Bayer, Lanxess to Sell Stakes in Currenta to Macquarie Infrastructure

August 06 2019 - 4:08PM

Dow Jones News

By Michael Dabaie

Bayer AG (BAYN.XE) and specialty chemicals company Lanxess AG

(LXS.XE) said they would sell their stakes in German chemical-park

operator Currenta to funds managed by Macquarie Infrastructure and

Real Assets.

Currenta manages and operates infrastructure, energy supply and

other essential services across the chemical parks in Leverkusen,

Dormagen and Krefeld-Uerdingen. Bayer has 60% of the joint venture

and Lanxess 40%.

Currenta, including a transferred real estate portfolio by

Bayer, has a total enterprise value of EUR3.5 billion before

deduction of net debt and pension obligations, the companies

said.

Bayer is selling real estate and infrastructure for EUR180

million. Bayer said its 60% stake in Currenta has an equity value

of about EUR1.17 billion.

Bayer expects its part of the transaction to close in the fourth

quarter of 2019, while Lanxess expects its transaction to done by

the end of April 2020. Lanxess is one of Currenta's main customers

and will provide MIRA with operational support during the

transition phase. Lanxess's stake has an equity value, after

deduction of net debt and pensions, of about EUR780 million

pre-tax.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

August 06, 2019 15:53 ET (19:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

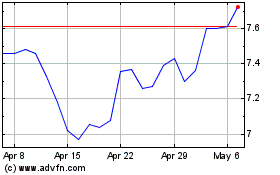

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

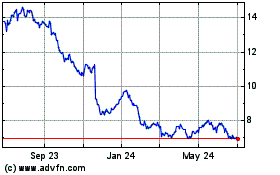

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024