Reports Net Revenue of $244 Million, Net

Income of $32 Million and Adjusted EBITDA of $53 Million

Targets Mid-Teens Revenue CAGR for 2019-2023

and a 30-35% Adjusted EBITDA Margin by 2023

Expects to Increase Adjusted EBITDA Margin

by 2-3 Percentage Points in 2019

Board Approves Increase of $250 Million to

Share Repurchase Program, Bringing Outstanding Authorization to

$500 Million; Plans to Repurchase $250 Million in the First Half of

2019

Announces Election of Three Seasoned

Executives to the Board of Directors

The third sentence of the third paragraph in the "Additions to

Board of Directors" section should read: Sharon is an accomplished

marketing executive who most recently served as CMO of Starbucks,

where she led go-to-market and product innovation, and played a key

role in the growth of their mobile apps and loyalty programs.

(instead of Sharon is an accomplished marketing executive who most

recently served as CMO of Starbucks, overseeing the growth of their

mobile apps and loyalty programs.)

The corrected release reads:

YELP REPORTS FOURTH QUARTER AND FULL YEAR

2018 FINANCIAL RESULTS

Reports Net Revenue of $244 Million, Net Income

of $32 Million and Adjusted EBITDA of $53 Million

Targets Mid-Teens Revenue CAGR for 2019-2023

and a 30-35% Adjusted EBITDA Margin by 2023

Expects to Increase Adjusted EBITDA Margin by

2-3 Percentage Points in 2019

Board Approves Increase of $250 Million to

Share Repurchase Program, Bringing Outstanding Authorization to

$500 Million; Plans to Repurchase $250 Million in the First Half of

2019

Announces Election of Three Seasoned Executives

to the Board of Directors

Yelp Inc. (NYSE: YELP), the company that connects people with

great local businesses, today posted its financial results for the

fourth quarter and full year ended December 31, 2018 in its Q4 2018

Shareholder Letter. The company has also provided an investor

presentation outlining its strategic plan and long-term financial

targets. Both are available on Yelp’s Investor Relations website at

www.yelp-ir.com.

“In 2018, we evolved our go-to-market strategy to capture more

of our addressable market and reduce sales friction,” said Jeremy

Stoppelman, co-founder and CEO of Yelp. “We also made significant

progress in driving consumer usage in the Restaurants vertical and

business-owner monetization in the Home & Local Services

vertical. We plan to continue the transition in 2019, and expect to

achieve stronger revenue growth and higher Adjusted EBITDA margins

in the second half of 2019 as our growth initiatives begin to

deliver. For the next five years, we see mid-teens revenue growth

and Adjusted EBITDA margins in the 30-35% range by 2023. Our board

of directors has increased our share repurchase authorization to

$500 million and elected three experienced business leaders to our

board of directors.”

Quarterly Conference Call

Yelp will host a conference call at 2:00 p.m. PT to discuss the

fourth quarter and full year 2018 financial results, the company’s

business outlook for the first quarter and full year 2019, and its

strategic plan and long-term financial targets. The webcast of the

conference call can be accessed on the Yelp Investor Relations

website at www.yelp-ir.com. A replay of the webcast will be

available at the same website until February 21, 2019.

Update on Strategic Initiatives and

Financial Targets

Yelp has identified a detailed path toward long-term shareholder

value. Key components include Yelp’s plans to:

- Deliver long-term double-digit revenue

growth: Yelp currently targets a compound annual revenue growth

rate in the mid-teens from 2019 through 2023, driven by initiatives

aimed at winning in key verticals, expanding business offerings,

driving more value to business customers, capturing enterprise, and

enhancing the consumer experience.

- Drive margin expansion and optimize

cost structure: Yelp has a clear strategy to deliver cost savings

and continue its track record of margin expansion to achieve

Adjusted EBITDA margin of 30-35% by 2023. This strategy includes

initiatives to shift its emphasis to the most efficient sales

channels, relocate its salesforce to more attractive locations, and

optimize marketing spend.

- Accelerate strategy through effective

partnerships: Partnerships like Yelp’s long-term Grubhub

relationship continue to deliver significant value and represent

attractive growth drivers for its business. Yelp recently further

expanded its partner relationships through new engagements with

industry leaders like Visa and GoDaddy, among others, and plans to

continue exploring such opportunities.

