April 2, 2020

Quarterly Report Under Section 13 or 15(d) of

The Securities Exchange Act of 1934

Commission File Number 333-65069

EXACT NAME as this appears in our Charter: Access-Power, Inc.

YEAR: 1996

STATE OF INC: FLORIDA

QUARTERLY REPORT PERIOD ENDING: March 31, 2020

I.R.S. Employer Identification No. 59-3420985

17164 Dune View Dr # 106 Grand Haven, MI 49417

(Address of principal executive office) (Zip Code)

Issuer's telephone number, including area code: (616) 312-5390

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

/X/ Quarterly Report Under Section 13 or 15(d) of

The Securities Exchange Act of 1934

For the Quarterly Period Ended September 30, 2019

/_/ Transition Report Under Section 13 or 15(d) of The Exchange Act

Commission File Number 333-65069

Access-Power, Inc.

(Exact Name of Small Business Issuer as Specified in its Charter)

Florida 59-3420985

(State or other jurisdiction of

(State or other jurisdiction of

|

Corporation or organization) (I.R.S. Employer Identification No.)

17164 Dune View Drive Apt 106, Grand Haven MI 49417

(Address of principal executive office) (Zip Code)

|

Issuer's telephone number, including area code: (616)312-5390

Transitional Small Business Disclosure Format (check one): Yes __ No X

Smaller Reporting Company: Yes X NO ___

Emerging Growth Company: Yes X NO ___

Indicate whether registrant is a shell company: Yes ___ NO X

MOST RECENT CLOSING PRICE $.005 PER SHARE. As of October

18, 2020, we started trading in the PINK NO INFORMATION tier of OTC Markets.

AS OF THE CLOSE OF BUSINESS MARCH 31, 2020, THE AGGREGATE MARKET

CAPITALIZATION ON A FULLY DILUTED BASIS IS $ 1,220,720.61, BASED ON A

CLOSING PRICE OF $.005 PER SHARE.

My Dear Shareholders and the Commissioners of the SEC,

****CURRENT UPDATE****

pjensen@myaccess-power.com

http://www.myaccess-power.com

https://www.otcmarkets.com/stock/ACCR/profile

I just filed the paperwork for the upgrade to OTC PINK CURRENT STATUS.

These are unprecendented times. We hired a Securities Counsel on a CASH

BASIS only:

Vic Devlaeminck PC

Securities Counsel

10013 N.E. Hazel Dell Avenue

Suite 317

Vancouver, WA 98685

(360) 993-0201

https://www.otcmarkets.com/learn/service-providers/3113?t=3

Access-Power & Co., Inc. is in the process with FINRA wo do to a name change.

The FLORIDA STATE SECRETARY OF STATE filing for our name change

is found here:

http://search.sunbiz.org/Inquiry/CorporationSearch/ConvertTiffToPDF?storagePath=

COR%5C2020%5C0327%5C41178718.Tif&documentNumber=P96000083992

As of March 31, 2020,

Authorized Common Stock: 300,000,000 shares

Outstanding Common Stock: 300,000,000 shares

Estimated Float: 98,376,146 shares

Restricted Common Stock: 201,625,854 Total Restricted shares or

|

As of March 31, 2020, we have $1,201.90 in our Premiere Checking account now.

We will be planning a 10-1 classic textbook merger.

Our #1 GOAL IS TO GET ACCESS-POWER, INC TO THE PINK CURRENT

TIER, and to get a MARKET MAKER to file our FORM 211 with FINRA.

We deserve a chance just like the millions of other Companies in the tiers.

On March 30, 2020, we merged with ACCESS-POWER LLP. This is

an international company that is in the Power Renewable Market.

The website for this organization is found here:

http://www.access-power.com

I certify, that Patrick J. Jensen invented and created this website in 2012.

The Dubai government, the DMCC bought the website in 2013.

STEPHANE BONTEMPS is the new CEO of the Company.

