Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on February 20, 2020

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

W.W. Grainger, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

Illinois

(State or other jurisdiction of

incorporation or organization)

|

|

36-1150280

(I.R.S. Employer

Identification Number)

|

W.W. Grainger, Inc.

100 Grainger Parkway

Lake Forest, Illinois 60045

(847) 535-1000

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

John L. Howard

Senior Vice President & General Counsel

W.W. Grainger, Inc.

100 Grainger Parkway

Lake Forest, Illinois 60045

(847) 535-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

|

|

|

Copies to:

|

Hugo Dubovoy, Jr.

Vice President, Corporate Secretary

W.W. Grainger, Inc.

100 Grainger Parkway

Lake Forest, Illinois 60056

(847) 535-1000

|

|

Christopher M. Bartoli

Baker & McKenzie LLP

300 East Randolph Street, Suite 5000

Chicago, Illinois 60601

(312) 861-8000

|

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box: o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer ý

|

|

Accelerated filer o

|

|

Non-accelerated filer o

|

|

Smaller reporting company o

Emerging growth company o

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of Securities Act. o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to Be

Registered

|

|

Proposed Maximum

Offering Price Per

Unit

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee(1)

|

|

|

|

Debt Securities

|

|

(2)

|

|

(2)

|

|

(2)

|

|

(2)

|

|

|

-

(1)

-

In

accordance with Rules 456(b) and 457(r) under the Securities Act of 1933, as amended, the registrant is deferring payment of all of the registration fee.

-

(2)

-

An

indeterminate aggregate initial offering price of debt securities is being registered as may from time to time be offered at indeterminate prices. If any debt

securities are issued at an original issue discount, then the amount registered shall include the principal amount of such securities measured by the initial offering price thereof.

Table of Contents

PROSPECTUS

W.W. GRAINGER, INC.

Debt Securities

We may offer and sell from time to time our debt securities in one or more offerings. This prospectus provides you with a general description of the debt

securities we may offer.

Each

time that securities are sold using this prospectus, we will provide a supplement to this prospectus that contains specific information about the offering. The supplement may also

add to or update information contained in this prospectus. You should read this prospectus and the supplement carefully before you invest.

The

securities may be offered and sold to or through one or more underwriters, dealers, or agents, or directly to purchasers. The supplements to this prospectus will provide the specific

terms of the plan of distribution.

Investing in our securities involves risks. You should carefully read the risk factors described under the heading "Risk Factors" contained in

this prospectus on page 1 and any applicable prospectus supplement, and under similar headings in other documents that are incorporated by reference into this prospectus or any prospectus

supplement.

Neither the Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is February 20, 2020.

Table of Contents

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this prospectus, or any accompanying prospectus supplement or free writing

prospectus. "Incorporated by reference" means that we can disclose important information to you by referring you to another document filed separately with the SEC. We have not authorized any other

person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making, nor will we make, an offer to sell

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any accompanying prospectus supplement or free writing

prospectus is current only as of the dates on their respective covers. Our business, financial condition, results of operations, and prospects may have changed since those

dates.

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration statement that we filed with the SEC as a "well-known seasoned issuer" (as defined in

Rule 405 under the Securities Act of 1933, as amended (the "Securities Act")). By using an automatic shelf registration statement, we may, at any time and from time to time, sell debt

securities under this prospectus in one or more offerings in an unlimited amount. The rules and regulations of the SEC allow us to omit some of the information included in the registration statement

from this prospectus. For further information, we refer to the registration statement, including its exhibits. Statements contained in this prospectus about the provisions or contents of any agreement

or other documents are not necessarily complete. If the SEC's rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, see that agreement or

document for a complete description of these matters.

This

prospectus provides you with a general description of the debt securities that we may offer. Each time that securities are sold using this prospectus, we will provide a supplement

to this prospectus that

contains specific information about the offering. The prospectus supplement may also add, update or change information contained in this prospectus. If there is any inconsistency between the

information in this prospectus and the prospectus supplement, you should rely on the information in the prospectus supplement.

To

understand the terms of our debt securities, you should carefully read both this document and the applicable prospectus supplement or supplements. Together, they provide the specific

terms of the debt securities we are offering. You should also read the documents we have referred you to under "Where You Can Find More Information" for information on our company and our business,

properties, financial condition, results of operations, and prospects.

ABOUT THE REGISTRANT

W.W. Grainger, Inc., incorporated in the State of Illinois in 1928, is a broad line, business-to-business distributor of maintenance,

repair, and operating products and services with operations primarily in North America, Europe, and Japan.

Our

principal executive offices are located at 100 Grainger Parkway, Lake Forest, Illinois 60045, and our telephone number is (847) 535-1000. We maintain a website at www.grainger.com. Information

contained on, or accessible through, our website is not incorporated by reference into and does not constitute part of

this prospectus.

Unless

the context otherwise requires, references in this prospectus to "Grainger," "we," "us" and "our" refer to W.W. Grainger, Inc. and its subsidiaries, collectively.

RISK FACTORS

Investing in our securities involves risks. Such risks represent those risks and uncertainties that we believe are material to our business,

financial condition, and results of operations. You should carefully read the risk factors incorporated by reference from our

Annual Report on Form 10-K for the year ended

December 31, 2019, as well as the risks, uncertainties, and additional information (i) set forth in our SEC reports on Forms 10-K, 10-Q, and 8-K and in the other documents that we

file with the SEC after the date of this prospectus (and prior to the termination of the offering of securities under this prospectus), and which are incorporated by

reference in this prospectus, and (ii) the information contained in any applicable prospectus supplement. The occurrence of any of such risks might cause you to lose all or part of your

investment.