Increased Commitment to Return Capital to

Shareholders

Yelp announced that its Board of Directors (“Board”) authorized

an increase of $250 million to the company’s current share

repurchase program, bringing the total outstanding authorization to

$500 million. The company currently plans to repurchase

approximately $250 million of its common stock in the first half of

2019. The company may repurchase shares at management’s discretion,

with the amount and timing of any repurchases subject to liquidity,

cash flow and market conditions, among other factors.

Additions to Board of Directors

As previously disclosed, the Board and its Nominating and

Corporate Governance Committee initiated a process, with the

support of the nationally-recognized director search firm Spencer

Stuart, to evaluate the Board’s composition and identify additional

director candidates to help drive the Yelp strategy. As a result of

that process, the Board, following the recommendation of the

Nominating and Corporate Governance Committee, appointed George Hu,

Sharon Rothstein and Brian Sharples to serve as members of the

Board, effective March 1, 2019. Hu, Rothstein and Sharples will

replace directors Geoff Donaker, Jeremy Levine, and Peter Fenton,

respectively, who will step down from the Board, effective March 1,

2019.

“We are excited to announce the appointment of George, Sharon

and Brian to our Board,” said Diane Irvine, Chairperson of the

Board. “As we work to capitalize on the opportunities before us to

drive long-term growth and deliver value to our shareholders, we

are committed to maintaining a Board that provides robust oversight

and has the right skills to support Yelp. George, Sharon and Brian

bring to our Board extensive experience as business leaders of

relevant verticals at a variety of impressive companies and their

expertise will be critical as we implement our strategy over the

coming years. On behalf of the entire Board, I would like to thank

Geoff Donaker, Jeremy Levine and Peter Fenton for their many

contributions to Yelp over the years, including preparing for and

taking the company public, and growing it to nearly $1 billion in

annual revenues today.”

“George, Sharon and Brian are experienced business veterans who

bring a wealth of practical, hands-on knowledge and skill sets to

Yelp, including scaling operations, sales, marketing, product and

monetization,” said Jeremy Stoppelman. “George has an extensive

track record in operations, including 13 years at Salesforce prior

to joining Twilio, where he currently serves as COO. Sharon is an

accomplished marketing executive who most recently served as CMO of

Starbucks, where she led go-to-market and product innovation, and

played a key role in the growth of their mobile apps and loyalty

programs. Brian is a successful technology CEO with significant

experience operating e-commerce and marketplace businesses.”

George Hu

Mr. Hu is an accomplished leader with extensive experience as a

software and operations executive at leading technology companies

including Twilio and Salesforce. Throughout his career he has

helped lead companies through hyper-growth, scale businesses and

has extensive experience operating large complex organizations. He

currently serves as Chief Operating Officer of Twilio, the leading

cloud communications platform, where he has overseen and executed

the Company’s strategy, including guiding the Company towards new

market opportunities. Previously Mr. Hu spent over 13 years at

Salesforce, where he served in multiple roles spanning products,

marketing and customer education, and the company grew from

generating $20 million to $5 billion in revenue. He most recently

served as Chief Operating Officer for four years, during which the

company delivered 78% total shareholder return. Earlier in his

career, Mr. Hu held product management and strategic consulting

roles at North Point Communications and The Boston Consulting

Group. Mr. Hu holds an A.B. from Harvard University and an MBA from

the Stanford Graduate School of Business.

Sharon Rothstein

Ms. Rothstein is a veteran marketing executive having led brand,

product and omni-channel marketing at some of the world’s most

iconic global consumer-facing companies. Ms. Rothstein currently

serves as Operating Partner of Stripes Group, a leading growth

equity firm that has been investing in high growth consumer and

SaaS companies for over a decade. Prior to joining Stripes, Ms.

