As

filed with the Securities and Exchange Commission on May 3, 2019

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Form

S-8

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ADHERA

THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

2834

|

|

11-2658569

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification

Number)

|

4721

Emperor Boulevard, Suite 350

Durham,

NC 27703

(919)

578-5901

(Address

of Principal Executive Offices)

ADHERA

THERAPEUTICS, INC. 2018 LONG-TERM INCENTIVE PLAN

NON-QUALIFIED

STOCK OPTION AGREEMENTS BETWEEN ADHERA THERAPEUTICS, INC.

AND

EACH OF JOSEPH W. RAMELLI, PHILIP C. RANKER AND PHILIPPE P. CALAIS

(Full

Title of the Plan)

Nancy

R. Phelan

Chief

Executive Officer

Adhera

Therapeutics, Inc.

4721

Emperor Boulevard, Suite 350

Durham,

North Carolina 27703

(Name

and Address of Agent for Service)

(919)

578-5901

(Telephone

Number, Including Area Code, of Agent for Service)

Copies

to:

Michael

T. Campoli, Esq.

Pryor

Cashman LLP

7

Times Square

New

York, New York 10036

(212)

421-4100

CALCULATION

OF REGISTRATION FEE

Title of Securities

to be Registered

|

|

Amount

to be

Registered

|

|

|

Proposed Maximum Offering

Price per Security(2)

|

|

|

Proposed Maximum Aggregate

Offering Price(2)

|

|

|

Amount of

Registration

Fee(2)

|

|

|

Common Stock ($0.006 par value)

|

|

6,380,000

|

(1)

|

|

$

|

0.28

|

|

|

$

|

1,786,400

|

|

|

$

|

216.52

|

|

|

|

(1)

|

Pursuant

to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement

shall also cover any additional shares of Adhera Therapeutics, Inc. (the “Company”) common stock, par value $0.006

per share (the “Common Stock”), which become issuable under the employee benefit plans described herein by reason

of any stock dividend, stock split, recapitalization or other similar transaction effected without the receipt of consideration

which results in an increase in the number of the outstanding shares of Common Stock.

|

|

|

|

|

|

|

(2)

|

Calculated

in accordance with Rule 457(c) under the Securities Act, based on the average of the high and low bid prices per share of

common stock on the OTCQB Tier of the OTC Markets on May 1, 2019.

|

Explanatory

Note

This

Registration Statement on Form S-8 (this “Registration Statement”) registers an aggregate of 6,380,000 shares of the

common stock, par value $0.006 per share (“Common Stock”), of Adhera Therapeutics, Inc. that have been or may be issued

and sold under the Adhera Therapeutics, Inc. 2018 Long-Term Incentive Plan (the “2018 Plan”) and the Non-Qualified

Stock-Option Agreements that Adhera Therapeutics, Inc. entered into with each of Joseph W. Ramelli, Philip C. Ranker and Philippe

P. Calais (the foregoing, collectively, the “Former Directors”) on May 2, 2018 (the “Separation Option Plans”,

and together with the 2018 Plan, the “Option Plans”). The Company and the Former Directors entered into the Separation

Option Plans in connection with the resignation of each of the Former Directors on May 2, 2018.

Unless

the context indicates otherwise, references to “Adhera Therapeutics”, “Adhera”, “the Company”,

“we”, “us”, or “our” refer to the combined company following the consummation of the merger

contemplated by that certain Agreement and Plan of Merger dated as of November 15, 2016 between and among Adhera Therapeutics,

Inc., IThenaPharma, Inc., Ithena Acquisition Corporation and the representative of the stockholders of IThenaPharma, Inc., and

the subsidiaries of such combined company.

This

Registration Statement also includes a prospectus (the “Reoffer Prospectus”) prepared in accordance with General Instruction

C of Form S-8 and in accordance with the requirements of Part I of Form S-3. This Reoffer Prospectus may be used for reofferings

and resales of shares of Common Stock that may be deemed to be “control securities” under the Securities Act of 1933,

as amended (the “Securities Act”), and the rules and regulations promulgated thereunder that have been acquired by

certain of our officers and directors, being the Selling Stockholders identified in the Reoffer Prospectus. The number of shares

of Common Stock included in the Reoffer Prospectus represents the total number of shares of Common Stock that have been or may

be acquired by the Selling Stockholders pursuant to awards made to the Selling Stockholders under the 2018 Plan and the Adhera

Therapeutics, Inc. 2014 Long-Term Incentive Plan, and does not necessarily represent a present intention to sell any or all such

shares of Common Stock.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(A) PROSPECTUS

The

documents containing the information specified in Part I of this Registration Statement will be sent or given to participants

in the Option Plans that are covered by this Registration Statement as specified by Rule 428(b)(1) promulgated under the Securities

Act of 1933, as amended (the “Securities Act”). Such documents need not be filed with the Securities and Exchange

Commission (the “SEC”) either as part of this Registration Statement or as prospectuses or prospectus supplements

pursuant to Rule 424 promulgated under the Securities Act. These documents and the documents incorporated by reference in this

Registration Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements

of Section 10(a) of the Securities Act.

PROSPECTUS

ADHERA

THERAPEUTICS, INC.

4,891,457

shares

of

Common

Stock

This

reoffer prospectus is a combined prospectus relating to shares of our common stock, par value $0.006 per share (the “Common

Stock”), that have been registered with the Securities and Exchange Commission (the “SEC”) under the Securities

Act of 1933, as amended (the “Securities Act”), and that have been or may be acquired by certain of our officers and

directors (the “Selling Stockholders”) pursuant to awards made to them under our 2018 Long-Term Incentive Plan (the

“2018 Incentive Plan”) and our 2014 Long-Term Incentive Plan (the “2014 Incentive Plan” and, together

with the 2018 Incentive Plan, the “Incentive Plans”). An aggregate of 6,000,000 shares of Common Stock relating to

the 2018 Incentive Plan are being registered with the SEC on the registration statement on Form S-8 of which this reoffer prospectus

is filed as a part.

