’s holdings include 1,000 shares of common stock held directly by Mr. Gardiner.

|

|

(13)

|

Dr. Ndhlovu’s holdings include 50,000 shares subject to options held directly by Dr. Ndhlovu.

|

|

(14)

|

Holdings are based upon a Beneficial Ownership Report on Schedule 13D filed on May 24, 2021, as amended on June 8, 2021 and July 2, 2021. After September 1, 2021, an “exit” amendment to the Schedule 13D was filed, which disclosed the dissolution of the Schedule 13D group.

|

IMPORTANT

Tell your Board what you think!

Your vote is important. No matter how many shares of Common Stock you own, please give the Investor Group your proxy FOR the election

of the Nominees and in accordance with the Investor Group’s recommendations on the other proposals on the agenda for the Annual

Meeting by taking three steps:

|

|

·

|

SIGNING the WHITE proxy card;

|

|

|

·

|

DATING the WHITE proxy card; and

|

|

|

·

|

MAILING the WHITE proxy card TODAY in the envelope previously provided (no postage is required

if mailed in the United States).

|

If any of your shares of Common

Stock are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such shares of Common Stock

and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free

telephone or by the Internet. Please refer to the voting form for instructions on how to vote electronically. You may also vote by signing,

dating and returning the enclosed WHITE voting form.

After submitting your vote

using the WHITE proxy card, WE URGE YOU NOT TO VOTE USING ANY PROXY CARD PROVIDED BY THE COMPANY, because only your latest

dated proxy card will be counted. Even if you return the Company proxy card marked “withhold” as a protest against the incumbent

directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our five nominees only on our

WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions,

require assistance in voting your WHITE proxy card, or need additional copies of the Investor Group’s proxy materials,

please contact Okapi Partners at the phone numbers or email address listed below.

Okapi Partners LLC

1212 Avenue of the Americas,

24th Floor

New York, New York 10036

Banks and Brokers Call Collect:

(212) 297-0720

All Others Call Toll Free: (844)

202-7428

E-mail: info@okapipartners.com

WHITE PROXY CARD

CYTODYN INC.

2021 ANNUAL MEETING OF STOCKHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF PAUL

A. ROSENBAUM, JEFFREY P.

BEATY, ARTHUR L. WILMES AND THE OTHER PARTICPANTS IN THEIR PROXY

SOLICITATION

THE BOARD OF DIRECTORS OF CYTODYN INC.

IS NOT SOLICITING THIS PROXY

PROXY

The undersigned appoints

Paul A. Rosenbaum (“Mr. Rosenbaum”), Jeffrey P. Beaty (“Mr. Beaty”) and Arthur L. Wilmes (“Mr.

Wilmes,” and together with Mr. Rosenbaum and Mr. Beaty, the “Investor Group”) and each of them, as attorneys and

agents with full power of substitution to vote all shares of common stock of CytoDyn Inc. (the “Company”) which the

undersigned would be entitled to vote if personally present at the 2021 Annual Meeting of Stockholders of the Company scheduled to

be held virtually on October 28, 2021 at 8:00 a.m. Pacific Time (including any adjournments or postponements thereof and any meeting

called in lieu thereof, the “Annual Meeting”).

The undersigned hereby revokes

any other proxy or proxies heretofore given to vote or act with respect to the shares of common stock of the Company held by the undersigned,

and hereby ratifies and confirms all action the herein named attorneys and proxies, their substitutes, or any of them may lawfully take

by virtue hereof. If properly executed, this Proxy will be voted as directed on the reverse and in the discretion of the herein named

attorneys and proxies or their substitutes with respect to any other matters as may properly come before the Annual Meeting that are unknown

to the Investor Group a reasonable time before this solicitation.

IF NO DIRECTION IS

INDICATED WITH RESPECT TO THE PROPOSALS ON THE REVERSE, THIS PROXY WILL BE VOTED “FOR ALL INVESTOR GROUP NOMINEES” IN

PROPOSAL 1, “AGAINST” PROPOSAL 2, “AGAINST” PROPOSAL 3 AND “AGAINST” PROPOSAL 4.

This Proxy will be valid until

the completion of the Annual Meeting. This Proxy will only be valid in connection with the Investor Group’s solicitation of proxies

for the Annual Meeting.

IMPORTANT: PLEASE SIGN, DATE AND MAIL THIS

PROXY CARD PROMPTLY!

