Quarterly Report (10-q)

December 26 2018 - 4:54PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-Q

|

(Mark One)

|

|

[x] QUARTERLY

REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For

the Quarterly Period Ended October 31, 2018

|

|

Or

|

|

[ ] TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition

period from

to

|

Commission

file number 000-50693

Cyber Apps

World Inc.

(Name of Registrant

as Specified in Its Charter)

|

Nevada

(State

or Other Jurisdiction

of

Incorporation or Organization)

|

|

90-0314205

(I.R.S.

Employer

Identification

No.)

|

|

420

N. Nellis Blvd., Suite A3-146, Las Vegas, Nevada

(Address

of Principal Executive Offices)

|

|

89110

(Zip

Code)

|

|

(702) 425-4289

(Issuer’s

Telephone Number, Including Area Code)

|

Securities

registered under Section 12(b) of the Exchange Act:

None

Securities

registered under Section 12(g) of the Exchange Act:

Common Stock,

Par value $0.001per share

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. [x] No

Indicate

by checkmark if the registrant is not required to file reports to Section 13 or 15(d) Of the Act. [ ] Yes [x] No

Indicate

by check mark whether the issuer: (1) filed all reports required to be filed by Section 13 or 15(d) of the

Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. [ ] Yes [X ] No

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not

contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller

reporting company" in Rule 12b-2 of the Exchange Act.

Large

accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [x]

(Do

not check if a smaller reporting company)

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ X ] Yes [ ] No

On

October 31, 2018, there were 24,319,935 shares of common stock outstanding.

Table

of Contents

|

|

|

Page

No.

|

|

PART

I. FINANCIAL INFORMATION

|

|

1

|

|

|

|

|

|

ITEM

1 - Unaudited Financial Statements

|

|

1

|

|

|

|

|

|

Balance

Sheets as of October 31, 2018 and July 31, 2017 (Unaudited)

|

|

1

|

|

Statements

of Operations for the Three Months Ended October 31, 2018 and 2017 (Unaudited)

|

|

2

|

|

Statements

of Cash Flows for the Three Months Ended October 31, 2018 and 2017 (Unaudited)

|

|

3

|

|

Notes

to Unaudited Financial Statements

|

|

4

|

|

|

|

|

|

ITEM

2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

6

|

|

|

|

|

|

ITEM

3 - Quantitative and Qualitative Disclosures About Market Risk

|

|

7

|

|

|

|

|

|

ITEM

4 - Controls and Procedures

|

|

7

|

|

|

|

|

|

PART

II. OTHER INFORMATION

|

|

8

|

|

|

|

|

|

ITEM

6 – Exhibits

|

|

9

|

PART I FINANCIAL INFORMATION

Certain information

and footnote disclosures required under accounting principles generally accepted in the United States of America have been condensed

or omitted from the following financial statements pursuant to the rules and regulations of the Securities and Exchange Commission.

It is suggested that the following financial statements be read in conjunction with the year-end financial statements and notes

thereto included in the Company’s Annual Report on Form 10K for the year ended July 31, 2018. In the opinion of management,

all adjustments considered necessary for a fair presentation of the results of operations and financial position have been included

and all such adjustments are of a normal recurring nature.

The results

of operations for the three months ended October 31, 2018 and 2017 are not necessarily indicative of the results for the entire

fiscal year or for any other period.

Cyber Apps World, Inc.

Balance Sheets

(unaudited)

|

|

|

|

|

|

|

`

|

|

October 31, 2018

|

|

July 31, 2018

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

$

|

6,702

|

|

|

|

469

|

|

|

Total current assets

|

|

|

6,702

|

|

|

|

469

|

|

|

Property & Equipment, net

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

6,702

|

|

|

$

|

469

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Deficiency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$

|

100,550

|

|

|

$

|

101,536

|

|

|

Convertible Note Payable

|

|

|

29,767

|

|

|

|

29,767

|

|

|

Notes Payable

|

|

|

1,448

|

|

|

|

77,593

|

|

|

Loan Payable

|

|

|

100,000

|

|

|

|

—

|

|

|

Total Current Liabilities

|

|

|

231,765

|

|

|

|

208,896

|

|

|

Commitments and contingencies

|

|

|

—

|

|

|

|

—

|

|

|

Stockholders' deficiency:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.001 par value, 10,000,000 shares authorized, 0 issued and outstanding

|

|

|

—

|

|

|

|

—

|

|

|

Common stock, $.001 par value, 50,000,000 shares authorized as of July 31, 2018;

|

|

|

|

|

|

|

|

|

|

24,319,935 issued and outstanding at October31, 2018 and July 31

st

2018, respectively.

|

|

|

24,320

|

|

|

|

24,320

|

|

|

Additional paid-in capital

|

|

|

8,347,541

|

|

|

|

8,347,541

|

|

|

Accumulated deficit

|

|

|

(8,596,924

|

)

|

|

|

(8,580,288

|

)

|

|

Stockholders' deficiency

|

|

|

(225,063

|

)

|

|

|

(208,427

|

)

|

|

Total liabilities and stockholders' equity

|

|

$

|

6,702

|

|

|

$

|

469

|

|

|

`

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited financial statements

Cyber Apps World, Inc.

