Table of Contents

As filed with the Securities and Exchange Commission on April 27, 2020

Registration No. 333-215730

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Post-Effective Amendment No. 3 to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

BIOLARGO, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

2800

|

|

65-0159115

|

|

(State or other jurisdiction of

|

|

(Primary Standard Industrial

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Classification Code Number)

|

|

Identification No.)

|

|

BioLargo, Inc.

|

|

14921 Chestnut St.

Westminster, CA 92683

|

|

(888) 400-2863

|

|

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

Agents and Corporations, Inc.

1201 Orange Street, Suite 600

Wilmington, DE 19801

(302) 575-0877

|

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

|

|

|

|

Copy to:

|

|

Christopher A. Wilson, Esq.

|

|

Wilson Bradshaw, LLP

|

|

18818 Teller Avenue, Suite 115

|

|

Irvine, CA 92612

|

|

Tel: (949) 752-1100

cwilson@wbc-law.com

|

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer: ☐

|

|

Smaller reporting company: ☒

|

|

Accelerated filer: ☐

|

|

Emerging growth company ☐

|

|

Non-accelerated filer: ☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

BioLargo, Inc. (the “Company,” “we,” or “us”) filed a Registration Statement on Form S-1 with the Securities and Exchange Commission (“SEC”) on June 9, 2017 (the “Registration Statement”). The Registration Statement was declared effective on June 15, 2017. The Company filed post-effective Amendment No. 1 to the Registration Statement on August 28, 2018, and it was declared effective on September 6, 2018, and post-effective Amendment No. 2 to the Registration Statement on August 30, 2019, and it was declared effective on September 11, 2019.

The Company is submitting this Post-Effective Amendment No. 3 (“Amendment”) to its Registration Statement for the purpose of (i) providing information from its Annual Report on Form 10-K for the period ended December 31, 2019 filed with the SEC March 31, 2020; (ii) incorporating by reference the Current Reports on Form 8-K filed since March 31, 2020, to the date of this Amendment.

The contents of the Registration Statement as previously filed which are not modified and revised by this Amendment are hereby incorporated by reference.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Dated: April 27, 2020

PROSPECTUS

36,090,857 shares of common stock

This prospectus relates to the sale of up to 36,090,857 shares of our common stock by persons who have purchased shares in a series of private placements. The aforementioned persons are sometimes referred to in this prospectus as the selling stockholders. The shares offered under this prospectus by the selling stockholders may be sold on the public market, in negotiated transactions with a broker-dealer or market maker as principal or agent, or in privately negotiated transactions not involving a broker dealer. The prices at which the selling stockholder may sell the shares may be determined by the prevailing market price of the shares at the time of sale, may be different than such prevailing market prices or may be determined through negotiated transactions with third parties. We will not receive proceeds from the sale of our shares by the selling stockholders.

As of the date of this prospectus, the selling stockholders have not exercised any of the warrants to purchase shares registered hereby. The selling shareholders have sold approximately ________ shares registered for sale in the registration statement of which this prospectus is part.

Each selling stockholder may be considered an “underwriter” within the meaning of the Securities Act of 1933, as amended.

Since January 23, 2008, our common stock has been quoted on the OTC Markets “OTCQB” marketplace (formerly known as the “OTC Bulletin Board”) under the trading symbol “BLGO.” The selling stockholders will sell up the shares at prices established on the OTC Bulletin Board during the term of this offering, at prices different than prevailing market prices or at privately negotiated prices. On April 21, 2020, the last reported sale price of our common stock on the OTC Markets was $0.16.

The securities offered in this prospectus involve a high degree of risk. You should consider the risk factors beginning on page 3 before purchasing our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 27, 2020

TABLE OF CONTENTS

Unless otherwise specified, the information in this prospectus is set forth as of April 27, 2020, and we anticipate that changes in our affairs will occur after such date. We have not authorized any person to give any information or to make any representations, other than as contained in this prospectus, in connection with the offer contained in this prospectus. If any person gives you any information or makes representations in connection with this offer, do not rely on it as information we have authorized. This prospectus is not an offer to sell our common stock in any state or other jurisdiction to any person to whom it is unlawful to make such offer.

PROSPECTUS SUMMARY

The following summary highlights selected information from this prospectus and may not contain all the information that is important to you. To understand our business and this registration statement fully, you should read this entire prospectus carefully, including the financial statements and the related notes beginning on page F-1. When we refer in this prospectus to “BioLargo,” the “Company,” “our company,” “we,” “us” and “our,” we mean BioLargo, Inc., a Delaware corporation, and its subsidiaries, BioLargo Life Technologies, Inc., a California corporation, Odor-No-More, Inc., a California corporation, BioLargo Water Investment Group, Inc., a California corporation (and its subsidiary, BioLargo Water, Inc., a Canadian corporation), BioLargo Development Corp., a California corporation, BioLargo Engineering, Science & Technologies, LLC, Tennessee limited liability company, and partially owned Clyra Medical Technologies, Inc., a California corporation. This prospectus contains forward-looking statements and information relating to BioLargo. See “Cautionary Note Regarding Forward Looking Statements” on page 14.

Our Company

BioLargo, Inc. is a Delaware corporation.

Our principal executive offices are located at 14921 Chestnut St., Westminster, California 92683. Our telephone number is (888) 400-2863.

The Registration Statement

This prospectus covers 36,090,857 shares of stock, all of which are offered for sale by the selling stockholders.

ABOUT THIS REGISTRATION

|

Securities Being Registered

|

This Prospectus covers the following shares, all of which are being sold by the selling stockholders: 20,159,062 shares of common stock of BioLargo issuable upon the exercise of outstanding warrants to purchase common stock, and 15,931,795 outstanding shares. As of the date hereof, the selling stockholders have not exercised any of the warrants, but have sold approximately __________ shares held by them and offered for sale by this prospectus.

|

|

|

|

|

Initial Offering Price

|

The selling stockholders will sell up to 36,090,857 shares at prices established on the OTC Electronic Bulletin Board during the term of this offering, at prices different than prevailing market prices or at privately negotiated prices. We may receive up to approximately $9.5 million in the event the selling stockholders exercise warrants to purchase 20,159,062 shares.

|

|

|

|

|

Termination of the Offering

|

The offering will conclude when all the 36,090,857 shares of common stock registered hereby have been sold by the selling stockholders.

|

|

|

|

|

Risk Factors

|

An investment in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 3.

|

RISK FACTORS

An investment in our common stock is highly speculative, involves a high degree of risk and should be made only by investors who can afford a complete loss. You should carefully consider the following risk factors, together with the other information in this prospectus, including our financial statements and the related notes, before you decide to buy our common stock. If any of the following risks actually occurs, then our business, financial condition or results of operations could be materially adversely affected, the trading of our common stock could decline, and you may lose all or part of your investment therein.

