UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

|

☐

|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

☒

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended 31 December 2020

OR

|

☐

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

☐

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company

report

For the transition period from to

Commission file number 001-38303

WPP

plc

(Exact Name of Registrant as specified in its charter)

Jersey

(Jurisdiction of incorporation or organization)

Sea Containers, 18 Upper Ground

London, United Kingdom, SE1 9GL

(Address of principal executive offices)

Andrea Harris

Group Chief Counsel

Sea Containers, 18 Upper Ground, London, United Kingdom, SE1 9GL

Telephone: +44(0) 20 7282 4600

E-mail:

andrea.harris@wpp.com

(Name, Telephone, E-mail and/or Facsimile number and Address of

Company Contact Person)

Securities registered or to be registered

pursuant to Section 12(b) of the Act.

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol (s)

|

|

Name of each exchange on which registered

|

|

Ordinary Shares of 10p each

American Depositary Shares, each

representing five Ordinary

Shares (ADSs)

|

|

WPP

WPP

|

|

London Stock Exchange

New York Stock Exchange

|

Securities registered or to

be registered pursuant to Section 12(g) of the Act.

Not applicable

(Title of Class)

Not applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the

Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the

issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

At December 31, 2020, the number of outstanding ordinary shares was 1,225,332,142 which included at such date ordinary shares represented by 13,240,935 ADSs.

Indicate by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act.

YES ☒ NO ☐

If this report is an annual or transition report, indicate by check mark if

the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

YES ☐ NO ☒

Note – Checking the box above will not relieve any registrant required

to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit and post such files).

YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in

Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

Non-accelerated filer

|

|

☐

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to

Section 13(a) of the Exchange Act.

|

|

†

|

|

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards

Codification after April 5, 2012.

|

Indicate by

check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act

(15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☒

Indicate by

check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

|

|

|

|

|

U.S. GAAP ☐

|

|

International Financial Reporting Standards as issued by the

International Accounting Standards Board ☒

|

|

Other ☐

|

If “Other” has been checked in

response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES ☐ NO ☒

TABLE OF CONTENTS

Forward-Looking Statements

In connection with the provisions of the U.S. Private Securities Litigation

Reform Act of 1995 (the ‘Reform Act’), the Company may include forward-looking statements (as defined in the Reform Act) in oral or written public statements issued by or on behalf of the Company. These forward-looking statements may

include, among other things, plans, objectives, beliefs, intentions, strategies, projections and anticipated future economic performance based on assumptions and the like that are subject to risks and uncertainties. These statements can be

identified by the fact that they do not relate strictly to historical or current facts. They use words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’,

‘plan’, ‘believe’, ‘target’, and other words and similar references to future periods but are not the exclusive means of identifying such statements. As such, all forward-looking statements involve risk and uncertainty

because they relate to future events and circumstances that are beyond the control of the Company. Actual results or outcomes may differ materially from those discussed or implied in the forward-looking statements. Therefore, you should not rely on

such forward-looking statements, which speak only as of the date they are made, as a prediction of actual results or otherwise. Important factors which may cause actual results to differ include but are not limited to: the impact of outbreaks,

epidemics or pandemics, such as the Covid-19 pandemic and ongoing challenges and uncertainties posed by the Covid-19 pandemic for businesses and governments around the world; the unanticipated loss of a material client or key personnel; delays or

reductions in client advertising budgets; shifts in industry rates of compensation; regulatory compliance costs or litigation; changes in competitive factors in the industries in which we operate and demand for our products and services; our

inability to realise the future anticipated benefits of acquisitions; failure to realise our assumptions regarding goodwill and indefinite lived intangible assets; natural disasters or acts of terrorism; the Company’s ability to attract new

clients; the UK’s exit from the EU; the risk of global economic downturn; technological changes and risks to the security of IT and operational infrastructure, systems, data and information resulting from increased threat of cyber and other

attacks; the Company’s exposure to changes in the values of other major currencies (because a substantial portion of its revenues are derived and costs incurred outside of the UK); and the overall level of economic activity in the

Company’s major markets (which varies depending on, among other things, regional, national and international political and economic conditions and government regulations in the world’s advertising markets). In addition, you should consider

the risks described in Item 3D, captioned “Risk Factors,” which could also cause actual results to differ from forward-looking information. In light of these and other uncertainties, the forward-looking statements included in this document

should not be regarded as a representation by the Company that the Company’s plans and objectives will be achieved. Neither the Company, nor any its directors, officers or employees, provides any representation, assurance or guarantee that the

occurrence of any events anticipated, expressed or implied in any forward-looking statements will actually occur. The Company undertakes no obligation to update or revise any such forward-looking statements, whether as a result of new information,

future events or otherwise.

PART I

|

ITEM 1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

Not applicable.

|

ITEM 2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

Not applicable.

Overview

WPP plc and its subsidiaries (WPP) is a leading worldwide creative transformation organisation offering national and multinational clients a comprehensive range of communications, experience, commerce and

technology services. At 31 December 2020, the Group, excluding associates, had 99,830 employees. For the year ended 31 December 2020, the Group had revenue of £12,002.8 million and operating loss of £2,278.1 million.

1

Unless the context otherwise requires, the terms “Company”, “Group” and

“Registrant” as used herein shall also mean WPP.

A. Selected Financial Data

[Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The Company is subject to a variety of possible risks that could adversely

impact its revenues, results of operations, reputation or financial condition. Some of these risks relate to the industries in which the Company operates while others are more specific to the Company. The table below sets out principal risks the

Company has identified that could adversely affect it. See also the discussion of Forward-Looking Statements preceding Item 1.

|

|

|

|

|

|

|

|

Principal risk

|

|

Potential impact

|

|

Covid-19 Pandemic

|

|

|

|

The coronavirus pandemic negatively impacted our business, revenues, results of operations,

financial condition and prospects in 2020. The extent of the continued impact of the Covid-19 pandemic on our business will depend on numerous factors that we are not able to accurately predict, including the

duration and scope of the pandemic, government actions to mitigate the effects of the pandemic and the intermediate and long-term impact of the pandemic on our clients’ spending plans.

|

|

The Covid-19 pandemic and the measures to contain its

spread, may have a continuing adverse effect on our business, revenues, results of operations and financial condition and prospects.

|

|

|

|

|

Strategic risks

|

|

|

|

The failure to successfully complete the strategic plan updated in December 2020 to return the

business to growth and simplify our structure.

|

|

A failure or delay in implementing or realising the benefits from the transformation plan and/or

returning the business to growth may have a material adverse effect on our market share and our business, revenues, results of operations, financial condition or prospects.

|

|

|

|

|

Operational risks

|

|

|

|

|

|

|

Clients

|

|

|

|

We compete for clients in a highly competitive industry which has been evolving and undergoing

structural change, now accelerated by the Covid-19 pandemic. Client loss to competitors or as a consequence of client consolidation, insolvency or a reduction in marketing budgets due to recessionary economic

conditions or a shift in client spending would have a material adverse effect on our market share, business, revenues, results of operations, financial condition and prospects.

|

|

The competitive landscape in our industry is constantly evolving and the role of traditional

agencies is being challenged. Competitors include multinational advertising and marketing communication groups, marketing services companies, database marketing information and measurement, social media and professional services and consultants and

consulting internet companies.