Statements of Operations

(unaudited)

|

|

|

For the Three Months Ended October 31,

|

|

|

|

2018

|

|

2017

|

|

Net Sales

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

16,636

|

|

|

|

(576

|

)

|

|

Research & Development

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

16,636

|

|

|

|

(576

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Income / (Loss) from operations

|

|

$

|

(16,636

|

)

|

|

$

|

576

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expenses)/ income

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income / (Loss) before provision for income taxes

|

|

$

|

(16,636

|

)

|

|

$

|

576

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for (benefit from) income taxes

|

|

|

—

|

|

|

|

—

|

|

|

Net Income / (Loss)

|

|

$

|

(16,636

|

)

|

|

$

|

576

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per common share- basic and diluted

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Weighted average number of common shares outstanding- basic and diluted

|

|

|

24,319,935

|

|

|

|

24,319,935

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited financial statements

Cyber Apps World, Inc.

Statements of Cash Flows

(unaudited)

|

|

|

|

|

|

|

|

|

Three Months Ended October 31,

|

|

|

|

2018

|

|

2017

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Net Income / (loss)

|

|

$

|

(16,636

|

)

|

|

$

|

576

|

|

|

Adjustments to reconcile net loss to net cash utilized in operating activities

|

|

|

|

|

|

|

|

|

|

Change in accounts receivable

|

|

|

—

|

|

|

|

—

|

|

|

Change in accounts payable and accrued expenses

|

|

|

(7,219

|

)

|

|

|

(25,895

|

)

|

|

Change in other receivable

|

|

|

—

|

|

|

|

—

|

|

|

Net cash used in operating activities

|

|

$

|

(23,855

|

)

|

|

$

|

(25,319

|

)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Loan Payable

|

|

$

|

100,000

|

|

|

$

|

—

|

|

|

Note Payable

|

|

|

(76,145

|

)

|

|

|

25,319

|

|

|

Net cash provided by financing activities

|

|

$

|

23,855

|

|

|

$

|

25,319

|

|

|

|

|

|

|

|

|

|

|

|

|

CHANGE IN CASH AND CASH EQUIVALENTS:

|

|

|

|

|

|

|

|

|

|

Net decrease in cash and cash equivalents

|

|

|

—

|

|

|

|

—

|

|

|

Cash and cash equivalents at beginning of year

|

|

|

—

|

|

|

|

—

|

|

|

Cash and cash equivalents at end of Period

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

NON-CASH SUPPLEMENTARY DISCLOSURES:

|

|

|

|

|

|

|

|

|

|

Cash paid for interest

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Cash paid for income taxes

|

|

$

|

—

|

|

|

$

|

—

|

|

The accompanying

notes are an integral part of these unaudited financial statements

NOTES TO

UNAUDITED FINANCIAL STATEMENTS

As of and

for the Three Ended October 31, 2018

(unaudited)

Note 1.

Summary of Significant Accounting Policies

Condensed

Interim Financial Statements –

The accompanying unaudited condensed financial statements include the accounts

of Cyber Apps World Inc. (the “Company”). These financial statements are condensed and, therefore, do not include

all disclosures normally required by accounting principles generally accepted in the United States of America. Therefore, these

statements should be read in conjunction with the most recent annual financial statements of Cyber Apps World for the year ended

July 31, 2018 included in the Company’s Form 10-K filed with the Securities and Exchange Commission. In particular, the

Company’s significant accounting principles were presented as Note 2 to the Financial Statements in that report. In

the opinion of management, all adjustments necessary for a fair presentation have been included in the accompanying condensed

financial statements and consist of only normal recurring adjustments. The results of operations presented in the accompanying

condensed financial statements are not necessarily indicative of the results that may be expected for the full year ending July

31, 2019.