Risks Relating to our Business

COVID-19

The Covid-19 crisis creates an environment in which no person can be certain about what is next. The global reach and impact are far reaching and place extreme pressure on financing, sales, accounts receivable collection cycles, and any growth plan. We believe the Covid-19 virus crisis may have a delaying effect on our plans for growth and expansion. We urge the reader to consider our forward-looking statements in light of the extraordinary circumstances of today’s business, social and economic climate. While our company is mobilizing to be a solutions provider to help inhibit the spread of Covid-19, these business plans are not mature and may be more difficult that we expect. While it may be reasonable to assume that the crisis will subside, we cannot be certain about the timing and a host of impacts that cannot be easily predicted to occur.

Our business could be adversely affected by the coronavirus or other pathogens, or similar crises.

Our business could be adversely affected by the recent outbreak of coronavirus in and across the United States and world. In addition, our results and financial condition may be adversely affected by pending or possible federal or state legislation (or other similar laws, regulations, orders or other governmental or regulatory actions) that, if adopted, would impose restrictions on our ability to operate our business. For example, our sales and technical field force has been restricted from traveling. While we have implemented cautionary procedures at our manufacturing facility, there may be disruptions to our ability to manufacture due to “stay at home” orders or additional workplace controls. Our workplace would be further disrupted if one or more of our employees tested positive for COVID-19. Our customers may be less inclined or unable to purchase our products due to restrictions under which they may be operating. If financial markets continue to tighten, we may have more limited ability to raise necessary financing. Further, our business plan includes products which will require regulatory approvals. Such approvals may be delayed significantly as a result of the pandemic as government resources are directed to address the pandemic. Even if the COVID-19 pandemic passes, another crisis with similar effects could develop and harm our business, financial results and liquidity.

Our limited operating history makes evaluation of our business difficult.

We have limited and only nominal historical financial data upon which to base planned operating expenses or forecast accurately our future operating results. Because our operations are not yet sufficient to fund our operational expenses, we rely on investor capital to fund operations. Our limited operational history make it difficult to forecast the need for future financing activities. Further, our limited operating history will make it difficult for investors and securities analysts to evaluate our business and prospects. Our failure to address these risks and difficulties successfully could seriously harm us.

We have never generated significant revenues, have a history of losses, and cannot assure you that we will ever become or remain profitable.

We have not yet generated any significant revenue from operations, and, accordingly, we have incurred net losses every year since our inception. To date, we have dedicated most of our financial resources to research and development, general and administrative expenses, and initial sales and marketing activities. We have funded the majority of our activities through the issuance of convertible debt or equity securities. Although sale of our CupriDyne Clean products are increasing, and we are devoting more energy and money to our sales and marketing activities, we continue to anticipate net losses and negative cash flow for the foreseeable future. Our ability to reach positive cash flow depends on many factors, including our ability to fund sales and marketing activities, and the rate of client adoption. There can be no assurance that our revenues will be sufficient for us to become profitable in 2020 or future years, or thereafter maintain profitability. We may also face unforeseen problems, difficulties, expenses or delays in implementing our business plan, including generally the need for odor control products in solid waste handling operations, which we may not fully understand or be able to predict.

Our cash requirements are significant. We will continue to require additional financing to sustain our operations and without it we may not be able to continue operations.

Our cash requirements and expenses continue to be significant. Our net cash used in continuing operations for the year ended December 31, 2019 was almost $4,000,000, over $300,000 per month, of which approximately $100,000 per month was financed by outside investors directly into Clyra Medical Technologies, Inc. During that same period, we generated only $1,861,000 in total gross revenues. Thus, in order to become profitable, we must significantly increase our revenues. Although our revenues have been increasing through sales of our products and from our engineering division, we expect to continue to use cash in 2020 as it becomes available.

At December 31, 2019, we had working capital deficit of approximately $3,289,000. Our auditor’s report for the year ended December 31, 2019 includes an explanatory paragraph to their audit opinion stating that our recurring losses from operations and working capital deficiency raise substantial doubt about our ability to continue as a going concern. We do not currently have sufficient financial resources to fund our operations or those of our subsidiaries. Therefore, we need additional financing to continue these operations.

We have relied on private securities offerings, as well as sales of shares to Lincoln Park Capital Fund, LLC (“Lincoln Park”) (see “Risks Relating to our Common Stock”, below), to provide cash needed to close the gap between operational revenue and expenses. Our ability to rely on private financing may change if the United States enters a recession, or if the stock market does not recover from the current bull market. The coronavirus pandemic, and the responses of governments worldwide to the pandemic, has caused significant turmoil and downward pressure in the U.S. stock market. We expect as a result that many private investors will forego high-risk investments, and thus while we have been able to rely on private investments in the past, we may not be able to do so in the foreseeable future. See “Risks Relating to Our Common Stock” at page 16.

We regularly issue stock, or stock options, instead of cash, to pay some of our operating expenses. These issuances are dilutive to our existing stockholders.

We are party to agreements that provide for the payment of, or permit us to pay at our option, securities rather than cash in consideration for services provided to us. We include these provisions in agreements to allow us to preserve cash. We anticipate that we will continue to do so in the future. All such issuances preserve our cash reserves, but are also dilutive to our stockholders because they increase (and will increase in the future) the total number of shares of our common stock issued and outstanding, even though such arrangements assist us with managing our cash flow. These issuances also increase the expense amount recorded.

Our stockholders face further potential dilution in any new financing.

Our private securities offerings typically provide for convertible securities, including notes and warrants. Any additional capital that we raise would dilute the interest of the current stockholders and any persons who may become stockholders before such financing. Given the low price of our common stock, such dilution in any financing of a significant amount could be substantial.

Our stockholders face further potential adverse effects from the terms of any preferred stock that may be issued in the future.

Our certificate of incorporation authorizes 50 million shares of preferred stock. None are outstanding as of the date hereof. In order to raise capital to meet expenses or to acquire a business, our board of directors may issue additional stock, including preferred stock. Any preferred stock that we may issue may have voting rights, liquidation preferences, redemption rights and other rights, preferences and privileges. The rights of the holders of our common stock will be subject to, and in many respects subordinate to, the rights of the holders of any such preferred stock. Furthermore, such preferred stock may have other rights, including economic rights, senior to our common stock that could have a material adverse effect on the value of our common stock. Preferred stock, while providing desirable flexibility in connection with possible acquisitions and other corporate purposes, can also have the effect of making it more difficult for a third party to acquire a majority of our outstanding voting stock, thereby delaying, deferring or preventing a change in control of our company.

