UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

June 4, 2019

Information Statement Pursuant to Section 14(c)

Of the Securities Exchange Act of 1934

☒

Filed by the registrant

Filed by a party other than the registrant

Check the appropriate box:

Preliminary Information Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

☒

Definitive Information Statement

CareView Communications, Inc.

(Name of Registrant as Specified In Charter)

(Name of Person(s) Filing Information Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒

No fee required

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1) Title of each class of securities to which transaction applies:

_______________________________________

2) Aggregate number of securities to which transaction applies:

_______________________________________

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

_______________________________________

4) Proposed maximum aggregate value of transaction:

_______________________________________

5) Total fee paid:

_______________________________________

☐

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.

3) Filing Party:

4) Date Filed:

CareView Communications, Inc.

405 State Highway 121

Suite B-240

Lewisville, TX 75067

Dear Stockholders:

On April 11, 2019, the board of directors of CareView Communications, Inc. adopted a resolution approving an amendment to our Articles of Incorporation to:

|

|

●

|

effectuate an increase of the authorized common shares from 300,000,000 par value $0.001 to 500,000,000 par value $0.001.

|

The Company obtained the written consent of stockholders representing 52.3% of its outstanding common stock as of May 14, 2019 approving an amendment to the Company’s Articles of Incorporation to affect the above-mentioned corporate action. The amendment has not yet been filed with the State of Nevada.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

No action is required by you. The accompanying information statement is furnished only to inform our stockholders of the actions taken place. This Information Statement is being mailed on or about June 5, 2019 to all of our stockholders of record as of the close of business on May 22, 2019.

By Order of the Board of Directors.

|

/s/ Steven G. Johnson

|

|

|

|

Name: Steven G. Johnson

|

|

|

Title: Chief Executive Officer

|

|

INFORMATION STATEMENT

June 4, 2019

CareView Communications, Inc.

405 State Highway 121

Suite B-240

Lewisville, TX 75067

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is furnished by the Board of Directors of CareView Communications, Inc., a Nevada corporation, to the holders of record at the close of business on May 22, 2019 of its outstanding common stock, par value $0.001 per share, pursuant to Rule 14c-2 of the Securities Exchange Act of 1934, as amended, and pursuant to the Nevada Revised Statutes (“NRS”).

The cost of furnishing this Information Statement will be borne by us. We will mail this Information Statement to registered stockholders and certain beneficial stockholders where requested by brokerage houses, nominees, custodians, fiduciaries and other like parties.

This Information Statement informs stockholders of the actions taken and approved on April 11, 2019 by our Board of Directors and by our stockholders holding 52.3% of the Company’s common stock issued and outstanding on April 11, 2019. Our Board of Directors and the Majority Stockholders approved an amendment of the Company’s Articles of Incorporation to:

|

|

●

|

effectuate an increase of the authorized common shares from 300,000,000 par value $0.001 to 500,000,000 par value $0.001.

|

Accordingly, all necessary corporate approvals in connection with the amendment to our Articles of Incorporation to affect the above corporate actions have been obtained. This Information Statement is furnished solely for the purpose of informing our stockholders, in the manner required under the Exchange Act of these corporate actions. Therefore, this Information Statement is being sent to you for informational purposes only.

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The Company’s stockholders as of the Record Date are being furnished copies of this Information Statement. This Information Statement is first being mailed or furnished to our stockholders on or about June 5, 2019.

NO DISSENTERS’ RIGHTS

Pursuant to the NRS, the corporate actions described in this Information Statement will not afford stockholders the opportunity to dissent from the actions described herein and to receive an agreed or judicially appraised value for their shares.

NOTICE OF ACTION TAKEN PURSUANT TO THE WRITTEN CONSENT OF STOCKHOLDERS HOLDING A MAJORITY OF THE OUTSTANDING COMMON SHARES OF CAREVIEW COMMUNICATIONS, INC. IN LIEU OF A SPECIAL MEETING OF THE STOCKHOLDERS

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that, on April 11, 2019, CareView Communications, Inc., a Nevada corporation, obtained the unanimous written consent of its board of directors and the written consent of stockholders holding 72,863,770 common shares of the Company or 52.3% of the voting power of the issued and outstanding shares of the Company’s common stock approving:

|

|

●

|

effectuate an increase of the authorized common shares from 300,000,000 par value $0.001 to 500,000,000 par value $0.001.

|

OUTSTANDING SHARES AND VOTING RIGHTS

As of May 22, 2019 (the “Record Date”), the Company’s authorized capitalization consisted of 300,000,000 common shares, of which 139,380,748 common shares were issued and outstanding, and 20,000,000 preferred shares, of which none were issued and outstanding.

