By Nina Trentmann

This Thursday is expected to be the most popular day to report

financial results this earnings season. And, for some companies,

that could be a good thing.

Deciding when to report financial performance increasingly

involves a deliberate weighing of regulations, executive travel

plans and the timing of competitors' reports, all in an effort to

maximize -- or perhaps avoid -- attention from analysts and

investors.

"Investors are paying close attention to when companies release

earnings, " said Sandy Peters, the head of financial reporting

policy at the CFA Institute. "That's something that CFOs and heads

of investor relations should factor into their thought

process."

On Thursday, more than 420 companies listed in the U.S. are

expected to release earnings, which could be good or bad, depending

on the company, according to Wall Street Horizon Inc., a data

provider that tracks over 7,500 companies globally.

Reporting on a busy day can make it easier for companies to hide

disappointing results amid a tsunami of information from other

businesses. But a small company with good news to present might be

overlooked by the volume of corporate behemoths reporting on the

same day.

Attention paid toward companies' earnings -- measured by metrics

such as downloads of regulatory filings, Google searches and news

articles -- drops on popular reporting days, said Ed deHaan, an

associate professor of accounting at the University of Washington's

Foster School of Business.

Mr. deHaan and his colleagues analyzed the timing and impact of

120,000 results announcements in 2015 and found that trading

volumes of individual stocks also went down on busy earnings days.

Their findings were published in the Journal of Accounting and

Economics.

"The ecosystem of investors and intermediaries is

capacity-constrained, which results in a reduced response to

earnings releases on busy days," Mr. deHaan said.

Most U.S. companies report on Tuesdays, Wednesdays and

Thursdays, often in the third or fourth week after the start of the

earnings season, said Wall Street Horizon Chief Executive Barry

Star. Companies tend to avoid Fridays for fear their results

release might draw less attention ahead of the weekend, he

said.

"The myth is that companies that announce results on a Friday

try to escape the wrath of the market," he said. "But evidence

shows that this is not true." Market volatility can be stronger on

a Friday because of the overall lower number of earnings releases,

Mr. deHaan added.

Institutional traders consider earnings-release dates as

"corporate body language" and might use that language to inform

trades, according to Wall Street Horizon.

Competitors' timing matters, too. Software maker Citrix Systems

Inc., for instance, usually reports on a Wednesday, after the

market closes, alongside other companies in the sector, including

technology heavyweight Microsoft Corp. Because of that, not all

analysts covering the sector manage to dial into the company's

earnings call, said Traci Tsuchiguchi, vice president for investor

relations at Citrix.

The company is now reviewing whether it should permanently move

its earnings date, following unsolicited feedback from analysts and

investors after it changed its third-quarter earnings date to

Thursday morning, Oct. 24 -- a day after Microsoft.

Citrix merged its earnings date with an analyst day, Ms.

Tsuchiguchi said. "We were due for an update for our longer-term

targets," she said. "If you can get it all out on the same day, you

don't want to defer questions to a later analyst day."

Some parameters around companies' earnings releases are set by

regulators. The U.S. Securities and Exchange Commission requires

firms with $75 million or more in publicly traded shares to file

quarterly results no more than 40 days after the end of a reporting

period, and companies in Europe and Asia also need to abide by

tight regulatory deadlines.

It is important for a company to adhere to its chosen date once

it has made an official announcement, Mr. Star said. "If dates are

moved and appearances are canceled, this sends a signal to the

market," he said.

Hexo Corp., a Canadian cannabis company, delayed its earnings

release to Oct. 28 from Oct. 24 after it borrowed money a day

before its planned results day.

The company previously had withdrawn its outlook for fiscal year

2020 and reduced its revenue expectations to reflect slower than

expected store openings, pricing pressure and a delay in government

approval for certain cannabis products, according to a news

release.

Hexo needed extra time to finalize its filings after the

financing, the company said.

The company's share price initially rose after the news about

the financing on Oct. 23 -- the day when Hexo announced it would

move its earnings day -- but fell 5.7% a day later on Oct. 24 and

another 6% the following day, underlining investor concerns about

the company's outlook.

Closing at 2.86 Canadian dollars ($2.17) on the Toronto Stock

Exchange on Wednesday, the company's share price has nearly halved

in the past month, according to FactSet, a data provider.

"A CFO should know that all of their actions are being watched,"

said Wall Street Horizon's Mr. Star.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

November 07, 2019 05:44 ET (10:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

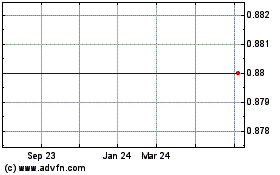

HEXO (TSX:HEXO)

Historical Stock Chart

From Mar 2024 to Apr 2024

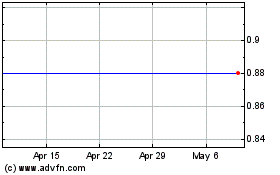

HEXO (TSX:HEXO)

Historical Stock Chart

From Apr 2023 to Apr 2024