There are several specific business opportunities we are considering in further development of our business. None of these opportunities is yet the subject of a definitive agreement, and most or all of these opportunities will require additional funding obligations on our part, for which funding is not currently in place.

In furtherance of our business plan, we are presently considering a number of opportunities to promote our business, to further develop and broaden, and to license, our technology with third parties. While discussions are underway with respect to such opportunities, there are no definitive agreements in place with respect to any of such opportunities at this time. There can be no assurance that any of such opportunities being discussed will result in definitive agreements or, if definitive agreements are entered into, that they will be on terms that are favorable to us.

Moreover, should any of these opportunities result in definitive agreements being executed or consummated, we may be required to expend additional monies above and beyond our current operating budget to promote such endeavors. No such financing is in place at this time for such endeavors, and we cannot assure you that any such financing will be available, or if it is available, whether it will be on terms that are favorable to our company.

We expect to incur future losses and may not be able to achieve profitability.

Although we are generating revenue from the sale of our products, and we expect to generate revenue from new products we are introducing, and eventually from other license or supply agreements, we anticipate net losses and negative cash flow to continue for the foreseeable future until our products are expanded in the marketplace and they gain broader acceptance by resellers and customers. Our current level of sales is not sufficient to support the financial needs of our business. We cannot predict when or if sales volumes will be sufficiently large to cover our operating expenses. We intend to expand our marketing efforts of our products as financial resources are available, and we intend to continue to expand our research and development efforts. Consequently, we will need to generate significant additional revenue or seek additional financings to fund our operations. This has put a proportionate corresponding demand on capital. Our ability to achieve profitability is dependent upon our efforts to deliver a viable product and our ability to successfully bring it to market, which we are currently pursuing. Although our management is optimistic that we will succeed in licensing our technology, we cannot be certain as to timing or whether we will generate sufficient revenue to be able to operate profitably. If we cannot achieve or sustain profitability, then we may not be able to fund our expected cash needs or continue our operations. If we are not able to devote adequate resources to promote commercialization of our technology, then our business plans will suffer and may fail.

Because we have limited resources to devote to sales, marketing and licensing efforts with respect to our technology, any delay in such efforts may jeopardize future research and development of technologies and commercialization of our technology. Although our management believes that it can finance commercialization efforts through sales of our securities and possibly other capital sources, if we do not successfully bring our technology to market, our ability to generate revenues will be adversely affected.

Our internal controls are not effective.

We have determined that our disclosure controls and procedures and our internal control over financial reporting are currently not effective. The lack of effective internal controls, has not yet, but could in the future, materially adversely affect our financial condition and ability to carry out our business plan. As more financial resources come available, we need to invest in additional personnel to better manage the financial reporting processes.

Our management team for financial reporting, under the supervision and with the participation of our chief executive officer and our chief financial officer, conducted an evaluation of the effectiveness of the design and operation of our internal controls. Recognizing the dynamic nature and growth of the Company’s business in the past two years, including the growth of the core operations and the increase in the number of employees, management has recognized the strain on the overall internal control environment. As a result, management has concluded that its internal controls over financial reporting are not effective. Management identified a material weakness with respect to deficiencies in its financial closing and reporting procedures. Management believes this is due to a lack of resources. Management intends to add accounting personnel and operating staff and more sophisticated systems in order to improve its reporting procedures and internal controls, subject to available capital. Until we have adequate resources to address these issues, any material weaknesses may materially adversely affect our ability to report accurately our financial condition and results of operations in the future in a timely and reliable manner. In addition, although we continually review and evaluate internal control systems to allow management to report on the sufficiency of our internal controls, we cannot assure you that we will not discover additional weaknesses in our internal control over financial reporting. Any such additional weakness or failure to remediate the existing weakness could materially adversely affect our financial condition or ability to comply with applicable financial reporting requirements and the requirements of the Company’s various financing agreements.

If we are not able to manage our anticipated growth effectively, we may not become profitable.

We anticipate that expansion will continue to be required to address potential market opportunities for our technology and our products. Our existing infrastructure is limited. While we believe our current manufacturing processes as well as our office and warehousing provide the basic resources to expand as we grow sales of CupriDyne Clean to more than $2 million per month, our infrastructure will need more staffing to support manufacturing, customer service, administration as well as sales/account executive functions. There can be no assurance that we will have the financial resources to create new infrastructure, or that any such infrastructure will be sufficiently scalable to manage future growth, if any. There also can be no assurance that, if we invest in additional infrastructure, we will be effective in expanding our operations or that our systems, procedures or controls will be adequate to support such expansion. In addition, we will need to provide additional sales and support services to our partners if we achieve our anticipated growth with respect to the sale of our technology for various applications. Failure to properly manage an increase in customer demands could result in a material adverse effect on customer satisfaction, our ability to meet our contractual obligations, and our operating results.

Some of the products incorporating our technology will require regulatory approval.

The products in which our technology may be incorporated have both regulated and non-regulated applications. The regulatory approvals for certain applications may be difficult, impossible, time consuming and/or expensive to obtain. While our management believes such approvals can be obtained for the applications contemplated, until those approvals from the FDA or the EPA or other regulatory bodies, at the federal and state levels, as may be required are obtained, we may not be able to generate commercial revenues for regulated products. Certain specific regulated applications and their use require highly technical analysis and additional third-party validation and will require regulatory approvals from organizations like the FDA. Certain applications may also be subject to additional state and local agency regulations, increasing the cost and time associated with commercial strategies. Additionally, most products incorporating our technology that may be sold in the European Union (“EU”) will require EU and possibly also individual country regulatory approval. All such approvals, including additional testing, are time-consuming, expensive and do not have assured outcomes of ultimate regulatory approval.

We need to outsource and rely on third parties for the manufacture of the chemicals, material components or delivery apparatus used in our technology, and part of our future success will be dependent on the timeliness and effectiveness of the efforts of these third parties.

We do not have the required financial and human resources or capability to manufacture the chemicals necessary to make our odor control products. Our business model calls for the outsourcing of the manufacture of these chemicals in order to reduce our capital and infrastructure costs as a means of potentially improving our financial position and the profitability of our business. Accordingly, we must enter into agreements with other companies that can assist us and provide certain capabilities, including sourcing and manufacturing, which we do not possess. We may not be successful in entering into such alliances on favorable terms or at all. Even if we do succeed in securing such agreements, we may not be able to maintain them. Furthermore, any delay in entering into agreements could delay the development and commercialization of our technology or reduce its competitiveness even if it reaches the market. Any such delay related to such future agreements could adversely affect our business. While we have been able to secure materials and supplies like plastic containers through the COVID-19 crisis, we have not assurances that our ability to purchase in large quantities on a continual basis.

