UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

Check the appropriate box:

|

|

|

Filed by the Registrant

|

x

|

|

Filed by a Party other than the Registrant

|

¨

|

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to Rule 14a-12

|

|

BODY AND MIND INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount previously paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

|

|

|

BODY AND MIND INC.

Suite 750, 1095 West Pender Street, Vancouver, British Columbia, Canada V6E 2M6

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on January 23, 2020

Dear Stockholder:

The annual meeting of stockholders (the “Annual Meeting”) of Body and Mind Inc. (the “Company”) will be held at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 4N7, on January 23, 2020, at 10:00 a.m. (Vancouver time). At the Annual Meeting stockholders will be asked to:

|

|

1.

|

elect David Wenger, Robert Hasman, Brent Reuter, Michael Mills and Dong Shim to act as directors of the Company;

|

|

|

|

|

|

|

2.

|

ratify the appointment of Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants, as the Company’s independent registered public accounting firm for the fiscal year ending July 31, 2020;

|

|

|

|

|

|

|

3.

|

approve continuation of the Company’s 2012 Incentive Stock Option Plan;

|

|

|

|

|

|

|

4.

|

approve, on a non-binding advisory basis, the compensation of our named executive officers;

|

|

|

|

|

|

|

5.

|

approve, on a non-binding advisory basis, the frequency of executive compensation votes; and

|

|

|

|

|

|

|

6.

|

transact any other business properly brought before the Annual Meeting or any adjournment thereof.

|

On or about December 10, 2019, the Company mailed to all stockholders of record, as of November 27, 2019, a Notice of Internet Availability of Proxy Materials (the “Notice”). Please carefully review the Notice for information on how to access the Notice of Annual Meeting, Proxy Statement, Proxy Card and our Annual Report on Form 10-K for the fiscal year ended July 31, 2019 (the “Annual Report on Form 10-K”), on www.proxyvote.com, in addition to instructions on how you may request to receive a paper or email copy of these documents. There is no charge to you for requesting a paper copy of these documents. Our Annual Report on Form 10-K, including financial statements for such period, does not constitute any part of the material for the solicitation of proxies.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record of the Company’s common stock at the close of business on November 27, 2019, are entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

It is important that your shares be represented and voted at the Annual Meeting. If you are the registered holder of the Company’s common stock, you can vote your shares by completing and returning the enclosed proxy card, even if you plan to attend the Annual Meeting. You may vote your shares of common stock in person even if you previously returned a proxy card. Please note, however, that if your shares of common stock are held of record by a broker, bank or other nominee and you wish to vote in person at the Annual Meeting, you must obtain a proxy issued in your name from such broker, bank or other nominee. Please carefully review the instructions on the proxy card or the information forwarded by your broker, bank or other nominee regarding voting instructions.

If you are planning to attend the Annual Meeting in person, you will be asked to register before entering the Annual Meeting. All attendees will be required to present government-issued photo identification (e.g., driver’s license or passport) to enter the Annual Meeting. If you are a stockholder of record, your ownership of the Company’s common stock will be verified against the list of stockholders of record as of November 27, 2019, prior to being admitted to the Annual Meeting. If you are not a stockholder of record and hold your shares of common stock in “street name” (that is, your shares of common stock are held in a brokerage account or by a bank or other nominee), you must also provide proof of beneficial ownership as of November 27, 2019, such as your most recent account statement prior to November 27, 2019, and a copy of the voting instruction card provided by your broker, bank or nominee or similar evidence of ownership.

By Order of the Board of Directors

|

BODY AND MIND INC.

|

|

|

|

|

|

/s/ Michael Mills

|

|

|

Michael Mills

|

|

|

President and Interim Chief Executive Officer

|

|

|

|

|

|

Dated: December 10, 2019.

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JANUARY 23, 2020:

The Proxy Statement and form of Proxy, as well as the

Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2019

are available on the Internet at:

www.proxyvote.com

BODY AND MIND INC.

Suite 750, 1095 West Pender Street, Vancouver, British Columbia, Canada V6E 2M6

PROXY STATEMENT FOR THE ANNUAL MEETING OF STOCKHOLDERS

To be held on January 23, 2020

THE ANNUAL MEETING

General

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board of Directors”) of Body and Mind Inc. (“we”, “us”, “our” or the “Company”) for use in connection with our annual meeting of our stockholders (the “Annual Meeting”) to be held on January 23, 2020, at 10:00 a.m. (Vancouver time), at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, Canada, V6E 4N7, or at any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting.

In accordance with rules and regulations adopted by the United States Securities and Exchange Commission (the “SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record, we may furnish proxy materials to our stockholders on the Internet. On or about December 10, 2019, the Company mailed to all stockholders of record, as of November 27, 2019 (the “Record Date”), a Notice of Internet Availability of Proxy Materials (the “Notice”). If you received only a Notice by mail, you will not receive a printed copy of the proxy materials.

Please carefully review the Notice for information on how to access our proxy materials, consisting of the Notice of Annual Meeting, Proxy Statement and Proxy Card, available at www.proxyvote.com. You may also access our Annual Report on Form 10-K for each of our fiscal year ended July 31, 2019 (the “Annual Report on Form 10-K”), including our financial statements for such periods. However, our Annual Report on Form 10-K do not constitute any part of the material for the solicitation of proxies.

The Notice also includes instructions as to how you may submit your proxy on the Internet or over the telephone.

If you received only a Notice of Internet Availability (the “Notice”) by mail and you would like to receive a printed copy of our proxy materials, including a Proxy Card, or a copy of our Annual Report on Form 10-K, you should follow the instructions for requesting such materials included in the Notice. There is no charge to you for requesting a paper copy of these documents.

Our principal offices are located at Suite 750, 1095 West Georgia Street, Vancouver, British Columbia, Canada, V6E 2M6. Our telephone number is: (800) 361-6312 and our website address is: www.bamcannabis.com

Manner of Solicitation and Expenses

This proxy solicitation is made on behalf of our Board of Directors. Solicitation of proxies may be made by our directors, officers and employees personally, by telephone, mail, facsimile, e-mail, internet or otherwise, but they will not be specifically compensated for these services. We will bear the expenses incurred in connection with the solicitation of proxies for the Annual Meeting. Upon request, we will also reimburse brokers, dealers, banks or similar entities acting as nominees for their reasonable expenses incurred in forwarding copies of the proxy materials to the beneficial owners of the shares of our common stock as of the Record Date.