Client contracts can generally be

terminated on 90 days’ notice or are on an assignment basis and clients put their business up for competitive review from time to time. The ability to attract new clients and to retain or increase the amount of work from existing clients may be

impacted if we fail to react quickly enough to changes in the market and to evolve our structure, and by loss of reputation, and may be limited by clients’ policies on conflicts of interest.

|

2

|

|

|

|

|

|

|

|

Principal risk

|

|

Potential impact

|

|

|

|

There are a range of different impacts on our clients globally as a consequence of the Covid-19 pandemic. In the past, clients have responded to weak economic and financial conditions by reducing or shifting their marketing budgets which are easier to reduce in the short term than their other

operating expenses.

|

|

We receive a significant portion of our revenues from a limited number of large clients and the

net loss of one or more of these clients could have a material adverse effect on our prospects, business, financial condition and results of operations.

|

|

A relatively small number of clients contribute a significant percentage of our consolidated

revenues. Our ten largest clients accounted for 16% of revenues in the year ended 31 December 2020. Clients can reduce their marketing spend, terminate contracts, or cancel projects on short notice. The loss of one or more of our largest

clients, if not replaced by new accounts or an increase in business from existing clients, would adversely affect our financial condition.

|

|

|

|

|

People, culture and succession

|

|

|

|

Our performance could be adversely affected if we do not react quickly enough to changes in our

market and fail to attract, develop and retain key creative, commercial, technology and management talent, or are unable to retain and incentivise key and diverse talent.

|

|

We are highly dependent on the talent, creative abilities and technical skills of our people as

well as their relationships with clients. We are vulnerable to the loss of people to competitors (traditional and emerging) and clients, leading to disruption to the business.

|

|

|

|

|

Cyber and information security

|

|

|

|

We are undertaking a series of IT transformation programmes to support the Group’s

strategic plan and a failure or delay in implementing the IT programmes may have a material adverse effect on its business, revenues, results of operations, financial conditions or prospects. The Group is reliant on third parties for the performance

of a significant portion of our worldwide information technology and operations functions. A failure to provide these functions could have an adverse effect on our business. During the transformation, we are still reliant on legacy systems which

could restrict our ability to change rapidly.

A cyber-attack

could result in disruption to one or more of our businesses or the security of data being compromised.

|

|

We may be subject to investigative or enforcement action or legal claims or incur fines,

damages, or costs and client loss if we fail to adequately protect data. A system breakdown or intrusion could have a material adverse effect on our business, revenues, results of operations, financial condition or prospects and have an impact on

long-term reputation and lead to client loss.

A significant

number of the Group’s people are working remotely as a consequence of the Covid-19 pandemic which has the potential to increase the risk of compromised data security and cyber-attacks.

|

|

|

|

|

Financial risks

|

|

|

|

|

|

|

Credit risk

|

|

|

|

We are subject to credit risk through the default of a client or other counterparty.

|

|

We are generally paid in arrears for our services. Invoices are typically payable within 30 to

60 days.

We commit to media and production purchases on behalf of

some of our clients as principal or agent depending on the client and market circumstances. If a client is unable to pay sums due, media and production companies may look to us to pay those amounts and there could be an adverse effect on our working

capital and operating cash flow.

|

|

|

|

|

Internal controls

|

|

|

|

Our performance could be adversely impacted if we failed to ensure adequate internal control

procedures are in place.

We have identified material weaknesses

in our internal control over financial reporting that, if not properly remediated, could adversely affect our results of operations, investor confidence in the Group and the market price of our ADSs and ordinary shares.

|

|

Failure to ensure that our businesses have robust control environments, or that the services we

provide and trading activities within the Group are compliant with client obligations, could adversely impact client relationships and business volumes and revenues.

As disclosed in Item 15, in connection with the Group’s assessment of

the effectiveness of internal control over financial reporting as of December 31, 2020, we identified material weaknesses in our internal control over financial reporting with respect to management’s review of the impairment assessment of

intangible assets and goodwill (specifically the selection of appropriate discount rates for use in the impairment calculations, the determination of the appropriateness of the cash flow

|

3

|

|

|

|

|

|

|

|

Principal risk

|

|

Potential impact

|

|

|

|

periods and associated discounting and determination of the assumptions in respect of working

capital cash flows, in each case used in the impairment calculation); the design and implementation of internal controls to ensure that the complex accounting matters and judgements are assessed against the requirements of IFRS and to reflect

changes in the applicable accounting standards and interpretations or changes in the underlying business on a timely basis; and our net investment hedging arrangements (specifically concerning the eligibility of hedging relationships under IFRS, the

adequacy and maintenance of contemporaneous documentation of the application of hedge accounting, and the review of the impact of changes in internal financing structures on such hedging relationships). As a result of such material weaknesses, we

concluded that our internal control over financial reporting was not effective.

If remedial measures are insufficient to address the material weaknesses, or if additional material weaknesses in internal control are discovered or occur in the future, our ability to accurately record,

process and report financial information and consequently, our ability to prepare financial statements within required time periods, could be adversely affected. In addition, the Group may be unable to maintain compliance with the federal securities

laws and NYSE listing requirements regarding the timely filing of periodic reports. Any of the foregoing could cause investors to lose confidence in the reliability of our financial reporting, which could have a negative effect on the trading price

of the Group’s ADSs and ordinary shares.

|

|

|

|

|

Compliance risks

|

|

|

|

|

|

|

Data Privacy

|

|

|

|

We are subject to strict data protection and privacy legislation in the jurisdictions in which

we operate and rely extensively on information technology systems. We store, transmit and rely on critical and sensitive data such as strategic plans, personally identifiable information and trade secrets:

- Security of

this type of data is exposed to escalating external threats that are increasing in sophistication, as well as internal data breaches.