If any party to which we have outsourced certain functions fails to perform its obligations under agreements with us, the commercialization of our technology could be delayed or curtailed.

To the extent that we rely on other companies to manufacture the chemicals used in our technology, or sell or market products incorporating our technology, we will be dependent on the timeliness and effectiveness of their efforts. If any of these parties does not perform its obligations in a timely and effective manner, the commercialization of our technology could be delayed or curtailed because we may not have sufficient financial resources or capabilities to continue such efforts on our own.

We rely on a small number of key supply ingredients in order to manufacture our products.

All of the supply ingredients used to manufacture our products are readily available from multiple suppliers. However, commodity prices for these ingredients can vary significantly, and the margins that we are able to generate could decline if prices rise. If our manufacturing costs rise significantly, we may be forced to raise the prices for our products, which may reduce their acceptance in the marketplace.

If our technology or products incorporating our technology do not gain market acceptance, it is unlikely that we will become profitable.

The potential markets for products into which our technology can be incorporated are rapidly evolving, and we have many successful competitors including some of the largest and most well-established companies in the world. The commercial success of products incorporating our technology will depend on the adoption of our technology by commercial and consumer end users in various fields.

Market acceptance may depend on many factors, including:

|

|

●

|

the willingness and ability of consumers and industry partners to adopt new technologies from a company with little or no history in the industry;

|

|

|

●

|

our ability to convince potential industry partners and consumers that our technology is an attractive alternative to other competing technologies;

|

|

|

●

|

our ability to license our technology in a commercially effective manner;

|

|

|

●

|

our ability to continue to fund operations while our products move through the process of gaining acceptance, before the time in which we are able to scale up production to obtain economies of scale; and

|

|

|

●

|

our ability to overcome brand loyalties.

|

If products incorporating our technology do not achieve a significant level of market acceptance, then demand for our technology itself may not develop as expected, and, in such event, it is unlikely that we will become profitable.

Any revenues that we may earn in the future are unpredictable, and our operating results are likely to fluctuate from quarter to quarter.

We believe that our future operating results will fluctuate due to a variety of factors, including:

|

|

●

|

delays in product development by us or third parties;

|

|

|

●

|

market acceptance of products incorporating our technology;

|

|

|

●

|

changes in the demand for, and pricing of, products incorporating our technology;

|

|

|

●

|

competition and pricing pressure from competitive products; and

|

|

|

●

|

expenses related to, and the results of, proceedings relating to our intellectual property.

|

We expect our operating expenses will continue to fluctuate significantly in 2020 and beyond, as we continue our research and development and increase our marketing and licensing activities. Although we expect to generate revenues from licensing our technology in the future, revenues may decline or not grow as anticipated, and our operating results could be substantially harmed for a particular fiscal period. Moreover, our operating results in some quarters may not meet the expectations of stock market analysts and investors. In that case, our stock price most likely would decline.

Some of our revenue may be dependent on the award of new contracts from the U.S. government, which we do not directly control.

Some of our revenue has been generated from sales to the U.S. Defense Logistics Agency through a bid process in response to request for bids. The timing and size of requests for bids is unpredictable and outside of our control. The number of other companies competing for these bids is also unpredictable and outside of our control. In the event of more competition for these awards, we may have to reduce our margins. These variables make it difficult to predict when or if we will sell more products to the U.S. government, which in turns makes it difficult to stock inventory and purchase raw materials.

We have limited product distribution experience, and we rely in part on third parties who may not successfully sell our products.

We have limited product distribution experience and rely in part on product distribution arrangements with third parties. In our future product offerings, we may rely solely on third parties for product sales and distribution. We also plan to license our technology to certain third parties for commercialization of certain applications. We expect to enter into additional distribution agreements and licensing agreements in the future, and we may not be able to enter into these additional agreements on terms that are favorable to us, if at all. In addition, we may have limited or no control over the distribution activities of these third parties. These third parties could sell competing products and may devote insufficient sales efforts to our products. As a result, our future revenues from sales of our products, if any, will depend on the success of the efforts of these third parties.

We may not be able to attract or retain qualified senior personnel.

We believe we are currently able to manage our current business with our existing management team. However, as we expand the scope of our operations, we will need to obtain the full-time services of additional senior management and other personnel. Competition for highly-skilled personnel is intense, and there can be no assurance that we will be able to attract or retain qualified senior personnel. Our failure to do so could have an adverse effect on our ability to implement our business plan. As we add full-time senior personnel, our overhead expenses for salaries and related items will increase from current levels and, depending upon the number of personnel we hire and their compensation packages, these increases could be substantial.

If we lose our key personnel or are unable to attract and retain additional personnel, we may be unable to achieve profitability.

Our future success is substantially dependent on the efforts of our senior management, particularly Dennis P. Calvert, our president and chief executive officer. The loss of the services of Mr. Calvert or other members of our senior management may significantly delay or prevent the achievement of product development and other business objectives. Because of the scientific nature of our business, we depend substantially on our ability to attract and retain qualified marketing, scientific and technical personnel. There is intense competition among specialized and technologically-oriented companies for qualified personnel in the areas of our activities. If we lose the services of, or do not successfully recruit, key marketing, scientific and technical personnel, then the growth of our business could be substantially impaired. At present, we do not maintain key man insurance for any of our senior management, although management is evaluating the potential of securing this type of insurance in the future as may be available.

Nondisclosure agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information.

In order to protect our proprietary technology and processes, we rely in part on nondisclosure agreements with our employees, potential licensing partners, potential manufacturing partners, testing facilities, universities, consultants, agents and other organizations to which we disclose our proprietary information. These agreements may not effectively prevent disclosure of confidential information and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information. In addition, others may independently discover trade secrets and proprietary information, and in such cases we could not assert any trade secret rights against such parties. Costly and time-consuming litigation could be necessary to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position. Since we rely on trade secrets and nondisclosure agreements, in addition to patents, to protect some of our intellectual property, there is a risk that third parties may obtain and improperly utilize our proprietary information to our competitive disadvantage. We may not be able to detect unauthorized use or take appropriate and timely steps to enforce our intellectual property rights.

We may become subject to product liability claims.