Record Date and Voting Shares

Our Board of Directors has fixed the close of business on November 27, 2019, as the Record Date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. As of the Record Date there were 101,853,217 shares of common stock issued, outstanding and entitled to vote at the Annual Meeting. Holders of shares of common stock are entitled to one vote at the Annual Meeting for each share of common stock held of record as of the Record Date. There is no cumulative voting in the election of directors.

Quorum

A quorum is necessary to hold a valid meeting of our stockholders. The required quorum for the transaction of business at the Annual Meeting is ten (10) percent of our issued and outstanding shares of common stock as of the Record Date.

In order to be counted for purposes of determining whether a quorum exists at the Annual Meeting, shares of common stock must be present at the Annual Meeting either in person or represented by proxy. Shares that will be counted for purposes of determining whether a quorum exists will include:

|

|

·

|

shares of common stock represented by properly executed proxies for which voting instructions have been given, including proxies which are marked “Abstain” or “Withhold” for any matter;

|

|

|

|

|

|

|

·

|

shares of common stock represented by properly executed proxies for which no voting instruction has been given; and

|

|

|

|

|

|

|

·

|

broker non-votes.

|

Broker non-votes occur when shares of common stock held by a broker for a beneficial owner are not voted with respect to a particular proposal because the broker has not received voting instructions from the beneficial owner and the broker does not have discretionary authority to vote such shares.

Entitlement to Vote

If you are a registered holder of shares of our common stock as of November 27, 2019, the Record Date for the Annual Meeting, you may vote those shares of our common stock in person at the Annual Meeting or by proxy in the manner described below under “Voting of Proxies”. If you hold shares of our common stock in “street name” through a broker or other financial institution, you must follow the instructions provided by your broker or other financial institution regarding how to instruct your broker or financial institution in respect of voting your shares.

Voting of Proxies

You can vote the shares of common stock that you own of record on the Record Date by either attending the Annual Meeting in person or by filling out and sending in a proxy in respect of the shares that you own. Your execution of a proxy will not affect your right to attend the Annual Meeting and to vote in person. You may also submit your proxy on the Internet or over the telephone by following the instructions contained in the Notice.

You may revoke your proxy at any time before it is voted by:

|

|

(a)

|

filing a written notice of revocation of proxy with our Corporate Secretary at any time before the taking of the vote at the Annual Meeting;

|

|

|

|

|

|

|

(b)

|

executing a later-dated proxy and delivering it to our Corporate Secretary at any time before the taking of the vote at the Annual Meeting; or

|

|

|

|

|

|

|

(c)

|

attending at the Annual Meeting, giving affirmative notice that you intend to revoke your proxy and voting in person. Please note that your attendance at the Annual Meeting will not, in and of itself, revoke your proxy.

|

All shares of common stock represented by properly executed proxies received at or prior to the Annual Meeting that have not been revoked will be voted in accordance with the instructions of the stockholder who has executed the proxy. If no choice is specified in a proxy, the shares represented by the proxy will be voted FOR all matters to be considered at the Annual Meeting as set forth in the accompanying Notice of Meeting. The shares represented by proxy will also be voted for or against such other matters as may properly come before the Annual Meeting in the discretion of the persons named in the proxy as proxyholders. We are currently not aware of any other matters to be presented for action at the Annual Meeting other than those described herein.

Any written revocation of a proxy or subsequent later-dated proxy should be delivered to the Company at Suite 750, 1095 West Georgia Street, Vancouver, British Columbia, Canada, V6E 2M6, Attention: Corporate Secretary.

Votes Required

Proposal One – Election of Directors: The affirmative vote of the holders of a plurality of our shares of common stock represented at the Annual Meeting in person or by proxy is required for the election of our directors. This means that the nominees who receive the greatest number of votes for each open seat will be elected. Votes may be cast in favor of the election of directors or withheld. Votes that are withheld and broker non-votes will be counted for the purposes of determining the presence or absence of a quorum, but will have no effect on the election of directors.

Proposal Two – Appointment of Independent Registered Public Accountants: The affirmative vote of the holders of a majority of our shares of common stock represented at the Annual Meeting in person or by proxy is required for the ratification of the appointment of our independent registered public accountants. Stockholders may vote in favor or against this Proposal or they may abstain. Abstentions are deemed to be “votes cast” and will have the same effect as a vote against this Proposal.

Proposal Three – Approval of Continuation of Stock Option Plan: The affirmative vote of the holders of a majority of our shares of common stock represented at the Annual Meeting in person or by proxy is required for the approval of continuation of the Company’s 2012 Incentive Stock Option Plan. Stockholders may vote in favor or against this Proposal or they may abstain. Abstentions are deemed to be “votes cast” and will have the same effect as a vote against this Proposal. Broker non-votes are not deemed to be votes cast and, therefore, will have no effect on the vote with respect to this Proposal.

Proposal Four – Say-on-Pay for Executive Compensation – Advisory Resolution: The vote to approve the compensation of our named executive officers (commonly known as a “say-on-pay” vote) is advisory and, therefore, not binding on the Company, the Compensation Committee or our Board of Directors. The affirmative vote of the holders of a majority of our common stock represented at the Annual Meeting in person or by proxy is required for the non-binding advisory vote on executive compensation. Stockholders may vote in favor of or against the Proposal or they may abstain. Abstentions are deemed to be “votes cast” and will have the same effect as a vote against this Proposal. Broker non-votes are not deemed to be votes cast and, therefore, will have no effect on the vote with respect to this Proposal.

Proposal Five – Frequency of Executive Compensation Votes – Advisory Resolution: The vote on how often the Company should include a say-on-pay vote in its proxy materials for future annual meetings of stockholders is advisory, and therefore not binding on the Company, the Compensation Committee or our Board of Directors. The affirmative vote of the holders of a majority of our common stock represented at the Annual Meeting in person or by proxy is required for the non-binding vote on frequency of executive compensation votes. Stockholders may vote to have the say-on-pay vote every year, every two years or every three years. Broker non-votes are not deemed to be votes cast and, therefore, will have no effect on the vote with respect to this Proposal. The option receiving the greatest number of votes (every one, two or three years) will be considered the frequency selected by stockholders.