The

Selling Stockholders are offering and selling up to 4,891,457 shares (the “Shares”) of Common Stock. We will

not receive any proceeds from the sale of the Shares. However, we will receive the proceeds, if any, from the exercise of the

options granted under the Incentive Plans.

The

Selling Stockholders may offer their Shares through public or private transactions, in the over-the-counter markets or on any

exchanges on which our Common Stock is traded at the time of sale, at prevailing market prices or at privately negotiated prices.

The Selling Stockholders may engage brokers or dealers who may receive commissions or discounts from the Selling Stockholders.

We will pay substantially all of the expenses incident to the registration of such shares, except for the selling commissions.

Our

Common Stock trades on the OTCQB Tier of the OTC Markets under the symbol “ATRX.” On April 25, 2019, the

last sale price of the Common Stock as reported on the OTCQB Tier of the OTC Markets was $0.36 per share.

An

investment in our securities involves risks. You should carefully read and consider the risk factors disclosed in any of our filings

with the SEC that are incorporated by reference in this prospectus, including, without limitation, the risk factors contained

in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018, as supplemented by the risk factors contained

in our Quarterly Reports filed thereafter with the SEC, before making a decision to purchase our securities.

Our

mailing address and telephone number are:

4721

Emperor Boulevard, Suite 350

Durham,

NC 27703

(919)

578-5901

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is

truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is May 3, 2019

TABLE

OF CONTENTS

You

should rely only on the information contained or incorporated by reference into this prospectus. We have not authorized any person

to give any information or to make any representations other than those contained or incorporated by reference in this prospectus,

and, if given or made, you must not rely upon such information or representations as having been authorized. This prospectus does

not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities described in this

prospectus or an offer to sell or the solicitation to buy such securities in any circumstances in which such offer or solicitation

is unlawful. You should not assume that the information we have included in this prospectus is accurate as of any date other than

the date of this prospectus or that any information we have incorporated by reference is accurate as of any date other than the

date of the document incorporated by reference regardless of the time of delivery of this prospectus or of any securities registered

hereunder.

This

document includes product names, trade names and trademarks of other companies. All such product names and trademarks appearing

in this document are the property of their respective holders.

INFORMATION

ABOUT THE COMPANY

The

following summary highlights information contained elsewhere in this prospectus or in the documents incorporated herein by reference.

This summary does not contain all of the information that you should consider before making an investment decision with respect

to our securities. After you read this summary, you should read and consider carefully the more detailed information and financial

statements and related notes that we include or incorporate by reference in this prospectus. If you acquire in our securities,

you are assuming a high degree of risk.

Unless

the context indicates otherwise, references to “Adhera Therapeutics”, “Adhera”, “the Company”,

“we”, “us”, or “our” refer to the combined company following the consummation of the merger

contemplated by that certain Agreement and Plan of Merger dated as of November 15, 2016 between and among Adhera Therapeutics,

Inc., IThenaPharma, Inc., Ithena Acquisition Corporation and the representative of the stockholders of IThenaPharma, Inc., and

the subsidiaries of such combined company.

Company

Overview

We are an emerging

specialty pharmaceutical company that leverages innovative distribution models and technologies to improve the quality of care

for patients in the United States suffering from chronic and acute diseases. We are focused on fixed dose combination (“FDC”)

therapies in hypertension, with plans to expand the portfolio of drugs we commercialize to include other therapeutic areas.

Our mission is to

provide effective and patient centric treatment for hypertension and resistant hypertension while actively seeking additional

assets that can be commercialized through our proprietary Total Care System (“TCS”). At the core of our TCS is DyrctAxess,

our patented technology platform. DyrctAxess is designed to offer enhanced efficiency, control and access to the information necessary

to empower patients, physicians and manufacturers to achieve optimal care.

We began marketing

Prestalia

®

, a single-pill FDC of perindopril arginine (“perindopril”) and amlodipine besylate (“amlodipine”)

in June of 2018. By combining Prestalia, DyrctAxess and an independent pharmacy network, we have created a proprietary system

for drug adherence and the effective treatment of hypertension, improving the distribution of FDC hypertensive drugs, such as

our FDA-approved product Prestalia, as well as improving the distribution of devices for therapeutic drug monitoring (“TDM”)

(e.g., blood pressure monitors), as well as patient counseling and prescription reminder services. We are focused on demonstrating

the therapeutic and commercial value of our TCS through the commercialization of Prestalia. Prestalia was developed in coordination

with Servier, a French pharmaceutical conglomerate, that sells the formulation outside the United States under the brand names

Coveram

®

and/or Viacoram

®

. Prestalia was approved by the U.S. Food and Drug Administration (“FDA”)

in January 2015 and is distributed through our DyrctAxess platform, which we acquired in 2017.

We have discontinued

all significant clinical development and are evaluating disposition options for all of our development assets, including: (i)

our next generation celecoxib program drug candidates for the treatment of acute and chronic pain, IT-102 and IT-103; (ii) CEQ508,

an oral delivery of small interfering RNA (“siRNA”) against beta-catenin, combined with IT-102 to suppress polyps

in the precancerous syndrome and orphan indication Familial Adenomatous Polyposis (“FAP”); (iii) CEQ508 combined with

IT-103 to treat Colorectal Cancer; (iv) CEQ608 and CEQ609, an oral delivery of IL-6Ra tkRNAi against irritable bowel disease (IBD)

gene targets, which could significantly reduce colon length and abolish the IL-6Rα message in proximal ileum; (v) Claudin-2

strains which (CEQ631 and CEQ632) significantly reduce Claudin-2 mRNA expression and protein levels in the colon as well as attenuation

of the disease phenotype and enhance survival; (vi) MIP3a therapeutic strains CEQ631 and CEQ632 which also resulted in a significant

reduction in sum pathology scores and reduction in MIP3a mRNA expression. We plan to license or divest these development assets

since they no longer align with our focus on the treatment of hypertension.

As our strategy is

to be a commercial pharmaceutical company, we will drive a primary corporate focus on revenue generation through our commercial

assets, with a focus on developing our technology and TCS. We intend to create value through the continued commercialization of

our FDA-approved product, Prestalia, while continuing to develop and leverage our TCS to further strengthen our commercial presence.