Some

statements in this prospectus and in the documents incorporated by reference in this prospectus constitute forward-looking statements. Please refer to the section captioned

"Cautionary Statement Regarding Forward-Looking Statements." Actual results could differ materially from those

1

Table of Contents

anticipated

in these forward-looking statements as a result of certain factors, including the risks described below and in the documents incorporated herein by reference.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein include certain statements that may be deemed to be "forward looking

statements" within the meaning of the Private Securities Litigation Reform Act of 1995, and are intended to be covered by the safe harbor provisions thereof. Statements that are not historical in

nature but concern forecasts of future results, business plans, analyses, prospects, strategies, objectives, and other matters may be deemed to be "forward-looking statements" under the federal

securities laws. Forward-looking statements can generally be identified by their use of terms such as "anticipate," "estimate," "believe," "expect," "could," "forecast," "may," "intend," "plan,"

"predict," "project," "will," or "would," and similar terms and phrases, including references to assumptions.

Grainger

cannot guarantee that any forward-looking statement will be realized and achievement of future results is subject to risks and uncertainties, many of which are beyond our

control, which could cause Grainger's results to differ materially from those that are presented.

Important

factors that could cause actual results to differ materially from those presented or implied in the forward-looking statements include, without limitation: higher product costs

or other expenses; a major loss of customers; loss or disruption of sources of supply; increased competitive pricing pressures; failure to develop or implement new technology initiatives or business

strategies; failure to adequately protect intellectual property or successfully defend against infringement claims; fluctuations or declines in our gross profit percentage; our responses to market

pressures; the outcome of pending and future litigation or governmental or regulatory proceedings, including with respect to wage and hour,

anti-bribery and corruption, environmental, advertising, product liability, safety or compliance, or privacy and cybersecurity matters; investigations, inquiries, audits, and changes in laws and

regulations; failure to comply with laws, regulations and standards; government contract matters; disruption of information technology or data security systems involving Grainger or third parties on

which we depend; general industry, economic, market, or political conditions; general global economic conditions including tariffs and trade issues and policies; currency exchange rate fluctuations;

market volatility, including volatility or price declines of our common stock; commodity price volatility; labor shortages; facilities disruptions or shutdowns; higher fuel costs or disruptions in

transportation services; pandemic diseases or viral contagions; natural and other catastrophes; unanticipated and/or extreme weather conditions; loss of key members of management; our ability to

operate, integrate, and leverage acquired businesses; changes in effective tax rates; changes in credit ratings or outlook; our incurrence of indebtedness and other factors identified under the

heading "Risk Factors" contained in this prospectus beginning on page 1 and any applicable prospectus supplement, and under similar headings in other documents that are incorporated by

reference into this prospectus or any prospectus supplement.

Caution

should be taken not to place undue reliance on Grainger's forward-looking statements and Grainger undertakes no obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or otherwise, except as required by law.

2

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting, proxy, and information requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"),

and are required to file periodic reports, proxy statements, and other information with the SEC. Our SEC filings are available to you on the SEC's website at www.sec.gov or on our website at

www.grainger.com.

Information

contained on, or accessible through, our website is not incorporated by reference into and does not constitute part of this prospectus, any prospectus supplement, or any

other documents we file with or furnish to the SEC.

INCORPORATION BY REFERENCE

The rules of the SEC allow us to incorporate by reference information into this prospectus. The information incorporated by reference is

considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. This prospectus incorporates by reference the

documents listed below (other than information in such documents that is deemed not to be filed):

All

documents filed by us pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of the offering of the

debt securities shall be deemed to be incorporated by reference and to be a part of this prospectus from the respective dates of filing of those documents. Current Reports on Form 8-K

containing only disclosures furnished under Item 2.02 or Item 7.01 of Form 8-K (including exhibits related thereto) are not incorporated by reference in this prospectus. Upon

request, we will provide without charge to each person to whom a copy of this prospectus has been delivered a copy of any and all filings incorporated by reference in this prospectus. You may request

a copy of these filings by writing or telephoning us at our principal executive offices:

W.W. Grainger, Inc., 100 Grainger Parkway, Lake Forest, Illinois 60045, Attention: Investor Relations, Telephone Number (847) 535-1000.

USE OF PROCEEDS

Unless the applicable prospectus supplement states otherwise, we intend to use the net proceeds from the sale of the offered securities for

working capital and other general corporate purposes, which may include the repayment of our indebtedness outstanding from time to time or repurchases of our common stock.

DESCRIPTION OF OUR DEBT SECURITIES

This section describes the general terms that will apply to any debt securities that we may offer under this prospectus. At the time that we

offer debt securities, we will describe in the prospectus supplement that relates to that offering (1) the specific terms of the debt securities and (2) the extent to which the general

terms described in this section apply to those debt securities.

The

debt securities are to be issued under an indenture, dated as of June 11, 2015 (as amended and supplemented, the "Indenture"), by and between W.W. Grainger, Inc. and

U.S. Bank National

3

Table of Contents

Association,

as trustee (the "trustee"). A copy of the Indenture is incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part. In the

discussion that follows, we summarize particular provisions of the Indenture. Our discussion of the Indenture provisions is not complete. You should read the Indenture for a more complete

understanding of the provisions we describe.

