UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10

General Form for Registration

of Securities of Small Business Issuers Under Section 12(g) of the Securities Exchange Act of 1934

CMG Holdings Group, Inc.

(Exact Name of Company as

Specified in Its Charter)

|

Nevada

|

|

87-0733770

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

2130 North Lincoln Park West 8N

|

|

|

|

Chicago,

IL

|

|

60614

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Company’s Telephone Number, Including

Area Code: (773) 770-3440

Securities

to be Registered Under Section 12(g) of the Act: Common Stock, $0.001

(Title of Class)

Indicate by check mark

whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or

an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

|

Non-accelerated filer ☐

|

|

Smaller reporting company ☒

|

|

|

Emerging Growth Company ☐

|

|

Emerging growth company ☐

|

If an emerging growth

company, indicate by check mark if the Company has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

|

|

TABLE OF CONTENTS

|

|

|

Item

|

|

Description

|

|

Page

|

|

ITEM 1.

|

|

DESCRIPTION OF BUSINESS

|

|

2

|

|

ITEM 1A.

|

|

RISK FACTORS

|

|

6

|

|

ITEM 2.

|

|

FINANCIAL INFORMATION

|

|

8

|

|

ITEM 3.

|

|

DESCRIPTION OF PROPERTY

|

|

9

|

|

ITEM 4.

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

|

|

|

|

|

|

RELATED SHAREHOLDER MATTERS

|

|

9

|

|

ITEM 5.

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

|

10

|

|

ITEM 6.

|

|

EXECUTIVE COMPENSATION

|

|

|

ITEM 7.

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

|

10

|

|

ITEM 8.

|

|

LEGAL PROCEEDINGS

|

|

10

|

|

ITEM 9.

|

|

MARKET PRICE OF AND DIVIDENDS ON THE COMPANY’S COMMON EQUITY AND RELATED

|

|

|

|

|

|

STOCKHOLDER MATTERS

|

|

10

|

|

ITEM 10.

|

|

RECENT SALES OF UNREGISTERED SECURITIES

|

|

11

|

|

ITEM 11.

|

|

DESCRIPTION OF COMPANY’S SECURITIES TO BE REGISTERED

|

|

11

|

|

ITEM 12.

|

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

|

12

|

|

ITEM 13.

|

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

13

|

|

ITEM 14.

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

|

|

|

|

|

|

FINANCIAL DISCLOSURE

|

|

28

|

|

ITEM 15.

|

|

FINANCIAL STATEMENT AND EXHIBITS

|

|

28

|

PART I

ITEM 1. DESCRIPTION OF BUSINESS

Some of the statements

contained in this registration statement on Form 10 of CMG Holdings Group, Inc. (hereinafter the “Company”, “we”

or the “Company”) discuss future expectations, contain projections of our plan of operation or financial condition

or state other forward- looking information. In this registration statement, forward-looking statements are generally identified

by the words such as “anticipate”, “plan”, “believe”, “expect”, “estimate”,

and the like. Forward-looking statements involve future risks and uncertainties, there are factors that could cause actual results

or plans to differ materially from those expressed or implied. These statements are subject to known and unknown risks, uncertainties,

and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking

information is based on various factors and is derived using numerous assumptions. A reader, whether investing in the Company’s

securities or not, should not place undue reliance on these forward-looking statements, which apply only as of the date of this

Registration Statement. Important factors that may cause actual results to differ from projections include, for example:

|

|

●

|

the success or failure of Management’s efforts to implement the Company’s plan of

operation;

|

|

|

●

|

the ability of the Company to fund its operating expenses;

|

|

|

●

|

the ability of the Company to compete with other companies that have a similar plan of operation;

|

|

|

●

|

the effect of changing economic conditions impacting our plan of operation;

|

|

|

●

|

the ability of the Company to meet the other risks as may be described in future filings with

the SEC.

|

General Background of the Company

CMG Holdings Group, Inc. (the

“Company” or “CMG”) was incorporated in the State of Nevada on July 30, 2004 under the name of “Pebble

Beach Enterprises, Inc.” From the date of incorporation until August 2004, it was a wholly-owned subsidiary of Fresh Veg

Broker.com, Inc. (“Fresh Veg”), a Nevada corporation. In August 2004, the Company was spun off from Fresh Veg. Until

May 27, 2008, the Company was a real estate investment company with three areas of operation: a) real estate acquisition and resale;

b) real estate development and resale; and c) real estate consulting and joint ventures. On February 20, 2008, a majority of the

shares of the Company were sold by the shareholders who were actively involved in the Company’s prior real estate business

(the “Change in Control”). Also, on February 20, 2008, the Company changed its name to “CMG Holdings, Inc.”

Since the Change in Control, the Company started to engage in the business of providing marketing, entertainment and management

services.

2

In October 2011, the Company changed

its name from “CMG Holdings, Inc.” to its current name “CMG Holdings Group, Inc.” to better reflect the

business of the Company.

The Company is a marketing

communications company focused on the operation of organizations in the alternative advertising, digital media, experiential and

interactive marketing, and entertainment. Our Company was formed by a core group of executives who have held senior level positions

with several of the largest companies in the entertainment and marketing management industry. Our Company delivers customized marketing

solutions at optimize profitability by concentrating our resources in those segments of the marketing communications and entertainment

industry. Our Company operates in the sectors of experiential marketing, event marketing, commercial rights, and talent management.

Experiential marketing includes

production and promotion, event designs, sponsorship evaluation, negotiation and activation, talent buying, show production, stage

and set designs, data analysis and management. We also offer branding and design services,

including graphic, industrial and package designs across traditional and new media, public relations, social media, media development

and relations and interactive marketing platforms to provide our clients with a customary private digital media networks to design

and develop individual broadcasting digital media channels for our clients to sell, promote and enhance their digital media video

contents through mobile, online and social mediums.