Stockholder Proposals

No proposals have been received from any stockholder for consideration at the Annual Meeting.

Other Matters

It is not expected that any matters other than those referred to in this Proxy Statement will be brought before the Annual Meeting. If other matters are properly presented, however, the persons named as proxyholders will vote in accordance with their best judgment on such matters. The grant of a proxy also will confer discretionary authority on the persons named as proxyholders to vote in accordance with their best judgment on matters incidental to the conduct of the Annual Meeting.

No Rights of Appraisal

There are no rights of appraisal or similar rights of dissenters with respect to the matters that are the subject of this proxy solicitation under the laws of the State of Nevada, our certificate of incorporation or our bylaws.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

None of the following persons has any substantial interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Annual Meeting, other than elections to office and as named executive officers in respect of whose compensation the non-binding advisory vote on executive compensation will be held:

|

|

·

|

each person who has been one of our directors or executive officers at any time since the beginning of our last fiscal year;

|

|

|

|

|

|

|

·

|

each nominee for election as one of our directors; or

|

|

|

|

|

|

|

·

|

any associate of any of the foregoing persons.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of November 27, 2019, by:

|

|

·

|

each person who is known by us to beneficially own more than 5% of our shares of common stock; and

|

|

|

|

|

|

|

·

|

each executive officer, each director and all of our directors and executive officers as a group.

|

The number of shares beneficially owned and the related percentages are based on 101,853,217 shares of common stock outstanding as of November 27, 2019.

For the purposes of the information provided below, Common Shares that may be issued upon the exercise or conversion of stock options, warrants and other rights to acquire shares of our common stock that are exercisable or convertible within 60 days following November 27, 2019, when there were deemed to be 101,853,217 Common Shares of the Company outstanding and beneficially owned by the stockholders for the purpose of computing the number of Common Shares and percentage ownership of each holder are reported below, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

|

Name and Address of Beneficial Owner (1)

|

|

Amount and Nature of Beneficial Ownership (1)

|

|

|

Percentage of Beneficial Ownership

|

|

|

Directors and Officers:

|

|

|

|

|

|

|

|

Michael Mills, President and Interim Chief Executive Officer

c/o Suite 750,1095 West Pender Street

Vancouver, British Columbia, Canada, V6E 2M6

|

|

|

311,000(2)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Darren Tindale, Corporate Secretary

c/o Suite 750,1095 West Pender Street

Vancouver, British Columbia, Canada, V6E 2M6

|

|

|

620,400(3)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Brent Reuter, Director

c/o Suite 750,1095 West Pender Street

Vancouver, British Columbia, Canada, V6E 2M6

|

|

Nil

|

|

|

Nil

|

|

|

|

|

|

|

|

|

|

|

Robert Hasman, Director

c/o Suite 750,1095 West Pender Street

Vancouver, British Columbia, Canada, V6E 2M6

|

|

|

7,632,950(4)

|

|

|

|

7.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Stephen (Trip) Hoffman, Chief Operating Officer

c/o Suite 750,1095 West Pender Street

Vancouver, British Columbia, Canada, V6E 2M6

|

|

|

175,000(5)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

Kevin Hooks, Director

c/o Suite 750,1095 West Pender Street

Vancouver, British Columbia, Canada, V6E 2M6

|

|

|

4,642,045(6)

|

|

|

|

4.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Dong Shim, Chief Financial Officer and Director

c/o Suite 750,1095 West Pender Street

Vancouver, British Columbia, Canada, V6E 2M6

|

|

|

619,792(7)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

David Wenger, Director

c/o Suite 750,1095 West Pender Street

Vancouver, British Columbia, Canada, V6E 2M6

|

|

Nil

|

|

|

Nil

|

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group

(8 persons)

|

|

|

14,001,187(8)

|

|

|

|

13.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Major Stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australis Capital Inc.

Suite 900, 510 Seymour Street

Vancouver, British Columbia

Canada V6B 1V5

|

|

|

37,782,719(9)

|

|

|

|

36.0

|

%

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

*

|

Less than one percent.

|

|

|

|

|

(1)

|

Under Rule 13d-3 of the Exchange Act, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise, has or shares: (i) voting power, which includes the power to vote, or to direct the voting of such security; and (ii) investment power, which includes the power to dispose or direct the disposition of the security. Certain shares of common stock may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares of common stock are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares of common stock outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of common stock of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding as of the date of this Proxy Statement. As of November 27, 2019, there were 101,853,217 shares of common stock of the Company issued and outstanding.

|

|

|

|

|

(2)

|

This figure represents (i) 18,000 shares of common stock held by Mr. Mills’ wife, (ii) 18,000 shares of common stock issuable upon exercise of warrants registered directly to Mr. Mills’ wife, and (iii) stock options to purchase 275,000 shares of common stock which have vested.

|

|

|

|

|

(3)

|

This figure represents (i) 170,400 shares of common stock held by Mr. Tindale’s wife, (ii) stock options to purchase 450,000 shares of common stock which have vested.

|

|

|

|

|

(4)

|

This figure represents (i) 4,345,071 shares of common stock held by SW Fort Apache, LLC, an entity controlled by Mr. Hasman, (ii) 2,037,879 shares of common stock held by TI Nevada, LLC, an entity controlled by Mr. Hasman, and (iii) stock options to purchase 1,250,000 shares of common stock which have vested.

|

|

|

|

|

(5)

|

This figure represents stock options to purchase 175,000 shares of common stock which have vested.

|

|

|

|

|

(6)

|

This figure represents (i) 4,192,045 shares of common stock held by KAJ Universal Real Estate Investments, LLC, an entity controlled by Mr. Hooks, and (ii) stock options to purchase 450,000 shares of common stock, which have vested.

|

|

|

|

|

(7)

|

This figure represents (i) 121,792 shares of common stock held by Mr. Shim, (ii) 48,000 shares of common stock issuable upon exercise of warrants registered directly to Mr. Shim, and (iii) stock options to purchase 450,000 shares of common stock which have vested.

|

|

|

|

|

(8)

|

This figure represents (i) 10,885,187 shares of common stock, (ii) 66,000 shares of common stock issuable upon exercise of warrants, and (iii) stock options to purchase 3,050,000 shares of common stock, which have vested.

|

|

|

|

|

(9)

|

This figure includes (i) 34,873,628 shares of common stock held by Australis Capital Inc., and (ii) 2,909,091 shares of common stock issuable to Australis Capital Inc. upon conversion of an outstanding convertible debenture that is convertible within 60 days.

|

Changes in Control

We are unaware of any contract, or other arrangement or provision, the operation of which may at a subsequent date result in a change of control of our Company.

