Current Report Filing (8-k)

October 04 2022 - 12:37PM

Edgar (US Regulatory)

0001750155

false

A1

true

0001750155

2022-09-30

2022-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 30, 2022

Charlotte’s

Web Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

| British Columbia |

000-56364 |

98-1508633 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

|

700 Tech Court

Louisville, Colorado |

80027 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (720) 617-7303

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 1.01. | Entry Into a Material Definitive Agreement. |

Effective as of September 30,

2022, Charlotte’s Web Holdings, Inc. (the “Company”) and its subsidiary, Charlotte's Web, Inc., a Delaware corporation

(“CWB”), entered into an Extension and Fourth Amending Agreement to Name and Likeness and License Agreement (the “Extension

Agreement”) with Leeland & Sig LLC d/b/a Stanley Brothers Brand Company, a Colorado limited liability company (“Licensor”).

Pursuant to the Extension Agreement, the term of the Name and Likeness and License Agreement dated August 1, 2018 between the Company,

CWB and Licensor, as amended by the Amending Agreement to Name and Likeness Agreement effective April 16, 2021 (as amended, the “Name

and Likeness Agreement”), was extended from September 30, 2022 to December 31, 2022. Additionally, the Name and Likeness Agreement

was also amended to provide the payment of a Company event fee of $1,500 per diem for each Stanley brother that, at the request of the

Company’s chief executive officer, participates in any of the following events: (i) customer meetings; (ii) strategic partner meetings;

(iii) speaking engagements; (iv) presentations; (v) social media postings; (vi) podcasts; (vi) public relations events; (vii) media

interviews; (viii) trade show appearances; and (ix) events substantively similar to any of the foregoing.

In addition to the Name and

Likeness Agreement, as amended by the Extension Agreement, affiliates of the Licensor are parties to certain agreements with the Company.

Jesse Stanley, one of the Company’s founders, and Master and A Hound Irrevocable Trust, are borrowers under that certain secured

promissory note, dated November 30, 2020, for $1,000,000 that, as amended as of March

22, 2022, matures as of November 13, 2023. Stanley Brothers USA Holdings, Inc. (“Stanley Brothers USA”), a Delaware corporation

whose majority shareholders are certain founders of the Company or entities controlled by such founders or their affiliates, is party

to the option purchase agreement (the “SBH Purchase Option”), dated March 2, 2021, with the Company, which provides the Company

with the option to acquire all or substantially all of Stanley Brothers USA on the earlier of February 26, 2024, and federal legalization

of Cannabis in the United States, or such earlier time as Stanley Brothers USA and Charlotte’s Web may agree, at a purchase price

to be determined at the time of exercise of the SBH Purchase Option. The SBH Purchase Option has a five-year term (extendable for an additional

two years upon payment of additional consideration).

Mr. Jared

Stanley, Chief Operating Officer of the Company, is a Co-Founder of Stanley Brothers USA and, following execution of the SBH Purchase

Option, assumed a seat on the board of directors of Stanley Brothers USA. Mr. Joel Stanley, a Co-Founder of Stanley Brothers USA,

is the former Chairman of the Company’s board of director. Mr. Jared Stanley and Mr. Joel Stanley each resigned as a member

of the Company’s board of directors effective March 2, 2021.

The

foregoing description of the Extension Amendment is qualified in its entirety by reference to the agreement, which is included as Exhibit

10.1 to this Current Report on Form 8-K.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

The

Company previously announced the departure of Wes Booysen as its Chief Financial & Operating Officer on April 25, 2022, which

was reported on a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission on April 28, 2022. Effective as of

September 30, 2022, Mr. Booysen and CWB entered into a separation agreement (the “Separation Agreement”) pursuant to which

Mr. Booysen will receive a lump sum payment of Two Hundred Fifty Thousand Dollars ($250,000) in exchange for a general release of all

claims against the Company and its subsidiaries and affiliates, subject to Mr. Booysen not revoking the Separation Agreement within seven

days. The Separation Agreement became effective on October 4th and the settlement payment to be paid thereunder will be due within 90

days from such effective date. The Company also agreed to release certain claims against Mr. Booysen in respect of the work performed

by or on behalf of Mr. Booysen at the Company, but which release of claims excludes any claims that the Company may not waive or

release under applicable law as well as claims based on any fraud, theft, embezzlement or similar misconduct chargeable as a criminal

offense.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

(d) |

Exhibits: |

| |

|

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

CHARLOTTE’S WEB HOLDINGS, INC. |

| |

|

|

|

| Date: October 4, 2022 |

|

By: |

/s/ Stephen Rogers |

| |

|

|

Stephen Rogers |

| |

|

|

Senior Vice President - General Counsel and Corporate Secretary |

| |

|

|

|

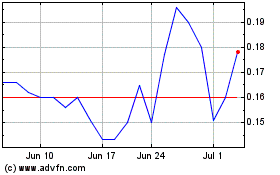

Charlottes Web (QX) (USOTC:CWBHF)

Historical Stock Chart

From Mar 2024 to Apr 2024

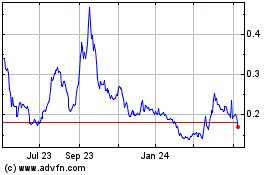

Charlottes Web (QX) (USOTC:CWBHF)

Historical Stock Chart

From Apr 2023 to Apr 2024