Below is the business description of XA, The Experiential

Agency, Inc., our wholly-owned subsidiary.

X

A, The Experiential Agency,

Inc. (“XA”)

Overview

XA, The Experiential Agency, Inc.

(“XA”) is the Company’s wholly-owned subsidiary engaged in event marketing and management. XA was acquired by

the Company on April 1, 2009. It engages in a diverse range of marketing services, including interactive event strategy and planning,

creative development, and nontraditional out of home marketing. XA has staged movie and show premiers, cross country tours, hosted

VIP events, staged press stunts, and other types of media events and services for leading shows, production houses, luxury fashion

brands, nonprofit agencies and local communities across the United States. In addition to the physical event planning, logistics

and event implementation, XA also engages in the interactive side of the events to increase branding awareness over the Internet.

XA’s

strong competitive advantage are (i) its long term presence and it is in its 31st year as a successful top tier event marketing

agency, (ii) its outstanding long-term vendor relationships that help deliver exceptional

programs to its clients, and

(iii)

the vertical integration that gives its clients a single source for all their event marketing

needs, which we believe will require less outsourcing and increased profitability

and delivering superior customer service and creates one of a kind events and programs.

Business Model

Rooted in brand creativity

and client partnerships, XA maintains unique client relationships by anticipating client challenges and providing innovative solutions.

The XA business model is taking strategic marketing programs to new levels of audience experience through alternative advertising

and experiential marketing and interactive media solutions. The XA marketing capabilities enable their clients and audience to

“experience” events compared to just hearing or seeing their client’s messages through holistic experiences to

boost sales and increase brand awareness and customer affinity.

While XA continues to seek

opportunities and win projects from Fortune 100 clients in the larger enterprise segment, we believe that rapid revenue growth

opportunities and margin improvements are available in the comprehensive advisory services of the small to medium enterprise (SME)

segment. The SME market has many smaller firms that specialize in only a few aspects of the event marketing and business communications

segments, yet SME’s face equally important challenges in terms of brand building

and content management. By acting as a comprehensive integrated single source for the total marketing needs of the SMEs, XA has

created a niche for itself on a national scale and will replicate the same success strategy internationally under the Company’s

holding company model. Given the fact that brand marketers are demanding a full-service agency for developing and executing integrated

marketing campaigns, we believe that XA will take advantage of the accelerating secular trend of shifts in corporate emphasis toward

online event/promotional marketing versus traditional media driven selling efforts. XA is specifically focused on strategically

target key segments within the event marketing space in order to capture market share in its existing geographic locations as well

as enhance its national and international presence. XA is positioning itself as the one of the few source marketing partners in

the market with its unique selling point being the ability to act as a source for the client’s total marketing needs. This

would encompass the entire spectrum of services associated with marketing, from strategizing and defining an event portfolio, conceptualization

of the event theme and content creation to the final implementation/management of events. XA will also provide an ultimate client

return on investment assessment following each implementation.

3

Market Strategy

Through our wholly-owned

subsidiary, XA, an integrated experiential marketing services company, we develop, manage and execute sales promotion programs

at both national and local levels, utilizing both online and offline marketing programs. Our programs assist our clients effectively

and promote their platforms and services directly to retailers and consumers, and are intended to assist our clients to achieve

maximum impact and return on their marketing investment. Our activities reinforce brand awareness, provide incentives to retailers

to motivate consumers to purchase their products, and are designed to meet the needs of our clients by focusing on the communities

who want to engage brands as part of their lifestyles.

Through our wholly owned

subsidiary, XA, an integrated experiential marketing services company, we develop, manage and execute sales promotion programs

at both national and local levels, utilizing both online and offline marketing programs. Our programs assist our clients effectively

and promote their platforms and services directly to retailers and consumers, and are intended to assist our clients to achieve

maximum impact and return on their marketing investment. Our activities reinforce brand awareness, provide incentives to retailers

to motivate consumers to purchase their products, and are designed to meet the needs of our clients by focusing on the communities

who want to engage brands as part of their lifestyles.

4

Sources of Revenue

Our revenues are generated

through the execution of marketing and communications programs derived primarily across the sectors of event management, talent

management and commercial rights as well as various media, planning and other management programs. The majority of our contracts

with our clients are negotiated individually and the terms of engagement with our clients and basis in which we earn fees and commissions

will vary significantly. Contracts with our client are multifaceted arrangements that may include incentive compensation provisions

and may include vendor credits. Our largest clients are corporations where they may arrange for our services to be provided locally

or nationally. Similar to larger marketing communications companies operating in our sector, our revenues are primarily derived

from planning and executing marketing and communications programs in various operating sectors. Most of our client contracts are

individually negotiated where terms of engagements and consideration in which we earn revenues vary among planning, creation, implementation

and executions of marketing and communications programs specific to the sectors of talent management, event management, and commercial

rights. Several of our clients have complex contract arrangements; therefore, we provide services to our clients from our own offices

as well as onsite where the events are held. In arranging for such services, we may enter

into national or local agreements and estimates are involved in determining both amount and timing of revenue recognition under

these arrangements.

Our fees are calculated to

reflect our expertise based on monthly rates as well as markup percentages and the relative overhead expenses to execute services

provided to our clients. Clients may seek to include incentive compensation components for successful execution as part of the

total compensation. Commissions earned are based on services provided and are usually calculated on a percentage over the total

revenues generated for our clients. Our revenues can also be generated when clients pay gross rates before we pay reduced rates—the

difference is commissions earned which is either retained in total or shared with the client depending on the nature

of the services agreement. Our generated revenues are dependent upon the marketing and communications requirements of our

corporate clients and dependent on the terms of the client contract. The revenues for services performed can be recognized as proportional

performance, monthly basis or execution of the completed contracts. For revenues recognized on a completed contract basis, the

contract terms are customary in the industry. Our client contracts generally provide terms for termination by either party on 90-day

notice.