PROPOSAL NUMBER ONE:

ELECTION OF DIRECTORS TO OUR BOARD OF DIRECTORS

Election of Directors

Each of our directors is elected at the annual meeting of our stockholders and, upon the director’s election, will hold office until our next annual meeting or until his or her successor is elected and qualified.

The persons named in the enclosed form of proxy as proxyholders intend to vote for the election of the nominees listed below as directors unless instructed otherwise, or unless a nominee is unable or unwilling to serve as a director of the Company. Our Board of Directors has no reason to believe that any nominee is unable or unwilling to serve, but if a nominee should determine not to serve, the persons named in the form of proxy as proxyholders will have the discretion and intend to vote for another candidate that would be nominated by our Board of Directors.

The affirmative vote of a plurality of the votes present in person or by proxy at the Annual Meeting and entitled to vote on the election of directors is required for the election of each nominee as a director. Our constating documents do not provide for cumulative voting in the election of directors.

Nominees for Election as Directors

Robert Hasman, Dong Shim, David Wenger and Brent Reuter, each of whom is a current director and Michael Mills, who is our President and Interim Chief Executive Officer, is a new director nominee, have been nominated for election as directors. It is the intention of the persons named in the accompanying form of proxy as proxyholders to vote proxies for the election of each of these individuals as a director and each of the nominees has consented to being named in this Proxy Statement and to serve as a director, if elected.

Directors and Executive Officers

Our current directors and executive officers and their respective ages as of November 27, 2019, are as follows:

|

Name

|

|

Age

|

|

Position with the Company

|

|

Michael Mills

|

|

51

|

|

President and Interim Chief Executive Officer (“CEO”)

|

|

Darren Tindale

|

|

47

|

|

Corporate Secretary

|

|

Stephen ‘Trip’ Hoffman

|

|

54

|

|

Chief Operating Officer (“COO”)

|

|

Brent Reuter

|

|

53

|

|

A director

|

|

Robert Hasman

|

|

38

|

|

A director

|

|

Kevin Hooks

|

|

56

|

|

A director

|

|

Dong Shim

|

|

36

|

|

Chief Financial Officer and a director

|

|

David Wenger

|

|

38

|

|

A director

|

The following describes the business experience of each nominee for election to our Board of Directors, including other directorships held in reporting companies:

Robert Hasman. Mr. Hasman has been a Board member since November 14, 2017. He is a pioneer of the Nevada marijuana market and is the founder and the President of NMG. Mr. Hasman was responsible for building NMG, which included directing all aspects of strategy, growth, coordinating and supervising all phases of construction & business development process from conceptual through final construction. He is also the Managing Director of Sperry Van Ness, a NV commercial real estate brokerage firm involved in the original and syndication of more than $1billion of commercial real estate acquisitions. Mr. Hasman has over 10 years’ experience in business development and operations. Mr. Hasman obtained his Bachelor of Arts degree in Political Science at Ohio State University.

Dong Shim. Mr. Shim has been a Board member since December 15, 2016 and was appointed as the Chief Financial Officer of the Company on August 21, 2019. Mr. Shim is a partner and founder of Shim & Associates LLP (June 2013 to present) and Golden Tree Capital Corp. (November 2015 to present) providing accounting and other business advisory services to numerous companies in various industries. Mr. Shim is a director of National Securities Administrators Ltd. (May 2017 to present), Chief Financial Officer for E-Play Digital Inc. (November 2016 to present), Chief Financial Officer for Arizona Silver Exploration Inc. (August 2017 to present), Chief Financial Officer for Canamex Resources Corp. (August 2017 to present), Chief Financial Officer for Mission Ready Solutions Inc. (June 2017 to present), Chief Financial Officer for Organimax Nutrient Corp. (April 2018 to present), Chief Financial Officer for Vanc Pharmaceuticals Inc. (February 2018 to September 2018), and interim Chief Financial Officer of Reliq Health Technologies Inc. (November 2018 to present). Mr. Shim also serves as the CFO for International Private Vault Inc., a private company based in British Columbia, Canada, and as a director of National Issuer Services Ltd., a transfer agent company based in British Columbia, Canada.

David Wenger. Mr. Wenger has been a Board member since October 1, 2019. Mr. Wenger is a member of the US Senate Cannabis Working Group and the US House of Representatives Cannabis Working Group. In those roles, he has the historic opportunity to work with senior Congressional staffers on advancing federal cannabis legislation. David wrote a seminal White Paper on the US cannabis industry widely read across the world: The Green Regulatory Arbitrage: A Case for Investing in US Multi-State Vertically-Integrated Cannabis Companies. Mr. Wenger is also an accomplished lawyer and for 13 years he represented foreign government and major corporate clients in high-stakes complex cross-border disputes and transactions. Working in the New York office of the global law firm DLA Piper, he coordinated multi-jurisdictional teams acting for clients around the world such as Kingdom of Thailand, Petrobras, Ruler of Dubai, Afghanistan, PPG, Irving Shipbuilding, Pfizer, Troy (Vietnam), and Oman. As a law student, he interned for federal court judge Honorable Harold Baer Jr. in the US District Court for the Southern District of New York. Mr. Wenger is a Global Advisory Council member for Bhang Corporation (CSE: BHNG); advisor to RCVR, a NYC-based manufacturer of organic athletic recovery products; advisor to Asia Horizon, which is involved in hemp cultivation/processing and product distribution in China and strategic Asia opportunities; and an advisory board member of America Israel Cannabis Association.