Going Concern

The Company’s

financial statements for the period ended October 31, 2018, have been prepared on a going concern basis which contemplates the

realization of assets and settlement of liabilities and commitments in the normal course of business. The Company did not have

any revenue in and as of October 31, 2018. Management recognized that the Company’s continued existence is dependent upon

its ability to obtain needed working capital through additional equity and/or debt financing and revenue to cover expenses as

the Company continues to incur losses.

Since its

incorporation, the Company financed its operations almost exclusively through advances from its controlling shareholders. Management’s

plans are to finance operations through the sale of equity or other investments for the foreseeable future, as the Company does

not receive significant revenue from its business operations. There is no guarantee that the Company will be successful in arranging

financing on acceptable terms.

The Company's

ability to raise additional capital is affected by trends and uncertainties beyond its control. The Company does not currently

have any arrangements for financing and it may not be able to find such financing if required. Obtaining additional financing

would be subject to a number of factors, including investor sentiment. Market factors may make the timing, amount, terms or conditions

of additional financing unavailable to it. These uncertainties raise substantial doubt about the ability of the Company to continue

as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of

these uncertainties.

The Company’s

significant accounting policies are summarized in Note 1 of the Company’s Annual Report on Form 10-K for the year ended

July 31, 2018. There were no significant changes to these accounting policies during the three months ended October 31, 2018 and

the Company does not expect that the adoption of other recent accounting pronouncements will have a material impact on its financial

statements

Note 2.

Net Loss Per Common Share

Basic loss

per common share is computed based on the weighted average number of shares outstanding during the year. Diluted earnings per

common share is computed by dividing net earnings (loss) by the weighted average number of common shares and potential common

shares during the specified periods. The Company has no outstanding options or warrants that could affect the calculated number

of shares. Common stock equivalents related to convertible debt are detailed in Note 3.

Note 3.

Convertible Notes Payable and Notes Payable

As of July

31, 2018, the Company has a balance of convertible notes is $77,593 which is convertible into common stock at approx. $0.02 per

share. If all of the debt is converted it would result in the issuance of 3,879,650 common shares. The debt is due upon demand

and bears 0% interest.

As of October

31, 2018, the Company has several notes payable totaling $1,448, which are due upon demand and bear 0% interest.

Note 4. Subsequent Events

On November

6, 2018 Kateryna Malenko was appointed as Secretary and a member of the board of Directors. Twenty-five million two hundred thousand

shares of common stock were issued to Kat Consulting Corp. according to a private placement subscription agreement. The shares

of common stock issued at par $.001. Financial Impact of shares issued is $25,200 which is 25,200,000 shares @ $.001

ITEM 2.

Management’s Discussion and Analysis of Financial Conditions and Results of Operations.

Forward

Looking Statements

This quarterly

report contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate,

believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. You should not

place too much reliance on these forward-looking statements. Our actual results are likely to differ materially

from those anticipated in these forward-looking statements for many reasons, including the risks faced

by us described in this section.

Background

We were incorporated

on July 15, 2002 under the laws of the State of Nevada. On April 5, 2011, we merged with our wholly owned subsidiary, Sky Power

Solutions Corp., and in the merger the name of the Company was changed to Sky Power Solutions Corp. December 24, 2012

Sky Power Solutions merged with our wholly owned subsidiary, Clean Enviro Tech Corp., and in the merger changed the name of the

Company to Clean Enviro Tech Corp. On April 9, 2015 the Company merged with our wholly owned subsidiary Cyber Apps World Inc.

and in the merger changed the name of the Company to Cyber Apps World Inc. (CYAP)

Cyber

Apps World redirected the Company focus and intended to develop and acquire a worldwide e-commerce internet platform in which

revenues would be based on the purchase and sale of products and services by way of mobile/computer applications online.

Results

of Operations for the Three months Ended October 31, 2018 and 2017

As

of October 31, 2018 and 2017, we had cash on hand of $0 and $0 respectively. As there is no cash in hand, liquidity is managed

through Notes payable which are due on demand and bear 0% interest. During the period ended October 31, 2018 and 2017 we incurred

a net loss of $16,636 and a gain of $576 respectively. On October 31, 2018 and 2017, we had a working capital deficiency of $93,848

and $99,528 respectively and a stockholders' deficit of $225,063 and $208,427 respectively.

Plan

of Operations

After termination

of the Agreement, management is still looking into other opportunities and direction for the Company.

We do not have sufficient

revenues to sustain our operations.

We

have no revenues from operations. All funding is from a third party. We expect that we will continue to incur operating losses Failure

to achieve or maintain profitability may materially and adversely affect the future value of our common stock.

If we do not obtain additional

financing, our business will fail.

