Additional Proxy Soliciting Materials (definitive) (defa14a)

May 07 2021 - 8:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filed by the Registrant x

|

|

Filed by a Party other than the Registrant ¨

|

|

Check the appropriate box:

|

|

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

Xenia Hotels & Resorts, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

|

|

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

|

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

(1)

|

|

Amount previously paid:

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

May 7, 2021

Dear Fellow Stockholders:

Before you cast your vote on Proposal 2: Advisory Vote to Approve Compensation of Named Executive Officers (the “Say-On-Pay Proposal”), we, on behalf of the members of the Board of Directors of Xenia Hotels & Resorts Inc. (“Xenia” or the “Company”), encourage you to review this supplement, as well as the detailed information provided in the Compensation Discussion and Analysis section of Xenia’s 2021 Proxy Statement. We are providing this letter in response to the proxy reports issued by Institutional Shareholder Services (“ISS”) on May 5, 2021, and Glass Lewis on April 22, 2021 (collectively, the “Reports”). Xenia takes issue with the recommendations in both Reports on Xenia’s Say on Pay Proposal. As you know, 2020 was an incredibly difficult year for the lodging and hospitality industry. Throughout 2020 and into 2021, Xenia has reported extensively on the challenges and difficulties brought on by the material impact of the novel coronavirus and related respiratory disease (“COVID-19”). We have also provided an extensive list of achievements accomplished in 2020 which were the result of the management team’s hard work, perseverance, and dedication to the long-term success of Xenia. If it were not for the management team’s successful execution on the Company’s broader strategy to navigate the sudden and devastating impact of the COVID-19 pandemic on the Company, we would not be in the position we are in today with a strong balance sheet and a recovery roadmap we believe will lead to the type of results we had seen prior to the onset of the pandemic.

In previous years, both Glass Lewis and ISS have provided Xenia with average to above-average compensation ratings and favorable vote recommendations on Say on Pay. We believe those ratings and recommendations are the result of a rigorous pay for performance compensation program implemented immediately after Xenia’s listing on the NYSE in 2015. We acknowledge that certain adjustments were made to our executive compensation program in 2020 to account for the unprecedented challenges faced by the Company in 2020. As we have stated since our listing, Xenia’s executive compensation program is designed and continues to fulfill its purpose to attract, retain and motivate experienced and talented executives who can help the Company maximize stockholder value. Just like the operational changes required to weather the impact of COVID-19, the compensation program also required temporary changes in 2020 in order to fulfill its purpose.

While we respect the attempt to standardize pay for performance analysis and evaluations across many sectors and industries, the metrics and methodology used by ISS and Glass Lewis to evaluate Xenia’s performance in 2020 and on a single year basis is inherently flawed and we believe the results of such analysis have little to no value to our stockholders when evaluating our Say on Pay proposal for 2020. We firmly believe that the compensation committee of our board of directors (the “Compensation Committee”), consisting entirely of independent directors, is best suited to make decisions regarding the executive compensation program based on the facts and circumstances at the time of those decisions.

More specifically, we respectfully disagree with ISS and Glass Lewis’ rationale for issuing the negative recommendation based on the following points:

1.The practice of utilizing any 2020 “realised pay” figures in assessing Xenia’s pay for performance program for 2020. The vast majority of the “realised pay” for 2020 as provided in both reports includes amounts for vested equity awards which were granted in 2017 and were based primarily on Xenia’s long-term company performance from the period beginning on January 1, 2017 and ending on December 31, 2019. Over this period, Xenia provided stockholders with an annualized total return of over 9%, which also resulted in the outperformance of all but one of its ten other peers in our peer group. Those equity awards vested prior to the pandemic in January 2020 and yet were included in the 2020 “realised pay” in both reports. To include these prior earned awards in the valuation of the Company’s performance for purposes of evaluating alignment in 2020 seems to defeat the purpose of evaluating Say on Pay specifically for 2020.