On November 15, 2016,

Adhera entered into an Agreement and Plan of Merger with IThenaPharma, Inc., a Delaware corporation, IThena Acquisition Corporation,

a Delaware corporation and a wholly-owned subsidiary of IThena (“Merger Sub”), and Vuong Trieu, Ph.D. as the IThena

representative (the “Merger Agreement”), pursuant to which, among other things, Merger Sub merged with and into IThena,

with IThena surviving as a wholly-owned subsidiary of Adhera (such transaction, the “Merger”). As a result of the

Merger, the former holders of IThena common stock immediately prior to the completion of the Merger owned approximately 65% of

the issued and outstanding shares of Adhera common stock immediately following the completion of the Merger.

IThena is deemed to

be the accounting acquirer in the Merger, and thus the historical financial statements of IThena will be treated as the historical

financial statements of our company and will be reflected in our quarterly and annual reports for periods ending after the effective

time of the Merger.

Subsequent to the

Merger, we executed on our strategy to become a commercial stage pharmaceutical company by acquiring Prestalia from Symplmed in

June 2017. Prestalia is an FDA-approved and marketed anti-hypertensive drug. Prestalia is an FDC of perindopril arginine, which

is an ACE inhibitor, and amlodipine besylate, which is a calcium-channel blocker (CCB) and is indicated as a first line therapy

for hypertension control.

The acquisition of

Prestalia transitioned our company from a clinical stage company to a commercial organization. Prestalia was approved by the FDA

in January 2015 and has been marketed in select U.S. states since then by Symplmed. Prestalia sales saw a solid growth through

September of 2016, via new patient acquisition and strong patient retention. Due to funding circumstances experienced by Symplmed,

further sales promotion of Prestalia were ceased by the end of 2016, and in June 2017 we acquired the Prestalia assets from Symplmed.

Our current focus is dedicated to the promotion and commercialization of Prestalia.

General

Adhera

Therapeutics, Inc. was incorporated under the laws of the State of Delaware under the name Nastech Pharmaceutical Company on September

23, 1983. Our mailing address is Adhera Therapeutics, Inc., 4721 Emperor Boulevard, Suite 350, Durham, NC 27703, and our telephone

number is (919) 578-5901. We maintain an Internet website at

www.adherathera.com.

We have not incorporated by reference

into this prospectus the information in, or that can be accessed through, our website, and you should not consider it to be a

part of this prospectus.

FORWARD-LOOKING

STATEMENTS

This

prospectus contains forward-looking statements that are based on current management expectations. Statements other than statements

of historical fact included in this prospectus, including statements about us and the future of our commercialization plans, clinical

trials, research programs, product pipelines, current and potential corporate partnerships, licenses and intellectual property,

the adequacy of capital reserves and anticipated operating results and cash expenditures, are forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”). When used in this prospectus the words “anticipate,”

“objective,” “may,” “might,” “should,” “could,” “can,”

“intend,” “expect,” “believe,” “estimate,” “predict,” “potential,”

“plan” or the negative of these and similar expressions identify forward-looking statements. These statements reflect

our current views with respect to uncertain future events and are based on imprecise estimates and assumptions and subject to

risk and uncertainties. Given these uncertainties, you should not place undue reliance on these forward-looking statements. While

we believe our plans, intentions and expectations reflected in those forward-looking statements are reasonable, these plans, intentions

or expectations may not be achieved. Our actual results, performance or achievements could differ materially from those contemplated,

expressed or implied by the forward-looking statements contained in this prospectus for a variety of reasons.

The

following factors, among others, could cause the future results of our company and our industry to differ materially from historical

results or those anticipated:

|

|

●

|

our

ability to obtain additional funding for our company on a timely basis, whether pursuant to a capital raising transaction

arising from the sale of our securities, a strategic transaction or otherwise;

|

|

|

|

|

|

|

●

|

our

ability to attract and/or maintain research, development, commercialization and manufacturing partners;

|

|

|

|

|

|

|

●

|

the

ability of our company and/or a partner to successfully complete product research and development, including pre-clinical

and clinical studies and commercialization;

|

|

|

|

|

|

|

●

|

the

ability of our company and/or a partner to obtain required governmental approvals, including product and patent approvals;

|

|

|

|

|

|

|

●

|

the

ability of our company and/or a partner to develop and commercialize products that can compete favorably with those of our

competitors;

|

|

|

|

|

|

|

●

|

the

timing of costs and expenses related to the research and development programs of our company and/or our partners;

|

|

|

|

|

|

|

●

|

the

timing and recognition of revenue from milestone payments and other sources not related to product sales;

|

|

|

|

|

|

|

●

|

our

ability to obtain suitable facilities in which to conduct our planned business operations on acceptable terms and on a timely

basis;

|

|

|

|

|

|

|

●

|

our

ability to attract and retain qualified officers, employees and consultants as necessary; and

|

|

|

|

|

|

|

●

|

costs

associated with any product liability claims, patent prosecution, patent infringement lawsuits and other lawsuits.

|

We

urge investors to carefully read and consider the risk factors disclosed in any of our filings with the SEC that are incorporated

by reference in this prospectus, including, without limitation, the risk factors contained in our Annual Report on Form 10-K for

the fiscal year ended December 31, 2018, in evaluating the forward-looking statements contained or incorporated by reference in this prospectus. We caution

investors not to place significant reliance on forward-looking statements contained or incorporated by reference in this document;

such statements need to be evaluated in light of all the information contained or incorporated by reference herein.

All

forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the

risk factors and other cautionary statements set forth or incorporated by reference in this prospectus. Other than as required

by applicable securities laws, we are under no obligation, and we do not intend, to update any forward-looking statement, whether

as result of new information, future events or otherwise.

USE

OF PROCEEDS

We

are registering the Shares offered by this prospectus for the account of the Selling Stockholders identified in the section of

this prospectus entitled “Selling Stockholders.” All of the net proceeds from the sale of the Shares will go to the

Selling Stockholders who offer and sell their Shares. We will not receive any part of the proceeds from the sale of such Shares.

We may receive proceeds of up to approximately $3.4 million if all of the options are exercised and no cashless-exercise

procedure is used. We anticipate that any such proceeds will be utilized for working capital and other general corporate purposes.