Each common share of the Company entitles its holder to one vote on each matter submitted to the Company’s stockholders. However, because the Majority Stockholders have consented to the foregoing actions by resolution dated April 11, 2019, in lieu of a special meeting in accordance with the NRS and because the Majority Stockholders have sufficient voting power to approve such actions through his ownership of common stock, no other stockholder vote will be solicited in connection with this Information Statement.

AMENDMENT TO

ARTICLES OF INCORPORATION

The Board of Directors and Majority Stockholders have approved an amendment to our Articles of Incorporation to affect an increase in the authorized common stock.

The Authorized Common Stock Increase

The purpose of the increase in common stock is to increase

the number of common shares available for issuance to investors who agree to provide the Company with the funding it requires

to continue its operations, and/or to persons in connection with potential acquisition transactions, warrant or option exercises

and other transactions under which our Board of Directors may determine is in the best interest of the Company and our stockholders.

The

increase in authorized common stock will not have any immediate effect on the rights of existing stockholders but may have a dilutive

effect our existing stockholders if additional common shares are issued.

We are not increasing our authorized common stock to construct or enable any anti-takeover defense or mechanism on behalf of the Company. It is possible that management could use the additional common shares to resist or frustrate a third-party transaction providing an above-market premium that is favored by a majority of the independent stockholders. For example, shares of the authorized by unissued common stock could (within the limits imposed by applicable law) be issued in one or more transactions that would discourage persons from attempting to gain control of the Company, by diluting the voting power of common shares then outstanding. Similarly, the issuance of additional common shares to certain persons allied with the Company’s management could have the effect of making it more difficult to remove the Company’s current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. Each of these, together with other anti-takeover provisions provided by Nevada law, could potentially limit the opportunity for the Company’s stockholders to dispose of their common shares at a premium. We do not have any anti-takeover provisions present in our governing documents.

The Board of Directors is not aware of any attempt, or contemplated attempt, to acquire control of the Company, and this proposal is not being presented with the intent that it be utilized as a type of anti-takeover device or to secure management’s positions within the Company. In addition, there are no plans or proposals to adopt any anti-takeover provisions or to enter into any other arrangements that may have material anti-takeover consequences.

The increase in our common shares is not in any way related to any plans or intentions to enter into a merger, consolidation, acquisition or similar business transaction.

EFFECTIVE DATE OF THE AMENDMENT

The amendment has not yet been filed with the State of Nevada.

The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the Company’s beneficial owners of common stock and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

As of the date of this filing, the following table sets forth certain information with respect to the beneficial ownership of our common stock by (i) each shareholder known by us to be the beneficial owner of more than five percent (5%) of our common stock, (ii) by each of our current directors and executive officers as identified herein, and (iii) all of our directors and executive officers as a group. Each person has sole voting and investment power with respect to the common shares, except as otherwise indicated. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Common shares, non-qualified stock options, common stock purchase warrants, and convertible securities that are currently exercisable or convertible into the Company’s common shares within sixty (60) days of the date of this document, are deemed to be outstanding and to be beneficially owned by the person holding the options, warrants, or convertible securities for the purpose of computing the percentage ownership of the person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise noted, the address for all officers and directors listed below is 405 State Highway 121, Suite B-240, Lewisville, Texas 75067.

|

Name and Address

|

|

Number of

Shares (1)

|

|

Percentage of Outstanding Common Shares

|

|

Steve G. Johnson

|

|

|

43,902,661

|

(2)

|

|

|

26.21

|

%

|

|

Jason T. Thompson

|

|

|

3,697,975

|

(3)

|

|

|

2.60

|

%

|

|

L. Allen Wheeler

|

|

|

25,362,486

|

(4)

|

|

|

17.06

|

%

|

|

Sandra K. McRee

|

|

|

8,738,040

|

(5)

|

|

|

5.93

|

%

|

|

Jeffrey C. Lightcap

|

|

|

45,224,086

|

(6)

|

|

|

24.50

|

%

|

|

David R. White

|

|

|

1,149,086

|

(7)

|

|

|

0.82

|

%

|

|

Steven B. Epstein

|

|

|

6,941,609

|

(8)

|

|

|

4.80

|

%

|

|

Dr. James R. Higgins

|

|

|

29,462,978

|

(9)

|

|

|

18.71

|

%

|

|

All officers and Directors as a Group (8 persons)

|

|

|

164,228,921

|

(10)

|

|

|

63.94

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Robert J. Smith

|

|

|

9,590,506

|

(11)

|

|

|

6.88

|

%

|

|

13650 Fiddlesticks Blvd.

|

|

|

|

|

|

|

|

|

|

Suite 202-324

|

|

|

|

|

|

|

|

|

|

Ft. Myers, FL 33912

|

|

|

|

|

|

|

|

|

|

(1)

|

Unless otherwise noted, we believe that all common shares are beneficially owned and that all persons named in the table have sole voting and investment power with respect to all common shares owned by them. Applicable percentage of ownership is based on 139,380,748 common shares currently outstanding, as adjusted for each shareholder.