Rothstein served as Executive Vice President, Global Chief

Marketing Officer and subsequently, Executive Vice President,

Global Chief Product Officer for Starbucks, the specialty coffee

retailer, where she had responsibility for the Starbucks brand and

go-to-market plan as well as the company’s portfolio of product

platforms. Ms. Rothstein led the creation of the narrative for

Starbucks’ global retail experiences and directed all product

initiatives, creative expressions, advertising, and omni channel

marketing and merchandising. In addition, Ms. Rothstein held senior

marketing and brand management positions at Sephora, Godiva,

Starwood Hotels & Resorts, Nabisco Biscuit Company and Procter

& Gamble. She currently serves as a Board member of True Food

Kitchen, a fast-growing healthy lifestyle restaurant company, and

Levain Cookies, a premium bakery famous for its decadent cookies.

Ms. Rothstein earned a Bachelor of Commerce from the University of

British Columbia and an MBA from the Anderson School of Management

of the University of California, Los Angeles.

Brian Sharples

Mr. Sharples is a successful serial entrepreneur, angel investor

and executive with extensive experience in startup and

well-established technology and e-commerce companies, both as a

board member and in leading operations and executive roles. Mr.

Sharples has founded and scaled several high-growth startups and

oversaw their strategic exits. Mr. Sharples co-founded and served

as Chairman and CEO of HomeAway, Inc., a global online marketplace

for the vacation rental industry, where he led the company's

successful public offering in 2011, and the $3.9 billion

acquisition by Expedia in 2015. Prior to HomeAway, Mr. Sharples was

President and CEO of IntelliQuest Information Group, Inc., a

supplier of marketing data and research to technology companies

that went public in 1996 and was sold to WPP Group in 2000. In

addition to his operational leadership, Mr. Sharples has served on

the boards of several global technology companies specializing in

the consumer space, including KAYAK and RetailMeNot, Inc., and

currently serves on the boards of GoDaddy and Ally Financial Group.

Mr. Sharples also helped oversee the successful acquisitions of

KAYAK (by Priceline) and RetailMeNot Inc. (by Harland Clarke)

during his board tenures. Mr. Sharples also has served on the

boards of several private companies, including most recently as

Chairman of Twyla, Inc., a company he co-founded in 2015 that

offers a software platform to license and sell limited edition

artwork. He also serves as Chairman of private-equity backed Fexy

Media, and on the board of RVShare, a leading online marketplace

for RV rentals. Early in his career, Mr. Sharples founded I Motors,

an event-based marketplace for used cars, and served as a

consultant at Bain & Co. Mr. Sharples holds a B.S. in Economics

and Math from Colby College and an MBA from the Stanford Graduate

School of Business of Stanford University.

About Yelp

Yelp Inc. (www.yelp.com) connects people with great local

businesses. With unmatched local business information, photos and

review content, Yelp provides a platform for consumers to discover,

interact and transact with local businesses of all sizes. Yelp was

founded in San Francisco in July 2004.

Yelp intends to make future announcements of material financial

and other information through its Investor Relations website. Yelp

will also, from time to time, disclose this information through

press releases, filings with the Securities and Exchange

Commission, conference calls or webcasts, as required by applicable

law.

Non-GAAP Financial Measures

This press release and statements made during the

above-referenced webcast may include information relating to

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin, each of which

the Securities and Exchange Commission has defined as a “non-GAAP

financial measure.”

We define EBITDA as Net income (loss), adjusted to exclude:

Provision for (benefit from) income taxes; Other income, net; and

Depreciation and amortization.

We define Adjusted EBITDA as Net income (loss), adjusted to

exclude: Provision for (benefit from) income taxes; Other income,

net; Depreciation and amortization; Stock-based compensation

expense; any Gain (loss) on the disposal of a business unit;

Restructuring and integration costs; and, in certain periods,

certain other income and expense items. We define Adjusted EBITDA

margin as Adjusted EBITDA divided by Net revenue.

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are key

measures used by Yelp management and the board of directors to

understand and evaluate core operating performance and trends, to

prepare and approve Yelp’s annual budget and to develop short- and

long-term operational plans. The presentation of this financial

information, which is not prepared under any comprehensive set of

accounting rules or principles, is not intended to be considered in

isolation or as a substitute for the financial information prepared

and presented in accordance with generally accepted accounting

principles in the United States (“GAAP”).