General

The Indenture provides that debt securities in an unlimited amount may be issued thereunder from time to time in one or more series. The debt

securities will be our senior unsecured obligations and will rank equally with our other senior unsecured indebtedness from time to time outstanding.

Each

prospectus supplement relating to a particular offering of debt securities will describe the specific terms of debt securities. Those specific terms will include the

following:

-

•

-

the title of the debt securities;

-

•

-

the purchase price of the debt securities;

-

•

-

any limit on the aggregate principal amount of the debt securities of a particular series;

-

•

-

whether any of the debt securities are to be issuable in permanent global form;

-

•

-

the date or dates on which the debt securities will mature;

-

•

-

the rate or rates at which the debt securities will bear interest, if any, or the formula pursuant to which such rate or rates shall be

determined, and the date or dates from which any such interest will accrue;

-

•

-

the payment dates on which interest, if any, on the debt securities will be payable and the record dates, if any;

-

•

-

any mandatory or optional sinking fund or analogous provisions;

-

•

-

each office or agency where, subject to the terms of the Indenture, the principal of and any premium and interest on the debt securities will

be payable and each office or agency where, subject to the terms of the Indenture, the debt securities may be presented for registration of transfer or exchange;

-

•

-

the date, if any, after which and the price or prices at which the debt securities may be redeemed, in whole or in part at the option of

Grainger or the holder of debt securities, or according to mandatory redemption provisions, and the other detailed terms and provisions of any such optional or mandatory redemption provisions;

-

•

-

the denominations in which any debt securities will be issuable, if other than denominations of $1,000 and any integral multiple of $1,000;

-

•

-

the portion of the principal amount of the debt securities, if other than the principal amount, payable upon acceleration of maturity;

-

•

-

the person who shall be the security registrar for the debt securities, if other than the trustee, the person who shall be the initial paying

agent, and the person who shall be the depositary; and

-

•

-

any other terms of the debt securities, including any additional events of default or covenants.

Except

as specifically described in this prospectus and in the applicable prospectus supplement with respect to any series of debt securities, the Indenture does not contain any

covenants designed to protect holders of the debt securities against a reduction in the creditworthiness of Grainger in the

4

Table of Contents

event

of a highly leveraged transaction or to prohibit other transactions which may adversely affect holders of the debt securities.

We

may issue debt securities as original issue discount securities to be sold at a substantial discount below their stated principal amounts. We will describe in the relevant prospectus

supplement any special U.S. federal income tax considerations that may apply to debt securities issued at such an original issue discount. Special U.S. tax considerations applicable to any debt

securities that are denominated in a currency other than U.S. dollars or that use an index to determine the amount of payments of principal of and any premium and interest on the debt securities will

also be set forth in a prospectus supplement.

Certain Covenants

Limitation on Liens

The Indenture provides that we will not and we will not permit any Restricted Subsidiary to create, incur, issue, assume, or guarantee any Debt

secured by a Lien upon any Principal Property or on the stock or Debt of any Restricted Subsidiary owned or held by us or another Restricted Subsidiary

unless:

This

limitation will not apply to any Debt secured by:

-

•

-

any Lien existing on the date of the Indenture;

-

•

-

any Lien in our favor or in favor of any Restricted Subsidiary;

-

•

-

any Lien existing on any asset of any entity at the time such entity becomes a Restricted Subsidiary or at the time such entity is merged or

consolidated with or into us or a Restricted Subsidiary, as long as such Lien does not attach to any of our or our Restricted Subsidiaries' other assets;

-

•

-

any Lien on any asset which exists at the time of the acquisition of the asset;

-

•

-

any Lien on any asset securing Debt incurred or assumed for the purpose of financing all or any part of the cost of acquiring or improving such

asset, if such Lien attaches to such asset concurrently with or within 180 days after its acquisition or improvement and the principal amount of the Debt secured by any such Lien, together with

all other Debt secured by a Lien on such property, does not exceed the purchase price of such property or the cost of such improvement;

-

•

-

any Lien incurred in connection with pollution control, industrial revenue, or any similar financing; or

-

•

-

any extension, renewal, substitution, or replacement of any of the Liens described above if the principal amount of the Debt secured thereby is

not increased and is secured by the same assets that secured the Lien immediately prior to such extension, renewal, substitution, or replacement.

5

Table of Contents

Limitations on Sale and Lease-Back Transactions

The Indenture provides that we will not and we will not permit any Restricted Subsidiary to enter into any Sale and Lease-Back Transaction. Such

limitation will not apply to any Sale and Lease-Back Transaction if:

-

•

-

we or such Restricted Subsidiary would be entitled to incur Debt secured by a Lien on the property to be leased as described under

"—Limitations on Liens"; or

-

•

-

within 180 days of the effective date of any such Sale and Lease-Back Transaction, we apply an amount equal to the greater of the net

proceeds of the transaction and the fair market value of the property so leased to the retirement of Funded Debt, other than Funded Debt we were otherwise obligated to repay within such 180-day

period.

Definitions

"Attributable Debt" means the present value, determined as set forth in the Indenture, of the

obligation of a lessee for rental payments for the remaining term of any lease.