- Data transfers between our global operating companies, clients or vendors may be

interrupted due to changes in law (eg EU adequacy decisions, CJEU Schrems II decision)

|

|

We may be subject to investigative or enforcement action or legal claims or incur fines,

damages, or costs and client loss if we fail to adequately protect data or observe privacy legislation in every instance:

- A system breakdown or intrusion could have a material adverse effect on our business,

revenues, results of operations, financial condition or prospects

- Restrictions or limitations on international data transfers could have an adverse effect on our business and operations.

|

|

|

|

|

Taxation

|

|

|

|

We may be subject to regulations restricting our activities or effecting changes in taxation.

|

|

Changes in local or international tax rules, for example as a consequence of the financial

support programmes implemented by governments during the Covid-19 pandemic, changes arising from the application of existing rules, or challenges by tax or competition authorities, may expose us to significant

additional tax liabilities or impact the carrying value of our deferred tax assets, which would affect the future tax charge.

|

|

Regulatory

|

|

|

|

We are subject to strict anti-corruption, anti-bribery and anti-trust legislation and enforcement in the countries in which we

operate.

|

|

We operate in a number of markets where the corruption risk has been identified as high by

groups such as Transparency International. Failure to comply or to create a culture opposed to corruption or failing to instil business practices that prevent corruption could expose us to civil and criminal sanctions.

|

4

|

|

|

|

|

|

|

|

Principal risk

|

|

Potential impact

|

|

|

|

|

Sanctions

|

|

|

|

We are subject to the laws of the United States, the EU and other jurisdictions that impose

sanctions and regulate the supply of services to certain countries.

|

|

Failure to comply with these laws could expose us to civil and criminal penalties including

fines and the imposition of economic sanctions against us and reputational damage and withdrawal of banking facilities which could materially impact our results.

|

|

Civil liabilities or judgements against the Company or its directors or officers based on United States federal or state securities laws may

not be enforceable in the United States or in England and Wales or in Jersey.

|

|

The Company is a public limited company incorporated under the laws of Jersey. Some of the

Company’s directors and officers reside outside of the United States. In addition, a substantial portion of the directly owned assets of the Company are located outside of the United States. As a result, it may be difficult or impossible for

investors to effect service of process within the United States against the Company or its directors and officers or to enforce against them any of the judgements, including those obtained in original actions or in actions to enforce judgements of

the United States courts, predicated upon the civil liability provisions of the federal or state securities laws of the United States.

|

|

|

|

|

Emerging risks

|

|

|

|

Increased frequency of extreme weather and climate-related natural disasters.

|

|

This includes storms, flooding, wildfires and water and heat stress which can damage our

buildings, jeopardise the safety of our people and significantly disrupt our operations. At present 10% of our headcount is located in countries at “extreme” risk from the physical impacts of climate change in the next 30 years.

|

|

Increased reputational risk associated with working on environmentally detrimental client briefs and/or misrepresenting environmental

claims.

|

|

As consumer consciousness around climate change rises, our sector is seeing increased scrutiny

of our role in driving unsustainable consumption. Our clients seek expert partners who can give recommendations that take into account stakeholder concerns around climate change.

Additionally, WPP serves some clients whose business models are under

increased scrutiny, for example oil and gas companies or associated industry groups who are not actively decarbonising. This creates both a reputational and related financial risk for WPP if we are not rigorous in our content standards as we grow

our sustainability-related services.

|

|

ITEM 4.

|

INFORMATION ON THE COMPANY

|

WPP is a leading worldwide creative transformation company offering national and multinational clients a comprehensive range of communications,

experience, commerce and technology services. The Company provides these services through a number of established global, multinational and national operating companies that are organised into three reportable segments. The largest reportable

segment is Global Integrated Agencies, which accounted for approximately 78% of the Company’s revenues in 2020. The remaining 22% of our revenues were derived from the reportable segments of Public Relations and Specialist Agencies.

Excluding associates, the Company currently employs 100,000 people in 111 countries.

The Company’s ordinary shares are admitted to the Official List of the UK Listing Authority and trade on the London Stock Exchange and American Depositary Shares (which are evidenced by American

Depository Receipts (ADRs) or held in book-entry form) representing deposited ordinary shares are listed on the New York Stock Exchange (NYSE). At 31 December 2020 the Company had a market capitalisation of approximately

£9.803 billion.

The Company’s executive office is

located at Sea Containers, 18 Upper Ground, London, United Kingdom, SE1 9GL, Tel:+44 (0)20 7282 4600 and its registered office is located at 13 Castle Street, St Helier, Jersey, JE1 1ES.

5

A. History and Development of the Company

WPP plc was incorporated in Jersey on 25 October 2012 under the name

WPP 2012 plc.

On 2 January 2013, under a scheme of

arrangement between WPP 2012 Limited (formerly known as WPP plc), (Old WPP), the former holding company of the Group, and its share owners pursuant to Article 125 of the Companies (Jersey) Law 1991, and as sanctioned by the Royal Court of Jersey

(the Jersey Court), a Jersey incorporated and United Kingdom tax resident company, WPP 2012 plc became the new parent company of the WPP Group and adopted the name WPP plc. Under the scheme of arrangement, all the issued shares in Old WPP were

cancelled and the same number of new shares were issued to WPP plc in consideration for the allotment to share owners of one share in WPP plc for each share in Old WPP held on the record date, 31 December 2012. Citibank, N.A., depositary for

the ADSs representing Old WPP shares, cancelled Old WPP ADSs held in book-entry uncertificated form in the direct registration system maintained by it and issued ADSs representing shares of WPP plc in book entry uncertificated form in the direct

registration system maintained by it to the holders. Holders of certificated ADSs, or ADRs, of Old WPP were entitled to receive ADSs of WPP plc upon surrender of the Old WPP ADSs, or ADRs, to the Depositary. Each Old WPP ADS represented five shares

of Old WPP and each WPP plc ADS represents five shares of WPP plc.

Pursuant to Rule 12g-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act), WPP plc succeeded

to Old WPP’s registration and periodic reporting obligations under the Exchange Act.

Old WPP was incorporated in Jersey on 12 September 2008 and became the holding company of the WPP Group on 19 November 2008 when the company now known as WPP 2008 Limited, the prior holding

company of the WPP Group which was incorporated in England and Wales, completed a reorganisation of its capital and corporate structure. WPP 2008 Limited had become the holding company of the Group on 25 October 2005 when the company now known

as WPP 2005 Limited, the original holding company of the WPP Group, completed a reorganisation of its capital and corporate structure. WPP 2005 Limited was incorporated and registered in England and Wales in 1971 and is a private limited company

under the Companies Act 1985, and until 1985 operated as a manufacturer and distributor of wire and plastic products. In 1985, new investors acquired a significant interest in WPP and changed the strategic direction of the Company from being a wire

and plastic products manufacturer and distributor to being a multinational communications services organisation. Since then, the Company has grown both organically and by the acquisition of companies, most significantly the acquisitions of J. Walter

Thompson Group, Inc. (now known as Wunderman Thompson LLC) in 1987, The Ogilvy Group, Inc. (now known as The Ogilvy Group LLC) in 1989, Young & Rubicam Inc. (now known as Young & Rubicam LLC) in 2000, Tempus Group plc (Tempus) in

2001, Cordiant Communications Group plc (Cordiant) in 2003, Grey Global Group, LLC (Grey) in 2005, 24/7 Real Media Inc (now known as Xaxis LLC) in 2007, Taylor Nelson Sofres plc (TNS) in 2008, AKQA Holdings, Inc. (AKQA) in 2012, IBOPE

Participações Ltda (IBOPE) in 2015, Triad Digital Media, LLC and the merger of most of the Group’s Australian and New Zealand assets with STW Communications Group Limited in Australia

(re-named WPP AUNZ Limited) in 2016. During 2018, the Company focused on simplifying its organisation with the completion of the merger of VML and Y&R to create VMLY&R as well as the merger of