We cannot estimate how many, if any, options may be exercised for cash.

SELLING

STOCKHOLDERS

The

Selling Stockholders are persons listed in the table below who have acquired or hereafter may acquire shares of common stock pursuant

to awards under the Incentive Plans. Each Selling Stockholder will receive all of the net proceeds from the sale of his or her

Shares offered by this Reoffer Prospectus.

The

table and notes below describe, with respect to each Selling Stockholder, as of April 25, 2019: (a) the name of the

Selling Stockholder; (b) his or her relationship to us during the last three years; (c) the total number of shares of common

stock he or she beneficially owned as of the date of this prospectus; (d) the number of Shares which he or she may offer

pursuant to this prospectus; and (e) the amount and the percentage of our common stock that he or she would own after

completion of this offering, assuming he or she disposes of all of the Shares being offered by him or her pursuant to this

prospectus. The information contained in this table and notes may be amended or supplemented from time to time.

|

|

|

Number of

|

|

|

Number

|

|

|

Number of

|

|

|

|

|

Shares Owned

|

|

|

of Shares

|

|

|

Shares to Be

|

|

|

|

|

Prior to

|

|

|

Registered

|

|

|

Owned After

|

|

|

Name and Position With Us

|

|

Offering(1)

|

|

|

Hereby(2)

|

|

|

Offering(3)

|

|

|

Nancy R. Phelan (4)

|

|

|

1,500,000

|

|

|

|

1,500,000

|

|

|

|

-0-

|

|

|

CEO, Secretary and a Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert C. Moscato, Jr. (5)

|

|

|

1,200,000

|

|

|

|

500,000

|

|

|

|

700,000

|

|

|

Former CEO, Secretary and Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Isaac Blech (6)

|

|

|

2,322,282

|

|

|

|

477,257

|

|

|

|

1,845,025

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Uli Hacksell, Ph.D. (7)

|

|

|

1,000,000

|

|

|

|

1,000,000

|

|

|

|

-0-

|

|

|

Chairman of the Board

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. Eric Teague (8)

|

|

|

200,000

|

|

|

|

200,000

|

|

|

|

-0-

|

|

|

Former CFO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Donald A. Williams (9)

|

|

|

344,200

|

|

|

|

29,200

|

|

|

|

315,000

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Erik Emerson (10)

|

|

|

1,185,000

|

|

|

|

1,185,000

|

|

|

|

-0-

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL: (11)

|

|

|

7,751,482

|

|

|

|

4,891,457

|

|

|

|

2,860,025

|

|

|

(1)

|

Includes

shares of common stock acquired not pursuant to any employee or director benefit plan (or that may be acquired within sixty

(60) days after April 25, 2019 (“Presently Exercisable”)), shares of common stock underlying options

granted pursuant to the Incentive Plans (both Presently Exercisable and not Presently Exercisable), shares of restricted

common stock granted pursuant to the Incentive Plans, and shares of common stock underlying Presently Exercisable options

granted pursuant to any employee or director benefit plan other than the Incentive Plans.

|

|

|

|

|

(2)

|

Includes

all shares of common stock underlying outstanding options (both Presently Exercisable and not Presently Exercisable) that

were granted pursuant to the Incentive Plans, and restricted shares of common stock that were granted pursuant to the Incentive

Plans, as of April 25, 2019.

|

|

|

|

|

(3)

|

Assumes

all shares registered under this prospectus will be sold.

|

|

|

|

|

(4)

|

Consists of options to purchase up to 1,500,000

shares of common stock, of which 400,000 are Presently Exercisable and 1,100,000 are not Presently Exercisable.

|

|

|

|

|

(5)

|

Includes

options to purchase up to 500,000 shares of common stock, all of which 250,000 are Presently Exercisable. Also

includes Presently Exercisable warrants to purchase 300,000 shares of common stock held by an entity of the general partner

of which Mr. Moscato is majority member and manager, and 400,000 shares of common stock issuable upon the conversion of 40

shares of Series F Preferred Stock held by an entity of the general partner of which Mr. Moscato is the majority member and

manager. Mr. Moscato resigned as an officer and as a director of our company effective April 4, 2019.

|

|

|

|

|

(6)

|

Includes

options to purchase up to 477,257 shares of common stock, of which 145,832 are Presently Exercisable and 331,425

are not Presently Exercisable. Also includes: (i) Presently Exercisable warrants to purchase 16,875 shares of common stock

held by Mr. Blech; (ii) 22,500 shares of common stock issuable upon conversion of 2.25 shares of Series E Preferred Stock

held by Mr. Blech; (iii) Presently Exercisable warrants to purchase 773,850 shares of common stock held by a trust affiliated

with Mr. Blech; and (iv) 1,031,800 shares of common stock issuable upon conversion of 103.18 shares of Series E Preferred

Stock held by a trust affiliated by Mr. Blech.

|

|

|

|

|

(7)

|

Consists

of options to purchase up to 1,000,000 shares of common stock, of which 500,000 are Presently Exercisable and 500,000 are

not Presently Exercisable.

|

|

|

|

|

(8)

|

Consists

of

options to purchase up to 200,000 shares of common

stock that are Presently Exercisable. Mr. Teague resigned as an officer of our company effective March 22, 2019.

|

|

|

|

|

(9)

|

Includes

options to purchase up to 29,200 shares of common stock, all of which are Presently Exercisable. Also includes Presently Exercisable

warrants to purchase 135,000 shares of common stock and 180,000 shares of common stock issuable upon conversion of 18 shares

of Series E Preferred Stock.

|

|

|

|

|

(10)

|

Consists

of 60,000 shares of restricted common stock granted under the 2014 Incentive Plan and options to purchase up to 1,125,000

shares of common stock (of which 750,000 are Presently Exercisable and 375,000 are not Presently Exercisable).

|

|

|

|

|

(11)

|

See

the information contained in footnotes (4) – (10) above.

|

None

of the Selling Stockholders will own more than one percent of our common stock at April 25, 2019 following the sale by

such Selling Stockholder of all of his or her shares of common stock registered under this Reoffer Prospectus other than Isaac

Blech, who would own approximately 14.6% of our common stock, Robert C. Moscato, Jr., who would own approximately 6.1% of our

common stock, and Donald A. Williams, who would own approximately 2.8% of our common stock, in each case after giving effect to

the conversion by such persons of the shares of convertible preferred stock held by such persons and/or the exercise of Presently

Exercisable warrants to purchase shares of common stock held by such persons, but without giving effect to the beneficial ownership

limitations set forth in such securities instruments.