"Consolidated Net Tangible Assets" means the total amount of our assets (less applicable reserves and other properly deductible items)

after deducting (i) all current liabilities (excluding liabilities that are extendable or renewable at the option of the obligor to a date more than 12 months after the date as of which

the amount is being determined), and (ii) all goodwill, trade names, trademarks, patents,

unamortized debt discount and expense, and other like intangible assets, all as set forth on our most recent consolidated balance sheet and determined in accordance with generally accepted accounting

principles.

"Debt" means any loans, notes, bonds, debentures, or similar evidences of indebtedness for money borrowed.

"Funded Debt" means all Debt which (i) has a final maturity, or a maturity renewable or extendable at the option of the issuer,

more than one year after the date as of which Funded Debt is to be determined, and (ii) ranks at least equally with the debt securities.

"Lien" means any mortgage, pledge, security interest, or other lien or encumbrance.

"Principal Property" means, as of any date, any building structure or other facility together with the underlying land and its fixtures,

used primarily for manufacturing, processing, production, or distribution, in each case located in the U.S., and owned or leased or to be owned or leased by us or any Restricted Subsidiary, and in

each case the net book value of which as of such date exceeds 2% of our Consolidated Net Tangible Assets as shown on the audited consolidated balance sheet contained in the latest annual report to our

stockholders, other than any such land, building, structure, or other facility or portion thereof which, in the opinion of our board of directors, is not of material importance to the business

conducted by us and our subsidiaries, considered as one enterprise.

"Restricted Subsidiary" means any subsidiary of ours which owns or leases a Principal Property.

"Sale and Lease-Back Transactions" means any arrangement with any person providing for the leasing by us or a Restricted Subsidiary of any

Principal Property that we or such Restricted Subsidiaries have sold or transferred or are about to sell or transfer to such person. However, the definition does not include temporary leases for a

term (including renewals) of not more than three years or transactions between us and a Restricted Subsidiary.

6

Table of Contents

Merger, Consolidation and Sale of Assets

The Indenture provides that we may consolidate or merge with or into any other corporation, and we may sell, lease, or convey all or

substantially all of our assets to any other corporation, in each case organized and existing under the laws of the U.S. or any U.S. state, provided that the corporation (if other than us) formed by

or resulting from any such consolidation or merger or which shall have received such assets shall expressly assume payment of the principal of (and premium, if any), any interest on and any additional

amounts payable with respect to, the debt securities and the performance and observance of all of the covenants and conditions of the Indenture to be performed or observed by us.

Events of Default, Waiver and Notice

An event of default with respect to any series of the debt securities is defined in the Indenture as

being:

-

•

-

default in payment of any interest on or any additional amounts payable in respect of the debt securities of that series which remains uncured

for a period of 30 days;

-

•

-

default in payment of principal of or premium, if any, on the debt securities of that series when due either at stated maturity, upon

redemption, by declaration of acceleration or otherwise;

-

•

-

our default in the performance or breach of any other covenant or agreement in the Indenture in respect of the debt securities of such series

which shall not have been remedied for a period of 60 days after notice;

-

•

-

the taking of certain actions by us or a court relating to our bankruptcy, insolvency, or reorganization; and

-

•

-

any other event of default provided in the Indenture with respect to debt securities of that series.

The

Indenture requires the trustee to give the holders of the debt securities notice of a default known to it within 90 days unless the default is cured or waived. However, the

Indenture provides that the trustee may withhold notice to the holders of the debt securities of any default with respect to any

series of the debt securities (except in payment of principal of, or interest on, or any additional amounts with respect to, the debt securities) if the trustee in good faith determines that it is in

the interest of the holders of the debt securities of such series to do so.

The

Indenture also provides that if an event of default (other than an event of default relating to our bankruptcy, insolvency or reorganization) shall have occurred and be continuing,

either the trustee or the holders of not less than 25% in principal amount of the outstanding debt securities of such series then may declare the principal amount of all the debt securities of that

series and interest accrued thereon, to be due and payable immediately.

Upon

certain conditions such declarations may be annulled and past defaults may be waived (except a continuing default in payment of principal of, or premium or interest on, the debt

securities) by the holders of a majority in principal amount of the outstanding debt securities of such series (or of all series, as the case may be).

If

an event of default under the Indenture relating to our bankruptcy, insolvency, or reorganization shall have occurred and is continuing, then the principal amount of all the

outstanding debt securities will automatically become due and payable immediately without any declaration or other act on the part of the trustee or any holder.

The

holders of a majority in principal amount of the outstanding debt securities of any series shall have the right to direct the time, method, and place of conducting any proceeding for

any remedy

7

Table of Contents

available

to the trustee or exercising any trust or power conferred on the trustee with respect to the debt securities of such series provided that such direction shall not be in conflict with any

rule of law or the Indenture and shall not be unduly prejudicial to the holders not taking part in such direction. If an event of default occurs and is continuing, then the trustee may in its

discretion (and subject to the rights of the holders to control remedies as described above) bring such judicial proceedings as the trustee shall deem necessary to protect and enforce the rights of

the holders of the debt securities.

