Current Report Filing (8-k)

November 01 2021 - 9:08AM

Edgar (US Regulatory)

false

0000108516

0000108516

2021-10-29

2021-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2021

WORTHINGTON INDUSTRIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Ohio

|

|

1-8399

|

|

31-1189815

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

200 Old Wilson Bridge Road, Columbus, Ohio 43085

(Address of Principal Executive Offices) (Zip Code)

(614) 438-3210

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares, without par value

|

WOR

|

NYSE

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b‑2 of the Securities Exchange Act of 1934 (§240.12b‑2 of this chapter).

|

Emerging growth company

|

|

☐

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

☐

|

Item 1.01 Entry into a Material Definitive Agreement.

On October 29, 2021, Worthington Steel of Michigan, Inc. (“WSMI”), a Michigan corporation and wholly-owned subsidiary of Worthington Industries, Inc. (the “Registrant”), entered into an Equity Interest Purchase Agreement (the “Purchase Agreement”) with Tempel Holdings Inc., an Illinois corporation (the “Seller”), and Tempel Steel Company, an Illinois corporation ( “Tempel”). The Purchase Agreement provides, among other things, that, upon the terms and subject to the conditions set forth therein, WSMI will purchase from Seller all of the issued and outstanding capital stock of Tempel (the “Transaction”). Effective upon the consummation of the Transaction (the “Closing”), Tempel will be a wholly-owned subsidiary of WSMI and operate within the Registrant’s Steel Processing segment.

The purchase price to be paid by WSMI in the Transaction is approximately $255 million plus the assumption of certain liabilities, and is subject to adjustment based on the working capital of Tempel as of the Closing. A portion of the purchase price will be used to pay off certain indebtedness and other liabilities of Tempel in conjunction with the Closing. The purchase price is expected to be funded primarily using the Registrant’s cash.

The Purchase Agreement contains customary representations, warranties and covenants, including a covenant that each of the parties will use commercially reasonable efforts to cause the Transaction contemplated by the Purchase Agreement to be consummated. The Purchase Agreement also requires Tempel to conduct its business and operations during the period between the execution of the Purchase Agreement and the Closing according to the ordinary course of business consistent with past practice. The Closing is expected to occur in December of 2021.

Tempel is headquartered in Chicago, Illinois and is a leading manufacturer of precision motor and transformer laminations for the electrical steel market. The operations at the five manufacturing facilities of Tempel will strengthen the Registrant’s Steel Processing business and complement the Registrant’s existing automotive offerings.

Operations of Tempel in Chicago, India and Mexico produce both motor and transformer laminations for the electrical steel market, while operations in Canada produce transformer laminations, and operations in China produce motor laminations.

The foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreement, a copy of which is filed herewith as Exhibit 2.1 and is incorporated herein by reference. The Purchase Agreement has been included as an exhibit to provide investors with information regarding its terms. It is not intended to provide any other factual information about the Registrant, WSMI, Tempel or any of their respective subsidiaries or affiliates. The representations, warranties and covenants contained in the Purchase Agreement were made only for purposes of that agreement and as of specific dates; were made solely for the benefit of the parties to that agreement; may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures; may not have been intended to be statements of fact, but rather, as a method of allocating contractual risk and governing the contractual rights and relationships between the parties to the Purchase Agreement; and may be subject to standards of materiality applicable to contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Registrant, WSMI or Tempel or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in the Registrant’s public disclosures.

Item 7.01 Regulation FD Disclosure

On November 1, 2021, the Registrant issued a press release announcing the execution of the Purchase Agreement. A copy of the press release is furnished herewith as Exhibit 99.1.

The information contained in this Item 7.01 and in the accompanying Exhibit 99.1 shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

2

Item 9.01. Financial Statements and Exhibits.

(a) through (c): Not applicable.

(d) Exhibits:

The following exhibits are included with this Current Report on Form 8‑K:

* The Disclosure Schedules and Exhibits referenced in the Equity Purchase Agreement have been omitted pursuant to Item 601(a)(5) of SEC Regulation S-K. The Registrant will supplementally furnish a copy of any of the omitted Disclosure Schedules and Exhibits to the Securities and Exchange Commission on a confidential basis upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

WORTHINGTON INDUSTRIES, INC.

|

|

|

|

|

|

|

|

Date: November 1, 2021

|

|

By:

|

|

/s/Patrick J. Kennedy

|

|

|

|

|

|

Patrick J. Kennedy, Vice President -

General Counsel and Secretary

|

3

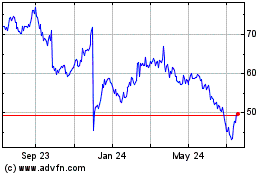

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Apr 2023 to Apr 2024