Current Report Filing (8-k)

April 17 2020 - 5:18PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 13, 2020

CAREVIEW COMMUNICATIONS,

INC.

(Exact name of registrant

as specified in its charter)

|

Nevada

|

000-54090

|

95-4659068

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

405 State Highway 121, Suite B-240, Lewisville,

TX 75067

(Address of principal executive offices and

Zip Code)

(972) 943-6050

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol(s)

|

Name

of each exchange on which registered

|

|

N/A

|

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230-405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has

elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

Item 1.01 Entry into a Material Definitive Agreement.

On April 10, 2020, CareView Communications, Inc., a

Texas corporation (the “Borrower”), a wholly owned subsidiary of CareView Communications, Inc., a Nevada corporation

(the “Company”), applied to BOKF, NA (“Bank of Oklahoma”) under the U.S. Small Business Administration

(the “SBA”) Paycheck Protection Program of the Coronavirus Aid, Relief and Economic Security Act of 2020 (the “CARES

Act”) for a loan of $781,800 (the “SBA Loan”). On April 13, 2020, the SBA Loan was approved and the Borrower

received the SBA Loan proceeds, which the Borrower plans to use for covered payroll costs, rent and utilities in accordance with

the relevant terms and conditions of the CARES Act.

The SBA Loan, which took the form of a promissory note issued

by the Borrower (the “Promissory Note”), has a two-year term, matures on April 10, 2022, and bears interest

at a rate of 1.0% per annum. Monthly principal and interest payments, less the amount of any potential forgiveness (discussed below),

will commence on November 10, 2020. The Borrower did not provide any collateral or guarantees for the SBA Loan, nor did the

Borrower pay any facility charge to obtain the SBA Loan. The Promissory Note provides for customary events of default, including,

among others, those relating to failure to make payment when due under the Promissory Note, bankruptcy, breaches of representations

and material adverse effects. The Borrower may prepay the principal of the SBA Loan at any time without incurring any prepayment

charges.

The SBA Loan may be forgiven partially or fully if the SBA

Loan proceeds are used for covered payroll costs, rent and utilities, provided that such amounts are incurred during the eight-week

period that commenced on April 13, 2020 and at least 75% of any forgiven amount has been used for covered payroll costs. Any

forgiveness of the SBA Loan will be subject to approval by the SBA and Bank of Oklahoma and will require the Borrower to apply

for such treatment in the future.

The foregoing description of the SBA Loan is qualified in

its entirety by reference to the Promissory Note, a copy of which is attached as an exhibit to this Current Report on Form 8-K

and is incorporated by reference into this Item 1.01.

Item 2.03 Creation of a Direct Financial Obligation or

an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report

on Form 8-K that relates to the creation of direct financial obligations of the Company is incorporated by reference into this

Item 2.03.

Forward-Looking Statements

This Current Report on Form 8-K

contains forward-looking statements concerning the Company’s expectations, anticipations, intentions, or beliefs regarding

the SBA Loan. These express or implied statements are not promises or guarantees and involve substantial risks and uncertainties.

Among the factors that could cause actual results to differ materially from those described or projected herein are the following:

financial market conditions; actions by the SBA Loan parties; changes by the SBA or other governmental authorities regarding the

CARES Act, the Payroll Protection Program or related administrative matters; and the Company’s and the Borrower’s ability

to comply with the terms of the SBA Loan and the CARES Act, including to use the proceeds of the SBA Loan as described herein.

The Company undertakes no obligation to update the information contained in this Current Report on Form 8-K to reflect subsequently

occurring events or circumstances.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit No.

|

Date

|

Document

|

|

10.01

|

04/13/20

|

Promissory Note from CareView Communications, Inc., a Texas corporation, to BOKF, NA

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

Date: April 17, 2020

|

CAREVIEW COMMUNICATIONS, INC.

|

|

|

|

|

|

By:

|

/s/ Steven G. Johnson

|

|

|

|

Steven G. Johnson

Chief Executive Officer

|

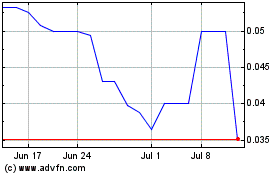

Careview Communications (QB) (USOTC:CRVW)

Historical Stock Chart

From Mar 2024 to Apr 2024

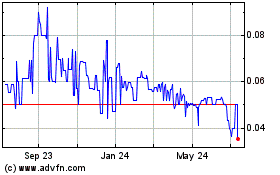

Careview Communications (QB) (USOTC:CRVW)

Historical Stock Chart

From Apr 2023 to Apr 2024