The

Indenture provides that no holder of the debt securities of any series will have any right to institute any proceeding, judicial or otherwise, with respect to the Indenture for the

appointment of a receiver or trustee or for any other remedy thereunder unless:

-

•

-

that holder has previously given the trustee written notice of a continuing event of default;

-

•

-

the holders of not less than 25% in principal amount of the outstanding debt securities of that series have made written request to the trustee

to institute proceedings in respect of that event of default and have offered the trustee indemnity satisfactory to the trustee against costs, expenses, and liabilities incurred in complying with such

request; and

-

•

-

for 60 days after receipt of such notice, request, and offer of indemnity, the trustee has failed to institute any such proceeding and

no direction inconsistent with such request has been given to the trustee during such 60-day period by the holders of a majority in principal amount of the outstanding debt securities of that series.

Furthermore,

no holder will be entitled to institute any such action if such action would disturb or prejudice the rights of other holders.

However,

each holder has an absolute and unconditional right to receive payment when due and to bring a suit to enforce that right. We are required to furnish to the trustee under the

Indenture annually a statement as to performance or fulfillment of our obligations under the Indenture and as to any default in such performance or fulfillment.

Modification, Amendment and Waiver

Together with the trustee, we may, when authorized by our board of directors, modify the Indenture without the consent of the holders of the

debt securities for limited purposes, including, but not limited to, adding to our covenants or events of default, curing ambiguities, or correcting any defective provisions or making any other

provisions with respect to matters or questions arising under the Indenture that do not adversely affect the rights of the holders of the debt securities of any series in any material respect.

The

Indenture provides that we and the trustee may modify and amend the Indenture with the consent of the holders of a majority in principal amount of the outstanding debt securities of

each series affected by the modification or amendment, provided that no such modification or amendment may, without the consent of the holder of each outstanding debt security affected by the

modification or amendment:

-

•

-

change the stated maturity of the principal of, or any installment of interest on or any additional amounts payable with respect to, any debt

security or change the redemption price;

-

•

-

reduce the principal amount of, or interest on, any debt security or reduce the amount of principal which could be declared due and payable

prior to the stated maturity;

-

•

-

impair the right to enforce any payment on or after the stated maturity or redemption date;

-

•

-

change the place or currency of any payment of principal or interest on any debt

security;

8

Table of Contents

-

•

-

reduce the percentage in principal amount of the outstanding debt securities of any series, the consent of whose holders is required to modify

or amend the Indenture;

-

•

-

reduce the percentage of outstanding debt securities necessary to waive any past default to less than a majority;

-

•

-

modify the provisions in the Indenture relating to adding provisions or changing or eliminating provisions of the Indenture or modifying rights

of holders of debt securities to waive defaults under the Indenture; or

-

•

-

adversely affect the right to repayment of the debt securities at the option of the holders.

Except

with respect to certain fundamental provisions, the holders of at least a majority in principal amount of outstanding debt securities of any series may, with respect to such

series, waive past defaults under the Indenture.

Satisfaction and Discharge

We may be discharged from our obligations under the Indenture when all of the debt securities not previously delivered to the trustee for

cancellation have either matured or will mature or be redeemed within one year and we deposit with the trustee enough cash or U.S. government obligations to pay all the principal, interest, and any

premium due to the stated maturity date or redemption date of such debt securities.

Governing Law

The Indenture and the debt securities issued thereunder will be governed by, and will be construed in accordance with, the laws of the State of

New York. The Indenture is subject to the provisions of the Trust Indenture Act of 1939, as amended.

The Trustee

U.S. Bank National Association is the trustee under the Indenture.

Book-Entry Securities

Unless otherwise indicated in the prospectus supplement, the debt securities will be issued in the form of one or more fully registered global

notes that will be deposited with, or on behalf of, The Depository Trust Company ("DTC"), New York, New York and registered in the name of DTC or its nominee, Cede & Co., or such other

name as may be requested by an authorized representative of DTC. Global notes are not exchangeable for definitive certificates except in the specific circumstances described below. For purposes of

this prospectus, "Global Note" refers to the Global Note or Global Notes representing an entire issue of debt securities. So long as DTC, or its nominee, is the registered owner of a Global Note, DTC

or the nominee, as the case may be, will be considered the sole owner or holder of such debt securities under the Indenture.

Except

as provided below, you will not be entitled to have debt securities registered in your name, will not receive or be entitled to receive physical delivery of debt securities in

definitive form, and will not be considered the owner or holder thereof under the Indenture.

Except

as set forth below, a Global Note may be transferred, in whole or in part, only to another nominee of DTC or to a successor of DTC or its nominee.

DTC

has advised us that it is:

-

•

-

a limited-purpose trust company organized under New York Banking Law;

9

Table of Contents

-

•

-

a "banking organization" within the meaning of the New York Banking Law;

-

•

-

a member of the Federal Reserve System;

-

•

-

a "clearing corporation" within the meaning of the New York Uniform Commercial Code; and

-

•

-

a "clearing agency" registered pursuant to the provisions of Section 17A of the Exchange Act.

DTC

holds securities that its participants ("Direct Participants") deposit with DTC and facilitates the post-trade settlement of transactions among Direct Participants in such securities

through electronic computerized book-entry transfers and pledges between Direct Participants' accounts, thereby eliminating the need for physical movement of securities certificates. Direct

Participants include U.S. and non-U.S. securities brokers and dealers, banks, trust companies, clearing corporations, and certain other organizations. DTC is a wholly-owned subsidiary of The

Depository Trust & Clearing Corporation ("DTCC"). DTCC is owned by the users of its regulated subsidiaries. Access to the DTC system is also

available to others, such as securities brokers and dealers, banks, and trust companies that clear transactions through or maintain a custodial relationship with a Direct Participant, either directly

or indirectly ("Indirect Participants"). The rules applicable to DTC and its participants are on file with the SEC. More information about DTC can be found at www.dtcc.com.