EBITDA and Adjusted EBITDA have limitations as analytical tools,

and you should not consider them in isolation or as substitutes for

analysis of Yelp’s financial results as reported under GAAP. Some

of these limitations are:

- although depreciation and amortization

are non-cash charges, the assets being depreciated and amortized

may have to be replaced in the future, and EBITDA and Adjusted

EBITDA do not reflect cash capital expenditure requirements for

such replacements or for new capital expenditure requirements;

- EBITDA and Adjusted EBITDA do not

reflect changes in, or cash requirements for, Yelp’s working

capital needs;

- Adjusted EBITDA does not consider the

potentially dilutive impact of equity-based compensation;

- EBITDA and Adjusted EBITDA do not

reflect tax payments that may represent a reduction in cash

available to Yelp;

- Adjusted EBITDA does not take into

account any restructuring or integration costs; and

- other companies, including those in

Yelp’s industry, may calculate EBITDA and Adjusted EBITDA

differently, which reduces their usefulness as comparative

measures.

Because of these limitations, you should consider EBITDA,

Adjusted EBITDA and Adjusted EBITDA margin alongside other

financial performance measures, including various cash flow

metrics, Net income (loss) and Yelp’s other GAAP results.

Forward-Looking Statements

This press release contains forward-looking statements relating

to, among other things, Yelp’s future performance that are based on

its current expectations, forecasts and assumptions and that

involve risks and uncertainties. These statements include, but are

not limited to, statements regarding Yelp’s:

- large market opportunity and ability to

sustain long-term growth;

- ability to achieve stronger revenue

growth in the second half of 2019 and mid-teens revenue growth on a

compound annual growth basis from 2019 to 2023;

- ability to achieve higher Adjusted

EBITDA margins in the second half of 2019 and targeted increases in

its Adjusted EBITDA margin of 2-3 percentage points in 2019 and of

30-35% by 2023;

- near-term and long-term strategic and

investment priorities — including optimizing its cost structure,

expanding its offerings, driving growth from customers of all sizes

and accelerating its strategy through effective partnerships — as

well as its ability to execute against those priorities;

- ability to increase customer

acquisition through the sale of non-term contracts;

- ability to drive more value to

consumers and businesses;

- plans to increase its focus on

different product distribution channels; and

- plans and ability to create shareholder

value and return capital to shareholders, including through its

share repurchase program.

Yelp’s actual results could differ materially from those

predicted or implied and reported results should not be considered

as an indication of future performance. Factors that could cause or

contribute to such differences include, but are not limited to

Yelp’s:

- limited operating history in an

evolving industry;

- ability to generate sufficient revenue

to maintain and increase profitability, particularly in light of

its significant ongoing sales and marketing expenses;

- ability to reduce or control expenses

sufficiently to meet its profitability targets;

- ability to increase traffic to its

platform and generate and maintain sufficient high-quality content

from its users;

- ability to introduce successful new

products and services; and

- ability to maintain and expand its base

of advertisers, including enterprise customers, particularly as an

increasing portion of advertisers have the ability to cancel their

advertising campaigns at any time.

Factors that could cause or contribute to such differences also

include those factors that could affect Yelp’s business, operating

results and stock price included under the captions “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” in Yelp’s most recent Annual Report on

Form 10-K or Quarterly Report on Form 10-Q at www.yelp-ir.com or

the SEC’s website at www.sec.gov.

Undue reliance should not be placed on the forward-looking

statements in this release, which are based on information

available to Yelp on the date hereof. Such forward-looking

statements do not include the potential impact of any acquisitions

or divestitures that may be announced and/or completed after the

date hereof. Yelp assumes no obligation to update such

statements.