Information

regarding each Selling Stockholder’s current relationship with us within the past three years is set forth below.

Robert

C. Moscato, Jr.

Mr. Moscato served as our Chief Executive Officer from June 2018 until April 2019, as our Secretary

from October 2018 until April 2019 and as a member of our Board of Directors from July 1, 2018 until April

2019.

Isaac

Blech

. Mr. Blech has served as a member of our Board of Directors since November 22, 2017.

Uli

Hacksell, Ph.D.

Dr. Hacksell has served as a director of our company, and as the Chairman of our Board of Directors, since

July 1, 2018.

R.

Eric Teague.

Mr. Teague served as our Chief Financial Officer from September 2018 until March 22, 2019.

Donald

A. Williams.

Mr. Williams has served as a member of our Board of Directors since September 15, 2014.

Erik

Emerson

. Mr. Emerson served as our Chief Commercial Officer from June 2017 until January 2019, and he has served as a director of our company since April 2018.

The

Selling Stockholders listed in the above table may have sold or transferred, in transactions pursuant to this prospectus or exempt

from the registration requirements of the Securities Act, some or all of their securities since the date on which the information

in the above table is presented. Information about the Selling Stockholders may change from time to time. Information about other

persons who may hereafter become Selling Stockholders will be set forth in prospectus supplements or post-effective amendments,

if required.

Because

the Selling Stockholders may offer all or some of their Common Stock from time to time, and none is obligated to sell any such

shares, we cannot estimate the amount of Common Stock that will be held by the Selling Stockholders after this offering. Also,

this prospectus does not include awards that we may grant to the Selling Stockholders in the future. Such shares may subsequently

be sold pursuant to this prospectus, as supplemented to reflect the offering of such shares for resale or in transactions exempt

from the registration requirements of the Securities Act. See “Plan of Distribution” for further information.

PLAN

OF DISTRIBUTION

The

Selling Stockholders may resell under this prospectus up to 4,891,457 Shares that have been or may be issued to the Selling

Stockholders. The Selling Stockholders may sell the Shares from time to time and may also decide not to sell all the Shares they

are permitted to sell under this prospectus. The Selling Stockholders will act independently of us in making decisions with respect

to the timing, manner and size of each sale. The Selling Stockholders may effect such transactions by selling the Shares to or

through broker-dealers. Subject to the restrictions described in this prospectus, the Shares being offered under this prospectus

may be sold from time to time by the Selling Stockholders in any of the following ways:

|

|

●

|

through

a broker or brokers, acting as principals or agents. Transactions through broker-dealers may include block trades in which

brokers or dealers will attempt to sell our Common Stock as agent but may position and resell the block as principal to facilitate

the transaction. Our Common Stock may be sold through dealers or agents or to dealers acting as market makers. Broker-dealers

may receive compensation in the form of discounts, concessions, or commissions from the Selling Stockholders and/or the purchase

of our Common Stock for whom such broker-dealers may act as agents or to whom they sell as principal, or both (which compensation

as to a particular broker-dealer might be in excess of customary commissions);

|

|

|

|

|

|

|

●

|

on

any national securities exchange or quotation service on which our Common Stock may be listed or quoted at the time of sale,

in the over-the-counter market, or in transactions otherwise than on such exchanges or services or in the over-the-counter

market; or

|

|

|

|

|

|

|

●

|

in

private sales directly to purchasers.

|

To

the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution.

In effecting sales, broker-dealers engaged by the Selling Stockholders may arrange for other broker-dealers to participate in

the resales.

The

Selling Stockholders may enter into option or other transactions with broker-dealers, which require the delivery of shares to

the broker-dealer. The broker-dealer may then resell or otherwise transfer such shares pursuant to this prospectus.

The

Selling Stockholders also may loan or pledge Shares to a broker-dealer. The broker-dealer may sell the Shares so loaned, or upon

a default the broker-dealer may sell the Shares so pledged, pursuant to this prospectus. Broker-dealers or agents may receive

compensation in the form of commissions, discounts or concessions from Selling Stockholders. Broker-dealers or agents may also

receive compensation from the purchasers of Shares for whom they act as agents or to whom they sell as principals, or both. Compensation

as to a particular broker-dealer might be in excess of customary commissions and will be in amounts to be negotiated in connection

with transactions involving Shares. Broker-dealers or agents and any other participating broker-dealers or the Selling Stockholders

may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act in connection with

sales of Shares. Accordingly, any such commission, discount or concession received by them and any profit on the resale of Shares

purchased by them may be deemed to be underwriting discounts or commissions under the Securities Act. Because the Selling Stockholders

may be deemed to be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act, the Selling Stockholders

will be subject to the prospectus delivery requirements of the Securities Act. In addition, any Shares of a Selling Stockholder

covered by this prospectus which qualify for sale pursuant to Rule 144 promulgated under the Securities Act may be sold under

Rule 144 rather than pursuant to this prospectus.

The

Shares may be sold by Selling Stockholders only through registered or licensed brokers or dealers if required under applicable

state securities laws. In addition, in certain states the Shares may not be sold unless they have been registered or qualified

for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied

with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of Shares may not simultaneously

engage in market making activities with respect to our Common Stock for a period of two business days prior to the commencement

of such distribution. In addition, each Selling Stockholder will be subject to applicable provisions of the Exchange Act and the

associated rules and regulations under the Exchange Act, including Regulation M, which provisions may limit the timing of purchases

and sales of Shares by the Selling Stockholders. We will make copies of this prospectus available to the Selling Stockholders

and have informed them of the need for delivery of copies of this prospectus to purchasers at or prior to the time of any sale

of the Shares.

