UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported): December 9,

2020

AMERICAN BIO MEDICA

CORPORATION

(Exact name of

registrant as specified in its charter)

|

New

York

|

0-28666

|

14-1702188

|

|

(State or other

jurisdiction of incorporation)

|

(Commission File

Number)

|

(IRS Employer

Identification Number)

|

|

122 Smith Road, Kinderhook,

NY

|

12106

|

|

(Address of

principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 518-758-8158

Not applicable

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see

General Instruction A.2.

below):

☐

Written communications pursuant to

Rule 425 under the Securities Act (17 CFR

230.425)

☐ Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each

class

|

Trading

Symbol(s)

|

Name of each exchange

on which registered

|

|

Common

|

ABMC

|

OTC

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this

chapter).

Emerging

growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

ITEM 1.01

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On

December 9, 2020, American Bio Medica Corporation (the "Company")

entered into a Purchase Agreement (the “Purchase

Agreement”) and a Registration Rights Agreement (the

“Registration Rights Agreement”) with Lincoln Park

Capital Fund, LLC (“Lincoln Park”) under which Lincoln

Park has agreed to purchase from the Company, from time to time, up

to $10,250,000 of our shares of common stock, par value $0.01 per

share, subject to certain limitations set forth in the Purchase

Agreement, during the term of the Purchase Agreement. Pursuant to

the terms of the Registration Rights Agreement, the Company will

file with the U.S. Securities and Exchange Commission (the

“SEC”) a registration statement on Form S-1 (the

“Registration Statement”) to register for resale under

the Securities Act of 1933, as amended (the “Securities

Act”), the shares of common stock that we have already issued

and sold and may in the future elect to issue and sell to Lincoln

Park from time to time under the Purchase Agreement.

On

December 9, 2020, the Company sold 500,000 shares of common stock

to Lincoln Park in an initial purchase under the Purchase Agreement

for a purchase price of $125,000.

The

Company does not have the right to commence any further sales to

Lincoln Park under the Purchase Agreement until all of the

conditions that are set forth in the Purchase Agreement, all of

which are outside of Lincoln Park’s control, have been

satisfied, including, but not limited to, the Registration

Statement being declared effective by the SEC (at which time all

conditions are satisfied, the “Commencement”). From and

after the Commencement, under the Purchase Agreement, on any

business day selected by us on which the closing sale price of our

common stock exceeds $0.05, we may direct Lincoln Park to purchase

up to 200,000 common shares on the applicable purchase date (a

“Regular Purchase”), which maximum number of shares may

be increased to certain higher amounts up to a maximum of 250,000

common shares, if the market price of our common shares at the time

of the Regular Purchase equals or exceeds $0.20 and which maximum

number of shares may be further increased to certain higher amounts

up to a maximum of 500,000 common shares, if the market price of

our common shares at the time of the Regular Purchase equals or

exceeds $0.50 (such share and dollar amounts subject to

proportionate adjustments for stock splits, recapitalizations and

other similar transactions as set forth in the Purchase Agreement),

provided that Lincoln Park’s purchase obligation under any

single Regular Purchase may not exceed $500,000. The purchase price

of common shares the Company may elect to sell to Lincoln Park

under the Purchase Agreement in a Regular Purchase, if any, will be

based on 95% of the lower of: (i) the lowest sale price on the

purchase date for such Regular Purchase and (ii) the arithmetic

average of the three lowest closing sale prices for the

Company’s common shares during the 15 consecutive business

days ending on the business day immediately preceding the purchase

date for a Regular Purchase (in each case, to be appropriately

adjusted for any reorganization, recapitalization, non-cash

dividend, stock split or other similar transaction.)

In

addition to Regular Purchases, the Company may also direct Lincoln

Park to purchase other amounts of the Company’s common shares

in “accelerated purchases” and in “additional

accelerated purchases” under the terms set forth in the

Purchase Agreement.

Lincoln

Park has no right to require us to sell any common shares to

Lincoln Park, but Lincoln Park is obligated to make purchases as

the Company directs, subject to certain conditions. There are no

upper limits on the price per share that Lincoln Park must pay for

the Company’s common shares that the Company may elect to

sell to Lincoln Park pursuant to the Purchase Agreement. In all

instances, the Company may not sell common shares to Lincoln Park

under the Purchase Agreement to the extent that the sale of shares

would result in Lincoln Park beneficially owning more than 9.99% of

our common shares.