As a business that manufactures and markets products for use by consumers and institutions, we may become liable for any damage caused by our products, whether used in the manner intended or not. Any such claim of liability, whether meritorious or not, could be time-consuming and/or result in costly litigation. Although we maintain general liability insurance, our insurance may not cover potential claims of the types described above and may not be adequate to indemnify for all liabilities that may be imposed. Any imposition of liability that is not covered by insurance or is in excess of insurance coverage could harm our business and operating results, and you may lose some or all of any investment you have made, or may make, in our company.

Litigation or the actions of regulatory authorities may harm our business or otherwise distract our management.

Substantial, complex or extended litigation could cause us to incur major expenditures and distract our management. For example, lawsuits by employees, former employees, investors, stockholders, partners, customers or others, or actions taken by regulatory authorities, could be very costly and substantially disrupt our business. As a result of our financing activities over time, and by virtue of the number of people that have invested in our company, we face increased risk of lawsuits from investors. Such lawsuits or actions could from time to time be filed against our company and/or our executive officers and directors. Such lawsuits and actions are not uncommon, and we cannot assure you that we will always be able to resolve such disputes or actions on terms favorable to our company.

If we suffer negative publicity concerning the safety or efficacy of our products, our sales may be harmed.

If concerns should arise about the safety or efficacy of any of our products that are marketed, regardless of whether or not such concerns have a basis in generally accepted science or peer-reviewed scientific research, such concerns could adversely affect the market for those products. Similarly, negative publicity could result in an increased number of product liability claims, whether or not those claims are supported by applicable law.

The licensing of our technology or the manufacture, use or sale of products incorporating our technology may infringe on the patent rights of others, and we may be forced to litigate if an intellectual property dispute arises.

If we infringe or are alleged to have infringed another party’s patent rights, we may be required to seek a license, defend an infringement action or challenge the validity of the patents in court. Patent litigation is costly and time consuming. We may not have sufficient resources to bring these actions to a successful conclusion. In addition, if we do not obtain a license, do not successfully defend an infringement action or are unable to have infringed patents declared invalid, we may:

|

|

●

|

incur substantial monetary damages;

|

|

|

●

|

encounter significant delays in marketing our current and proposed product candidates;

|

|

|

●

|

be unable to conduct or participate in the manufacture, use or sale of product candidates or methods of treatment requiring licenses;

|

|

|

●

|

lose patent protection for our inventions and products; or

|

|

|

●

|

find our patents are unenforceable, invalid or have a reduced scope of protection

|

Parties making such claims may be able to obtain injunctive relief that could effectively block our company’s ability to further develop or commercialize our current and proposed product candidates in the United States and abroad and could result in the award of substantial damages. Defense of any lawsuit or failure to obtain any such license could substantially harm our company. Litigation, regardless of outcome, could result in substantial cost to, and a diversion of efforts by, our company.

Our patents are expensive to maintain, our patent applications are expensive to prosecute, and thus we are unable to file for patent protection in many countries.

Our ability to compete effectively will depend in part on our ability to develop and maintain proprietary aspects of our technology and either to operate without infringing the proprietary rights of others or to obtain rights to technology owned by third parties. Pending patent applications relating to our technology may not result in the issuance of any patents or any issued patents that will offer protection against competitors with similar technology. We must employ patent attorneys to prosecute our patent applications both in the United States and internationally. International patent protection requires the retention of patent counsel and the payment of patent application fees in each foreign country in which we desire patent protection, on or before filing deadlines set forth by the International Patent Cooperation Treaty (“PCT”). We therefore choose to file patent applications only in foreign countries where we believe the commercial opportunities require it, considering our available financial resources and the needs for our technology. This has resulted, and will continue to result, in the irrevocable loss of patent rights in all but a few foreign jurisdictions.

Patents we receive may be challenged, invalidated or circumvented in the future, or the rights created by those patents may not provide a competitive advantage. We also rely on trade secrets, technical know-how and continuing invention to develop and maintain our competitive position. Others may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets.

We are subject to risks related to future business outside of the United States.

Over time, we may develop business relationships outside of North America, and as those efforts are pursued, we will face risks related to those relationships such as:

|

|

●

|

foreign currency fluctuations;

|

|

|

●

|

unstable political, economic, financial and market conditions;

|

|

|

●

|

import and export license requirements;

|

|

|

●

|

increases in tariffs and taxes;

|

|

|

●

|

high levels of inflation;

|

|

|

●

|

restrictions on repatriating foreign profits back to the United States;

|

|

|

●

|

greater difficulty collecting accounts receivable and longer payment cycles;

|

|

|

●

|

less favorable intellectual property laws, and the lack of intellectual property legal protection;

|

|

|

●

|

regulatory requirements;

|

|

|

●

|

unfamiliarity with foreign laws and regulations; and

|

|

|

●

|

changes in labor conditions and difficulties in staffing and managing international operations.

|

The volatility of certain raw material costs may adversely affect operations and competitive price advantages for products that incorporate our technology.

Most of the chemicals and other key materials that we use in our business, such as minerals, fiber materials and packaging materials, are neither generally scarce nor price sensitive, but prices for such chemicals and materials can be cyclical. Supply and demand factors, which are beyond our control, generally affect the price of our raw materials. We try to minimize the effect of price increases through production efficiency and the use of alternative suppliers, but these efforts are limited by the size of our operations. If we are unable to minimize the effects of increased raw material costs, our business, financial condition, results of operations and cash flows may be materially adversely affected.

Certain of our products sales historically have been highly impacted by fluctuations in seasons and weather.

Industrial odor control products have proven highly effective in controlling volatile organic compounds that are released as vapors produced by decomposing waste material. Such vapors are produced with the highest degree of intensity in temperatures between 40 degrees Fahrenheit (5 degrees Celsius) and 140 degrees Fahrenheit (60 degrees Celsius). When weather patterns are cold or in times of precipitation, our clients are less prone to use our odor control products, presumably because such vapors are less noticeable or, in the case of precipitation, can be washed away or altered. This leads to unpredictability in use and sales patterns for, especially, our CupriDyne Clean product line which accounts for over one-half our total sales.

The cost of maintaining our public company reporting obligations is high.

We are obligated to maintain our periodic public filings and public reporting requirements, on a timely basis, under the rules and regulations of the SEC. In order to meet these obligations, we will need to continue to raise capital. If adequate funds are not available, we will be unable to comply with those requirements and could cease to be qualified to have our stock traded in the public market. As a public company, we incur significant legal, accounting and other expenses. In addition, the Sarbanes-Oxley Act of 2002, as well as related rules adopted by the SEC, has imposed substantial requirements on public companies, including certain corporate governance practices and requirements relating to internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act.

Business disruptions could seriously harm our future revenue and financial condition and increase our costs and expenses.