We

will file a supplement to this prospectus, if required, pursuant to Rule 424(b) under the Securities Act upon being notified by

a Selling Stockholder that any material arrangement has been entered into with a broker-dealer for the sale of Shares through

a block trade, special offering, exchange distribution or secondary distribution or a purchase by a broker or dealer. Such supplement

will disclose:

|

|

●

|

the

name of each such Selling Stockholder and of the participating broker-dealer(s);

|

|

|

|

|

|

|

●

|

the

number of Shares involved;

|

|

|

|

|

|

|

●

|

the

price at which such Shares were sold;

|

|

|

|

|

|

|

●

|

the

commissions paid or discounts or concessions allowed to such broker-dealer(s), where applicable;

|

|

|

|

|

|

|

●

|

that

such broker-dealer(s) did not conduct any investigation to verify the information set out or incorporated by reference in

this prospectus; and

|

|

|

|

|

|

|

●

|

other

facts material to the transaction.

|

We

will bear all costs, expenses and fees in connection with the registration of the Shares. The Selling Stockholders will bear all

commissions and discounts, if any, attributable to the sales of the Shares.

DESCRIPTION

OF COMMON STOCK

The

following is a summary of all material characteristics of our Common Stock as set forth in our certificate of incorporation and

bylaws. The summary does not purport to be complete and is qualified in its entirety by reference to our certificate of incorporation

and bylaws, and to the provisions of the General Corporation Law of the State of Delaware.

Common

Stock

We

are authorized to issue up to 180,000,000 shares of common stock, par value $0.006 per share. As of December 31, 2018,

10,761,684 shares of our common stock were issued and outstanding, 66,666 unissued shares of common stock were reserved

for issuance upon the conversion of outstanding shares of our Series C Convertible Preferred Stock, 50,000 unissued shares of

common stock were reserved for issuance upon the conversion of outstanding shares of our Series D Convertible Preferred Stock,

34,880,000 unissued shares of common stock were reserved for issuance upon the conversion of outstanding shares of our

Series E Convertible Preferred Stock, 3,810,000 unissued shares of common stock were reserved for issuance upon the conversion

of outstanding shares of our Series F Convertible Preferred Stock, 36,267,329 unissued shares of common stock were reserved

for issuance upon the exercise of outstanding warrants, and 5,613,057 unissued shares of common stock were reserved for

issuance upon the exercise of outstanding options.

All

shares of common stock issued will be duly authorized, fully paid and non-assessable. The holders of our common stock are entitled

to one vote for each share held of record on all matters submitted to a vote of the holders of our common stock. Under Delaware

law, stockholders generally are not liable for our debts or obligations. Our certificate of incorporation does not authorize cumulative

voting for the election of directors. Subject to the rights of the holders of any class of our capital stock having any preference

or priority over our common stock, the holders of shares of our common stock are entitled to receive dividends that are declared

by the board of directors out of legally available funds. In the event of our liquidation, dissolution or winding-up, the holders

of common stock are entitled to share ratably in our net assets remaining after payment of liabilities, subject to prior rights

of preferred stock, if any, then outstanding. Our common stock has no preemptive rights, conversion rights, redemption rights

or sinking fund provisions, and there are no dividends in arrears or default. All shares of our common stock have equal distribution,

liquidation and voting rights, and have no preferences or exchange rights.

Delaware

Anti-Takeover Statute

We

are subject to Section 203 of the DGCL. This law prohibits a publicly held Delaware corporation from engaging in any business

combination with any interested stockholder for a period of three years following the date that the stockholder became an interested

stockholder unless:

|

|

●

|

prior

to the date of the transaction, the board of directors of the corporation approved either the business combination or the

transaction which resulted in the stockholder becoming an interested stockholder;

|

|

|

|

|

|

|

●

|

upon

consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder

owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for

purposes of determining the number of shares outstanding those shares owned by persons who are directors and also officers

and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares

held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

|

|

|

|

●

|

on

or subsequent to the date of the transaction, the business combination is approved by the board of directors and authorized

at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least two-thirds

of the outstanding voting stock which is not owned by the interested stockholder.

|

Section

203 defines “business combination” to include:

|

|

●

|

Any

merger or consolidation involving the corporation and the interested stockholder;

|

|

|

|

|

|

|

●

|

Any

sale, transfer, pledge or other disposition of 10% or more of our assets involving the interested stockholder;

|

|

|

|

|

|

|

●

|

In

general, any transaction that results in the issuance or transfer by a corporation of any of its stock to the interested stockholder;

or

|

|

|

|

|

|

|

●

|

The

receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits

provided by or through the corporation.

|

In

general, Section 203 defines an “interested stockholder” as an entity or person beneficially owning 15% or more of

the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by the entity

or person.

Common

Stock Listing

Our

Common Stock currently is trading on the OTCQB Tier of the OTC Markets under the symbol “ATRX.”.

Transfer

Agent and Registrar

American

Stock Transfer & Trust Company, LLC is the transfer agent and registrar for our Common Stock.

LEGAL

MATTERS

The

validity of the issuance of the common stock described in this prospectus has been passed upon for us by Pryor Cashman LLP, New

York, New York.

EXPERTS

The consolidated financial

statements of Adhera Therapeutics, Inc. as of December 31, 2018 and 2017 and for each of the years in the two-year period ended

December 31, 2018 incorporated in this prospectus by reference from the Adhera Therapeutics, Inc. Annual Report on Form 10-K for

the year ended December 31, 2018 have been audited by Squar Milner LLP, an independent registered public accounting firm, as stated

in their report thereon, incorporated herein by reference, and have been incorporated by reference in this prospectus and registration

statement in reliance upon such report and upon the authority of such firm as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available

to the public over the Internet at the SEC’s website at

http://www.sec.gov.

The SEC’s website contains reports,

proxy and information statements and other information regarding issuers, such as us, that file electronically with the SEC. You

may also read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room

1580, Washington, D.C. 20549. You may also obtain copies of these documents at prescribed rates by writing to the SEC. Please

call the SEC at 1-800-SEC-0330 for further information on the operation of its Public Reference Room. We maintain a website at

www.adherathera.com.