Purchases

of debt securities under the DTC system must be made by or through Direct Participants, which will receive a credit for the debt securities on DTC's records. The ownership

interest of each actual purchaser of each debt security will be recorded on the Direct and Indirect Participants' records. These beneficial owners will not receive written confirmation from DTC of

their purchase, but beneficial owners are expected to receive written confirmations providing details of the transaction, as well as periodic statements of their holdings, from the Direct or Indirect

Participants through which the beneficial owner entered into the transaction. Transfers of ownership interests in the debt securities are to be accomplished by entries made on the books of Direct and

Indirect Participants acting on behalf of beneficial owners. Beneficial owners will not receive certificates representing their ownership interests in debt securities, except in the event that use of

the book-entry system for the debt securities is discontinued.

To

facilitate subsequent transfers, all debt securities deposited by Direct Participants with DTC are registered in the name of DTC's partnership nominee, Cede & Co., or

such other name as may be requested by an authorized representative of DTC. The deposit of debt securities with DTC and their registration in the name of Cede & Co. or such other DTC

nominee will not change the beneficial ownership of the debt securities. DTC has no knowledge of the actual beneficial owners of the debt securities; DTC's records reflect only the identity of the

Direct Participants to whose accounts such debt securities are credited, which may or may not be the beneficial owners. The Direct and Indirect Participants will remain responsible for keeping account

of their holdings on behalf of their customers.

Conveyance

of notices and other communications by DTC to Direct Participants, by Direct Participants to Indirect Participants, and by Direct Participants and Indirect Participants to

beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

Redemption

notices will be sent to DTC. If less than all of the debt securities of a series are being redeemed, DTC's practice is to determine by lot the amount of the interest of each

Direct Participant in such series to be redeemed.

In

any case where a vote may be required with respect to the debt securities of any series, neither DTC nor Cede & Co. (nor any other DTC nominee) will consent or vote with

respect to such debt securities unless authorized by a Direct Participant in accordance with DTC's MMI Procedures. Under its usual procedures, DTC mails an omnibus proxy to Grainger as soon as

possible after the record date. The omnibus proxy assigns Cede & Co.'s consenting or voting rights to those Direct Participants

10

Table of Contents

to

whose accounts the debt securities of the series are credited on the record date (identified in the listing attached to the omnibus proxy).

Principal

and interest payments, if any, on the debt securities will be made to Cede & Co, as nominee of DTC, or such other nominee as may be requested by an authorized

representative of DTC. DTC's practice is to credit Direct Participants' accounts, upon DTC's receipt of funds and corresponding detail information from Grainger or the trustee, on the applicable

payment date in accordance with their respective holdings shown on DTC's records. Payments by participants to beneficial owners will be governed by standing instructions and customary practices, as is

the case with securities held for the accounts of customers in bearer form or registered in "street name," and will be the responsibility of such participant and not of DTC, Grainger or the trustee,

subject to any statutory or regulatory requirements as may be in effect from time to time. Payment of principal and interest to Cede & Co. (or such other nominee as may be requested by

an authorized representative of DTC) is the responsibility of us or the trustee. Disbursement of payments from Cede & Co. to Direct Participants is DTC's responsibility. Disbursements of

payments to beneficial owners are the responsibility of Direct and Indirect Participants.

In

any case where we have made a tender offer for the purchase of any debt securities, a beneficial owner must give notice through a participant to a tender agent to elect to have its

debt securities purchased or tendered. The beneficial owner must deliver debt securities by causing the Direct Participants to transfer the participant's interest in the debt securities, on DTC's

records, to a tender agent. The requirement for physical delivery of debt securities in connection with an optional tender or a mandatory purchase is satisfied when the ownership rights in the debt

securities are transferred by Direct Participants on DTC's records and followed by a book-entry credit of tendered debt securities to the tender agent's DTC account.

We

obtained the information in this section concerning DTC and DTC's book-entry system from sources that we believe to be reliable, but we take no responsibility for the accuracy of this

information.

If

at any time DTC or any successor depository for the debt securities of any series notifies us that it is unwilling or unable to continue as the depository for the debt securities of

such series, or if at any time DTC or such successor depository shall no longer be a clearing agency registered under the Exchange Act and any other applicable statute or regulation, we will be

obligated to appoint another depository for the debt securities of such series. If another depository is not appointed by us within 90 days after we receive such notice, definitive certificates

will be issued in exchange for the Global Note representing the debt securities of that series.

We

may at any time in our sole discretion determine that the debt securities of any series shall no longer be represented by the Global Note, in which case definitive certificates will

be issued in exchange for the Global Note representing the debt securities of that series.

PLAN OF DISTRIBUTION

We may offer and sell the securities that may be offered pursuant to this prospectus to or through one or more underwriters, dealers, and

agents, or directly to purchasers, on a continuous or delayed basis. We will set forth in the applicable prospectus supplement a description of the specific plan of distribution of the securities that

may be offered pursuant to this prospectus.

