OMERS to Invest in RiverStone UK

December 20 2019 - 7:59AM

Fairfax Financial Holdings Limited (“Fairfax”) (TSX: FFH and FFH.U)

and OMERS, the pension plan for Ontario’s municipal employees, are

pleased to announce that they have entered into an agreement

pursuant to which OMERS will acquire a 40% interest in Fairfax’s UK

run-off group, RiverStone UK.

The transaction gives RiverStone UK the joint

operational expertise of Fairfax and OMERS and the flexibility to

raise inexpensive capital, while enabling Fairfax to focus on

significant premium growth in the ongoing insurance and reinsurance

businesses. The investment provides RiverStone UK with additional

flexibility to raise capital at historically low rates in Europe in

order to opportunistically pursue UK run-off transactions. Luke

Tanzer will remain CEO of RiverStone UK post-closing.

“We welcome OMERS’ investment in RiverStone UK

and the opportunity it brings to continue to offer the most trusted

and effective run-off solutions in the insurance market,” said Luke

Tanzer, CEO of RiverStone UK.

“When Nick Bentley and Luke Tanzer expressed

their desire to take steps to bring partners into the UK run-off

business, OMERS was the natural choice given our past successes

together,” said Prem Watsa, Chairman and CEO of Fairfax.

“OMERS’ investment and their ability to work jointly with Luke and

his team will provide RiverStone UK with the opportunity to

prudently leverage the business and pursue opportunistic

transactions.”

“The acquisition of RiverStone UK advances our

strategy to make investments that can generate sustainable, stable

income and growth,” said Ken Miner, Executive Vice President and

Global Head of OMERS Capital Markets. “We are excited to work with

Fairfax to maximize the value of this asset for our members.”

The cash purchase price for the RiverStone UK

investment of at least US$560 million, subject to certain book

value adjustments at closing, will result in Fairfax recording a

gain of approximately US$280 million before tax (an increase in

book value per basic share of Fairfax of approximately US$10 before

tax on a pro forma basis).

Upon completion of the transaction, Fairfax will

deconsolidate the UK run-off group and apply the equity method of

accounting for its remaining interest. Fairfax may further monetize

its remaining interest in UK run-off in the future although the

company also retains the flexibility to repurchase its interest

over time.

The transaction remains subject to regulatory

approval and is expected to close in the first quarter of

2020.

About Fairfax

Fairfax is a holding company which, through its

subsidiaries, is engaged in property and casualty insurance and

reinsurance and the associated investment management.

About OMERS

Founded in 1962, OMERS is one of Canada’s

largest defined benefit pension plans, with more than $97 billion

in net assets as at December 31, 2018. OMERS invests and

administers pensions for more than half a million members through

originating and managing a diversified portfolio of investments in

public markets, private equity, infrastructure and real estate. For

more information, please visit omers.com.

Contact Information:

Fairfax:

John Varnell Vice President, Corporate Development Tel: (416)

367-4941

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

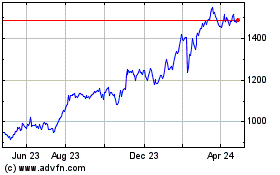

Fairfax Financial (TSX:FFH)

Historical Stock Chart

From Apr 2023 to Apr 2024