Current Report Filing (8-k)

December 02 2021 - 4:06PM

Edgar (US Regulatory)

0001389518

false

0001389518

2021-11-26

2021-11-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 26, 2021

CLUBHOUSE

MEDIA GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

333-140645

|

|

99-0364697

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

3651

Lindell Road, D517

Las

Vegas, Nevada 89103

(Address

of principal executive offices) (Zip code)

(702)

479-3016

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01. Entry into a Material Definitive Agreement.

On

November 26, 2021, Clubhouse Media Group, Inc. (the “Company”) entered into an Amendment and Restructuring Agreement (the

“Restructuring Agreement”) with GS Capital Partners, LLC (“GS Capital”). Prior to entry into the Restructuring

Agreement, the Company and GS Capital were parties to the following agreements:

|

|

(i)

|

the Securities Purchase

Agreement, dated as of January 25, 2021 (the “1/25/21 Agreement”) and the Convertible Promissory Note dated as of January

25, 2021, issued pursuant to the 1/25/21 Agreement (the “1/25/21 Note”), which 1/25/21 Note, and the $288,889 of principal

amount and $11,556 of interest thereunder, has since been converted into 107,301 shares of common stock of the Company on June 21,

2021 (the “Converted Shares”);

|

|

|

(ii)

|

the Securities Purchase

Agreement, dated as of February 16, 2021 (the “2/16/21 Agreement”) and the Convertible Promissory Note dated as of February

16, 2021, issued pursuant to the 2/16/21 Agreement (the “2/16/21 Note”);

|

|

|

(iii)

|

the Securities Purchase

Agreement, dated as of March 22, 2021 (the “3/22/21 Agreement”) and the Convertible Promissory Note dated as of March

22, 2021, issued pursuant to the 3/22/21 Agreement (the “3/22/21 Note”);

|

|

|

(iv)

|

the Securities Purchase

Agreement, dated as of April 1, 2021 (the “4/1/21 Agreement”) and the Convertible Promissory Note dated as of April 1,

2021, issued pursuant to the 4/1/21 Agreement (the “4/1/21 Note”);

|

|

|

(v)

|

the Securities Purchase

Agreement, dated as of April 29, 2021 (the “4/29/21 Agreement”) and the Convertible Promissory Note dated as of April

29, 2021, issued pursuant to the 4/29/21 Agreement (the “4/29/21 Note”); and

|

|

|

(vi)

|

the Securities Purchase

Agreement, dated as of June 3, 2021 (the “6/3/21 Agreement” and, collectively with the 2/16/21 Agreement, the 3/22/21

Agreement, the 4/1/21 Agreement and the 4/29/21 Agreement, the “Purchase Agreements”) and the Convertible Promissory

Note dated as of June 39, 2021, issued pursuant to the 6/3/21 Agreement (the “6/3/21 Note” and, collectively with the

2/16/21 Note, the 3/22/21 Note, the 4/1/21 Note and the 4/29/21 Note, the “Notes”).

|

Pursuant

to the terms of the Restructuring Agreement, the maturity date of each of the Notes was extended by six months, such that the maturity

date in each of the Notes is six months later than the original maturity date under the respective Note.

In

addition, pursuant to the terms of the Restructuring Agreement, on November 26, 2021, GS Capital sold to the Company, and the Company

redeemed from GS Capital, the Converted Shares, and in exchange therefor, the Company issued to GS Capital a new convertible promissory

note in the aggregate principal amount of $300,445 (the “New Note”).

The

New Note has a maturity date of May 31, 2022 (the “Maturity Date”) and bears interest at 10% per year. No payments of the

principal amount or interest are due prior to the Maturity Date, other than as specifically set forth in the Note, and there is no prepayment

penalty.

The

New Note provides GS Capital with conversion rights to convert all or any part of the outstanding and unpaid principal amount of the

New Note from time to time into fully paid and non-assessable shares of the Company’s common stock, at a conversion price of $1.00,

subject to adjustment as provided in the New Note and subject to a 9.99% equity blocker.

The

New Note contains customary events of default, including, but not limited to, failure to pay principal or interest on the New Note when

due. If an event of default occurs and continues uncured, GS Capital may declare all or any portion of the then outstanding principal

amount of the New Note, together with all accrued and unpaid interest thereon, due and payable, and the New Note will thereupon become

immediately due and payable.

The

foregoing descriptions of the Restructuring Agreement and the New Note do not purport to be complete and are qualified in their entirety

by reference to the full texts of the Restructuring Agreement and the New Note, copies of which are filed as Exhibits 10.1 and 10.2,

respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

As

disclosed in Item 1.01 of this Current Report on Form 8-K, the Company issued the New Note to GS Capital on November 26, 2021. The disclosure

in Item 1.01 hereof concerning the New Note is incorporated by reference into this Item 2.03.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

The

following exhibits are filed with this Current Report on Form 8-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

Dated: December 2, 2021

|

CLUBHOUSE MEDIA GROUP, INC.

|

|

|

|

|

|

|

By:

|

/s/

Amir Ben-Yohanan

|

|

|

|

Amir Ben-Yohanan

|

|

|

|

Chief Executive Officer

|

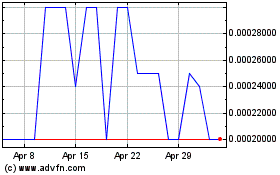

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

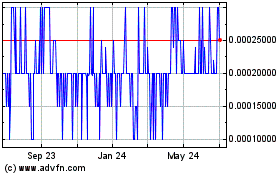

Clubhouse Media (PK) (USOTC:CMGR)

Historical Stock Chart

From Apr 2023 to Apr 2024