Competition

In the highly competitive

and fragmented marketing and communications industry, our Company competes for business with mid-size marketing firms such as Mktg,

Inc. as well as large global holding companies such as International Management Group, Interpublic Group of Companies, Inc., MDC

Partners, Inc. and Omnicom. These global companies generally have greater resources than those available to us, and such resources

may enable them to aggressively compete with our Company’s marketing communications businesses. We

also face competition from numerous independent agencies that operate in multiple markets. Our competitive advantage is

to provide clients with marketing strategies that are focused on increasing clients’ revenues and profits.

Industry Trend

Historically, event management

and talent management have been primary service provided by global companies in the marketing communications industry. However,

as clients aim to establish individual and enhanced relationships with their customers to more accurately measure the effectiveness

of their marketing expenditures, specialized and digital communications services are consuming

a growing portion of marketing dollars. This increases the demand for a broader range of marketing communications services. The

mass market audience is giving way to life style segments, social events/networks, and online/mobile communities, with each segment

requiring a different message and/or different, often nontraditional, channels of communication. Global marketers now seek innovative

strategies, concepts and programs for new opportunities for small to mid-sized communications companies.

Clients

The Company serves clients

across the marketing communication industry. Marketing agreements and talent representation for our clients means that the Company

handles marketing communications and multiple brands, product lines of the client in every geographical location. We have contracts

with many of our clients and the terms of the contracts are customary in the industry. These contracts provide for termination

by either party on relatively short notice. “Management’s Discussion and Analysis — Executive Overview”

for a further discussion of our arrangements with our clients.

Employees

As of December 31, 2019,

the Company and its subsidiary had 3 employees. The personal service character of the marketing communications sector, the quality

of personnel and executive management are crucially important to the Company’s continuing success. As of December 31, 2019,

the Company has 3 independent contractors they are used on a regular Basis for services.

Environmental Laws

The company believes it

complies with all regulations concerning the discharge of materials into the environment, and such regulations have not had a material

effect on the capital expenditures or operations of the company.

5

ITEM 1A. RISK FACTORS

Forward-Looking Statements

This registration statement

on Form 10 contains forward-looking statements that are based on current expectations, estimates, forecasts and projections about

us, our future performance, the market in which we operate, our beliefs and our Management’s assumptions. In addition, other

written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words

such as “expects”, “anticipates”, “targets”, “goals”, “projects”,

“intends”, “plans”, “believes”, “seeks”, “estimates”, variations of

such words and similar expressions are intended to identify such forward-looking statements.

These statements are not guaranteeing of future performance and involve certain risks,

uncertainties and assumptions that are difficult to predict or assess. Therefore, actual outcomes and results may differ materially

from what is expressed or forecast in such forward-looking statements.

Any investment in our shares

of common stock involves a high degree of risk. You should carefully consider the following information about these risks, together

with the other information contained in this annual report before you decide to invest in our common stock. Each of the following

risks may materially and adversely affect our business objective, plan of operation and financial condition. These risks may cause

the market price of our common stock to decline, which may cause you to lose all or a part of the money you invested in our common

stock. We provide the following cautionary discussion of risks, uncertainties and possible inaccurate assumptions relevant to our

business plan. In addition to other information included in this annual report, the following factors should be considered in evaluating

the Company’s business and future prospects.

Dependence on key personnel.

The Company is dependent

upon the continued services of Management. To the extent that his services become

unavailable, the Company will be required to obtain other qualified personnel and there

can be no assurance that it will be able to recruit qualified persons upon acceptable terms.

The Company’s

officers and directors may allocate their time to other businesses activities, thereby causing conflicts of interest as to how

much time to devote to the Company’s affairs and prioritize the availability of an acquisition with the Company. This could

have a negative impact on the Company’s ability to consummate an acquisition in a timely manner, if at all.

6

Risks Related to Our Common

Stock

The Company’s

shares of common stock are traded from time to time on the OTC Pink Sheet Market.

Our common stock is

traded on the OTC Pink Sheet Market. There can be no assurance that there will be a liquid trading market for the

Company’s common stock following an acquisition. In the event that a liquid trading market commences, there can be no

assurance as to the market price of the Company’s shares of common stock, whether any trading market will provide

liquidity to investors, or whether any trading market will be sustained. As a result of becoming fully-reporting management

is evalulating moving to a higher exchange subject to listing requirements.

Our common

stock is subject to the Penny Stock Rules of the SEC and the trading market in our common stock is limited, which makes transactions

in our stock cumbersome and may reduce the value of an investment in our common stock.

The Securities and Exchange

Commission has adopted Rule 3a51-1 which establishes the definition of a “penny stock,” for the purposes relevant to

us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than

$5.00 per share, subject to certain exceptions. For

any transaction involving a penny stock, unless exempt, Rule 15g-9 require:

|

|

●

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

|

●

|

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person’s account for transactions

in penny stocks, the broker or dealer must:

|

|

●

|

obtain financial information and investment experience objectives of the person; and

|

|

|

●

|

make a reasonable determination that the transactions in penny

stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of

evaluating the risks of transactions in penny stocks.

|

The broker or dealer must

also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock

market, which, in highlight form:

|

|

●

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

|

●

|

that the broker or dealer received a signed, written agreement from the investor prior to the

transaction.

|

Generally, brokers may

be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult

for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to

be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing

recent price information for the penny stock held in the account and information on the limited market in penny stocks.

State blue sky registration; potential limitations

on resale of the Company’s common stock

The holders of the Company’s

shares of common stock registered under the Exchange Act and those persons who desire to purchase them in any trading market that

may develop in the future, should be aware that there may be state blue-sky law restrictions upon the ability of investors to resell

the Company’s securities. Accordingly, investors should consider the secondary market for the Company’s securities

to be a limited one.