Brent Reuter. Mr. Reuter has been a Board member since October 16, 2019. Mr. Reuter has deep experience driving new revenue growth and managing businesses in the banking and investment sectors, most recently as principal investor relations for Onex Corp., a private equity firm, vice-president of asset management for Canadian Imperial Bank of Commerce and as managing director at Royal Bank of Canada with roles in Hong Kong and New York. In these roles, he built high-value client and strategic partnerships, recruited and developed sales teams, and implemented and executed high-impact revenue coverage models. In addition, Mr. Reuter is the senior vice-president of investor relations and strategy of Australis Capital Inc. Mr. Reuter obtained a Bachelor of Business Administration from Lakehead University in Thunder Bay, Ontario in 1990.

Michael Mills. Mr. Mills was appointed President and Interim Chief Executive Officer on August 21, 2019 and was previously the Vice-President, Communications of the Company from June 2018 to August 21, 2019. Prior to joining the Company, Mr. Mills was the President of Fairlawn Capital Partners Ltd., a consulting company offering finance, communications and capital market solutions to public and private businesses. Mr. Mills has experience in industries including media, manufacturing and technology and held increasingly senior roles at the Financial Post and National Post newspapers. Mr. Mills obtained a Bachelors of Business Administration from Bishop’s University.

The following describes the business experience of each of the non-director executive officers of the Company other than Michael Mills who is a director nominee and whose business experience is disclosed above:

Darren Tindale. Mr. Tindale has been our Chief Financial Officer since March 6, 2017 to August 20, 2019 and Corporate Secretary since August 20, 2019. Mr. Tindale brings over 17 years of financial accounting and management experience and has worked for both public and private companies. Mr. Tindale has served as Chief Financial Officer for numerous TSX Venture listed companies.

Stephen ‘Trip’ Hoffman. Mr. Hoffman was appointed as Chief Operating Officer (“COO”) of the Company on November 15, 2018. Mr. Hoffman was previously the Chief Executive Officer of Bolder Venture Ltd., a privately held medical and recreational marijuana cultivation and dispensary company located in Boulder, Colorado, from 2016 until his appointment as Chief Operating Officer of the Company. From 2011 to 2016, Mr. Hoffman was the Chief Executive Officer of Trading Block Holdings Inc., a financial technology company located in Chicago, Illinois. Mr. Hoffman obtained a PhD in physics from Purdue University in December 1991.

Term of Office

All of our directors, when elected, hold office until the next annual meeting of our stockholders or until their successors are elected and qualified. Our officers are appointed by our Board of Directors and hold office until their successors are appointed and qualified.

Significant Employees

There are no significant employees of the Company other than our executive officers who provide their services on a consulting basis. NMG, our wholly-owned operating subsidiary has 95 employees at all of its locations.

Family Relationships

There is no family relationship between any of our executive officers or directors.

Involvement in Certain Legal Proceedings

Except as disclosed in this proxy statement, during the past ten years none of the following events have occurred with respect to any of our directors and officers:

|

|

1.

|

A petition under any legislation relating to bankruptcy laws or insolvency laws was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

|

|

|

|

|

|

|

2.

|

Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

|

|

|

|

|

|

|

3.

|

Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

|

|

|

|

i.

|

Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

|

|

|

|

|

|

|

|

|

ii.

|

Engaging in any type of business practice; or

|

|

|

|

|

|

|

|

|

iii.

|

Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of applicable securities legislation, whether federal, state or provincial or any applicable commodities legislation;

|

|

|

4.

|

Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (3)(i) above, or to be associated with persons engaged in any such activity;

|

|

|

|

|

|

|

5.

|

Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

|

|

|

|

|

|

|

6.

|

Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

|

|

|

|

|

|

|

7.

|

Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

|

|

|

|

i.

|

Any Federal or State securities or commodities law or regulation; or

|

|

|

|

|

|

|

|

|

ii.

|

Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

|

|

|

|

|

|

|

|

|

iii.

|

Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

|

8.

|

Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the U.S. Securities Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

|

In 2010, Mr. Hasman was acting as manager of Resort Holdings 2, LLC (“Resort 2”). Resort 2 filed Chapter 11 for a default of a commercial loan. Mr. Hasman was the personal guarantor for the commercial loan on a property located in Las Vegas, Nevada that was owned by Resort 2. The property was foreclosed and a judgment was filed against Mr. Hasman. On July 28, 2017, Mr. Hasman signed an official settlement agreement.

There are currently no legal proceedings to which any of our directors or officers is a party adverse to us or in which any of our directors or officers has a material interest adverse to us.

Meetings of Directors during the last Fiscal Year ended July 31, 2019

The Company’s Board of Directors held 5 meetings in person or by teleconference during the fiscal year ended July 31, 2019 (“Fiscal 2019”). No director attended fewer than 60% of the total number of the meetings of the Board of Directors held during Fiscal 2019.

The Company does not have a formal policy with respect to director attendance at annual stockholders’ meetings; however, all directors are encouraged to attend. It is anticipated that four directors will attend the 2019 annual meeting of stockholders in person or by teleconference.

Board Independence

The Board of Directors has determined that David Wenger, Brent Reuter and Kevin Hooks each qualify as independent directors under the listing standards of the NYSE American. Messrs. Shim and Hasman are not considered independent directors. Mr. Shim is an officer of the Company and Mr. Hasman is the President of the Company’s indirect wholly-owned operating subsidiary. In addition, the Board of Directors has determined that Michael Mills, who is a new director nominee, does not qualify as an independent director under the listing standards of the NYSE American as he is an officer of the Company.

Board Committees

Nominating Committee

We do not have a Nominating Committee and our Board of Directors as a whole is responsible for identifying and nominating qualified individuals to our Board of Directors. Since our formation we have relied upon the personal relationships of our President and directors to attract individuals to our Board of Directors.

Our Board of Directors considers its size each year when it considers the number of directors to recommend to the shareholders for election at the annual meeting of shareholders, taking into account the number required to carry out the Board’s duties effectively and to maintain a diversity of views and experience.

We do not have a policy regarding the consideration of any director candidates which may be recommended by our stockholders, including the minimum qualifications for director candidates, nor has our Board of Directors established a process for identifying and evaluating director nominees. We have not adopted a policy regarding the handling of any potential recommendation of director candidates by our stockholders, including the procedures to be followed. Our Board has not considered or adopted any of these policies as we have never received a recommendation from any stockholder for any candidate to serve on our Board of Directors. Given our relative size and lack of directors and officers insurance coverage, we do not anticipate that any of our stockholders will make such a recommendation in the near future. While there have been no nominations of additional directors proposed, in the event such a proposal is made, all members of our Board will participate in the consideration of director nominees.