|

|

(2)

|

This amount includes (i) 208,977 common shares directly owned by Johnson, (ii) 1,655,556 common shares due to Johnson upon exercise of vested options, (iii) 550,001 common shares due to Johnson upon exercise of vested warrants, (iv) 25,926,511 common shares that may be acquired upon conversion of convertible debt (including interest paid in kind through May 28, 2019), and (v) 15,561,616 common shares beneficially owned by SJ Capital, LLC, a company controlled by Johnson. The percentage of class for Johnson is based on 167,512,816 common shares which would be outstanding if all of Johnson’s vested options and warrants were exercised and convertible debt was converted.

|

|

(3)

|

This amount includes (i) 737,500 common shares directly owned by Thompson, (ii) 529,086 common shares due to Thompson upon exercise of vested options, (iii) 55,769 common shares due to Thompson upon exercise of vested warrants, and (iv) 2,375,620 common shares that may be acquired upon conversion of convertible debt (including interest paid in kind through May 28, 2019). The percentage of class for Thompson is based on 142,341,223 common shares which would be outstanding if all of Thompson’s vested options and warrants were exercised and convertible debt was converted.

|

|

(4)

|

This amount includes (i) 1,856,345 common shares directly owned by Wheeler, (ii) 679,086 common shares due to Wheeler upon exercise of options, (iii) 382,692 common shares due to Wheeler upon exercise of vested warrants (iv) 8,210,327 common shares that may be acquired upon conversion of convertible debt (including interest paid in kind through May 28, 2019), (v) 14,201,820 common shares beneficially owned by Dozer Man, LLC, an entity controlled by Wheeler, and (vi) 32,216 common shares beneficially owned by Global FG, LLC, an entity of which Wheeler owns 50%. The percentage of class for Wheeler is based on 148,652,853 common shares which would be outstanding if all of Wheeler’s vested options and warrants were exercised and convertible debt was converted.

|

|

(5)

|

This amount includes (i) 750,000 common shares directly owned by McRee, (ii) 5,000,001 common shares due to McRee upon exercise of vested options, (iii) 148,076 common shares due to McRee upon exercise of vested warrants, and (iv) 2,839,963 common shares that may be acquired upon conversion of convertible debt (including interest paid in kind through May 28,2019). The percentage of class for McRee is based on 147,368,788 common shares which would be outstanding if all of McRee’s vested options and warrants were exercised and convertible debt was converted.

|

|

(6)

|

HealthCor Management, LP, HealthCor Associates, LLC, HealthCor Hybrid Offshore Master Fund, LP, HealthCor Hybrid Offshore GP, LLC, HealthCor Group, LLC, HealthCor Partners Management, L.P., HealthCor Partners Management GP, LLC, HealthCor Partners Fund, LP, HealthCor Partners, LP HealthCor Partners GP, LLC, and Jeffrey C. Lightcap (collectively, the Reporting Persons), beneficially own an aggregate of 45,224,086 common shares, representing (i) 26,101,737 common shares that may be acquired upon conversion of convertible debt (including interest paid in kind through May 28,2019) and (ii) 5,615,384 common shares that may be acquired upon exercise of warrants. The amounts detailed above include (i) 493,269 common shares due to Lightcap upon exercise of vested warrants and (ii) 13,013,696 common shares that may be acquired upon conversion of convertible debt (including interest paid in kind through May 28, 2019). The percentage of class for Reporting Persons and Lightcap, as an individual, is based on 184,604,834 common shares which would be outstanding if the Reporting Persons notes and convertible debt held by Lightcap were converted and all warrants held by the Reporting Persons and Lightcap were exercised.

|

|

(7)

|

This amount includes (i) 270,000 common shares directly owned by White (ii) 879,086 common shares due to White upon exercise of vested options. The percentage of class for White is based on 140,259,834 common shares which would be outstanding if all of White’s vested options were exercised.

|

|

(8)

|

This amount includes (i) 1,780,000 common shares directly owned by Epstein, (ii) 929,086 common shares due to Epstein upon exercise of vested options, (iii) 178,846 common shares due to Epstein upon exercise of vested warrants, and (iv) 4,053,677 common shares that may be acquired upon conversion of convertible debt (including interest paid in kind through May 28, 2019). The percentage of class for Epstein is based on 144,542,357 common shares which would be outstanding if all of Epstein’s vested options and warrants were exercised and convertible debt was converted.

|

|

(9)

|

This amount includes (i) 4,731,445 common shares directly owned by Higgins, (ii) 1,361,538 common shares jointly owned by Higgins and his wife, (iii) 5,270,484 common shares held in trust by Higgins’ wife, (iv) 529,086 common shares due to Higgins upon exercise of vested options, (v) 682,692 common shares due to Higgins upon exercise of vested warrants, and (vi) 16,887,733 common shares that may be acquired upon conversion of convertible debt (including interest paid in kind through May 28, 2019). The percentage of class for Higgins is based on 157,480,259 common shares which would be outstanding if all of Higgins’ vested options and warrants were exercised and convertible debt was converted.