It is the intention of

the Company’s Management following the consummation of an acquisition to seek coverage and publication of information regarding

the Company in an accepted publication manual which permits a manual exemption. The manual exemption permits a security to be distributed

in a particular state without being registered if the Company issuing the security has a listing for that security in a securities

manual recognized by the state. However, it is not enough for the security to be listed in a recognized manual. The listing entry

must contain (1) the names of issuers, officers, and directors, (2) an issuer’s balance sheet, and (3) a profit and loss

statement for either the fiscal year preceding the balance sheet or for the most recent fiscal year of operations. Furthermore,

the manual exemption is a non-issuer exemption restricted to secondary trading transactions, making it unavailable for issuers

selling newly issued securities.

Most of the accepted manuals

are those published by Standard and Poor’s, Moody’s Investor Service, Fitch’s Investment Service, and Best’s

Insurance Reports, and many states expressly recognize these manuals. A smaller number of states declare that they “recognize

securities manuals” but do not specify the recognized manuals. The following states do not have any provisions and therefore

do not expressly recognize the manual exemption: Alabama, Georgia, Illinois, Kentucky, Louisiana, Montana, South Dakota, Tennessee,

Vermont and Wisconsin.

7

ITEM 2. FINANCIAL INFORMATION

Management’s Plan of Operation

The following discussion

contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You

can identify these statements by the fact that they do not relate strictly to historical or current facts. They use of words such

as “anticipate”, “estimate”, “expect”, “project”, “intend”, “plan”,

“believe”, and other words and terms of similar meaning in connection with any discussion of future operating or financial

performance. From time to time, we also may provide forward- looking statements in other materials we release to the public.

Overview

Revenues

The Company had revenues

of $1,778,773 in our fiscal year ended December 31, 2019, as compared to $1,258,160 in fiscal year ended December 31, 2018. The

increase in revenues was mainly due to increase of business revenues generated in event marketing operations of XA, The Experiential

Agency, Inc.

Cost of Sales

The Company had cost of sales of revenues of $1,283,496

in the year ended December 31, 2019, as compared to $828,536 in the year ended December 31, 2018. The increase in cost of sales

was mainly associated to the increase in event marketing operations of XA, The Experiential

Agency, Inc.

Expenses

The Company had total general

and administrative expenses of $629,875 in the year ended December 31, 2019, as compared to $643,005 in the year ended December

31, 2018. The increase in general and administrative expense was, exercisable at $.0035 mainly due to an increase in General and

Administrative Expenses during the year ended December 31, 2019 compared to the year ending December 31, 2018.

Income

The Company had a net income of $1,520,563

in the year ended December 31, 2019 as compared to net loss of $128,381 in the year ended December 31, 2018.

Year ended December 31, 2019 compared to the year

ended December 31, 2018 Liquidity and capital resources

As at December 31, 2019,

the Company had a cash balance of $781,752 and working capital deficit of $100,698 compared with a cash balance of $151,871 and

a working capital deficit of $1,585,975 at December 31, 2018. The increase in working capital was due to the increase in business

for XA and the receipt of settlement proceeds on lawsuits during the year ended December 31, 2019.

Cash Flows from Operating Activities

During the year ended December 31, 2019, cash

flows provided by operating activities was $919,541 compared with provided by $40,808 of cash flow during the year ended

December 31, 2018. The increase in cash flow from operating activities was due to the increase in business for XA and the receipt

of settlement proceeds on lawsuits during the year ended December 31, 2019.

Cash Flows from Investing Activity

During the year ended December 31, 2019, cash

flows used in investing activities were $250,660 compared to cash flow provided by investing activities of $71,497 for the year

ended December31, 2018.

Cash Flows from Financing Activities

During the year ended December 31, 2019, cash

used in financing activities was $39,000 as compared to $0 for the year ended December 31, 2018.

8

Off-Balance Sheet Arrangements

None

Contractual Obligations and Commitments

None

Critical Accounting Policies

None

ITEM 3. DESCRIPTION OF PROPERTY

The Company’s corporate

office is located at 2130 North Lincoln Park West 8N, Chicago, IL 60614, which space

has been provided to us on a rent-free basis.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets

forth information regarding the beneficial ownership of our common stock as of December 31, 2019. The information in this table

provides the ownership information for: each person known by us to be the beneficial owner of more than 5% of our common stock;

each of our directors; each of our executive officers; and our executive officers and directors as a group.

Beneficial ownership has

been determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to

the shares. Unless otherwise indicated, the persons named in the table below have sole voting and investment power with respect

to the number of shares indicated as beneficially owned by them.

|

Name of Beneficial Owner

|

|

Common Stock Beneficially

Owned (1)

|

|

Percentage of Common Stock Owned

(1)

|

|

Glenn and Barbara Laken

|

|

|

11,500,000

|

|

|

|

2.6

|

%

|

|

2130 Lincoln Park West 8N

|

|

|

|

|

|

|

|

|

|

Chicago, IL 60614

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Applicable percentage ownership is based on

440,350,000 shares of common stock outstanding as of May 1, 2020. Beneficial ownership is determined in accordance with the rules

of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities.

|

|

|

(2)

|

Glenn Laken owns 40,000,000 warrants, exercisable at $.0035 per warrant, convertible

at 1 share of common stock per each warrant owned. If Glenn Laken were to convert these 40,000,000 warrants his ownership of common

stock would be 51,500,000 shares or 10.7% of outstanding shares.

|

|

|

(3)

|

Glenn Laken is the sole officer and director of the Company at present.

|

9

ITEM 5. DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS

AND CONTROL PERSONS

The following table sets forth the names and ages

of the member of our Board of Director and our executive officers and the positions held by each.

|

Name

|

|

Age

|

|

Title

|

|

Glenn Laken

|

|

66

|

|

CEO and Chairman

|

Glenn

Laken. Over the past 30 years, Mr. Laken has held multiple senior executive positions

and created successful growth strategies in the financial services sector. His expansive professional experience includes working

as an advisor to the 22 billion-dollar Ameritech Pension fund, partnership in a Wall Street

specialist firm, ownership of a Chicago clearing house with offices nationwide, and the purchase and restructuring of the Cigarette

Racing Team Company. He has also enjoyed success in the area of mergers and acquisitions

as an accomplished business leader.

