Amidst slight national growth, Yelp’s

Third-Quarter Economic Average finds California’s local economies

declining

Yelp Inc. (NYSE: YELP), the company that connects people with

great local businesses, today released third quarter data for the

Yelp Economic Average (YEA), a benchmark of local economic strength

in the U.S. The report finds slow national growth, up by only .07%

in the third quarter, as several of California’s local economies

continued long-term declines, led by San Jose and San

Francisco.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20191022005375/en/

The Yelp Economic Average Rebounded

Slightly in Q3 2019 (Graphic: Business Wire)

YEA is calculated from the fourth quarter of 2016, nationally

and for 50 metros, reflecting data from millions of local

businesses and tens of millions of users on Yelp’s platform. The

report measures local economic strength through business survival

and consumer interest. For every quarterly release since the

introduction of YEA earlier this year, its change from the prior

quarter has matched the change in GDP growth. According to

researchers, Yelp provides a timely and accurate measure of a huge

swath of the economy that is often missed by many major

indicators.

“As China trade tensions, Fed deliberations, and impeachment

inquiry talk trickles down to Main Street, the Yelp Economic

Average has barely budged,” said Carl Bialik, Yelp’s data science

editor. “At the same time, California’s biggest local economies are

continuing to struggle. Construction limits and increasing rent are

pushing consumers and workers farther from businesses, contributing

to continued quarterly declines in some of the state’s biggest

metro areas, with retail and restaurants taking the biggest

hits.”

California’s Local Economy Declines

While reports show that California’s position in the national

and global economies is strong, the state has seen the biggest

decline in local economic activity among the 50 major U.S. metros

YEA tracks. San Francisco, San Jose and San Diego all rank in the

bottom five metros, while Los Angeles is in the bottom ten and

Sacramento places below average. Limits to development around

California have driven up housing costs, which has restricted the

supply of workers, raised labor costs, and limited consumption,

according to the McKinsey Global Institute.

California’s shopping businesses have been hardest hit, ranking

at the bottom in each of the five California metros, with stores

selling shoes, cellphones, and women’s clothing falling the

sharpest. Restaurants, food, and nightlife categories are also

struggling in all five California cities. The declines range from

2.6% in San Diego to 9.3% in San Jose, with an above-average fall

of 6% in San Francisco. As rents in San Jose and San Francisco have

surged, retail and restaurants have felt the impact.

San Francisco and San Jose have particularly struggled with

construction limits and rents, and they’ve consistently ranked as

the bottom two metros in the economic average in each of the last

three quarters. The other California metros had been doing better

at times but dipped in performance heading into this quarter.

New Fast Growing Cities Emerge

Buffalo (NY) and Pittsburgh (PA) join Milwaukee (WI), Honolulu

(HI), and Portland (ME) in the top five boomtowns this quarter,

knocking out Louisville (KY) and Memphis (TN) from last quarter.

Home services businesses have been among the strongest in all five

of the top metros. Local factors also propelled these boomtowns to

their success, including food trucks in Milwaukee, life coaches in

Buffalo, junk removal in Honolulu, juice bars in Portland, and

software developers in Pittsburgh.

Shopping and Lower-Priced Restaurants Gain Ground

While still below its level three years ago, retail gained

ground for a second straight quarter. Stores selling items that

shoppers might want to check out in person were among the gainers:

sporting goods, appliances, hardware stores, antiques, furniture

stores, and art galleries. Department stores and women’s clothing

also advanced. Cellphones and computers, which previously lost

business to online retail, made a bit of a comeback this

quarter.

Lower-priced and stay-at-home options were among the strongest

in the restaurants, food, and nightlife categories, while several

types of upscale restaurants declined, indicating a shift toward

value and eating in. The strongest types of food and drink

businesses in the third quarter included chicken wings, pizza, and

sandwiches; and grocery stores, delis, and stores selling beer,

wine and spirits.

For more assets and images, please find them here. For more

information and Yelp’s latest metrics, visit:

https://www.yelp.com/factsheet

Methodology

The Yelp Economic Average (YEA) is a composite measure of the

economy, reflecting both business health and consumer demand among

businesses in 30 sectors.

The 30 business sectors, or categories — the “Yelp 30″ — are

drawn from eight umbrella business categories on Yelp: restaurants,

food, nightlife, local services, automotive, professional services,

home services, and shopping.

The share of YEA components from each of these eight categories

is based on each one’s share of the economy, as estimated from

County Business Patterns reports.

Each of the Yelp 30 is chosen based on maximizing four criteria,

relative to other candidates within its family of categories, as

measured in the first quarter of 2016:

- Number of businesses on Yelp in the category;

- Consumer interest on Yelp for businesses in the category;

- Number of the 50 metro areas — whose economic health we have

been measuring a year and a half, originally as part of our Local

Economic Outlook — in which the category is present;

- Uniform spread across the four Census Bureau-defined regions of

the country.

We then chose baseline categories against which to compare the

fortunes of the Yelp 30. This step helps remove changes due to

seasonality and Yelp’s internal growth; what remains is a

reflection of real economic patterns. We selected all other root

categories not represented by the YEA components as baselines

because they provided the most robust controls against seasonality

and activity on Yelp.

For each of the Yelp 30 in each quarter, its two scores — one

for business population and one for consumer interest — are

calculated as follows:

- Count the component’s total for the quarter;

- For consumer interest only: Count the baseline’s total for the

quarter;

- For consumer interest only: Divide the component’s total by the

baseline total to get the component’s score;

- Divide the component’s score for the quarter of interest by the

component’s score in the equivalent quarter in 2016 — comparing,

for instance, the fourth quarter of 2018 to the fourth quarter of

2016, to adjust for seasonality;

- Multiply by 100 to make 100 a typical score.

Then the two scores are normalized to have the same variance, so

that each contributes equally across components. To reduce the

effect of outliers, the overall score for both consumer engagement

and business count is the median of each component’s score. The YEA

is the mean of the overall consumer engagement score and

business-count score.

The YEA is separate from, and not meant to inform or predict,

Yelp’s financial performance because our figures are adjusted to

remove the effects of changes to usage of our product.

We calculated equivalent scores at the regional and metro level

to provide a local look at the state of the local economy.

When comparing YEA to GDP growth we compare the change in both

indicators rather than the absolute magnitude because they’re

measured and reported differently.

About Yelp Inc.

Yelp Inc. (www.yelp.com) connects people with great local

businesses. With unmatched local business information, photos and

review content, Yelp provides a one-stop local platform for

consumers to discover, connect and transact with local businesses

of all sizes by making it easy to request a quote, join a waitlist,

and make a reservation, appointment or purchase. Yelp was founded

in San Francisco in July 2004. Since then, Yelp has taken root in

major metros in more than 30 countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191022005375/en/

Yelp Inc. Julianne Rowe jrowe@yelp.com

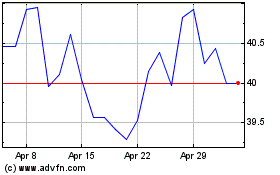

Yelp (NYSE:YELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

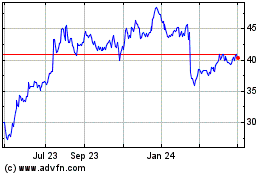

Yelp (NYSE:YELP)

Historical Stock Chart

From Apr 2023 to Apr 2024