Our operations, and those of our contractors and consultants, could be subject to pandemics, earthquakes, power shortages, telecommunications failures, water shortages, floods, hurricanes, typhoons, fires, extreme weather conditions, medical epidemics, acts of terrorism, acts of war and other natural or man-made disasters or business interruptions, for which we are predominantly self-insured. The occurrence of any of these business disruptions could seriously harm our operations and financial condition and increase our costs and expenses. We rely in part on third-party manufacturers to produce and process our products or the raw materials used to make our products. Our ability to obtain supplies of our products or raw materials could be disrupted if the operations of these suppliers are affected by a man-made or natural disaster, pandemics, epidemics, or other business interruption, including the recent novel strain of coronavirus (SARS-CoV-2 aka COVID-19) that originally surfaced in Wuhan, China in December 2019. The extent to which COVID-19 impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions to contain 2 or treat its impact, among others. Our corporate headquarters and offices of Odor-No-More are in Southern California near major earthquake faults and fire zones. Our operations and financial condition could suffer in the event of a major earthquake, fire or other natural disaster.

A coronavirus pandemic is ongoing in many parts of the world and may result in significant disruptions to our clients and/or supply chain which could have a material adverse effect on our business and revenues.

A coronavirus pandemic exists as of the filing of this report. As the pandemic is still evolving as of this time, much of its impact remains unknown, and it is impossible to predict the impact it may have on the development of our business and on our revenues.

Our corporate headquarters and offices of our Odor-No-More division are in Southern California. On March 19, 2020, California’s Governor issued an executive order that all residents of the State must stay at home indefinitely except as needed to maintain “essential critical infrastructure”. As a result, many businesses have closed and many people are out of work. Although many of our clients are included in the definitions of “essential critical infrastructure”, such as wastewater treatment plants and refuse collection infrastructure, it is likely that this “stay at home” order and its effect on California’s economy (and similar orders across the country and world, and their effect on the U.S. and worldwide economy) will adversely affect our clients willingness to purchase our products and services, and thus adversely affect our revenues. No one knows how long these “stay at home” orders will remain in effect, and experts expect that an extended (months-long) stay at home requirement is likely to have an extended and significant impact on the economy as a whole.

The severity of the coronavirus pandemic could also make access to our existing supply chain difficult or impossible by delaying the delivery of key raw materials used in our product candidates and therefore delay the delivery of our products. Any of these results could materially impact our business and have an adverse effect on our business.

A recession in the United States may affect our business.

If the U.S. economy were to contract into a recession or depression, our existing clients, and potential future clients, may divert their resources to other goods and services, and our business may suffer.

Risks Relating to our Common Stock

The sale or issuance of our common stock to Lincoln Park may cause dilution, and the sale of the shares of common stock acquired by Lincoln Park, or the perception that such sales may occur, could cause the price of our common stock to fall.

On August 25, 2017, we entered into an agreement Lincoln Park, pursuant to which Lincoln Park committed to purchase up to $10,000,000 of our common stock for a three-year period. Throughout the 2017 agreement, we sold Lincoln Park approximately 6,300,000 shares of our stock for approximately $1,800,000.

On March 30, 2020, we entered into a second agreement with Lincoln Park (the “2020 LPC Agreement”), replacing the 2017 agreement, pursuant to which we can sell Lincoln Park up to $10,250,000 of our shares. We issued Lincoln Park 1,785,715 shares as consideration for its commitments under the agreement, and Lincoln Park made an initial purchase of $250,000 of shares for $0.14 per share. We filed a registration statement with the SEC that was declared effective on April 21, 2020, registering Lincoln Park’s sale of the commitment shares, the $250,000 in shares in the initial purchase, and an additional 40,000,000 shares that it may purchase. Under the 2020 LPC Agreement, we generally have the right to control the timing and amount of any sales of our shares to Lincoln Park. Sales of our common stock, if any, to Lincoln Park will depend on market conditions and other factors to be determined by us. We may ultimately decide to sell to Lincoln Park all, some or none of the shares of our common stock that may be available for us to sell pursuant to the 2020 LPC Agreement. If and when we do sell shares to Lincoln Park, after Lincoln Park has acquired the shares, Lincoln Park may resell all, some or none of those shares at any time or from time to time in its discretion. Therefore, sales to Lincoln Park by us could result in substantial dilution to the interests of other holders of our common stock, as well as sales of our stock by Lincoln Park into the open market causing reductions in the price of our common stock. Additionally, the sale of a substantial number of shares of our common stock to Lincoln Park, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at a price that we might otherwise desire to effect sales.

Our common stock is thinly traded and largely illiquid.

Our stock is currently quoted on the OTC Markets (OTCQB). Being quoted on the OTCQB has made it more difficult to buy or sell our stock and from time to time has led to a significant decline in the frequency of trades and trading volume. Continued trading on the OTCQB will also likely adversely affect our ability to obtain financing in the future due to the decreased liquidity of our shares and other restrictions that certain investors have for investing in OTCQB traded securities. While we intend to seek listing on the Nasdaq Stock Market (“Nasdaq”) or another national stock exchange when our company is eligible, there can be no assurance when or if our common stock will be listed on Nasdaq or another national stock exchange.

The market price of our stock is subject to volatility.

Because our stock is thinly traded, its price can change dramatically over short periods, even in a single day. An investment in our stock is subject to such volatility and, consequently, is subject to significant risk. The market price of our common stock could fluctuate widely in response to many factors, including:

|

|

●

|

developments with respect to patents or proprietary rights;

|

|

|

●

|

announcements of technological innovations by us or our competitors;

|

|

|

●

|

announcements of new products or new contracts by us or our competitors;

|

|

|

●

|

actual or anticipated variations in our operating results due to the level of development expenses and other factors;

|

|

|

●

|

changes in financial estimates by securities analysts and whether any future earnings of ours meet or exceed such estimates;

|

|

|

●

|

conditions and trends in our industry;

|

|

|

●

|

new accounting standards;

|

|

|

●

|

general economic, political and market conditions and other factors; and

|

|

|

●

|

the occurrence of any of the risks described herein.

|

You may have difficulty selling our shares because they are deemed a “penny stock”.

Because our common stock is not quoted or listed on a national securities exchange, if the trading price of our common stock remains below $5.00 per share, which we expect for the foreseeable future, trading in our common stock will be subject to the requirements of certain rules promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which require additional disclosure by broker-dealers in connection with any trades involving a stock defined as a penny stock (generally, any non-Nasdaq equity security that has a market price of less than $5.00 per share, subject to certain exceptions). Such rules require the delivery, before any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and accredited investors (generally defined as an investor with a net worth in excess of $1,000,000 or annual income exceeding $200,000 individually or $300,000 together with a spouse). For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction before the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer and current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed on broker-dealers by such requirements could discourage broker-dealers from effecting transactions in our common stock, which could severely limit the market liquidity of our common stock and the ability of holders of our common stock to sell their shares.