Yelp Inc. Condensed Consolidated Balance

Sheets (In thousands, except share data) (Unaudited)

December 31, December 31, 2018

2017 (1) Assets Current assets: Cash and cash

equivalents $ 332,764 $ 547,850 Short-term marketable securities

423,096 273,366 Accounts receivable, net 87,305 76,173 Prepaid

expenses and other current assets 17,104

15,700 Total current assets 860,269 913,089

Long-term marketable securities - 25,032 Property, equipment and

software, net 114,800 103,651 Goodwill 105,620 107,954 Intangibles,

net 13,359 16,893 Restricted cash 22,071 18,554 Other non-current

assets 59,444 40,428 Total assets $

1,175,563 $ 1,225,601

Liabilities and

Stockholders' Equity Current liabilities: Accounts payable $

6,540 $ 9,033 Accrued liabilities 54,522 73,665 Deferred revenue

3,843 3,469 Total current liabilities

64,905 86,167 Long-term liabilities 35,140

30,737 Total liabilities 100,045

116,904 Stockholders' equity Common stock - -

Additional paid-in capital 1,139,462 1,038,017 Treasury stock - (46

) Accumulated other comprehensive loss (11,021 ) (8,444 )

(Accumulated deficit) retained earnings (52,923 )

79,170 Total stockholders' equity 1,075,518

1,108,697 Total liabilities and stockholders' equity

$ 1,175,563 $ 1,225,601 (1) As of January 1,

2018, the company adopted Accounting Standards Update 2014-09,

"Revenue from Contracts with Customers (Topic 606)" ("ASC 606"),

using the full retrospective method. Accordingly, the company has

recast certain amounts in prior periods presented.

Yelp Inc. Condensed Consolidated Statements of

Operations (In thousands, except per share data) (Unaudited)

Three Months EndedDecember

31,

Year Ended December 31,

2018 2017 (1) 2018 2017

(1) Net revenue $ 243,740 $ 219,441 $ 942,773 $ 850,847

Costs and expenses: Cost of revenue (2) 14,255 16,236 57,872

70,518 Sales and marketing (2) 121,256 111,013 483,309 437,424

Product development (2) 54,273 47,994 212,319 175,787 General and

administrative (2) 29,677 27,898 120,569 109,707 Depreciation and

amortization 11,557 9,729 42,807 41,198 Restructuring and

integration - 1 - 288 Gain on disposal of a business unit -

(163,697 ) - (163,697 ) Total costs and

expenses 231,018 49,174 916,876

671,225 Income from operations 12,722 170,267 25,897 179,622

Other income, net 4,160 1,897 14,109

4,864 Income before income taxes 16,882 172,164

40,006 184,486 Benefit from (provision for) income taxes

15,064 (31,074 ) 15,344 (31,491 ) Net income

attributable to common stockholders $ 31,946 $ 141,090 $

55,350 $ 152,995 Net income per share attributable to

common stockholders: Basic $ 0.39 $ 1.69 $ 0.66 $ 1.87

Diluted $ 0.37 $ 1.58 $ 0.62 $ 1.76

Weighted-average shares used to compute

net income per share attributable to common stockholders:

Basic 82,706 83,264 83,573

81,602 Diluted 86,287 89,064

88,709 87,170 (1) As of January 1,

2018, the company adopted ASC 606 using the full retrospective

method. Accordingly, the company has recast certain amounts in the

prior period presented. (2) Includes stock-based

compensation expense as follows:

Three Months EndedDecember

31,

Year Ended December 31,

2018 2017 2018 2017 Cost of revenue $

1,227 $ 1,079 $ 4,572 $ 4,010 Sales and marketing 7,265 6,666

30,779 28,100 Product development 15,004 12,851 56,882 47,280

General and administrative 5,157 4,811

22,153 21,025 Total stock-based compensation $ 28,653

$ 25,407 $ 114,386 $ 100,415

Yelp

Inc. Condensed Consolidated Statements of Cash Flows (In

thousands) (Unaudited)

Year Ended December

31, 2018 2017 (1) Operating

activities Net income attributable to common stockholders $

55,350 $ 152,995 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

42,807 41,198 Bad debt expense 24,515 20,917 Stock-based

compensation 114,386 100,415 Release of valuation allowance against

deferred tax assets (16,632 ) - Gain on disposal of a business unit

- (163,697 ) Other adjustments (3,978 ) 293 Changes in operating

assets and liabilities: Accounts receivable (35,664 ) (36,146 )

Prepaid expenses and other assets (773 ) (1,362 ) Accounts payable,

accrued expenses and other liabilities (19,824 )

