Allianz Global Investors Liquidates Two Hedge Funds -- Update

March 27 2020 - 3:57PM

Dow Jones News

By Justin Baer

Allianz Global Investors is liquidating two hedge funds after

they took heavy losses in recent weeks on stock-options trades.

An Allianz Global Investors spokesman said the two funds,

Structured Alpha 1000 and Structured Alpha 1000 Plus, had been net

buyers of puts, or options giving the holder the right to sell an

asset at a predetermined price in the future. The puts were

designed to hedge against losses the funds might endure from other

positions should the market decline.

They didn't work, in large part because the market sold off more

rapidly this month than it had during past downturns, including the

2008 financial crisis, a person familiar with the funds said.

This pace "had a particularly large impact on the options

positions held by Structured Alpha funds, particularly the two

highest target alpha private strategies," the spokesman said in an

email.

As the market continued its descent, the funds were forced to

lock in losses.

"The portfolios were restructured and de-risked significantly

during the course of this turmoil, but not without sustaining

significant realized losses," the spokesman said.

Allianz Global Investors, an investing arm of German insurer

Allianz SE, will also close a related offshore feeder fund.

"While markets will remain challenging, we believe the remaining

funds are now well positioned," the spokesman wrote. The firm has

27 Structured Alpha funds.

Structured Alpha 1000 and 1000 Plus were the most aggressive of

those funds. The "1000" in their names refer to their return

targets: 1,000 basis points, or 10 percentage points, above their

benchmarks.

U.S. stocks sold off sharply earlier this month as the

coronavirus pandemic upended everything from travel and commerce to

manufacturing and tourism.

While many hedge funds have reported losses this year, the group

has held up well relative to benchmark indexes. The HRFC Global

Hedge Fund Index is down 5.5% this year through March 13, besting

the S&P 500 index's 2020 decline of 19%.

Allianz Global Investors manages $569 billion in assets. Like

many large insurers, Allianz owns money-management businesses that

oversee its assets, as well as those of outside clients. Another

Allianz manager, Pacific Investment Management Co., is one of the

world's largest bond investors.

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

March 27, 2020 15:42 ET (19:42 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

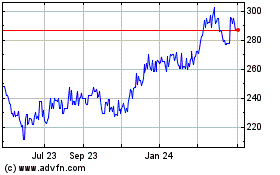

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Mar 2024 to Apr 2024

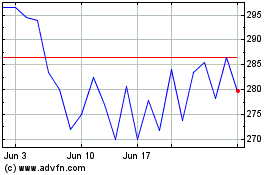

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Apr 2023 to Apr 2024