2.Both Reports claim that a misalignment between pay and performance merits careful scrutiny, yet in the chart below which appears in the Glass Lewis report, the Company is clearly within the preferred alignment (see the grey shaded area) based upon a five-year total shareholder return period. This is exactly the type of analysis that should be undertaken when judging Company performance over time as it relates to compensation. To include the material impact of the pandemic in 2020 when evaluating the company’s performance over a longer time period is not appropriate given the impact was beyond the control of management or the Company and it is not indicative of long-term Company performance. Additionally, we believe that the Company, led by its management team, has successfully navigated these extreme and sudden external factors brought on by the COVID-19 pandemic and we believe the current share price reflects both the achievements by the Company in 2020 and the outlook going forward. In other words, to measure a Say on Pay proposal using a methodology that evaluates only a fixed time period which ends during the middle of a global health crisis which has severely impacted the lodging and hospitality industry is not appropriate. We urge you to evaluate Xenia’s pay for performance compensation program based upon a totality of all factors and not to turn a blind eye to the disproportionate impact of the pandemic on our industry.

3.Furthermore, both ISS and Glass Lewis have selected other companies outside of the lodging industry as part of their methodology in determining pay for performance alignment which is measured on a relative basis. Many of these non-Company selected “peers” were less impacted by COVID-19 or in some cases even benefited from tailwinds directly attributed to the pandemic. To use these companies in analyzing Xenia’s pay for performance alignment does not provide an accurate or beneficial comparison to stockholders. Given the disparate impact of COVID-19 on the lodging and hospitality industry, we firmly believe that pay for performance alignment should be viewed in comparison solely to other companies within our industry for purposes of 2020 pay for performance alignment, or at the very least, comparisons made to other companies that were impacted similarly to Xenia. As displayed in the chart below, solely focusing on performance relative to all other lodging and hospitality REITs clearly shows that the Company provided the best shareholder return over the last five years.

4.The Glass Lewis report claims that a misalignment between pay and performance merits careful scrutiny and stockholders should carefully weigh the appropriateness of the Company's decisions regarding compensation awards in the context of this disconnect. However, we believe we have provided a compelling rationale for the compensation adjustments made in 2020 given the circumstances and the material impact of COVID-19 on the Company. The timeline below provides an overview of the events of 2020 as they unfolded over the course of the year against the backdrop of the impact that COVID-19 had on the Company’s share price. Over the course of 2020, the Compensation Committee met numerous times in order to fulfill its purpose of retaining and motivating this specific proven outperforming executive team. These thoughtful deliberations took place throughout the year and decisions were made with the information provided at that time. The decision to cancel the performance-based awards granted prior to the onset of COVID-19 and to replace those awards with time-based awards was made during a time which the Company’s share price was trading at an all-time low and with extreme volatility. This provided the management team with an incentive to continue to lead Xenia through the crisis and the potential for share appreciation over time. The Compensation Committee continues to believe that the adjustments made in 2020 were in the best interests of the stockholders and will ultimately benefit Xenia by fulfilling its philosophy and purpose of retaining and motivating the executive team.

5.While we recognize the importance of using Return on Assets, Return on Equity, and Return on Invested Capital for analyzing the performance of certain companies, we respectfully disagree with the use of these financial metrics for purposes of measuring Xenia’s performance given its status as a REIT. These financial measures are not widely used to evaluate REIT performance and do not accurately portray Company performance over time. Furthermore, the use of EBITDA and Cash Flow Growth on a one year basis (using solely 2020 results) in the context of such an unprecedented year of impact from COVID-19 also does not provide much utility in the context of measuring the overall long-term performance of the Company.

Again, we thank you for your interest and continued support in Xenia Hotels & Resorts, Inc., and respectfully request that you consider this letter when evaluating your vote for the Company’s Say on Pay in 2020. As stated in Xenia’s 2021 Proxy Statement, the Board of Directors unanimously recommends a vote “for” the Say on Pay proposal.

Sincerely,

|

|

|

|

|

|

|

|

|

|

|

Jeff H. Donahue

Lead Independent Director

|

|

Thomas M. Gartland

Chair, Compensation Committee

|

Forward-looking Statements

This letter contains forward-looking statements regarding Xenia’s current expectations within the meaning of the applicable securities laws and regulations. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the risks detailed in Xenia’s filings with the Securities and Exchange Commission, including the Risk Factors section of Xenia’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

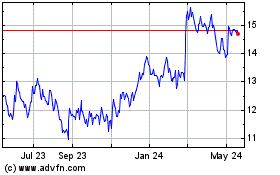

Xenia Hotels and Resorts (NYSE:XHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

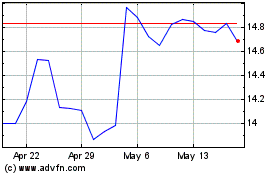

Xenia Hotels and Resorts (NYSE:XHR)

Historical Stock Chart

From Apr 2023 to Apr 2024