Burson-Marsteller and Cohn & Wolfe to create Burson Cohn & Wolfe. The merger of Wunderman and J. Walter Thompson to create Wunderman Thompson began at the end of 2018 and was finalized in 2019. In July 2019, the Company entered

into an agreement to sell 60% of the Kantar group to Bain Capital Private Equity. The transaction was completed with respect to the sale of approximately 90% of the Kantar group in December 2019. Completion of the sale of the remaining approximately

10% of the Kantar group occurred in 2020. In November 2020, the Company submitted a proposal to the Board of WPP AUNZ to pursue an acquisition of the remaining shares in WPP AUNZ. WPP currently holds a stake of approximately 61.5% of the share

capital of WPP AUNZ, which is listed on the Australian Securities Exchange (ASX:WPP). The proposed acquisition is in line with WPP’s global strategy of simplifying its structure and will move WPP to 100% ownership and control of its Australian

and New Zealand operations. The proposal of A$0.70 per share in cash, which was accepted by WPP AUNZ in December 2020 and approved by shareholders of WPP AUNZ in April 2021, is subject to customary conditions (including regulatory approvals) and, if

implemented, is expected to be completed in 2021.

6

The Company received £13.3 million, £1,917.0 million and £440.3 million

related to acquisitions and disposals in 2020, 2019 and 2018, respectively, including proceeds on disposal of investments and subsidiaries, payments in respect of earnout payments resulting from acquisitions in prior years and net of cash and cash

equivalents disposed. For the same periods, cash spent on purchases of property, plant and equipment and other intangible assets was £272.7 million, £394.1 million and £375.2 million, respectively, and cash spent on

share repurchases and buybacks was £290.2 million, £43.8 million and £207.1 million, respectively.

The Company is subject to the informational requirements of the Exchange Act. In accordance with these requirements, the Company files reports and other

information with the United States Securities and Exchange Commission. You may read and copy any materials filed with the SEC at www.sec.gov that contains reports, proxy statements and other information regarding registrants that file electronically

with the SEC. The Company’s Form 20-F is also available on the Company’s website, www.wpp.com.

B. Business Overview

Introduction

Certain Non-GAAP measures included in this business overview and in the operating and financial review and prospects have been derived from amounts calculated in

accordance with IFRS but are not themselves IFRS measures. They should not be viewed in isolation as alternatives to the equivalent IFRS measure, rather they should be read in conjunction with the equivalent IFRS measure. These include constant

currency, pro-forma (‘like-for-like’), headline operating profit, headline PBIT (Profit Before Interest and Taxation),

headline PBT (Profit Before Taxation), billings and estimated net new business/billings, free cash flow and net debt and average net debt, which we define, explain the use of and reconcile to the nearest IFRS measure on pages 25 to 29.

Management believes that these measures are both useful and

necessary to present herein because they are used by management for internal performance analyses; the presentation of these measures facilitates comparability with other companies, although management’s measures may not be calculated in the

same way as similarly titled measures reported by other companies; and these measures are useful in connection with discussions with the investment community.

The Company is a leading worldwide creative transformation organisation offering national and multinational clients a comprehensive range of

communications, experience, commerce and technology services.

A

key element of our strategy is to align our technology capabilities more closely with our creative expertise, and to simplify WPP through the creation of fewer, stronger, integrated agencies. In 2020, we announced we would bring AKQA and Grey

together within AKQA Group, and move Geometry into VMLY&R to create VMLY&R Commerce, a new end-to-end creative commerce agency. These moves follow the creation of Wunderman Thompson and VMLY&R in prior years. In 2020 we also announced

changes within our public relations business, bringing together three of our agencies to form Finsbury Glover Hering, a leading global strategic communications and public affairs firm.

Global Integrated Agencies

The principal functions of integrated agencies are the planning and creation of marketing, branding campaigns, design and production of advertisements

across all media, and media buying services including strategy & business development, media investment, data & technology and content. In 2020, WPP’s integrated agency networks included Ogilvy, VMLY&R, Wunderman Thompson,

Grey, GroupM and Hogarth. Following the alignment of AKQA and Grey and the creation of VMLY&R Commerce, from January 2021 AKQA and VMLY&R Commerce will be reported within Global Integrated Agencies.

7

Public Relations

WPP’s public relations companies advise clients who are seeking to

communicate with a range of stakeholders from consumers to governments and the business and financial communities. They include Burson Cohn & Wolfe (BCW), Hill+Knowlton Strategies, as well as Finsbury Glover Hering.

Specialist Agencies

Our specialist agencies provide services by region or type. In 2020, they

included AKQA, GTB, Landor & Fitch and Superunion. From January 2021, AKQA will be reported within Global Integrated Agencies.

The following tables show, for the last three fiscal years, reported revenue and revenue less pass-through costs from continuing operations attributable

to each reportable segment in which the Company operates.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue1

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

|

|

£m

|

|

|

% of

total

|

|

|

£m

|

|

|

% of

total

|

|

|

£m

|

|

|

% of

total

|

|

|

Global Integrated Agencies

|

|

|

9,302.5

|

|

|

|

77.5

|

|

|

|

10,205.2

|

|

|

|

77.1

|

|

|

|

9,930.7

|

|

|

|

76.1

|

|

|

Public Relations

|

|

|

892.9

|

|

|

|

7.4

|

|

|

|

956.5

|

|

|

|

7.2

|

|

|

|

931.7

|

|

|

|

7.1

|

|

|

Specialist Agencies

|

|

|

1,807.4

|

|

|

|

15.1

|

|

|

|

2,072.4

|

|

|

|

15.7

|

|

|

|

2,184.3

|

|

|

|

16.8

|

|

|

Total

|

|

|

12,002.8

|

|

|

|

100.0

|

|

|

|

13,234.1

|

|

|

|

100.0

|

|

|

|

13,046.7

|

|

|

|

100.0

|

|

|

1

|

|

Intersegment sales have not been separately disclosed as they are not material.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue less pass-through

costs1

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

|

|

£m

|

|

|

% of

total

|

|

|

£m

|

|

|

% of

total

|

|

|

£m

|

|

|

% of

total

|

|

|

Global Integrated Agencies

|

|

|

7,318.5

|

|

|

|

75.0

|

|

|

|

8,108.1

|

|

|

|

74.7

|

|

|

|

8,070.8

|

|

|

|

74.2

|

|

|

Public Relations

|

|

|

854.4

|

|

|

|

8.7

|

|

|

|

898.0

|

|

|

|

8.3

|

|

|

|

879.9

|

|

|

|

8.1

|

|

|

Specialist Agencies

|

|

|

1,589.1

|

|

|

|

16.3

|

|

|

|

1,840.4

|

|

|

|

17.0

|

|

|

|

1,925.0

|

|

|

|

17.7

|

|

|

1

|

|

Revenue less pass-through costs is revenue less media and other pass-through costs. Pass-through costs comprise fees paid to external suppliers where

they are engaged to perform part or all of a specific project and are charged directly to clients, predominantly media costs. See note 3 to the consolidated financial statements for more details of the pass-through costs.