We have not incorporated by reference into this prospectus the information in, or that can be accessed

through, our website, and you should not consider it to be a part of this prospectus.

We

have filed with the SEC a registration statement on Form S-8 (of which this prospectus is a part) under the Securities Act, with

respect to certain of the securities offered by this prospectus. This prospectus does not contain all of the information set forth

in the registration statement, certain portions of which have been omitted as permitted by the rules and regulations of the SEC.

Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete, and

in each instance please see the copy of such contract or other document filed as an exhibit to the registration statement, each

such statement being qualified in all respects by such reference and the exhibits and schedules thereto. For further information

regarding us and the securities offered by this prospectus, please refer to the registration statement and such exhibits and schedules

which may be obtained from the SEC at its principal office in Washington, D.C. upon payment of the fees prescribed by the SEC,

or from its web site.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus the information we have filed with the SEC. The information

we incorporate by reference into this prospectus is an important part of this prospectus. Any statement in a document we have

filed with the SEC prior to the date of this prospectus and which is incorporated by reference into this prospectus will be considered

to be modified or superseded to the extent a statement contained in this prospectus or any other subsequently filed document that

is incorporated by reference into this prospectus modifies or supersedes that statement. The modified or superseded statement

will not be considered to be a part of this prospectus, except as modified or superseded.

We

incorporate by reference into this prospectus the information contained in the documents listed below, which is considered to

be a part of this prospectus:

|

|

●

|

our

annual report on Form 10-K for the fiscal year ended December 31, 2018, filed with the SEC on April 16, 2019;

|

|

|

|

|

|

|

●

|

our

current reports on Form 8-K, as filed with the SEC on January 22, 2019, March 7, 2019, March 15, 2019 and April 5, 2019;

|

|

|

|

|

|

|

●

|

the

description of our common stock and the description of certain provisions of Delaware Law contained or incorporated by reference

in our registration statement on Form 8-A, filed with the SEC on August 12, 1985, including any amendments or reports filed

for the purposes of updating this description; and

|

|

|

|

|

|

|

●

|

future

filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the date of this prospectus

but prior to the termination of the offering of the securities covered by this prospectus.

|

You

may obtain copies of these filings, at no cost, by writing or telephoning us at the following

address:

Adhera

Therapeutics, Inc.

4721

Emperor Boulevard, Suite 350

Durham,

NC 27703

(919)

578-5901

You

should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized any

person to give any information or to make any representations other than those contained in or incorporated by reference into

this prospectus, and, if given or made, you must not rely upon such information or representations as having been authorized.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities

described in this prospectus or an offer to sell or the solicitation of an offer to buy such securities in any circumstances in

which such offer or solicitation is unlawful. You should not assume that the information we have included in this prospectus is

accurate as of any date other than the date of this prospectus or that any information we have incorporated by reference into

this prospectus is accurate as of any date other than the date of the document incorporated by reference regardless of the time

of delivery of this prospectus or of any securities registered hereunder.

4,891,457

Shares

ADHERA

THERAPEUTICS, INC.

Common

Stock

PROSPECTUS

May 3, 2019

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference.

The

SEC allows us to “incorporate by reference” into this Registration Statement the information we have filed with the

SEC. The information we incorporate by reference into this Registration Statement is an important part of this Registration Statement.

Any statement in a document we have filed with the SEC prior to the date of this Registration Statement and which is incorporated

by reference into this Registration Statement will be considered to be modified or superseded to the extent a statement contained

in this Registration Statement or any other subsequently filed document that is incorporated by reference into this Registration

Statement modifies or supersedes that statement. The modified or superseded statement will not be considered to be a part of this

Registration Statement, except as modified or superseded.

We

incorporate by reference into this Registration Statement the information contained in the documents listed below, which is considered

to be a part of this Registration Statement:

|

|

●

|

our

annual report on Form 10-K for the fiscal year ended December 31, 2018, filed with the SEC on April 16, 2019;

|

|

|

|

|

|

|

●

|

our

current reports on Form 8-K, as filed with the SEC on January 22, 2019, March 7, 2019, March 15, 2019 and April 5, 2019;

|

|

|

|

|

|

|

●

|

the

description of our common stock and the description of certain provisions of Delaware Law contained or incorporated by reference

in our registration statement on Form 8-A, filed with the SEC on August 12, 1985, including any amendments or reports filed

for the purposes of updating this description; and

|

|

|

|

|

|

|

●

|

future

filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the date of this prospectus

but prior to the termination of the offering of the securities covered by this prospectus.

|

You

may obtain copies of these filings, at no cost, by writing or telephoning us at the following address: Adhera Therapeutics, Inc.,

4721 Emperor Boulevard, Suite 350, Durham, NC 27703: Tel. No. (919) 578-5901.

Item

4. Description of Securities.

Not

applicable.

Item

5. Interests of Named Experts and Counsel.

Not

applicable.

Item

6. Indemnification of Directors and Officers.

Our

Amended and Restated Certificate of Incorporation, as amended to date, currently provides that our board of directors has the

authority to utilize, to the fullest extent possible, the indemnification provisions of Sections 102(b)(7) and 145 of the Delaware

General Corporation Law (the “DGCL”), and our directors and officers are provided with the broadest available indemnification

coverage. Such indemnification for our directors and officers is mandatory. Our Certificate of Incorporation also expressly provides

that the advancement of expenses is mandatory and not subject to the discretion of our board of directors, except that any of

our directors or officers who request advancement must undertake to repay the advanced amounts if it is determined that such person

is not entitled to be indemnified by us. Further, our Certificate of Incorporation contains provisions to eliminate the liability

of our directors to us or our stockholders to the fullest extent permitted by Section 102(b)(7) of the DGCL, as amended from time

to time.

Section

102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a director of the corporation

shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director,

except for liability (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for

acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) for unlawful

payments of dividends or unlawful stock repurchases, redemptions or other distributions, or (iv) for any transaction from which

the director derived an improper personal benefit. Our Certificate of Incorporation provides for such limitation of liability.

