LONDON MARKETS: London Markets Trail Global Peers After A Week Of Brexit Turmoil

September 06 2019 - 8:36AM

Dow Jones News

By Mark Cobley

U.K. markets looked set to close the week out on a gain of

almost 1% after a week of extraordinary political turmoil in

London. But British stocks continue to trail their counterparts

around the world.

The FTSE 100 index was flat on Friday morning at around 7,270,

as investors digested the fallout from a hectic few days in

parliament. Since Monday, the U.K.'s new Prime Minister Boris

Johnson has lost a series of crunch votes on Brexit

(http://www.marketwatch.com/story/boris-johnsons-brexit-plans-stymied-again-parliament-rejects-call-for-election-2019-09-04),

collapsed his own parliamentary majority by sacking rebellious

lawmakers, failed to win backing for a new election

(http://www.marketwatch.com/story/boris-johnson-says-snap-election-is-the-only-way-to-resolve-brexit-gridlock-2019-09-05),

and suffered the resignation of his own brother as a minister

(http://www.marketwatch.com/story/boris-johnsons-brother-jo-resigns-from-the-cabinet-2019-09-05).

Against that backdrop, the U.K. benchmark has undershot most

others. The U.S.'s S&P 500 is up 1.7% for the week, while

Europe's Stoxx 600 is up 1.8%.

British shares' underperformance continues a trend seen for much

of 2019, according to stockbroker AJ Bell. "Only the key benchmarks

in India, Hong Kong and Japan have fared worse than the FTSE 100,

250 and All-Share [in 2019]," the firm said in a note this

morning.

Meanwhile, the British pound has rallied by almost 2.5%

throughout the week to $1.2302, as the defeats inflicted on the

strongly pro-Brexit Johnson government have made a quick,

disorderly exit from the EU less likely.

U.K. stock investors have also had their eyes at least as much

on the prospects for the global economy, with this week's Brexit

chaos balanced by hopes the U.S. and China might soon sit down to

strike a trade deal

(http://www.marketwatch.com/story/china-says-trade-talks-with-us-to-take-place-in-october-2019-09-05).

Markets are also awaiting the U.S. jobs report later today

(http://www.marketwatch.com/story/us-likely-added-173000-jobs-in-august-but-watch-out-for-an-end-of-summer-surprise-2019-09-05),

a key indicator for the health of the world's biggest economy.

Among individual stocks, home builder Berkeley Group (BKG.LN)

gained almost 2% after it released an upbeat market outlook

(http://www.marketwatch.com/story/uk-builder-berkeley-market-conditions-stable-2019-09-06).

Shares in U.K.-listed security group G4S (GFS.LN) soared almost

9% on a report that the U.S.-listed Brinks Company is planning a

GBP1bn bid

(https://news.sky.com/story/us-cash-handling-giant-brinks-plots-raid-on-1bn-g4s-arm-11803439)

for part of the business. British network Sky News said the two

firms are in talks but other bidders might yet emerge.

Car-seller Motorpoint (MOTR.LN) was the largest faller in the

FTSE All Share index, dropping almost 15% after the company

announced its co-founder had sold the majority of his stake

(https://www.investegate.co.uk/numis-securities-ltd/rns/result-of-accelerated-bookbuild-in-motorpoint/201909060700054330L/).

Among blue-chip firms, utilities Centrica (CNA.LN), United

Utilities (UU.LN) and Severn Trent (SVT.LN) were all off by more

than 3%, after analysts at RBC Capital Markets downgraded United

Utilities

(http://www.morningstar.co.uk/uk/news/AN_1567764316633815700/winners--losers-summary-broker-cuts-send-united-utilities-rbs-lower.aspx),

according to Morningstar.

(END) Dow Jones Newswires

September 06, 2019 08:21 ET (12:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

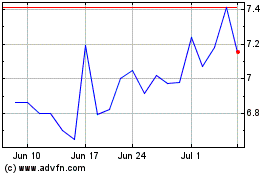

Centrica (PK) (USOTC:CPYYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

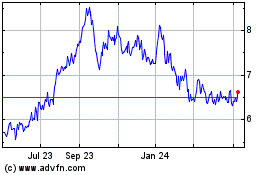

Centrica (PK) (USOTC:CPYYY)

Historical Stock Chart

From Apr 2023 to Apr 2024