EXPERTS

The consolidated financial statements incorporated in this prospectus by reference from our Annual Report on Form 10-K, and the

effectiveness of W.W. Grainger, Inc.'s internal control over financial reporting as of December 31, 2019 have been audited by Ernst & Young LLP, an independent registered

public accounting firm, as set forth in their reports thereon, which are incorporated herein

11

Table of Contents

by

reference. Such consolidated financial statements have been so incorporated in reliance on their reports given on their authority as experts in accounting and auditing.

LEGAL MATTERS

The validity of the debt securities offered by this prospectus will be passed upon by Baker & McKenzie LLP, Chicago, Illinois, on

behalf of Grainger.

12

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses payable by the registrant in connection with the sale of the securities being registered

hereby.

|

|

|

|

|

|

|

|

Amount to

be Paid

|

|

|

SEC Registration fee

|

|

|

|

(1)

|

|

Printing

|

|

|

|

*

|

|

Legal fees and expenses

|

|

|

|

*

|

|

Trustee fees

|

|

|

|

*

|

|

Accounting fees and expenses

|

|

|

|

*

|

|

Miscellaneous

|

|

|

|

*

|

|

|

|

|

|

|

|

TOTAL

|

|

|

|

*

|

-

(1)

-

Applicable

SEC registration fees have been deferred in reliance upon Rule 456(b) and Rule 457(r) under the Securities Act and are not presently

determinable.

-

*

-

Not

presently determinable.

Item 15. Indemnification of Officers and Directors.

(a) Section 8.75

of the Illinois Business Corporation Act of 1983, as amended, provides that a corporation shall have the power to indemnify any person who was or is

a party or is threatened to be made a party to any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative, or investigative (other than an action by or

in the right of the corporation) by reason of the fact that he or she is or was a director, officer, employee, or agent of the corporation, or who is or was serving at the request of the corporation

as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise, against expenses (including attorneys' fees), judgments, fines, and amounts

paid in settlement actually and reasonably incurred by such person in connection with such action, suit, or proceeding, provided that such person acted in good faith and in a manner he or she

reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or proceeding, had no reasonable cause to believe his or her conduct was

unlawful. Under certain circumstances, such section permits a corporation to indemnify its directors, officers, employees, and agents against expenses actually and reasonably incurred in connection

with the defense or settlement of shareholder derivative actions. Such section also provides that the corporation may purchase insurance on behalf of any such director, officer, employee, or agent.

(b) Grainger's

Bylaws provide that Grainger shall indemnify the directors and officers of Grainger under the circumstances described in the preceding paragraph, subject,

except in the case of defense expenses, to a finding by Grainger's Board of Directors, a designated committee thereof, its shareholders or, under certain circumstances, independent legal counsel that

the applicable standard of conduct has been met.

(c) Grainger

has entered into Indemnification Agreements with each of its directors and certain of its officers providing that Grainger shall indemnify the directors and

officers under the circumstances described in paragraph (a) above, subject, except in the case of defense expenses, to a finding by any appropriate person or body consisting of a member or

members of Grainger's Board of Directors or any other person or body appointed by the Board of Directors who is not a party to the particular

II-1

Table of Contents

claim

for which the director or officer is seeking indemnification or independent legal counsel that the applicable standard of conduct has been met.

(d) Under

an insurance policy maintained by Grainger, the directors and officers of Grainger are insured, within the limits and subject to the limitations of the policy,

against certain expenses in connection with the liabilities that might be imposed as a result of claims, actions, suits, or proceedings that may be brought against them by reason of being or having

been such directors or officers.

Item 16. Exhibits.

EXHIBIT INDEX

|

|

|

|

|

|

|

1.1

|

*

|

Underwriting Agreement relating to debt securities issued by the registrant.

|

|

|

|

|

|

|

|

4.1

|

(1)

|

Indenture, dated as of June 11, 2015, by and between W.W. Grainger, Inc. and U.S. Bank National Association, as

trustee.

|

|

|

|

|

|

|

|

4.2

|

(1)

|

First Supplemental Indenture, dated as of June 11, 2015, by and between W.W. Grainger, Inc. and U.S. Bank

National Association, as trustee.

|

|

|

|

|

|

|

|

4.3

|

(2)

|

Second Supplemental Indenture, dated as of May 16, 2016, by and between W.W. Grainger, Inc. and U.S. Bank

National Association, as trustee.

|

|

|

|

|

|

|

|

4.4

|

(3)

|

Third Supplemental Indenture, dated as of May 22, 2017, by and between W.W. Grainger, Inc. and U.S. Bank

National Association, as trustee.

|

|

|

|

|

|

|

|

5.1

|

|

Opinion of Baker & McKenzie LLP, counsel for the registrant, as to the validity of the debt securities of the registrant.

|

|

|

|

|

|

|

|

23.1

|

|

Consent of Ernst & Young LLP.

|

|

|

|

|

|

|

|

23.2

|

|

Consent of Baker & McKenzie LLP (included in Exhibit 5.1).

|

|

|

|

|

|

|

|

24.1

|

|

Powers of Attorney (included on the signature page).

|

|

|

|

|

|

|

|

25.1

|

|

Statement of Eligibility on Form T-1 under the Trust Indenture Act of 1939, as amended, of U.S. Bank National Association.

|

-

*

-

To

be filed, if necessary, by a post-effective amendment to this registration statement or incorporated by reference pursuant to a Current Report on Form 8-K in

connection with an offering of securities.

