Current Report Filing (8-k)

June 04 2020 - 7:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 16, 2020

B2Digital, Incorporated

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

000-11882

|

|

84-0916299

|

|

(State or Other Jurisdiction

|

|

(Commission File

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

Number)

|

|

Identification Number)

|

|

4522 West Village Drive, Suite 215, Tampa, FL 33624

|

|

(Address of principal executive offices, including zip code)

|

|

(813) 961-3051

|

|

(Registrant’s telephone number,

including area code)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

N/A

|

N/A

|

N/A

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

Economic

Injury Disaster Loan

On May 26, 2020,

B2Digital, Incorporated, a Delaware corporation (the “Company”), executed the standard loan documents required

for securing loans (the “EIDL Loans”) offered by the U.S. Small Business Administration (the “SBA”)

under its Economic Injury Disaster Loan (“EIDL”) assistance program in light of the impact of the COVID-19 pandemic

on the Company’s business. The principal amount of each EIDL Loan is $97,300 and $10,000, respectively, with proceeds to

be used for working capital purposes. Interest accrues at the rate of 3.75% per annum and will accrue from the date of the EIDL

Loans. Installment payments, including principal and interest, are due monthly beginning May 26, 2021 (twelve months from the date

of the EIDL Loans) in the amount of $475 (for the larger loan). The balance of principal and interest is payable 30 years from

the date of the EIDL Loans.

The EIDL Loans

are secured by a security interest on all of the Company’s assets.

Paycheck

Protection Program Loan

On April 16, 2020,

the Company issued a Promissory Note (the “PPP Note”) pursuant to which the lender agreed to make a loan to

the Company under the Paycheck Protection Program (the “PPP Loan”) offered by the SBA to qualified small businesses

in a principal amount of $15,600.

The interest rate

on the PPP Note is a fixed rate of 1% per annum based on a 365-day year. The Company is required to make one payment of all outstanding

principal plus all accrued unpaid interest on April 16, 2022 (the “Maturity Date”). Commencing on the seventh

month anniversary of date of the PPP Note and continuing on the same day of each month thereafter, the Company is required to make

a monthly principal payment on the outstanding principal balance (after application of any loan forgiveness) in an amount that

shall fully amortize the outstanding principal balance of the PPP Note by the Maturity Date. Accrued interest shall be due and

payable with each monthly principal payment.

The PPP Loan proceeds

are to be used to pay for payroll costs, continuation of group health care benefits during periods of paid sick, medical, or family

leave, or insurance premiums; salaries or commissions or similar compensation; rent; utilities; and interest on certain other outstanding

debt; however, 75% of the PPP Loan proceeds must be used for payroll purposes.

According to the

terms of the Paycheck Protection Program (the “PPP”), all or a portion of loans under the PPP may be forgiven

if all employees are kept on the payroll for eight weeks after the date of such loan and the proceeds of such loan are used for

payroll, rent, mortgage interest, or utilities. Forgiveness is also based on the employer maintaining or quickly rehiring

employees and maintaining salary levels. Forgiveness will be reduced if full-time headcount declines, or if salaries and

wages decrease.

At the Company’s

option, the Company may prepay all or a portion of the PPP Loan without penalty.

The PPP Note includes

events of default, the occurrence and continuation of which would provide the lender with the right to exercise remedies against

the Company including the right to declare the entire unpaid principal balance under the PPP Note and all accrued unpaid interest

immediately due.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

B2Digital, Incorporated

|

|

|

|

|

Date: June 4, 2020

|

By:

|

/s/ Greg P. Bell

|

|

|

|

Greg P. Bell, Chief Executive Officer

|

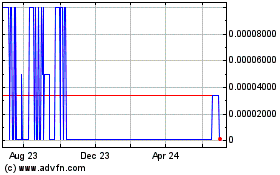

B2Digital (CE) (USOTC:BTDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

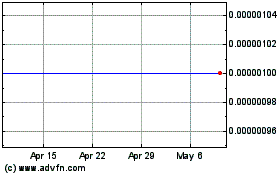

B2Digital (CE) (USOTC:BTDG)

Historical Stock Chart

From Apr 2023 to Apr 2024