Current Report Filing (8-k)

August 17 2021 - 4:16PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 16, 2021

World Wrestling Entertainment, Inc.

_________________________________________________________________________________

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-16131

|

|

04-2693383

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1241 East Main Street, Stamford, CT

|

|

|

06902

|

|

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: (203) 352-8600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2.):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.01 per share

|

WWE

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company ad defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On August 16, 2021, World Wrestling Entertainment, Inc. (the “Company”) reached an agreement in principle and signed a

term sheet to settle the previously disclosed shareholder derivative actions titled (i) Merholz et al. v. McMahon et al., No. 3:20-cv-00557-VAB;

(ii) Kooi v. McMahon et al., No. 3:20-cv-00743-VAB; (iii) Nordstrom v. McMahon et al., No. 3:20-cv-00904-VAB; (iv) Merholz/Jimenez v. McMahon et al., No. 3:21-cv-00789-VAB; (v) Rezendes v. McMahon et al., No.

3:21-cv-00793-VAB; and (vi) City of Pontiac Police and Fire Retirement System v. McMahon et al., No. 3:21-cv-00930-VAB, currently pending in the

United States District Court for the District of Connecticut (collectively, the “Derivative Actions”), as well as related lawsuits filed in the Court of Chancery of the State of Delaware titled (i) Leavy v. World Wrestling Entertainment, Inc., No. 2020-0907-KSJM; (ii) Dastgir v. McMahon et al.,

No. 2021-0513-LWW; and (iii) Lowinger v. McMahon et al., No. 2021-0656-LWW (together with the Derivative Actions, the “Actions”). Among other things, the plaintiffs in the Actions have alleged violations by certain current and former Company directors and officers related to

disclosures concerning the Company’s business relationship in and with the Kingdom of Saudi Arabia and that certain of these defendants engaged in improper stock trading.

The proposed settlement would include,

among other things, a full release of all defendants in connection with all allegations made in the Actions, and it would not contain any admission of liability or admission as to the validity or truth of any or all allegations or claims by the

Company or any of the other defendants. The proposed settlement also would provide that the Company will implement and maintain certain corporate governance measures. As part of the settlement, the plaintiffs have indicated an intent to seek

payment of their attorneys’ fees, reimbursement of expenses, and case contribution awards, which the proposed settlement provides would be paid by the Company’s insurance carriers. The proposed settlement remains subject to shareholder notice, court approval and other customary conditions. In the event that the parties are not able to cause all of these conditions to be satisfied, the

Company and the other defendants intend to continue to vigorously defend against the claims asserted in the Actions.

Although the Company and the other defendants have denied, and continue to deny, all claims asserted by the plaintiffs

in the Actions, the Company believes that resolving the Actions in accordance with the terms of the proposed settlement is the proper business decision and that it is prudent to end the protracted and uncertain derivative litigation process on the

terms of the proposed settlement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

WORLD WRESTLING ENTERTAINMENT, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Samira Shah

|

|

|

|

|

Samira Shah

|

|

|

|

|

General Counsel and Corporate Secretary

|

|

|

|

Dated: August 17, 2021

false

0001091907

0001091907

2021-08-16

2021-08-16

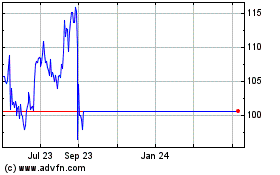

World Wrestling Entertai... (NYSE:WWE)

Historical Stock Chart

From Mar 2024 to Apr 2024

World Wrestling Entertai... (NYSE:WWE)

Historical Stock Chart

From Apr 2023 to Apr 2024