-

(1)

-

Incorporated

by reference to W.W. Grainger, Inc.'s Current Report on Form 8-K filed with the SEC on June 11, 2015

-

(2)

-

Incorporated

by reference to W.W. Grainger, Inc.'s Current Report on Form 8-K filed with the SEC on May 16, 2016

-

(3)

-

Incorporated

by reference to W.W. Grainger, Inc.'s Current Report on Form 8-K filed with the SEC on May 22, 2017

II-2

Table of Contents

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may

be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the

maximum aggregate offering price set forth in the "Calculation of Registration Fee" table in the effective registration statement; and

(iii) to

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such

information in the registration statement;

provided, however, that subparagraphs (i), (ii) and (iii) do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that

are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That,

for purposes of determining any liability under the Securities Act to any purchaser:

(i) Each

prospectus filed by a registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was

deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating

to an offering made pursuant to Rule 415(a)(l)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be

part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in

the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a

new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a

registration statement or prospectus that is part of the registration

II-3

Table of Contents

statement

or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a

time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made

in any such document immediately prior to such effective date.

(5) That,

for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the undersigned

registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities

to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be

considered to offer or sell such securities to such purchaser:

(i) Any

preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii) The

portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided

by or on behalf of an undersigned registrant; and

(iv) Any

other communication that is an offer in the offering made by an undersigned registrant to the purchaser.

(6) That,

for purposes of determining any liability under the Securities Act, each filing of our annual report pursuant to Section 13(a) or Section 15(d) of

the Exchange Act (and, where applicable, each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the

registration statement shall be deemed to be a new registration statement relating to the securities offered in this registration statement, and the offering of those securities at that time shall be

deemed to be the initial bona fide offering thereof.

(7) Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling persons of each registrant pursuant

to the provisions described under Item 15 above, or otherwise, the registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the

Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by a registrant of expenses incurred or paid by a

director, officer or controlling person in the successful defense of any action, suit, or proceeding) is asserted by any such director, officer, or controlling person in connection with the securities

being registered, that registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether

such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

(8) That,

for purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this registration

statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be

deemed to be part of this registration statement as of the time it was declared effective.

(9) That,

for the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

II-4

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Lake Forest,

State of Illinois, on February 20, 2020.

|

|

|

|

|

|

|

|

|

|

|

W.W. Grainger, Inc.

|

|

|

By:

|

|

/s/ D.G. MACPHERSON

|

|

|

|

|

|

Name:

|

|

D.G. Macpherson

|

|

|

|

|

|

Title:

|

|

Chairman and Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints each of D.G. Macpherson, Thomas B. Okray and Eric R. Tapia such person's true

and lawful attorney-in-fact and agent, with full and several power of substitution, for him or her and his or her name, place and stead, in any and all capacities, to sign any and all amendments

(including post-effective amendments) to this registration statement, and all other documents in connection therewith (including registration statements filed pursuant to Rule 462(b) of the

Securities Act of 1933), and to file the same, with all exhibits thereto, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them full power and

authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person,

hereby ratifying and confirming all that said attorneys-in-fact and agents or any of them, or their substitutes, may lawfully do or cause to be done.

Pursuant

to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ D.G. MACPHERSON

D.G. Macpherson

|

|

Chairman and Chief Executive Officer (Principal Executive Officer and Director)

|

|

February 20, 2020

|

/s/ THOMAS B. OKRAY

Thomas B. Okray

|

|

Senior Vice President and Chief Financial Officer (Principal Financial Officer)

|

|

February 20, 2020

|

/s/ ERIC R. TAPIA

Eric R. Tapia

|

|

Vice President and Controller (Principal Accounting Officer)

|

|

February 20, 2020

|

/s/ RODNEY C. ADKINS

Rodney C. Adkins

|

|

Director

|

|

February 20, 2020

|

II-5

Table of Contents

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ BRIAN P. ANDERSON

Brian P. Anderson

|

|

Director

|

|

February 20, 2020

|

/s/ V. ANN HAILEY

V. Ann Hailey

|

|

Director

|

|

February 20, 2020

|

/s/ STUART L. LEVENICK

Stuart L. Levenick

|

|

Director

|

|

February 20, 2020

|

/s/ NEIL S. NOVICH

Neil S. Novich

|

|

Director

|

|

February 20, 2020

|

/s/ BEATRIZ R. PEREZ

Beatriz R. Perez

|

|

Director

|

|

February 20, 2020

|

/s/ MICHAEL J. ROBERTS

Michael J. Roberts

|

|

Director

|

|

February 20, 2020

|

/s/ E. SCOTT SANTI

E. Scott Santi

|

|

Director

|

|

February 20, 2020

|

/s/ JAMES D. SLAVIK

James D. Slavik

|

|

Director

|

|

February 20, 2020

|

/s/ LUCAS E. WATSON

Lucas E. Watson

|

|

Director

|

|

February 20, 2020

|

II-6

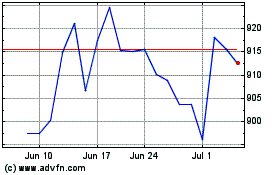

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

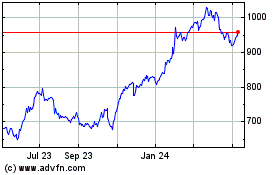

WW Grainger (NYSE:GWW)

Historical Stock Chart

From Apr 2023 to Apr 2024