Current Report Filing (8-k)

August 04 2022 - 9:29AM

Edgar (US Regulatory)

0001389518

false

0001389518

2022-07-31

2022-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 31, 2022

CLUBHOUSE

MEDIA GROUP, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

333-140645 |

|

99-0364697 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

3651

Lindell Road, D517

Las

Vegas, Nevada 89103

(Address

of principal executive offices) (Zip code)

(702)

479-3016

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

1.01. |

Entry

into a Material Definitive Agreement. |

On

July 31, 2022 (the “Effective Date”), Clubhouse Media Group, Inc. (the “Company”) entered into a joint venture

deal memo (the “Agreement”) with Alden Henri Reiman (“Mr. Reiman”), pursuant to which the parties agreed to enter

into a more permanent joint venture arrangement, involving the creation of a Nevada limited liability company, The Reiman Agency LLC

(the “Agency”), of which the Company shall own 51% of the membership units, and Mr. Reiman shall own 49% of the membership

units. Mr. Reiman is to serve as President of the Agency, pursuant to the terms of an Executive Employment Agreement described under

Item 5.02 of this Current Report on Form 8-K. The parties’ respective membership interests shall be non-transferrable, and the

Agency shall not issue additional membership interests, unless the parties mutually consent in each instance.

Mr. Reiman shall oversee the day-to-day operations

of the Agency, but shall consult with the Company on a regular basis and regularly update the Company on the status of deals and the operations

of the business. All material business and financial decisions shall be subject to the Company’s final approval. The Company shall

not exercise its approval rights in an arbitrary or capricious manner.

In

the event that Mr. Reiman determines that office space is required to properly carry on the business of the Agency, Mr. Reiman shall

have the authority to lease a reasonable office space on behalf of the Agency, subject to the Company’s prior review and approval.

The Company has agreed and approved an office leasing budget of up to $200,000 USD annually. Expenses in excess of $400 USD must be pre-approved

by the Company.

On

the Effective Date, the parties closed the Agreement by executing an Operating Agreement for the Agency, dated the Effective Date, which

encapsulates the essential terms and conditions contained in the Agreement.

The

description above of the Agreement and Operating Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the Agreement and Operating Agreement, copies of which are filed as Exhibits 10.1 and 10.2 respectively, to this

Current Report on Form 8-K and are incorporated herein by reference.

| Item

3.02. | Unregistered

Sales of Equity Securities. |

In

May, June and July 2022, the Company issued an aggregate of 437,496,862 shares of restricted common stock (“New Issuances”).

As of

May 5, 2022, there were 143,414,563 shares of common stock, par value $0.001 per share, of the registrant issued and outstanding.

After giving effect to the New Issuances, as of July 22, 2022, the Company had a total of 580,911,425 shares

of common stock issued and outstanding.

The New Issuances described herein were

exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemptions

provided by Regulation D and Section 4(a)(2), as applicable under the Securities Act.

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

In

connection with Mr. Reiman’s appointment as President of the Agency, on the Effective Date, the Company and the Agency, a majority

owned subsidiary of the Company, entered into a written Executive Employment Agreement (the “Employment Agreement”) with

Mr. Reiman for a term of two (2) years following the Effective Date (the “Initial Term”). The Initial Term and any renewal

term shall automatically be extended for up to two (2) more additional terms of two (2) years (each a “Renewal Term”), for

an aggregate of up to six (6) years.

The

Employment Agreement provides Mr. Reiman with an monthly base salary of Thirty-Seven Thousand Five Hundred US Dollars ($37,500 USD) per

month, payable on a weekly basis in equal weekly installments ($8,653.85 USD) in accordance with the Company’s own payroll policies

for the initial term, provided however, that if within the three (3) month period following full execution of the Employment Agreement

(the “Period”) the Agency is profitable, the Base Salary shall increase to Forty-Two Thousand Five Hundred US Dollars ($42,500

USD) per month, resulting in equal weekly installments of $9,807.69 USD, beginning the week following the end of the Period.

Upon

full execution of the Employment Agreement, Mr. Reiman shall also be entitled to:

| |

(i) |

A

one-time signing bonus of One Hundred Twenty-Five Thousand US Dollars ($125,000 USD), as well as an additional One Hundred Twenty-Five

Thousand US Dollars ($125,000 USD), which shall be paid in equal monthly installments over the first three (3) months. The payments

described in the previous sentence shall not apply towards the base salary, but shall be subject to a reasonable claw back in the

event of a termination for cause; and |

| |

(ii) |

Twenty-Five

Million (25,000,000) shares of unregistered Company common stock. |

Additionally,

on the last day of each month of the term, Mr. Reiman shall be entitled to an amount of shares equal to seven and one half percent (7.5%)

of the net receipts for the applicable month (“Additional Shares”), divided by the twenty (20) day VWAP of such shares from

the last day of the applicable month. All Additional Shares issued to Mr. Reiman pursuant to the Employment Agreement shall be issued

to Mr. Reiman within seven (7) business days of the date such shares vest.

Mr.

Reiman shall also be entitled to Twenty-Five Percent (25%) of the net receipts, generated by the Agency during each month (the “Commission

Bonus”). The Commission Bonus shall be calculated monthly and paid to Reiman within seven (7) business days of the last business

day of the applicable month.

Mr.

Reiman, aged 28, had previously served as Vice President of Digital Talent & Brand Partnerships at BrandArmy, from 2020 through 2021.

Mr. Reiman has worked with top creators, including the Ace Family, BowWow, Nathan Davis Jr., Trevor Stines, Matthew Espinosa, Landon

McBroom, and Ireland Baldwin among others, and has brokered more than $5,000,000 in brand partnership agreements since 2020. Previously,

Mr. Reiman led digital talent for an LA-based boutique agency and formerly worked at both CAA and the NFL, from 2016 through 2020.

The

description above of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the full

text of the Employment Agreement, a copy of which is filed as Exhibit 10.3 to this Current Report on Form 8-K and is incorporated herein

by reference.

| Item

9.01 | Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

August 4, 2022 |

CLUBHOUSE

MEDIA GROUP, INC. |

| |

|

|

| |

By: |

/s/

Amir Ben-Yohanan |

| |

|

Amir

Ben-Yohanan |

| |

|

Chief

Executive Officer |

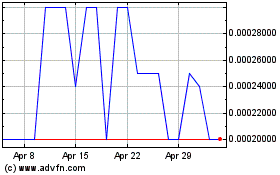

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

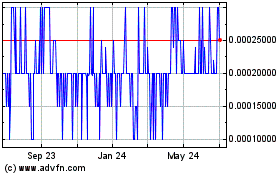

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Apr 2023 to Apr 2024