The

Company currently has no operating funds, all funding is from a third party. If funding from shareholders, third parties

or financing is not obtained we will not be able to launch the apps, and nor will we be able to complete our business plan.

We do not currently have any arrangements for financing and we may not be able to find such financing if required. Market factors

may make the timing, amount, terms or conditions of additional financing unavailable to us.

We have been the subject

of a going concern opinion from our independent auditors, which means that we may not be able to continue operations unless we

obtain additional funding.

Our

independent auditors have added an explanatory paragraph to their audit opinions, issued in connection with our financial

statements, which states that our ability to continue as a going concern is uncertain.

Item 4. Controls and Procedures.

As

supervised by our board of directors and our principal executive and principal financial officer, management has established a

system of disclosure, controls and procedures and has evaluated the effectiveness of that system. The system and its

evaluation are reported on in the below Management's Annual Report on Internal Control over Financial Reporting. Our principal

executive and financial officer has concluded that our disclosure, controls and procedures (as defined in Securities Exchange

Act of 1934 (“Exchange Act”) Rule 13a-15(e)) as of July 31, 2016, were not effective, based on the evaluation of these

controls and procedures required by paragraph (b) of Rule 13a-15.

Management's Annual Report

on Internal Control over Financial Reporting

Management

is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in

Rule 13a-15(f) of the Exchange Act. Internal control over financial reporting is a process designed to provide reasonable assurance

regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance

with U.S. generally accepted accounting principles.

Management

assessed the effectiveness of internal control over financial reporting as of July 31, 2015. We carried out this assessment using

the criteria of the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control—Integrated

Framework.

This

annual report does not include an attestation report of our registered public accounting firm regarding internal control over

financial reporting. Management's report was not subject to attestation by our registered public accounting firm, pursuant

to rules of the Securities and Exchange Commission that permit us to provide only management's report in this annual report.

Management concluded in this assessment that as of July 31, 2018, our internal control over financial reporting is not effective.

There

have been no significant changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f)

under the Exchange Act) during the fourth quarter of our 2015 fiscal year that have materially affected, or are reasonably

likely to materially affect, our internal control over financial reporting.

PART II—OTHER INFORMATION

Item 1. Legal Proceedings.

None

Item 2. Unregistered Sales of Equity

Securities and Use of Proceeds.

Private placement restricted shares

of 25,200,000 issued at $.001 per share with proceeds of $25,200 used towards working capital of the company.

Item 3. Defaults Upon Senior

Securities.

None

Item 4. Mine Safety

Not Applicable

PART II

Item 6.

Exhibits.

Copies of

the following documents are included as exhibits to this report pursuant to Item 601 of Regulation S-K.

|

|

SEC

Ref. No.

|

|

Title of Document

|

|

|

101.

|

INS

|

|

XBRL

Instance Document

|

|

|

101.

|

SCH

|

|

XBRL

Taxonomy Extension Schema Document

|

|

|

101.

|

CAL

|

|

XBRL

Taxonomy Calculation Linkbase Document

|

|

|

101.

|

DEF

|

|

XBRL

Taxonomy Extension Definition Linkbase Document

|

|

|

101.

|

LAB

|

|

XBRL

Taxonomy Label Linkbase Document

|

|

|

101.

|

PRE

|

|

XBRL

Taxonomy Presentation Linkbase Document

|

The XBRL related

information in Exhibits 101 to this Annual Report on Form 10-K shall not be deemed “filed” or a part of a registration

statement or prospectus for purposes of Section 11 or 12 of the Securities Act of 1933, as amended, and is not filed for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of those sections.

SIGNATURES

In accordance

with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Cyber Apps World, Inc.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Liudmilla

Voinarovska

|

|

|

|

|

Chief Executive Officer and Principal Financial

Officer

|

|

|

|

|

|

|

|

|

|

Date: December 26, 2018

|

|

In accordance with

the Securities Exchange Act, this report has been signed below by the following persons on behalf

of the registrant and in the capacities and on the dates indicated.

|

By:

|

|

/s/

Liudmilla Voinarovska

|

|

|

|

|

Liudmilla Voinarovska

|

|

|

|

|

(President, Chief Executive Officer and Director)

|

|

|

|

|

|

|

|

|

|

Date: December 26, 2018

|

|

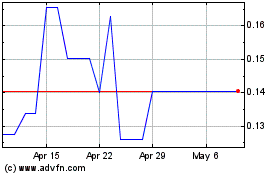

Cyber Apps World (PK) (USOTC:CYAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cyber Apps World (PK) (USOTC:CYAP)

Historical Stock Chart

From Apr 2023 to Apr 2024