Under

Section 145 of the DGCL, a corporation may indemnify any individual made a party or threatened to be made a party to any type

of proceeding, other than an action by or in the right of the corporation, because he or she is or was an officer, director, employee

or agent of the corporation or was serving at the request of the corporation as an officer, director, employee or agent of another

corporation or entity against expenses, judgments, fines and amounts paid in settlement actually and reasonably incurred in connection

with such proceeding: (1) if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed

to the best interests of the corporation; or (2) in the case of a criminal proceeding, he or she had no reasonable cause to believe

that his or her conduct was unlawful. A corporation may indemnify any individual made a party or threatened to be made a party

to any threatened, pending or completed action or suit brought by or in the right of the corporation because he or she was an

officer, director, employee or agent of the corporation, or is or was serving at the request of the corporation as a director,

officer, employee or agent of another corporation or other entity, against expenses actually and reasonably incurred in connection

with such action or suit if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed

to the best interests of the corporation, provided that such indemnification will be denied if the individual is found liable

to the corporation unless, in such a case, the court determines the person is nonetheless entitled to indemnification for such

expenses. A corporation must indemnify a present or former director or officer who successfully defends himself or herself in

a proceeding to which he or she was a party because he or she was a director or officer of the corporation against expenses actually

and reasonably incurred by him or her. Expenses incurred by an officer or director, or any employees or agents as deemed appropriate

by the board of directors, in defending civil or criminal proceedings may be paid by the corporation in advance of the final disposition

of such proceedings upon receipt of an undertaking by or on behalf of such director, officer, employee or agent to repay such

amount if it shall ultimately be determined that he or she is not entitled to be indemnified by the corporation. The Delaware

law regarding indemnification and expense advancement is not exclusive of any other rights which may be granted by our restated

certificate of incorporation or restated bylaws, a vote of stockholders or disinterested directors, agreement or otherwise.

We

maintain a policy of directors and officer’s liability insurance covering certain liabilities incurred by our directors

and officers in connection with the performance of their duties.

Insofar

as indemnification for liabilities arising under the Securities Act is permitted for our directors, officers or controlling persons,

pursuant to the above mentioned statutes or otherwise, we understand that the SEC is of the opinion that such indemnification

may contravene federal public policy, as expressed in the Securities Act, and therefore, is unenforceable. Accordingly, in the

event that a claim for such indemnification is asserted by any of our directors, officers or controlling persons, and the SEC

is still of the same opinion, we (except insofar as such claim seeks reimbursement from us of expenses paid or incurred by a director,

officer of controlling person in successful defense of any action, suit or proceeding) will, unless the matter has theretofore

been adjudicated by precedent deemed by our counsel to be controlling, submit to a court of appropriate jurisdiction the question

whether or not indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

At

present, there is no pending litigation or proceeding involving any of our directors, officers or employees as to which indemnification

is sought, nor are we aware of any threatened litigation or proceeding that may result in claims for indemnification.

Item

7. Exemption from Registration Claimed.

Not

applicable.

Item

8. Exhibits.

See

Exhibit Index.

Item

9. Undertakings.

|

(a)

|

The

undersigned registrant hereby undertakes:

|

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration

Statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most

recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the

information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any

deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed

with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a

20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in

the effective registration statement; or

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the Registration

Statement or any material change to such information in the Registration Statement;

Provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) shall not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in periodic reports filed by the registrant pursuant to Section 13 or Section 15(d)

of the Exchange Act that are incorporated by reference in this Registration Statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities

being registered which remain unsold at the termination of the offering.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each

filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is

incorporated by reference in this Registration Statement shall be deemed to be a new registration statement relating to the

securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

(c)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and

controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised

that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is,

therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by

the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in

connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has

been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such

indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final

adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its

behalf by the undersigned, thereunto duly authorized, on the 3

rd

day of May, 2019.

|

|

ADHERA

THERAPEUTICS, INC.

|

|

|

|

|

|

|

By:

|

/s/

Nancy R. Phelan

|

|

|

Name:

|

Nancy

R. Phelan

|

|

|

Title:

|

Chief

Executive Officer

|

KNOW

ALL MEN BY THESE PRESENTS, that each of the undersigned constitutes and appoints Nancy R. Phelan as his or her true and

lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name,

place and stead, in any and all capacities, to sign this registration statement (including all pre-effective and post-effective

amendments thereto), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities

and Exchange Commission, granting unto such attorney-in-fact and agent full power and authority to do and perform each and every

act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she

might or could do in person, hereby ratifying and confirming all that such attorney-in-fact and agent, or his or her substitute,

may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons

in the capacities on May 3, 2019.

|

Signature

|

|

Title

|

|

|

|

|

|

/s/

Nancy R. Phelan

|

|

Chief

Executive Officer and Secretary

|

|

Nancy

R. Phelan

|

|

(Principal

Executive Officer, Principal Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

/s/

Uli Hacksell, Ph.D.

|

|

Chairman

of the Board

|

|

Uli

Hacksell, Ph.D.

|

|

|

|

|

|

|

|

/s/

Isaac

Blech

|

|

Director

|

|

Isaac

Blech

|

|

|

|

|

|

|

|

/s/

Tim Boris

|

|

Director

|

|

Tim

Boris

|

|

|

|

|

|

|

|

|

|

Director

|

|

Erik

Emerson

|

|

|

|

|

|

|

|

/s/

Donald A. Williams

|

|

Director

|

|

Donald

A. Williams

|

|

|

EXHIBIT

INDEX

|

(1)

|

Filed

herewith.

|

|

**

|

Indicates

management contract or compensatory plan or arrangement.

|

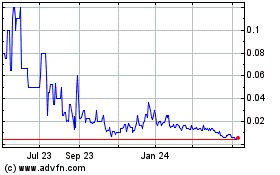

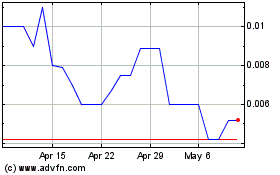

Adhera Therapeutics (PK) (USOTC:ATRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Adhera Therapeutics (PK) (USOTC:ATRX)

Historical Stock Chart

From Apr 2023 to Apr 2024