Section 16(a) Compliance

Section 16(a) of the Securities

and Exchange Act of 1934 requires the Company’s directors and executive officers, and persons who own beneficially more than

ten percent (10%) of the Company’s Common Stock, to file reports of ownership and changes of ownership with the Securities

and Exchange Commission. Copies of all filed reports are required to be furnished to the Company pursuant to Section 16(a). Once

the Company becomes subject to the Exchange Act of 1934, our office and director has informed us that he intends to file reports

required to be filed under Section 16(a).

ITEM 6. EXECUTIVE COMPENSATION

During the fiscal years

ended December 31, 2019 the company paid $180,000 of salary and $103,475 of deferred compensation to the Company’s CEO. This

brings to a total of $283,475 in payments to the Company’s CEO. The Company paid to Alexis Laken for the years ended December

31, 2019 and 2018 $99,000 and $90,000, respectively. The Company has no employment agreement with any of its officers and directors,

other than the Company’s CEO.

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

AND DIRECTOR INDEPENDENCE

The Company was not a party

to any transaction (where the amount involved exceeded the lesser of $120,000 or 1% of the average of our assets for the last two

fiscal years) in which a director, executive officer, holder of more than five percent of our common stock, or any member of the

immediate family of any such person have or will have a direct or indirect material interest and no such transactions are currently

proposed.

The Company’s Board

conducts an appropriate review of and oversees all related party transactions on a continuing basis and reviews potential conflict

of interest situations where appropriate. The Board has not adopted formal standards to apply when it reviews, approves or ratifies

any related party transaction. However, the Board believes that the related party transactions are fair and reasonable to the Company

and on terms comparable to those reasonably expected to be agreed to with independent third parties for the same goods and/or services

at the time they are authorized by the Board.

ITEM 8. LEGAL PROCEEDING

None.

ITEM 9. MARKET PRICE OF AND DIVIDENDS

ON THE COMPANY’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

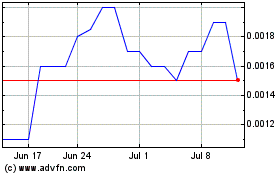

Our common stock is currently

quoted on the OTC market “Pink Sheets” under the symbol CMGO. For the periods indicated, the following table sets forth

the high and low bid prices per share of common stock. The below prices represent inter-dealer quotations without retail markup,

markdown, or commission and may not necessarily represent actual transactions.

10

|

|

|

Price Range

|

|

Period

|

|

High

|

|

Low

|

|

|

|

|

|

|

|

Year ended December 31, 2019

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.0232

|

|

|

$

|

0.0123

|

|

|

Second Quarter

|

|

$

|

0.0080

|

|

|

$

|

0.0074

|

|

|

Third Quarter

|

|

$

|

0.0085

|

|

|

$

|

0.0072

|

|

|

Fourth Quarter

|

|

$

|

0.0073

|

|

|

$

|

0.0057

|

|

|

Year ended December 31, 2018

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$

|

0.0019

|

|

|

$

|

0.0012

|

|

|

Second Quarter

|

|

$

|

0.0057

|

|

|

$

|

0.0051

|

|

|

Third Quarter

|

|

$

|

0.0029

|

|

|

$

|

0.0023

|

|

|

Fourth Quarter

|

|

$

|

0.0220

|

|

|

$

|

0.0016

|

|

As of May 1, 2020, our

shares of common stock were held by approximately 199 stockholders of record. The transfer agent of our common stock is Corporate

Stock Transfer, Inc. 3200 Cherry Creek Dr. South Suite 430 Denver, CO 80209. (303) 282-4800.

Dividends

Holders of common stock

are entitled to dividends when, as, and if declared by the Board of Directors, out of funds legally available therefore. We have

never declared cash dividends on its common stock and our Board of Directors does not anticipate paying cash dividends in the foreseeable

future as it intends to retain future earnings to finance the growth of our businesses. There are no restrictions in our articles

of incorporation or bylaws that restrict us from declaring dividends.

Securities Authorized for Issuance Under Equity Compensation

Plans

No equity compensation plan or agreements

under which our common stock is authorized for issuance has been adopted during the fiscal years ended December 31, 2019 and 2018.

ITEM 10. RECENT SALES OF

UNREGISTERED SECURITIES

None

ITEM 11. DESCRIPTION OF COMPANY’S SECURITIES

TO BE REGISTERED

The following statements

relating to the capital stock set forth the material terms of the Company’s securities; however, reference is made to the

more detailed provisions of our Certificate of Incorporation and by-laws, copies of which are filed herewith.

Common Stock

Our Certificate of Incorporation

authorize the issuance of 450,000,000 shares of common stock, par value $0.001. Our holders of

shares of common stock are entitled to one vote for each share on all matters to be voted on by the shareholders. Holders of common

stock do not have cumulative voting rights. Holders of common stock are entitled to share ratably in dividends, if any,

as may be declared from time to time by the board of directors in its discretion from legally available funds. In the event

of a liquidation, dissolution or winding up of the Company, the holders of common stock are entitled to share pro rata all assets

remaining after payment in full of all liabilities. Holders of common stock have no preemptive rights to purchase the Company’s

common stock. There are no conversion or redemption rights or sinking fund provisions with respect to the common stock.

