Centrica Shares Tumble After Slashing Dividend, CEO Exit -- Update

July 30 2019 - 7:15AM

Dow Jones News

--Centrica said it will cut its 2019 dividend to 5 pence a share

from 12 pence in 2018, exit oil-and-gas production and target

further cost savings

--Chief Executive Iain Conn plans to step down from his role

next year

--Shares in the owner of British Gas fell sharply on the back of

the news, sending the stock to a two-decade low

By Adria Calatayud

Shares in Centrica PLC (CNA.LN) fell Tuesday after the British

Gas owner said that it plans to slash its 2019 dividend by 58% and

exit oil-and-gas production, and that Chief Executive Iain Conn

intends to step down next year.

The FTSE 100-listed utilities company launched plans to step up

its restructuring efforts and refocus its portfolio on

customer-facing activities, as it hopes to revive its fortunes

after taking a hit from an energy-price cap imposed by the U.K.

government.

The company said it will complete its shift toward focusing on

customer-facing businesses by divesting its oil-and-gas production

assets, a move that follows its intended exit from nuclear-power

generation. Divestment proceeds will be used to fund restructuring

costs and underpin its balance sheet, it said.

Centrica said it targets 1 billion pounds ($1.23 billion) in

cost savings over the 2019-2022 period, GBP250 million more than

previously planned. This will require cash restructuring

expenditure of around GBP1.25 billion, the company said.

The company said it will partly fund restructuring costs through

a cut to its full-year dividend to 5 pence a share from 12 pence a

share.

Mr. Conn will remain with the company at least until next year's

annual general meeting to lead the repositioning of its portfolio,

having joined the group in January 2015, Centrica said.

Centrica shares at 1034 GMT dropped 15% to 76.94 pence, which

would be the company's worst one-day percentage fall ever, and sent

the stock to a 21-year low.

Centrica reported a swing to a pretax loss of GBP569 million for

the first half compared with a profit of GBP415 million in the

year-earlier period. The company attributed the loss to lower

adjusted earnings and remeasurements due to falling gas prices.

Centrica posted a net loss of GBP550 million compared with a profit

of GBP238 million a year before.

Adjusted earnings attributable to shareholders fell by 63% to

GBP134 million, the company said.

Revenue fell to GBP11.57 billion in the first half from GBP12.10

billion a year before, the company said.

Centrica declared an interim dividend of 1.50 pence a share,

down from 3.60 pence a share in the first half of 2018. The company

backed its full-year guidance and said adjusted earnings will be

weighted toward the second half of the year.

Write to Adria Calatayud at

adria.calatayudvaello@dowjones.com

(END) Dow Jones Newswires

July 30, 2019 07:00 ET (11:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

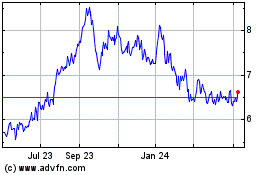

Centrica (PK) (USOTC:CPYYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

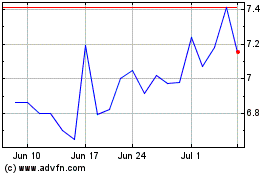

Centrica (PK) (USOTC:CPYYY)

Historical Stock Chart

From Apr 2023 to Apr 2024