Current Report Filing (8-k)

January 11 2022 - 4:16PM

Edgar (US Regulatory)

0001498067

false

0001498067

2022-01-05

2022-01-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO

SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): January 5, 2022

CITRINE

GLOBAL, CORP.

|

Delaware

|

|

000-55680

|

|

68-0080601

|

|

(State

or Other Jurisdiction

|

|

(commission

|

|

(IRS

Employer

|

|

Of

incorporation)

|

|

File

Number)

|

|

Identification

Number)

|

|

2

Jabotinsky St., Atrium Tower, Ramat Gan, Tel Aviv District, Israel

|

|

5250501

|

|

(Address

of Principal Executive Offices)

|

|

(Area

Code)

|

+

(972) 73 7600341

(Registrant’s

telephone number, including area code)

Not

applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Pursuant

to the Convertible Note Purchase Agreement dated as of April 1, 2020, as subsequently amended (the “Convertible Note Agreement”),

entered into by Citrine Global, Corp. (the “Company”) and Citrine S A L Investment & Holdings Ltd, WealthStone Private

Equity Ltd, WealthStone Holdings Ltd, Golden Holdings Neto Ltd, Beezz Home Technologies Ltd, Citrine Biotech 5 LP, Citrine High Tech

6 LP, Citrine High Tech 7 LP, Citrine 8 LP, Citrine 9 LP and Citrine Biotech 10 LP, all of which are affiliated entities (each a “Buyer”

and collectively the “Buyers”), on January 5, 2022, Citrine 9 LP, one of the Buyer entities (hereinafter “Citrine 9”)

agreed to honor a Draw Down Notice (as defined in the Convertible Note Agreement) for, and has advanced to the Company, $180,000 on the

same terms and conditions as are specified in the Convertible Note Agreement. The maturity date of the loan is the earlier of July 31,

2023 or at such time as the Company shall have consummated an investment of at least $5 million in Company securities. The terms of the

advances under the Convertible note agreement were previously disclosed by the Company in Current Reports on Form 8-K filed on each of

April 21, April 23, June 12, 2020 and June 24, 2021. The annual interest on the loan continues to be nine percent (9%). The principal

and interest payment on the Note shall be made in New Israeli Shekels (NIS) at the conversion rate which was in effect on the date on

which the loan was advanced.

As

provided for under the terms of the Convertible Note Agreement, Citrine 9 will be issued 6,666,667 Series A warrants and 6,666,667 Series

B warrants for shares of common stock, where the Series A warrants are exercisable beginning July 5, 2022 through July 5, 2024 and the

Series B warrants are exercisable beginning July 5, 2022 through July 5, 2025, in each case at an exercise price of $0.5 per share.

Additionally,

on January 5, 2022, the Company and the Buyers entered into the Fourth Amendment to the Convertible Note Agreement pursuant to which

the following was agreed to:

|

|

(i)

|

The

principal and accrued interest on all outstanding loans shall be made in New Israeli Shekels

(NIS) at the conversion rate which was in effect on the date on which the loan was advanced;

|

|

|

|

|

|

|

(ii)

|

The

conversion price on all outstanding notes under the Convertible Note Agreement has been adjusted

to a conversion price of $0.05 per share

|

|

|

|

|

|

|

(iii)

|

The

exercise price on all outstanding warrants issued in connection with advances made under

the Convertible Note Agreement has been adjusted to an exercise price of $0.05 per

share.

|

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information included in Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 2.03.

Item

3.02. Unregistered Sales of Equity Securities.

The

information included in Item 1.01 of this Form 8-K is hereby incorporated by reference into this Item 3.02.

The

foregoing issuances of the Series A Warrants and Series B Warrants were made in reliance on the exemption from registration under Section

4(a)(2) of the Securities Act of 1933, as amended (the “Act”), in reliance upon exemptions from the registration requirements

of the Act in transactions not involving a public offering, including, but not limited to the exemption provided pursuant to Rule 506(b)

of Regulation D, as promulgated by the Securities and Exchange Commission under the Act for offers and sales of restricted securities

in a private, non-public transactions.

Item 9.01

Financial Statements and Exhibits

(d) Exhibits

10.1 Fourth Amendment to the Convertible Note Purchase Agreement

104

Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

Citrine

Global, Corp

|

|

|

|

|

|

|

By:

|

/s/

Ora Elharar Soffer

|

|

|

Name:

|

Ora

Elharar Soffer

|

|

|

Title:

|

Chairperson

of the Board and CEO

|

Date:

January 11, 2022

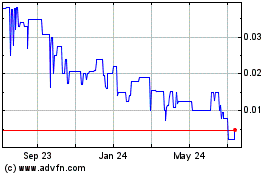

Citrine Global (QB) (USOTC:CTGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

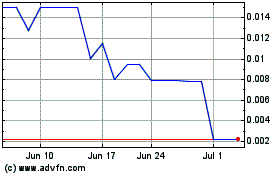

Citrine Global (QB) (USOTC:CTGL)

Historical Stock Chart

From Apr 2023 to Apr 2024