Dividends

Dividends, if any,

will be contingent upon our revenues and earnings, if any, capital requirements

and financial conditions. The payment of dividends, if any,

will be within the discretion of our board of directors. We intend to retain

earnings, if any, for use in our business operations and accordingly, the board of

directors does not anticipate declaring any dividends prior to an acquisition transaction, nor can there be any assurance that

any dividends will be paid following any acquisition.

11

ITEM 12. INDEMNIFICATION

OF DIRECTORS AND OFFICERS

Our articles of incorporation,

by-laws and director indemnification agreements provide that each person who was or is made a party or is threatened to be made

a party to or is otherwise involved (including, without limitation, as a witness) in any action, suit or proceeding, whether civil,

criminal, administrative or investigative, by reason of the fact that he or she is or was a director or an officer of Brenham or,

in the case of a director, is or was serving at our request as a director, officer, or trustee of another corporation, or

of a partnership, joint venture, trust or other enterprise, including service with respect to an employee benefit plan, whether

the basis of such proceeding is alleged action in an official capacity as a director,

officer or trustee or in any other capacity while serving as a director, officer or trustee, shall be indemnified and held harmless

by us to the fullest extent authorized by the Nevada General Corporation Law against all expense, liability and loss reasonably

incurred or suffered by such.

Section 145 of the

Nevada General Corporation Law permits a corporation to indemnify any director or officer of the corporation against expenses (including

attorney’s fees), judgments, fines and amounts paid in settlement actually and reasonably incurred in connection with any

action, suit or proceeding brought by reason of the fact that such person is or was a director or officer of the corporation, if

such person acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best interests

of the corporation, and, with respect to any criminal action or proceeding, if he or she had no reason to believe his or her conduct

was unlawful. In a derivative action, (i.e., one brought by or on behalf of the corporation), indemnification may be provided only

for expenses actually and reasonably incurred by any director or officer in connection with the defense or settlement of such an

action or suit if such person acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to,

the best interests of the corporation, except that no indemnification shall be provided if such person shall have been adjudged

to be liable to the corporation, unless and only to the extent that the court in which the action or suit was brought shall determine

that the defendant is fairly and reasonably entitled to indemnity for such expenses despite such adjudication of liability.

Pursuant to Section 102(b)(7)

of the Nevada General Corporation Law, Article Seven of our articles of incorporation eliminates the liability of a director to

us for monetary damages for such a breach of fiduciary duty as a director, except for liabilities arising:

|

|

●

|

from any breach of the director’s duty of loyalty to us;

|

|

|

●

|

from acts or omissions not in good faith or which involve intentional misconduct or a knowing

violation of law;

|

|

|

●

|

under Section 174 of the Nevada General Corporation Law; and

|

|

|

●

|

from any transaction from which the director derived an improper personal benefit.

|

12

ITEM 13. FINANCIAL STATEMENTS AND SUPPLEMENTARY

DATA

Report of Independent Registered

Public Accounting Firm

To the shareholders and the board of directors

of CMG Holdings Group, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated

balance sheets of CMG Holdings Group, Inc. as of December 31, 2019 and 2018, the related statements of operations, stockholders'

equity (deficit), and cash flows for the years then ended, and the related notes (collectively referred to as the "financial

statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of

the Company as of December 31, 2019 and 2018, and the results of its operations and its cash flows for the years then ended, in

conformity with accounting principles generally accepted in the United States.

Basis for Opinion

These financial statements are the responsibility

of the Company's management. Our responsibility is to express an opinion on the Company's financial statements based on our audit.

We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB")

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the

standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether

the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have,

nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required

to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the

effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to

assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures

that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures

in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by

management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable

basis for our opinion.

/S/ BF Borgers CPA PC

BF Borgers CPA PC

We have served as the Company's auditor since

2020

Lakewood, CO

May 6, 2020

13

|

CMG Holdings Group, Inc.

|

|

Consolidated Balance Sheet

|

|

As of December 31,

|

|

|

|

|

|

|

|

ASSETS

|

|

|

2019

|

|

|

|

2018

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

781,752

|

|

|

$

|

151,871

|

|

|

Accounts receivable

|

|

|

40,513

|

|

|

|

13,693

|

|

|

Loan receivable

|

|

|

67,500

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

889,765

|

|

|

|

165,564

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment

|

|

|

13,625

|

|

|

|

17,339

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$

|

903,390

|

|

|

$

|

182,903

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

74,500

|

|

|

$

|

548,942

|

|

|

Deferred compensation

|

|

|

656,526

|

|

|

|

760,000

|

|

|

Loan Payable

|

|

|

19,437

|

|

|

|

71,497

|

|

|

Loan from outside party

|

|

|

90,000

|

|

|

|

125,000

|

|

|

Loan from shareholder

|

|

|

—

|

|

|

|

96,100

|

|

|

Note payable

|

|

|

150,000

|

|

|

|

150,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

990,463

|

|

|

|

1,751,539

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

990,463

|

|

|

|

1,751,539

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

Common Stock 450,000,000 shares authorized; $0.001 par value,

|

|

|

|

|

|

|

|

|

|

449,506,008 shares issued and outstanding

|

|

|

|

|

|

|

|

|

|

as of December 31, 2019 and 2018

|

|

|

449,506

|

|

|

|

449,506

|

|

|

Additional paid in capital

|

|

|

14,687,865

|

|

|

|

14,687,865

|

|

|

Treasury stock

|

|

|

(39,000

|

)

|

|

|

—

|

|

|

Accumulated deficit

|

|

|

(15,185,444

|

)

|

|

|

(16,706,007

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS DEFICIT

|

|

|

(87,073

|

)

|

|

|

(1,568,636

|

)

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

$

|

903,390

|

|

|

$

|

182,903

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

14

|

CMG Holdings Group, Inc.