|

The following tables show, for the last three

fiscal years, reported revenue and revenue less pass-through costs from continuing operations attributable to each geographic area in which the Company operates and demonstrates the Company’s regional diversity.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue1

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

|

|

£m

|

|

|

% of

total

|

|

|

£m

|

|

|

% of

total

|

|

|

£m

|

|

|

% of

total

|

|

|

North America2

|

|

|

4,464.9

|

|

|

|

37.3

|

|

|

|

4,854.7

|

|

|

|

36.7

|

|

|

|

4,851.7

|

|

|

|

37.2

|

|

|

United Kingdom

|

|

|

1,637.0

|

|

|

|

13.6

|

|

|

|

1,797.1

|

|

|

|

13.6

|

|

|

|

1,785.6

|

|

|

|

13.7

|

|

|

Western Continental Europe

|

|

|

2,441.6

|

|

|

|

20.3

|

|

|

|

2,628.8

|

|

|

|

19.8

|

|

|

|

2,589.6

|

|

|

|

19.8

|

|

|

Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe

|

|

|

3,459.3

|

|

|

|

28.8

|

|

|

|

3,953.5

|

|

|

|

29.9

|

|

|

|

3,819.8

|

|

|

|

29.3

|

|

|

Total

|

|

|

12,002.8

|

|

|

|

100.0

|

|

|

|

13,234.1

|

|

|

|

100.0

|

|

|

|

13,046.7

|

|

|

|

100.0

|

|

|

1

|

|

Intersegment sales have not been separately disclosed as they are not material.

|

|

2

|

|

North America includes the United States with revenue of £4,216.1 million (2019: £4,576.5 million, 2018:

£4,576.1 million).

|

8

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue less pass-through

costs1

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

|

|

£m

|

|

|

% of

total

|

|

|

£m

|

|

|

% of

total

|

|

|

£m

|

|

|

% of

total

|

|

|

North America2

|

|

|

3,743.4

|

|

|

|

38.4

|

|

|

|

4,034.3

|

|

|

|

37.2

|

|

|

|

4,059.7

|

|

|

|

37.3

|

|

|

United Kingdom

|

|

|

1,233.8

|

|

|

|

12.6

|

|

|

|

1,390.1

|

|

|

|

12.8

|

|

|

|

1,393.8

|

|

|

|

12.8

|

|

|

Western Continental Europe

|

|

|

2,019.4

|

|

|

|

20.7

|

|

|

|

2,176.4

|

|

|

|

20.1

|

|

|

|

2,182.9

|

|

|

|

20.1

|

|

|

Asia Pacific, Latin America, Africa & Middle East and Central & Eastern Europe

|

|

|

2,765.4

|

|

|

|

28.3

|

|

|

|

3,245.7

|

|

|

|

29.9

|

|

|

|

3,239.3

|

|

|

|

29.8

|

|

|

1

|

|

Revenue less pass-through costs is revenue less media and other pass-through costs. Pass-through costs comprise fees paid to external suppliers where

they are engaged to perform part or all of a specific project and are charged directly to clients, predominantly media costs. See note 3 to the consolidated financial statements for more details of the pass-through costs.

|

|

2

|

|

North America includes the United States with revenue less pass-through costs of £3,524.8 million (2019: £3,806.3 million, 2018:

£3,836.0 million).

|

WPP Head

Office

The central functions of WPP, with principal offices

in London and New York, are to develop the strategy of the Company, coordinate the provision of services to cross-Company clients, perform a range of cross-Company functions in areas such as new business, talent recruitment and development,

training, IT, finance, audit, legal affairs, mergers & acquisitions (M&A), property, sustainability, investor relations and communications, promote best practice in areas such as our agencies’ approach to diversity and inclusion,

drive operating efficiencies and monitor the financial performance of WPP’s operating companies.

Our strategy

It has been two years since we set out our strategy to return WPP to growth. We have made significant progress, with stronger agency brands, new

leadership, a simpler structure and a strong balance sheet. The results were evident in our industry-leading new business performance in 2020.

The events of 2020 have only accelerated the structural changes in our industry, from the expansion of digital channels to growing demand for ecommerce

solutions. The actions that we have taken have positioned us well, and we are already working with 76 of our top 100 clients on ecommerce. There are significant new growth opportunities for WPP as clients demand simple, integrated solutions that

combine creativity with technology and data expertise. Clients need trusted partners more than ever to help them transform and succeed.

In December 2020, we held a Capital Markets Day to provide an update on progress and to outline our plans to accelerate our growth. We aim to return our

communications business to sustainable growth and invest further in the high-growth areas of commerce, experience and technology. A new transformation programme will make us more effective and efficient as we share expertise across a simpler company

of stronger agency brands. We are targeting approximately £600 million of cost savings by 2025, of which £400 million will be used to fund investment in the capabilities and technology that will drive future growth for our

people, our clients, our agencies, and our shareholders.

The five

elements of our corporate strategy are:

|

|

•

|

|

Vision & Offer. A vision developed with our people and clients and a modern offer to meet the needs of our clients in a rapidly changing

market.

|

|

|

•

|

|

Creativity. A renewed commitment to creativity, WPP’s most important competitive advantage.

|

|

|

•

|

|

Data & Technology. Harnessing the strength of marketing and advertising technology, and our unique partnerships with leading technology firms.

|

|

|

•

|

|

Simpler Structure. Reducing complexity and making sure our clients can access the best resources from across the Company.

|

9

|

|

•

|

|

People & Culture. Investment in our people, culture and values to ensure WPP is the natural home for the best and brightest talent.

|

Sustainability

We have set a new sustainability strategy that directs us to use the power

of creativity to build better futures for our people, planet, clients and communities. It sets out the action we are taking to make sure we are the employer of choice for all people – a company where a sense of belonging is felt by everyone,

and our differences are celebrated. And it shows how we are tackling the greatest environmental challenges we face, committing to reach net zero carbon emissions across our value chain by 2030.

We know our clients also recognise these challenges and are looking for

support and advice. That is why we are increasing our skills and capacity to assist them to make the transition to a sustainable and inclusive world. As an employer of 100,000 people in more than 100 countries, we are using our unique convening

power and global partnerships to effect positive change for society as a whole. That is why we are proud to partner with the United Nations, especially the World Health Organization and UN Women, to provide our skills in creativity, communications,

data and technology to support them as they support the world.

There has never been a better time to seize the opportunities before us. We are determined to do our very best to realise this potential.

Our sustainability strategy is aligned to all five elements of our corporate

strategy:

Sustainability at the heart of our offer for clients: A growing number of clients are embracing inclusion, diversity and sustainability and looking to articulate the purpose of their brands. They look for

partners who share their sustainability values and aspirations. Our commitment to responsible and sustainable business practices helps us to broaden and deepen these partnerships, and to meet the growing expectations and sustainability requirements

in client procurement processes.