I have known STEPHANE via Linkedin for almost 3 years. I will remain as CFO

and Director of this Company. STEPHANE's profile may be found here:

https://www.linkedin.com/in/stephane-bontemps-3757b05

I have all my texts and communications with STEPHANE saved for our

Corporate files. Our plan is to perform a 10-1 CLASSIC TEXTBOOK REVERSE

MERGER.

I am waiting on a FUNDING AGREEMENT. We agreed in principle to fund

ACCR at par value $.001 270,000,000 shares to be issued or $270,000,000.00.

Further, I will be cancelling 15,000,0000 restricted shares as a gesture on

my part. This will give Access-Power Power Renewables a total of

285,000,000 future shares or 95.00% of the Company. AFRICA is our target...

PRE MERGER

AS 500,000,000

OS 244,144,121

POST MERGER

AS 300,000,000

OS 300,000,000

The LLP will drop the LLP, and has merged with ACCR. We are just waiting on

the funding agreement from our new CEO, STEPHANE.

PATRICK

Part I. Financial Information

Item 1. Financial Statements

ACCESS-POWER, INC.

(An Emerging Growth Company)

Balance Sheets Comps Assets

March 31, Dec 31,

2020 2019

------------------------- --------------

(unaudited)

Current assets:

Cash $ 1,205.61 $1,138.73

CDs

Accounts receivable $ 0 $ 0

Prepaid expenses $1,500.00 $1,000.00

----------------------------- ------------

Total current assets $ $ 2,638.73 $2,138.73

--------------------------------------

Property and equipment, net $ 0 $ 0

Other assets $ 0 $ 0

---------------------------------------------------------

Total assets $ 2,638.73 $ 2,138.73

====================================

Liabilities and

Stockholders' Equity

(Deficit)

Current liabilities:

Accounts payable and accrued

expenses $2,000.00 $ 0

Current portion of long-term debt -

Total current liabilities $ 0 $ 0

Convertible debentures $ 0 $ 0

Total liabilities $2,000.00 $ 0

----------------------------------

Stockholders' equity

(deficit):

Common stock,

$.001 par value,

authorized

300,000,000 shares issues

=================================

Total liabilities

and stockholders'

|

equity (deficit) $300,000,000.00 $244,144.12

ACCESS-POWER, INC

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS (unaudited)

THREE MONTHS ENDED September 30, 2019:

CASH FLOW

REVENE $ 6,890.50

COST OF REVENUE $ 0

---------------------------------------------------------------------------

GROSS PROFIT (LOSS) $ 6,890.50

|

OPERATING EXPENSES

Selling, general and administrative exp rent, and utilities $ 0.00

Consulting fees $ 0.00

Professional fees and related expenses $ 28,200.00

TOTAL OPERATING EXPENSES $ 0.00

Salaries $ 36,000.00

Fair value of derivative liability $ 0.00

OTHER INCOME nonrecurring $ 0.00

Gain on debt extinguishment $ 0.00

(LOSS) INCOME BEFORE PROVISION FOR $ 0.00

INCOME TAXES $ 28,200.00

PROVISION FOR INCOME TAXES

treated as prepaid expense on

balance sheet $ 0.00

NET (LOSS) INCOME $ (7,8000.00)

BASIC (LOSS) INCOME PER SHARE

DILUTED (LOSS) INCOME PER SHARE $ (000.00)

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING BASIC 300,000,000 shares

RESTRICTED SHARES 201,625,854 shares

ESTIMATED FLOAT LESS THAN 98,376,146 shares

/s/

Patrick J Jensen

|

Item 2. MANAGEMENT'S DISCUSSION AND ANALYSIS

Overview and Plan of Operation

OIL REVENUES TO BE DERIVED BY EMERGING MARKETS

COUNTRIES HAS CHANGED FOREVER.

Business Overview

ACCR will come back. We have multiple business segments. We are

following direction from our new CEO, STEPHANE BONTEMPS.

He isan international powerhouse.

Access-Power, INC, or ACCR is a public holding company that

serves the various sectors in our economy. As of today, we only

service the Work at Home business model.

I am waiting on my SSA.GOV soon to be paid.

Access-Power, Inc. has TWO (2) key employee.

We were incorporated back on October 10, 1996. There was

a change in control in the Registrant on June 4, 2018.

WE ARE IN THE PROCESS OF A FINRA NAME CHANGE

FROM: ACCESS-POWER, INC TO

ACCESS-POWER & CO., INC. I have another dream:

http://tsdr.uspto.gov/#caseNumber=88690325&caseType=

SERIAL_NO&searchType=statusSearch

ACCR is not currently offering any stock for sale.

Any stock to be purchased is available in the open market.

We are currently quoted in the PINK NO INFORMATION

TIER OF OTC MARKETS IN THE OTC.

We are current in our obligation to report with the SEC.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

NONE.

Item 2. Changes in Securities and Use of Proceeds

NONE.

ILLUSTRATIVE PURPOSES BELOW:

At $.0001 BID, the entire value of the Company shares on a fully

diluted basis is: $30,000.00

At $.001 BID, the entire value of the Company shares on a fully

diluted basis is: $300,000.00

At $.01 BID, the entire value of the Company shares on a fully

diluted basis is: $3,000,000.00

At $.06 BID, the entire value of the Company shares on a fully

diluted basis is: $30,000,000.00

at $.100 BID the entire value of the Company shares on a fully

diluted basis is: $300,000,000.00

Management will make informed well processed decisions, and management

will succeed, as failure is not an option.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There is no current risk with management. Everything is under control.

**********

Item 4. Controls and Procedures

Access-Power, Inc. will FOREVER employ good management decisions.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

NONE

**********

Item 1A. Risk Factors

MANY

**********

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

NONE

**********

Item 3. Defaults Upon Senior Securities

NONE

**********

Item 4. Other Information

NONE.

**********

Item 5. Exhibits

(a) No Exhibits are being filed.

Patrick J Jensen profile on LinkedIn:

https://www.linkedin.com/in/patrick-j-jensen-564946b4

My contact information is:

pjensen@myaccess-power.com

616-312-5390

Our comeback song:

https://www.youtube.com/watch?v=xbhCPt6PZIU

Access-Power, Inc. was the victim of naked convertible short selling.

This is the reason why we have a RED STOP SIGN at OTC

MARKETS.COM, and I am planning on getting rid of this very soon.

There is NO DILUTION PERIOD in Access-Power, INC.

I have a vision to do this merger. It has been my dream

to do this. I will do this. Why? This is a perfect time for a

classic reverse merger as an alternative

re-IPO process. I believe in myself,

Respectfully yours,

PATRICK

SIGNATURES*

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

In accordance with the requirements of the Exchange Act, the Company caused this

report to be signed on its behalf by the undersigned, thereunto duly authorized.

ACCESS-POWER, INC.

BY:

/s/

Patrick J. Jensen

President, Treasurer, and Director

October 2, 2019

|

Caution Concerning Forward Looking Statements:

Please also see our annual reports on Form 10-K and quarterly reports on Form

10-Q that we file with the SEC. Caution Concerning Forward Looking Statements

Our public communications and SEC filings may contain "forward-looking

statements" - that is, statements related to future, not past, events. In this

context, forward-looking statements often address our expected future business

and financial performance and financial condition, and o ften contain words

such as "expect," "anticipate," "intend," "plan," " believe," "seek," "see,"

"will," and "would." This section contains important information about

our forward-looking statements

Forward-looking statements by their nature address matters that are, to

different degrees, uncertainty and statements about potential business or asset

dispositions. For us, particular uncertainties that could cause our actual

results to be materially different than those expressed in our forward-looking

statements.

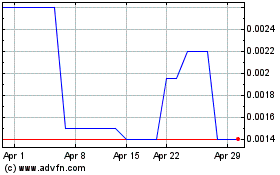

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

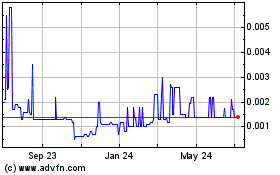

Access Power & (PK) (USOTC:ACCR)

Historical Stock Chart

From Apr 2023 to Apr 2024