53,034 Net cash provided by operating activities

160,187 167,647

Investing

activities Purchases of marketable securities (751,237 )

(354,895 ) Maturities of marketable securities 613,700 264,000 Sale

of investment prior to maturity 17,895 - Sale of a business, net of

cash sold - 252,663 Acquisitions, net of cash received - (50,544 )

Purchases of property, equipment and software (24,849 ) (15,598 )

Capitalized website and software development costs (20,123 )

(14,647 ) Other investing activities 245 157

Net cash (used in) provided by investing activities

(164,369 ) 81,136

Financing activities

Proceeds from issuance of common stock for employee stock-based

plans 29,779 40,917 Taxes paid related to net share settlement of

equity awards (50,144 ) (1,199 ) Repurchases of common stock

(187,382 ) (12,556 ) Net cash (used in) provided by

financing activities (207,747 ) 27,162

Effect of exchange rate changes on cash, cash equivalents and

restricted cash 360 941 Change in cash, cash equivalents and

restricted cash (211,569 ) 276,886 Cash, cash equivalents and

restricted cash - Beginning of period 566,404

289,518 Cash, cash equivalents and restricted cash - End of

period $ 354,835 $ 566,404 (1) As of January

1, 2018, the company adopted ASC 606 using the full retrospective

method. Accordingly, the company has recast certain amounts in the

prior period presented. Also as of January 1, 2018, the company

adopted Accounting Standards Update No. 2016-18, "Statement of Cash

Flows (Subtopic 230): Restricted Cash," and recast the prior period

presented.

Yelp Inc. Reconciliation of GAAP

to Non-GAAP Financial Measures (In thousands) (Unaudited)

Three Months EndedDecember

31,

Year Ended December 31,

2018 2017 (1) 2018 2017

(1) Reconciliation of GAAP net income to EBITDA and

adjusted EBITDA: GAAP net income $ 31,946 $ 141,090 $

55,350 $ 152,995 (Benefit from) provision for income taxes (15,064

) 31,074 (15,344 ) 31,491 Other income, net (4,160 ) (1,897 )

(14,109 ) (4,864 ) Depreciation and amortization 11,557

9,729 42,807 41,198

EBITDA $ 24,279 $ 179,996 $ 68,704 $

220,820 Stock-based compensation 28,653 25,407

114,386 100,415 Gain on disposal of a business unit - (163,697 ) -

(163,697 ) Restructuring and integration costs -

1 - 288 Adjusted EBITDA $

52,932 $ 41,707 $ 183,090 $ 157,826

Net revenue $ 243,740 $ 219,441 $ 942,773 $ 850,847 Adjusted

EBITDA margin

22%

19%

19%

19%

(1) As of January 1, 2018, the company adopted ASC 606 using

the full retrospective method. Accordingly, the company has recast

certain amounts in the prior period presented.

Yelp Inc. Fourth Quarter and Full Year Net Revenue

Adjusted for Eat24, Nowait and Turnstyle (In thousands)

(Unaudited)

Three Months Ended Year

Ended December 31, December 31, 2018

2017 (1) 2018 2017 (1) Net

revenue, as reported $ 243,740 $ 219,441 $ 942,773 $ 850,847 Eat24

revenue - (1,830 ) - (53,909 ) Nowait and Turnstyle revenue

- - (8,453 ) (5,188 )

Adjusted net revenue

$ 243,740 $ 217,611 $ 934,320 $ 791,750

(1) As of January 1, 2018, the company adopted ASC 606 using the

full retrospective method. Accordingly, the company has recast

certain amounts in the prior period presented.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190213005713/en/

Investor Relations ContactKate

Krieger415-266-3513ir@yelp.com

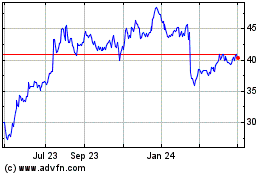

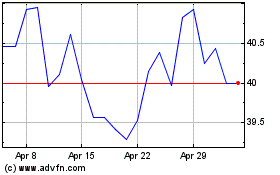

Yelp (NYSE:YELP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yelp (NYSE:YELP)

Historical Stock Chart

From Apr 2023 to Apr 2024