Social investment: Our pro bono work can make a significant difference to charities and

non-governmental organisations (NGOs), enabling our partners to raise awareness and funds, recruit members, and achieve campaign objectives. Pro bono work benefits our business too, providing rewarding

creative opportunities for our people that often result in award-winning campaigns that raise the profile of our companies.

Diverse, equitable and inclusive teams: Diversity and difference powers creativity. We foster an inclusive culture across WPP: one that is

equitable, tolerant and respectful of diverse thoughts and individual expression. We want all of our people to feel valued and able to fulfil their potential, regardless of background, lived experience, sex, gender, race and ethnicity, thinking

style, sexual orientation, age, religion, disability, family status and so much more.

Privacy and data ethics: Data – including consumer data – can play an essential role in our work for clients. Data security and privacy are increasingly high-profile topics for regulators,

consumers and our clients. We have a responsibility to look after this data carefully, to collect data only when needed and with consent where required, and to store and transfer data securely.

Greener office space: Our work to simplify our structure and consolidate our office space is driving a positive impact on our energy use and carbon footprint. We continue to move employees into Campuses,

closing multiple smaller sites and replacing them with fewer, larger, more environmentally friendly buildings that offer modern, world-class workspaces.

10

Shared values across our business and supply chain: Strong employment policies, investment in skills and inclusive working practices help us recruit, motivate and develop the talented people we need to

serve our clients in all disciplines across our locations. Selecting suppliers and partners who adopt standards consistent with our own can reduce costs, improve efficiency and protect our reputation.

Clients

|

|

•

|

|

Recognising our clients’ growing focus on sustainable products and practices, we continue to strengthen our offer to ensure we can provide our

clients with the best support and the expertise they need to deliver against their own sustainability ambitions. For example, in 2020 we became a founding member of AdGreen – alongside clients and partners including Google, Sky and Unilever

– an initiative to unite the advertising industry to eliminate the negative environmental impacts of production.

|

|

|

•

|

|

We have established a Diversity Review Panel to provide a forum to escalate concerns around potentially offensive or culturally insensitive work and

receive guidance and advice designed to ensure those concerns are appropriately addressed. Our new Inclusive Marketing Playbook and resource library codifies inclusive marketing principles and best practice for communications, marketing and new

business projects to train and equip our client leads for the complexity of this issue.

|

People

|

|

•

|

|

We spent £19.7 million on training in 2020.

|

|

|

•

|

|

At year-end 2020, women comprised 40% of the WPP Board and Executive leadership roles, 51% of Senior Managers,

and 55% of total employees.

|

Environment

|

|

•

|

|

WPP is a member of RE100 and has committed to sourcing 100% of its electricity from renewable sources by 2025. In 2020, we purchased 65% of our

electricity from renewable sources, including 100% of electricity purchased in the United States and, for the first time, in Canada, UK and most European markets.

|

|

|

•

|

|

During the year, the Covid-19 pandemic increased global demand for

single-use plastics. We remain committed to phasing out plastics that cannot be reused, recycled or composted across all of our offices and Campuses worldwide. To give our offices – many of which were

unoccupied for much of 2020 – time to adjust to new safety requirements and consumption patterns, we have extended our timeline to December 2021. We are applying a new level of rigour to how we source products to ensure they comply with our

Circular Economy Plastics Policy.

|

|

|

•

|

|

Our scope 1 and 2 market-based emissions per full-time employee for 2020 were 0.52 tonnes of

CO2e/head. This represents a 37% reduction from 2019 of 0.82

tonnes of CO2e/head. The 2019 figures have been restated due

to the integration of new best practice carbon emissions reporting and data reviews upon joining RE100.

|

Social investment

|

|

•

|

|

Our pro bono work was worth £12.6 million in 2020 for clients including UN Women and World Health Organization. We also made cash donations

to charities of £4.3 million, resulting in a total social investment worth £16.9 million. This is equivalent to 1.6% of headline profit before tax.

|

|

|

•

|

|

WPP media agencies negotiated free media space worth £59.3 million on behalf of pro bono clients.

|

Clients

The Group works with 325 of the Fortune Global 500, all 30 of the Dow Jones 30, 62 of the NASDAQ 100, and 61 of the FTSE 100.

11

The Company’s 10 largest clients accounted for 16% of the Company’s revenues in the year ended

31 December 2020. No client of the Company represented more than 5% of the Company’s aggregate revenues in 2020. The Group’s companies have maintained long-standing relationships with many of their clients, with an average length of

relationship for the top 10 clients of approximately 50 years.

Government Regulation

From time to time, governments, government agencies and industry self-regulatory bodies in the United States, European Union and other countries in which

the Company operates have adopted statutes, regulations, and rulings that directly or indirectly affect the form, content, and scheduling of advertising, public relations and public affairs, and market research, or otherwise limit the scope of the

activities of the Company and its clients. Some of the foregoing relate to privacy and data protection and general considerations such as truthfulness, substantiation and interpretation of claims made, comparative advertising, relative

responsibilities of clients and advertising, public relations and public affairs firms, and registration of public relations and public affairs firms’ representation of foreign governments.

There has been a trend towards expansion of specific rules, prohibitions,

media restrictions, labeling disclosures and warning requirements with respect to advertising for certain products, such as over-the-counter drugs and pharmaceuticals,

cigarettes, food and certain alcoholic beverages, and to certain groups, such as children. Though the Company does not expect any existing or proposed regulations to have a material adverse impact on the Company’s business, the Company is

unable to estimate the effect on its future operations of the application of existing statutes or regulations or the extent or nature of future regulatory action.

IT

We have established the WPP Risk Sub-committee focusing on data privacy, security and

ethics. Co-chaired by WPP’s Chief Privacy Officer and Chief Information Officer, the Sub-committee consists of representation from across the security, technology

and data leadership. The Sub-committee is responsible for reviewing and monitoring the Group’s approach to regulatory and legal compliance, as well as monitoring data privacy, ethics and security risk.

This Sub-committee is pivotal in our approach to our own and our clients’ data, as well as contributing to our overall strategy.

2020 saw the first full-increment version of the WPP Data Privacy &

Security Charter. Bringing together our related policies, the Charter communicates our approach to data, setting out core principles for responsible data management through our Data Code of Conduct, our technology, privacy and social media policies,

and our security standards (based on ISO 27001).

In 2019, we

launched the revised data protection and privacy “Safer Data” training as part of the relaunch of the WPP How We Behave training. Completed by all staff, the new training completely overhauls the content and delivery. This training is

augmented by subject-focused training, where required, covering specific regulations, regional laws or activities undertaken by our agencies.

Our annual Data Health Checker provides us with insight into how data is used, stored and transferred and helps to identify any parts of the business that

need further support on data practices. The results show us that the majority of our agencies continue to have mitigation measures that match or exceed their level of privacy risk, with the average risk score being 1.6 out of five, where five is the

maximum score possible and indicates maximum risk.