CONTINUED AND TO BE SIGNED ON REVERSE SIDE

WHITE PROXY CARD

x Please mark

vote as in this example

THE INVESTOR GROUP STRONGLY RECOMMENDS THAT

STOCKHOLDERS VOTE IN

FAVOR OF THE NOMINEES LISTED BELOW IN PROPOSAL 1. THE INVESTOR GROUP

MAKES NO RECOMMENDATION WITH RESPECT TO PROPOSAL

2. THE INVESTOR

GROUP RECOMMENDS A VOTE “AGAINST” PROPOSAL 3 AND PROPOSAL 4.

|

|

1.

|

The Investor Group’s proposal to elect Thomas Errico, M.D., Bruce K. Patterson, M.D., Paul A. Rosenbaum,

Peter Staats, M.D. and Melissa A. Yeager, J.D. as directors of the Company.

|

|

|

FOR ALL INVESTOR GROUP NOMINEES

¨

|

WITHHOLD AUTHORITY

TO VOTE FOR

ALL INVESTOR GROUP

NOMINEES

¨

|

FOR ALL INVESTOR GROUP NOMINEES EXCEPT NOMINEE(S) WRITTEN

BELOW

¨

|

Nominees: Thomas Errico, M.D.

Bruce K. Patterson, M.D.

Paul A. Rosenbaum

Peter Staats, M.D.

Melissa A. Yeager, J.D.

|

|

|

|

The Investor Group does not

expect that any of the nominees will be unable to stand for election, but, in the event any nominee is unable to serve or for good cause

will not serve, the shares of common stock represented by this proxy card will be voted for substitute nominee(s), to the extent this

is not prohibited under the Company’s organizational documents and applicable law. In addition, the Investor Group has reserved

the right to nominate substitute person(s) if the Company makes or announces any changes to its organizational documents or takes or announces

any other action that has, or if consummated would have, the effect of disqualifying any nominee, to the extent this is not prohibited

under the Company’s organizational documents and applicable law. In any such case, shares of common stock represented by this proxy

card will be voted for such substitute nominee(s).

THE INVESTOR GROUP

INTENDS TO USE THIS PROXY TO VOTE “FOR ALL INVESTOR GROUP NOMINEES.” THERE IS NO ASSURANCE THAT ANY OF THE CANDIDATES

WHO HAVE BEEN NOMINATED BY THE COMPANY WILL SERVE AS DIRECTORS IF THE INVESTOR GROUP’S NOMINEES ARE ELECTED. BECAUSE THE INVESTOR GROUP IS

NOMINATING A MAJORITY OF THE PRESENT SIZE OF THE BOARD, THE INVESTOR GROUP CANNOT PERMIT STOCKHOLDERS TO VOTE FOR ANY OF THE COMPANY’S

NOMINEES ON THEIR WHITE PROXY CARD.

NOTE: If you do not wish for your shares

to be voted “FOR” a particular nominee, mark the “FOR ALL INVESTOR GROUP NOMINEES EXCEPT NOMINEE(S) WRITTEN

BELOW” box and write the name(s) of the nominee(s) you do not support on the line(s) above. Your shares will be voted for the

remaining nominee(s).

WHITE PROXY CARD

|

|

2.

|

Company’s proposal to ratify, on an advisory (non-binding) basis, the selection of Warren Averett, LLC as the Company’s independent

registered public accounting firm for the fiscal year ending May 31, 2022.

|

|

|

¨ FOR

|

¨ AGAINST

|

¨ ABSTAIN

|

|

|

3.

|

Company’s proposal to approve, on an advisory (non-binding)

basis, the compensation of the Company’s named executive officers.

|

|

|

¨ FOR

|

¨ AGAINST

|

¨ ABSTAIN

|

|

|

4.

|

Company’s proposal to amend the Company’s Certificate of Incorporation to increase the total

number of authorized shares of common stock from 800,000,000 to 1,000,000,000.

|

|

|

¨ FOR

|

¨ AGAINST

|

¨ ABSTAIN

|

|

DATED:

|

|

|

|

|

|

|

|

|

|

(Signature)

|

|

|

|

|

|

|

|

|

(Signature, if held jointly)

|

|

|

|

|

|

|

|

|

(Title)

|

|

WHEN SHARES ARE HELD JOINTLY, JOINT OWNERS

SHOULD EACH SIGN. EXECUTORS, ADMINISTRATORS, TRUSTEES, ETC., SHOULD INDICATE THE CAPACITY IN WHICH SIGNING. PLEASE SIGN EXACTLY AS NAME

APPEARS ON THIS PROXY.

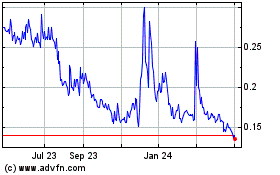

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

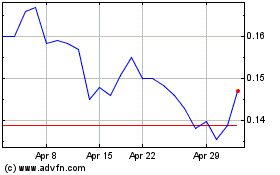

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024