|

|

(10)

|

This amount includes all common shares directly and beneficially owned by all officers and directors and all common shares to be issued directly and beneficially upon exercise of vested common shares under options and warrants and upon conversion of convertible securities. The percentage of class for all officers and directors is based on 256,847,728 common shares which would be outstanding if all the aforementioned options, warrants and convertible securities were exercised or converted.

|

|

(11)

|

This amount includes: (i) 265,000 common shares directly owned by Smith, (ii) 60,000 common shares held in trust for Smith’s minor children, (iii) 6,210,723 common shares beneficially owned by Plato & Associates, LLC, a company controlled by Smith, and (iv) 3,054,783 common shares beneficially owned by Energy Capital, LLC, a company controlled by Smith. The percentage of class for Smith is based on 139,380,748 common shares which would be outstanding if all warrants owned by Plato & Associates, LLC were exercised.

|

Under Rule 144 promulgated under the Securities Act, our officers, directors and beneficial shareholders may sell up to one percent (1%) of the total outstanding shares (or an amount of shares equal to the average weekly reported volume of trading during the four calendar weeks preceding the sale) every three months provided that (1) current public information is available about our Company, (2) the shares have been fully paid for at least one year, (3) the shares are sold in a broker’s transaction or through a market-maker, and (4) the seller files a Form 144 with the SEC if seller is an affiliate.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As of April 11, 2019, there were 139,380,748 common shares issued and outstanding. Each common shareholder is entitled to one vote per common share.

Stockholders holding in the aggregate 72,863,770 common shares of the Company, or 52.3% of the voting power of our outstanding common shares, have approved the corporate actions discussed herein by written consent dated April 11, 2019.

VOTING PROCEDURES

Pursuant to the Nevada Revised Statutes and our Articles of Incorporation, the affirmative vote of the holders of a majority of our outstanding common shares is sufficient to amend our Articles of Incorporation, which vote was obtained by the written consent of the Majority Stockholders as described herein. As a result, the amendment to our Articles of Incorporation has been approved and no further votes will be needed.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No director, executive officer, associate of any director or executive officer or any other person has any substantial interest, direct or indirect, by security holdings or otherwise, in the amendment of our Articles of Incorporation relative to the increase in authorized common shares.

DISSENTER’S RIGHT OF APPRAISAL

Under Nevada law, stockholders are not entitled to dissenter’s rights of appraisal with respect to the corporate actions discussed herein.

WHERE YOU CAN OBTAIN ADDITIONAL INFORMATION

The Company is subject to the informational requirements of the Exchange Act, and in accordance therewith files reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q with the Commission. Reports and other information filed by the Company can be inspected and copied at the public reference facilities maintained at the Commission at 100 F Street NW, Washington, D.C. 20549. Copies of such material can be obtained upon written request addressed to the Commission, Public Reference Section, 100 F Street NW, Washington D.C. 20549, at prescribed rates. The Commission maintains a website on the Internet (http://www.sec.gov) that contains the filings of issuers that file electronically with the Commission through the EDGAR system. Copies of such filings may also be obtained by writing to CareView Communications, Inc. at 405 State Highway 121, Suite B-240, Lewisville, TX 75067.

INCORPORATION BY REFERENCE

The Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 has been incorporated by reference.

STOCKHOLDERS SHARING AN ADDRESS

Unless we have received contrary instructions from a stockholder, we are delivering only one Information Statement to multiple stockholders sharing an address. We will, upon request, promptly deliver a separate copy of this Information Statement to a stockholder who shares an address with another stockholder. A stockholder who wishes to receive a separate copy of the Information Statement may make such a request in writing to CareView Communications, Inc. at 405 State Highway 121, Suite B-240, Lewisville, TX 75067.

On behalf of the Board of Directors,

June 4, 2019

|

/s/ Steven G. Johnson

|

|

|

|

Steven G. Johnson

|

|

|

Chief Executive Officer

|

|

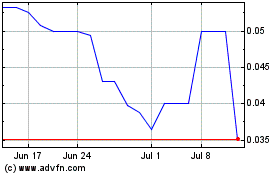

Careview Communications (QB) (USOTC:CRVW)

Historical Stock Chart

From Mar 2024 to Apr 2024

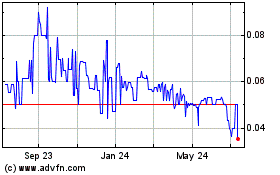

Careview Communications (QB) (USOTC:CRVW)

Historical Stock Chart

From Apr 2023 to Apr 2024