|

|

Consolidated Statements of Operations

|

|

For the year ended December 31,

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

1,778,773

|

|

|

$

|

1,258,160

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

Cost of revenues

|

|

|

1,283,496

|

|

|

|

828,536

|

|

|

Interest expense

|

|

|

15,380

|

|

|

|

4,738

|

|

|

General and administrative expenses

|

|

|

533,270

|

|

|

|

638,267

|

|

|

Total operating expenses

|

|

|

1,832,146

|

|

|

|

1,471,541

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income from operations

|

|

|

(53,373

|

)

|

|

|

(213,381

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

|

|

|

|

|

|

|

Gain (loss) on sale of stock

|

|

|

—

|

|

|

|

190,000

|

|

|

Settlement of lawsuit Burkhard

|

|

|

—

|

|

|

|

(105,000

|

)

|

|

Settlement of Lawsuit Hudson Gray

|

|

|

629,469

|

|

|

|

|

|

|

Settlement of Lawsuit EVW

|

|

|

378,500

|

|

|

|

|

|

|

Write off of accounts payable

|

|

|

565,967

|

|

|

|

—

|

|

|

Total other income

|

|

|

1,573,936

|

|

|

|

85,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

1,520,563

|

|

|

$

|

(128,381

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Number of Common Shares Outstanding - Basic and Diluted

|

|

|

449,506,008

|

|

|

|

499,506,008

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) per Common Share - Basic and Diluted

|

|

$

|

0.0030

|

|

|

$

|

(0.0003

|

)

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

15

|

CMG Holdings Group, Inc.

|

|

Consolidated Statement of Stockholders Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock

|

|

|

|

|

|

|

|

Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

Number of

|

|

|

|

|

|

|

|

Number of

|

|

|

|

|

|

|

|

Paid In

|

|

|

|

Treasury

|

|

|

|

Accumulated

|

|

|

|

Stockholders'

|

|

|

|

|

|

Shares

|

|

|

|

Amount

|

|

|

|

Shares

|

|

|

|

Amount

|

|

|

|

Capital

|

|

|

|

Stock

|

|

|

|

Deficit

|

|

|

|

Equity

|

|

|

Balance December 31, 2017

|

|

|

—

|

|

|

$

|

—

|

|

|

|

449,506,008

|

|

|

$

|

449,506

|

|

|

$

|

14,687,865

|

|

|

$

|

—

|

|

|

$

|

(16,577,626

|

)

|

|

$

|

(1,440,255

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income(Loss) for the year

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(128,381

|

)

|

|

|

(128,381

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance December 31, 2018

|

|

|

—

|

|

|

|

—

|

|

|

|

449,506,008

|

|

|

|

449,506

|

|

|

|

14,687,865

|

|

|

|

—

|

|

|

|

(16,706,007

|

)

|

|

|

(1,568,636

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of Treasury Stock

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(39,000

|

)

|

|

|

—

|

|

|

|

(39,000

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income(Loss) for the year

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,520,563

|

|

|

|

1,520,563

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance December 31, 2019

|

|

|

—

|

|

|

$

|

—

|

|

|

|

449,506,008

|

|

|

$

|

449,506

|

|

|

$

|

14,687,865

|

|

|

$

|

(39,000

|

)

|

|

$

|

(15,185,444

|

)

|

|

$

|

(87,073

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

16

|

CMG Holdings Group, Inc.

|

|

Consolidated Statement of Cash Flows

|

|

For the year ended December 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

|

2018

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$

|

1,520,563

|

|

|

$

|

(128,381

|

)

|

|

Adjustments to reconcile net income to cash used in operating activities

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

3,714

|

|

|

|

3,714

|

|

|

Deferred compensation

|

|

|

(103,474

|

)

|

|

|

180,000

|

|

|

Accounts receivable

|

|

|

(26,820

|

)

|

|

|

(13,693

|

)

|

|

Accrued liabilities

|

|

|

—

|

|

|

|

—

|

|

|

Accounts payable

|

|

|

(474,442

|

)

|

|

|

(832

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operations

|

|

|

919,541

|

|

|

|

40,808

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Proceeds from loans payable

|

|

|

25,000

|

|

|

|

147,300

|

|

|

Payments of loans payable

|

|

|

(208,160

|

)

|

|

|

(75,803

|

)

|

|

Payment of loan receivable

|

|

|

(67,500

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

(250,660

|

)

|

|

|

71,497

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Purchase treasury stock

|

|

|

(39,000

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by investing activities

|

|

|

(39,000

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in cash

|

|

|

629,881

|

|

|

|

112,305

|

|

|

Cash, beginning of year

|

|

|

151,871

|

|

|

|

39,566

|

|

|

Cash, end of year

|

|

$

|

781,752

|

|

|

$

|

151,871

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

17

CMG HOLDINGS GROUP, INC.

Notes to the Consolidated Financial

Statements

|

|

1.

|

Nature of Operations and Continuance of

Business

|

Creative Management Group,

Inc. was formed in Delaware on August 13, 2002 as a limited liability company named Creative Management Group, LLC. On August

7, 2007, this entity converted to a corporation. The Company is a sports, entertainment, marketing and management company providing

event management implementation, sponsorships, licensing and broadcast, production and syndication.