C. Organizational Structure

The Company’s business comprises the provision of creative

transformation services on a national, multinational and global basis. It operates in 111 countries (including associates). For a list of the Company’s subsidiary undertakings and their country of incorporation see Exhibit 8.1 to this Form 20-F.

12

D. Property, Plant and Equipment

The majority of the Company’s properties are leased, although certain

properties which are used mainly for office space are owned. Owned properties are in Latin America (principally in Argentina, Brazil, Chile, Mexico, Peru and Puerto Rico), Asia (India and China) and in Europe (Spain and UK). Principal leased

properties, which include office space at the following locations:

|

|

|

|

|

|

|

|

|

Location

|

|

Use

|

|

Approximate

square footage

|

|

|

3 World Trade Center, New York, NY

|

|

GroupM, Mindshare, Wavemaker, Mediacom, Essence, Xaxis, Kinetic, WPP, Wunderman Thompson, AKQA, Finance+,

WPP-IT

|

|

|

690,000

|

|

|

636 Eleventh Avenue, New York, NY

|

|

Hogarth, MJM, SET (89% vacant held for disposition)

|

|

|

564,000

|

|

|

399 Heng Feng Road, Zhabei, Shanghai

|

|

Ogilvy, GroupM, Wavemaker, Mediacom, Mindshare, VMLY&R Commerce, Hill+Knowlton Strategies, Global Team Blue, Sudler MDS, Burson

Cohn & Wolfe, Peclars, Hogarth, Wunderman Thompson, Superunion, Kinetic

|

|

|

488,000

|

|

|

Calle de Ríos Rosas, 26, Madrid

|

|

GroupM, Grey, WPP Health & Wellness, Ogilvy, Hill+Knowlton Strategies, Burson Cohn & Wolfe, Axicom, WPP, Lambie Nairn,

Finance +, Superunion, SCPF, VMLY&R, Wunderman Thompson

|

|

|

382,402

|

|

|

The Orb Adjacent to JW Marriott Sahar, Chatrapati Shivaji International Airport, Andheri East, Mumbai

|

|

GroupM, Wavemaker, Mindshare, Mediacom, Kinetic, Ogilvy, Grey, Wunderman Thompson, Hill+Knowlton Strategies, Landor & Fitch,

VMLY&R, Genesis Burson Cohn & Wolfe, WPP

|

|

|

375,000

|

|

|

3 Columbus Circle, New York, NY

|

|

VMLY&R, VMLY&R Commerce, Berlin Cameron, CMI, Taxi, Red Fuse, VMLY&Rx

|

|

|

374,000

|

|

|

200 Fifth Avenue and 23 West 23rd Street, New York, NY

|

|

Grey, Ogilvy, Burson Cohn & Wolfe, Landor & Fitch, GCI Health, SJR, Superunion

|

|

|

349,000

|

|

|

Tower B, DLF Cyber Park, Gurugram

|

|

GroupM, Wavemaker, Mindshare, Mediacom, Ogilvy, Wunderman Thompson, Hogarth, Grey, Global Team Blue, AKQA, ADK, WPP

|

|

|

340,000

|

|

|

971 Mofarrej Avenue, Sao Paulo

|

|

Ogilvy, Wunderman Thompson, VMLY&R, VMLY&R Commerce, Grey, AKQA, David, Mirum, GTB, Fbiz, Blinks Essence, Jussi, Possible, Enext,

Try, PmWeb, Foster, Mutato, Burson Cohn & Wolfe, Hill+Knowlton Strategies, Hogarth (Estimated Occupancy Q4 2024)

|

|

|

311,927

|

|

|

333 North Green Street, Chicago, IL

|

|

Burson Cohn & Wolfe, Branding, VMLY&R Commerce, GroupM, Hill+Knowlton Strategies, Kinetic, Ogilvy, VMLY&R, Wunderman

Thompson, Hogarth, WBA

|

|

|

265,108

|

|

|

125 Queens Quay, Toronto

|

|

GroupM, Ogilvy, Wunderman Thompson, VMLY&R, Grey, Hill+Knowlton Strategies (Estimated Q3 2022 Occupancy)

|

|

|

258,053

|

|

|

Sea Containers House, Upper Ground, London SE1

|

|

Ogilvy, Wavemaker, WPP

|

|

|

226,000

|

|

|

550 Town Center Drive, Dearborn, MI

|

|

Global Team Blue, PRISM, Burrows, POSSIBLE, VMLY&R

|

|

|

217,900

|

|

The Company considers its properties, owned

or leased, to be in good condition and generally suitable and adequate for the purposes for which they are used. At 31 December 2020, the fixed asset value (cost less depreciation) representing land, freehold buildings and leasehold buildings

as reflected in the Company’s consolidated financial statements was £613.7 million.

In 2020, we added three new Campuses in Chicago, Hong Kong and Rome, taking the total to 20. Before the end of 2021 we expect to open a further 11 sites. Under our simplification strategy, we expect to

locate 85% of our people in Campuses by 2025, compared to 33% today, and a reduction in our office space requirements of between 15% and 20%.

See note 13 to the consolidated financial statements for a schedule by years of lease payments as at 31 December 2020.

|

ITEM 4A.

|

UNRESOLVED STAFF COMMENTS

|

Not applicable.

|

ITEM 5.

|

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

As introduced on page 7, certain

Non-GAAP measures are included in the operating and financial review and prospects.

13

A. Operating Results

Overview

WPP is a creative transformation company with a service offering that allows us to meet the present and future needs of our

clients. Our business model is client-centric, and we leverage resource and skills across our internal structures to provide the best possible service. The Company offers services in three reportable segments:

|

|

•

|

|

Global Integrated Agencies;

|

In 2020, approximately 78% of the Company’s consolidated revenues from continuing operations were derived from Global Integrated Agencies, with the

remaining 22% of its revenues being derived from the remaining two segments.

The following discussion is based on the Company’s audited consolidated financial statements beginning on page F-1 of this report. The Group’s

consolidated financial statements have been prepared in accordance with IFRS as issued by the IASB.

2020 was a tough year for everyone, including our people as they faced the personal and professional challenges of Covid-19. Since March 16 last year, most of

them have been working, for most of the time, from their homes – and dealing with all the difficulties this brings. Their commitment to our clients, support for one another and contribution to the communities we serve have been a constant

source of inspiration and pride.

Our Company’s performance

has been remarkably resilient, thanks to the efforts of our people and the demonstrable value of what we do for our clients. While revenues were significantly impacted as clients reduced spending, particularly in the second quarter, our performance

exceeded our own expectations and those of the market throughout the year.

The actions taken during 2018 and 2019 to streamline and simplify WPP, and the reduction in our debt to sustainable levels meant that we entered 2020 in a strong financial position. In March 2020 we took

action to strengthen our business further, including the suspension of the Kantar share buyback scheme and final dividend for 2019, and a comprehensive programme of cost reduction and cash conservation initiatives, with the aim of protecting as many

jobs as possible. More than 3,000 senior executives, beginning with the Board and Executive Committee, volunteered to take a 20% cut in their fees or salary for a three-month period.