Because our shares are deemed a “penny stock,” rules enacted by FINRA make it difficult to sell previously restricted stock.

Rules put in place by the Financial Industry Regulatory Authority (FINRA) require broker-dealers to perform due diligence before depositing unrestricted common shares of penny stocks, and as such, some broker-dealers, including many large national firms (such as eTrade and Charles Schwab), are refusing to deposit previously restricted common shares of penny stocks. We routinely issued non-registered restricted common shares to investors, vendors and consultants. The issuance of such shares is subjected to the FINRA-enacted rules. As such, it can be difficult for holders of restricted stock, including those issued in our private securities offerings, to deposit the shares with broker-dealers and sell those shares on the open market.

Because we will not pay dividends in the foreseeable future, stockholders will only benefit from owning common stock if it appreciates.

We have never declared or paid a cash dividend to stockholders. We intend to retain any earnings that may be generated in the future to finance operations. Accordingly, any potential investor who anticipates the need for current dividends from his investment should not purchase our common stock, and must rely on the benefit of owning shares, and presumably a rise in share price. We cannot predict the future price of our stock, and due to the factors enumerated herein, can make no assurance of a future increase in the price of our common stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

All statements, other than statements of historical fact, included in this prospectus regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects and plans and objectives of management are forward-looking statements. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

We have based these forward-looking statements on our current expectations and projections about future events. Although we believe that the expectations underlying our forward-looking statements are reasonable, these expectations may prove to be incorrect, and all of these statements are subject to risks and uncertainties. Therefore, you should not place undue reliance on our forward-looking statements. We have included important risks and uncertainties in the cautionary statements included in this prospectus, particularly the section titled “Risk Factors” incorporated by reference herein. We believe these risks and uncertainties could cause actual results or events to differ materially from the forward-looking statements that we make. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections or expectations prove incorrect, actual results, performance or financial condition may vary materially and adversely from those anticipated, estimated or expected. Our forward-looking statements do not reflect the potential impact of future acquisitions, mergers, dispositions, joint ventures or investments that we may make. We do not assume any obligation to update any of the forward-looking statements contained herein, whether as a result of new information, future events or otherwise, except as required by law. In the light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur, and actual results could differ materially from those anticipated or implied in the forward-looking statements. Any forward-looking statement made by us in this prospectus is based only on information currently available to us and speaks only as of the date on which it is made.

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders upon exercise of outstanding warrants to purchase common stock. We will receive no proceeds from the sale of shares of common stock by the selling stockholders in this offering. We may receive up to $9.5 million in aggregate gross proceeds upon exercise of the underlying warrants; provided, however, the exercise price of the warrants is currently much higher than the price at which our common stock is trading and therefore we do not anticipate the warrants to be exercised unless and until the price of our stock increases. See “Plan of Distribution” elsewhere in this prospectus for more information.

We expect to use any proceeds that we receive under the exercise of the warrants to help fund general working capital for our corporate operations and repayment of debt

DIVIDEND POLICY

We have never declared or paid a cash dividend to stockholders. We intend to retain any earnings that may be generated in the future to finance operations.

CAPITALIZATION

The following table sets forth our actual cash and cash equivalents and our capitalization as of December 31, 2019 (unaudited), and as adjusted to give effect to the sale of the shares offered hereby and the use of proceeds, as described in the section titled “Use of Proceeds” above.

You should read this information in conjunction with “Managements’ Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing in our Annual Report on Form 10-K for the year ended December 31, 2019.

|

|

|

As of December 31, 2019

|

|

|

|

|

Actual

|

|

|

As Adjusted(1)

|

|

|

CASH AND CASH EQUIVALENTS

|

|

$

|

655,000

|

|

|

$

|

10,130,000

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ DEFICIT:

|

|

|

|

|

|

|

|

|

|

Convertible Preferred Series A, $.00067 Par Value, 50,000,000 Shares Authorized, -0- Shares Issued and Outstanding at December 31, 2019.

|

|

|

—

|

|

|

|

—

|

|

|

Common stock, $.00067 Par Value, 400,000,000 Shares Authorized, 166,256,024 Shares Issued at December 31, 2019, and 186,415,086 Shares Issued, as adjusted.

|

|

|

111,000

|

|

|

|

125,000

|

|

|

Additional paid-in capital

|

|

|

121,327,000

|

|

|

|

130,788,000

|

|

|

Accumulated other comprehensive loss

|

|

|

(99,000

|

)

|

|

|

(99,000

|

)

|

|

Accumulated deficit

|

|

|

123,492,000

|

|

|

|

123,492,000

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Biolargo stockholders’ deficit

|

|

|

(2,153,000

|

)

|

|

|

7,322,000

|

|

|

Non-controlling interest

|

|

|

(27,000

|

)

|

|

|

(27,000

|

)

|

|

Total stockholders’ deficit

|

|

|

(2,180,000

|

)

|

|

|

7,295,000

|

|

|

Total liabilities and stockholders’ deficit

|

|

|

3,621,000

|

|

|

|

13,096,000

|

|

|

|

(1)

|

Assumes the selling stockholders exercise all 20,159,062 shares available for purchase under the stock purchase warrants, at an aggregate average exercise price $0.47 per share. Given our stock currently trades at less than $0.25 per share, we do not expect the selling stockholders will exercise all warrants, and thus do not expect to receive $9,475,000 cash as reflected in the “as adjusted” column in the above table.

|

DILUTION

The net tangible book value of our company as of December 31, 2019 was $(4,073,000) or approximately $(0.024) per share of common stock. Net tangible book value per share is determined by dividing the net tangible book value of our company (total tangible assets less total liabilities) by the number of outstanding shares of our common stock.

Assuming net proceeds of $9,475,000 from the sale of shares to the selling stockholders pursuant to the stock purchase warrants (see Note 1 in the Capitalization section immediately above), our adjusted net tangible book value as of December 31, 2019 would have been $5,402,000 or $0.029 per share. This represents an immediate increase in net tangible book value of approximately $0.053 per share to existing stockholders.

MARKET PRICE OF AND DIVIDENDS ON COMMON EQUITY

AND RELATED STOCKHOLDER MATTERS

Market Information

Since January 23, 2008, our common stock has been quoted on the OTC Markets “OTCQB” marketplace (formerly known as the “OTC Bulletin Board”) under the trading symbol “BLGO”.

