Uncovers Possible Ride-sharing Effect: Auto

Businesses Slump in First Quarter of 2019

Yelp Inc. (NYSE: YELP), the company that connects people with

great local businesses, today released the Yelp Economic Average

(YEA), a benchmark of local economic strength in the U.S.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190424006180/en/

Yelp Economic Average (Graphic: Business

Wire)

“Many of today’s data resources for measuring economic health

generally either focus on giant corporations or move at a glacial

pace,” said Carl Bialik, Yelp’s data science editor. “Yelp has

information on millions of U.S. brick-and-mortar businesses and the

interests and needs of the millions of consumers who use Yelp every

day, which researchers have found makes us well positioned to

quickly measure a huge swath of the economy that is missed by many

major indicators.”

The Yelp Economic Average rose by eight tenths of a point in the

first quarter of 2019 after a tough end to 2018. In the last

quarter of that year, the YEA—a measure of the health of important

sectors across the economy, based on Yelp’s unique data set—fell by

2.2 points. The YEA measures success using two signals: business

survival and consumer interest. The opening of new businesses and

an increase in consumer engagement both boost the YEA.

Local and professional services businesses drove the increase,

but two major sectors bucked the trend by falling in the first

quarter. Retail businesses continue to struggle. And automotive

businesses extended their slump. In most major metros around the

country, businesses associated with the auto industry have

experienced a steady decline over the past two and a half

years.

Why Auto is Slumping

One question that emerged from the Yelp Economic Average is

whether the declining health of the auto sector is a side-effect of

the growing popularity in ride-sharing. Far more people are getting

around by Uber and Lyft today, and many of those rides may replace

individual driving trips and even contribute to a decline in car

ownership. That’s one of several challenges facing local auto

businesses around the country. Yelp charted the fortune of auto

businesses in 50 major metros around the nation, looking at the

overall Yelp Economic Average score as well as the performance of

its two constituents: auto repair and gas stations. While the

picture for gas stations is mixed, the major slump in auto repair

across the board is weighing on the automotive sector in every

corner of the country.

Auto businesses are facing other challenges. Increasing fuel

efficiency may mean more miles between fill-ups while auto-repair

shops struggle to find qualified workers.

The Marie Kondo and Trump Tax Effects

Beyond the auto sector’s slump, the surge in junk removal and

hauling businesses suggests that Marie Kondo is on to something.

The number of Americans hiring professionals to cart their stuff

away is rising enough to significantly move the needle on junk

haulers’ YEA score, up 7.2 points.

Americans also are increasingly turning to lawyers. Whether they

specialize in real estate, divorce and family, or personal injury,

lawyers had a strong start to 2019. Their professional-services

peers, accountants, also had a strong quarter, with the tax

overhaul likely fueling demand months before the filing

deadline.

A rebound in these core business sectors, such as local

services, professional services, and restaurants, may be early

signs of an economic turnaround. A third successive first-quarter

rise isn’t a result of seasonality; Yelp normalized the data so

that it is seasonally adjusted.

Methodology

The Yelp Economic Average (YEA) is a composite measure of the

economy, reflecting both business health and consumer demand among

businesses in 30 sectors.

The eight root categories

The 30 business sectors, or categories — the “Yelp 30” — are

drawn from eight umbrella business categories on Yelp: restaurants,

food, nightlife, local services, automotive, professional services,

home services, and shopping.

Root categories’ share of the 30 components

The share of YEA components from each of these eight categories

is based on each one’s share of the economy, as estimated from

County Business Patterns reports.

Choosing the Yelp 30

Each of the Yelp 30 is chosen based on maximizing four criteria,

relative to other candidates within its family of categories, as

measured in the first quarter of 2016:

- Number of businesses on Yelp in the

category;

- Consumer interest on Yelp for

businesses in the category;

- Number of the 50 metro areas — whose

economic health Yelp has been measuring for a year and a half,

originally as part of the company’s Local Economic Outlook — in

which the category is present;

- Uniform spread across the four Census

Bureau-defined regions of the country.

Choosing baseline categories

Yelp’s data science team then chose baseline categories against

which to compare the fortunes of the Yelp 30. This step helps

remove changes due to seasonality and Yelp’s internal growth; what

remains is a reflection of real economic patterns. The team

selected all other root categories not represented by YEA

components as baselines because they provided the most robust

controls against seasonality and activity on Yelp.

Calculating YEA scores

For each of the Yelp 30 in each quarter, its two scores — one

for business population and one for consumer interest — are

calculated as follows:

- Count the component’s total for the

quarter;

- For consumer interest only: Count the

baseline’s total for the quarter;

- For consumer interest only: Divide the

component’s total by the baseline total to get the component’s

score;

- Divide the component’s score for the

quarter of interest by the component’s score in the equivalent

quarter in 2016 — comparing, for instance, the fourth quarter of

2018 to the fourth quarter of 2016, to adjust for seasonality;

- Multiply by 100 to make 100 a typical

score.

Then the two scores are normalized to have the same variance, so

that each contributes equally across components.

To reduce the effect of outliers, the overall score for both

consumer engagement and business count is the median of each

component’s score.

YEA is the mean of the overall consumer engagement score and

business-count score.

Yelp calculated equivalent scores at the regional and metro

level to provide a local look at the state of the local

economy.

About Yelp Inc.

Yelp Inc. (www.yelp.com) connects people with great local

businesses. With unmatched local business information, photos and

review content, Yelp provides a platform for consumers to discover,

interact and transact with local businesses of all sizes. Yelp was

founded in San Francisco in July 2004.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190424006180/en/

Yelp Inc.Kathleen Liupress@yelp.com

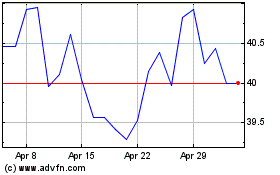

Yelp (NYSE:YELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

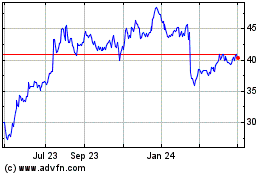

Yelp (NYSE:YELP)

Historical Stock Chart

From Apr 2023 to Apr 2024