We saw five years’ worth of innovation in five weeks as society and the economy were digitised at amazing speed. Platforms

like TikTok – with whom we signed an exclusive global partnership at the beginning of 2021 – saw record growth. It quickly became clear that the pandemic was accelerating the trends on which we based our vision for WPP, from the explosion

of ecommerce and digital experiences as people’s lives went online, to growing demand from clients for simple, integrated solutions that combine outstanding creativity with sophisticated data and technology skills.

Having modernised our client offer, simplified our structure and strengthened

our agency brands in the 18 months before the pandemic began, we saw the benefits of this acceleration in parts of our business. And because we have such close relationships with the world’s leading companies, we could understand their

requirements, react quickly to changing consumer behaviour and deliver what clients need. Being fast was vital, and work that might have taken weeks or months to conceive and produce before the pandemic was turned around in days or even hours.

We had a very positive year in terms of client retention and

business development, winning an industry-leading $4.4 billion in net new business during 2020 with clients including Alibaba, HSBC, Intel, Uber and Unilever.

14

Our client satisfaction scores continued to improve as we were recognized for our capabilities in experience, commerce and technology, alongside our classic strengths in communications. During

2020 we worked with 76 of our top 100 clients on ecommerce assignments.

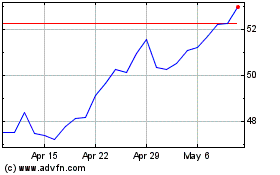

The share price decreased by 25% in 2020 as compared to 2019, closing at 800.0 pence at year end. Since then it has increased to 967.8 pence, up 21%, at 23 April 2021. Dividends in respect of

2020 are 24.0 pence, an increase from 22.7 pence in respect of 2019.

2020 compared with 2019

The financial results for 2020 are based on the Group’s continuing operations and the results of Kantar are presented separately as discontinued operations.

Revenues

Revenue was down 9.3% at £12.003 billion in 2020 compared to £13.234 billion in 2019. Revenue on a

constant currency basis was down 8.1% compared with last year. Net changes from acquisitions and disposals had a negative impact of 0.8% on growth, leading to a

like-for-like performance, excluding the impact of currency and acquisitions, of -7.3%, as compared to 2019. Billings were

£46.918 billion in 2020, down 11.6% from £53.059 billion in 2019, and down 9.6% on a like-for-like basis compared to last year.

Costs of services, general and administrative costs

Costs of services decreased by 7.7% in 2020 to £9,987.9 million

from £10,825.1 million in 2019.

General and

administrative costs increased by 285.7% in 2020 to £4,293.0 million from £1,113.1 million in 2019, principally in relation to an increase in goodwill impairment, an increase in investment write-downs, and an increase in

restructuring and transformation costs. Restructuring and transformation costs mainly comprise severance and property-related costs arising from the continuing structural review of parts of the Group’s operations and our response to the Covid-19 situation.

Staff costs

decreased by 7.5% in 2020 to £6,556.5 million from £7,090.6 million in 2019. Staff costs, excluding incentives (short- and long-term incentives and cost of share-based incentives), decreased by 6.3%. Incentive payments were

£185 million compared to £294 million in 2019.

On a like-for-like basis, the average number of people in the Group in 2020 was 102,822 compared to 106,185 in 2019. On the

same basis, the total number of people at 31 December 2020 was 99,830 compared to 106,478 at 31 December 2019.

Impairments of £3.119 billion (including £2.823 billion of goodwill impairments and £0.296 billion of investment and

other write-downs) were recognised in 2020. The goodwill impairments relate to historical acquisitions whose carrying values have been reassessed in light of the impact of Covid-19. The impairments are driven

by a combination of higher discount rates used to value future cash flows, a lower profit base in 2020 and lower industry growth rates. The majority of the impairments relate to businesses acquired as part of the Y&R acquisition in 2000.

In addition to the impairments outlined above, the Group incurred

net exceptional losses of £477 million in 2020. This comprises the Group’s share of associate company exceptional losses (£146 million), restructuring and transformation costs (£313 million) and other net exceptional

losses (£18 million). Restructuring and transformation costs mainly comprise severance and property-related costs arising from the continuing structural review of parts of the Group’s operations and our response to the Covid-19 situation. This compares with net exceptional losses in 2019 of £136 million.

15

Operating loss/profit

Operating loss was £2.278 billion in 2020 compared to a profit of

£1.296 billion in 2019, reflecting principally the impairments of £3.119 billion (including £2.823 billion goodwill impairments and £0.296 billion of investment and other write-downs) that were recognized

in 2020. Headline operating profit was down 19.2% to £1.261 billion in 2020 compared to £1.561 billion in 2019, and down 17.2% on a like-for-like

basis compared to 2019. The sharp decline in profitability year-on-year reflects the sudden and significant impact of Covid-19 on

revenue.

Loss/profit before interest and tax

Loss before interest and tax was £2.414 billion in 2020, compared

to a profit of £1.311 billion in 2019. Headline PBIT for 2020 was down 21.7% to £1.271 billion from £1.623 billion for 2019.

Finance and investment income, finance costs and revaluation and retranslation of financial instruments

Net finance costs, finance and investment income less finance costs

(excluding the revaluation and retranslation of financial instruments), were £229.3 million compared with £260.0 million in 2019, a decrease of £30.7 million year-on-year, primarily as a result of lower average net debt. Revaluation and retranslation of financial instruments resulted in a loss of £147.2 million in 2020, a decrease of

£311.0 million from a gain of £163.8 million in 2019 primarily as a result of £196.3 million of retranslation losses for the year ended 31 December 2020.

Loss/profit before taxation

Loss before tax was £2.791 billion in 2020, compared to a profit of £1.214 billion in 2019, reflecting principally the

£3.119 billion of impairment charges and investment write-downs and £313 million of restructuring and transformation costs. Headline PBT was down 23.6% to £1.041 billion in 2020 from £1.363 billion in 2019, and

down 24.6% on a like-for-like basis compared to 2019.

Taxation

The Group’s effective tax rate on loss/profit before tax was -4.6% in 2020 against 22.6% in 2019.

The difference in the rate in 2020 was principally due to non-deductible goodwill

impairment. Given the Group’s geographic mix of profits and the changing international tax environment, the tax rate is expected to increase slightly over the next few years.

Loss/profit for the year

Loss after tax was £2.920 billion, compared to a profit of

£0.939 billion in 2019. Losses attributable to shareholders was £2.974 billion, compared to a profit of £0.860 billion, again reflecting principally the £3.119 billion of impairments,

£313 million of restructuring and transformation losses and £146 million of the Group’s share of associate company exceptional losses. See note 4 to the consolidated financial statements for more details of share of

associate company exceptional losses.

Diluted loss per share was

243.2p, compared to earnings per share of 68.2p in the prior period.

Segment performance