Compensation Committee

Our Compensation Committee is comprised of Mr. Reuter, Mr. Wenger and Mr. Hasman. This committee reviews and recommends to our Board of Directors the salaries, and benefits of all employees, consultants, directors and other individuals compensated by us.

Audit Committee

The Audit Committee is comprised of Mr. Shim, Mr. Wenger and Mr. Reuter.

Our Board of Directors has determined that we have at least one financial expert. Mr. Wenger and Mr. Reuter are considered independent.

An audit committee financial expert means a person who has the following attributes:

|

|

(a)

|

An understanding of generally accepted accounting principles and financial statements;

|

|

|

|

|

|

|

(b)

|

The ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves;

|

|

|

|

|

|

|

(c)

|

Experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the small business issuer’s financial statements, or experience actively supervising one or more persons engaged in such activities;

|

|

|

|

|

|

|

(d)

|

An understanding of internal control over financial reporting; and

|

|

|

|

|

|

|

(e)

|

An understanding of audit committee functions.

|

The audit committee’s primary function is to provide advice with respect to our financial matters and to assist the Board of Directors in fulfilling its oversight responsibilities regarding finance, accounting and legal compliance. The audit committee’s primary duties and responsibilities are to:

|

|

|

·

|

serve as an independent and objective party to monitor our financial reporting process and internal control system;

|

|

|

|

|

|

|

|

|

·

|

review and appraise the audit efforts of our independent accountants;

|

|

|

|

|

|

|

|

|

·

|

evaluate our quarterly financial performance as well as our compliance with laws and regulations;

|

|

|

|

|

|

|

|

|

·

|

oversee management’s establishment and enforcement of financial policies and business practices; and

|

|

|

|

|

|

|

|

|

·

|

provide an open avenue of communication among the independent accountants, management and the Board of Directors.

|

Stockholder Communications

Stockholders may contact an individual director, the Board of Directors as a group or a specified Board of Directors’ committee or group, including any non-employee directors as a group, either by: (i) writing to Body and Mind Inc., c/o Suite 750, 1095 West Pender Street, Vancouver, British Columbia, Canada V6E 2M6, Attention: Corporate Secretary; or (ii) sending an e-mail message to info@bamcannabis.com.

Our Corporate Secretary will conduct an initial review of all such stockholder communications and will forward the communications to the persons to whom it is addressed, or if no addressee is specified, to our President and Interim CEO, the appropriate members of the Board of Directors or the entire Board of Directors depending on the nature of the communication. Such communications will be assessed by the recipients as soon as reasonably practicable taking into consideration the nature of the communication and whether expedited review is appropriate.

Certain Relationships and Related Party Transactions

Except as described herein, none of the following parties (each a “Related Party”) has had any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that has or will materially affect us:

|

|

·

|

any of our directors or officers;

|

|

|

·

|

any person proposed as a nominee for election as a director;

|

|

|

·

|

any person who beneficially owns, directly or indirectly, shares carrying more than 10% of the voting rights attached to our outstanding shares of common stock; or

|

|

|

·

|

any member of the immediate family (including spouse, parents, children, siblings and in- laws) of any of the above persons.

|

Related Party Transactions during the year ended July 31, 2019

|

|

|

Accounts

Payable

|

|

|

Consulting

Fees

|

|

|

Dong Shim (Director and CFO)

|

|

$

|

5,127

|

|

|

$

|

37,791

|

|

|

Leonard Clough (Former CEO & Former Director)

|

|

$

|

Nil

|

|

|

$

|

90,696

|

|

|

Darren Tindale (Former CFO & Corporate Secretary)

|

|

$

|

Nil

|

|

|

$

|

62,353

|

|

|

Michael Mills (President & Interim CEO)

|

|

$

|

7,825

|

|

|

$

|

50,072

|

|

|

Robert Hasman (Director)

|

|

$

|

Nil

|

|

|

$

|

225,992

|

|

|

Kevin Hooks (Director)

|

|

$

|

Nil

|

|

|

$

|

Nil

|

|

|

Scott Dowty (Director)

|

|

$

|

Nil

|

|

|

$

|

Nil

|

|

|

Stephen (Trip) Hoffman (COO)

|

|

$

|

Nil

|

|

|

$

|

90,000

|

|

Included in stock-based compensation for the year ended 31 July 2019 is $579,904 (2018 - $377,443) related to stock options issued to directors and officers of the Company.

During the year ended 31 July 2019, the Company entered into an agreement to purchase the remaining 70% of NMG Ohio for total cash payments of $1,575,000 and issuance of 3,173,864 common shares of the Company, of which cash of $461,251 and 929,488 common shares are payable to Robert Hasman and Kevin Hooks, who are both directors of the Company.

Our Board reviews any proposed transaction involving Related Parties and considers whether such transactions are fair and reasonable and in the Company’s best interests.

Conflicts of Interest

To our knowledge, and other than as disclosed in this Proxy Statement, there are currently no known existing or potential conflicts of interest among us, our promoters, directors and officers, or other members of management, or any proposed director, officer or other member of management as a result of their outside business interests, except that certain of the directors and officers serve as directors and officers of other companies and, therefore, it is possible that a conflict may arise between their duties to us and their duties as a director or officer of such other companies.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Exchange Act requires our directors and officers, and the persons who beneficially own more than 10% of our common stock, to file reports of ownership and changes in ownership with the SEC. Copies of all filed reports are required to be furnished to us pursuant to Rule 16a-3 promulgated under the Exchange Act. Based solely on the reports received by us and on the representations of the reporting persons, we believe that these persons have complied with all applicable filing requirements during the fiscal year ended July 31, 2019, except as follows:

|

Name

|

|

Position Held

|

|

Late or Unfiled Report

|

|

Michael Mills

|

|

President and Interim Chief Executive Officer

|

|

Form 3 upon becoming an officer filed late

|

|

Darren Tindale

|

|

Corporate Secretary and former Chief Financial Officer

|

|

Form 3 upon the effectiveness of the Company’s registration statement on Form 10 becoming effective and one Form 4 filed late