There

are no restrictions on future financings, rights of first refusal,

participation rights, penalties or liquidated damages in the

Purchase Agreement or Registration Rights Agreement, other than the

Company’s agreement not to enter into any “variable

rate” transactions (as defined in the Purchase Agreement)

with any third party, subject to certain exceptions set forth in

the Purchase Agreement, for the period set forth in the Purchase

Agreement. Lincoln Park has covenanted not to cause or engage in

any direct or indirect short selling or hedging of the

Company’s common shares.

Actual

sales of common shares, if any, to Lincoln Park under the Purchase

Agreement will depend on a variety of factors to be determined by

the Company from time to time, including, among others, market

conditions, the trading price of the Company’s common shares

and determinations by the Company as to the appropriate sources of

funding for the Company and its operations. The net proceeds to us

from sales of common shares to Lincoln Park under the Purchase

Agreement, if any, will depend on the frequency and prices at which

the Company sells shares to Lincoln Park under the Purchase

Agreement. Any proceeds that the Company receives from sales of

common shares to Lincoln Park under the Purchase Agreement will be

used for general

corporate purposes, capital expenditures and working

capital.

The

Purchase Agreement and the Registration Rights Agreement contain

customary representations, warranties, conditions and

indemnification obligations of the parties. During any “event

of default” under the Purchase Agreement, all of which are

outside of Lincoln Park’s control, Lincoln Park does not have

the right to terminate the Purchase Agreement; however, the Company

may not initiate any Regular Purchase or any other purchase of

common shares by Lincoln Park, until such event of default is

cured. The Company has the right to terminate the Purchase

Agreement at any time, at no cost or penalty. In addition, in the

event of bankruptcy proceedings by or against the Company, the

Purchase Agreement will automatically terminate. The

representations, warranties and covenants contained in such

agreements were made only for purposes of such agreements and as of

specific dates, were solely for the benefit of the parties to such

agreements, and may be subject to limitations agreed upon by the

contracting parties.

As

consideration for Lincoln Park’s irrevocable commitment to

purchase common shares upon the terms of and subject to

satisfaction of the conditions set forth in the Purchase Agreement,

upon execution of the Purchase Agreement, the Company issued to

Lincoln Park 1,250,000 common shares as commitment

shares.

The

common shares are being offered and sold by the Company to Lincoln

Park under the Purchase Agreement in reliance upon an exemption

from the registration requirements of the Securities Act afforded

by Section 4(a)(2) of the Securities Act and Rule 506(b) of

Regulation D promulgated thereunder.

The

foregoing descriptions of the Purchase Agreement and the

Registration Rights Agreement are qualified in their entirety by

reference to the full text of such agreements, copies of which are

attached hereto as Exhibit 4.27 and 4.28, respectively, and each of

which is incorporated herein in its entirety.

ITEM

3.02

UNREGISTERED

SALES OF EQUITY SECURITIES

The

information contained above in Item 1.01 is hereby incorporated by

reference into this Item 3.02. The securities to be issued by the

Company pursuant to the Purchase Agreement are not being registered

under the Securities Act of 1933 in reliance upon the exemption

from registration provided by Section 4(a)(2) thereof, which

exempts transactions by an issuer not involving any public

offering.

ITEM

9.01

FINANCIAL STATEMENTS AND EXHIBITS

(d)

10.45 Purchase Agreement dated December 8, 2020, by and between

American Bio Medica Corporation and Lincoln Park Capital Fund,

LLC.

10.46 Registration Rights Agreement dated December 8, 2020, by

and between American Bio Medica Corporation and Lincoln Park

Capital Fund, LLC.

99.1 Company Press Release

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AMERICAN

BIO MEDICA CORPORATION (Registrant)

|

|

|

|

|

|

|

|

Date: December 10,

2020

|

By:

|

/s/ Melissa A.

Waterhouse

|

|

|

|

|

Melissa A.

Waterhouse

|

|

|

|

|

Chief Executive

Officer (Principal Executive Officer)

Principal Financial

Officer

|

|

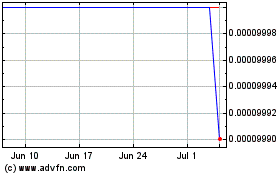

American Bio Medica (CE) (USOTC:ABMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

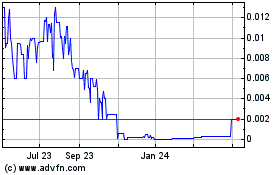

American Bio Medica (CE) (USOTC:ABMC)

Historical Stock Chart

From Apr 2023 to Apr 2024