Current Report Filing (8-k)

September 14 2018 - 4:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act Of 1934

September 5, 2018

Date of Report (Date of earliest event reported)

___________________________________________________________

ACURA PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in

Charter)

___________________________________________________________

|

State of New York

|

1-10113

|

11-0853640

|

|

(State of Other Jurisdiction

|

(Commission

File Number)

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

Identification

Number)

|

616 N. North Court, Suite 120

Palatine, Illinois 60067

(Address of principal executive offices)

(Zip Code)

(847) 705-7709

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17CFR240.14d- 2(b))

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17CFR 240.13e- 4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement.

On September 13, 2018 we received a $300,000

loan from John Schutte, which combined with earlier loans, total $2.2 million in loans from Mr. Schutte. In connection with the

$300,000 loan, we issued a promissory note, or the Schutte Note, in that principal amount to him. The Schutte Note bears interest

at prime plus 2%, and matures on January 2, 2020, at which time all principal and interest is due. Events of Default under the

Schutte Note include bankruptcy events and failure to pay interest and principal when due. The note is unsecured until our obligations

to Oxford Finance, LLC (“Oxford”) have been satisfied in full under the Loan and Security Agreement dated as of December

27, 2013, as amended (the “Loan Agreement”) between us, our subsidiary Acura Pharmaceutical Technologies, Inc. (“APT”)

and Oxford, and thereafter will be secured by a security interest in all of our assets. The Schutte Note may be prepaid in whole

or part at any time, provided that prior to the satisfaction of our obligations to Oxford, under the Loan Agreement, any prepayment

will require Oxford’s consent. These terms are the same as the terms for the $1.9 million loans previously received from

Mr. Schutte.

The funding provided by Mr. Schutte enables

us to continue operations into early October 2018, by which time we hope to have entered into a licensing agreement or raised additional

funds.

There can be no assurance we will be successful

entering into such a licensing arrangement or receive additional financing. In the absence of the receipt of additional financing

or adequate payments under license or collaborative agreements by the end of September 2018, we will be required to scale back

or terminate operations and/or seek protection under applicable bankruptcy laws. This could result in a complete loss of shareholder

value in the Company. Even assuming we are successful in securing additional sources of financing to fund continued operations,

there can be no assurance that the proceeds of such financing will be sufficient to fund operations until such time, if at all,

that we generate sufficient revenue from our products and product candidates to sustain and grow our operation.

Mr. Schutte is our largest shareholder

and directly owns approximately 47.5% of our common stock (after giving effect to the exercise of warrants he holds). Mr. Schutte

also controls Mainpointe Pharmaceuticals LLC, or MainPointe. In March 2017, we granted MainPointe an exclusive license to our Impede®

technology to commercialize our Nexafed® and Nexafed® Sinus Pressure + Pain Products in the United States and Canada. MainPointe

also has options to expand the territory and for other covered products for additional sums.

Mr. Schutte and Oxford previously entered into a subordination

agreement, approved by us and APT pursuant to which Mr. Schutte subordinated our obligations under the Schutte Note to our obligations

to Oxford under the Loan Agreement.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The contents of Item 1.01 are incorporated herein by reference.

Item 2.04 Triggering Events That Accelerate or Increase a

Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

Acura Pharmaceuticals, Inc. and its subsidiary

Acura Pharmaceutical Technologies, Inc. (collectively, “Acura”) failed to make a required monthly installment payment

of approximately $260,000 due on or about September 4, 2018, under the Loan Agreement. Such failure constitutes an Event of Default

under the Loan Agreement and gives Oxford the right to accelerate payment of all principal and interest due thereunder. Currently,

approximately $1,025,000 million of principal and interest is due on the loan (the initial principal amount of the loan was $10,000,000),

plus a balloon interest payment of $795,000. If payment is accelerated by Oxford, a prepayment penalty of approximately $10,200

will also be due. Such loan is secured by substantially all of Acura’s assets, including the stock of Acura Pharmaceutical

Technologies, Inc., and the occurrence of the Event of Default gives Oxford the right to foreclose on the collateral as well as

all other remedies specified in the Loan Agreement. As a result of the occurrence of the Event of Default, the interest rate on

the loan is automatically increased from 8.35% to 13.35%. The Company is in discussions with Oxford to present a plan to remedy

the default and forestall acceleration although there can be no assurance that these discussions will result in a plan satisfactory

to Oxford.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

|

|

ACURA PHARMACEUTICALS, INC.

|

|

|

|

|

|

By:

|

/s/ Peter

A. Clemens

|

|

|

|

Peter

A. Clemens

Senior

Vice President & Chief Financial Officer

|

Date: September 14, 2018

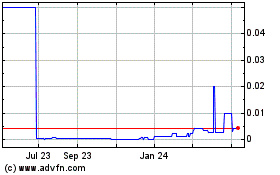

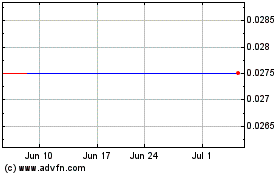

Acura Pharmaceuticals (CE) (USOTC:ACUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acura Pharmaceuticals (CE) (USOTC:ACUR)

Historical Stock Chart

From Apr 2023 to Apr 2024