|

|

Leonard Clough

|

|

Former President, CEO and Director

|

|

Form 3 upon the effectiveness of the Company’s registration statement on Form 10 becoming effective and one Form 4 filed late

|

|

Robert Hasman

|

|

Director

|

|

Form 3 upon the effectiveness of the Company’s registration statement on Form 10 becoming effective and two Form 4s filed late

|

|

Kevin Hooks

|

|

Director

|

|

Form 3 upon the effectiveness of the Company’s registration statement on Form 10 becoming effective and three Form 4s filed late

|

|

Dong Shim

|

|

Chief Financial Officer and Director

|

|

Form 3 upon the effectiveness of the Company’s registration statement on Form 10 becoming effective and three Form 4s filed late

|

|

Scott Dowty

|

|

Director

|

|

Form 3 upon becoming a director and one Form 4 filed late

|

|

Stephen Hoffman

|

|

Chief Operating Officer

|

|

Form 3 upon becoming an officer and two Form 4s filed late

|

|

Australis Capital Inc.

|

|

Shareholder

|

|

Form 3 upon becoming a more than 10% shareholder and one Form 4 filed late

|

EXECUTIVE COMPENSATION

General

For the purposes of this section:

“CEO” means an individual who acted as the Chief Executive Officer of Body and Mind, or acted in a similar capacity, for any part of the most recently completed financial year;

“CFO” means an individual who acted as the Chief Financial Officer of Body and Mind, or acted in a similar capacity, for any part of the most recently completed financial year;

“incentive plan” means any plan providing compensation that depends on achieving certain performance goals or similar conditions within a specified period;

“incentive plan award” means compensation awarded, earned, paid or payable under an incentive plan;

“NEO” means each of the following individuals:

|

|

(c)

|

each of Body and Mind’s three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year; and

|

|

|

|

|

|

|

(d)

|

each individual who would be a NEO under paragraph (c) but for the fact that the individual was neither an executive officer of Body and Mind, nor acting in a similar capacity, at the end of that financial year;

|

“option-based award” means an award under an equity incentive plan of options, including, for greater certainty, share options, share appreciation rights and similar instruments that have option-like features; and

“share-based award” means an award under an equity incentive plan of equity-based instruments that do not have option-like features, including, for greater certainty, common shares, restricted shares, restricted share units, deferred share units, phantom shares, phantom share units, common share equivalent units, and stock.

Compensation Discussion and Analysis

Compensation Program Objectives

We have not established a strategy for setting executive salary levels, creating standards it applies in setting compensation levels or what factors it intends to encourage by establishing compensation levels. Since we acquired NMG, raised equity capital and have been generative revenues from the sale of our products, we have been compensating our NEOs at levels comparable to executive officers of companies within its industry at similar stages of growth.

Our Compensation Committee reviews and recommends to our Board of Directors the salaries, and benefits of all employees, consultants, directors and other individuals compensated by us. The Board of Directors assumes responsibility for reviewing the recommendations of the Compensation Committee and monitoring the long-range compensation strategy for our senior management. The Compensation Committee and the Board of Directors reviews the compensation of senior management on a semi-annual basis taking into account compensation paid by other issuers of similar size and activity. The Compensation Committee and the Board of Directors receives independent competitive market information on compensation levels for executives. It uses salary data of comparable private and public companies as a benchmark for setting executive compensation. This data is obtained from various sources including online research and market surveys.

Although permitted, at this time no NEO or director has or intends to purchase financial instruments that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the NEO or director.

Elements of the Compensation Program

The total compensation plan for NEOs consists of a base compensation structure and equity-based compensation program in the form of stock options. The compensation program for our senior management is designed with a view that the level and form of compensation achieves certain objectives, including:

|

|

(a)

|

attracting and retaining qualified executives;

|

|

|

|

|

|

|

(b)

|

motivating the short and long-term performance of these executives; and

|

|

|

|

|

|

|

(c)

|

better aligning their interests with those of the Company’s shareholders.

|

In compensating our senior management, we have arranged for equity participation through our 2012 Incentive Stock Option Plan.

Base Salary

The base salary component of NEO compensation is intended to provide a fixed level of competitive pay that reflects each NEO’s primary duties and responsibilities. The policy of Body and Mind is that salaries for its NEOs are competitive within its industry and generally set at the median salary level among entities its size.

Stock Options

Effective October 25, 2012, our Board adopted the 2012 Incentive Stock Option Plan (the “2012 Incentive Stock Option Plan”). The purpose of the 2012 Incentive Stock Option Plan is to enhance the long-term shareholder value by offering opportunities to our directors, executive officers, key employees and eligible consultants to acquire our Common Shares in order to give these persons the opportunity to participate in our growth and success, and to encourage them to remain in the service of the Company.

Previous grants will be taken into account when considering new grants and a maximum of 10% of the number of our issued and outstanding Common Shares are available for issuance under the 2012 Incentive Stock Option Plan. There are currently 8,775,000 options issued under the 2012 Incentive Stock Option Plan.

Compensation Governance

Our Compensation Committee is responsible for recommending to our Board of Directors the compensation to be paid to our directors and executive officers. We do not have any formal compensation policies and the practices adopted by the Compensation Committed and our Board of Directors to determine the compensation for our directors and executive officers is described above.

Summary Compensation Table

Dong Shim, our Chief Financial Officer and director, Darren Tindale, our former Chief Financial Officer, Leonard Clough our President and Chief Executive Officer until August 21, 2019, Stephen Hoffman, our Chief Operating Officer, and Robert Hasman, a director and the President of our indirect wholly-owned subsidiary NMG are NEOs for the purposes of the following disclosure.