On February 20, 2008, Creative

Management Group, Inc. formed CMG Acquisitions, Inc., a Delaware company, for the purpose of acquiring companies and expansion

strategies. On February 20, 2008, Creative Management Group, Inc. acquired 92.6% of Pebble Beach Enterprises, Inc. (a publicly

traded company) and changed the name to CMG Holdings Group, Inc. (“the Company”). The purpose of the acquisition was

to effect a reverse merger with Pebble Beach Enterprises, Inc. at a later date. On May 27, 2008, Pebble Beach

entered into an Agreement and Plan of Reorganization with its controlling shareholder, Creative Management Group, Inc.,

a privately held Delaware corporation. Upon closing the eighty shareholders of Creative Management Group delivered all their equity

interests in Creative Management Group to Pebble Beach in exchange for shares of common stock in Pebble Beach owned by Creative

Management Group, as a result of which Creative Management Group became a wholly-owned subsidiary of Pebble Beach. The shareholders

of Creative Management Group received one share of Pebble Beach’s common stock previously owned by Creative Management Group

for each issued and outstanding common share owned of Creative Management Group. As a result, the 22,135,148 shares of Pebble Beach

that were issued and previously owned by Creative Management Group, are now owned directly by its shareholders. The 22,135,148

shares of Creative Management Group previously owned by its shareholders are now owned by Pebble Beach, thereby making Creative

Management Group a wholly-owned subsidiary of Pebble Beach. Pebble Beach did not issue any new shares as part of the Reorganization.

The transaction was accounted for as a reverse merger and recapitalization whereby Creative Management Group is the accounting

acquirer. Pebble Beach was renamed CMG Holdings Group, Inc.

On April 1, 2009, the Company,

through a newly formed subsidiary CMGO Capital, Inc., a Nevada corporation, completed the acquisition of XA, The Experiential Agency,

Inc. On March 31, 2010, the Company and AudioEye, Inc. (“AudioEye”) completed a Stock Purchase Agreement under which

the Company acquired all the capital stock of AudioEye. On June 22, 2011 the Company entered into a Master Agreement subject to

shareholder approval and closing conditions with AudioEye Acquisition Corp., a Nevada corporation where the shareholders of AudioEye

Acquisition Corp. exchanged 100% of the stock in AudioEye Acquisition Corp for 80% of the capital stock of AudioEye. The Company

retained 15% of AudioEye subject to transfer restrictions in accordance with the Master Agreement; in October 2012, the Company

distributed to its shareholders, in a dividend, 5% of the capital stock of AudioEye

in accordance with provisions of the Master Agreement.

On March 28, 2014, CMG Holdings

Group, Inc. (the “Company” or “CMG”), completed its acquisition of 100% of the shares of Good Gaming, Inc.

(“GGI”) by entering into a Share Exchange Agreement (the “SEA”) with BMB Financial, Inc. and Jackie Beckford,

shareholders of GGI. The sole owner of BMB Financial, Inc. is also the sole owner of Infinite Alpha, Inc. which provides consulting

services to CMG. Pursuant to the SEA, the Company received 100% of the shares of GGI in exchange for 5,000,000 shares of the Company’s

common stock, $33,000 in equipment and consultant compensation and a commitment to pay $200,000 in development costs.

18

CMG HOLDINGS GROUP, INC.

Notes to the Consolidated Financial

Statements

On February 18, 2016, the Company

sold the assets of Good Gaming, Inc. to HDS International Corp. and thereafter, HDS changed their name to Good Gaming, Inc, from

CMG Holdings Group, Inc. (OTCQB: GMER) (“Good Gaming”). The Company received in exchange 100,000,000 Class B Preferred

Shares in Good Gaming which are convertible into shares of common stock at a rate of 200 common shares for each Class B Preferred

Shares. Good Gaming, Inc. did a 1,000 to 1 reverse split, thus the 100,000,000 Class B Preferred Shares were converted to 100,000

Class B Preferred Shares. The Company has sold a portion of these Good Gaming shares to date in the market and currently owns the

equivalent of 14,076,200 common shares in the form of preferred stock and common stock.

The Company’s operating

subsidiary is XA - The Experiential Agency, Inc. - which is a sports, entertainment, marketing and management company providing

event management implementation, sponsorships, licensing and broadcast, production and syndication. Its President is Alexis Laken,

the daughter of the Company’s president.

|

|

2.

|

Summary of Significant Accounting Policies

|

|

|

a)

|

Basis of Presentation and Principles of Consolidation

|

These

consolidated financial statements and related notes are presented in accordance with accounting principles generally accepted in

the United States of America ("GAAP") and are expressed in US dollars. The consolidated financial statements include

the accounts of the Company and its wholly-owned subsidiary, Ship Ahoy LLC. All intercompany transactions have been eliminated.

The Company's fiscal year-end is December 31.

The preparation of financial

statements in conformity with generally accepted accounting principles in the United

States requires management to make estimates and assumptions that affect the reported amounts of assets and li abilities

and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues

and expenses during the reporting period. The Company regularly evaluates estimates and assumptions related

to the recoverability of its long-lived assets, stock-based compensation, and

deferred income tax

asset valuation allowances. The

Company bases its estimates

and assumptions on current facts, historical experience and various other factors

that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying

values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual

results experienced by the Company may differ materially and adversely from the Company's estimates. To the extent there are material

differences between the estimates and the actual results, future results of operations will be affected.

|

|

c)

|

Cash and Cash Equivalents

|

The

Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash

equivalents. As of December 31, 20 19 and 2018, the Company had no cash equivalents.

|

|

d)

|

Basic and Diluted Net Loss Per Share

|

The

Company computes net loss per share in accordance with ASC 260, Earnings Per Share, which requires presentation of both

basic and diluted earnings per share (EPS) on the face of the income statement. Basic EPS is computed by dividing net loss available

to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted

EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible

preferred stock using the if-converted method. In computing Diluted EPS, the average

stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock

|

|

•

|

options or warrants. Diluted EPS excludes all dilutive potential

shares if their effect is anti-dilutive.

|

19

CMG HOLDINGS GROUP, INC.

Notes to the Consolidated Financial

Statements

ASC

820, '" Fair Value

Measurements”, requires an entity

to maximize the

use of observable inputs and

minimize the use of unobservable inputs when measuring fair value.

It establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure

fair value. A financial instrument's categorization within the fair value hierarchy is based upon the lowest level of input that

is significant to the fair value measurement. It prioritizes the inputs into three levels that may be used to measure fair value: