Ninepoint Partners Announces Ninepoint 2019 Short Duration Flow-Through Limited Partnership

August 28 2019 - 9:16AM

Ninepoint Partners LP (“Ninepoint”) is pleased to announce that the

Ninepoint 2019 Short Duration Flow-Through Limited Partnership (the

"Partnership") has filed a preliminary prospectus in connection

with its offering of limited partnership units (the “Units”). A

receipt for the preliminary prospectus has been issued by the

securities regulatory authorities in each of the provinces and

territories of Canada. The Units are being offered at a price per

Unit of $25.00 with a minimum subscription of 100 Units ($2,500).

The Partnership has retained Sprott Asset

Management LP (“Sprott”) to act as sub-advisor to the Partnership.

The Partnership intends to provide liquidity to limited partners

through a rollover to the Ninepoint Resource Class in the period

between January 15, 2021 to February 28, 2021.

Investment Objective of the

PartnershipThe Partnership’s investment objective is to

achieve capital appreciation and significant tax benefits for

Limited Partners by investing in a diversified portfolio of

Flow-Through Shares and other securities, if any, of Resource

Issuers.

Attractive

Tax-Reduction

BenefitsFlow-through partnerships are one of the most

effective tax reduction strategies available to Canadians. Sprott

anticipates that investors participating in the Partnership will be

eligible to receive a tax deduction of approximately 100% of the

amount invested.

Resource

ExpertiseThe Partnership will be

sub-advised by Sprott, one of Canada’s leading investment advisors

in small and mid- cap resource companies. Over its long history of

investing in the resource sector, Sprott has developed

relationships with hundreds of companies. Its experienced team of

portfolio managers is supported by a team of technical experts with

extensive backgrounds in mining and geology.

Portfolio manager Jason Mayer will manage the

portfolio of the Partnership and will be supported by Sprott’s

broader team of experienced resource investment professionals.

AgentsThe offering is being

made through a syndicate of agents led by RBC Dominion Securities

Inc., CIBC World Markets Inc., TD Securities Inc., National Bank

Financial Inc., BMO Nesbitt Burns Inc., Scotia Capital Inc., GMP

Securities L.P., Industrial Alliance Securities Inc., Manulife

Securities Incorporated, Raymond James Ltd., Canaccord Genuity

Corp., Desjardins Securities Inc. and Echelon Wealth Partners

Inc.

About Ninepoint Partners

LPBased in Toronto, Ninepoint Partners LP is one of

Canada’s leading alternative investment management firms overseeing

approximately $3.1 billion in assets under management. Committed to

helping investors explore innovative investment solutions that have

the potential to enhance returns and manage portfolio risk,

Ninepoint offers a diverse set of alternative strategies including

North American Equity, Global Equity, Real Assets & Alternative

Income.

Ninepoint is an operating company that has been

created to assume portfolio management of the Canadian diversified

assets of Sprott Asset Management LP, including actively managed

hedge and mutual funds.

For more information on Ninepoint Partners LP,

please visit www.ninepoint.com or for inquiries regarding the

offering, please contact us at (416) 943-6707 or (866) 299-9906 or

invest@ninepoint.com.

About Sprott Asset Management

LPSprott is an alternative asset manager and a global

leader in precious metal and real asset investments. Sprott

is a subsidiary of Sprott Inc. (the “Corporation”). Through

its subsidiaries in Canada, the US and Asia, the Corporation is

dedicated to providing investors with best-in-class investment

strategies that include Exchange Listed Products, Alternative Asset

Management and Private Resource Investments. The Corporation also

operates Merchant Banking and Brokerage businesses in both Canada

and the US. Sprott is based in Toronto with offices in New York,

Carlsbad and Vancouver and its common shares are listed on the

Toronto Stock Exchange under the symbol (TSX:SII). For more

information, please visit www.sprott.com.

Certain statements included in this news release

constitute forward-looking statements, including, but not limited

to, those identified by the expressions “expects”, “intends”,

“anticipates”, “will” and similar expressions to the extent that

they relate to the Partnership. The forward-looking statements are

not historical facts but reflect the General Partner’s, Ninepoint’s

and Sprott’s current expectations regarding future results or

events. These forward-looking statements are subject to a number of

risks and uncertainties that could cause actual results or events

to differ materially from current expectations. Although the

General Partner, Ninepoint and Sprott believe the assumptions

inherent in the forward-looking statements are reasonable,

forward-looking statements are not guarantees of future performance

and, accordingly, readers are cautioned not to place undue reliance

on such statements due to the inherent uncertainty therein. Neither

the General Partner, nor Ninepoint or Sprott undertake any

obligation to update publicly or otherwise revise any

forward-looking statement or information whether as a result of new

information, future events or other such factors which affect this

information, except as required by law.

A preliminary prospectus containing

important information relating to these securities has been filed

with securities commissions or similar authorities in all the

provinces and territories of Canada. The preliminary prospectus is

still subject to completion or amendment. Copies of the preliminary

prospectus may be obtained from one of the dealers noted above.

There will not be any sale or any acceptance of an offer to buy the

securities until a receipt for the final prospectus has been

issued.

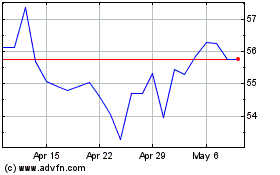

Sprott (TSX:SII)

Historical Stock Chart

From Mar 2024 to Apr 2024

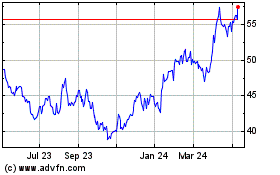

Sprott (TSX:SII)

Historical Stock Chart

From Apr 2023 to Apr 2024