The compensation for those NEOs, directly or indirectly, for our most recently completed financial years ended July 31, 2019 and 2018 are as follows:

|

|

|

|

|

|

|

|

Share-

|

|

|

Option-

|

|

|

Non-equity

incentive plan

compensation

($)

|

|

|

Nonqualified deferred

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

Fiscal Year

|

|

Salary

(CAD$)

|

|

|

based awards

(CAD$)

|

|

|

based awards

(CAD$)

|

|

|

Annual incentive plans

|

|

|

Long-term incentive plans

|

|

|

compensation earnings

($)

|

|

|

All other compensation

($)

|

|

|

Total compensation

(CAD$)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dong Shim(1)

|

|

2019

|

|

|

50,001

|

|

|

|

-

|

|

|

|

142,087

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

192,088

|

|

|

Director and CFO

|

|

2018

|

|

|

49,600

|

|

|

|

-

|

|

|

|

47,917

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

97,517

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Darren Tindale(2)

|

|

2019

|

|

|

82,500

|

|

|

|

-

|

|

|

|

142,087

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

224,587

|

|

|

Former CFO

|

|

2018

|

|

|

60,000

|

|

|

|

-

|

|

|

|

47,917

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

107,917

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leonard Clough(3)

|

|

2019

|

|

|

120,000

|

|

|

|

-

|

|

|

|

142,087

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

262,087

|

|

|

Former CEO and director

|

|

2018

|

|

|

66,759

|

|

|

|

-

|

|

|

|

47,917

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

114,676

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen Hoffman(4)

|

|

2019

|

|

|

119,080

|

|

|

|

-

|

|

|

|

99,461

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

218,541

|

|

|

COO

|

|

2018

|

|

Nil

|

|

|

|

-

|

|

|

Nil

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Nil

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert Hasman(5)

|

|

2019

|

|

|

299,010

|

|

|

|

-

|

|

|

|

142,087

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

441,097

|

|

|

Director, and President of NMG

|

|

2018

|

|

|

184,018

|

|

|

|

-

|

|

|

|

188,722

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

372,740

|

|

Notes:

|

|

(1)

|

Mr. Shim was appointed CFO in December 2016. He resigned on March 6, 2017 and was reappointed as interim CEO in August 2017 and resigned on November 14, 2017 when Mr. Clough was appointed as CEO. Mr. Shim was appointed CFO on August 21, 2019.

|

|

|

(2)

|

Mr. Tindale was appointed CFO on March 7, 2017. Mr. Tindale resigned as the CFO on August 21, 2019.

|

|

|

(3)

|

Mr. Clough was appointed CEO and a director on November 14, 2017. Mr. Clough resigned on August 20, 2019.

|

|

|

(4)

|

Mr. Hoffman was appointed COO on November 15, 2018.

|

|

|

(5)

|

Mr. Hasman was appointed as a director of the Company on November 14, 2017 and is the President of our indirect wholly-owned operating subsidiary, NMG.

|

During our most recently completed financial years, we did not pay any other executive compensation to our NEOs.

Effective November 14, 2017, we entered into a formal consulting agreement with Toro, whereby Toro will provide the services of our new Chief Executive Officer, Leonard Clough, for an annual salary of CAD$120,000. Leonard Clough, through Toro, is also entitled to a severance fee of CAD$60,000. However, Mr. Clough resigned on August 21, 2019, and the consulting agreement with Toro is no longer in force or effect.

Effective November 14, 2017, we entered into a formal consulting agreement with TI Nevada, whereby TI Nevada will provide the services of NMG’s President, Robert Hasman, for an annual salary of $200,000. Robert Hasman, through TI Nevada, is also entitled to a severance fee of $100,000. On November 2, 2018, the consulting agreement with TI Nevada was amended to extend the non-competition and non-solicitation provisions to include the State of Ohio as well as Nevada.

Incentive Plan Awards

The only stock options to purchase shares of our common stock that we granted to our NEOs during the fiscal year ended July 31, 2019 was on December 11, 2018 as set out in the table below.

|

|

|

# of

Options

|

|

|

Fair Value

(CAD$)

|

|

|

Leonard Clough

|

|

|

250,000

|

|

|

$

|

142,087

|

|

|

Dong Shim

|

|

|

250,000

|

|

|

$

|

142,087

|

|

|

Darren Tindale

|

|

|

250,000

|

|

|

$

|

142,087

|

|

|

Stephen Hoffman

|

|

|

175,000

|

|

|

$

|

99,461

|

|

|

Robert Hasman

|

|

|

250,000

|

|

|

$

|

142,087

|

|

Outstanding Equity Awards Held by Named Executive Officers at Fiscal Year End

The following table sets forth information as of July 31, 2019, relating to outstanding equity awards held by each NEO:

Outstanding Equity Awards at Year End

|

|

Option Awards

|

Stock Awards

|

|

Name

|

Number of

Securities

Underlying

Unexer-

cised

Options

(#)

(exercise-

able)

|

Number of

Securities

Underlying

Unexer-

cised

Options

(#)

(unexer-

ciseable)

|

Equity

Incentive

Plan

Awards:

Number of

Securities

Underlying

Unexer-

cised

Unearned

Options

(#)

|

Option

Exercise

Price

(CAD$)

|

Option

Expiration

Date

|

Number of

Shares or

Units of

Stock

That Have

Not

Vested

(#)

|

Market

Value of

Shares or

Units of

Stock

That Have

Not

Vested

($)

|

Equity

Incentive

Plan

Awards:

Number of

Unearned

Shares,

Units or

Other

Rights That

Have Not

Vested

(#)

|

Equity

Incentive

Plan Awards:

Market or

Payout Value

of Unearned

Shares, Units

or Other

Rights That

Have Not

Vested ($)

|

|

Dong Shim(1)

|

200,000

250,000

|

N/A

N/A

|

N/A

N/A

|

0.66

0.57

|

11/24/2022

12/10/2023

|

N/A

|

N/A

|

N/A

|

N/A

|

|

Darren Tindale (2)

|

200,000

250,000

|

N/A

N/A

|

N/A

N/A

|

0.66

0.57

|

11/24/2022

12/10/2023

|

N/A

|

N/A

|

N/A

|

N/A

|

|

Leonard Clough (3)

|

200,000

250,000

|

N/A

N/A

|

N/A

N/A

|

0.66

0.57

|

11/24/2022

12/10/2023

|

N/A

|

N/A

|

N/A

|

N/A

|

|

Stephen Hoffman (4)

|

175,000

|

N/A

|

N/A

|

0.57

|

12/10/2023

|

N/A

|

N/A

|

N/A

|

N/A

|

|

Robert Hasman (5)

|

1,000,000

250,000

|

N/A

N/A

|

N/A

N/A

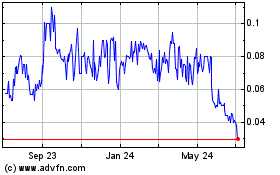

|