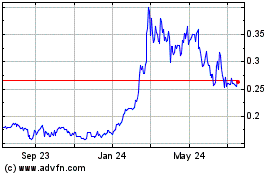

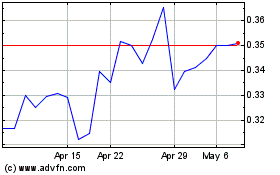

The table below represents the quarterly high and low closing prices of our common stock for the last three fiscal years as reported by www.otcmarkets.com.

|

|

|

2018

|

|

|

2018

|

|

|

2020

|

|

|

|

|

High

|

|

|

Low

|

|

|

High

|

|

|

High

|

|

|

High

|

|

|

Low

|

|

|

First Quarter

|

|

$

|

0.41

|

|

|

$

|

0.27

|

|

|

$

|

0.27

|

|

|

$

|

0.16

|

|

|

$

|

0.29

|

|

|

$

|

0.12

|

|

|

Second Quarter

|

|

$

|

0.45

|

|

|

$

|

0.31

|

|

|

$

|

0.31

|

|

|

$

|

0.16

|

|

|

$

|

0.17

|

*

|

|

$

|

0.15

|

*

|

|

Third Quarter

|

|

$

|

0.45

|

|

|

$

|

0.38

|

|

|

$

|

0.38

|

|

|

$

|

0.22

|

|

|

|

n/a

|

|

|

|

n/a

|

|

|

Fourth Quarter

|

|

$

|

0.30

|

|

|

$

|

0.36

|

|

|

$

|

0.36

|

|

|

$

|

0.22

|

|

|

|

n/a

|

|

|

|

n/a

|

|

* For the partial quarterly period through April 21, 2020.

The closing price for our common stock on April 21, 2020, was $0.16 per share.

Holders of our Common Stock

As of April 21, 2020, 178,692,138 shares of our common stock were outstanding and held of record by approximately 650 stockholders of record, and approximately 2,600 beneficial owners.

Dividends

We have never declared or paid a cash dividend to stockholders. We intend to retain any earnings that may be generated in the future to finance operations.

Securities Authorized for Issuance Under Equity Compensation Plans

Equity Compensation Plan Information as of December 31, 2019

|

Plan Category

|

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

(a)

|

Weighted average

exercise price of

outstanding options,

warrants and rights

(b)

|

Number of securities

remaining available for

future issuance

(c)

|

|

Equity compensation plans approved by security holders

|

17,983,808(1)

|

$0.36

|

32,785,644

|

|

Equity compensation plans not approved by security holders(2)

|

19,604,107

|

$0.41

|

n/a

|

|

Total

|

37,587,915

|

$0.40

|

32,785,644

|

|

|

(1)

|

Includes 8,769,451 shares issuable under the 2007 Equity Plan, which expired September 6, 2017, and 9,214,356 shares issuable under the 2018 Equity Incentive Plan adopted by the Board on March 7, 2018 and subsequently approved by stockholders on May 23, 2018.

|

|

|

(2)

|

This includes various issuances to specific individuals either as a conversion of un-paid obligations pursuant to a plan adopted by our board of directors, or as part of their agreement for services

|

2018 Equity Incentive Plan

On June 22, 2018, our stockholders adopted the BioLargo 2018 Equity Incentive Plan (“2018 Plan”) as a means of providing our directors, key employees and consultants additional incentive to provide services. Both stock options and stock grants may be made under this plan for a period of 10 years. It is set to expire on its terms on June 22, 2028. Our Board of Director’s Compensation Committee administers this plan. As plan administrator, the Compensation Committee has sole discretion to set the price of the options. The plan authorizes the following types of awards: (i) incentive and non-qualified stock options, (ii) restricted stock awards, (iii) stock bonus awards, (iv) stock appreciation rights, (v) restricted stock units, and (vi) performance awards. The total number of shares reserved and available for awards pursuant to this Plan as of the date of adoption of this 2018 Plan by the Board is 40 million shares. The number of shares available to be issued under the 2018 Plan increases automatically each January 1st by the lesser of (a) 2 million shares, or (b) such number of shares determined by our Board.

2007 Equity Incentive Plan

On September 7, 2007, and as amended April 29, 2011, the BioLargo, Inc. 2007 Equity Incentive Plan (“2007 Plan”) was adopted as a means of providing our directors, key employees and consultants additional incentive to provide services. Both stock options and stock grants may be made under this plan for a period of 10 years, which expired on September 7, 2017. The Board’s Compensation Committee administers this plan. As plan administrator, the Compensation Committee has sole discretion to set the price of the options. As of September 2017, the Plan was closed to further stock option grants.

Equity Compensation Plans not approved by stockholders

In addition to the 2018 and 2007 Equity Plans, our board of directors has approved a plan for employees, consultants and vendors by which outstanding amounts owed to them by our company may be converted to common stock or options to purchase common stock. The conversion and exercise price is based on the closing price of our common stock on the date of agreement. If an option is issued, the number of shares purchasable by the option is calculated by dividing the amount owed by the exercise price, times one and one-half.

DESCRIPTION OF BUSINESS

Our Business - Innovator and Solution Provider

BioLargo, Inc. is an innovator of technology-based products and an environmental engineering solutions provider driven by a mission to “make life better”. We feature unique disruptive solutions to deliver clean air, clean water and a clean, safe environment.

Our mission is highlighted by our most recent innovation supported in part with grant funding from the U.S. Environmental Protection Agency to deliver a cost effective solution to remove PFAS from water. PFAS is a contaminant commonly referred to as ‘forever chemicals’ and the ‘contaminant of the decade’ that has been linked to adverse health effects, with cost to clean up estimates by analysts to approach $160 billion globally over the next 20-30 years.

We deliver:

|

|

●

|

complete environmental solutions to clients;

|

|

|

●

|

cost-effective products sold through distribution partners; and

|

|

|

●

|

proven technology to our licensing partners

|

BioLargo combines its robust innovation culture with a highly trained team to be fully equipped to serve clients’ needs in a wide range of environmental projects from start to finish. Our three environmentally focused operating units work together to deliver complete solutions, technology innovation, scientific validation, engineering, design, build, and construction services, maintenance, manufacturing, training, permitting, regulatory compliance, system integration, testing, monitoring and the like.

As a result of our continued commercial progress as well as the continual validation of our technologies, we are now actively engaged in partnership discussions with industry leaders at every level. We are continually reminded by these potential partners that they believe it is better to be the disruptor than to be the disrupted. We fully expect our products and technologies to find commercial adoption around the world and are focused on finding the right partners.